Key Insights

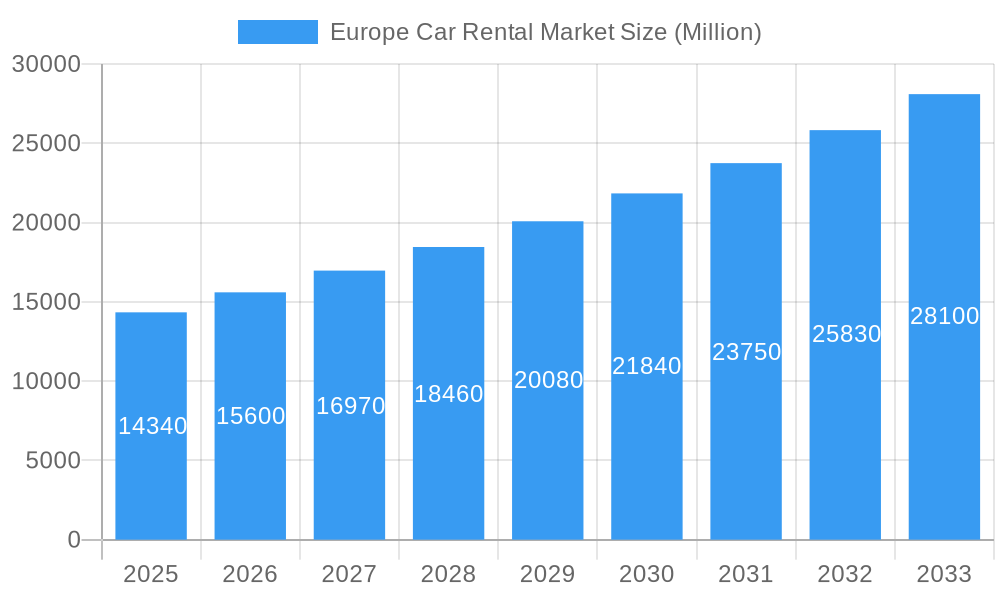

The European car rental market, valued at €14.34 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.96% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning tourism sector across Europe, particularly in popular destinations like Germany, France, Italy, and Spain, significantly drives demand for short-term rentals. Simultaneously, the increasing business travel and the growth of the corporate sector contribute to the demand for long-term car rentals. Furthermore, the convenience and flexibility offered by online booking platforms are transforming consumer behavior, pushing the market towards higher adoption rates. The market is segmented by booking type (offline, online), rental duration (short-term, long-term), application type (leisure/tourism, business), vehicle type (economy/budget, premium/luxury), and country. Germany, the UK, France, and Italy represent the largest national markets, reflecting their established tourism infrastructure and robust business environments. Competitive dynamics are shaping the market landscape, with key players like Enterprise Holdings, Sixt SE, Europcar Mobility Group, and Avis Budget Group Inc. vying for market share through innovative services, fleet diversification, and strategic partnerships.

Europe Car Rental Market Market Size (In Billion)

The sustained growth trajectory is anticipated to be influenced by several evolving market trends. The increasing adoption of electric and hybrid vehicles within rental fleets will cater to environmentally conscious travelers and corporate sustainability initiatives. Technological advancements such as improved mobile applications, integrated navigation systems, and automated check-in/check-out processes are streamlining the rental experience and enhancing customer satisfaction. However, challenges remain. Fluctuations in fuel prices, economic downturns impacting travel and business spending, and evolving regulatory frameworks concerning emissions and vehicle standards could potentially temper growth. Nevertheless, the long-term outlook for the European car rental market remains positive, driven by a combination of increasing travel demand, technological innovation, and the sustained efforts of market leaders to improve services and cater to evolving customer preferences.

Europe Car Rental Market Company Market Share

Europe Car Rental Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe car rental market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (Transportation & Logistics) and delves into various child markets, providing granular insights into market segmentation and key players. The market size is presented in million units.

Europe Car Rental Market Dynamics & Structure

The European car rental market is a dynamic and competitive landscape characterized by a blend of established international players and regional operators. Market concentration is moderate, with a few major players holding significant market share, but with ample room for smaller, specialized companies to thrive. Technological innovation is a key driver, with the adoption of online booking platforms, mobile applications, and innovative fleet management systems transforming the customer experience and operational efficiency. Regulatory frameworks, varying across European countries, influence operational costs and market access. The emergence of ride-sharing services and other mobility solutions presents a competitive substitute, requiring car rental companies to adapt and offer value-added services. The market is segmented by various factors to provide detailed insights.

- Market Concentration: Moderate, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Focus on mobile apps, online booking, fleet management software, and electric vehicle integration.

- Regulatory Frameworks: Varying regulations across countries regarding licensing, taxation, and environmental standards.

- Competitive Substitutes: Ride-sharing services (e.g., Uber, Bolt), public transportation, and personal vehicle ownership.

- End-User Demographics: Primarily leisure travelers and business professionals, with varying preferences based on age, income, and travel purpose.

- M&A Trends: Consolidation is expected, with larger players acquiring smaller regional companies to expand their geographical reach and service offerings. xx M&A deals were recorded in the historical period (2019-2024).

Europe Car Rental Market Growth Trends & Insights

The Europe car rental market experienced significant growth during the historical period (2019-2024), driven by increasing tourism, business travel, and the rising adoption of online booking platforms. The market is expected to continue its growth trajectory, albeit at a moderated pace, during the forecast period (2025-2033). Factors influencing growth include expanding middle-class populations, improving infrastructure in several European countries, and technological advancements enhancing convenience and affordability. However, economic downturns and evolving consumer preferences towards alternative mobility solutions could pose challenges. The market is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. Market penetration is expected to increase from xx% in 2025 to xx% in 2033.

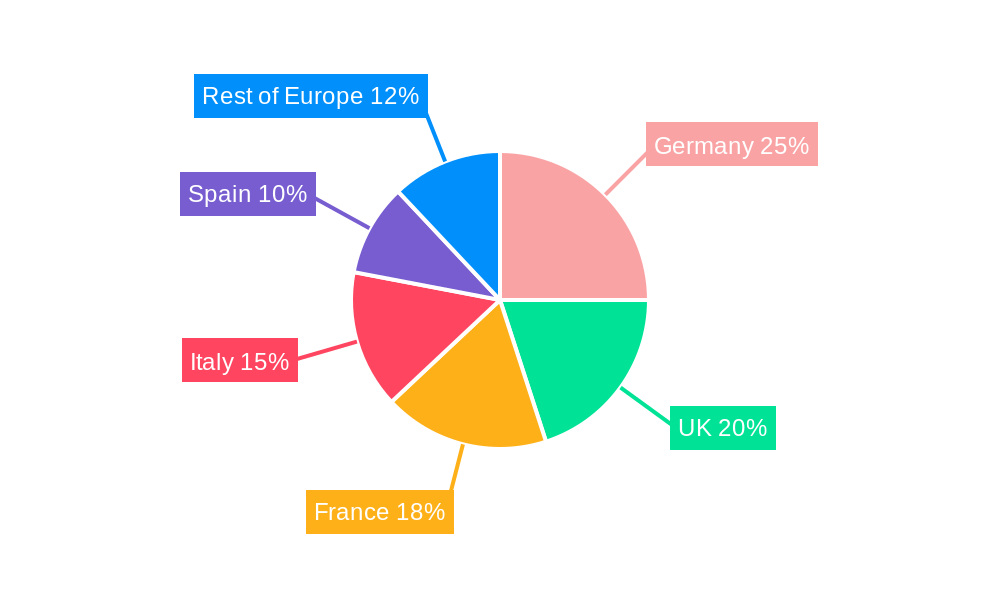

Dominant Regions, Countries, or Segments in Europe Car Rental Market

Germany, the United Kingdom, France, and Spain represent the largest national markets within the European car rental sector, driven by robust tourism, thriving business sectors, and well-developed transportation infrastructure. The online booking segment is rapidly gaining traction, surpassing offline bookings in terms of growth rate and market share. Short-term rentals continue to dominate the market, although the long-term rental segment is experiencing steady growth, particularly among business travelers. The leisure/tourism application type is the largest segment. Economy/budget cars remain the most popular vehicle type due to price sensitivity.

- By Country: Germany, United Kingdom, France, Spain (top 4 markets, accounting for xx% of the total market in 2025).

- By Booking Type: Online booking segment exhibiting faster growth than offline.

- By Rental Duration: Short-term rentals dominating the market; long-term rental segment showing steady growth.

- By Application Type: Leisure/Tourism application type leading the market.

- By Vehicle Type: Economy/Budget cars represent the largest vehicle type segment.

Europe Car Rental Market Product Landscape

The car rental market offers a range of vehicle types, from economy to luxury, catering to diverse customer needs. Recent innovations focus on enhancing the customer experience through user-friendly mobile applications, streamlined booking processes, and personalized services. Telematics and IoT technologies are being incorporated to optimize fleet management and improve vehicle tracking and maintenance. The introduction of electric and hybrid vehicles is gaining momentum, though challenges remain regarding charging infrastructure and resale values.

Key Drivers, Barriers & Challenges in Europe Car Rental Market

Key Drivers:

- Increasing tourism and business travel.

- Growth of online booking platforms.

- Technological advancements in fleet management and customer service.

- Expansion of electric vehicle fleets (despite recent setbacks like SIXT's decision).

Key Challenges and Restraints:

- Fluctuations in fuel prices and economic conditions impacting operational costs and consumer spending.

- Intense competition from ride-sharing services and other alternative mobility solutions.

- Stringent regulations and environmental concerns affecting fleet composition and operations. This could result in a xx% increase in operational costs by 2030.

- Supply chain disruptions impacting vehicle availability and maintenance.

Emerging Opportunities in Europe Car Rental Market

- Expansion into underserved rural areas and smaller towns.

- Development of specialized rental services, catering to specific customer segments (e.g., eco-friendly vehicles, campervans).

- Strategic partnerships with hotels, airlines, and tour operators.

- Integration of AI and machine learning for improved customer service and operational efficiency.

Growth Accelerators in the Europe Car Rental Market Industry

The long-term growth of the European car rental market will be fueled by continued technological advancements, strategic partnerships, and market expansion initiatives. The adoption of shared mobility solutions and subscription models is expected to create new revenue streams. Investments in sustainable transportation options, including electric and hybrid vehicles, will be crucial for addressing environmental concerns and attracting environmentally conscious customers.

Key Players Shaping the Europe Car Rental Market Market

Notable Milestones in Europe Car Rental Market Sector

- December 2023: SIXT SE phases out Tesla electric rental cars due to reduced resale costs.

- October 2023: Enterprise Holdings rebrands to Enterprise Mobility.

- June 2023: Europcar partners with BringOz logistics platform to optimize vehicle movement.

In-Depth Europe Car Rental Market Market Outlook

The future of the European car rental market looks promising, with continued growth driven by technological innovation, evolving consumer preferences, and strategic partnerships. The market is poised to capitalize on emerging opportunities within the shared mobility space, the growing demand for sustainable transportation options, and the increasing adoption of digital technologies. Companies that successfully adapt to changing market dynamics and invest in advanced technologies will be best positioned for long-term success.

Europe Car Rental Market Segmentation

-

1. Booking Type

- 1.1. Offline

- 1.2. Online

-

2. Rental Duration

- 2.1. Short Term

- 2.2. Long Term

-

3. Application Type

- 3.1. Leisure/Tourism

- 3.2. Business

-

4. Vehicle Type

- 4.1. Economy/Budget Cars

- 4.2. Premium/Luxury Cars

Europe Car Rental Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Car Rental Market Regional Market Share

Geographic Coverage of Europe Car Rental Market

Europe Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inbound Tourism to Fuel Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Online Segment of the Market to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline

- 5.1.2. Online

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short Term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Leisure/Tourism

- 5.3.2. Business

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Economy/Budget Cars

- 5.4.2. Premium/Luxury Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OK Mobility Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Car Rental

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Auto Europe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enterprise Holdings

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SIXT SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Budget Rent a Car System Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alamo Rent a Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ACE Rent A Ca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hertz Global Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Europcar Mobility Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Avis Budget Group Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 OK Mobility Group

List of Figures

- Figure 1: Europe Car Rental Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 3: Europe Car Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Europe Car Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 8: Europe Car Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 9: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Europe Car Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Car Rental Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the Europe Car Rental Market?

Key companies in the market include OK Mobility Group, National Car Rental, Auto Europe, Enterprise Holdings, SIXT SE, Budget Rent a Car System Inc, Alamo Rent a Car, ACE Rent A Ca, Hertz Global Holdings, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Europe Car Rental Market?

The market segments include Booking Type, Rental Duration, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inbound Tourism to Fuel Market Growth.

6. What are the notable trends driving market growth?

Online Segment of the Market to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023: SIXT SE, a German-based car rental company, announced that it was phasing out Tesla electric rental cars from its fleets because of reduced resale costs. SIXT was the second company apart from Hertz to announce the replacement of its electric vehicle fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Car Rental Market?

To stay informed about further developments, trends, and reports in the Europe Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence