Key Insights

The European automotive thermoplastic polymer composite market is experiencing robust growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce carbon emissions. The market, valued at approximately €X million in 2025 (assuming a logical estimation based on the provided CAGR of >6% and a market size "XX" which needs a specific value for accurate calculation), is projected to maintain a healthy CAGR of over 6% throughout the forecast period (2025-2033). Key growth drivers include stringent government regulations promoting vehicle electrification and stricter emission standards, pushing automakers to adopt lighter and more efficient materials. The rising adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies also contributes to the increased demand, as these systems often require lightweight, high-performance components. Within the market, injection molding is expected to witness significant growth due to its ability to produce complex parts with high precision and repeatability. Furthermore, the structural assembly application segment is anticipated to dominate, reflecting the increasing use of thermoplastic composites in critical vehicle components. Leading players like DuPont De Nemours, Daicel Polymer Ltd., and Celanese Corporation are actively investing in research and development to enhance material properties and expand their product portfolios, further fueling market expansion. Competition is intense, with companies focusing on innovation and strategic partnerships to maintain market share. The European region, particularly Germany, France, and the UK, constitutes a significant portion of the overall market due to established automotive manufacturing hubs and a strong focus on technological advancement.

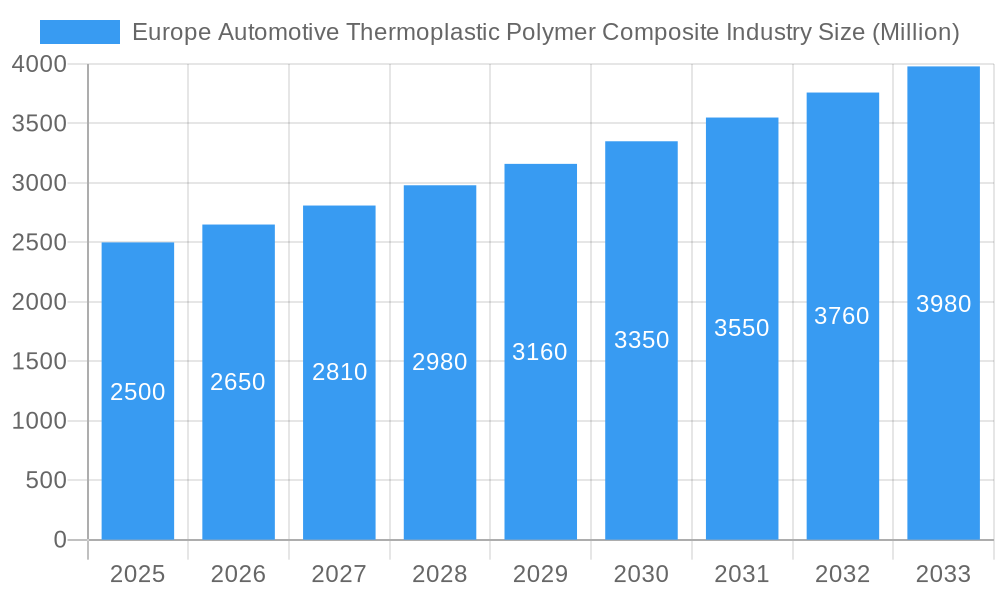

Europe Automotive Thermoplastic Polymer Composite Industry Market Size (In Billion)

While the market presents significant opportunities, certain restraints exist. The relatively high cost of thermoplastic polymer composites compared to traditional materials can limit widespread adoption, particularly in cost-sensitive segments. Furthermore, the complexities associated with the manufacturing process, including material processing and part design, present technological challenges for some automakers. However, ongoing technological advancements, such as the development of more efficient processing techniques and the availability of high-performance materials, are gradually mitigating these challenges. The shift towards sustainable materials is also driving innovation within the industry, offering additional opportunities for growth. The forecast period indicates a sustained upward trajectory, with the market size exceeding €Y million by 2033 (again, requiring a specific value for "XX" to accurately calculate this projection). This growth will be largely fueled by continued technological innovation, stricter environmental regulations, and the increasing demand for sophisticated automotive features.

Europe Automotive Thermoplastic Polymer Composite Industry Company Market Share

Europe Automotive Thermoplastic Polymer Composite Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European automotive thermoplastic polymer composite industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. It delves into market dynamics, growth trends, regional performance, product landscape, challenges, opportunities, and key players, providing a 360-degree view of this rapidly evolving sector. The report's analysis encompasses both parent market (Automotive Composites) and child market (Thermoplastic Polymer Composites within Automotive). Market values are presented in million units.

Europe Automotive Thermoplastic Polymer Composite Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the European automotive thermoplastic polymer composite industry. We explore market concentration, revealing the market share held by key players such as DuPont De Nemours, Daicel Polymer Ltd, and others. The analysis also examines the impact of technological innovation, focusing on advancements in material science and manufacturing processes such as injection molding and resin transfer molding. Regulatory frameworks impacting material usage and sustainability are discussed, along with an assessment of competitive substitutes and their market penetration. Furthermore, the report explores end-user demographics and their influence on market demand, alongside an analysis of recent mergers and acquisitions (M&A) activities within the industry. We estimate that xx M&A deals occurred between 2019 and 2024, with a projected xx deals for 2025-2033.

- Market Concentration: Highly fragmented with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation Drivers: Lightweighting initiatives, improved mechanical properties, and enhanced recyclability.

- Regulatory Frameworks: EU regulations on emissions and material safety influencing material selection and manufacturing processes.

- Competitive Product Substitutes: Traditional materials like steel and aluminum facing increasing competition.

- End-User Demographics: Growing demand driven by the increasing adoption of electric and hybrid vehicles.

- M&A Trends: Strategic acquisitions driving consolidation and technological advancements.

Europe Automotive Thermoplastic Polymer Composite Industry Growth Trends & Insights

The European automotive thermoplastic polymer composite market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% from 2025 to 2033. This expansion is fueled by several converging factors: the escalating demand for lightweight vehicles to enhance fuel efficiency and reduce emissions, the implementation of stringent regulatory standards promoting sustainability, and the widespread adoption of advanced driver-assistance systems (ADAS). Our analysis delves into the historical market size, providing a detailed forecast of future expansion. We examine adoption rates across various vehicle segments, considering the influence of technological disruptions on market dynamics. The evolving consumer preferences for eco-friendly solutions and the increasing demand for sustainable, recyclable materials significantly contribute to this positive growth trajectory. The report further explores regional variations within Europe, highlighting key growth pockets and potential challenges.

Dominant Regions, Countries, or Segments in Europe Automotive Thermoplastic Polymer Composite Industry

This section identifies the leading regions, countries, and segments within the European automotive thermoplastic polymer composite market. Germany and France are expected to remain dominant due to a strong automotive manufacturing base and supportive government policies. Within production types, Injection Molding holds the largest market share due to its high automation capabilities and suitability for high-volume production. In application types, the Structural Assembly segment dominates, driven by the growing demand for lightweight and high-strength components in vehicles.

- Germany & France: Strong automotive manufacturing clusters and favorable government support for innovation in the automotive industry.

- Injection Molding: High production volume, automation capabilities, and cost-effectiveness.

- Structural Assembly: Demand for lightweight and high-strength components in vehicle bodies.

- Other Key Segments: Powertrain Components (xx Million Units), Interior (xx Million Units), Exterior (xx Million Units), Others (xx Million Units).

Europe Automotive Thermoplastic Polymer Composite Industry Product Landscape

The automotive thermoplastic polymer composite market showcases continuous innovation in material properties and processing techniques. New materials offer improved strength-to-weight ratios, enhanced durability, and better recyclability compared to traditional materials. The industry is witnessing the rise of advanced composite materials with tailored properties to meet specific application requirements. Manufacturers are constantly striving to improve processing efficiencies and reduce production costs. Unique selling propositions include the high performance-to-weight ratio, design flexibility, and potential for improved recyclability.

Key Drivers, Barriers & Challenges in Europe Automotive Thermoplastic Polymer Composite Industry

Key Drivers: The automotive industry's ongoing push for improved fuel economy, driven by stringent government regulations, necessitates the adoption of lightweight materials. Thermoplastic polymer composites offer a compelling solution, providing significant weight reduction without compromising performance. Furthermore, continuous technological advancements in materials science and manufacturing processes are leading to enhanced material properties, increased production efficiency, and reduced costs. Government initiatives promoting the use of sustainable materials further accelerate market growth.

Key Barriers & Challenges: Despite the significant potential, several challenges hinder the widespread adoption of thermoplastic polymer composites. High initial investment costs for specialized manufacturing equipment and the relatively high material costs pose a considerable barrier to entry for new players. Supply chain disruptions and fluctuations in raw material prices can impact production efficiency and profitability. Meeting stringent regulatory compliance requirements adds to the complexity of market operations. Intense competition among established players and the automotive industry's often conservative approach to material adoption remain key obstacles to overcome.

Emerging Opportunities in Europe Automotive Thermoplastic Polymer Composite Industry

The European automotive thermoplastic polymer composite market presents numerous opportunities for innovation and growth. The development of advanced high-performance materials with superior strength, stiffness, temperature resistance, and durability is a key area of focus. Expansion into niche applications, such as electric vehicle battery casings, hydrogen fuel cell components, and lightweight body panels, offers significant potential. The growing consumer demand for sustainable and recyclable materials creates lucrative opportunities for manufacturers offering bio-based and easily recyclable composite solutions. Furthermore, advancements in design and manufacturing techniques, enabling faster and more cost-effective production, will play a crucial role in shaping future market dynamics. The focus on circular economy principles opens further avenues for growth.

Growth Accelerators in the Europe Automotive Thermoplastic Polymer Composite Industry Industry

Technological breakthroughs in material science and processing technologies are driving market growth. Strategic partnerships between material suppliers and automotive manufacturers facilitate the development and adoption of new composite solutions. Expansion into new markets and geographical regions increases the overall market size.

Key Players Shaping the Europe Automotive Thermoplastic Polymer Composite Industry Market

- DuPont De Nemours

- Daicel Polymer Ltd

- Base Binani Group

- Celanese Corporation

- 3B-Fibreglass

- Arkema Group

- Technocompound GmbH

- Polyone Corporation

- Hexcel Corporation

- Cytec Industries Inc

Notable Milestones in Europe Automotive Thermoplastic Polymer Composite Industry Sector

- 2020: Introduction of a new high-strength thermoplastic composite by [Company Name] – [Add details about the composite and its impact].

- 2021: Acquisition of [Company A] by [Company B], expanding market share and production capabilities – [Add details about the synergy and market impact].

- 2022: Launch of a new manufacturing facility in [Country] by [Company Name], significantly increasing production capacity and regional reach – [Specify the location and capacity increase].

- 2023: Several key players announced strategic partnerships focused on the development and commercialization of sustainable composite materials – [Name some key players and collaborations].

- 2024: Several new regulations related to the use of sustainable materials came into effect, creating both challenges and opportunities for market players – [Specify the nature of regulations].

- [Current Year]: [Add a recent significant milestone]

In-Depth Europe Automotive Thermoplastic Polymer Composite Industry Market Outlook

The European automotive thermoplastic polymer composite market is projected to experience considerable expansion in the coming years, driven by a confluence of factors including technological advancements, increasing demand for lightweight vehicles, supportive government policies, and the rising adoption of electric vehicles. The focus on sustainability is a key catalyst, prompting manufacturers to develop and adopt eco-friendly composite materials. Strategic partnerships, substantial investments in research and development, and the development of cost-effective manufacturing processes will play a pivotal role in shaping the market's future trajectory. Companies capable of delivering innovative and sustainable solutions are poised to capture significant market share in this rapidly growing sector. The report provides detailed segmentation analysis and regional forecasts, offering valuable insights for industry stakeholders.

Europe Automotive Thermoplastic Polymer Composite Industry Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vaccum Infusion Processing

- 1.4. Compression Molding

- 1.5. Injection Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Power Train Components

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

Europe Automotive Thermoplastic Polymer Composite Industry Segmentation By Geography

- 1. Germay

- 2. France

- 3. United Kingdom

- 4. Italy

- 5. Rest of Europe

Europe Automotive Thermoplastic Polymer Composite Industry Regional Market Share

Geographic Coverage of Europe Automotive Thermoplastic Polymer Composite Industry

Europe Automotive Thermoplastic Polymer Composite Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Lightweight Materials

- 3.3. Market Restrains

- 3.3.1. High Expenses of Composite Processing and Manufacturing

- 3.4. Market Trends

- 3.4.1. Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vaccum Infusion Processing

- 5.1.4. Compression Molding

- 5.1.5. Injection Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Power Train Components

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germay

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Germay Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 6.1.1. Hand Layup

- 6.1.2. Resin Transfer Molding

- 6.1.3. Vaccum Infusion Processing

- 6.1.4. Compression Molding

- 6.1.5. Injection Molding

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Structural Assembly

- 6.2.2. Power Train Components

- 6.2.3. Interior

- 6.2.4. Exterior

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 7. France Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 7.1.1. Hand Layup

- 7.1.2. Resin Transfer Molding

- 7.1.3. Vaccum Infusion Processing

- 7.1.4. Compression Molding

- 7.1.5. Injection Molding

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Structural Assembly

- 7.2.2. Power Train Components

- 7.2.3. Interior

- 7.2.4. Exterior

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 8. United Kingdom Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 8.1.1. Hand Layup

- 8.1.2. Resin Transfer Molding

- 8.1.3. Vaccum Infusion Processing

- 8.1.4. Compression Molding

- 8.1.5. Injection Molding

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Structural Assembly

- 8.2.2. Power Train Components

- 8.2.3. Interior

- 8.2.4. Exterior

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 9. Italy Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 9.1.1. Hand Layup

- 9.1.2. Resin Transfer Molding

- 9.1.3. Vaccum Infusion Processing

- 9.1.4. Compression Molding

- 9.1.5. Injection Molding

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Structural Assembly

- 9.2.2. Power Train Components

- 9.2.3. Interior

- 9.2.4. Exterior

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 10. Rest of Europe Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 10.1.1. Hand Layup

- 10.1.2. Resin Transfer Molding

- 10.1.3. Vaccum Infusion Processing

- 10.1.4. Compression Molding

- 10.1.5. Injection Molding

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Structural Assembly

- 10.2.2. Power Train Components

- 10.2.3. Interior

- 10.2.4. Exterior

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dupont De Nemours

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daicel Polymer Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Base Binani Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Celanese Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3B-Fibreglass

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Technocompound GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Polyone Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hexcel Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cytec Industries Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dupont De Nemours

List of Figures

- Figure 1: Europe Automotive Thermoplastic Polymer Composite Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Thermoplastic Polymer Composite Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 2: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 5: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 8: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 9: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 11: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 12: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 14: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 15: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 17: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 18: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Thermoplastic Polymer Composite Industry?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Europe Automotive Thermoplastic Polymer Composite Industry?

Key companies in the market include Dupont De Nemours, Daicel Polymer Ltd, Base Binani Group, Celanese Corporation, 3B-Fibreglass, Arkema Group, Technocompound GmbH, Polyone Corporatio, Hexcel Corporation, Cytec Industries Inc.

3. What are the main segments of the Europe Automotive Thermoplastic Polymer Composite Industry?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Lightweight Materials.

6. What are the notable trends driving market growth?

Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace.

7. Are there any restraints impacting market growth?

High Expenses of Composite Processing and Manufacturing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Thermoplastic Polymer Composite Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Thermoplastic Polymer Composite Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Thermoplastic Polymer Composite Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Thermoplastic Polymer Composite Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence