Key Insights

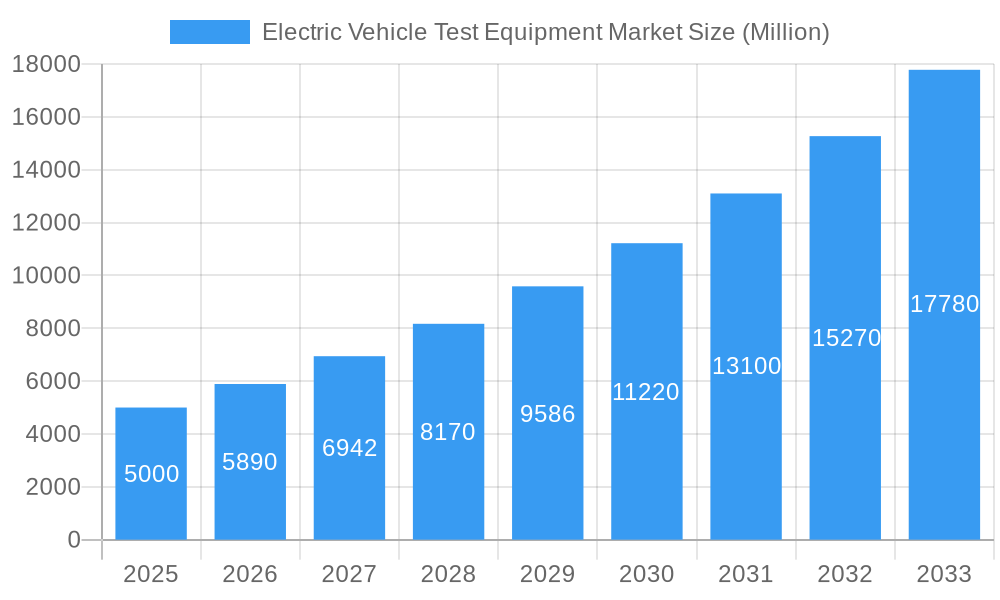

The Electric Vehicle (EV) Test Equipment market is experiencing substantial growth, driven by the global acceleration of EV adoption. The market is currently valued at 211.72 million and is projected to expand at a Compound Annual Growth Rate (CAGR) of 31.42% from the base year 2025 to 2033. Key growth drivers include stringent government regulations promoting EVs, increasing demand for high-performance and reliable electric vehicles, and continuous advancements in battery and powertrain technologies. The growing complexity of EV systems necessitates rigorous testing, creating significant demand for advanced test equipment. Battery testing equipment, essential for ensuring safety and performance, is a primary growth segment. The market is segmented by propulsion type (plug-in hybrid, battery electric, fuel cell electric vehicles), equipment type (battery, powertrain, EV component, EV charging, and other equipment), and vehicle type (passenger cars and commercial vehicles). Significant market expansion is anticipated across North America, Europe, and Asia Pacific, with China, the US, and Germany leading the way. Challenges include high initial investment costs for sophisticated testing equipment and potential supply chain bottlenecks for specialized components.

Electric Vehicle Test Equipment Market Market Size (In Million)

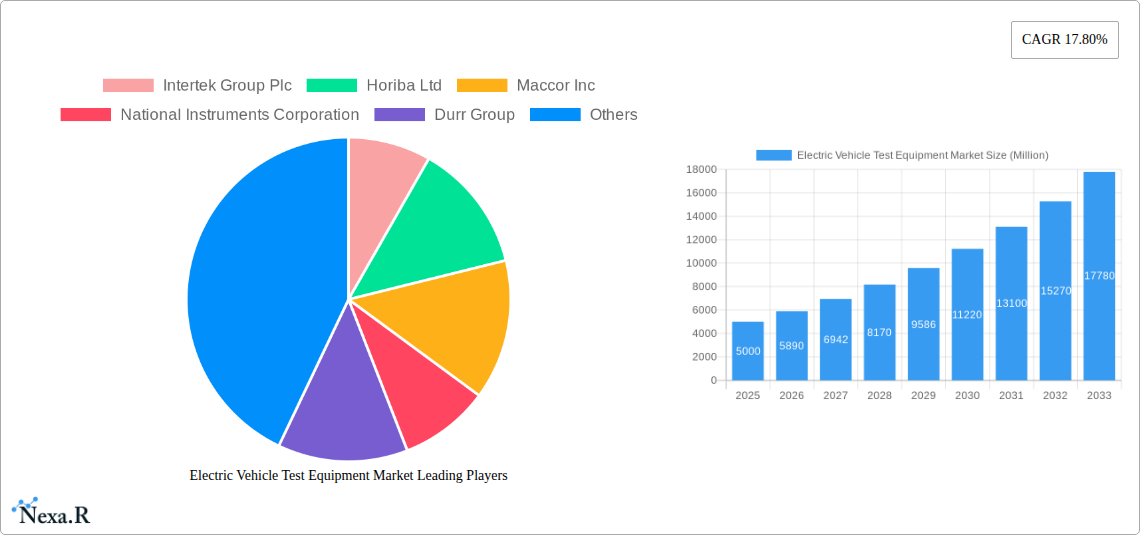

The competitive landscape features established players such as Intertek, Horiba, and National Instruments, alongside specialized manufacturers. The forecast period indicates continued market expansion fueled by technological innovation, rising EV sales, and expanding global charging infrastructure. The ongoing expansion of the EV industry presents numerous opportunities for test equipment manufacturers and suppliers. Strategic partnerships and collaborations will be crucial for meeting evolving automaker needs. Developing innovative, cost-effective, and automated testing solutions will be paramount. Addressing the need for standardized testing procedures and data sharing will improve efficiency and accelerate EV development. As electric mobility accelerates, the EV Test Equipment market is set for considerable growth. Market success will depend on companies' ability to keep pace with rapidly evolving EV technologies and meet the growing demand for high-quality, efficient testing solutions.

Electric Vehicle Test Equipment Market Company Market Share

Electric Vehicle Test Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Electric Vehicle (EV) Test Equipment market, encompassing its current state, future trends, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines various segments within the broader automotive testing industry, providing crucial insights for stakeholders across the parent market (Automotive Testing Equipment) and child market (EV Test Equipment). The report values are presented in Million units.

Electric Vehicle Test Equipment Market Dynamics & Structure

The EV test equipment market is experiencing dynamic growth fueled by the rapid expansion of the electric vehicle industry. Market concentration is currently moderate, with several key players holding significant market share, but a fragmented landscape due to numerous specialized equipment providers. Technological innovation is a primary driver, with continuous advancements in battery testing, powertrain simulation, and charging infrastructure testing. Stringent regulatory frameworks governing EV safety and performance are further propelling market demand. Competitive substitutes are limited, given the specialized nature of the equipment. End-user demographics primarily comprise EV manufacturers, component suppliers, and testing laboratories. The market has witnessed a moderate level of M&A activity in recent years, driven by the need for expansion and technological integration.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024 (estimated).

- Technological Innovation: Focus on faster, more accurate, and cost-effective testing methodologies for batteries, powertrains, and charging systems.

- Regulatory Frameworks: Stringent safety and performance standards drive demand for advanced testing equipment.

- Competitive Substitutes: Limited, due to the specialized nature of EV test equipment.

- End-User Demographics: Primarily EV manufacturers (xx%), component suppliers (xx%), and independent testing labs (xx%).

- M&A Trends: xx M&A deals closed between 2019-2024, driven by the need for technological advancement and market consolidation.

Electric Vehicle Test Equipment Market Growth Trends & Insights

The global EV test equipment market is projected to experience robust growth, driven by the surging adoption of electric vehicles worldwide. The market size witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is expected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is attributed to several factors, including increasing investments in EV infrastructure, supportive government policies and incentives, rising consumer demand for electric vehicles, and technological advancements in battery technology and charging infrastructure. Market penetration is gradually increasing, with a significant share of new EV models incorporating advanced testing procedures. Technological disruptions, like the advent of solid-state batteries, will further stimulate demand for specialized testing equipment. Shifting consumer preferences toward sustainable mobility further reinforce the growth trajectory.

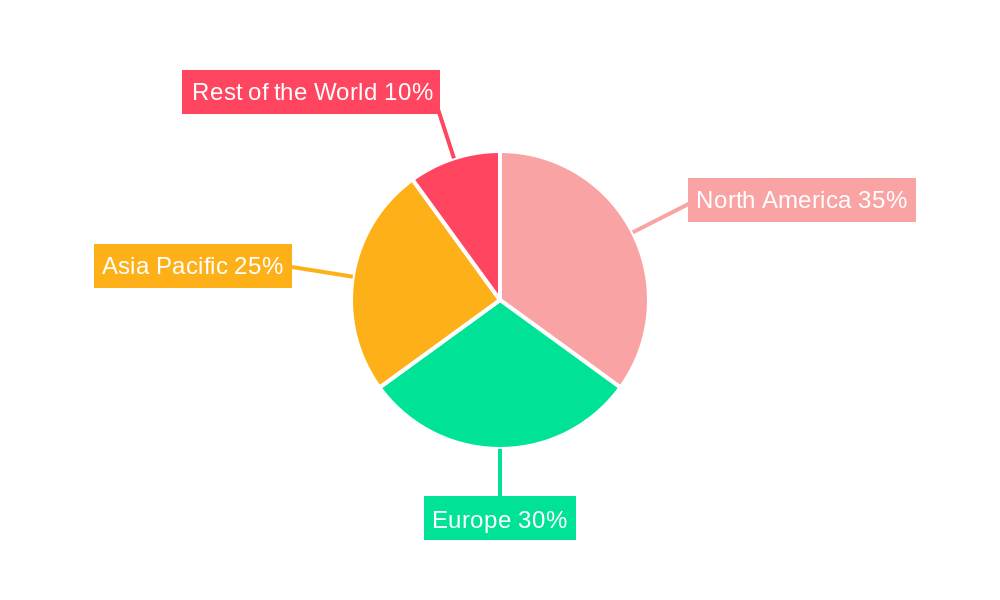

Dominant Regions, Countries, or Segments in Electric Vehicle Test Equipment Market

The EV test equipment market exhibits regional disparities in growth, with North America and Europe currently dominating due to well-established EV industries and stringent regulations. Asia-Pacific is projected to witness rapid growth fueled by increasing EV production and government support for e-mobility.

By Propulsion Type: Battery Electric Vehicles (BEVs) currently dominate, followed by Plug-in Hybrid Vehicles (PHEVs), while Fuel Cell Electric Vehicles (FCEVs) represent a smaller but rapidly growing segment.

By Equipment Type: Battery testing equipment holds the largest share, followed by powertrain and EV component testing. EV charging equipment is also experiencing significant growth.

By Vehicle Type: Passenger cars constitute the major segment, followed by commercial vehicles, with the latter segment showing higher growth potential in the coming years.

- Key Drivers (North America & Europe): Established EV infrastructure, stringent safety regulations, high consumer adoption rates.

- Key Drivers (Asia-Pacific): Rapid EV production growth, government incentives, rising middle class, and increasing urbanization.

- Market Share: North America (xx%), Europe (xx%), Asia-Pacific (xx%), Rest of the World (xx%) in 2024 (estimated).

Electric Vehicle Test Equipment Market Product Landscape

The EV test equipment market showcases a diverse range of products, from basic battery testers to sophisticated powertrain simulators and charging infrastructure analyzers. Continuous innovation focuses on improving accuracy, speed, and efficiency. Products are tailored to specific EV types and testing needs, encompassing diverse functionalities like thermal cycling, fast charging simulation, and performance evaluation under extreme conditions. Unique selling propositions often include advanced software integration, data analysis capabilities, and remote monitoring features.

Key Drivers, Barriers & Challenges in Electric Vehicle Test Equipment Market

Key Drivers:

- Increasing EV adoption globally.

- Stringent safety and performance regulations.

- Growing investments in EV infrastructure.

- Technological advancements in battery and powertrain technologies.

Key Challenges and Restraints:

- High initial investment costs for advanced equipment.

- The complexity of testing procedures for advanced EV technologies.

- Potential supply chain disruptions affecting equipment availability.

- Intense competition among equipment manufacturers.

Emerging Opportunities in Electric Vehicle Test Equipment Market

- Growth of the autonomous driving market demands specialized testing equipment.

- Increasing adoption of solid-state batteries requires new testing methodologies and equipment.

- Expansion into developing markets presents significant opportunities for equipment providers.

- Development of sophisticated testing solutions for fast-charging capabilities.

Growth Accelerators in the Electric Vehicle Test Equipment Market Industry

Technological advancements such as AI-powered testing solutions and improved battery simulation tools are significantly accelerating market growth. Strategic collaborations between equipment manufacturers and EV producers are facilitating the development of specialized testing solutions. Government initiatives and subsidies are also playing a crucial role in promoting wider adoption of EV testing equipment. Market expansion into emerging economies is further adding momentum to the growth trajectory.

Key Players Shaping the Electric Vehicle Test Equipment Market Market

- Intertek Group Plc

- Horiba Ltd

- Maccor Inc

- National Instruments Corporation

- Durr Group

- Tuv Rheinland

- Arbin Instruments

- Toyo System Co Ltd

- Wonik Pne Co Ltd

- Keysight Technologies Inc

- Froude Inc

- Dynomerk Controls

Notable Milestones in Electric Vehicle Test Equipment Sector

- July 2022: TÜV SÜD Thailand opened a new Battery and Automotive Components Testing Centre, expanding its global testing network.

- July 2022: National Instruments Japan established a new Co-engineering Lab for collaborative research on EV technologies.

- April 2022: Tevva partnered with HORIBA MIRA for access to advanced testing capabilities.

In-Depth Electric Vehicle Test Equipment Market Outlook

The future of the EV test equipment market appears promising, driven by sustained growth in EV adoption and technological innovation. Strategic partnerships, investments in R&D, and expansion into new markets represent significant opportunities for industry players. The increasing complexity of EV technologies necessitates the development of advanced and specialized testing solutions, ensuring high safety and performance standards. This evolving landscape presents significant growth potential for companies that can adapt and innovate, creating a dynamic and competitive market poised for continued expansion in the coming years.

Electric Vehicle Test Equipment Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion Type

- 2.1. Battery Electric Vehicles (BEVs)

- 2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 2.3. Hybrid Electric Vehicles (HEVs)

- 2.4. Fuel Cell Electric Vehicles (FCEVs)

-

3. Equipment Type

- 3.1. Electric Vehicle (EV) Battery Test Systems

- 3.2. Powertrain Testing

- 3.3. Electric Vehicle (EV) Component

- 3.4. Electric Vehicle (EV) Charging

- 3.5. Others (EV Drivetrain Test)

Electric Vehicle Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Vehicle Test Equipment Market Regional Market Share

Geographic Coverage of Electric Vehicle Test Equipment Market

Electric Vehicle Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Vehicle Sales to Fuel Market Growth

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Electric Vehicle Adoption Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicles (BEVs)

- 5.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 5.2.3. Hybrid Electric Vehicles (HEVs)

- 5.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 5.3. Market Analysis, Insights and Forecast - by Equipment Type

- 5.3.1. Electric Vehicle (EV) Battery Test Systems

- 5.3.2. Powertrain Testing

- 5.3.3. Electric Vehicle (EV) Component

- 5.3.4. Electric Vehicle (EV) Charging

- 5.3.5. Others (EV Drivetrain Test)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Battery Electric Vehicles (BEVs)

- 6.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 6.2.3. Hybrid Electric Vehicles (HEVs)

- 6.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 6.3. Market Analysis, Insights and Forecast - by Equipment Type

- 6.3.1. Electric Vehicle (EV) Battery Test Systems

- 6.3.2. Powertrain Testing

- 6.3.3. Electric Vehicle (EV) Component

- 6.3.4. Electric Vehicle (EV) Charging

- 6.3.5. Others (EV Drivetrain Test)

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Battery Electric Vehicles (BEVs)

- 7.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 7.2.3. Hybrid Electric Vehicles (HEVs)

- 7.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 7.3. Market Analysis, Insights and Forecast - by Equipment Type

- 7.3.1. Electric Vehicle (EV) Battery Test Systems

- 7.3.2. Powertrain Testing

- 7.3.3. Electric Vehicle (EV) Component

- 7.3.4. Electric Vehicle (EV) Charging

- 7.3.5. Others (EV Drivetrain Test)

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Battery Electric Vehicles (BEVs)

- 8.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 8.2.3. Hybrid Electric Vehicles (HEVs)

- 8.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 8.3. Market Analysis, Insights and Forecast - by Equipment Type

- 8.3.1. Electric Vehicle (EV) Battery Test Systems

- 8.3.2. Powertrain Testing

- 8.3.3. Electric Vehicle (EV) Component

- 8.3.4. Electric Vehicle (EV) Charging

- 8.3.5. Others (EV Drivetrain Test)

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Battery Electric Vehicles (BEVs)

- 9.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 9.2.3. Hybrid Electric Vehicles (HEVs)

- 9.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 9.3. Market Analysis, Insights and Forecast - by Equipment Type

- 9.3.1. Electric Vehicle (EV) Battery Test Systems

- 9.3.2. Powertrain Testing

- 9.3.3. Electric Vehicle (EV) Component

- 9.3.4. Electric Vehicle (EV) Charging

- 9.3.5. Others (EV Drivetrain Test)

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group Plc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Horiba Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maccor Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 National Instruments Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Durr Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tuv Rheinland

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arbin Instruments

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toyo System Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wonik Pne Co Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Keysight Technologies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Froude Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Dynomerk Controls

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Electric Vehicle Test Equipment Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 3: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 5: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 7: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: North America Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 13: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 14: Europe Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 15: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Europe Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 21: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 23: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 24: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 29: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 31: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 32: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 4: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 7: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 8: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 14: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 15: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 24: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 25: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: India Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Japan Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 34: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: South America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Test Equipment Market?

The projected CAGR is approximately 31.42%.

2. Which companies are prominent players in the Electric Vehicle Test Equipment Market?

Key companies in the market include Intertek Group Plc, Horiba Ltd, Maccor Inc, National Instruments Corporation, Durr Group, Tuv Rheinland, Arbin Instruments, Toyo System Co Ltd, Wonik Pne Co Ltd*List Not Exhaustive, Keysight Technologies Inc, Froude Inc, Dynomerk Controls.

3. What are the main segments of the Electric Vehicle Test Equipment Market?

The market segments include Vehicle Type, Propulsion Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 211.72 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Vehicle Sales to Fuel Market Growth.

6. What are the notable trends driving market growth?

Increased Electric Vehicle Adoption Globally.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: At the Amata City Chonburi Industrial Estate, TÜV SÜD Thailand officially opened its Battery and Automotive Components Testing Centre. This facility will add to TÜV SÜD's existing network of eight battery testing labs located in North America, Germany, and Asia. This integrated facility, which covers over 3,000 square meters, makes it simple to access global and local expertise to meet the quality and safety requirements necessary for e-Mobility to be adopted more quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Test Equipment Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence