Key Insights

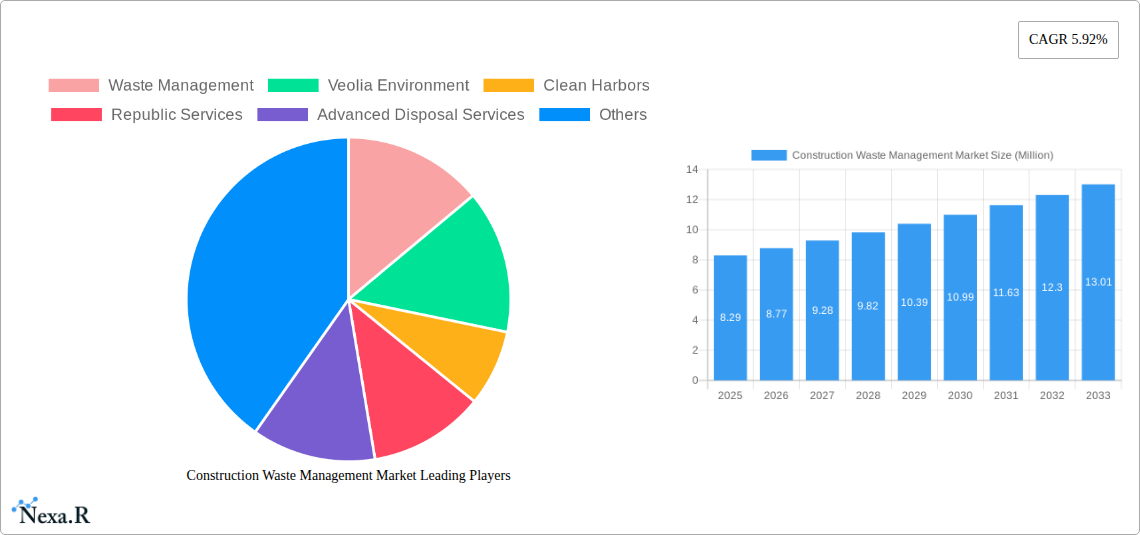

The global Construction Waste Management market is poised for robust expansion, projected to reach a significant size of 8.29 Million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 5.92% throughout the forecast period of 2025-2033. This upward trajectory is largely attributed to the increasing global focus on sustainable construction practices and stringent environmental regulations mandating responsible waste disposal and recycling. Key drivers include the growing demand for green building certifications, rising public awareness regarding the environmental impact of construction debris, and advancements in waste sorting and processing technologies. The market is segmented by waste type into Hazardous and Non-hazardous, with Non-hazardous waste constituting a larger share due to the sheer volume generated from demolition and renovation projects. Residential and Non-residential sources are the primary generators of this waste, with the former seeing increased activity due to urbanization and infrastructure development.

Construction Waste Management Market Market Size (In Million)

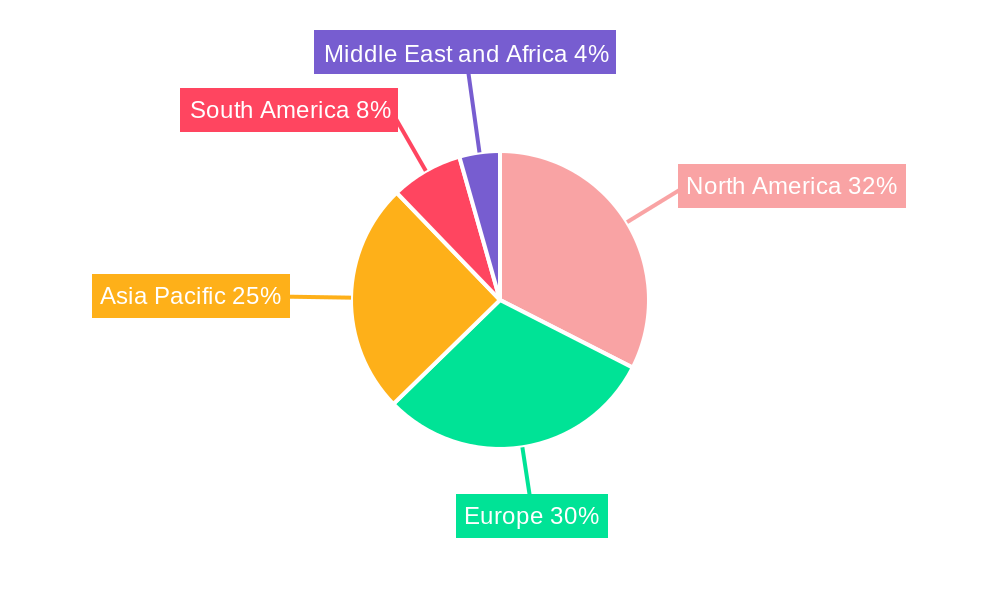

Further analysis reveals that materials like Concrete & Bricks, Wood, and Metal represent substantial portions of construction waste, presenting significant opportunities for recycling and resource recovery. The market is further characterized by key players such as Waste Management, Veolia Environment, and Clean Harbors, who are actively investing in innovative solutions and expanding their service portfolios. Geographically, North America and Europe currently lead the market, owing to well-established regulatory frameworks and a mature construction industry. However, the Asia Pacific region is expected to witness the fastest growth, fueled by rapid infrastructure development and increasing government initiatives promoting circular economy principles within the construction sector. Despite the positive outlook, challenges such as the high cost of advanced recycling technologies and inconsistent waste management infrastructure in developing regions present restraining factors that market participants need to address.

Construction Waste Management Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Construction Waste Management Market, offering critical insights into market dynamics, growth trends, and future opportunities. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for stakeholders seeking to navigate the evolving landscape of sustainable construction practices. Our analysis focuses on key segments including Hazardous and Non-hazardous waste, Residential and Non-residential sources, and diverse materials such as Concrete & Bricks, Wood, Metal, Plastics, Glass, and Other Materials (Soil, Drywall, Plaster, etc.). We deliver actionable intelligence on market size, segmentation, regional dominance, and the competitive strategies of leading companies.

Construction Waste Management Market Market Dynamics & Structure

The Construction Waste Management Market is characterized by a dynamic interplay of regulatory pressures, technological advancements, and shifting end-user demands. Market concentration varies by region, with established players and emerging innovators coexisting. Technological innovation is primarily driven by the need for more efficient recycling processes, advanced sorting technologies, and the development of circular economy solutions within the construction sector. Regulatory frameworks, such as landfill diversion targets and extended producer responsibility schemes, are pivotal in shaping market growth and encouraging sustainable waste management practices. Competitive product substitutes, while evolving, are largely focused on alternative building materials that generate less waste. End-user demographics are increasingly favoring eco-friendly construction and demanding transparent waste management solutions. Mergers and acquisitions (M&A) are a significant trend, consolidating market share and expanding service offerings. For instance, the period saw numerous smaller firms being acquired by larger entities aiming to scale operations and enhance their service portfolios. The market is moderately concentrated, with a few major global players holding significant market share, while a larger number of regional and specialized companies cater to specific needs. Barriers to innovation include high capital investment for advanced recycling infrastructure and the complex logistics of waste collection and processing.

- Market Concentration: Moderate, with a mix of large global corporations and numerous regional specialists.

- Technological Drivers: Automation in sorting, advanced material recovery, waste-to-energy solutions, and digital tracking platforms.

- Regulatory Impact: Stringent environmental regulations and government incentives are crucial for market expansion.

- End-User Demand: Growing preference for green building certifications and lifecycle assessment, driving demand for responsible waste management.

- M&A Activity: Robust M&A trend focused on expanding geographical reach and technological capabilities.

Construction Waste Management Market Growth Trends & Insights

The Construction Waste Management Market is poised for significant expansion driven by increasing urbanization, infrastructure development, and a global push towards sustainability. The market size is projected to grow at a substantial Compound Annual Growth Rate (CAGR) over the forecast period. Adoption rates of advanced waste management techniques, such as on-site sorting and material reuse, are steadily increasing. Technological disruptions, including AI-powered sorting and advanced chemical recycling of plastics and composites, are set to revolutionize the industry. Consumer behavior shifts are evident, with developers and contractors increasingly prioritizing waste reduction and circular economy principles to enhance their brand reputation and comply with evolving environmental standards. The market penetration of specialized construction waste management services is expected to rise as awareness and regulatory enforcement intensify. For example, the increasing demand for recycled aggregates in new construction projects is a clear indicator of this trend. Furthermore, the adoption of building information modeling (BIM) is facilitating better waste tracking and planning from the project's inception, contributing to improved waste diversion rates. The growing emphasis on a circular economy model within the construction sector, where materials are kept in use for as long as possible, is a fundamental driver of market growth. This shift not only addresses environmental concerns but also presents economic opportunities through resource recovery and reduced reliance on virgin materials. The projected market size for 2025 is estimated to be xx Million.

Dominant Regions, Countries, or Segments in Construction Waste Management Market

The Construction Waste Management Market is witnessing dynamic growth across various regions and segments, with several factors contributing to the dominance of specific areas. In terms of Waste Type, Non-hazardous waste, primarily comprising materials like concrete, bricks, and wood, constitutes the largest segment due to the sheer volume generated from demolition and construction activities. The Non-residential Source segment, encompassing commercial, industrial, and public infrastructure projects, is a major contributor to market revenue, often generating larger volumes of waste with higher potential for segregation and recycling.

Among the Material segments, Concrete & Bricks dominate due to their prevalence in demolition and construction. However, segments like Wood and Metal also represent significant opportunities due to their high recyclability and value. The Other Materials segment, including soil, drywall, and plaster, is gaining traction as advanced processing techniques become more widespread.

Regionally, North America and Europe currently lead the market, driven by stringent environmental regulations, robust infrastructure development, and a mature circular economy ecosystem. Countries like the United States, Germany, and the United Kingdom are at the forefront, with proactive government policies and significant investment in waste management infrastructure. Asia-Pacific, particularly China and India, presents the fastest-growing market, fueled by rapid urbanization, large-scale construction projects, and increasing environmental awareness. Economic policies promoting waste reduction, such as landfill taxes and tax incentives for recycling, are key drivers. Infrastructure development projects, including new roads, bridges, and buildings, directly impact the generation of construction waste and the demand for management services. Market share in these leading regions is substantial, with dedicated waste management companies playing a pivotal role in collection, processing, and material recovery. The growth potential in emerging economies is immense, as they are increasingly adopting Western environmental standards and investing in modern waste management solutions.

Construction Waste Management Market Product Landscape

The product landscape within the Construction Waste Management Market is characterized by innovations aimed at improving efficiency, increasing recovery rates, and reducing the environmental impact of construction activities. Advanced sorting technologies, including optical sorters and magnetic separators, are enhancing the ability to recover valuable materials from mixed waste streams. Mobile crushing and screening plants are enabling on-site processing of demolition waste, reducing transportation costs and carbon emissions. The development of specialized containers and collection systems for different waste types is streamlining the logistics of waste management. Performance metrics are increasingly focused on diversion rates, recycled content percentages, and the reduction of landfill volumes. Unique selling propositions often revolve around cost-effectiveness, compliance with environmental regulations, and the provision of comprehensive, integrated waste management solutions.

Key Drivers, Barriers & Challenges in Construction Waste Management Market

Key Drivers: The Construction Waste Management Market is propelled by a confluence of critical factors. Increasingly stringent environmental regulations and government mandates for waste diversion and recycling are primary drivers. The growing emphasis on sustainable construction and green building certifications is fostering demand for responsible waste management practices. Economic incentives, such as tax credits for recycling and landfill taxes, further encourage the adoption of waste management solutions. Technological advancements in sorting, processing, and material recovery are making waste management more efficient and cost-effective. The rising cost of raw materials also makes recycled construction materials a more attractive alternative.

Barriers & Challenges: Despite its growth potential, the market faces several challenges. High capital investment required for advanced recycling infrastructure and technology can be a significant barrier, particularly for smaller enterprises. The complexity of logistics, including collection, transportation, and processing of diverse waste streams across different project sites, poses operational hurdles. Fluctuations in commodity prices for recycled materials can impact the economic viability of recycling operations. Lack of standardized regulations across different regions can also create complexities for businesses operating internationally. Public awareness and education regarding proper waste segregation and disposal practices are still evolving, leading to contamination of waste streams. Competitive pressures from less regulated or informal waste management sectors can also present challenges.

Emerging Opportunities in Construction Waste Management Market

Emerging opportunities in the Construction Waste Management Market lie in the burgeoning demand for circular economy solutions within the built environment. The development of innovative recycling technologies for complex materials like composites and treated wood presents a significant untapped market. The increasing adoption of modular construction and prefabrication generates different waste profiles, requiring specialized management strategies. There is a growing opportunity in providing waste management services for the deconstruction and renovation of existing buildings, as opposed to new builds. Furthermore, the development of digital platforms for waste tracking, material passports, and blockchain-based solutions for transparency is gaining momentum. Evolving consumer preferences for businesses with strong environmental, social, and governance (ESG) credentials are also creating opportunities for waste management providers to offer services that enhance their clients' sustainability profiles.

Growth Accelerators in the Construction Waste Management Market Industry

The Construction Waste Management Market is experiencing significant growth acceleration driven by several key catalysts. Technological breakthroughs in automated sorting and advanced material processing are enabling higher recovery rates and the creation of higher-value recycled products. Strategic partnerships between waste management companies, construction firms, and material manufacturers are fostering integrated solutions and driving innovation. Government initiatives and investments in developing waste management infrastructure, alongside favorable policy frameworks, are creating a more conducive environment for market expansion. The growing global recognition of the economic and environmental benefits of a circular economy within construction is a powerful long-term growth accelerator. Expansion into emerging markets, where construction activity is booming and environmental awareness is rising, also presents substantial growth potential.

Key Players Shaping the Construction Waste Management Market Market

- Waste Management

- Veolia Environment

- Clean Harbors

- Republic Services

- Advanced Disposal Services

- Biffa

- Covanta Holding

- Daiseki

- Hitachi Zosen

- 6 Other Companies

Notable Milestones in Construction Waste Management Market Sector

- July 2024: Sortera, a leader in recycling and processing residual products from the building and construction industries in Northern Europe, announced that it was bolstering its presence in Greater London's construction waste market through the acquisition of Reston Waste Management Ltd. Reston Waste stands out as one of South West London's prominent independent waste management firms.

- July 2024: Holcim, a key player in construction, completed its acquisition of Land Recovery in the United Kingdom. This strategic move enhances Holcim's standing in circular construction. With this deal, Holcim expanded its portfolio, particularly in construction demolition materials, leveraging Land Recovery's track record of recycling over 300,000 tons in 2023.

In-Depth Construction Waste Management Market Market Outlook

The future outlook for the Construction Waste Management Market is exceptionally promising, driven by a sustained commitment to sustainability and circular economy principles within the global construction industry. Growth accelerators such as advancements in recycling technologies, strategic collaborations between industry stakeholders, and supportive government policies will continue to fuel expansion. The increasing focus on resource efficiency and waste reduction in construction projects worldwide presents vast opportunities for innovative service providers. The market's trajectory suggests a significant shift towards advanced waste segregation, material reuse, and the valorization of construction by-products. As regulatory frameworks tighten and environmental consciousness rises, the demand for comprehensive and sustainable construction waste management solutions will undoubtedly intensify, solidifying its position as a critical sector for a greener built environment.

Construction Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Hazardous

- 1.2. Non-hazardous

-

2. Source

- 2.1. Residential

- 2.2. Non-residential

-

3. Material

- 3.1. Concrete & Bricks

- 3.2. Wood

- 3.3. Metal

- 3.4. Plastics

- 3.5. Glass

- 3.6. Other Materials (Soil, Drywall, Plaster, etc.)

Construction Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Construction Waste Management Market Regional Market Share

Geographic Coverage of Construction Waste Management Market

Construction Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Urbanization and Population Growth Driving the Market4.; Economic Growth Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Urbanization and Population Growth Driving the Market4.; Economic Growth Driving the Market

- 3.4. Market Trends

- 3.4.1. Residential Construction Waste Holds a Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Hazardous

- 5.1.2. Non-hazardous

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Concrete & Bricks

- 5.3.2. Wood

- 5.3.3. Metal

- 5.3.4. Plastics

- 5.3.5. Glass

- 5.3.6. Other Materials (Soil, Drywall, Plaster, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. North America Construction Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Waste Type

- 6.1.1. Hazardous

- 6.1.2. Non-hazardous

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Residential

- 6.2.2. Non-residential

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Concrete & Bricks

- 6.3.2. Wood

- 6.3.3. Metal

- 6.3.4. Plastics

- 6.3.5. Glass

- 6.3.6. Other Materials (Soil, Drywall, Plaster, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Waste Type

- 7. Europe Construction Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Waste Type

- 7.1.1. Hazardous

- 7.1.2. Non-hazardous

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Residential

- 7.2.2. Non-residential

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Concrete & Bricks

- 7.3.2. Wood

- 7.3.3. Metal

- 7.3.4. Plastics

- 7.3.5. Glass

- 7.3.6. Other Materials (Soil, Drywall, Plaster, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Waste Type

- 8. Asia Pacific Construction Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Waste Type

- 8.1.1. Hazardous

- 8.1.2. Non-hazardous

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Residential

- 8.2.2. Non-residential

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Concrete & Bricks

- 8.3.2. Wood

- 8.3.3. Metal

- 8.3.4. Plastics

- 8.3.5. Glass

- 8.3.6. Other Materials (Soil, Drywall, Plaster, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Waste Type

- 9. South America Construction Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Waste Type

- 9.1.1. Hazardous

- 9.1.2. Non-hazardous

- 9.2. Market Analysis, Insights and Forecast - by Source

- 9.2.1. Residential

- 9.2.2. Non-residential

- 9.3. Market Analysis, Insights and Forecast - by Material

- 9.3.1. Concrete & Bricks

- 9.3.2. Wood

- 9.3.3. Metal

- 9.3.4. Plastics

- 9.3.5. Glass

- 9.3.6. Other Materials (Soil, Drywall, Plaster, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Waste Type

- 10. Middle East and Africa Construction Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Waste Type

- 10.1.1. Hazardous

- 10.1.2. Non-hazardous

- 10.2. Market Analysis, Insights and Forecast - by Source

- 10.2.1. Residential

- 10.2.2. Non-residential

- 10.3. Market Analysis, Insights and Forecast - by Material

- 10.3.1. Concrete & Bricks

- 10.3.2. Wood

- 10.3.3. Metal

- 10.3.4. Plastics

- 10.3.5. Glass

- 10.3.6. Other Materials (Soil, Drywall, Plaster, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Waste Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Waste Management

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Veolia Environment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clean Harbors

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Republic Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advanced Disposal Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Biffa

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Covanta Holding

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daiseki

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hitachi Zosen6 3 Other Companies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Waste Management

List of Figures

- Figure 1: Global Construction Waste Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Construction Waste Management Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Construction Waste Management Market Revenue (Million), by Waste Type 2025 & 2033

- Figure 4: North America Construction Waste Management Market Volume (Billion), by Waste Type 2025 & 2033

- Figure 5: North America Construction Waste Management Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 6: North America Construction Waste Management Market Volume Share (%), by Waste Type 2025 & 2033

- Figure 7: North America Construction Waste Management Market Revenue (Million), by Source 2025 & 2033

- Figure 8: North America Construction Waste Management Market Volume (Billion), by Source 2025 & 2033

- Figure 9: North America Construction Waste Management Market Revenue Share (%), by Source 2025 & 2033

- Figure 10: North America Construction Waste Management Market Volume Share (%), by Source 2025 & 2033

- Figure 11: North America Construction Waste Management Market Revenue (Million), by Material 2025 & 2033

- Figure 12: North America Construction Waste Management Market Volume (Billion), by Material 2025 & 2033

- Figure 13: North America Construction Waste Management Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: North America Construction Waste Management Market Volume Share (%), by Material 2025 & 2033

- Figure 15: North America Construction Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Construction Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Construction Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Construction Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Construction Waste Management Market Revenue (Million), by Waste Type 2025 & 2033

- Figure 20: Europe Construction Waste Management Market Volume (Billion), by Waste Type 2025 & 2033

- Figure 21: Europe Construction Waste Management Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 22: Europe Construction Waste Management Market Volume Share (%), by Waste Type 2025 & 2033

- Figure 23: Europe Construction Waste Management Market Revenue (Million), by Source 2025 & 2033

- Figure 24: Europe Construction Waste Management Market Volume (Billion), by Source 2025 & 2033

- Figure 25: Europe Construction Waste Management Market Revenue Share (%), by Source 2025 & 2033

- Figure 26: Europe Construction Waste Management Market Volume Share (%), by Source 2025 & 2033

- Figure 27: Europe Construction Waste Management Market Revenue (Million), by Material 2025 & 2033

- Figure 28: Europe Construction Waste Management Market Volume (Billion), by Material 2025 & 2033

- Figure 29: Europe Construction Waste Management Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Europe Construction Waste Management Market Volume Share (%), by Material 2025 & 2033

- Figure 31: Europe Construction Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Construction Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Construction Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Construction Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Construction Waste Management Market Revenue (Million), by Waste Type 2025 & 2033

- Figure 36: Asia Pacific Construction Waste Management Market Volume (Billion), by Waste Type 2025 & 2033

- Figure 37: Asia Pacific Construction Waste Management Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 38: Asia Pacific Construction Waste Management Market Volume Share (%), by Waste Type 2025 & 2033

- Figure 39: Asia Pacific Construction Waste Management Market Revenue (Million), by Source 2025 & 2033

- Figure 40: Asia Pacific Construction Waste Management Market Volume (Billion), by Source 2025 & 2033

- Figure 41: Asia Pacific Construction Waste Management Market Revenue Share (%), by Source 2025 & 2033

- Figure 42: Asia Pacific Construction Waste Management Market Volume Share (%), by Source 2025 & 2033

- Figure 43: Asia Pacific Construction Waste Management Market Revenue (Million), by Material 2025 & 2033

- Figure 44: Asia Pacific Construction Waste Management Market Volume (Billion), by Material 2025 & 2033

- Figure 45: Asia Pacific Construction Waste Management Market Revenue Share (%), by Material 2025 & 2033

- Figure 46: Asia Pacific Construction Waste Management Market Volume Share (%), by Material 2025 & 2033

- Figure 47: Asia Pacific Construction Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Construction Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Construction Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Construction Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Construction Waste Management Market Revenue (Million), by Waste Type 2025 & 2033

- Figure 52: South America Construction Waste Management Market Volume (Billion), by Waste Type 2025 & 2033

- Figure 53: South America Construction Waste Management Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 54: South America Construction Waste Management Market Volume Share (%), by Waste Type 2025 & 2033

- Figure 55: South America Construction Waste Management Market Revenue (Million), by Source 2025 & 2033

- Figure 56: South America Construction Waste Management Market Volume (Billion), by Source 2025 & 2033

- Figure 57: South America Construction Waste Management Market Revenue Share (%), by Source 2025 & 2033

- Figure 58: South America Construction Waste Management Market Volume Share (%), by Source 2025 & 2033

- Figure 59: South America Construction Waste Management Market Revenue (Million), by Material 2025 & 2033

- Figure 60: South America Construction Waste Management Market Volume (Billion), by Material 2025 & 2033

- Figure 61: South America Construction Waste Management Market Revenue Share (%), by Material 2025 & 2033

- Figure 62: South America Construction Waste Management Market Volume Share (%), by Material 2025 & 2033

- Figure 63: South America Construction Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Construction Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 65: South America Construction Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Construction Waste Management Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Construction Waste Management Market Revenue (Million), by Waste Type 2025 & 2033

- Figure 68: Middle East and Africa Construction Waste Management Market Volume (Billion), by Waste Type 2025 & 2033

- Figure 69: Middle East and Africa Construction Waste Management Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 70: Middle East and Africa Construction Waste Management Market Volume Share (%), by Waste Type 2025 & 2033

- Figure 71: Middle East and Africa Construction Waste Management Market Revenue (Million), by Source 2025 & 2033

- Figure 72: Middle East and Africa Construction Waste Management Market Volume (Billion), by Source 2025 & 2033

- Figure 73: Middle East and Africa Construction Waste Management Market Revenue Share (%), by Source 2025 & 2033

- Figure 74: Middle East and Africa Construction Waste Management Market Volume Share (%), by Source 2025 & 2033

- Figure 75: Middle East and Africa Construction Waste Management Market Revenue (Million), by Material 2025 & 2033

- Figure 76: Middle East and Africa Construction Waste Management Market Volume (Billion), by Material 2025 & 2033

- Figure 77: Middle East and Africa Construction Waste Management Market Revenue Share (%), by Material 2025 & 2033

- Figure 78: Middle East and Africa Construction Waste Management Market Volume Share (%), by Material 2025 & 2033

- Figure 79: Middle East and Africa Construction Waste Management Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Construction Waste Management Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Construction Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Construction Waste Management Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: Global Construction Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: Global Construction Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Global Construction Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 5: Global Construction Waste Management Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Construction Waste Management Market Volume Billion Forecast, by Material 2020 & 2033

- Table 7: Global Construction Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Construction Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Construction Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 10: Global Construction Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 11: Global Construction Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Global Construction Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 13: Global Construction Waste Management Market Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Construction Waste Management Market Volume Billion Forecast, by Material 2020 & 2033

- Table 15: Global Construction Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Construction Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of North America Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of North America Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Global Construction Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 26: Global Construction Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 27: Global Construction Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 28: Global Construction Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 29: Global Construction Waste Management Market Revenue Million Forecast, by Material 2020 & 2033

- Table 30: Global Construction Waste Management Market Volume Billion Forecast, by Material 2020 & 2033

- Table 31: Global Construction Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Construction Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: United Kingdom Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Germany Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Germany Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: France Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: France Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Russia Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Italy Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Italy Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Spain Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Spain Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Construction Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 48: Global Construction Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 49: Global Construction Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 50: Global Construction Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 51: Global Construction Waste Management Market Revenue Million Forecast, by Material 2020 & 2033

- Table 52: Global Construction Waste Management Market Volume Billion Forecast, by Material 2020 & 2033

- Table 53: Global Construction Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Construction Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: India Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: China Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: China Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Japan Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Australia Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Australia Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of Asia Pacific Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Global Construction Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 66: Global Construction Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 67: Global Construction Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 68: Global Construction Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 69: Global Construction Waste Management Market Revenue Million Forecast, by Material 2020 & 2033

- Table 70: Global Construction Waste Management Market Volume Billion Forecast, by Material 2020 & 2033

- Table 71: Global Construction Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Construction Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Brazil Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Argentina Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Global Construction Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 80: Global Construction Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 81: Global Construction Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 82: Global Construction Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 83: Global Construction Waste Management Market Revenue Million Forecast, by Material 2020 & 2033

- Table 84: Global Construction Waste Management Market Volume Billion Forecast, by Material 2020 & 2033

- Table 85: Global Construction Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 86: Global Construction Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 87: United Arab Emirates Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: United Arab Emirates Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: South Africa Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: South Africa Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Middle East and Africa Construction Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East and Africa Construction Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Waste Management Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the Construction Waste Management Market?

Key companies in the market include Waste Management, Veolia Environment, Clean Harbors, Republic Services, Advanced Disposal Services, Biffa, Covanta Holding, Daiseki, Hitachi Zosen6 3 Other Companies.

3. What are the main segments of the Construction Waste Management Market?

The market segments include Waste Type, Source, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.29 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Urbanization and Population Growth Driving the Market4.; Economic Growth Driving the Market.

6. What are the notable trends driving market growth?

Residential Construction Waste Holds a Significant Share of the Market.

7. Are there any restraints impacting market growth?

4.; Urbanization and Population Growth Driving the Market4.; Economic Growth Driving the Market.

8. Can you provide examples of recent developments in the market?

July 2024: Sortera, a leader in recycling and processing residual products from the building and construction industries in Northern Europe, announced that it was bolstering its presence in Greater London's construction waste market through the acquisition of Reston Waste Management Ltd. Reston Waste stands out as one of South West London's prominent independent waste management firms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Waste Management Market?

To stay informed about further developments, trends, and reports in the Construction Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence