Key Insights

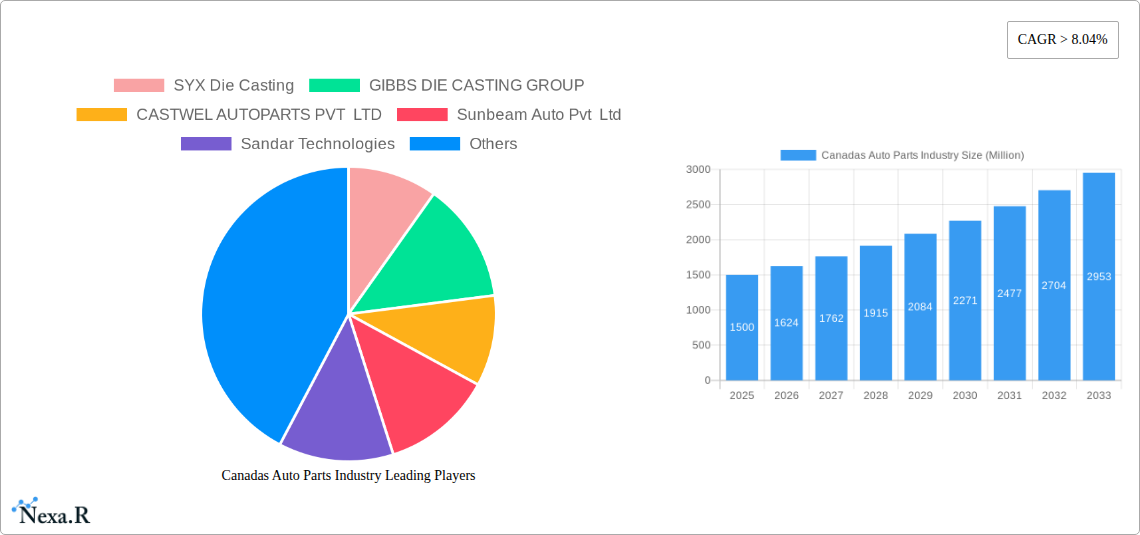

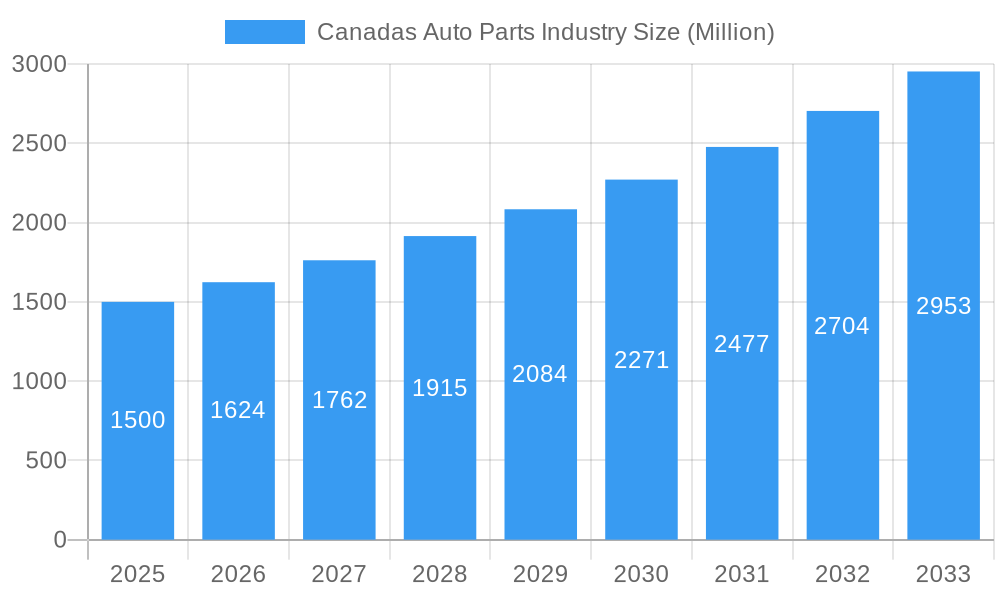

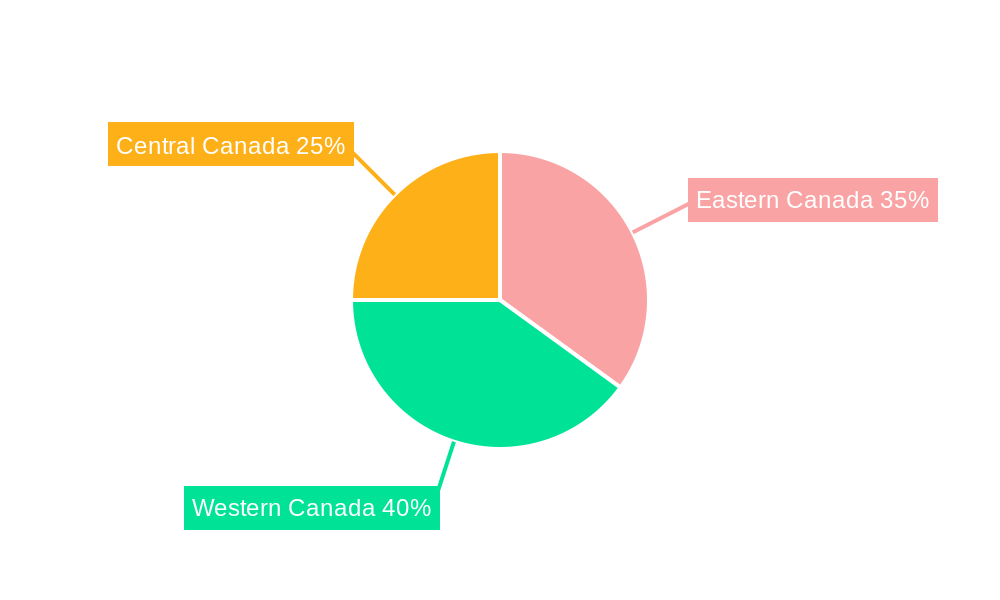

The Canadian automotive parts industry demonstrates strong growth potential, with a projected Compound Annual Growth Rate (CAGR) of 3.2%. The market size was valued at 16152.4 million in the base year 2025 and is expected to expand significantly. Key growth drivers include rising vehicle production, a robust automotive sector, and government support for sustainable transportation initiatives. Major market segments feature aluminum, zinc, and magnesium die castings for applications spanning body assembly, engine components, and transmission systems. Pressure die casting is the dominant production method, underscoring the industry's focus on high-volume, cost-effective manufacturing. Despite challenges like volatile raw material costs and supply chain disruptions, technological advancements in die casting are enhancing efficiency and precision, mitigating these concerns. The competitive environment is dynamic, featuring established global players such as SYX Die Casting, Gibbs Die Casting Group, and Amtek Group, alongside innovative emerging companies. Regional growth is expected to be particularly strong in Western Canada, benefiting from its proximity to major US automotive manufacturing centers. The forecast period, 2025-2033, is anticipated to see sustained growth fueled by ongoing innovation and increasing demand for lightweight, high-performance automotive components.

Canadas Auto Parts Industry Market Size (In Billion)

Future expansion in the Canadian auto parts sector will be propelled by escalating investments in electric vehicle (EV) manufacturing, driving demand for specialized EV components. Additionally, a continued emphasis on improving vehicle fuel efficiency and reducing weight will boost the demand for lightweight materials like aluminum and magnesium in die casting. The market's competitive structure, comprising both multinational corporations and specialized niche firms, fosters innovation and strengthens overall market growth. Segmentation by production process, including pressure and vacuum die casting, highlights the industry's technological capabilities and adaptability to evolving market needs. Government policies concerning environmental regulations, advancements in materials science and manufacturing, and the overall health of the Canadian and North American automotive sectors will be critical in shaping future growth prospects.

Canadas Auto Parts Industry Company Market Share

Canada's Auto Parts Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of Canada's auto parts industry, encompassing market dynamics, growth trends, dominant segments, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The report leverages extensive data and qualitative insights to provide a 360-degree view of the Canadian auto parts landscape.

Canada's Auto Parts Industry Market Dynamics & Structure

This section analyzes the structure and dynamics of Canada's auto parts market, considering market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A activity. The Canadian auto parts market is characterized by a mix of large multinational corporations and smaller specialized suppliers. Market concentration is moderate, with a few dominant players controlling significant market share, estimated at xx%. Technological innovation is crucial, driven by advancements in lightweight materials, electric vehicle components, and autonomous driving technologies. However, significant barriers to entry exist, including high capital investment needs and stringent quality standards. Regulatory frameworks, including environmental regulations and safety standards, significantly influence market dynamics. The increasing adoption of electric vehicles is leading to a shift in demand towards specialized components, while traditional combustion engine parts are experiencing a decline. The M&A activity in the sector is moderate, with xx deals recorded in the historical period (2019-2024).

- Market Concentration: Moderate, with top 5 players holding xx% market share.

- Technological Innovation: Driven by lightweight materials, EVs, and autonomous driving.

- Regulatory Framework: Stringent safety and environmental standards impacting production.

- Competitive Substitutes: Limited substitutes for specialized components.

- End-User Demographics: Focus on original equipment manufacturers (OEMs) and aftermarket suppliers.

- M&A Trends: Moderate activity, with xx deals during 2019-2024.

Canada's Auto Parts Industry Growth Trends & Insights

Canada's auto parts market experienced a xx% CAGR during the historical period (2019-2024), reaching a market size of xx Million units in 2024. This growth was driven by increasing vehicle production, rising consumer demand, and government initiatives promoting the automotive sector. However, the COVID-19 pandemic and global supply chain disruptions impacted growth in 2020 and 2021. The market is projected to continue its expansion, with a forecasted CAGR of xx% during 2025-2033, reaching xx Million units by 2033. This growth will be driven by the increasing adoption of electric and autonomous vehicles, technological advancements in manufacturing processes, and a growing focus on lightweight materials. Consumer behavior shifts towards eco-friendly vehicles and technological sophistication will further fuel market expansion. Market penetration of advanced driver-assistance systems (ADAS) and electric vehicle components will be key indicators of growth.

Dominant Regions, Countries, or Segments in Canada's Auto Parts Industry

Ontario remains the dominant region in Canada's auto parts industry, accounting for xx% of the market share in 2024. This dominance is attributed to a high concentration of automotive manufacturing plants and a robust supply chain ecosystem. The Aluminum segment dominates by raw material, representing xx% of the market, followed by Zinc at xx% and Magnesium at xx%. In terms of application type, the Body Assembly segment is the largest, holding xx% market share, driven by increasing demand for lightweight and durable vehicle bodies. Pressure Die Casting is the most prevalent production process, holding xx% market share, thanks to its efficiency and scalability.

- Key Drivers for Ontario's Dominance: Established automotive manufacturing hub, robust supply chain, skilled labor.

- Aluminum Segment Dominance: Lightweight properties, cost-effectiveness, and recyclability.

- Body Assembly Segment Leadership: High demand from OEMs and increasing vehicle production.

- Pressure Die Casting Prevalence: High efficiency, scalability, and suitability for mass production.

Canada's Auto Parts Industry Product Landscape

Product innovation is crucial in Canada's auto parts industry. Lightweight materials like aluminum alloys and high-strength steel are increasingly used to improve fuel efficiency and safety. Advanced driver-assistance systems (ADAS) components, electric vehicle parts (motors, batteries, inverters), and connected car technologies are shaping product development. Key performance indicators include durability, weight reduction, safety compliance, and cost-effectiveness. Unique selling propositions focus on enhanced performance, improved fuel efficiency, and integration of advanced technologies.

Key Drivers, Barriers & Challenges in Canada's Auto Parts Industry

Key Drivers:

- Increasing vehicle production and sales.

- Growing demand for electric vehicles.

- Advancements in automotive technology.

- Government initiatives supporting the automotive sector.

Challenges:

- Supply chain disruptions and rising raw material costs.

- Stringent environmental regulations and safety standards.

- Intense competition from both domestic and international players. This competition has resulted in a price war, reducing profit margins by an estimated xx%.

Emerging Opportunities in Canada's Auto Parts Industry

The growing adoption of electric vehicles (EVs) presents significant opportunities for auto parts suppliers. The development of lightweight materials and advanced battery technologies will drive innovation. The increasing demand for autonomous driving features creates opportunities for sensors, software, and related components. The aftermarket segment offers growth potential through the supply of replacement parts and repair services.

Growth Accelerators in Canada's Auto Parts Industry

Technological breakthroughs in lightweight materials, advanced manufacturing processes, and autonomous driving technologies are key growth accelerators. Strategic partnerships between automotive OEMs and parts suppliers will foster innovation and market expansion. Government incentives and policies supporting the development of the EV sector will significantly stimulate growth.

Key Players Shaping the Canada's Auto Parts Industry Market

- SYX Die Casting

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Sunbeam Auto Pvt Ltd

- Sandar Technologies

- Amtek Group

- ECO Die Castings

- Endurance Technologies Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

Notable Milestones in Canada's Auto Parts Industry Sector

- May 2023: Linamar Corporation announces a new giga casting facility in Welland, Ontario, representing a significant investment in high-pressure die casting technology and job creation.

- April 2023: Rheinmetall AG and Xiaomi partner to produce die-cast components for electric vehicles, highlighting the growing importance of this technology in the EV market.

In-Depth Canada's Auto Parts Industry Market Outlook

The Canadian auto parts market is poised for significant growth over the forecast period (2025-2033), driven by technological advancements, increasing EV adoption, and government support. Strategic partnerships, investments in advanced manufacturing, and a focus on sustainability will be crucial for long-term success. Companies that can adapt to the evolving market landscape, embrace technological innovation, and meet stringent regulatory requirements will be best positioned to capitalize on the numerous growth opportunities.

Canadas Auto Parts Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Other Raw Materials

-

3. Application Type

- 3.1. Body Assembly

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Other Applications

Canadas Auto Parts Industry Segmentation By Geography

- 1. Canada

Canadas Auto Parts Industry Regional Market Share

Geographic Coverage of Canadas Auto Parts Industry

Canadas Auto Parts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Automotive Segment will Drive The Market In Coming Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canadas Auto Parts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Other Raw Materials

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assembly

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SYX Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GIBBS DIE CASTING GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CASTWEL AUTOPARTS PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbeam Auto Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amtek Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECO Die Castings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Endurance Technologies Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SYX Die Casting

List of Figures

- Figure 1: Canadas Auto Parts Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canadas Auto Parts Industry Share (%) by Company 2025

List of Tables

- Table 1: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 2: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 3: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Canadas Auto Parts Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 6: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 7: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Canadas Auto Parts Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadas Auto Parts Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Canadas Auto Parts Industry?

Key companies in the market include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the Canadas Auto Parts Industry?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16152.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand.

6. What are the notable trends driving market growth?

Automotive Segment will Drive The Market In Coming Year.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

May 2023: Linamar Corporation unveiled plans for a cutting-edge giga casting facility in Welland, Ontario. Spanning approximately 300,000 square feet, the plant will create employment for around 200 workers. The facility will house three 6,100-ton high-pressure die-cast machines, with the first installation scheduled for January 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadas Auto Parts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadas Auto Parts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadas Auto Parts Industry?

To stay informed about further developments, trends, and reports in the Canadas Auto Parts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence