Key Insights

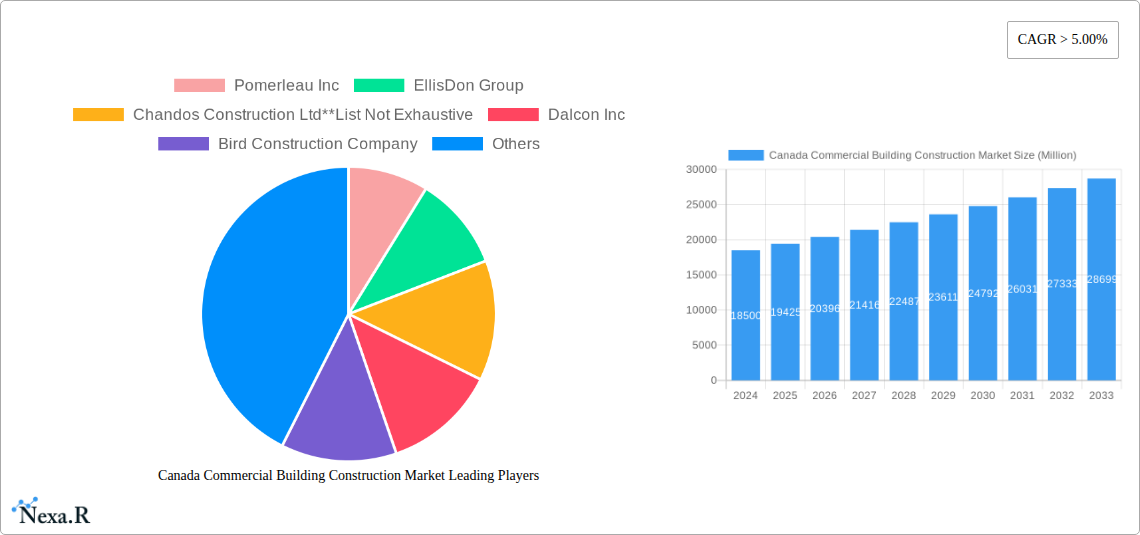

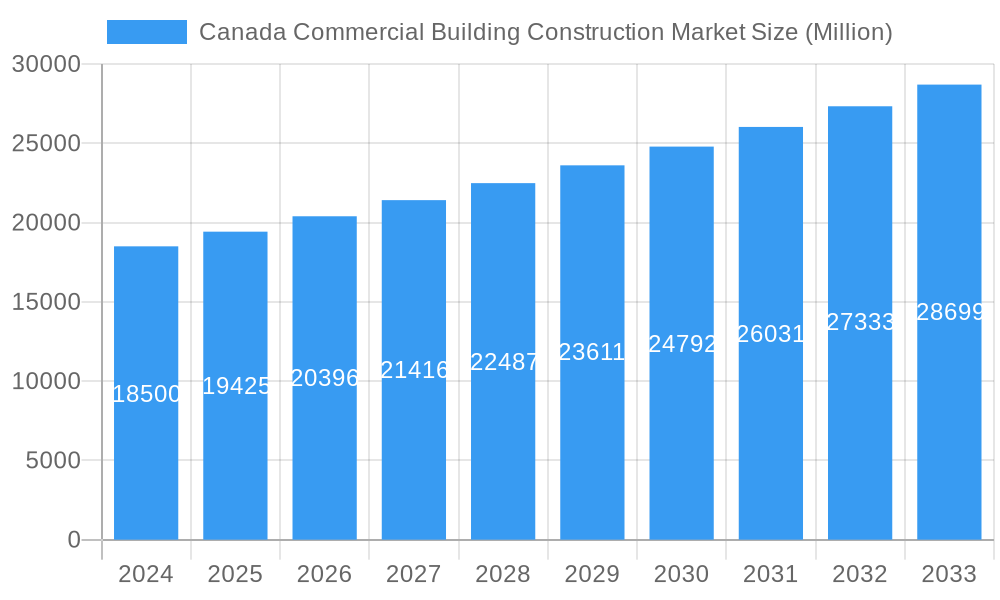

The Canadian commercial building construction market is projected to experience substantial growth, reaching an estimated market size of $39.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 0.9%. This expansion is largely driven by significant investments in the hospitality and office building sectors. Growing demand for modern, adaptable workspaces, alongside a recovery in tourism and business travel, is fueling new construction and renovation projects. Furthermore, ongoing infrastructure development and the increasing need for institutional facilities, such as healthcare and educational institutions, are contributing to this positive market trend. Key urban centers, including Toronto, Ottawa, and Vancouver, are leading this growth due to their economic strength and population increases. Major industry participants like Pomerleau Inc., EllisDon Group, and PCL Construction are actively involved in these developments, indicating a competitive market focused on innovation and scale.

Canada Commercial Building Construction Market Market Size (In Billion)

Several key trends are expected to shape the future of this market. A heightened focus on sustainable construction, encompassing green building materials and energy-efficient designs, is emerging as a critical differentiator. The integration of smart building technologies to improve operational efficiency and occupant experience is also gaining momentum. However, the market faces challenges such as rising material costs and labor shortages, which may impact the pace of growth. Supply chain disruptions and increasing financing costs also present hurdles for developers and contractors. Despite these obstacles, robust demand for commercial spaces, supported by economic recovery and demographic shifts, underscores the resilience and evolving nature of the Canadian commercial building construction sector throughout the forecast period (2025-2033).

Canada Commercial Building Construction Market Company Market Share

Gain comprehensive insights into the dynamic Canadian Commercial Building Construction Market. This report provides an in-depth analysis of market size, growth trends, segmentation, key players, and emerging opportunities, based on meticulous research and data-driven forecasts. We examine the interplay of commercial construction trends, real estate development, and infrastructure investment across Canada. Explore parent and child market dynamics, understanding the contributions of segments such as Office Building Construction, Retail Construction, and Institutional Construction. This report serves as your essential guide to navigating the evolving Canadian commercial real estate development landscape, from major cities like Toronto, Ottawa, and Vancouver to the Rest of Canada.

Canada Commercial Building Construction Market Market Dynamics & Structure

The Canada Commercial Building Construction Market is characterized by a moderately consolidated structure, with a handful of large players holding significant market share. However, the presence of a substantial number of regional and specialized contractors fosters a competitive environment. Technological innovation is a key driver, with advancements in Building Information Modeling (BIM), prefabrication, and sustainable construction practices enhancing efficiency and project delivery. Regulatory frameworks, including building codes, zoning laws, and environmental standards, significantly influence project feasibility and timelines. While direct competitive product substitutes within construction services are limited, alternative investment vehicles for commercial real estate can indirectly impact demand. End-user demographics, such as corporate office space requirements and retail consumer behavior shifts, are critical determinants of segment growth. Mergers and acquisitions (M&A) are a notable trend, as larger firms seek to expand their capabilities, geographic reach, and market share.

- Market Concentration: Dominated by major national players with substantial regional presence.

- Technological Innovation: Driven by BIM, modular construction, and green building technologies.

- Regulatory Frameworks: Influence project approvals, sustainability standards, and safety protocols.

- End-User Demographics: Shifting demand for flexible office spaces and experiential retail.

- M&A Activity: Indicates a trend towards consolidation and strategic expansion.

Canada Commercial Building Construction Market Growth Trends & Insights

The Canada Commercial Building Construction Market is poised for robust growth over the forecast period, driven by a confluence of economic, demographic, and technological factors. The market size is projected to expand significantly, fueled by ongoing urbanization, a growing population, and increasing business investment. Adoption rates for advanced construction technologies, such as prefabrication and smart building systems, are accelerating, leading to improved project timelines and cost efficiencies. Technological disruptions are reshaping design, construction, and operational phases, with a focus on sustainability and occupant well-being. Consumer behavior shifts, particularly in the retail and office sectors, are prompting a re-evaluation of existing commercial spaces and the development of new, adaptive designs. The CAGR for the forecast period is estimated to be robust, indicating a sustained upward trajectory. Market penetration of sustainable building practices is also on the rise, aligning with Canada's environmental goals.

Dominant Regions, Countries, or Segments in Canada Commercial Building Construction Market

The Office Building Construction segment is anticipated to be a dominant force in the Canada Commercial Building Construction Market, driven by evolving work models and the demand for modern, flexible, and sustainable office spaces. Major urban centers, particularly Toronto, are expected to lead market growth due to their economic vitality, significant corporate presence, and ongoing urban development initiatives. The Rest of Canada also presents substantial growth opportunities, with a focus on diversified economic bases and increasing infrastructure investments in various provinces.

- Dominant Segment: Office Building Construction, responding to hybrid work trends and the need for collaborative spaces.

- Leading Cities:

- Toronto: A hub for corporate headquarters, driving demand for high-rise office towers and mixed-use developments.

- Ottawa: Government sector and tech industry growth contribute to steady office construction.

- Vancouver: Booming tech sector and population growth fuel demand for modern office facilities.

- Key Drivers:

- Economic Policies: Government incentives and investments in business growth.

- Infrastructure Development: Expansion of transportation networks and urban renewal projects.

- Technological Advancements: Adoption of smart building technologies and sustainable design.

- Population Growth: Increasing demand for commercial services and amenities.

- Growth Potential in Rest of Canada: Emerging economic hubs and resource sector investments stimulating construction activity.

Canada Commercial Building Construction Market Product Landscape

The product landscape within the Canada Commercial Building Construction Market is marked by a continuous drive for innovation and enhanced performance. Advancements in building materials, such as high-strength concrete, advanced insulation technologies, and sustainable wood products, are enabling the construction of more durable, energy-efficient, and environmentally responsible buildings. Digital tools, including sophisticated design software and virtual reality for client visualization, are becoming standard. Prefabricated and modular construction components are gaining traction for their ability to accelerate project timelines and improve quality control. The focus is increasingly on integrated building systems that optimize energy consumption, occupant comfort, and operational efficiency, setting new benchmarks for performance metrics in the industry.

Key Drivers, Barriers & Challenges in Canada Commercial Building Construction Market

The Canada Commercial Building Construction Market is propelled by several key drivers, including sustained economic growth, increasing foreign investment, and government initiatives promoting infrastructure development and green building practices. Technological advancements in construction methodologies and materials further accelerate project delivery and improve sustainability.

However, significant barriers and challenges exist. Supply chain disruptions, particularly for critical materials and skilled labor shortages, pose considerable risks to project timelines and costs. Stringent regulatory frameworks and permitting processes can lead to delays. Competitive pressures from both established players and new entrants, coupled with fluctuating material prices, create an uncertain operating environment.

Emerging Opportunities in Canada Commercial Building Construction Market

Emerging opportunities in the Canada Commercial Building Construction Market lie in the growing demand for sustainable and net-zero buildings, driven by environmental consciousness and regulatory pressures. The rise of the data center construction sector presents a significant growth avenue due to increasing digital infrastructure needs. Furthermore, the redevelopment and adaptive reuse of existing commercial spaces to meet new functional requirements, such as mixed-use developments and co-working spaces, offer substantial untapped potential. Investment in healthcare and institutional facilities, particularly in underserved regions, also represents a promising opportunity.

Growth Accelerators in the Canada Commercial Building Construction Market Industry

Several catalysts are accelerating long-term growth in the Canada Commercial Building Construction Market. The ongoing commitment to green building standards and the pursuit of net-zero emissions targets are driving innovation in sustainable materials and construction techniques. Strategic partnerships between construction firms, technology providers, and material suppliers are fostering collaborative development and the adoption of cutting-edge solutions. Government investments in public infrastructure projects and urban revitalization initiatives are creating sustained demand. Furthermore, the increasing adoption of digital twins and advanced analytics in project management and building operations are enhancing efficiency and predictive capabilities, leading to more predictable outcomes and cost savings.

Key Players Shaping the Canada Commercial Building Construction Market Market

- Pomerleau Inc

- EllisDon Group

- Chandos Construction Ltd

- Dalcon Inc

- Bird Construction Company

- Heatherbrae Builders

- Graham Group Ltd

- IDL Projects Inc

- PCL Construction

- SNC-Lavalin Group Inc

Notable Milestones in Canada Commercial Building Construction Market Sector

- March 2022: Anthem Properties and KingSett Capital acquired an 8.34-acre mixed-use site in Burnaby, developing a four-phased master-planned community including 2,100 market condominiums, 340 rental units, and 60,000 sq ft of retail and office spaces.

- January 2022: Bird Construction Inc. partnered with Chandos Construction Inc. for the "Building Good" initiative, a thought leadership program aimed at transforming architectural, engineering, and construction practices for societal and environmental betterment.

In-Depth Canada Commercial Building Construction Market Market Outlook

The future outlook for the Canada Commercial Building Construction Market is exceptionally positive, driven by a strong pipeline of infrastructure projects and a sustained demand for modern, sustainable commercial spaces. Growth accelerators include the increasing adoption of advanced construction technologies, such as AI-powered project management and robotic automation, which promise enhanced efficiency and safety. Strategic alliances aimed at developing innovative and sustainable building solutions will further propel the market forward. The ongoing focus on urban densification and the creation of resilient, community-oriented developments will shape future construction trends, offering significant opportunities for market expansion and value creation.

Canada Commercial Building Construction Market Segmentation

-

1. Type

- 1.1. Hospitality Construction

- 1.2. Office Building Construction

- 1.3. Retail Construction

- 1.4. Institutional Construction

- 1.5. Other Types

-

2. Key Cities

- 2.1. Toronto

- 2.2. Ottawa

- 2.3. Vancouver

- 2.4. Rest of Canada

Canada Commercial Building Construction Market Segmentation By Geography

- 1. Canada

Canada Commercial Building Construction Market Regional Market Share

Geographic Coverage of Canada Commercial Building Construction Market

Canada Commercial Building Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry; Need for Precast Concrete Technology Driving the Market

- 3.3. Market Restrains

- 3.3.1. Higher Transportation Cost

- 3.4. Market Trends

- 3.4.1. Office Building Construction is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Commercial Building Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hospitality Construction

- 5.1.2. Office Building Construction

- 5.1.3. Retail Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Toronto

- 5.2.2. Ottawa

- 5.2.3. Vancouver

- 5.2.4. Rest of Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pomerleau Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EllisDon Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chandos Construction Ltd**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dalcon Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bird Construction Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Heatherbrae Builders

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Graham Group Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDL Projects Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PCL Construction

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SNC-Lavalin Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pomerleau Inc

List of Figures

- Figure 1: Canada Commercial Building Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Commercial Building Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Commercial Building Construction Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Canada Commercial Building Construction Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: Canada Commercial Building Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Commercial Building Construction Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Canada Commercial Building Construction Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: Canada Commercial Building Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Commercial Building Construction Market?

The projected CAGR is approximately 0.9%.

2. Which companies are prominent players in the Canada Commercial Building Construction Market?

Key companies in the market include Pomerleau Inc, EllisDon Group, Chandos Construction Ltd**List Not Exhaustive, Dalcon Inc, Bird Construction Company, Heatherbrae Builders, Graham Group Ltd, IDL Projects Inc, PCL Construction, SNC-Lavalin Group Inc.

3. What are the main segments of the Canada Commercial Building Construction Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry; Need for Precast Concrete Technology Driving the Market.

6. What are the notable trends driving market growth?

Office Building Construction is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Higher Transportation Cost.

8. Can you provide examples of recent developments in the market?

March 2022: Anthem Properties (a Canadian development, investment, and management company), along with KingSett Capital (a capital market company), have acquired an 8.34-acre mixed-use site located at Willingdon Avenue and Dawson Street in the City of Burnaby's active Brentwood Town Centre. The company developed this space into a four-phased master-planned community, including 2,100 market condominiums, 340 rental units, and 60,000 square feet of new retail and office spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Commercial Building Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Commercial Building Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Commercial Building Construction Market?

To stay informed about further developments, trends, and reports in the Canada Commercial Building Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence