Key Insights

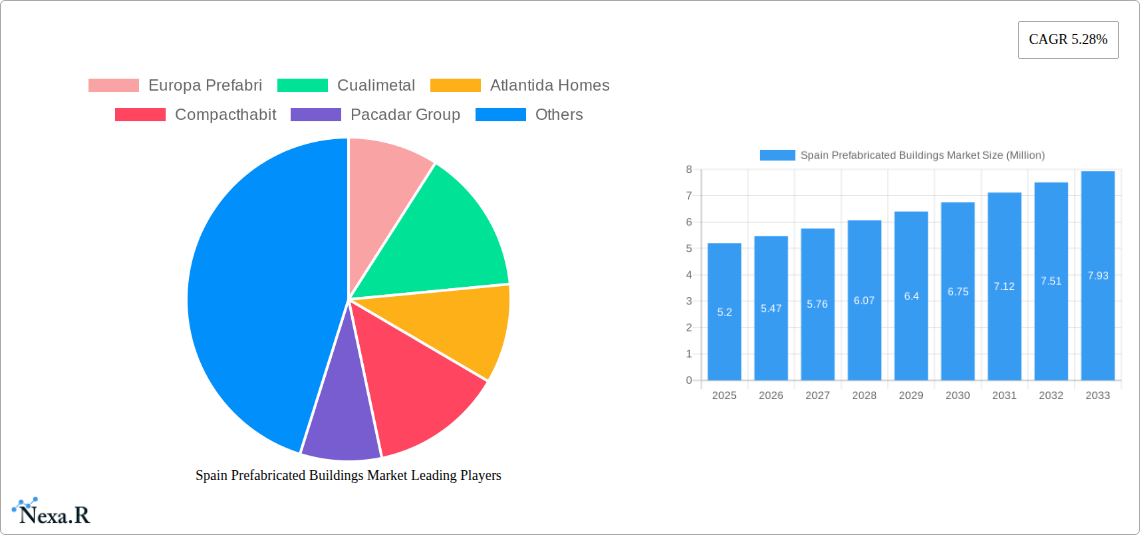

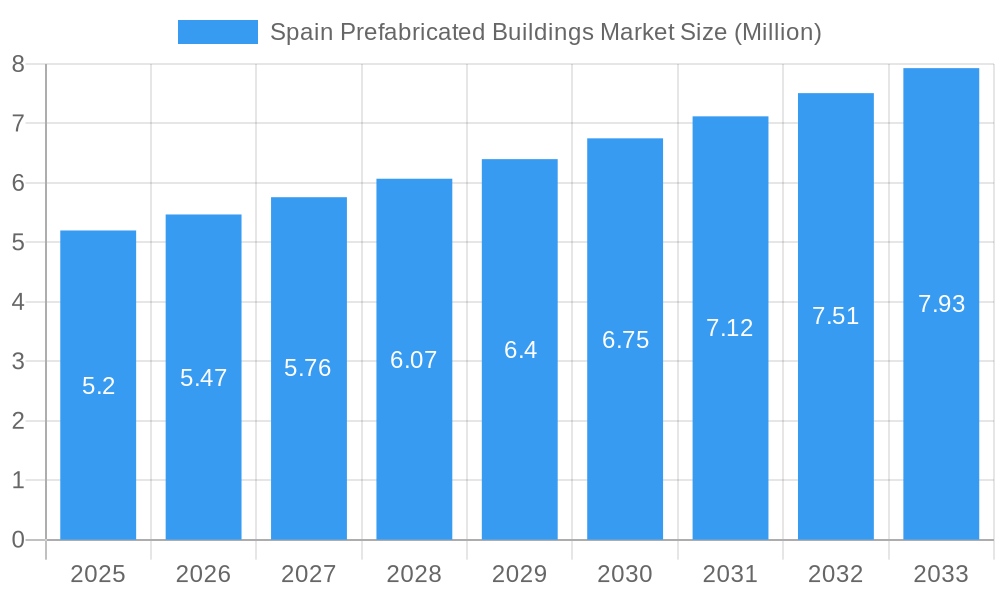

The Spanish prefabricated buildings market is poised for significant expansion, with a current estimated market size of $5.20 million. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 5.28%, indicating a robust and sustained upward trajectory. The demand for prefabricated structures in Spain is being propelled by several key drivers, most notably the increasing need for affordable and rapid housing solutions to address housing shortages. Furthermore, the inherent sustainability benefits of modular construction, such as reduced waste and energy efficiency, align perfectly with Spain's commitment to green building practices and environmental regulations. The commercial sector is also a substantial contributor, with businesses seeking faster deployment of retail spaces, offices, and hospitality facilities to capitalize on market opportunities. This dynamic interplay of economic necessity and environmental consciousness is setting a strong foundation for market advancement.

Spain Prefabricated Buildings Market Market Size (In Million)

The market's growth is further fueled by evolving trends in construction technology and design, favoring innovative and customizable modular solutions. Prefabricated buildings are increasingly recognized for their superior quality control, cost-effectiveness, and reduced construction timelines compared to traditional building methods. The residential segment, in particular, is witnessing a surge in interest as more homeowners and developers embrace the efficiency and modern aesthetics offered by prefabricated homes. While the market demonstrates strong potential, it is not without its challenges. Restraints such as initial perception issues regarding the durability and aesthetic appeal of prefabricated structures, alongside potential logistical hurdles in transportation and site preparation for larger modules, need to be strategically addressed by industry players. Nevertheless, the overwhelming advantages in speed, cost, and sustainability are expected to outweigh these limitations, driving continued investment and adoption across various applications in Spain.

Spain Prefabricated Buildings Market Company Market Share

This in-depth report provides an authoritative exploration of the Spain prefabricated buildings market, offering critical insights into its current landscape and future trajectory. Covering the historical period of 2019-2024 and projecting forward to 2033 with a base and estimated year of 2025, this analysis is indispensable for stakeholders seeking to capitalize on the burgeoning opportunities in the modular and off-site construction sector. Discover market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, and emerging opportunities, all presented with quantitative data and expert analysis. The report delves into parent and child market segments, material types including Concrete, Glass, Metal, and Timber, and applications such as Residential and Commercial, providing a holistic view of the market's evolution.

Spain Prefabricated Buildings Market Market Dynamics & Structure

The Spain prefabricated buildings market is characterized by a dynamic interplay of factors shaping its growth and evolution. Market concentration is moderate, with a growing number of specialized players vying for market share, driven by increasing demand for efficient and sustainable construction solutions. Technological innovation is a significant driver, with advancements in materials science, design software, and manufacturing processes enabling the creation of more sophisticated and customizable prefabricated structures. Regulatory frameworks, while evolving to support sustainable building practices, can also present certain adoption barriers. The competitive landscape includes established construction firms and emerging modular specialists, with ongoing competition from traditional building methods. End-user demographics are shifting, with a growing preference for faster construction timelines, cost predictability, and environmental consciousness, particularly among residential and commercial developers. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate market positions, expand their product portfolios, and enhance their technological capabilities. For instance, the acquisition of smaller modular manufacturers by larger entities aims to achieve economies of scale and broader market reach.

- Market Concentration: Moderate, with an increasing number of specialized prefabricated building solution providers.

- Technological Innovation: Driven by advancements in modular design, 3D printing integration, and sustainable material development.

- Regulatory Frameworks: Growing support for sustainable construction, but potential for standardization challenges.

- Competitive Product Substitutes: Traditional on-site construction methods remain a significant substitute.

- End-User Demographics: Increasing demand from residential developers for affordable housing, and from commercial sectors for rapid deployment of retail and office spaces.

- M&A Trends: Strategic acquisitions aimed at market consolidation and technology integration.

Spain Prefabricated Buildings Market Growth Trends & Insights

The Spain prefabricated buildings market is poised for significant expansion, fueled by a confluence of economic, environmental, and social factors. The market size evolution is marked by a consistent upward trend, driven by escalating adoption rates across various sectors. Technological disruptions, including the integration of Building Information Modeling (BIM) and advanced manufacturing techniques, are revolutionizing the design, production, and assembly of prefabricated modules, leading to enhanced efficiency and reduced waste. Consumer behavior shifts are a pivotal element, with a growing awareness and preference for the sustainability, speed, and cost-effectiveness inherent in prefabricated construction. This is particularly evident in the residential sector, where demand for faster housing solutions and a reduction in construction timelines is paramount. Furthermore, the commercial segment is increasingly embracing modular buildings for their flexibility and scalability, enabling businesses to adapt to changing market demands with greater agility. The market penetration of prefabricated solutions is projected to climb steadily as awareness increases and the perceived limitations of off-site construction diminish. The forecast CAGR for the period 2025-2033 is estimated at XX%, indicating a robust growth trajectory. The market is moving beyond basic modular units towards highly customized and aesthetically sophisticated designs, blurring the lines between traditional and prefabricated construction.

Dominant Regions, Countries, or Segments in Spain Prefabricated Buildings Market

Within the Spain prefabricated buildings market, the Residential application segment emerges as a dominant force, significantly outpacing other applications in terms of market share and projected growth. This dominance is propelled by a multifaceted set of drivers, including Spain's persistent housing deficit, the increasing demand for affordable housing solutions, and a growing preference for faster construction timelines among homeowners and developers. Economic policies aimed at stimulating the housing sector, coupled with government initiatives promoting energy-efficient and sustainable building practices, further bolster the appeal of prefabricated residential solutions. The use of Timber as a primary material type is also gaining considerable traction within the residential segment, owing to its sustainable credentials, excellent thermal insulation properties, and aesthetic appeal. Regions with high population density and robust urban development plans, such as Madrid and Catalonia, are at the forefront of this growth, benefiting from extensive infrastructure development and a higher concentration of real estate investment.

- Dominant Application: Residential, driven by affordability, speed, and sustainability demands.

- Key Material Type Drivers: Timber's growing popularity for its environmental benefits and performance in residential construction.

- Leading Regions: Madrid and Catalonia, due to urbanization and investment in new housing.

- Economic Policy Impact: Government incentives for affordable and sustainable housing directly benefit the residential prefab market.

- Market Share & Growth Potential: The residential segment is projected to hold a XX% market share by 2033, with a projected growth rate of XX%.

Spain Prefabricated Buildings Market Product Landscape

The product landscape of the Spain prefabricated buildings market is increasingly characterized by innovation and versatility. Manufacturers are pushing the boundaries of design and functionality, offering a wide array of solutions tailored to diverse needs. From compact, efficient modular homes to expansive commercial spaces, the focus is on delivering high-quality, durable, and aesthetically pleasing structures. Advancements in prefabrication techniques allow for greater customization, incorporating smart home technologies and sustainable features as standard. Performance metrics such as rapid assembly times, reduced on-site disruption, and enhanced energy efficiency are key selling propositions. The integration of advanced materials like engineered wood and high-performance composites further elevates the structural integrity and thermal performance of these buildings.

Key Drivers, Barriers & Challenges in Spain Prefabricated Buildings Market

Key Drivers:

- Demand for Speed & Efficiency: Prefabricated buildings offer significantly faster construction times compared to traditional methods, a critical factor in addressing housing shortages and project deadlines.

- Cost Predictability: Off-site manufacturing in controlled environments leads to better cost management and reduced risk of budget overruns.

- Sustainability Focus: The inherent waste reduction and potential for using eco-friendly materials align with growing environmental consciousness and regulations.

- Labor Shortages: Prefabrication can alleviate reliance on skilled on-site labor, a persistent challenge in the construction industry.

- Technological Advancements: Innovations in design software and manufacturing processes enable greater design flexibility and product quality.

Barriers & Challenges:

- Perception & Acceptance: Lingering perceptions of prefabricated structures as temporary or lower quality can hinder broader adoption.

- Logistical Complexity: Transportation of large modular units to remote or congested sites can pose significant logistical challenges and incur additional costs.

- Regulatory Hurdles: Variations in building codes and permitting processes across different regions can create complexity for nationwide projects.

- Initial Capital Investment: While offering long-term savings, the upfront investment in specialized manufacturing facilities can be a barrier for some smaller companies.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials, affecting production timelines and profitability. For example, a XX% increase in timber prices due to supply chain disruptions could impact the profitability of timber-based prefabricated units.

Emerging Opportunities in Spain Prefabricated Buildings Market

The Spain prefabricated buildings market is ripe with emerging opportunities driven by evolving societal needs and technological advancements. The burgeoning demand for sustainable and energy-efficient housing presents a significant avenue for growth, particularly with the integration of renewable energy sources and advanced insulation technologies. The increasing need for flexible and rapidly deployable commercial spaces, such as pop-up retail outlets, temporary event structures, and modular office expansions, offers substantial potential. Furthermore, the development of prefabricated solutions for specialized sectors like healthcare facilities, educational institutions, and disaster relief shelters is an untapped market segment poised for expansion. The increasing adoption of digital technologies, including IoT integration for smart building management and virtual reality for design visualization, will further enhance the appeal and functionality of prefabricated structures.

Growth Accelerators in the Spain Prefabricated Buildings Market Industry

Several catalysts are propelling the long-term growth of the Spain prefabricated buildings market. Technological breakthroughs in areas such as advanced robotics for manufacturing and artificial intelligence for design optimization are streamlining production processes and enhancing product quality. Strategic partnerships between prefabricated manufacturers and material suppliers are crucial for ensuring a stable and cost-effective supply chain, fostering innovation in material development. Market expansion strategies, including entry into new geographical regions within Spain and targeting specific under-served market segments like affordable student housing or modular retirement communities, are critical for sustained growth. The increasing focus on circular economy principles and the use of recycled or recyclable materials in prefab construction will also act as a significant growth accelerator, appealing to environmentally conscious consumers and investors.

Key Players Shaping the Spain Prefabricated Buildings Market Market

- Europa Prefabri

- Cualimetal

- Atlantida Homes

- Compacthabit

- Pacadar Group

- Mader House

- ABC Modular

- Prefabri Steel

- Casas Mundiales

- Turboconstroi

- Armodul

Notable Milestones in Spain Prefabricated Buildings Market Sector

- November 2023: Algeco, a leader in modular and off-site building solutions in Europe, secured a significant order for state-of-the-art GRIDSERVE Electrical Forecourts®. This contract underscores the increasing demand for advanced modular buildings to support critical infrastructure development.

- September 2023: ADRA in Spain, with international support, funded the construction of 8 prefabricated shelters in a Moroccan village affected by an earthquake. Each 16-square-meter modular house offers a safe and functional temporary living space, highlighting the vital role of prefab solutions in humanitarian aid and rapid housing.

In-Depth Spain Prefabricated Buildings Market Market Outlook

The outlook for the Spain prefabricated buildings market remains exceptionally positive, driven by sustained demand for efficient, sustainable, and cost-effective construction solutions. Growth accelerators, including ongoing technological advancements in manufacturing and design, coupled with strategic partnerships that enhance supply chain resilience and innovation, will continue to propel market expansion. The increasing governmental support for green building initiatives and affordable housing projects further solidifies the long-term growth potential. Emerging opportunities in specialized sectors and the growing consumer acceptance of high-quality modular construction present significant avenues for market players to explore and capitalize on. The market is set to witness a paradigm shift towards more sophisticated, technologically integrated, and environmentally responsible prefabricated building solutions, reinforcing its position as a cornerstone of the future construction landscape in Spain. The market is projected to reach a value of XX Million units by 2033.

Spain Prefabricated Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Spain Prefabricated Buildings Market Segmentation By Geography

- 1. Spain

Spain Prefabricated Buildings Market Regional Market Share

Geographic Coverage of Spain Prefabricated Buildings Market

Spain Prefabricated Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in residential construction driving the market; Development of hospitality infrastructure driving the market

- 3.3. Market Restrains

- 3.3.1. Limited access to financing; Shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increase in investment among infrastructural sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Europa Prefabri

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cualimetal

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Atlantida Homes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Compacthabit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pacadar Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mader House

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABC Modular

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Prefabri Steel **List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Casas Mundiales

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turboconstroi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Armodul

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Europa Prefabri

List of Figures

- Figure 1: Spain Prefabricated Buildings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Prefabricated Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Spain Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Spain Prefabricated Buildings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Spain Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Spain Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Spain Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Prefabricated Buildings Market?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Spain Prefabricated Buildings Market?

Key companies in the market include Europa Prefabri, Cualimetal, Atlantida Homes, Compacthabit, Pacadar Group, Mader House, ABC Modular, Prefabri Steel **List Not Exhaustive, Casas Mundiales, Turboconstroi, Armodul.

3. What are the main segments of the Spain Prefabricated Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in residential construction driving the market; Development of hospitality infrastructure driving the market.

6. What are the notable trends driving market growth?

Increase in investment among infrastructural sector.

7. Are there any restraints impacting market growth?

Limited access to financing; Shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

November 2023: Algeco, the world’s largest modular and off-site building solutions brand in Europe, has secured a large order for new, state-of-the-art GRIDSERVE Electrical Forecourts® The latest generation of Algeco modular buildings are helping to meet the increasing demand for GrisEnergy Electric Forecourts®, across the nation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Prefabricated Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Prefabricated Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Prefabricated Buildings Market?

To stay informed about further developments, trends, and reports in the Spain Prefabricated Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence