Key Insights

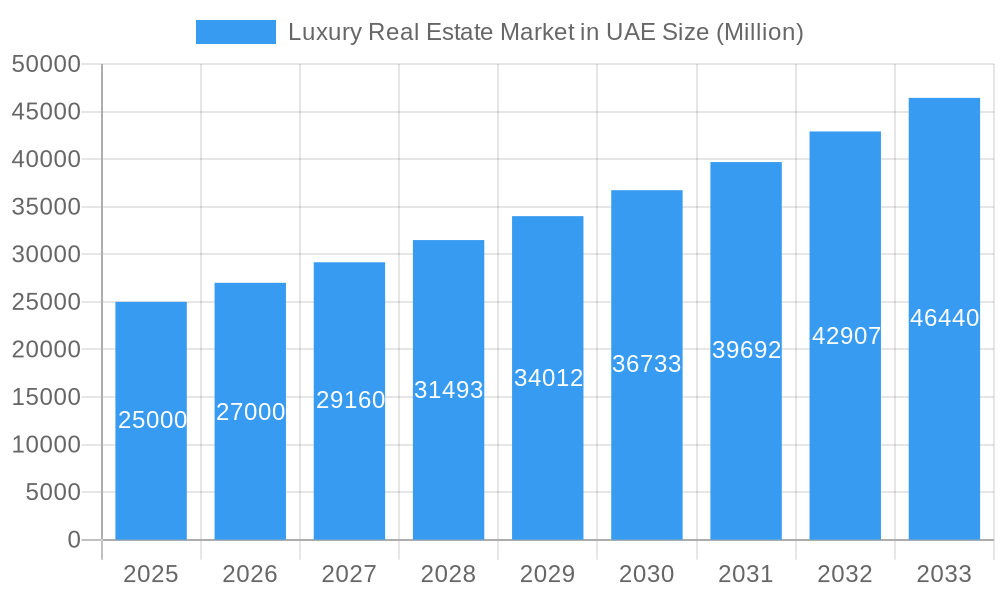

The UAE luxury real estate market is poised for significant expansion, projected to reach an impressive market size of approximately USD 25,000 million by 2025 and beyond. This growth is propelled by a robust CAGR exceeding 8.00%, indicating sustained and strong upward momentum. Key drivers fueling this surge include the UAE's status as a global hub for high-net-worth individuals (HNWIs), driven by its attractive tax policies, world-class infrastructure, and a thriving tourism and business environment. Furthermore, government initiatives focused on diversifying the economy and attracting foreign investment continue to bolster the real estate sector, particularly the premium segment. The increasing demand for opulent residences, branded residences, and properties with exclusive amenities further fuels this market.

Luxury Real Estate Market in UAE Market Size (In Billion)

The market is characterized by a dynamic landscape of evolving consumer preferences and technological integration. Trends such as the growing demand for smart homes, sustainable living features, and integrated wellness amenities are reshaping property development. The rise of ultra-luxury developments and bespoke living experiences caters to the sophisticated tastes of affluent buyers. While the market benefits from strong demand, potential restraints such as global economic uncertainties, fluctuating oil prices (though less impactful on the luxury segment), and the increasing supply in certain prime locations could exert some pressure. However, the inherent appeal of UAE's premier locations like Dubai, Abu Dhabi, and Sharjah, coupled with a proactive approach from developers like Emaar Properties, Aldar Properties, and DAMAC Properties, ensures the market's resilience and continued attractiveness to both local and international investors seeking high-value assets in a secure and prosperous environment.

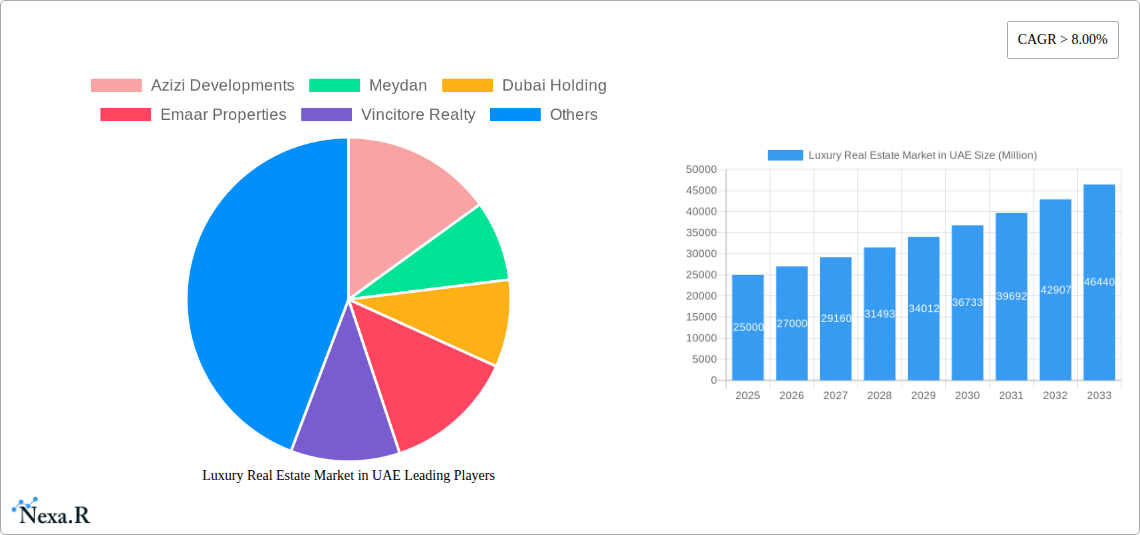

Luxury Real Estate Market in UAE Company Market Share

This in-depth report provides a detailed analysis of the Luxury Real Estate Market in UAE, covering market dynamics, growth trajectories, regional dominance, product landscape, key players, and future outlook from 2019 to 2033. It offers critical insights for industry professionals, investors, and stakeholders seeking to understand the evolving UAE property market, with a specific focus on high-net-worth individuals and premium residential offerings. Leveraging extensive data and expert analysis, this report delves into the intricate workings of the Dubai luxury real estate and Abu Dhabi luxury property sectors, as well as emerging opportunities in Sharjah real estate and other key emirates. The report analyzes the parent market and individual child markets within the UAE luxury real estate ecosystem, providing a holistic view of market segmentation and investment potential.

Luxury Real Estate Market in UAE Market Dynamics & Structure

The luxury real estate market in the UAE is characterized by a dynamic interplay of factors shaping its growth and structure. Market concentration remains high, with a few dominant developers controlling significant portions of the ultra-luxury segment. Technological innovation is increasingly driving the development of smart homes, sustainable luxury, and immersive virtual property tours, enhancing buyer engagement and operational efficiency. The regulatory framework, while robust, is continuously adapting to attract foreign investment and ensure market stability, with government initiatives often supporting the UAE property development sector. Competitive product substitutes are emerging, particularly in serviced apartments and branded residences, offering lifestyle amenities that rival traditional standalone villas and apartments. End-user demographics are shifting towards younger, tech-savvy global investors seeking unique experiences and strong ROI. Merger and acquisition (M&A) trends are indicative of market maturation, with consolidation likely to occur among smaller players.

- Market Concentration: Dominated by major developers like Emaar Properties, Nakheel Properties, and Dubai Holding.

- Technological Drivers: Smart home integration, AI-powered property management, sustainable building technologies.

- Regulatory Framework: Golden Visa initiatives, foreign ownership laws, streamlined property transaction processes.

- Product Substitutes: Branded residences, serviced apartments, fractional ownership models.

- End-User Demographics: Growing interest from high-net-worth individuals (HNWIs) from Asia, Europe, and the CIS region.

- M&A Trends: Potential for consolidation and strategic alliances to enhance market reach and offerings.

Luxury Real Estate Market in UAE Growth Trends & Insights

The UAE luxury real estate market is poised for significant growth, driven by a confluence of economic resurgence, strategic government policies, and a consistent influx of global wealth. The market size has witnessed a steady evolution, with a projected substantial increase in value and transaction volumes over the forecast period. Adoption rates for premium properties, particularly those offering exclusive amenities and prime locations, are on an upward trajectory. Technological disruptions are not only reshaping construction but also the customer experience, from initial property search to post-purchase services. Consumer behavior shifts are evident, with a greater emphasis on lifestyle, wellness, and investment security.

The Dubai luxury property market continues to lead this expansion, fueled by its status as a global hub for tourism, business, and investment. Abu Dhabi is also demonstrating robust growth, attracting discerning buyers with its cultural offerings and long-term development plans. The market penetration of ultra-luxury segments is expanding, with new project launches catering to a diverse range of preferences. The Compound Annual Growth Rate (CAGR) is expected to remain strong, reflecting the market's resilience and appeal. Factors such as geopolitical stability in the region, favorable tax regimes, and a high quality of life are contributing to sustained demand. The increasing availability of off-plan properties from reputable developers like Azizi Developments and Sobha Realty provides attractive entry points for investors. Furthermore, the development of integrated communities offering both residential and leisure facilities by companies like Meydan and Meraas is a key trend.

Dominant Regions, Countries, or Segments in Luxury Real Estate Market in UAE

Within the UAE luxury real estate market, Dubai unequivocally stands as the dominant city, driving the lion's share of growth and setting global benchmarks. Its unparalleled infrastructure, world-class amenities, and strategic global connectivity make it a magnet for international investors and affluent residents. The Apartments and Condominiums segment, particularly in prime waterfront and downtown locations, consistently outperforms due to its accessibility, modern design, and integrated lifestyle offerings.

- Dubai:

- Market Share: Consistently holds over 70% of the UAE luxury real estate transactions.

- Key Drivers: Tourism hub status, business-friendly environment, iconic landmarks, ongoing mega-projects.

- Growth Potential: High, driven by continued foreign direct investment and infrastructure development.

- Apartments and Condominiums:

- Market Share: The most sought-after segment within luxury, particularly in Dubai and Abu Dhabi.

- Key Drivers: Availability of high-end finishes, smart home technology, integrated community facilities, security.

- Growth Potential: Robust, with developers like Emaar Properties and Sobha Realty continually launching premium projects.

- Abu Dhabi:

- Market Share: Significant, though smaller than Dubai, showing steady growth.

- Key Drivers: Cultural attractions, focus on quality of life, government investment in infrastructure and tourism.

- Growth Potential: Promising, with a focus on sustainable development and family-oriented communities.

The dominance of Dubai is further amplified by the strategic positioning of major developers like Emaar Properties and Dubai Holding, who consistently deliver landmark projects that capture global attention. The city's ability to innovate in urban planning and create aspirational living environments directly translates to its leading market share in luxury residential sales.

Luxury Real Estate Market in UAE Product Landscape

The luxury real estate product landscape in the UAE is characterized by sophistication, innovation, and an unwavering focus on resident experience. Properties are increasingly defined by their unique selling propositions, ranging from unparalleled architectural designs and expansive living spaces to exclusive amenities and personalized services. Technological advancements are integral, with smart home systems, integrated building management, and sustainable features becoming standard. Performance metrics are measured not only by capital appreciation but also by the quality of life and community engagement offered. Developers like Vincitore Realty are known for their distinctive architectural styles and focus on delivering high-quality, aesthetically pleasing residences.

- Product Innovations: Ultra-modern architectural designs, bespoke interior finishes, expansive private amenities (e.g., private pools, home cinemas).

- Applications: High-net-worth individuals seeking primary residences, vacation homes, and investment opportunities.

- Performance Metrics: High rental yields, significant capital appreciation, premium lifestyle offerings.

- Technological Advancements: Integrated smart home systems, sustainable building materials, advanced security features.

Key Drivers, Barriers & Challenges in Luxury Real Estate Market in UAE

The luxury real estate market in UAE is propelled by several key drivers. Technologically advanced infrastructure, coupled with government initiatives like long-term residency visas (e.g., Golden Visa), significantly attracts global investors and affluent individuals. The UAE's reputation as a safe, stable, and cosmopolitan destination, combined with a robust economy and a high quality of life, acts as a major economic driver. Policy-driven factors, including favorable tax environments and streamlined property ownership regulations, further bolster market attractiveness.

- Key Drivers:

- Economic Growth: Strong GDP growth and a thriving business ecosystem.

- Government Initiatives: Golden Visa, foreign ownership incentives, visa reforms.

- Infrastructure Development: World-class airports, transportation networks, and city planning.

- Safe Haven Appeal: Political stability and security in the region.

However, the market also faces barriers and challenges. Global economic downturns and geopolitical instability can impact investor confidence and demand. High property prices can be a barrier for some segments of the HNWIs. Supply chain disruptions and rising construction costs can affect project delivery timelines and profitability. Intense competition among developers and a need for continuous innovation to meet evolving consumer expectations are also significant challenges.

- Key Barriers & Challenges:

- Global Economic Volatility: Potential impact of global recessions on investment.

- High Entry Costs: Significant capital required for luxury property acquisition.

- Supply Chain Issues: Rising material costs and logistical challenges.

- Intense Competition: Need for differentiation and continuous product innovation.

- Regulatory Evolution: Adapting to new or changing real estate laws.

Emerging Opportunities in Luxury Real Estate Market in UAE

Emerging opportunities in the UAE luxury real estate market are diverse and promising. The growing demand for sustainable and eco-friendly properties presents a significant avenue for developers focusing on green building practices. The rise of branded residences, offering a blend of luxury living and hotel-like services, continues to expand. Furthermore, the development of exclusive communities focusing on wellness and health-conscious lifestyles is gaining traction. The untapped potential in secondary cities and developing emirates, beyond Dubai and Abu Dhabi, offers new investment horizons.

- Sustainable Luxury: Eco-friendly developments and green building certifications.

- Branded Residences: Partnerships with international luxury brands for exclusive living experiences.

- Wellness-Focused Communities: Properties integrating health, fitness, and mindfulness amenities.

- Secondary Market Growth: Exploring investment opportunities in Sharjah, Al Ain, and other emerging cities.

Growth Accelerators in the Luxury Real Estate Market in UAE Industry

Several factors are acting as growth accelerators for the luxury real estate industry in the UAE. The continuous influx of foreign direct investment, particularly from emerging economies, provides sustained capital for the market. Strategic partnerships between leading developers like Aldar Properties and international hospitality brands are creating unique and high-value offerings. The UAE's ongoing commitment to developing world-class infrastructure and urban environments further enhances its appeal as a prime global real estate destination. The government's proactive approach to economic diversification and attracting talent is also a significant catalyst.

- Sustained FDI: Continued investment from international HNWIs and institutional investors.

- Strategic Partnerships: Collaborations with luxury hospitality and lifestyle brands.

- Infrastructure Excellence: Ongoing development of transportation, leisure, and urban amenities.

- Economic Diversification: Reduced reliance on oil and gas, fostering a stable economic environment.

Key Players Shaping the Luxury Real Estate Market in UAE Market

- Azizi Developments

- Meydan

- Dubai Holding

- Emaar Properties

- Vincitore Realty

- Nakheel Properties

- Sobha Realty

- Aldar Properties

- DAMAC Properties

- Meraas

Notable Milestones in Luxury Real Estate Market in UAE Sector

- March 2023: Emaar The Economic City (Emaar EC) agreed to sell a prime beachfront land plot in Murooj Golf Community District, King Abdullah Economic City (KAEC), as an in-kind contribution to Al Bilad Tourism Fund. Emaar EC will acquire units in the fund worth USD 717 million, representing 41.15% of the fund's equity. The fund aims to develop and operate a luxury resort under the Rixos Premium brand, enhancing value creation.

- February 2023: Dubai Holding acquired full ownership of The Westin Paris - Vendome, strengthening its global portfolio and supporting its long-term strategy of expansion in strategic international destinations.

In-Depth Luxury Real Estate Market in UAE Market Outlook

The luxury real estate market in UAE is set for sustained growth, propelled by its inherent appeal as a global hub for investment and lifestyle. The outlook is optimistic, driven by the market's ability to adapt and innovate. Key accelerators include ongoing government support, a robust economic environment, and a continuous influx of international wealth. Opportunities lie in the expansion of sustainable living, branded residences, and the development of niche luxury segments. Strategic investments in infrastructure and a commitment to maintaining a high quality of life will continue to cement the UAE's position as a premier destination for luxury property acquisition. The market is expected to see consistent demand from HNWIs seeking not just properties, but exclusive experiences and sound investment returns.

Luxury Real Estate Market in UAE Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Cities

- 2.1. Dubai

- 2.2. Abu Dhabi

- 2.3. Sharjah

- 2.4. Al Ain

- 2.5. Other Cities

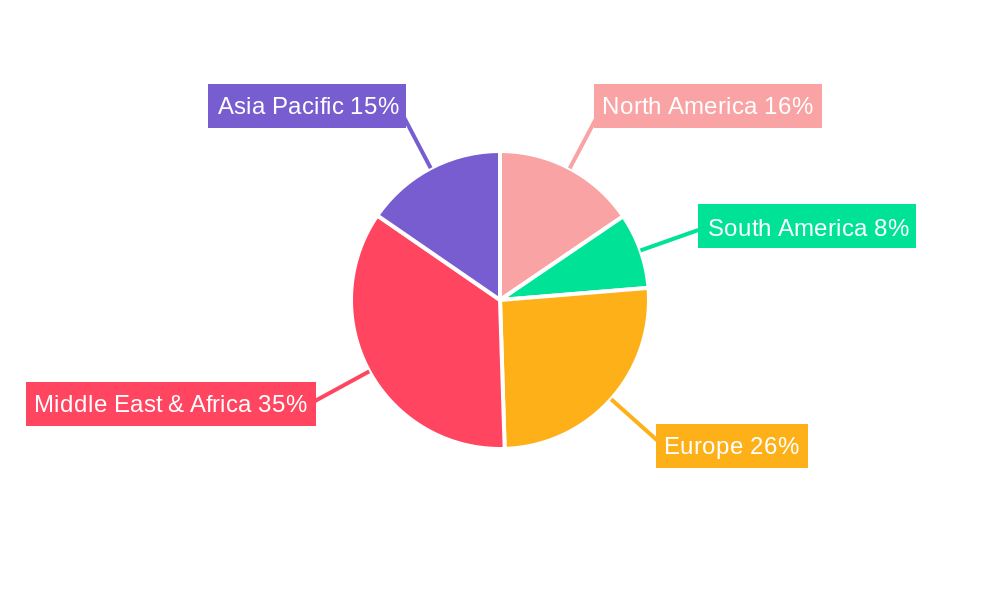

Luxury Real Estate Market in UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Real Estate Market in UAE Regional Market Share

Geographic Coverage of Luxury Real Estate Market in UAE

Luxury Real Estate Market in UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending on the Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Materials and Labor Shortages

- 3.4. Market Trends

- 3.4.1. Post-Expo landscape looks bright for Dubai luxury home market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Dubai

- 5.2.2. Abu Dhabi

- 5.2.3. Sharjah

- 5.2.4. Al Ain

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Villas and Landed Houses

- 6.2. Market Analysis, Insights and Forecast - by Cities

- 6.2.1. Dubai

- 6.2.2. Abu Dhabi

- 6.2.3. Sharjah

- 6.2.4. Al Ain

- 6.2.5. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Villas and Landed Houses

- 7.2. Market Analysis, Insights and Forecast - by Cities

- 7.2.1. Dubai

- 7.2.2. Abu Dhabi

- 7.2.3. Sharjah

- 7.2.4. Al Ain

- 7.2.5. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Villas and Landed Houses

- 8.2. Market Analysis, Insights and Forecast - by Cities

- 8.2.1. Dubai

- 8.2.2. Abu Dhabi

- 8.2.3. Sharjah

- 8.2.4. Al Ain

- 8.2.5. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Villas and Landed Houses

- 9.2. Market Analysis, Insights and Forecast - by Cities

- 9.2.1. Dubai

- 9.2.2. Abu Dhabi

- 9.2.3. Sharjah

- 9.2.4. Al Ain

- 9.2.5. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Real Estate Market in UAE Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Villas and Landed Houses

- 10.2. Market Analysis, Insights and Forecast - by Cities

- 10.2.1. Dubai

- 10.2.2. Abu Dhabi

- 10.2.3. Sharjah

- 10.2.4. Al Ain

- 10.2.5. Other Cities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Azizi Developments

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Meydan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dubai Holding

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Emaar Properties

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vincitore Realty

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nakheel Properties

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sobha Realty

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aldar Properties

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DAMAC Properties**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Meraas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Azizi Developments

List of Figures

- Figure 1: Global Luxury Real Estate Market in UAE Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Real Estate Market in UAE Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Luxury Real Estate Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Luxury Real Estate Market in UAE Revenue (Million), by Cities 2025 & 2033

- Figure 5: North America Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2025 & 2033

- Figure 6: North America Luxury Real Estate Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Luxury Real Estate Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Luxury Real Estate Market in UAE Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Luxury Real Estate Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Luxury Real Estate Market in UAE Revenue (Million), by Cities 2025 & 2033

- Figure 11: South America Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2025 & 2033

- Figure 12: South America Luxury Real Estate Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Luxury Real Estate Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Luxury Real Estate Market in UAE Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Luxury Real Estate Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Luxury Real Estate Market in UAE Revenue (Million), by Cities 2025 & 2033

- Figure 17: Europe Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2025 & 2033

- Figure 18: Europe Luxury Real Estate Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Luxury Real Estate Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Luxury Real Estate Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million), by Cities 2025 & 2033

- Figure 23: Middle East & Africa Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2025 & 2033

- Figure 24: Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Luxury Real Estate Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Luxury Real Estate Market in UAE Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Luxury Real Estate Market in UAE Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Luxury Real Estate Market in UAE Revenue (Million), by Cities 2025 & 2033

- Figure 29: Asia Pacific Luxury Real Estate Market in UAE Revenue Share (%), by Cities 2025 & 2033

- Figure 30: Asia Pacific Luxury Real Estate Market in UAE Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Luxury Real Estate Market in UAE Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2020 & 2033

- Table 3: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2020 & 2033

- Table 6: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2020 & 2033

- Table 12: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2020 & 2033

- Table 18: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2020 & 2033

- Table 30: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Cities 2020 & 2033

- Table 39: Global Luxury Real Estate Market in UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Luxury Real Estate Market in UAE Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Real Estate Market in UAE?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Luxury Real Estate Market in UAE?

Key companies in the market include Azizi Developments, Meydan, Dubai Holding, Emaar Properties, Vincitore Realty, Nakheel Properties, Sobha Realty, Aldar Properties, DAMAC Properties**List Not Exhaustive, Meraas.

3. What are the main segments of the Luxury Real Estate Market in UAE?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending on the Commercial Construction.

6. What are the notable trends driving market growth?

Post-Expo landscape looks bright for Dubai luxury home market.

7. Are there any restraints impacting market growth?

Materials and Labor Shortages.

8. Can you provide examples of recent developments in the market?

March 2023: Emaar The Economic City (Emaar EC) agreed to sell a prime beachfront land plot in Murooj Golf Community District, King Abdullah Economic City (KAEC), as an in-kind contribution to Al Bilad Tourism Fund. It is a Capital Market Authority (CMA)-regulated Shariah-compliant closed-end private real estate investment fund. In return for the land sale, Emaar EC will acquire units in the fund worth SAR 269.2 million (USD 717 million), representing 41.15% of the fund's equity. The fund strategy is to develop and operate the resort under the Rixos Premium brand (an all-inclusive luxury resort and waterpark comprising around 550 properties with lifestyle, retail, and food and beverage offerings). This is to create value and exit at the planned maturity of 12 years, said the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Real Estate Market in UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Real Estate Market in UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Real Estate Market in UAE?

To stay informed about further developments, trends, and reports in the Luxury Real Estate Market in UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence