Key Insights

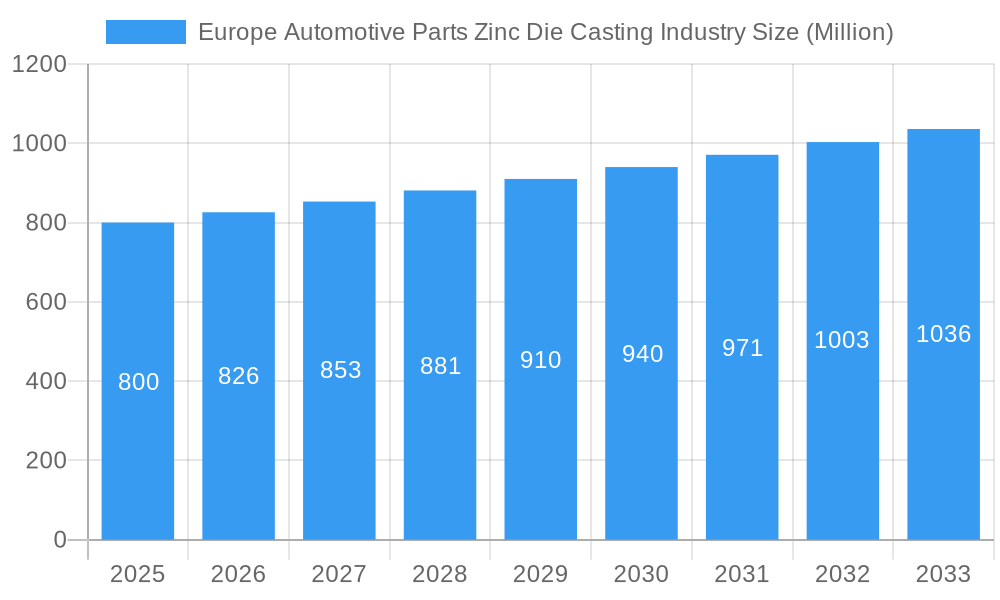

The European automotive parts zinc die casting market is poised for significant expansion, propelled by the escalating demand for lightweight, high-strength vehicle components. This dynamic sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.6%. The market size was estimated at €6.08 billion in the base year 2025 and is expected to experience sustained growth through 2033. Key growth drivers include the increasing adoption of electric vehicles (EVs), which necessitate lighter components to enhance battery range and overall efficiency. Furthermore, stringent emission regulations are compelling automakers to leverage zinc die casting, recognized for its durability and recyclability, in the production of fuel-efficient vehicles. The established use of zinc die casting in critical areas such as body assemblies, engine parts, and transmission components further underpins market growth. Despite potential challenges from supply chain disruptions and raw material price volatility, the long-term outlook remains exceptionally positive, bolstered by the burgeoning EV market and ongoing advancements in die casting technologies, including vacuum die casting, which delivers enhanced precision and superior product quality. Germany, France, and the United Kingdom represent key market segments within Europe, primarily due to their robust automotive manufacturing infrastructure and extensive supplier networks. The competitive landscape features both established global manufacturers and specialized regional players, fostering a diverse market environment ripe with opportunities for innovation and strategic consolidation.

Europe Automotive Parts Zinc Die Casting Industry Market Size (In Billion)

Analysis of market segments indicates a strong preference for pressure die casting, owing to its cost-effectiveness and rapid production capabilities. However, vacuum die casting is progressively gaining prominence due to its superior surface finish and dimensional accuracy. The ongoing integration of automation and digitization in manufacturing processes is set to further elevate efficiency and precision across the sector. While challenges persist, the market is strategically positioned for continuous expansion, driven by technological innovation, environmental mandates, and the evolving demands of the automotive industry.

Europe Automotive Parts Zinc Die Casting Industry Company Market Share

Europe Automotive Parts Zinc Die Casting Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe automotive parts zinc die casting industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, dominant segments, and key players. The report utilizes a robust methodology, incorporating both qualitative and quantitative data to deliver actionable intelligence. The total market size is projected to reach xx Million units by 2033.

Europe Automotive Parts Zinc Die Casting Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the European automotive parts zinc die casting market. The market exhibits a moderately concentrated structure, with key players holding significant market share. Technological innovation, particularly in automation and precision casting techniques, is a major driver. Stringent environmental regulations and safety standards impact production processes and material selection. The increasing adoption of lightweight materials in automobiles fuels market growth, while the availability of alternative manufacturing techniques presents competitive challenges. M&A activity within the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on automation, precision casting, and material optimization.

- Regulatory Framework: Stringent environmental and safety regulations driving sustainable practices.

- Competitive Substitutes: Plastic injection molding, aluminum die casting, and other metal forming techniques.

- End-User Demographics: Primarily automotive OEMs and Tier 1 suppliers.

- M&A Trends: Moderate activity, with xx deals recorded between 2019 and 2024.

Europe Automotive Parts Zinc Die Casting Industry Growth Trends & Insights

The European automotive parts zinc die casting market experienced steady growth during the historical period (2019-2024), driven by increasing vehicle production and the rising demand for lightweight components. The market is projected to witness continued growth during the forecast period (2025-2033), with a CAGR of xx% . Technological advancements, particularly in high-pressure die casting and vacuum die casting, are enhancing production efficiency and part quality. Consumer preferences for fuel-efficient and environmentally friendly vehicles are further boosting demand for lightweight zinc die castings. The adoption rate of zinc die casting in automotive applications is expected to increase significantly, reaching xx% by 2033. Market penetration in specific segments like engine parts shows promising growth, driven by technological advancements and cost-effectiveness.

Dominant Regions, Countries, or Segments in Europe Automotive Parts Zinc Die Casting Industry

Germany, France, and the UK represent the largest markets within Europe, driven by strong automotive manufacturing hubs and well-established supply chains. Within production process types, Pressure Die Casting remains dominant, owing to its cost-effectiveness and high production rates. However, Vacuum Die Casting is gaining traction due to its ability to produce high-quality, complex parts. In terms of application types, Body Assemblies currently hold the largest market share, followed by Engine Parts and Transmission Parts.

- Germany: Strong automotive industry, established infrastructure, and skilled workforce contribute to its dominance.

- France: Significant automotive manufacturing presence and government support for technological advancements.

- UK: A major player, although Brexit uncertainties have slightly impacted growth.

- Pressure Die Casting: Cost-effective and widely adopted, holding the largest market share.

- Body Assemblies: Largest application segment, driven by high demand for lightweight exterior parts.

Europe Automotive Parts Zinc Die Casting Industry Product Landscape

The market showcases a diverse range of zinc die casting products tailored to various automotive applications. Innovations focus on enhanced surface finishes, improved dimensional accuracy, and the development of specialized alloys for specific performance requirements. Technological advancements include the integration of sensors and other embedded components within die castings. Unique selling propositions emphasize lightweight design, durability, and cost-effectiveness compared to alternative materials.

Key Drivers, Barriers & Challenges in Europe Automotive Parts Zinc Die Casting Industry

Key Drivers: The growing demand for lightweight vehicles, stringent fuel efficiency standards, and advancements in die casting technologies are key drivers. Government incentives for electric vehicle adoption further boost market growth. The cost-effectiveness of zinc die casting compared to other materials also contributes to its widespread use.

Key Challenges: Fluctuations in zinc prices, intense competition from alternative manufacturing processes, and the need to comply with stringent environmental regulations pose significant challenges. Supply chain disruptions and skilled labor shortages also impact production capacity and profitability. The projected impact of these challenges on market growth is estimated at a reduction of xx% by 2033.

Emerging Opportunities in Europe Automotive Parts Zinc Die Casting Industry

Emerging opportunities lie in the increasing adoption of electric vehicles (EVs), requiring lightweight and highly efficient components. The development of high-strength zinc alloys and innovative surface treatment techniques opens new possibilities for enhanced performance and durability. Expansion into niche markets, such as specialty vehicles and industrial applications, also presents significant growth potential.

Growth Accelerators in the Europe Automotive Parts Zinc Die Casting Industry Industry

Strategic partnerships between die casters and automotive OEMs are accelerating market growth. Investments in automation and advanced manufacturing technologies are boosting production efficiency and reducing costs. The development of sustainable and environmentally friendly zinc alloys contributes to enhanced market competitiveness and regulatory compliance. Expansion into new geographic markets, particularly in Eastern Europe, also presents significant growth opportunities.

Key Players Shaping the Europe Automotive Parts Zinc Die Casting Industry Market

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Ningbo Die Casting Company

- Ashook Minda Group

- Dynacast

- Kemlows Diecasting Products Ltd

Notable Milestones in Europe Automotive Parts Zinc Die Casting Industry Sector

- 2020: Introduction of a new high-strength zinc alloy by [Company Name], significantly improving part durability.

- 2022: [Company Name] invested in a new automated die casting facility in Germany, boosting production capacity.

- 2023: Several major mergers and acquisitions reshaped the competitive landscape.

In-Depth Europe Automotive Parts Zinc Die Casting Industry Market Outlook

The future of the European automotive parts zinc die casting market appears promising, driven by sustained growth in the automotive sector and technological advancements. Strategic investments in automation, R&D, and sustainable manufacturing practices will be crucial for maintaining competitiveness. The market presents significant opportunities for companies that can leverage technological innovation, optimize supply chains, and meet evolving customer demands. The continued focus on lightweighting, sustainability, and improved performance will drive long-term growth.

Europe Automotive Parts Zinc Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Other Productino Process Types

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

Europe Automotive Parts Zinc Die Casting Industry Segmentation By Geography

- 1. Germay

- 2. France

- 3. United Kingdom

- 4. Italy

- 5. Rest of Europe

Europe Automotive Parts Zinc Die Casting Industry Regional Market Share

Geographic Coverage of Europe Automotive Parts Zinc Die Casting Industry

Europe Automotive Parts Zinc Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Parts Zinc Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Other Productino Process Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germay

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Germay Europe Automotive Parts Zinc Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6.1.1. Pressure Die Casting

- 6.1.2. Vacuum Die Casting

- 6.1.3. Other Productino Process Types

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Body Assemblies

- 6.2.2. Engine Parts

- 6.2.3. Transmission Parts

- 6.2.4. Other Aplication Types

- 6.1. Market Analysis, Insights and Forecast - by Production Process Type

- 7. France Europe Automotive Parts Zinc Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Process Type

- 7.1.1. Pressure Die Casting

- 7.1.2. Vacuum Die Casting

- 7.1.3. Other Productino Process Types

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Body Assemblies

- 7.2.2. Engine Parts

- 7.2.3. Transmission Parts

- 7.2.4. Other Aplication Types

- 7.1. Market Analysis, Insights and Forecast - by Production Process Type

- 8. United Kingdom Europe Automotive Parts Zinc Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Process Type

- 8.1.1. Pressure Die Casting

- 8.1.2. Vacuum Die Casting

- 8.1.3. Other Productino Process Types

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Body Assemblies

- 8.2.2. Engine Parts

- 8.2.3. Transmission Parts

- 8.2.4. Other Aplication Types

- 8.1. Market Analysis, Insights and Forecast - by Production Process Type

- 9. Italy Europe Automotive Parts Zinc Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Process Type

- 9.1.1. Pressure Die Casting

- 9.1.2. Vacuum Die Casting

- 9.1.3. Other Productino Process Types

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Body Assemblies

- 9.2.2. Engine Parts

- 9.2.3. Transmission Parts

- 9.2.4. Other Aplication Types

- 9.1. Market Analysis, Insights and Forecast - by Production Process Type

- 10. Rest of Europe Europe Automotive Parts Zinc Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Process Type

- 10.1.1. Pressure Die Casting

- 10.1.2. Vacuum Die Casting

- 10.1.3. Other Productino Process Types

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Body Assemblies

- 10.2.2. Engine Parts

- 10.2.3. Transmission Parts

- 10.2.4. Other Aplication Types

- 10.1. Market Analysis, Insights and Forecast - by Production Process Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sandhar technologies Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Empire Casting Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pace Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brillcast Manufacturing LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cascade Die Casting Group Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ningbo Die Casting Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ashook Minda Grou

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dynacast

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kemlows Diecasting Products Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Sandhar technologies Ltd

List of Figures

- Figure 1: Europe Automotive Parts Zinc Die Casting Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Parts Zinc Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 8: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 11: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 14: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 15: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 17: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Europe Automotive Parts Zinc Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Parts Zinc Die Casting Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Europe Automotive Parts Zinc Die Casting Industry?

Key companies in the market include Sandhar technologies Ltd, Empire Casting Co, Pace Industries, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Ningbo Die Casting Company, Ashook Minda Grou, Dynacast, Kemlows Diecasting Products Ltd.

3. What are the main segments of the Europe Automotive Parts Zinc Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market.

6. What are the notable trends driving market growth?

Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Parts Zinc Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Parts Zinc Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Parts Zinc Die Casting Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Parts Zinc Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence