Key Insights

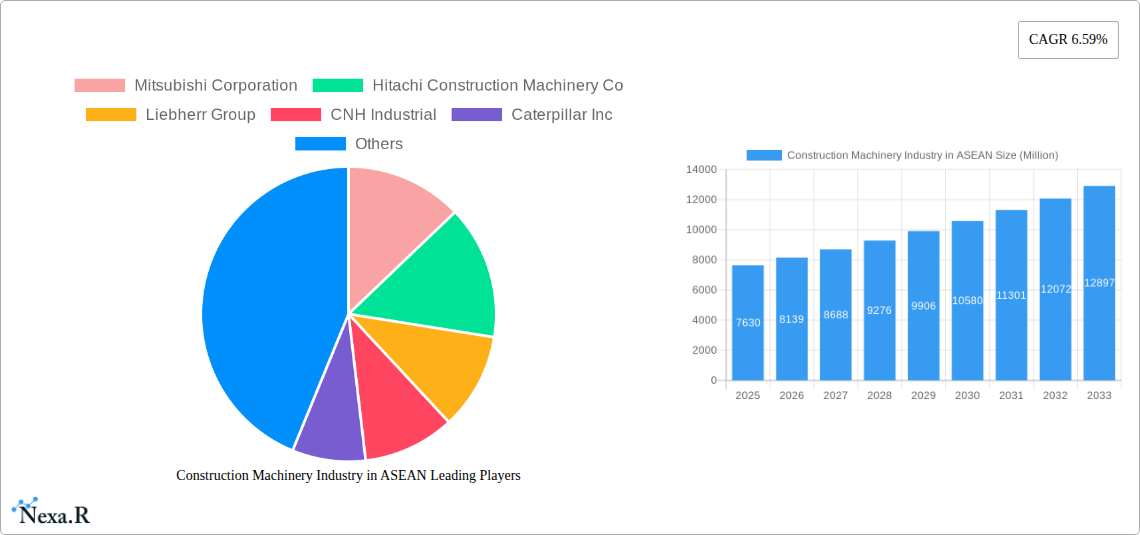

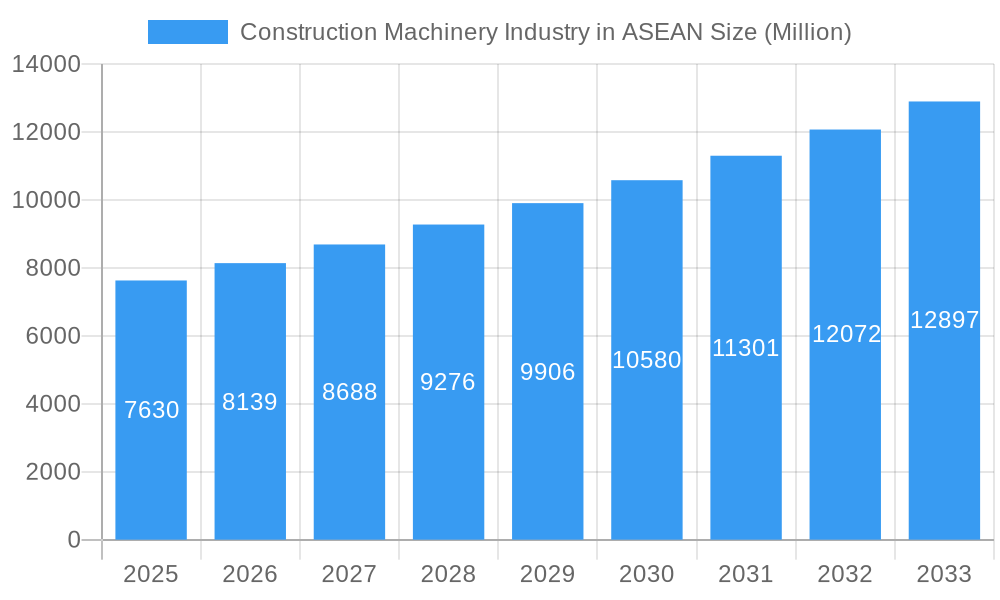

The ASEAN construction machinery market, valued at $7.63 billion in 2025, is projected to experience robust growth, driven by significant infrastructure development across the region. A compound annual growth rate (CAGR) of 6.59% from 2025 to 2033 indicates a substantial expansion, reaching an estimated market value exceeding $13 billion by 2033. This growth is fueled by several key factors. Government initiatives focused on improving transportation networks, expanding urban areas, and boosting industrial capacities are driving demand for earthmoving equipment, cranes, and other heavy machinery. The rising population and urbanization within ASEAN nations further contribute to the increasing need for construction projects, stimulating the market. Furthermore, technological advancements in construction machinery, such as improved fuel efficiency, automation, and enhanced safety features, are enhancing productivity and attracting investments. However, challenges remain, including potential fluctuations in raw material prices and the impact of global economic uncertainty on construction activities. The market is segmented by machinery type (cranes, excavators, loaders, backhoes, motor graders, and others) and application (concrete and road construction, earthmoving, and material handling). Key players like Caterpillar, Komatsu, Hitachi, and Liebherr are vying for market share, engaging in competitive pricing and product innovation. The specific market shares for individual countries within ASEAN (Indonesia, Thailand, Vietnam, Singapore, Malaysia, Philippines, and Rest of ASEAN) will vary based on their respective infrastructure projects and economic growth rates.

Construction Machinery Industry in ASEAN Market Size (In Billion)

Market segmentation analysis reveals that excavators and loaders dominate the machinery segment due to their versatility in diverse construction applications. The earthmoving application segment leads in terms of value due to the extensive infrastructure development projects underway. However, the concrete and road construction segment is anticipated to experience substantial growth, driven by ongoing road expansion and infrastructure modernization across the region. The competitive landscape is marked by a blend of global giants and regional players, resulting in a dynamic market with continuous product innovation and strategic partnerships. The projected growth signifies considerable opportunities for both established and emerging players in the ASEAN construction machinery market. However, adaptation to evolving technological advancements and mitigation of potential economic risks are crucial for sustained success within this dynamic landscape.

Construction Machinery Industry in ASEAN Company Market Share

Construction Machinery Industry in ASEAN: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Construction Machinery Industry in ASEAN, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, growth trends, key players, and future opportunities across various segments. The report delves into specific machinery types (cranes, excavators, loaders, backhoes, motor graders, and other machinery) and applications (concrete & road construction, earth moving, and material handling), providing a granular understanding of this dynamic market. Projected values are presented in million units.

Construction Machinery Industry in ASEAN Market Dynamics & Structure

The ASEAN construction machinery market exhibits a moderately concentrated landscape, with key players like Mitsubishi Corporation, Hitachi Construction Machinery Co, Liebherr Group, CNH Industrial, Caterpillar Inc, JC Bamford Excavators Ltd (JCB), Komatsu Ltd, and Xuzhou Construction Machinery Group Co Ltd competing for market share. Technological innovation, driven by automation, electrification, and digitalization, is reshaping the industry. Stringent environmental regulations and safety standards influence product design and market access. The presence of substitute technologies, such as alternative construction methods, presents competitive challenges.

- Market Concentration: xx% of market share held by top 5 players in 2025 (estimated).

- M&A Activity: xx deals recorded between 2019-2024, with an average deal value of xx million units.

- Technological Innovation: Focus on electrification, autonomous systems, and data analytics poses both opportunities and challenges related to initial investment costs and skilled labor availability.

- Regulatory Landscape: Varying regulations across ASEAN nations impact market access and product standardization.

- End-User Demographics: The construction sector's growth directly impacts demand, with infrastructure projects being a key driver.

Construction Machinery Industry in ASEAN Growth Trends & Insights

The ASEAN construction machinery market experienced robust growth during the historical period (2019-2024), driven primarily by large-scale infrastructure development projects across the region. The market size is expected to reach xx million units in 2025, growing at a CAGR of xx% from 2025-2033. Technological disruptions, such as the adoption of electric and autonomous machinery, are accelerating market transformation. Consumer behavior is shifting toward environmentally friendly and efficient machinery.

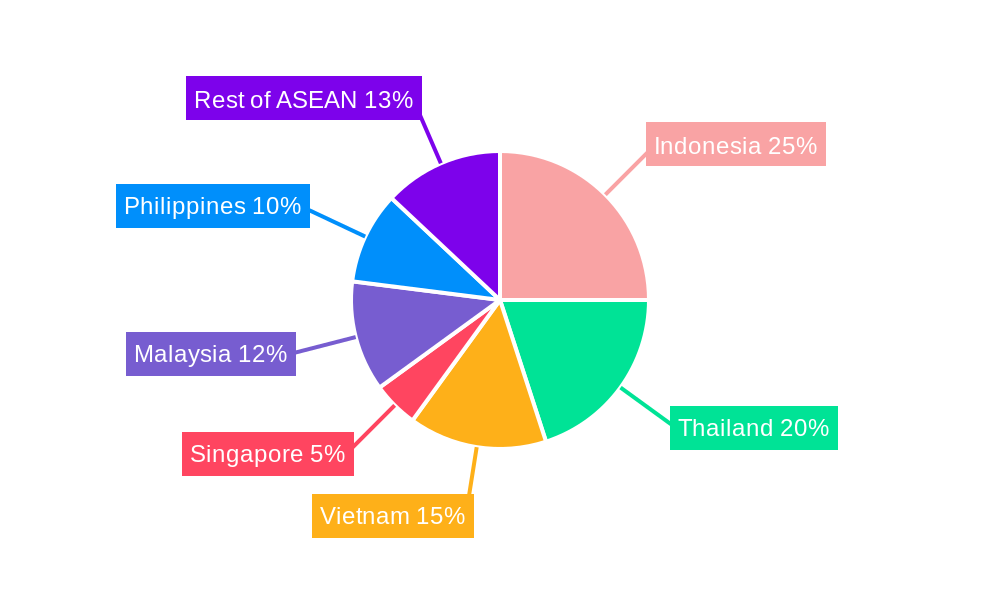

Dominant Regions, Countries, or Segments in Construction Machinery Industry in ASEAN

Within ASEAN, Indonesia, Thailand, and Vietnam represent the largest markets for construction machinery, driven by robust infrastructure development and urbanization. The excavator segment holds the largest market share due to its extensive use in earthmoving applications. Concrete and road construction represent significant application segments.

- Key Drivers:

- Infrastructure Development: Massive investments in transportation, energy, and urban development projects.

- Economic Growth: Steady economic growth in key ASEAN nations fuels demand for construction services.

- Government Policies: Supportive government policies and initiatives promoting infrastructure development.

- Dominant Segments: Excavators (xx% market share), followed by Loaders (xx%), and Cranes (xx%). High growth potential in the electric and autonomous segment.

Construction Machinery Industry in ASEAN Product Landscape

The product landscape within the ASEAN construction machinery sector is undergoing a significant transformation, prioritizing enhanced efficiency, robust safety, and improved environmental performance. A notable trend is the increasing adoption of electric and hybrid construction machinery, reflecting a global shift towards sustainable operations. Furthermore, advanced features such as integrated telematics for real-time monitoring and remote diagnostics are becoming standard, enabling proactive maintenance and minimizing downtime. The unique selling propositions (USPs) for manufacturers revolve around delivering enhanced productivity through optimized machine performance, significantly reduced operating costs over the machine's lifecycle, and a focus on improved operator comfort and ergonomics to boost user experience and reduce fatigue. Cutting-edge technological advancements, including the integration of automation and artificial intelligence (AI), are further pushing the boundaries of machine performance, enabling more precise operations and intelligent decision-making on construction sites.

Key Drivers, Barriers & Challenges in Construction Machinery Industry in ASEAN

Key Drivers: The ASEAN construction machinery market is propelled by a confluence of powerful factors. Foremost among these is the sustained and escalating infrastructure spending across the region, fueled by government initiatives aimed at modernizing transportation networks, energy grids, and urban development. Urbanization continues its relentless pace, necessitating new residential, commercial, and industrial constructions. A growing middle class with rising disposable incomes translates to increased demand for housing and improved living standards, indirectly boosting construction activity. Moreover, significant government support for construction projects through favorable policies, incentives, and public-private partnerships plays a crucial role in driving market expansion.

Challenges: Despite the robust growth potential, the industry faces considerable hurdles. Persistent supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to extended lead times and component shortages. Fluctuating raw material prices for steel, aluminum, and other essential components directly impact manufacturing costs and pricing strategies. A critical challenge is the shortage of skilled labor, encompassing trained operators, technicians, and maintenance personnel, which can hinder project execution and adoption of new technologies. Additionally, increasingly stringent environmental regulations and emissions standards require manufacturers to invest in cleaner technologies, while also imposing compliance burdens on end-users. These combined challenges can lead to significant increases in operational costs and project delays, with an estimated 25-30% of projects experiencing delays due to supply chain issues in 2024.

Emerging Opportunities in Construction Machinery Industry in ASEAN

Untapped markets in less developed ASEAN nations, demand for sustainable construction equipment, and the increasing adoption of digital technologies represent significant growth opportunities. Specialized machinery for niche applications presents further potential.

Growth Accelerators in the Construction Machinery Industry in ASEAN Industry

Several key factors are acting as powerful catalysts for growth in the ASEAN construction machinery industry. The rapid pace of technological advancements is a primary driver, with innovations such as fully autonomous operations promising to revolutionize efficiency and safety. The widespread adoption of digitalization across the construction value chain, from project planning to execution and maintenance, is enhancing operational intelligence and productivity. The strategic shift towards electric and hybrid machinery not only aligns with sustainability goals but also offers reduced running costs and noise pollution, making them increasingly attractive. Furthermore, fostering strategic partnerships between leading machinery manufacturers and prominent construction companies is proving instrumental. These collaborations facilitate co-development of innovative solutions tailored to regional needs, accelerate the adoption of new technologies, and expand market reach through shared expertise and resources.

Key Players Shaping the Construction Machinery Industry in ASEAN Market

- Mitsubishi Corporation: A diversified conglomerate with significant investments in infrastructure and heavy industries across ASEAN.

- Hitachi Construction Machinery Co.: A global leader renowned for its robust excavators, loaders, and specialized equipment.

- Liebherr Group: Known for its high-quality construction machinery, including cranes, earthmoving equipment, and concrete technology.

- CNH Industrial: A major player offering a wide range of agricultural and construction equipment under brands like CASE and New Holland.

- Caterpillar Inc.: The world's largest manufacturer of construction and mining equipment, with a strong presence and extensive dealer network in ASEAN.

- JC Bamford Excavators Ltd (JCB): A privately owned multinational company celebrated for its innovative backhoe loaders and a broad spectrum of construction machinery.

- Komatsu Ltd: A prominent Japanese manufacturer offering a comprehensive line of construction and industrial machinery, including excavators and bulldozers.

- Xuzhou Construction Machinery Group Co Ltd (XCMG): A leading Chinese manufacturer with a rapidly expanding global footprint, offering a diverse range of heavy machinery.

Notable Milestones in Construction Machinery Industry in ASEAN Sector

- June 2023: Volvo CE's first fully electric construction machinery launched in Singapore.

- May 2022: CASE Construction Equipment launched new products across South Asia.

- April 2022: Liebherr redeveloped its mid-sized wheel loaders.

- January 2022: Liebherr introduced three new wheel loaders.

In-Depth Construction Machinery Industry in ASEAN Market Outlook

The ASEAN construction machinery market is on a trajectory of sustained and robust growth, underpinned by the region's ongoing commitment to extensive infrastructure development and the pervasive influence of technological advancements. The continuous expansion of transportation networks, urbanization projects, and energy infrastructure will fuel a persistent demand for a wide array of construction equipment. To effectively capitalize on these burgeoning opportunities and to successfully navigate the inherent complexities and challenges within this dynamic market, strategic investments in research and development (R&D) will be paramount. Manufacturers must focus on developing solutions that are not only technologically advanced but also environmentally sustainable and cost-effective. Simultaneously, cultivating and deepening strategic partnerships across the value chain – from suppliers to end-users – will be crucial for fostering innovation, ensuring market penetration, and building resilience. Projections indicate a significant expansion, with the market expected to reach approximately 1.5 - 1.7 million units by 2033, signifying substantial volume growth and market potential.

Construction Machinery Industry in ASEAN Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Excavators

- 1.3. Loaders

- 1.4. Backhoe

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Application

- 2.1. Concrete and Road Construction

- 2.2. Earth Moving

- 2.3. Material Handling

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Vietnam

- 3.4. Singapore

- 3.5. Malaysia

- 3.6. Philippines

- 3.7. Rest of ASEAN

Construction Machinery Industry in ASEAN Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Vietnam

- 4. Singapore

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

Construction Machinery Industry in ASEAN Regional Market Share

Geographic Coverage of Construction Machinery Industry in ASEAN

Construction Machinery Industry in ASEAN REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activity May Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Equipment Cost may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Concrete and Road Construction To Propel The Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Excavators

- 5.1.3. Loaders

- 5.1.4. Backhoe

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete and Road Construction

- 5.2.2. Earth Moving

- 5.2.3. Material Handling

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Vietnam

- 5.3.4. Singapore

- 5.3.5. Malaysia

- 5.3.6. Philippines

- 5.3.7. Rest of ASEAN

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Vietnam

- 5.4.4. Singapore

- 5.4.5. Malaysia

- 5.4.6. Philippines

- 5.4.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Indonesia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Cranes

- 6.1.2. Excavators

- 6.1.3. Loaders

- 6.1.4. Backhoe

- 6.1.5. Motor Graders

- 6.1.6. Other Machinery Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Concrete and Road Construction

- 6.2.2. Earth Moving

- 6.2.3. Material Handling

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Vietnam

- 6.3.4. Singapore

- 6.3.5. Malaysia

- 6.3.6. Philippines

- 6.3.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. Thailand Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Cranes

- 7.1.2. Excavators

- 7.1.3. Loaders

- 7.1.4. Backhoe

- 7.1.5. Motor Graders

- 7.1.6. Other Machinery Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Concrete and Road Construction

- 7.2.2. Earth Moving

- 7.2.3. Material Handling

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Vietnam

- 7.3.4. Singapore

- 7.3.5. Malaysia

- 7.3.6. Philippines

- 7.3.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Vietnam Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Cranes

- 8.1.2. Excavators

- 8.1.3. Loaders

- 8.1.4. Backhoe

- 8.1.5. Motor Graders

- 8.1.6. Other Machinery Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Concrete and Road Construction

- 8.2.2. Earth Moving

- 8.2.3. Material Handling

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Vietnam

- 8.3.4. Singapore

- 8.3.5. Malaysia

- 8.3.6. Philippines

- 8.3.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Singapore Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Cranes

- 9.1.2. Excavators

- 9.1.3. Loaders

- 9.1.4. Backhoe

- 9.1.5. Motor Graders

- 9.1.6. Other Machinery Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Concrete and Road Construction

- 9.2.2. Earth Moving

- 9.2.3. Material Handling

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Vietnam

- 9.3.4. Singapore

- 9.3.5. Malaysia

- 9.3.6. Philippines

- 9.3.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Malaysia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Cranes

- 10.1.2. Excavators

- 10.1.3. Loaders

- 10.1.4. Backhoe

- 10.1.5. Motor Graders

- 10.1.6. Other Machinery Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Concrete and Road Construction

- 10.2.2. Earth Moving

- 10.2.3. Material Handling

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Vietnam

- 10.3.4. Singapore

- 10.3.5. Malaysia

- 10.3.6. Philippines

- 10.3.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Philippines Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11.1.1. Cranes

- 11.1.2. Excavators

- 11.1.3. Loaders

- 11.1.4. Backhoe

- 11.1.5. Motor Graders

- 11.1.6. Other Machinery Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Concrete and Road Construction

- 11.2.2. Earth Moving

- 11.2.3. Material Handling

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Thailand

- 11.3.3. Vietnam

- 11.3.4. Singapore

- 11.3.5. Malaysia

- 11.3.6. Philippines

- 11.3.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12. Rest of ASEAN Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12.1.1. Cranes

- 12.1.2. Excavators

- 12.1.3. Loaders

- 12.1.4. Backhoe

- 12.1.5. Motor Graders

- 12.1.6. Other Machinery Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Concrete and Road Construction

- 12.2.2. Earth Moving

- 12.2.3. Material Handling

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Indonesia

- 12.3.2. Thailand

- 12.3.3. Vietnam

- 12.3.4. Singapore

- 12.3.5. Malaysia

- 12.3.6. Philippines

- 12.3.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Construction Machinery Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Liebherr Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 CNH Industrial

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Caterpillar Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 JC Bamford Excavators Ltd (JCB)*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Komatsu Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Xuzhou Construction Machinery Group Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Corporation

List of Figures

- Figure 1: Global Construction Machinery Industry in ASEAN Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 3: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 5: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 6: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 7: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 9: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 10: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 11: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 12: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 13: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 14: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 15: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 17: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 18: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 19: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 20: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 21: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 22: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 23: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 25: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 26: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 27: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 29: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 30: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 31: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 33: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 34: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 35: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 36: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 37: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 38: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 39: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 41: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 42: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 43: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 44: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 45: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 46: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 47: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 49: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 51: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 52: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 53: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 54: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 55: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 56: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 57: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 6: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 10: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 14: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 18: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 22: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 26: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 30: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 32: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Machinery Industry in ASEAN?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Construction Machinery Industry in ASEAN?

Key companies in the market include Mitsubishi Corporation, Hitachi Construction Machinery Co, Liebherr Group, CNH Industrial, Caterpillar Inc, JC Bamford Excavators Ltd (JCB)*List Not Exhaustive, Komatsu Ltd, Xuzhou Construction Machinery Group Co Ltd.

3. What are the main segments of the Construction Machinery Industry in ASEAN?

The market segments include Machinery Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activity May Drive the Market.

6. What are the notable trends driving market growth?

Concrete and Road Construction To Propel The Demand.

7. Are there any restraints impacting market growth?

High Equipment Cost may Hamper the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Volvo Construction Equipment's (Volvo CE) first fully electric construction machinery arrived in Singapore and was formally introduced to the Southeast Asia market at a grand event on the island of Sentosa in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Machinery Industry in ASEAN," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Machinery Industry in ASEAN report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Machinery Industry in ASEAN?

To stay informed about further developments, trends, and reports in the Construction Machinery Industry in ASEAN, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence