Key Insights

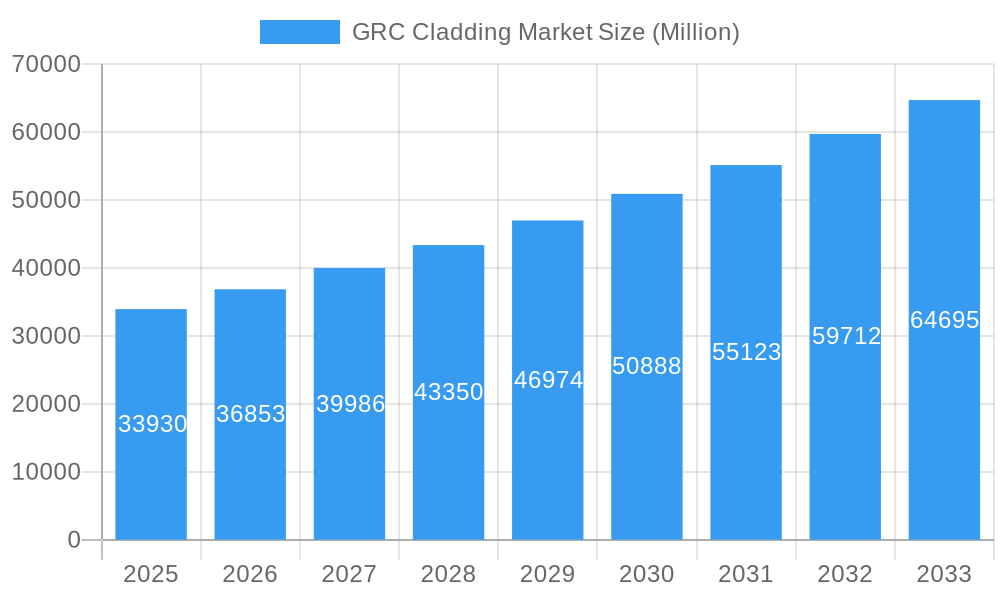

The global GRC (Glassfiber Reinforced Concrete) Cladding market is projected for robust expansion, estimated to reach $33.93 billion in 2025. This growth is underpinned by a significant Compound Annual Growth Rate (CAGR) of 8.78%, signaling a strong upward trajectory for the sector throughout the forecast period of 2025-2033. The increasing adoption of GRC cladding in commercial and residential construction, driven by its inherent advantages such as durability, lightweight properties, and aesthetic versatility, is a primary catalyst. Furthermore, the infrastructure construction segment is witnessing a surge in demand for GRC as it offers sustainable and cost-effective building solutions for public works projects. Emerging economies, particularly in the Asia Pacific region, are expected to contribute substantially to this growth due to rapid urbanization and extensive infrastructure development initiatives.

GRC Cladding Market Market Size (In Billion)

While the market demonstrates considerable promise, certain factors could influence its pace. These may include the availability and cost of raw materials, evolving building codes and regulations, and the emergence of alternative cladding materials. However, the inherent benefits of GRC, including its fire resistance, weatherability, and low maintenance requirements, continue to position it as a preferred choice for architects and developers globally. The competitive landscape is characterized by a mix of established players and emerging companies, each vying for market share through product innovation, strategic partnerships, and a focus on sustainable manufacturing processes. This dynamic environment is expected to foster further advancements in GRC cladding technology and applications.

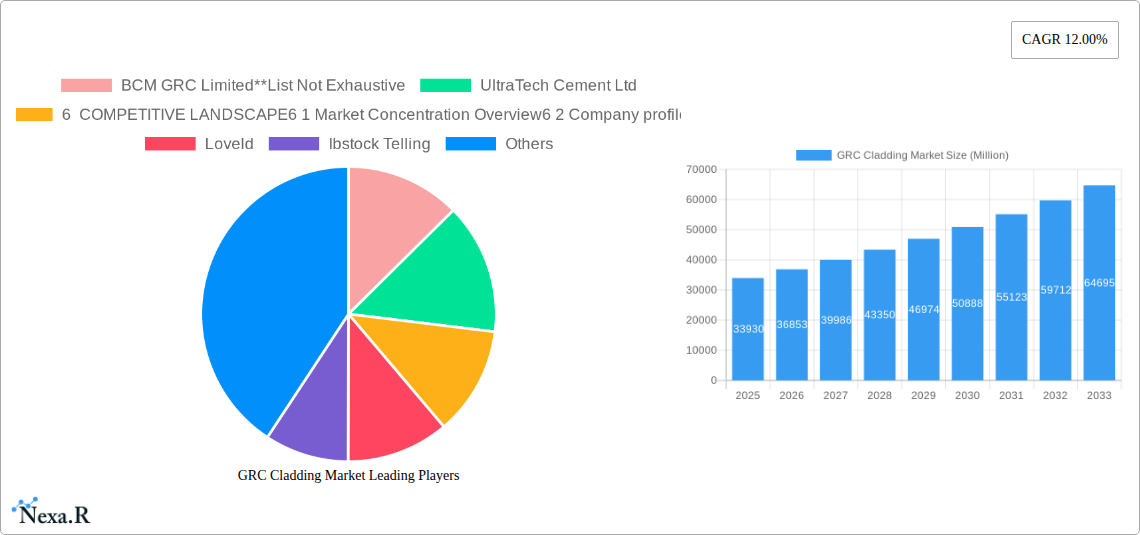

GRC Cladding Market Company Market Share

GRC Cladding Market: Comprehensive Analysis of Growth, Trends, and Competitive Landscape (2019-2033)

This in-depth report provides a definitive outlook on the global GRC cladding market, meticulously analyzing its dynamics, growth trajectories, and competitive environment. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this analysis offers unparalleled insights for industry stakeholders. The report delves into the Glass Fiber Reinforced Concrete cladding market size, GRC facade market trends, architectural precast concrete market, and the burgeoning GRC building materials market. We explore key applications such as commercial construction GRC cladding, residential GRC facade solutions, and infrastructure GRC applications, providing a granular understanding of demand drivers across diverse sectors.

The report also examines the global GRC cladding market share, GRC cladding manufacturers, and the impact of sustainable building materials on market evolution. Furthermore, it addresses the parent GRC cladding market and its relationship with its child markets, offering a holistic view of the value chain. With a focus on quantitative data and qualitative analysis, this report is an essential resource for anyone looking to navigate the complexities and capitalize on the opportunities within the GRC cladding industry. The estimated market value in 2025 is $12.5 billion, with a projected growth to $22.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.5%.

GRC Cladding Market Market Dynamics & Structure

The GRC cladding market is characterized by a moderately concentrated landscape, with a few key players holding significant market share while a broader base of smaller manufacturers cater to niche demands. Technological innovation remains a primary driver, with ongoing advancements in GRC formulations, manufacturing processes, and aesthetic finishes enhancing its appeal as a premium facade material. Regulatory frameworks, particularly those promoting sustainable construction and energy efficiency, indirectly bolster the adoption of GRC due to its inherent durability, low maintenance, and potential for recycled content. Competitive product substitutes include traditional materials like brick, stone, metal, and HPL panels, but GRC's unique advantages in design flexibility, lightweight properties, and fire resistance often give it a competitive edge.

End-user demographics are increasingly favoring GRC for its aesthetic versatility and performance. The growing demand for visually striking and architecturally complex buildings in commercial and residential sectors, coupled with the need for durable and low-maintenance solutions in infrastructure projects, fuels market expansion. Mergers and acquisitions (M&A) trends are notable, with larger entities seeking to consolidate their market position and expand their product portfolios. For instance, the merger of BB fiberbeton with Syntec GRC and Synergies Moulds signifies a strategic move to enhance European market presence and production capabilities. While innovation barriers are relatively low due to established manufacturing techniques, the initial investment in specialized GRC production equipment can be a factor for new entrants.

- Market Concentration: Moderately concentrated, with a strong presence of established players and regional specialists.

- Technological Drivers: Advancements in GRC mix designs, spraying techniques, and mould manufacturing.

- Regulatory Influence: Building codes favoring fire-resistant, durable, and sustainable materials.

- Competitive Landscape: Competition from traditional facade materials and other advanced composite panels.

- End-User Focus: Growing demand from architectural firms, developers, and contractors for aesthetic and performance benefits.

- M&A Activity: Consolidation for market share expansion and synergistic benefits.

GRC Cladding Market Growth Trends & Insights

The GRC cladding market is experiencing robust growth, propelled by a confluence of factors that are reshaping the construction industry. The market size is projected to surge from an estimated $12.5 billion in 2025 to $22.8 billion by 2033, reflecting a healthy CAGR of 7.5%. This expansion is underpinned by increasing adoption rates across various construction segments, driven by the material's superior performance characteristics and design flexibility. Technological disruptions, such as advancements in GRC formulations for enhanced strength and durability, and sophisticated moulding techniques allowing for intricate architectural designs, are significantly contributing to its market penetration.

Consumer behavior shifts, particularly a growing preference for sustainable and aesthetically pleasing building facades, are also playing a crucial role. Architects and developers are increasingly specifying GRC for its ability to mimic natural materials, create unique architectural expressions, and contribute to the longevity and low maintenance of structures. The inherent lightweight nature of GRC panels also translates into reduced structural loads, leading to cost savings in foundation and framing, further boosting its appeal. Moreover, the increasing focus on fire safety in buildings and the material's excellent fire-resistant properties are driving its adoption, especially in high-rise and public buildings. The global push towards sustainable construction practices further amplifies the demand for GRC, as it can incorporate recycled materials and offers a long service life, minimizing the need for frequent replacements. The market penetration of GRC cladding is expected to rise significantly in developed and developing economies as awareness of its benefits grows and as manufacturing capabilities become more widespread. This growth is not just about volume but also about value, as GRC enables higher-value architectural projects.

Dominant Regions, Countries, or Segments in GRC Cladding Market

The Commercial Construction segment is currently the dominant force driving the GRC cladding market, exhibiting significant growth potential and market share. This dominance is attributed to several key factors that align perfectly with the capabilities and benefits offered by GRC. Modern architectural trends in commercial buildings increasingly demand visually striking, complex, and customizable facades. GRC's inherent design flexibility allows architects to create intricate shapes, textures, and finishes, enabling them to realize ambitious design visions for office buildings, retail spaces, and hospitality venues. Furthermore, the durability, weather resistance, and low maintenance requirements of GRC are highly valued in commercial applications where longevity and reduced lifecycle costs are paramount.

Economic policies in many developed and developing nations are fostering urban development and the construction of new commercial infrastructure, directly benefiting the GRC market. Government initiatives promoting visually appealing and sustainable urban environments further encourage the use of advanced facade materials like GRC. The market share for GRC in commercial construction is estimated to be around 55% of the total market value. Key drivers in this segment include:

- Architectural Versatility: Ability to achieve complex geometries and aesthetic finishes, meeting diverse design briefs.

- Durability and Longevity: Resistance to weathering, pollution, and structural degradation, ensuring a long service life.

- Low Maintenance: Reduced ongoing costs for cleaning and repair, attractive for property owners.

- Fire Resistance: Compliance with stringent building codes for safety in public and commercial spaces.

- Lightweight Properties: Reduced load on building structures, leading to potential cost savings in design and construction.

- Sustainability Credentials: Potential for incorporating recycled materials and contributing to energy efficiency through facade insulation.

While Residential Construction and Infrastructure Construction are also significant growth areas for GRC cladding, the sheer volume and complexity of commercial projects currently position them as the primary market influencers. The ongoing urbanisation and demand for high-performance, aesthetically superior buildings in city centres worldwide continue to cement Commercial Construction's leading role in the GRC cladding market.

GRC Cladding Market Product Landscape

The GRC cladding market is characterized by a diverse and evolving product landscape driven by continuous innovation in material science and manufacturing techniques. Key product innovations revolve around enhancing the strength-to-weight ratio of GRC, improving its thermal insulation properties, and expanding the range of available aesthetic finishes. Advanced GRC formulations now offer higher tensile strength and improved impact resistance, making them suitable for more demanding architectural applications. The development of self-compacting GRC and spray-applied GRC further streamlines the manufacturing process, enabling faster production cycles and reducing labor costs.

Application-wise, GRC cladding is extensively used for external facades, offering a lightweight yet durable alternative to traditional materials. Its versatility allows for the creation of bespoke panels, including those with intricate decorative patterns, smooth finishes, or textures that mimic natural stone or timber. Performance metrics such as compressive strength, flexural strength, and water absorption are continually being optimized. Unique selling propositions include exceptional design freedom, inherent fire resistance, and environmental benefits. Technological advancements are also focusing on integrating GRC with smart functionalities, such as embedded sensors for building performance monitoring, further expanding its application scope. The market is seeing a rise in pre-fabricated GRC elements, contributing to faster on-site construction and improved quality control.

Key Drivers, Barriers & Challenges in GRC Cladding Market

Key Drivers:

- Architectural Design Freedom: GRC's unparalleled ability to be moulded into complex shapes, intricate patterns, and diverse finishes drives its adoption in unique architectural projects.

- Sustainability and Environmental Benefits: Growing demand for eco-friendly building materials, with GRC offering durability, low maintenance, and potential for recycled content, aligns with green building initiatives.

- Lightweight Properties: Reduced structural load translates to cost savings in foundations and framing, making it an attractive option for various construction types.

- Fire Resistance and Durability: GRC's inherent non-combustibility and resilience to weathering, pollution, and impact ensure longevity and safety, meeting stringent building codes.

- Technological Advancements: Ongoing improvements in GRC formulations and manufacturing processes enhance performance, reduce costs, and expand application possibilities.

Key Barriers & Challenges:

- Higher Initial Cost: Compared to some conventional facade materials, the initial cost of GRC cladding can be a deterrent for budget-constrained projects, with an estimated 10-15% higher upfront investment.

- Specialized Manufacturing and Installation Expertise: Requires skilled labor and specialized equipment for production and installation, limiting the pool of qualified contractors in certain regions.

- Supply Chain and Logistics: Transportation of large, custom-designed GRC panels can be complex and costly, especially for international projects, impacting lead times and overall project cost.

- Perception and Awareness: In some markets, GRC may still be perceived as a niche material, requiring increased education and awareness campaigns to highlight its full range of benefits and applications.

- Competition from Established Materials: Continued competition from traditional materials like brick, concrete, and metal panels, which have long-established supply chains and familiar installation methods.

Emerging Opportunities in GRC Cladding Market

Emerging opportunities in the GRC cladding market are primarily centered around expanding its application into novel areas and enhancing its performance through technological integration. The growing global emphasis on retrofitting older buildings to improve energy efficiency and aesthetic appeal presents a significant opportunity for GRC, particularly for its lightweight and insulating properties. Furthermore, the increasing use of GRC in prefabricated modular construction systems offers potential for rapid deployment and cost-effectiveness, catering to the demand for faster construction timelines. The development of self-healing GRC formulations to address micro-cracking and enhance long-term durability is another promising avenue. Moreover, tapping into emerging economies with rapidly developing urban infrastructure and a growing appetite for modern architectural solutions offers substantial untapped market potential. The integration of GRC with smart building technologies, such as embedded sensors for structural health monitoring, also opens up new possibilities for high-value applications.

Growth Accelerators in the GRC Cladding Market Industry

Several key catalysts are accelerating long-term growth within the GRC cladding industry. Continuous research and development into advanced GRC formulations are leading to materials with superior strength, reduced weight, and enhanced thermal performance, making GRC a more competitive and versatile option. Strategic partnerships between GRC manufacturers, architectural firms, and construction companies are fostering collaborative innovation, leading to the development of integrated facade solutions and driving market adoption. Market expansion strategies, including penetrating new geographical regions and targeting specific niche applications like bespoke decorative elements or complex facade geometries, are also significant growth drivers. Furthermore, the increasing global awareness of sustainability in construction is a powerful accelerator, as GRC aligns with the demand for durable, low-maintenance, and potentially recycled materials. Government initiatives supporting green building certifications and energy-efficient construction practices further bolster the adoption of GRC.

Key Players Shaping the GRC Cladding Market Market

- BCM GRC Limited

- UltraTech Cement Ltd

- Loveld

- Ibstock Telling

- ASAHI BUILDING-WALL CO LTD

- Fibrobeton

- Willis Construction Co Inc

- GB Architectural Cladding Products Ltd

- BB Fiberbeton

- Clark Pacific

Notable Milestones in GRC Cladding Market Sector

- May 2022: Willis Construction, a leading Architectural Precast Concrete manufacturer, successfully completed a 35,000 SF / 167 Panels project utilizing Glass Fiber Reinforced Concrete, subsequently earning the 2022 PCI National Merit Award for the Contra Costa Administration Building Project. This highlights the growing recognition and quality achievements within the GRC sector.

- September 2021: BB fiberbeton concrete underwent a significant merger with two British fiber concrete companies, Syntec GRC and Synergies Moulds. This strategic consolidation solidified BB fiberbeton's position as a leading fiber concrete producer in Europe, enhancing its production capabilities and market reach across Denmark and England.

In-Depth GRC Cladding Market Market Outlook

The GRC cladding market is poised for significant future expansion, driven by a synergistic interplay of technological innovation, evolving architectural trends, and a global commitment to sustainable construction. Growth accelerators such as the development of more resilient and aesthetically versatile GRC formulations, coupled with advancements in manufacturing efficiencies, will continue to drive down costs and broaden accessibility. Strategic collaborations between material manufacturers and the design-build community are crucial for unlocking new application potentials and ensuring seamless integration of GRC into complex projects. The increasing adoption of GRC in emerging markets, fueled by rapid urbanization and a demand for modern, durable building materials, represents a substantial untapped opportunity. As the construction industry continues its trajectory towards higher performance, sustainability, and design sophistication, GRC cladding is exceptionally well-positioned to not only meet but exceed these evolving demands, solidifying its role as a premier facade solution for the future.

GRC Cladding Market Segmentation

-

1. Application

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Infrastructure Construction

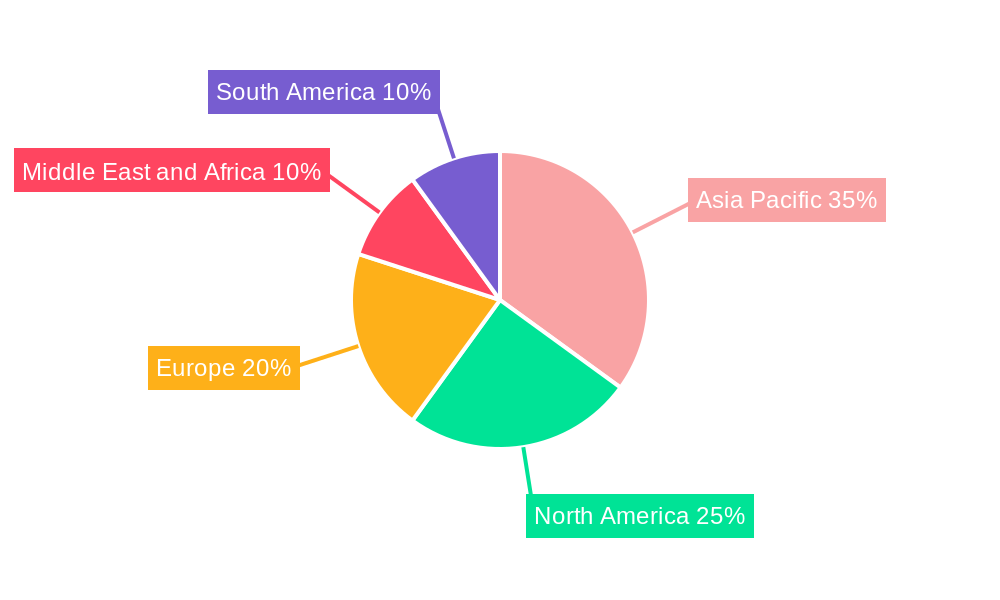

GRC Cladding Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. South America

- 5. Middle East and Africa

GRC Cladding Market Regional Market Share

Geographic Coverage of GRC Cladding Market

GRC Cladding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Economic Growth; High Demand for Property Boosting the Market

- 3.3. Market Restrains

- 3.3.1. Experiencing Slower Growth due to Government Measures; Rising Interest Rates Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. United States is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Infrastructure Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Infrastructure Construction

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Infrastructure Construction

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Infrastructure Construction

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Infrastructure Construction

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Infrastructure Construction

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BCM GRC Limited**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UltraTech Cement Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 6 COMPETITIVE LANDSCAPE6 1 Market Concentration Overview6 2 Company profiles

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Loveld

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ibstock Telling

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ASAHI BUILDING-WALL CO LTD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fibrobeton

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Willis Construction Co Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GB Architectural Cladding Products Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BB Fiberbeton

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Clark Pacific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 BCM GRC Limited**List Not Exhaustive

List of Figures

- Figure 1: Global GRC Cladding Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global GRC Cladding Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: Asia Pacific GRC Cladding Market Revenue (undefined), by Application 2025 & 2033

- Figure 4: Asia Pacific GRC Cladding Market Volume (K Units), by Application 2025 & 2033

- Figure 5: Asia Pacific GRC Cladding Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific GRC Cladding Market Volume Share (%), by Application 2025 & 2033

- Figure 7: Asia Pacific GRC Cladding Market Revenue (undefined), by Country 2025 & 2033

- Figure 8: Asia Pacific GRC Cladding Market Volume (K Units), by Country 2025 & 2033

- Figure 9: Asia Pacific GRC Cladding Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific GRC Cladding Market Volume Share (%), by Country 2025 & 2033

- Figure 11: North America GRC Cladding Market Revenue (undefined), by Application 2025 & 2033

- Figure 12: North America GRC Cladding Market Volume (K Units), by Application 2025 & 2033

- Figure 13: North America GRC Cladding Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America GRC Cladding Market Volume Share (%), by Application 2025 & 2033

- Figure 15: North America GRC Cladding Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America GRC Cladding Market Volume (K Units), by Country 2025 & 2033

- Figure 17: North America GRC Cladding Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America GRC Cladding Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe GRC Cladding Market Revenue (undefined), by Application 2025 & 2033

- Figure 20: Europe GRC Cladding Market Volume (K Units), by Application 2025 & 2033

- Figure 21: Europe GRC Cladding Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe GRC Cladding Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe GRC Cladding Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe GRC Cladding Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe GRC Cladding Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe GRC Cladding Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America GRC Cladding Market Revenue (undefined), by Application 2025 & 2033

- Figure 28: South America GRC Cladding Market Volume (K Units), by Application 2025 & 2033

- Figure 29: South America GRC Cladding Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America GRC Cladding Market Volume Share (%), by Application 2025 & 2033

- Figure 31: South America GRC Cladding Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: South America GRC Cladding Market Volume (K Units), by Country 2025 & 2033

- Figure 33: South America GRC Cladding Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America GRC Cladding Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa GRC Cladding Market Revenue (undefined), by Application 2025 & 2033

- Figure 36: Middle East and Africa GRC Cladding Market Volume (K Units), by Application 2025 & 2033

- Figure 37: Middle East and Africa GRC Cladding Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa GRC Cladding Market Volume Share (%), by Application 2025 & 2033

- Figure 39: Middle East and Africa GRC Cladding Market Revenue (undefined), by Country 2025 & 2033

- Figure 40: Middle East and Africa GRC Cladding Market Volume (K Units), by Country 2025 & 2033

- Figure 41: Middle East and Africa GRC Cladding Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa GRC Cladding Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GRC Cladding Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global GRC Cladding Market Volume K Units Forecast, by Application 2020 & 2033

- Table 3: Global GRC Cladding Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global GRC Cladding Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Global GRC Cladding Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global GRC Cladding Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: Global GRC Cladding Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global GRC Cladding Market Volume K Units Forecast, by Country 2020 & 2033

- Table 9: Global GRC Cladding Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global GRC Cladding Market Volume K Units Forecast, by Application 2020 & 2033

- Table 11: Global GRC Cladding Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global GRC Cladding Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Global GRC Cladding Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global GRC Cladding Market Volume K Units Forecast, by Application 2020 & 2033

- Table 15: Global GRC Cladding Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global GRC Cladding Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Global GRC Cladding Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global GRC Cladding Market Volume K Units Forecast, by Application 2020 & 2033

- Table 19: Global GRC Cladding Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Global GRC Cladding Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Global GRC Cladding Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global GRC Cladding Market Volume K Units Forecast, by Application 2020 & 2033

- Table 23: Global GRC Cladding Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global GRC Cladding Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GRC Cladding Market?

The projected CAGR is approximately 8.78%.

2. Which companies are prominent players in the GRC Cladding Market?

Key companies in the market include BCM GRC Limited**List Not Exhaustive, UltraTech Cement Ltd, 6 COMPETITIVE LANDSCAPE6 1 Market Concentration Overview6 2 Company profiles, Loveld, Ibstock Telling, ASAHI BUILDING-WALL CO LTD, Fibrobeton, Willis Construction Co Inc, GB Architectural Cladding Products Ltd, BB Fiberbeton, Clark Pacific.

3. What are the main segments of the GRC Cladding Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Economic Growth; High Demand for Property Boosting the Market.

6. What are the notable trends driving market growth?

United States is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Experiencing Slower Growth due to Government Measures; Rising Interest Rates Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

May 2022: Willis Construction, one of the leading Architectural Precast Concrete manufacturers and installers in the Western United States, completed a recent project size is 35,000 SF / 167 Panels of Glass Fiber Reinforced Concrete and was awarded the 2022 PCI National Merit Award for the Contra Costa Administration Building Project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GRC Cladding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GRC Cladding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GRC Cladding Market?

To stay informed about further developments, trends, and reports in the GRC Cladding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence