Key Insights

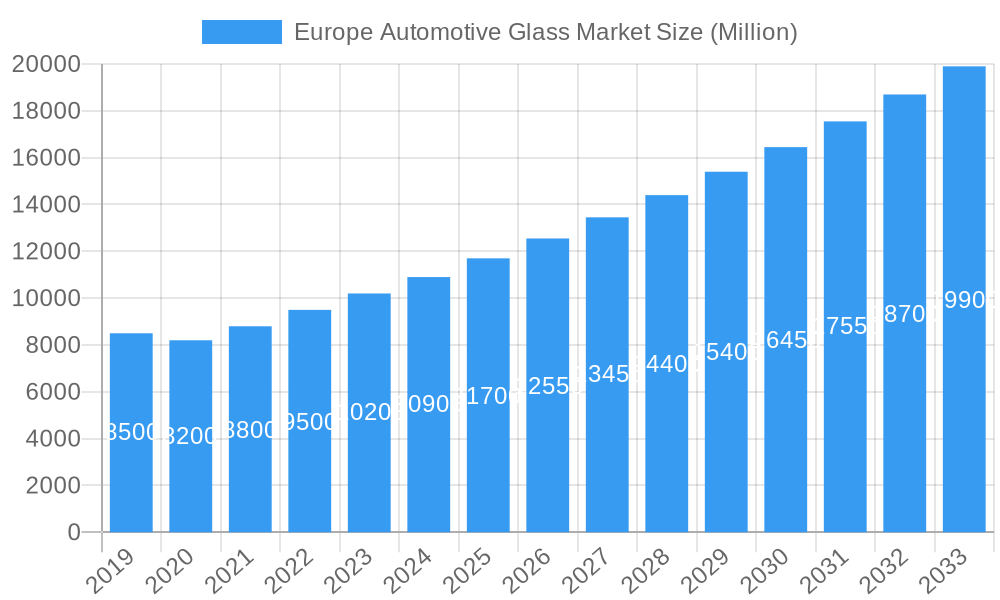

The European automotive glass market is set for significant expansion, projected to reach a valuation of 8959 million by 2033, with a compound annual growth rate (CAGR) of 6.8% from the base year 2024. Key growth drivers include the increasing integration of advanced glass technologies, such as smart glass offering dynamic tinting and integrated displays. Rising demand for premium vehicle features and evolving regulations promoting safety and energy efficiency also contribute to market momentum. The commercial vehicle sector's modernization and adoption of specialized glass solutions for enhanced visibility and driver comfort further propel growth. Emerging trends, including the seamless integration of sensors, antennas, and heating elements into automotive glass, alongside a preference for lighter, durable solutions, are reshaping the competitive landscape.

Europe Automotive Glass Market Market Size (In Billion)

Potential restraints include fluctuations in raw material prices for specialized chemicals and rare earth elements, and the high cost associated with advanced technology integration. However, continuous innovation in cost optimization and performance enhancement demonstrates the market's resilience. Market segmentation indicates strong demand for windshields and sunroofs, with smart glass emerging as a significant differentiator. Europe, a leading automotive manufacturing hub with early adoption of advanced technologies, is expected to maintain dominance, with key contributions from Germany, France, and the United Kingdom. Leading companies are actively investing in research and development and expanding production capacity to capitalize on these evolving market dynamics.

Europe Automotive Glass Market Company Market Share

Europe Automotive Glass Market: Comprehensive Analysis and Future Outlook (2019–2033)

Report Description:

This in-depth report provides a comprehensive analysis of the Europe Automotive Glass Market, exploring its intricate dynamics, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study offers critical insights into the evolving landscape of automotive glazing solutions across Europe. We dissect parent and child markets, providing granular detail on key segments, technological advancements, and competitive strategies. This report is an indispensable resource for manufacturers, suppliers, automotive OEMs, investors, and industry stakeholders seeking to understand market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. Dive deep into market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, understanding the dominant regions, countries, and segments shaping the market. With detailed product landscape analysis, key drivers, barriers, challenges, and emerging opportunities, this report equips you with the knowledge to navigate and capitalize on the dynamic Europe Automotive Glass Market. Expect to find quantitative data presented in Million units, enhancing the actionable intelligence derived from this research.

Europe Automotive Glass Market Market Dynamics & Structure

The Europe Automotive Glass Market is characterized by a moderate to high degree of market concentration, with key players such as AGC Inc., Saint Gobain, and Nippon Sheet Glass Co Ltd holding significant market share. Technological innovation is a primary driver, fueled by advancements in smart glass functionalities like electrochromic dimming, heads-up displays (HUDs), and integrated antenna systems. Regulatory frameworks, particularly those concerning vehicle safety standards and sustainability (e.g., stringent CO2 emission targets influencing vehicle lightweighting), play a crucial role in shaping product development and adoption. Competitive product substitutes are relatively limited due to the specialized nature of automotive glass, but innovation in materials and manufacturing processes can offer competitive advantages. End-user demographics, especially the growing demand for premium features in passenger cars and the increasing adoption of electric and autonomous vehicles, are influencing product mix. Merger and acquisition (M&A) trends are notable as companies seek to expand their product portfolios, gain market access, and consolidate their positions. For instance, a significant M&A deal volume in the historical period indicates a trend towards strategic consolidation.

- Market Concentration: Moderate to High. Key players like AGC Inc., Saint Gobain, Nippon Sheet Glass Co Ltd, and Xinyi Glass Holdings Limited dominate the market.

- Technological Innovation Drivers: Development of advanced features for smart glass, lightweighting solutions, enhanced safety properties (e.g., laminated glass), and integration of sensors and electronics.

- Regulatory Frameworks: European Union directives on vehicle safety, environmental impact, and energy efficiency are key influences.

- Competitive Product Substitutes: Limited, but advancements in polymer-based transparent materials and alternative assembly methods pose potential long-term competition.

- End-User Demographics: Shift towards SUVs and electric vehicles, increasing demand for panoramic sunroofs and advanced infotainment integration.

- M&A Trends: Ongoing consolidation to achieve economies of scale, expand geographic reach, and acquire new technologies. The M&A deal volume in the historical period was significant, reflecting strategic consolidation efforts.

Europe Automotive Glass Market Growth Trends & Insights

The Europe Automotive Glass Market is poised for substantial growth, driven by a confluence of technological advancements, shifting consumer preferences, and evolving automotive designs. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is underpinned by the increasing demand for advanced smart glass solutions that offer enhanced comfort, safety, and in-cabin experience. Adoption rates for features like solar-controlled glass, privacy glass, and integrated Heads-Up Display (HUD) technologies are steadily rising, particularly in the premium and luxury passenger car segments. Technological disruptions, including the integration of sensors for autonomous driving and advanced driver-assistance systems (ADAS), are creating new avenues for innovation in automotive glazing. Consumer behavior shifts towards sustainability and a greater emphasis on in-car connectivity and personalized experiences are also influencing the demand for more sophisticated and multifunctional automotive glass. For example, the push for lightweighting in electric vehicles directly impacts glass manufacturing, encouraging the use of thinner, stronger, and lighter materials. The forecast period will likely see a significant increase in the penetration of these advanced solutions, moving beyond traditional windshields and rear-view mirrors to encompass a wider array of vehicle applications. The increasing complexity of vehicle designs, with larger glass areas and curved surfaces, also necessitates advanced manufacturing capabilities and specialized glass formulations, further propelling market growth. The market's evolution is closely tied to the automotive industry's broader transformation towards electrification, digitalization, and shared mobility. The demand for integrated functionalities within the glass itself, such as antennas, heating elements, and even touch interfaces, will continue to shape product development and market dynamics. The estimated market size for 2025 is projected to reflect a significant upward trend from the historical period, indicating strong underlying demand.

Dominant Regions, Countries, or Segments in Europe Automotive Glass Market

Within the Europe Automotive Glass Market, Germany stands out as a dominant country, driven by its robust automotive manufacturing sector, particularly its leadership in passenger car production and its high adoption rate of advanced automotive technologies. The German automotive industry's strong emphasis on innovation, premium vehicle offerings, and stringent quality standards directly translates to a high demand for sophisticated automotive glass solutions. This dominance is further amplified by the presence of major automotive OEMs and Tier-1 suppliers within the country, fostering a competitive and technologically advanced ecosystem for automotive glass manufacturers.

- Dominant Country: Germany.

- Key Drivers: Strong automotive manufacturing base (OEMs and suppliers), high consumer demand for premium vehicles, advanced technological adoption (ADAS, EVs), and stringent quality standards.

- Market Share: Germany consistently holds a significant share of the European automotive glass market due to its production volumes and innovation focus.

- Growth Potential: Continued leadership in electric vehicle development and autonomous driving research will further solidify its position.

The Regular Glass segment, while mature, continues to be the largest in terms of volume due to its widespread application across all vehicle types. However, the Smart Glass segment is exhibiting the highest growth rate, propelled by increasing consumer demand for comfort, convenience, and advanced functionalities. This includes electrochromic glass for variable tinting, heated glass for improved visibility in all weather conditions, and glass with integrated sensors and displays.

Dominant Segment (by Volume): Regular Glass.

- Key Drivers: Ubiquitous application in all vehicle types, cost-effectiveness, and established manufacturing processes.

- Market Share: Represents the largest portion of the total market volume.

- Growth Potential: Steady, driven by overall vehicle production.

Dominant Segment (by Growth Rate): Smart Glass.

- Key Drivers: Increasing demand for enhanced user experience, safety features, energy efficiency, and integration of advanced electronics.

- Market Share: Growing rapidly, capturing a larger share of the premium and technologically advanced vehicle segments.

- Growth Potential: Significant, fueled by innovation and consumer acceptance of advanced features.

In terms of application types, Windshield remains the most critical segment, serving as a primary safety component and a platform for integrated technologies like ADAS sensors and HUDs. The Sunroof segment is also experiencing significant growth, driven by consumer preference for open-air experiences and panoramic roof designs, particularly in the SUV and premium car segments.

Dominant Application Type: Windshield.

- Key Drivers: Essential safety component, platform for ADAS and HUD integration, and structural integrity.

- Market Share: The largest application segment by value and volume.

- Growth Potential: Continual innovation in safety and integration capabilities.

High Growth Application Type: Sunroof.

- Key Drivers: Consumer demand for enhanced vehicle aesthetics and comfort, rise of SUVs and premium vehicles with panoramic roofs.

- Market Share: Increasing penetration and value share.

- Growth Potential: Strong, especially with evolving sunroof designs and technologies.

The Passenger Cars segment overwhelmingly dominates the market due to higher production volumes compared to commercial vehicles. However, the increasing use of commercial vehicles in logistics and delivery services, coupled with advancements in their design to incorporate more advanced glazing for driver comfort and safety, presents a growing sub-segment.

- Dominant Vehicle Type: Passenger Cars.

- Key Drivers: Higher production volumes, strong demand for premium features, and diverse model offerings.

- Market Share: The largest segment by a significant margin.

- Growth Potential: Stable to growing, influenced by overall automotive market trends.

Europe Automotive Glass Market Product Landscape

The Europe Automotive Glass Market product landscape is characterized by a relentless pursuit of innovation, pushing the boundaries of functionality and aesthetics. Beyond traditional regular glass, the market is increasingly dominated by advanced smart glass solutions. These include electrochromic glass that offers variable tinting for glare control and privacy, acoustic glass for enhanced cabin quietness, and heated glass for improved visibility in adverse weather. Furthermore, there's a growing trend towards integrating technology directly into the glass, such as embedded antennas for improved signal reception, sensors for ADAS and autonomous driving capabilities, and transparent display technologies for Heads-Up Displays (HUDs). The performance metrics that define these products include enhanced durability, improved thermal insulation, lightweighting for fuel efficiency and EV range, and superior optical clarity. Manufacturers are focusing on developing solutions that contribute to vehicle safety, driver comfort, and a more connected in-car experience. For instance, advancements in laminated glass technology are improving impact resistance and reducing the risk of ejection in accidents. The seamless integration of these functionalities within the glass itself represents a key unique selling proposition for leading companies in this dynamic market.

Key Drivers, Barriers & Challenges in Europe Automotive Glass Market

Key Drivers:

The Europe Automotive Glass Market is propelled by several significant drivers. Technological advancements in smart glass, such as electrochromic and photovoltaic glazing, are creating new market opportunities by offering enhanced comfort, safety, and energy efficiency. The increasing adoption of electric vehicles (EVs) and autonomous driving technologies necessitates lightweight, robust, and sensor-integrated glass solutions, acting as a major growth catalyst. Stringent European safety regulations mandating improved visibility and occupant protection further drive demand for advanced glazing. Additionally, consumer demand for premium features like panoramic sunroofs and HUDs is expanding the market for specialized automotive glass.

Barriers & Challenges:

Despite the promising growth, the market faces several barriers and challenges. The high cost of research and development for new technologies can be a significant hurdle. The complex and lengthy automotive homologation process for new glass products can slow down market penetration. Supply chain disruptions, as witnessed in recent years, pose a continuous challenge to timely production and delivery. Intense competition among established players and the threat of new entrants with innovative solutions can put pressure on profit margins. Furthermore, the economic fluctuations and geopolitical uncertainties within Europe can impact overall vehicle sales, directly affecting the demand for automotive glass. The disposal and recycling of specialized automotive glass also present evolving environmental challenges that require innovative solutions.

Emerging Opportunities in Europe Automotive Glass Market

Emerging opportunities in the Europe Automotive Glass Market lie in the continued development and integration of advanced smart glass functionalities. The growing demand for personalized and connected in-car experiences presents a fertile ground for glass solutions with integrated displays, augmented reality capabilities, and advanced connectivity features. The electrification of vehicles is creating a demand for lightweight, high-strength glass that contributes to improved battery range. Furthermore, the burgeoning autonomous driving sector requires highly sophisticated glass for sensor integration, camera visibility, and lidar compatibility, opening up new product development avenues. The increasing focus on sustainability also presents opportunities for the development of energy-generating glass and enhanced recyclability solutions.

Growth Accelerators in the Europe Automotive Glass Market Industry

The Europe Automotive Glass Market is experiencing growth acceleration driven by several key factors. The rapid advancement and adoption of Electric Vehicles (EVs) are a significant accelerator, as they often incorporate larger glass areas for aesthetics and lightweighting, and require specialized glass for battery management and thermal regulation. The push towards autonomous driving is another major catalyst, demanding highly integrated glass solutions with embedded sensors, cameras, and LiDAR components for seamless operation. Strategic partnerships between glass manufacturers and automotive OEMs are crucial for co-developing innovative glazing solutions tailored to future vehicle architectures. Furthermore, increasing consumer willingness to pay for advanced in-car features, such as heads-up displays, panoramic roofs, and smart tinting glass, is directly fueling demand and accelerating market growth. Government incentives and regulations promoting vehicle safety and emission reductions also play a vital role in driving the adoption of advanced automotive glass technologies.

Key Players Shaping the Europe Automotive Glass Market Market

- AGC Inc.

- Saint Gobain

- Nippon Sheet Glass Co Ltd

- Xinyi Glass Holdings Limited

- Gentex Corporation

- Webasto SE

- Central Glass Co Ltd

- Vitro S A B de C V

- Fuyao Group

- Samvardhana Motherson

- Magna International

Notable Milestones in Europe Automotive Glass Market Sector

- 2021: Launch of advanced electrochromic glass solutions by key players, offering enhanced driver comfort and energy efficiency.

- 2022: Increased M&A activity as companies consolidate to expand technological capabilities and market reach in the automotive glass sector.

- 2023: Significant advancements in sensor integration within windshields for sophisticated ADAS capabilities, responding to evolving vehicle safety demands.

- 2024: Introduction of lighter and stronger glass formulations to support the growing demand for electric vehicles and improved range.

In-Depth Europe Automotive Glass Market Market Outlook

The Europe Automotive Glass Market outlook remains exceptionally strong, driven by the relentless pace of innovation in the automotive industry. The synergy between electrification, autonomy, and digitalization is creating unprecedented demand for intelligent and multifunctional glazing. Growth accelerators like the expansion of smart glass applications, from advanced HUDs to integrated solar panels, will continue to shape product development. Strategic collaborations between automotive giants and specialized glass manufacturers are expected to deepen, fostering a rapid introduction of next-generation automotive glass solutions. The market is poised for significant expansion as vehicles transform into sophisticated, connected, and personalized mobility platforms, with automotive glass playing a central role in this evolution.

Europe Automotive Glass Market Segmentation

-

1. Type

- 1.1. Regular Glass

- 1.2. Smart Glass

-

2. Application Type

- 2.1. Windshield

- 2.2. Rear View Mirrors

- 2.3. Sunroof

- 2.4. Other Application Types

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Europe Automotive Glass Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

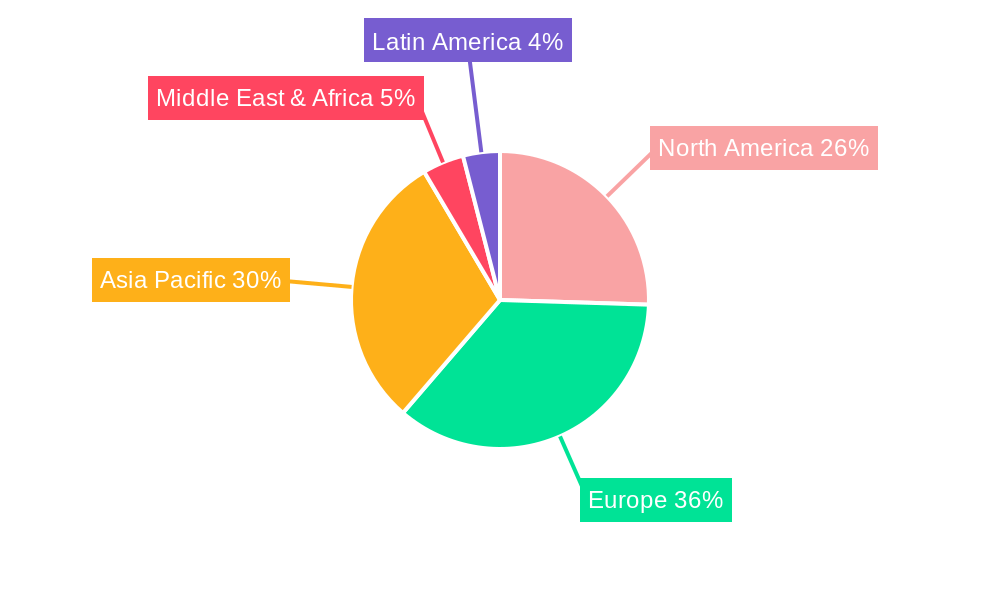

Europe Automotive Glass Market Regional Market Share

Geographic Coverage of Europe Automotive Glass Market

Europe Automotive Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. The Smart Glass will witness the highest growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Regular Glass

- 5.1.2. Smart Glass

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Windshield

- 5.2.2. Rear View Mirrors

- 5.2.3. Sunroof

- 5.2.4. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nippon Sheet Glass Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xinyi Glass Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gentex Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Webasto SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Central Glass Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vitro S A B de C V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fuyao Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Samvardhana Motherson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Magna International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saint Gobain

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AGC Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Nippon Sheet Glass Co Ltd

List of Figures

- Figure 1: Europe Automotive Glass Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Glass Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Automotive Glass Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Europe Automotive Glass Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Automotive Glass Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Glass Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Europe Automotive Glass Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Europe Automotive Glass Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Europe Automotive Glass Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Automotive Glass Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Glass Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Europe Automotive Glass Market?

Key companies in the market include Nippon Sheet Glass Co Ltd, Xinyi Glass Holdings Limited, Gentex Corporation, Webasto SE, Central Glass Co Ltd, Vitro S A B de C V, Fuyao Group, Samvardhana Motherson, Magna International, Saint Gobain, AGC Inc.

3. What are the main segments of the Europe Automotive Glass Market?

The market segments include Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8959 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

The Smart Glass will witness the highest growth in the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Glass Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence