Key Insights

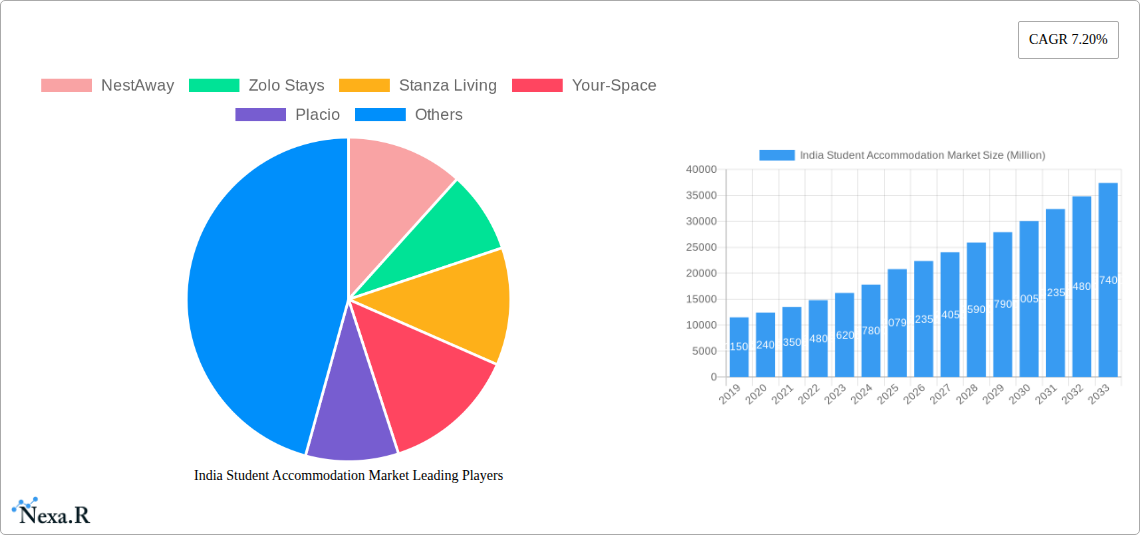

The India Student Accommodation Market is poised for significant expansion, projected to reach an estimated USD 20.79 billion by 2025, demonstrating robust growth with a projected CAGR of 7.2% over the forecast period of 2025-2033. This burgeoning market is primarily fueled by escalating student enrollments in higher education institutions across India and a growing preference for organized and safe living spaces. The increasing urbanization and a substantial influx of students from smaller towns and rural areas to metropolitan cities are further amplifying the demand for dedicated student housing solutions. Key market drivers include the need for improved living standards, enhanced security, and a conducive academic environment, which traditional rental accommodations often fail to provide. The growing disposable income among the student demographic and their parents also plays a pivotal role in driving the adoption of premium student accommodation services.

India Student Accommodation Market Market Size (In Billion)

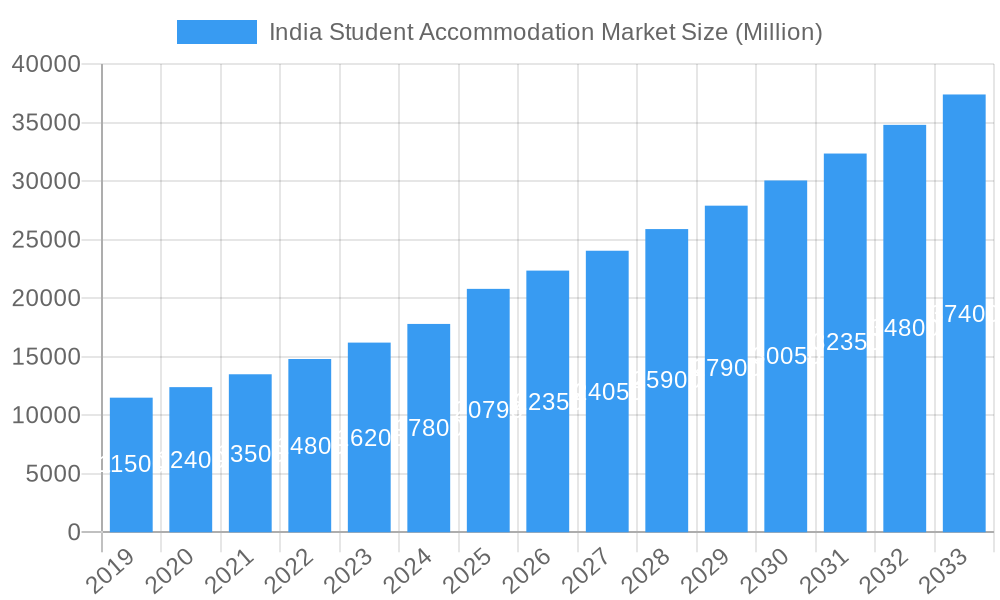

The market is characterized by a dynamic evolution of service types and accommodation formats catering to diverse student needs. While Wi-Fi, laundry, and utility services are standard offerings, specialized amenities like dishwashers and readily available parking are becoming increasingly sought after. The accommodation landscape itself is diversifying, with the rise of Purpose-Built Student Accommodation (PBSA) and managed PG (Paying Guest) facilities, alongside the continued presence of studio apartments and on-campus and off-campus housing options. Leading companies such as NestAway, Zolo Stays, Stanza Living, and OYO Life are actively innovating and expanding their footprints, offering a spectrum of services from budget-friendly to premium living experiences. This competitive environment fosters better service quality and drives market growth, though challenges like rising operational costs and the need for consistent regulatory frameworks remain areas for focus. The market's trajectory indicates a sustained demand for professionally managed student housing that prioritizes student well-being and academic success.

India Student Accommodation Market Company Market Share

India Student Accommodation Market: Comprehensive Growth Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the India Student Accommodation Market, a rapidly expanding sector driven by a burgeoning student population and evolving living preferences. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers critical insights into market dynamics, growth trends, regional dominance, product landscape, key challenges, and emerging opportunities. For industry professionals seeking to understand the intricacies of this vital market, this report delivers actionable intelligence. All monetary values are presented in billions of USD.

India Student Accommodation Market Market Dynamics & Structure

The India Student Accommodation Market is characterized by a moderate to high level of concentration, with established players actively consolidating their positions through strategic acquisitions and service expansions. Technological innovation is a significant driver, with companies leveraging digital platforms for bookings, property management, and enhanced resident experiences. The regulatory framework, while evolving, is becoming more conducive to organized student housing, fostering greater transparency and standardization. Competitive product substitutes, such as traditional rental apartments and on-campus dormitories, continue to exist, but purpose-built student accommodation (PBSA) and managed PG accommodations are gaining traction due to their comprehensive service offerings. End-user demographics are increasingly sophisticated, with students and their parents prioritizing safety, comfort, connectivity, and convenience. Merger and acquisition (M&A) trends are on the rise as larger players seek to expand their geographical reach and service portfolios, aiming for economies of scale and market leadership. The market is projected to witness substantial M&A activity, with an estimated $1.5 billion in deal volumes anticipated during the forecast period.

- Market Concentration: Moderate to High, with key players dominating specific regions.

- Technological Innovation Drivers: Propelled by demand for seamless booking platforms, AI-driven property management, and smart living solutions.

- Regulatory Frameworks: Increasingly supportive of organized student housing, focusing on safety and quality standards.

- Competitive Product Substitutes: Traditional rentals, on-campus housing, and informal PG accommodations.

- End-User Demographics: Students and parents prioritizing safety, convenience, and digital integration.

- M&A Trends: Accelerating as companies seek market expansion and competitive advantage.

India Student Accommodation Market Growth Trends & Insights

The India Student Accommodation Market is experiencing robust growth, propelled by a significant increase in student enrollment and a widening gap between the demand for quality housing and available supply. The market size is projected to grow from an estimated $7.2 billion in the base year 2025 to $15.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 10.2% during the forecast period. Adoption rates for organized student housing solutions, particularly Purpose-Built Student Accommodation (PBSA) and professionally managed Paying Guest (PG) facilities, are surging. This shift is driven by a growing awareness among students and parents about the benefits of secure, well-serviced living environments. Technological disruptions are playing a pivotal role, with the integration of smart home technologies, AI-powered management systems, and mobile-first booking and communication platforms transforming the resident experience. Consumer behavior is shifting towards a preference for hassle-free living, encompassing amenities like high-speed Wi-Fi, laundry services, and security features, all of which are readily available in managed student accommodations. The increasing urbanization and the establishment of new educational institutions in Tier 2 and Tier 3 cities are further fueling the demand for student housing. The penetration of organized student accommodation is expected to rise from an estimated 25% in 2025 to over 40% by 2033, indicating a significant market transformation. Furthermore, the rise of the co-living concept, adapted for student needs, is creating new avenues for growth. The digital transformation in education, with a rise in online courses and hybrid learning models, is also influencing demand patterns, requiring flexible and accessible accommodation options. The growing disposable income of middle-class families in India is enabling greater investment in premium student housing. The market's growth trajectory is also supported by government initiatives aimed at improving educational infrastructure and student welfare.

Dominant Regions, Countries, or Segments in India Student Accommodation Market

The India Student Accommodation Market's dominance is significantly influenced by key regions, with metropolitan cities and educational hubs spearheading growth. Major Metropolitan Cities (e.g., Delhi NCR, Mumbai, Bengaluru, Pune, Hyderabad) are currently the most dominant regions, driven by the presence of a high concentration of universities, colleges, and professional institutes, attracting a vast student influx. The Type segment of Purpose-Built Student Accommodation (PBSA) is also a major growth driver, experiencing rapid adoption due to its modern amenities, security features, and community living aspects, expected to capture an estimated 35% market share by 2028. The Service Type of Wi-Fi and Utilities collectively accounts for the largest share within service offerings, with an estimated 40% of the market value, as seamless internet connectivity and essential services are non-negotiable for students.

Dominant Region: Major Metropolitan Cities:

- High concentration of educational institutions, attracting a substantial student population.

- Robust infrastructure and connectivity facilitate easy access and urban lifestyle.

- Presence of established players and higher disposable incomes contribute to market growth.

- Examples include Delhi NCR, Bengaluru, Mumbai, Pune, and Hyderabad.

Dominant Segment (Type): Purpose-Built Student Accommodation (PBSA):

- Offers dedicated facilities, enhanced security, and a conducive living environment.

- Appeals to both students and parents seeking quality and convenience.

- Projected to grow at a CAGR of 12% from 2025-2033.

Dominant Segment (Service Type): Wi-Fi and Utilities:

- Essential for academic pursuits, communication, and entertainment.

- High demand across all student demographics.

- Bundled packages offered by accommodation providers enhance value proposition.

The dominance of these regions and segments is further amplified by supportive economic policies, increasing foreign student enrollment, and a growing trend of students preferring off-campus housing for greater independence and customized living experiences. Market share for PBSA is projected to reach $5.5 billion by 2028. The demand for Wi-Fi and Utilities is anticipated to grow to $6.3 billion by the same year.

India Student Accommodation Market Product Landscape

The product landscape of the India Student Accommodation Market is characterized by innovation focused on delivering a seamless and enriching living experience for students. Key product innovations include fully furnished rooms, communal study spaces, recreational facilities, and integrated smart home technology for enhanced convenience and security. Applications range from individual student rooms to shared apartments designed for collaborative living. Performance metrics are increasingly evaluated based on resident satisfaction scores, occupancy rates, and the seamless integration of digital platforms for bookings, rent payments, and service requests. Unique selling propositions often revolve around all-inclusive rental packages that cover utilities, internet, and regular cleaning services, alleviating the burden of separate bill payments. Technological advancements are evident in the adoption of AI-powered property management systems for efficient operations and personalized resident support.

Key Drivers, Barriers & Challenges in India Student Accommodation Market

Key Drivers: The India Student Accommodation Market is primarily driven by the relentless surge in student enrollment numbers across the nation, coupled with a significant demand for organized and safe living spaces. Economic growth and rising disposable incomes enable students and their families to invest in better accommodation. Technological advancements, particularly in digital platforms for booking and management, enhance convenience and accessibility. Government initiatives promoting education and skill development indirectly fuel demand for student housing.

- Drivers:

- Rapidly increasing student population.

- Growing preference for organized and safe living environments.

- Economic growth and rising disposable incomes.

- Technological integration in booking and management.

Barriers & Challenges: Significant challenges include the substantial capital investment required for developing purpose-built facilities, leading to a supply-demand gap in many emerging locations. Regulatory hurdles and lengthy approval processes can impede rapid expansion. Intense competition from unorganized sectors and traditional rental markets can put pressure on pricing. Infrastructure development in Tier 2 and Tier 3 cities can be a bottleneck. Supply chain issues for construction materials can also affect development timelines. The estimated financial impact of supply chain disruptions could lead to a 5-8% increase in development costs.

- Barriers & Challenges:

- High capital investment and limited supply.

- Complex regulatory landscape and approval processes.

- Competition from unorganized players.

- Infrastructure limitations in certain regions.

- Supply chain vulnerabilities.

Emerging Opportunities in India Student Accommodation Market

Emerging opportunities lie in the untapped potential of Tier 2 and Tier 3 cities, where the demand for quality student housing is rapidly escalating with the establishment of new educational institutions. The integration of smart technologies and sustainable building practices presents avenues for differentiated offerings. Co-living concepts tailored for student needs, focusing on community building and shared resources, are gaining traction. Furthermore, partnerships with educational institutions to provide integrated accommodation solutions offer a significant growth avenue. The demand for specialized student accommodation for postgraduate and international students also presents niche opportunities.

Growth Accelerators in the India Student Accommodation Market Industry

Growth accelerators in the India Student Accommodation Market industry are primarily fueled by technological breakthroughs in property management and resident engagement, leading to improved operational efficiencies and enhanced customer experiences. Strategic partnerships between accommodation providers, educational institutions, and technology firms are crucial for expanding market reach and developing integrated solutions. Market expansion strategies focusing on underserved regions and developing innovative, flexible accommodation models to cater to diverse student needs will further catalyze long-term growth. The increasing adoption of modular construction techniques can also accelerate the development of new properties.

Key Players Shaping the India Student Accommodation Market Market

- NestAway

- Zolo Stays

- Stanza Living

- Your-Space

- Placio

- StayAbode

- Weroom

- OYO Life

- CoHo

Notable Milestones in India Student Accommodation Market Sector

- 2019: Increased funding rounds for several major student housing startups, indicating growing investor confidence.

- 2020: Introduction of enhanced safety and hygiene protocols by leading players in response to the global pandemic.

- 2021: Expansion of PBSA offerings into Tier 2 and Tier 3 cities, addressing unmet demand.

- 2022: Strategic partnerships between accommodation providers and ed-tech platforms to offer bundled services.

- 2023: Increased adoption of smart home technologies and digital payment solutions across the sector.

- 2024: Focus on sustainable building practices and eco-friendly amenities gaining momentum.

In-Depth India Student Accommodation Market Market Outlook

The India Student Accommodation Market is poised for substantial growth, driven by persistent demand from a growing student populace and evolving living preferences. Future market potential is anchored in the expansion into emerging cities and the development of technologically advanced, community-centric living spaces. Strategic opportunities abound in forming synergistic partnerships with educational bodies and leveraging data analytics to personalize resident experiences. The market is expected to witness continued innovation in service offerings, with a growing emphasis on holistic student well-being, including access to career development resources and mental health support. The projected market size is anticipated to reach $15.8 billion by 2033, underscoring its significant economic impact.

India Student Accommodation Market Segmentation

-

1. Service Type

- 1.1. Wi-Fi

- 1.2. Laundry

- 1.3. Utilities

- 1.4. Dishwasher

- 1.5. Parking

-

2. Type

- 2.1. PG

- 2.2. PBSA

- 2.3. Studio Apartment

- 2.4. Live in On-Campus Housing

- 2.5. Live in Off-Campus Housing

India Student Accommodation Market Segmentation By Geography

- 1. India

India Student Accommodation Market Regional Market Share

Geographic Coverage of India Student Accommodation Market

India Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Education Sector; Rising Demand for Quality Accomodation

- 3.3. Market Restrains

- 3.3.1. Enrolment Fluctuations

- 3.4. Market Trends

- 3.4.1. Urbanization Helping to Grow the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Wi-Fi

- 5.1.2. Laundry

- 5.1.3. Utilities

- 5.1.4. Dishwasher

- 5.1.5. Parking

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PG

- 5.2.2. PBSA

- 5.2.3. Studio Apartment

- 5.2.4. Live in On-Campus Housing

- 5.2.5. Live in Off-Campus Housing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NestAway

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zolo Stays

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stanza Living

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Your-Space

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Placio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 StayAbode

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Weroom**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OYO Life

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CoHo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NestAway

List of Figures

- Figure 1: India Student Accommodation Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Student Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: India Student Accommodation Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 2: India Student Accommodation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: India Student Accommodation Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Student Accommodation Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 5: India Student Accommodation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: India Student Accommodation Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Student Accommodation Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the India Student Accommodation Market?

Key companies in the market include NestAway, Zolo Stays, Stanza Living, Your-Space, Placio, StayAbode, Weroom**List Not Exhaustive, OYO Life, CoHo.

3. What are the main segments of the India Student Accommodation Market?

The market segments include Service Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growth of Education Sector; Rising Demand for Quality Accomodation.

6. What are the notable trends driving market growth?

Urbanization Helping to Grow the Market.

7. Are there any restraints impacting market growth?

Enrolment Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Student Accommodation Market?

To stay informed about further developments, trends, and reports in the India Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence