Key Insights

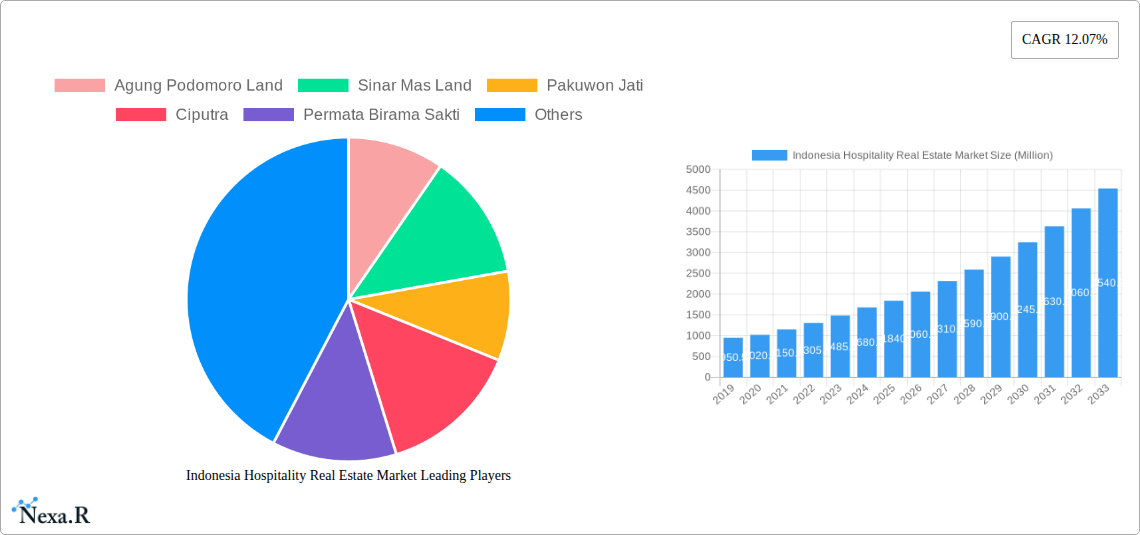

The Indonesia Hospitality Real Estate Market is poised for significant expansion, projected to reach an estimated USD 1.84 Billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 12.07% throughout the forecast period of 2025-2033. This impressive growth is fueled by several key drivers, including the burgeoning tourism sector, increased disposable incomes, and supportive government initiatives aimed at boosting infrastructure development and promoting tourism. As Indonesia continues to attract both domestic and international travelers, the demand for quality accommodation, including hotels, resorts, and spas, is escalating. The evolving preferences of modern travelers, seeking unique experiences and luxurious amenities, are also shaping the market, encouraging developers to innovate and diversify their offerings. This dynamic environment presents lucrative opportunities for investors and stakeholders within the hospitality real estate landscape.

Indonesia Hospitality Real Estate Market Market Size (In Million)

The market's expansion is further characterized by emerging trends such as the rise of eco-friendly and sustainable properties, the integration of smart technologies for enhanced guest experiences, and the development of mixed-use properties that combine hospitality with retail and residential components. While the outlook is overwhelmingly positive, certain restraints, such as land acquisition challenges in prime locations and evolving regulatory frameworks, warrant strategic consideration. Key segments within this market include Hotels and Accommodation, Spas and Resorts, and Other Property Types, each contributing to the overall market value. Prominent companies like Agung Podomoro Land, Sinar Mas Land, and Pakuwon Jati are actively investing and developing projects, underscoring the competitive yet opportunity-rich nature of the Indonesia Hospitality Real Estate Market. The focus on enhancing infrastructure and promoting diverse tourist destinations within Indonesia will continue to be a critical factor in sustaining this growth trajectory.

Indonesia Hospitality Real Estate Market Company Market Share

Indonesia Hospitality Real Estate Market: Comprehensive Analysis & Future Outlook (2019-2033)

Gain a strategic advantage in the burgeoning Indonesian hospitality real estate sector with this in-depth report. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the pivotal players shaping the future of hotels and accommodation, spas and resorts, and other property types. Essential for investors, developers, and industry professionals seeking to navigate and capitalize on one of Southeast Asia's most dynamic real estate markets.

Indonesia Hospitality Real Estate Market Market Dynamics & Structure

The Indonesian hospitality real estate market is characterized by a moderately concentrated structure, with a few large-scale developers and hotel operators holding significant market share. Technological innovation is increasingly driving the adoption of smart building solutions, energy-efficient designs, and integrated property management systems, particularly in response to growing demand for sustainable tourism. Regulatory frameworks, while evolving to support foreign investment and streamline development processes, can still present challenges, particularly concerning land acquisition and zoning laws. Competitive product substitutes include alternative accommodation options like serviced apartments and short-term rental platforms, necessitating a focus on unique guest experiences and premium amenities within traditional hospitality properties. End-user demographics are diversifying, with a growing segment of millennial and Gen Z travelers prioritizing experiences, wellness, and sustainable practices, influencing hotel design and service offerings. Mergers and acquisition (M&A) trends are observed as established players seek to expand their portfolios and geographical reach, driven by the potential for high returns in popular tourist destinations and developing economic hubs.

- Market Concentration: Dominated by a mix of large, publicly listed conglomerates and specialized hospitality development firms.

- Technological Innovation: Focus on IoT integration for guest services, energy management systems (EMS), and sustainable building materials.

- Regulatory Frameworks: Government initiatives to boost tourism and foreign investment are crucial, but local regulations can impact development timelines.

- Competitive Landscape: Intense competition from serviced apartments and alternative lodging, pushing for differentiation in service and experience.

- End-User Demographics: Shifting preferences towards experiential travel, eco-tourism, and wellness-focused stays.

- M&A Trends: Strategic acquisitions to gain market share and access prime locations; an estimated 15-20 M&A deals in the past two years, valuing in the hundreds of millions of dollars.

Indonesia Hospitality Real Estate Market Growth Trends & Insights

The Indonesia hospitality real estate market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025-2033. This expansion is underpinned by a rising middle class, increasing disposable incomes, and a concerted government effort to boost international and domestic tourism. Market size evolution indicates a significant increase in investment value, with the market valued at an estimated $20,000 million in 2025, and projected to reach $40,000 million by 2033. Adoption rates for sustainable building practices and smart technologies are accelerating, driven by both consumer demand and regulatory incentives. Technological disruptions are evident in the rise of integrated booking platforms, personalized guest experiences powered by AI, and the development of mixed-use hospitality projects that combine hotels with retail and residential components. Consumer behavior shifts are clearly demonstrating a preference for unique, authentic, and health-conscious travel experiences. The penetration of branded hotels in secondary cities is increasing, indicating a wider geographic distribution of modern hospitality infrastructure.

- Market Size Evolution: Expected to double its value from an estimated $20,000 million in 2025 to $40,000 million by 2033.

- CAGR: Projecting a steady growth of approximately 7.5% from 2025 to 2033.

- Adoption Rates: Rapid adoption of eco-friendly materials and renewable energy solutions by leading developers.

- Technological Disruptions: Integration of AI for personalized guest services and advanced property management systems.

- Consumer Behavior Shifts: Growing demand for wellness tourism, sustainable travel, and authentic local experiences.

- Market Penetration: Expansion of hotel brands into emerging tourist destinations and secondary cities.

Dominant Regions, Countries, or Segments in Indonesia Hospitality Real Estate Market

Within the Indonesia hospitality real estate market, Hotels and Accommodation emerge as the dominant segment, consistently driving market growth and investment. This segment benefits from a broad appeal to both leisure and business travelers, supported by expanding infrastructure and a growing tourism industry. While Bali remains a perennial powerhouse for luxury resorts and villas, other regions like Greater Jakarta are witnessing significant growth in business hotels and integrated developments. The archipelago's diverse attractions, from the cultural heart of Yogyakarta to the natural beauty of Lombok and the emerging destinations in Sumatra and Kalimantan, are fueling demand across various property types. The "Other Property Types" segment, encompassing serviced apartments, co-living spaces, and boutique guesthouses, is also experiencing a surge in popularity due to evolving lifestyle preferences and the need for flexible accommodation solutions.

- Dominant Segment: Hotels and Accommodation, accounting for an estimated 65% of the total market value.

- Key Regions:

- Bali: Continues to lead in luxury resorts and villas, attracting high-net-worth individuals.

- Greater Jakarta: Dominant in business hotels, convention facilities, and integrated mixed-use developments.

- Emerging Destinations: Regions like Yogyakarta, Lombok, and parts of Sumatra are showing significant growth potential.

- Drivers of Dominance:

- Economic Policies: Government focus on tourism development and infrastructure upgrades (e.g., airport expansion, new toll roads).

- Infrastructure Development: Significant investments in transportation networks facilitating easier access to tourist areas.

- Foreign Direct Investment: Supportive policies attracting international hotel brands and developers.

- Growing Middle Class: Increased domestic travel expenditure and demand for varied accommodation options.

- Market Share & Growth Potential: While Hotels and Accommodation hold the largest share, Spas and Resorts are seeing a higher percentage growth due to the wellness tourism trend. Other Property Types are experiencing rapid adoption due to changing lifestyle demands.

Indonesia Hospitality Real Estate Market Product Landscape

The product landscape within the Indonesia hospitality real estate market is characterized by a dynamic evolution towards integrated experiences and sustainable design. Innovations are focused on creating smart hotels that offer personalized guest services through IoT devices and AI-driven platforms, enhancing convenience and efficiency. Hotels and Accommodation are increasingly incorporating wellness facilities, flexible co-working spaces, and immersive local cultural experiences to cater to discerning travelers. Spas and Resorts are pushing the boundaries with unique wellness programs, eco-friendly practices, and a strong emphasis on natural healing and rejuvenation. The performance metrics for these properties are increasingly measured not just by occupancy rates and revenue per available room (RevPAR), but also by guest satisfaction scores related to sustainability, personalized service, and overall experience. Technological advancements in energy management and water conservation are also becoming key selling points, appealing to both environmentally conscious consumers and developers seeking operational cost savings.

Key Drivers, Barriers & Challenges in Indonesia Hospitality Real Estate Market

Key Drivers: The Indonesia hospitality real estate market is propelled by several key drivers. The sustained growth in domestic and international tourism, fueled by government initiatives to promote diverse destinations, is a primary catalyst. Increasing disposable incomes and a burgeoning middle class are translating into higher spending on travel and accommodation. Furthermore, strategic government policies aimed at attracting foreign investment, coupled with ongoing infrastructure development (e.g., new airports, toll roads), are enhancing accessibility and appeal of various regions. The growing demand for experiential travel and the rising popularity of wellness tourism are also significant drivers.

Barriers & Challenges: Despite the promising outlook, the market faces certain barriers and challenges. Complex and sometimes inconsistent local land acquisition regulations and permitting processes can cause delays and increase development costs, impacting an estimated 10-15% of project timelines. Supply chain disruptions for construction materials, particularly for large-scale projects, can affect project execution and budget. Intense competition from established international brands and rapidly growing local players requires continuous innovation and differentiation. Furthermore, ensuring consistent quality of service and skilled labor across a geographically diverse archipelago remains a challenge, potentially affecting guest satisfaction and brand reputation. Economic volatility and currency fluctuations can also pose risks to investment returns.

Emerging Opportunities in Indonesia Hospitality Real Estate Market

Emerging opportunities in the Indonesia hospitality real estate market lie in the development of niche tourism offerings and underserved regions. The growing demand for eco-tourism and sustainable resorts presents significant potential for projects that prioritize environmental conservation and community engagement. The rise of digital nomads and remote work is creating opportunities for serviced apartments and co-living spaces with integrated co-working facilities in both major cities and emerging lifestyle destinations. Furthermore, the untapped potential of lesser-known but naturally beautiful islands and regions, with strategic infrastructure development, can offer unique investment prospects. The integration of technology for personalized guest experiences, from AI-powered concierge services to augmented reality attractions, also represents a key growth avenue.

Growth Accelerators in the Indonesia Hospitality Real Estate Market Industry

Several catalysts are accelerating growth within the Indonesia hospitality real estate market. Technological breakthroughs in sustainable construction materials and renewable energy integration are lowering operational costs and enhancing property appeal. Strategic partnerships between local developers and international hotel brands are crucial for bringing global standards and brand recognition to new markets. Furthermore, market expansion strategies focusing on developing infrastructure in secondary cities and promoting niche tourism segments like MICE (Meetings, Incentives, Conferences, and Exhibitions) are unlocking new revenue streams. The increasing focus on digitalization, from online booking platforms to in-room technology, is improving efficiency and customer reach, further boosting market expansion.

Key Players Shaping the Indonesia Hospitality Real Estate Market Market

- Agung Podomoro Land

- Sinar Mas Land

- Pakuwon Jati

- Ciputra

- Permata Birama Sakti

- Plaza Indonesia Realty

- PP Properti

- Tokyu Land Corporation

- PT Surya Semesta Internusa (Persero) Tbk

- Duta Anggada Realty

Notable Milestones in Indonesia Hospitality Real Estate Market Sector

- March 2024: Sinar Mas Land and IABHI spearheaded sustainable development by prioritizing eco-friendly materials and harnessing New Renewable Energy (EBT). Their initiatives include installing solar panels in commercial buildings like hotels, resorts, and spas, implementing renewable energy certificates (RECs) from PT PLN (Persero), and revamping energy management systems across their operational buildings, thereby contributing to government goals and reducing CO2 emissions.

- November 2023: Indonesia's Vice President officially inaugurated Accor's first property in Central Kalimantan, the Mercure Pangkalan Bun. This hotel, featuring 150 rooms and suites, offers amenities such as a restaurant, lounge, bar, ballroom, multipurpose rooms, a wellness area, and a swimming pool. Its strategic location, just a 15-minute drive from Iskandar Airport, makes it an attractive option for both business and leisure travelers.

In-Depth Indonesia Hospitality Real Estate Market Market Outlook

The future outlook for the Indonesia hospitality real estate market is exceptionally bright, driven by sustained growth in tourism and strategic government support. Market potential is being unlocked by the development of integrated hospitality complexes that blend accommodation with retail, entertainment, and residential spaces, catering to evolving consumer lifestyles. Strategic opportunities lie in capitalizing on the growing demand for wellness tourism and eco-friendly accommodations, as consumers increasingly seek responsible and rejuvenating travel experiences. The expansion into secondary cities and the promotion of diverse cultural and natural attractions will further diversify revenue streams and broaden the market's appeal. The continued influx of foreign investment, coupled with the adoption of advanced technologies for personalized guest services and efficient property management, will solidify Indonesia's position as a leading hospitality destination in Southeast Asia.

Indonesia Hospitality Real Estate Market Segmentation

-

1. Property Type

- 1.1. Hotels and Accommodation

- 1.2. Spas and Resorts

- 1.3. Other Property Types

Indonesia Hospitality Real Estate Market Segmentation By Geography

- 1. Indonesia

Indonesia Hospitality Real Estate Market Regional Market Share

Geographic Coverage of Indonesia Hospitality Real Estate Market

Indonesia Hospitality Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Indonesia's Hospitality Market Shifting Preference for Local and Authentic Experiences

- 3.3. Market Restrains

- 3.3.1. Difficulties in Implementing Tourism Policies

- 3.4. Market Trends

- 3.4.1. Increase in Tourism in Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Hospitality Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Hotels and Accommodation

- 5.1.2. Spas and Resorts

- 5.1.3. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Agung Podomoro Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sinar Mas Land

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pakuwon Jati

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ciputra

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Permata Birama Sakti

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Plaza Indonesia Realty

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PP Properti

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokyu Land Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Surya Semesta Internusa (Persero) Tbk**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Duta Anggada Realty

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agung Podomoro Land

List of Figures

- Figure 1: Indonesia Hospitality Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Hospitality Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 2: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 4: Indonesia Hospitality Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Hospitality Real Estate Market?

The projected CAGR is approximately 12.07%.

2. Which companies are prominent players in the Indonesia Hospitality Real Estate Market?

Key companies in the market include Agung Podomoro Land, Sinar Mas Land, Pakuwon Jati, Ciputra, Permata Birama Sakti, Plaza Indonesia Realty, PP Properti, Tokyu Land Corporation, PT Surya Semesta Internusa (Persero) Tbk**List Not Exhaustive, Duta Anggada Realty.

3. What are the main segments of the Indonesia Hospitality Real Estate Market?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Indonesia's Hospitality Market Shifting Preference for Local and Authentic Experiences.

6. What are the notable trends driving market growth?

Increase in Tourism in Indonesia.

7. Are there any restraints impacting market growth?

Difficulties in Implementing Tourism Policies.

8. Can you provide examples of recent developments in the market?

March 2024: Sinar Mas Land and IABHI led the charge in sustainable development by prioritizing eco-friendly materials and harnessing New Renewable Energy (EBT). Their efforts include installing solar panels in commercial buildings (hotels, resorts. and spas), implementing renewable energy certificates (RECs) from PT PLN (Persero), and even revamping energy management across their operational buildings. By championing these initiatives, Sinar Mas Land is not only aligning with government goals but also actively curbing CO2 emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Hospitality Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Hospitality Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Hospitality Real Estate Market?

To stay informed about further developments, trends, and reports in the Indonesia Hospitality Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence