Key Insights

The Brazil automotive composites market is experiencing robust growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. A Compound Annual Growth Rate (CAGR) exceeding 13% from 2019 to 2033 signifies a significant market expansion. This growth is fueled by several key factors. The burgeoning automotive industry in Brazil, coupled with government initiatives promoting sustainable transportation, creates a fertile ground for composite material adoption. Furthermore, the increasing preference for advanced driver-assistance systems (ADAS) and the rising popularity of electric vehicles (EVs) are driving the demand for high-performance composites. The automotive sector’s focus on enhancing vehicle safety and durability also contributes significantly to the market's expansion. Different segments are contributing to this growth, with a likely higher share from the structural assembly and powertrain component applications due to their significant weight-reduction potential. Thermoset polymers currently hold a dominant position in material type, due to their established use and cost-effectiveness, but thermoplastic polymers and carbon fiber are witnessing increasing adoption due to performance benefits. The adoption of advanced production processes like continuous molding and injection molding is enhancing production efficiency and cost-competitiveness, while hand layup remains relevant for smaller-scale or specialized applications.

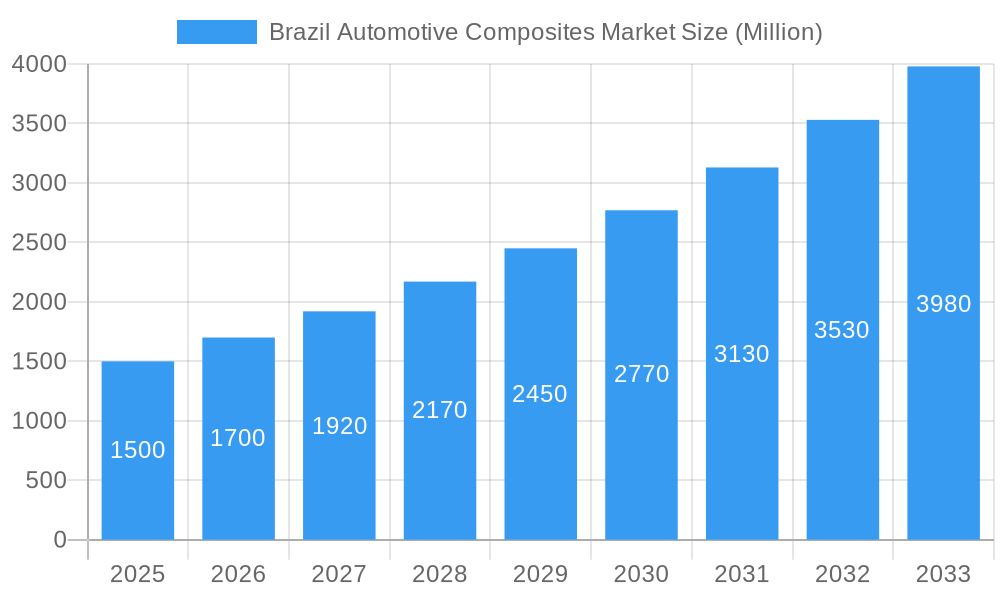

Brazil Automotive Composites Market Market Size (In Billion)

The competitive landscape is characterized by a mix of global and regional players. International companies such as Toray Industries, Hexcel Corporation, and SGL Carbon bring in advanced technologies and established market positions, while local players focus on catering to specific regional needs. However, the market's growth is not without challenges. Fluctuations in raw material prices, particularly for carbon fiber and resins, and the relatively high initial investment costs associated with composite manufacturing can hinder market expansion. Furthermore, the need for skilled labor and infrastructure development in some regions is necessary to support the industry's growth trajectory. Despite these challenges, the long-term outlook for the Brazil automotive composites market remains optimistic, driven by continuous technological advancements and increasing regulatory pressures towards fuel efficiency and sustainable transportation.

Brazil Automotive Composites Market Company Market Share

Brazil Automotive Composites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil automotive composites market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a detailed examination of market dynamics, growth trends, and key players, this report serves as an essential resource for navigating this rapidly evolving sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. Market values are presented in million units.

Keywords: Brazil Automotive Composites Market, Automotive Composites, Composites Market Brazil, Hand Layup, Compression Molding, Continuous Process, Injection Molding, Structural Assembly, Powertrain Component, Interior Composites, Exterior Composites, Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, Glass Fiber, SGL Carbon, Sigmatex, MouldCam Pty Ltd, Mitsubishi Chemical, Toho Tenex, Nippon Sheet Glass, Toray Industries, Hexcel Corporation, Solva, Market Size, Market Share, CAGR, Market Growth, Market Trends, Market Analysis, Brazil Automotive Industry.

Brazil Automotive Composites Market Dynamics & Structure

The Brazilian automotive composites market is characterized by moderate concentration, with a few large international players and several domestic companies competing. Technological innovation, driven by the demand for lightweighting and improved fuel efficiency, is a key driver. Stringent government regulations concerning emissions and safety standards are also shaping the market landscape. Competitive substitutes include traditional automotive materials like steel and aluminum, but composites offer advantages in specific applications. The end-user demographics are primarily focused on the burgeoning middle class and the growing demand for automobiles. M&A activity has been relatively low in recent years, with xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Focus on lightweighting, improved fuel efficiency, and enhanced design flexibility. Innovation barriers include high initial investment costs and specialized manufacturing expertise.

- Regulatory Framework: Stringent emission and safety regulations drive demand for lightweight, high-performance composites.

- Competitive Substitutes: Steel, aluminum, and other traditional materials.

- End-User Demographics: Expanding middle class driving increased automobile demand.

- M&A Trends: Relatively low activity (xx deals) between 2019 and 2024; projected increase to xx deals by 2033.

Brazil Automotive Composites Market Growth Trends & Insights

The Brazil automotive composites market experienced a CAGR of xx% during the historical period (2019-2024). This growth is attributed to the increasing adoption of composites in various automotive applications, driven by the need for lightweighting and improved fuel efficiency. Technological advancements in material science and manufacturing processes have further accelerated market penetration. Consumer preference for technologically advanced and fuel-efficient vehicles contributes significantly to this trend. The market is expected to maintain a strong growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%, reaching a market size of xx million units by 2033. This growth will be influenced by factors such as government incentives for green technologies and the expansion of the automotive industry in Brazil. Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Regions, Countries, or Segments in Brazil Automotive Composites Market

The Southeast region of Brazil is the dominant market for automotive composites, driven by the high concentration of automotive manufacturing facilities and a robust automotive supply chain. Within this region, São Paulo state holds the largest market share. In terms of segment dominance, the Structural Assembly application segment leads the market, accounting for xx% of the total market value in 2025. This is followed by the Powertrain Component segment (xx%), driven by the increasing use of composites in lightweight engine components. The Thermoset Polymer material type dominates the market, holding xx% of the market share due to its established manufacturing processes and cost-effectiveness. The Injection Molding production process is the fastest-growing segment, experiencing a CAGR of xx% during the forecast period.

Key Drivers (Southeast Region):

- High concentration of automotive manufacturing facilities.

- Well-developed automotive supply chain.

- Government incentives for industrial growth.

Segment Dominance:

- Structural Assembly: xx% market share in 2025, driven by lightweighting needs.

- Powertrain Component: xx% market share in 2025, propelled by the use of composites in engine components.

- Thermoset Polymer: xx% market share in 2025, due to cost-effectiveness and established manufacturing.

- Injection Molding: Fastest-growing production process, with xx% CAGR during the forecast period.

Brazil Automotive Composites Market Product Landscape

The Brazilian automotive composites market showcases a diverse range of products, encompassing a wide spectrum of materials, processing techniques, and applications. Key product innovations include the development of high-performance, lightweight composites with improved durability and thermal properties. These advancements are driven by stringent industry regulations and the relentless pursuit of fuel efficiency. The use of advanced simulation tools and design techniques enables optimized component designs, maximizing the benefits of composites while meeting stringent performance criteria. Unique selling propositions center around weight reduction, enhanced strength-to-weight ratios, and improved design flexibility, which leads to a cost-effective solution for manufacturers.

Key Drivers, Barriers & Challenges in Brazil Automotive Composites Market

Key Drivers:

The Brazilian automotive composites market is propelled by the growing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. Government regulations mandating improved fuel economy and emissions standards are further incentivizing the adoption of composites. The increasing focus on safety and the development of advanced composite materials with enhanced strength and durability are additional drivers.

Key Challenges:

High initial investment costs associated with composite manufacturing equipment and processes pose a significant challenge. The relatively high cost of advanced composite materials compared to traditional materials like steel and aluminum can hinder widespread adoption. Supply chain limitations in terms of raw materials and skilled labor also present obstacles. Fluctuations in the price of raw materials and currency exchange rates can affect the overall cost competitiveness of composites.

Emerging Opportunities in Brazil Automotive Composites Market

The expanding middle class and the growing demand for automobiles in Brazil present a significant opportunity for the automotive composites market. The increasing focus on electric vehicles (EVs) creates demand for lightweight composites in battery packs and other components. The development of innovative composite materials with enhanced performance characteristics, such as recyclability and biodegradability, opens new avenues for growth. Government incentives and supportive policies aimed at promoting the adoption of sustainable automotive technologies can further accelerate market expansion.

Growth Accelerators in the Brazil Automotive Composites Market Industry

Technological advancements in material science, manufacturing processes, and design tools are key growth accelerators. Strategic partnerships between automotive manufacturers and composite material suppliers are fostering innovation and driving the adoption of advanced composite solutions. Government initiatives promoting the use of lightweight materials in the automotive sector are creating a favorable market environment. Expansion of the automotive manufacturing base in Brazil and increasing exports of Brazilian-made vehicles are also contributing to market growth.

Key Players Shaping the Brazil Automotive Composites Market Market

- SGL Carbon

- Sigmatex

- MouldCam Pty Ltd

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Toho Tenex

- Nippon Sheet Glass Company Limited

- Toray Industries

- Hexcel Corporation

- Solva

Notable Milestones in Brazil Automotive Composites Market Sector

- 2021 (Q3): Launch of a new high-strength carbon fiber composite by Toray Industries for use in automotive structural components.

- 2022 (Q1): Partnership between Hexcel Corporation and a major Brazilian automotive manufacturer to develop lightweight body panels.

- 2023 (Q4): Government announcement of tax incentives for the adoption of lightweight materials in automotive manufacturing.

In-Depth Brazil Automotive Composites Market Market Outlook

The Brazil automotive composites market is poised for significant growth in the coming years, driven by technological advancements, government support, and a growing demand for lightweight, fuel-efficient vehicles. Strategic opportunities lie in developing innovative composite materials and processes tailored to the specific needs of the Brazilian automotive industry. Collaboration between material suppliers, automotive manufacturers, and research institutions will be crucial in driving innovation and accelerating market penetration. The market is expected to experience sustained growth, driven by factors such as increased vehicle production, adoption of eco-friendly materials, and government support.

Brazil Automotive Composites Market Segmentation

-

1. Production Process Type

- 1.1. Hand Layup

- 1.2. Compression Molding

- 1.3. Continous Process

- 1.4. Injection Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Powertrain Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

-

3. Material Type

- 3.1. Thermoset Polymer

- 3.2. Thermoplastic Polymer

- 3.3. Carbon Fiber

- 3.4. Glass Fiber

Brazil Automotive Composites Market Segmentation By Geography

- 1. Brazil

Brazil Automotive Composites Market Regional Market Share

Geographic Coverage of Brazil Automotive Composites Market

Brazil Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lightweight Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Hand Layup

- 5.1.2. Compression Molding

- 5.1.3. Continous Process

- 5.1.4. Injection Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Thermoset Polymer

- 5.3.2. Thermoplastic Polymer

- 5.3.3. Carbon Fiber

- 5.3.4. Glass Fiber

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sigmatex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MouldCam Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 itsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toho Tenex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexcel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solva

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Brazil Automotive Composites Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Automotive Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Automotive Composites Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Brazil Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Brazil Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 4: Brazil Automotive Composites Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Brazil Automotive Composites Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 6: Brazil Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 7: Brazil Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 8: Brazil Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Automotive Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Brazil Automotive Composites Market?

Key companies in the market include SGL Carbon, Sigmatex, MouldCam Pty Ltd, itsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, Solva.

3. What are the main segments of the Brazil Automotive Composites Market?

The market segments include Production Process Type, Application Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Growing Demand for Lightweight Materials.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Brazil Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence