Key Insights

The Indian bike rental market is projected for substantial growth, forecasting a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033. This expansion is driven by increasing urbanization, rising fuel costs, and a growing demand for convenient, on-demand mobility, especially among younger demographics. The market is segmented by two-wheeler type (motorcycles and scooters), rental duration (short-term and long-term), and application (touring and commuting). Currently, short-term rentals for commuting dominate, propelled by popular app-based services like Yulu, Bounce, and VOGO, ideal for daily commutes and short journeys. Long-term rentals are expected to see significant uptake, catering to tourists and individuals seeking economical transportation. Adoption rates are higher in metropolitan areas of South and West India, influenced by infrastructure and urban density. The competitive landscape is intense, with numerous companies vying for market share. Future growth hinges on regulatory clarity, infrastructure development, and the successful integration of sustainable practices.

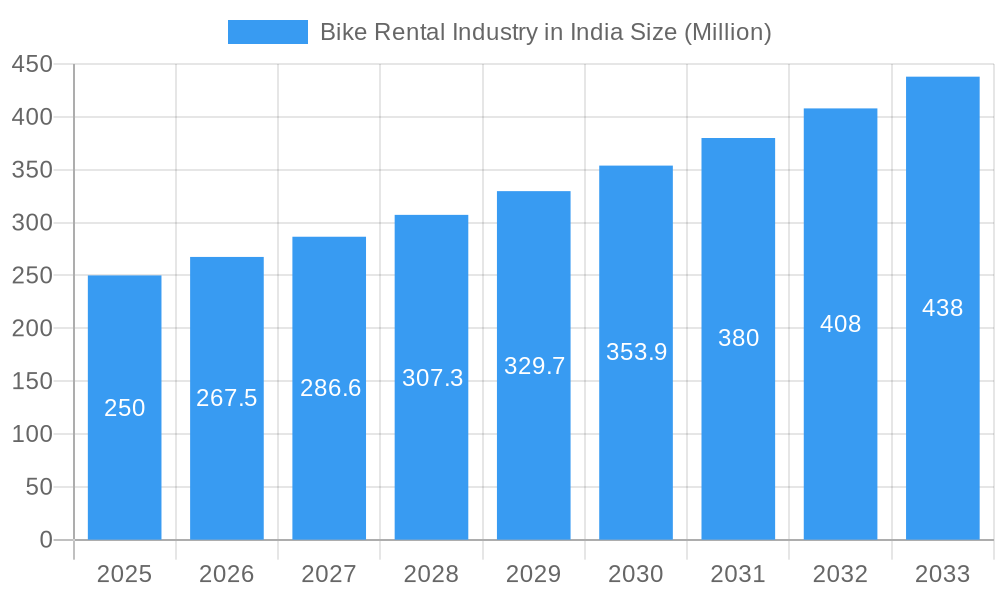

Bike Rental Industry in India Market Size (In Billion)

This dynamic market presents both challenges, such as fluctuating fuel prices and seasonal variations, and opportunities. Strong tailwinds include consistent growth in smartphone penetration and increasing digital literacy. Expanding services into smaller cities and towns will be crucial for sustained success. The integration of advanced technologies, like GPS tracking and enhanced booking systems, improves user experience and operational efficiency, further accelerating market expansion. Companies are prioritizing strategic partnerships, fleet expansion, and technological innovation to strengthen their competitive positions and capture a larger market share. The introduction of electric two-wheelers into rental fleets is a key driver for promoting sustainable and eco-friendly mobility.

Bike Rental Industry in India Company Market Share

Indian Bike Rental Market Analysis: Size, Growth, and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the Indian bike rental industry, examining market dynamics, growth trends, the competitive landscape, and future projections. Key players including Yulu, Bounce, VOGO, Wickedride Adventure Services, Moto Business Service India, Drivezy, Wheelstreet, ONN Bikes Rental, and Fae Bikes are analyzed. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The market size is estimated at $7.1 billion in 2025, with a forecast period from 2025 to 2033. The historical period analyzed is 2019-2024.

Bike Rental Industry in India Market Dynamics & Structure

The Indian bike rental market is characterized by increasing market concentration amongst key players, driven by technological innovation and strategic acquisitions. Regulatory frameworks, while evolving, are impacting market access and operations. The market exhibits strong substitution potential with public transportation and personal vehicle ownership. End-user demographics primarily comprise young professionals and tourists seeking flexible mobility solutions.

- Market Concentration: The top 5 players control approximately xx% of the market (2025 estimate).

- Technological Innovation: GPS tracking, mobile app integration, and smart locking systems are key drivers. Barriers include high initial investment costs and infrastructure limitations in some regions.

- Regulatory Framework: Licensing requirements and safety standards are increasingly stringent.

- Competitive Substitutes: Public transport, ride-hailing services, and personal vehicle ownership represent significant competitive pressures.

- End-User Demographics: The primary customer base consists of millennials and Gen Z, along with tourists.

- M&A Trends: Consolidation is expected, with xx M&A deals projected between 2025 and 2033 (a predicted value).

Bike Rental Industry in India Growth Trends & Insights

The Indian bike rental market has experienced significant growth, fueled by rising urbanization, increasing disposable incomes, and the convenience offered by on-demand mobility solutions. Technological advancements, such as mobile apps and digital payment integration, have further accelerated market expansion. Changing consumer preferences towards shared mobility and environmental concerns also contribute to growth.

The market size grew from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. Market penetration remains relatively low, offering significant growth potential. Technological disruptions, such as the introduction of electric scooters and improved GPS tracking, are reshaping consumer behavior. Increased adoption of subscription models is also contributing to this growth. The forecast for 2033 projects a market size of xx million units, driven by continued technological innovation and expanding infrastructure.

Dominant Regions, Countries, or Segments in Bike Rental Industry in India

Metropolitan areas such as Mumbai, Delhi, Bengaluru, and Chennai lead the market in terms of both adoption and revenue generation. Scooter rentals dominate the two-wheeler segment, reflecting affordability and practicality. Short-term rentals represent the largest market segment, driven by tourist demand and occasional use cases. Commuting applications show high growth potential.

- By Two-wheeler Type: Scooters hold the largest market share (xx%) due to lower costs and ease of use.

- By Rental Duration Type: Short-term rentals (less than 24 hours) dominate (xx%), followed by long-term rentals (xx%).

- By Application Type: Commuting is projected to be the fastest-growing segment (xx% CAGR), fueled by rising traffic congestion and fuel costs. Touring applications also contribute significantly.

- Key Drivers: Growing urbanization, improved infrastructure in major cities, and supportive government policies.

Bike Rental Industry in India Product Landscape

The Indian bike rental market showcases a range of two-wheelers, from basic scooters to premium motorcycles. Product innovations focus on enhanced safety features, GPS tracking, and convenient mobile app interfaces. Electric vehicle integration is gaining traction, addressing environmental concerns and reducing operational costs. Unique selling propositions include flexible rental periods, doorstep delivery, and seamless digital booking processes. Technological advancements have increased efficiency and improved user experience, influencing customer loyalty.

Key Drivers, Barriers & Challenges in Bike Rental Industry in India

Key Drivers: Increasing urbanization, rising disposable incomes, traffic congestion, environmental concerns, and the convenience of on-demand mobility solutions drive market growth. Government initiatives promoting sustainable transportation also play a crucial role.

Key Challenges: High initial investment costs for fleet acquisition, competition from established ride-hailing services, regulatory hurdles concerning licensing and operations, and managing operational efficiency and maintenance remain significant challenges. Supply chain disruptions also occasionally impact operations, impacting profitability.

Emerging Opportunities in Bike Rental Industry in India

Untapped markets exist in smaller cities and towns. Opportunities lie in expanding into niche segments such as last-mile delivery services and integrating with other mobility solutions. The growing demand for electric two-wheelers presents significant opportunities for innovation and expansion. Personalized service packages, loyalty programs, and strategic partnerships with hotels and tourism companies can further enhance market penetration.

Growth Accelerators in the Bike Rental Industry in India Industry

Strategic partnerships with technology providers, expanding into new geographic regions, and investing in advanced fleet management systems are crucial growth accelerators. Technological breakthroughs, such as advancements in battery technology for electric vehicles and improved fleet management software, will continue to drive market expansion and efficiency. Focus on sustainability and environmentally friendly practices also enhance brand image and attract environmentally conscious customers.

Notable Milestones in Bike Rental Industry in India Sector

- 2020: Introduction of electric scooters by multiple players.

- 2021: Significant increase in mobile app usage for bookings.

- 2022: Several mergers and acquisitions consolidate market share.

- 2023: Government regulations on electric vehicle adoption.

- 2024: Expansion into Tier 2 and Tier 3 cities.

In-Depth Bike Rental Industry in India Market Outlook

The Indian bike rental market is poised for sustained growth, driven by technological innovations, expanding infrastructure, and supportive government policies. Strategic partnerships and a focus on sustainability will be crucial for long-term success. The market's potential is significant, particularly in underserved regions and emerging application segments, presenting lucrative opportunities for established players and new entrants alike.

Bike Rental Industry in India Segmentation

-

1. Two-wheeler Type

- 1.1. Motorcycle

- 1.2. Scooter

-

2. Rental Duration Type

- 2.1. Short term

- 2.2. Long Term

-

3. Application Type

- 3.1. Touring

- 3.2. Commuting

Bike Rental Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bike Rental Industry in India Regional Market Share

Geographic Coverage of Bike Rental Industry in India

Bike Rental Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Metals and Minerals to Fuel the Market

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations and Community Concerns may Hinder the Market

- 3.4. Market Trends

- 3.4.1. Short Term Rentals Capturing Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bike Rental Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 5.2.1. Short term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Touring

- 5.3.2. Commuting

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 6. North America Bike Rental Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 6.1.1. Motorcycle

- 6.1.2. Scooter

- 6.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 6.2.1. Short term

- 6.2.2. Long Term

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Touring

- 6.3.2. Commuting

- 6.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 7. South America Bike Rental Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 7.1.1. Motorcycle

- 7.1.2. Scooter

- 7.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 7.2.1. Short term

- 7.2.2. Long Term

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Touring

- 7.3.2. Commuting

- 7.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 8. Europe Bike Rental Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 8.1.1. Motorcycle

- 8.1.2. Scooter

- 8.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 8.2.1. Short term

- 8.2.2. Long Term

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Touring

- 8.3.2. Commuting

- 8.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 9. Middle East & Africa Bike Rental Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 9.1.1. Motorcycle

- 9.1.2. Scooter

- 9.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 9.2.1. Short term

- 9.2.2. Long Term

- 9.3. Market Analysis, Insights and Forecast - by Application Type

- 9.3.1. Touring

- 9.3.2. Commuting

- 9.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 10. Asia Pacific Bike Rental Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 10.1.1. Motorcycle

- 10.1.2. Scooter

- 10.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 10.2.1. Short term

- 10.2.2. Long Term

- 10.3. Market Analysis, Insights and Forecast - by Application Type

- 10.3.1. Touring

- 10.3.2. Commuting

- 10.1. Market Analysis, Insights and Forecast - by Two-wheeler Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Yulu

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bounce

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 VOGO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wickedride Adventure Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Moto Business Service India*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Drivezy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wheelstreet

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ONN Bikes Rental

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fae Bikes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Yulu

List of Figures

- Figure 1: Global Bike Rental Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Bike Rental Industry in India Revenue (billion), by Two-wheeler Type 2025 & 2033

- Figure 3: North America Bike Rental Industry in India Revenue Share (%), by Two-wheeler Type 2025 & 2033

- Figure 4: North America Bike Rental Industry in India Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 5: North America Bike Rental Industry in India Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 6: North America Bike Rental Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 7: North America Bike Rental Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 8: North America Bike Rental Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Bike Rental Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Bike Rental Industry in India Revenue (billion), by Two-wheeler Type 2025 & 2033

- Figure 11: South America Bike Rental Industry in India Revenue Share (%), by Two-wheeler Type 2025 & 2033

- Figure 12: South America Bike Rental Industry in India Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 13: South America Bike Rental Industry in India Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 14: South America Bike Rental Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 15: South America Bike Rental Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 16: South America Bike Rental Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Bike Rental Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Bike Rental Industry in India Revenue (billion), by Two-wheeler Type 2025 & 2033

- Figure 19: Europe Bike Rental Industry in India Revenue Share (%), by Two-wheeler Type 2025 & 2033

- Figure 20: Europe Bike Rental Industry in India Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 21: Europe Bike Rental Industry in India Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 22: Europe Bike Rental Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 23: Europe Bike Rental Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Europe Bike Rental Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Bike Rental Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Bike Rental Industry in India Revenue (billion), by Two-wheeler Type 2025 & 2033

- Figure 27: Middle East & Africa Bike Rental Industry in India Revenue Share (%), by Two-wheeler Type 2025 & 2033

- Figure 28: Middle East & Africa Bike Rental Industry in India Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 29: Middle East & Africa Bike Rental Industry in India Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 30: Middle East & Africa Bike Rental Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 31: Middle East & Africa Bike Rental Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 32: Middle East & Africa Bike Rental Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Bike Rental Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Bike Rental Industry in India Revenue (billion), by Two-wheeler Type 2025 & 2033

- Figure 35: Asia Pacific Bike Rental Industry in India Revenue Share (%), by Two-wheeler Type 2025 & 2033

- Figure 36: Asia Pacific Bike Rental Industry in India Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 37: Asia Pacific Bike Rental Industry in India Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 38: Asia Pacific Bike Rental Industry in India Revenue (billion), by Application Type 2025 & 2033

- Figure 39: Asia Pacific Bike Rental Industry in India Revenue Share (%), by Application Type 2025 & 2033

- Figure 40: Asia Pacific Bike Rental Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Bike Rental Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bike Rental Industry in India Revenue billion Forecast, by Two-wheeler Type 2020 & 2033

- Table 2: Global Bike Rental Industry in India Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 3: Global Bike Rental Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Global Bike Rental Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Bike Rental Industry in India Revenue billion Forecast, by Two-wheeler Type 2020 & 2033

- Table 6: Global Bike Rental Industry in India Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 7: Global Bike Rental Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 8: Global Bike Rental Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Bike Rental Industry in India Revenue billion Forecast, by Two-wheeler Type 2020 & 2033

- Table 13: Global Bike Rental Industry in India Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 14: Global Bike Rental Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 15: Global Bike Rental Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Bike Rental Industry in India Revenue billion Forecast, by Two-wheeler Type 2020 & 2033

- Table 20: Global Bike Rental Industry in India Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 21: Global Bike Rental Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 22: Global Bike Rental Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Bike Rental Industry in India Revenue billion Forecast, by Two-wheeler Type 2020 & 2033

- Table 33: Global Bike Rental Industry in India Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 34: Global Bike Rental Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 35: Global Bike Rental Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Bike Rental Industry in India Revenue billion Forecast, by Two-wheeler Type 2020 & 2033

- Table 43: Global Bike Rental Industry in India Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 44: Global Bike Rental Industry in India Revenue billion Forecast, by Application Type 2020 & 2033

- Table 45: Global Bike Rental Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Bike Rental Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bike Rental Industry in India?

The projected CAGR is approximately 15%.

2. Which companies are prominent players in the Bike Rental Industry in India?

Key companies in the market include Yulu, Bounce, VOGO, Wickedride Adventure Services, Moto Business Service India*List Not Exhaustive, Drivezy, Wheelstreet, ONN Bikes Rental, Fae Bikes.

3. What are the main segments of the Bike Rental Industry in India?

The market segments include Two-wheeler Type, Rental Duration Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Metals and Minerals to Fuel the Market.

6. What are the notable trends driving market growth?

Short Term Rentals Capturing Significant Demand.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations and Community Concerns may Hinder the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bike Rental Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bike Rental Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bike Rental Industry in India?

To stay informed about further developments, trends, and reports in the Bike Rental Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence