Key Insights

The European commercial vehicle Advanced Driver-Assistance Systems (ADAS) market is experiencing substantial growth, propelled by stringent safety regulations, increased demand for enhanced driver comfort and fuel efficiency, and the rising adoption of autonomous driving technologies. The market, valued at approximately $4.2 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) exceeding 18% from 2025 to 2033, reaching an estimated value of over $12 billion by 2033. Key growth drivers include the mandatory integration of ADAS features in new commercial vehicles across European nations and a growing preference for vehicles equipped with advanced safety and convenience technologies. Leading ADAS features currently include Parking Assist Systems, Adaptive Front-lighting, and Blind Spot Detection, with LiDAR technologies gaining traction due to their superior performance in adverse weather. While the passenger car segment currently holds a larger market share, the commercial vehicle segment is expected to exhibit accelerated growth, driven by a strong focus on fleet safety and operational efficiency. Major industry players like Bosch, Autoliv, and Continental are significantly investing in R&D to develop specialized ADAS solutions for the commercial vehicle sector, further stimulating market expansion.

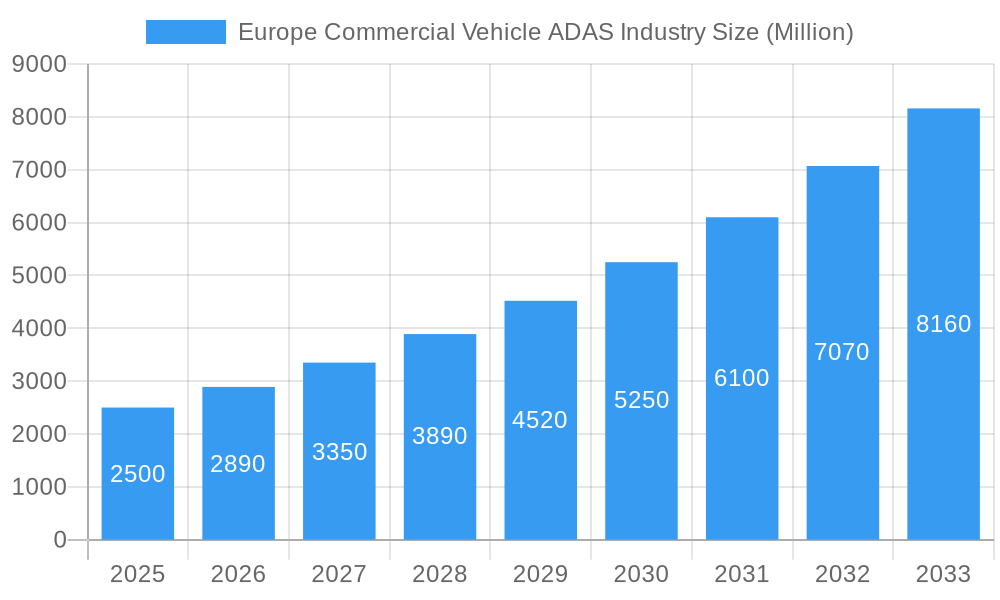

Europe Commercial Vehicle ADAS Industry Market Size (In Billion)

Despite significant growth potential, certain challenges impact market expansion. The high initial investment for ADAS integration in commercial vehicles remains a primary barrier, particularly for smaller fleet operators. Furthermore, the necessity for robust infrastructure to support advanced driver-assistance systems presents an ongoing obstacle. However, continuous technological advancements and supportive government policies aimed at enhancing road safety and reducing accidents in Europe are anticipated to mitigate these challenges and sustain the expansion of the European commercial vehicle ADAS market. The increasing availability of cost-effective ADAS solutions and heightened awareness among fleet managers regarding their benefits are expected to accelerate market penetration.

Europe Commercial Vehicle ADAS Industry Company Market Share

Europe Commercial Vehicle ADAS Industry Market Report: Market Size, Growth, and Forecast (2019-2033)

This comprehensive report offers a detailed analysis of the European Commercial Vehicle ADAS market, covering market dynamics, growth trends, regional insights, product offerings, key players, and future projections. The report spans the period 2019-2033, with a specific focus on the 2025-2033 forecast. It examines both the broader automotive ADAS market and the specialized commercial vehicle ADAS segment, providing critical insights for industry professionals. Market values are presented in billions of units.

Europe Commercial Vehicle ADAS Industry Market Dynamics & Structure

The European commercial vehicle ADAS market is characterized by moderate concentration, with key players like Bosch Group, Continental AG, and Autoliv AB holding significant market share (estimated at xx% combined in 2025). Technological innovation, driven by advancements in radar, LiDAR, and camera technologies, is a major growth driver. Stringent European Union regulations mandating ADAS features in commercial vehicles are further fueling market expansion. The market faces competition from alternative safety solutions, but the increasing demand for enhanced safety and fuel efficiency is expected to offset this. The end-user demographic includes logistics companies, trucking firms, and public transportation operators. M&A activity is significant, with recent partnerships like the Continental-HERE-IVECO collaboration signifying a trend towards integrated solutions.

- Market Concentration: Moderately concentrated, with top 3 players holding xx% market share in 2025.

- Technological Innovation: Rapid advancements in radar, LiDAR, and camera technologies are driving market growth.

- Regulatory Framework: Stringent EU regulations mandating ADAS features are key growth catalysts.

- Competitive Substitutes: Alternative safety solutions pose moderate competition.

- End-User Demographics: Primarily logistics companies, trucking firms, and public transport operators.

- M&A Trends: Increasing strategic partnerships and collaborations to develop and integrate advanced ADAS solutions.

Europe Commercial Vehicle ADAS Industry Growth Trends & Insights

The European commercial vehicle ADAS market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue during the forecast period (2025-2033), driven by factors such as increasing safety regulations, rising consumer demand for advanced safety features, and technological advancements. Market penetration of ADAS features in commercial vehicles is currently at xx% in 2025, and it's expected to reach xx% by 2033. Technological disruptions, such as the development of autonomous driving capabilities, are expected to further accelerate market growth. Consumer behavior shifts towards prioritizing safety and fuel efficiency are supporting this trend. The market size is estimated at xx million units in 2025 and is projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Europe Commercial Vehicle ADAS Industry

Western European countries, particularly Germany, France, and the UK, dominate the European commercial vehicle ADAS market due to higher vehicle sales, robust infrastructure, and stringent safety regulations. Within the segment breakdown, Blind Spot Detection and Lane Departure Warning systems hold significant market share due to their relatively lower cost and high demand. The commercial vehicle segment is growing faster than the passenger car segment due to the increasing focus on safety and efficiency in the commercial sector.

- Leading Regions: Western Europe (Germany, France, UK)

- Key Drivers: Stringent safety regulations, advanced infrastructure, high vehicle sales.

- Dominant Segments: By Type: Blind Spot Detection, Lane Departure Warning; By Technology: Radar; By Vehicle Type: Heavy-duty commercial vehicles.

Europe Commercial Vehicle ADAS Industry Product Landscape

The European commercial vehicle Advanced Driver-Assistance Systems (ADAS) market is characterized by a sophisticated and expanding product portfolio designed to enhance safety, efficiency, and driver comfort. Key offerings include advanced parking assist systems that simplify maneuvering in complex urban environments, and intelligent adaptive front-lighting that optimizes visibility based on driving conditions. Night vision systems are increasingly being integrated to improve driver perception in low-light scenarios, while blind spot detection systems provide critical awareness of surrounding traffic. Lane departure warning systems and their more advanced counterparts, lane-keeping assist, actively contribute to preventing unintended lane excursions. These systems leverage a range of cutting-edge sensor technologies, including high-resolution radar for distance and speed measurement, precise LiDAR for detailed environmental mapping, and sophisticated cameras for object recognition and lane tracking. Recent innovations are heavily focused on enhancing system accuracy through sensor fusion and advanced algorithms, enabling the integration of multiple functionalities into single units for greater efficiency and cost-effectiveness. Furthermore, ADAS plays a pivotal role in improving fuel efficiency through features like intelligent speed assistance, which helps drivers adhere to speed limits and optimize fuel consumption. The primary selling points for these products revolve around significantly enhanced safety for drivers and other road users, a tangible improvement in driver comfort by reducing workload and fatigue, and a direct impact on reduced operational costs through accident prevention and fuel savings.

Key Drivers, Barriers & Challenges in Europe Commercial Vehicle ADAS Industry

Key Drivers: A confluence of powerful factors is propelling the growth of the European commercial vehicle ADAS market. Foremost among these are increasingly stringent safety regulations mandated by European authorities, which compel manufacturers and fleet operators to adopt advanced safety technologies. This is complemented by a growing demand for enhanced safety features from both commercial entities and society at large, recognizing the tangible benefits of ADAS in accident reduction. Rapid technological advancements in sensor technology, artificial intelligence, and data processing are continuously making ADAS more capable and affordable. Additionally, various government incentives and subsidies for adopting ADAS technologies further encourage their widespread implementation. The persistent rising demand for fuel-efficient vehicles, driven by environmental concerns and operational cost pressures, positions ADAS as a key enabler of this efficiency. Lastly, the fundamental need for improved driver assistance to combat driver fatigue and enhance overall operational safety is a significant underlying driver.

Challenges: Despite the robust growth, the market faces several considerable hurdles. The high initial investment costs associated with purchasing and integrating ADAS technology can be a significant barrier for smaller fleet operators. Supply chain disruptions, particularly the ongoing global shortages of semiconductor components, continue to impact production volumes and lead times. The complexity in integrating different ADAS systems from various suppliers, ensuring seamless interoperability and data sharing, presents an ongoing technical challenge. Furthermore, the need for skilled technicians for proper installation, calibration, and ongoing maintenance of these sophisticated systems is a constraint in many regions. Intense competition from established automotive suppliers and the dynamic emergence of new tech-focused entrants also increase market pressure and necessitate continuous innovation and competitive pricing strategies.

Emerging Opportunities in Europe Commercial Vehicle ADAS Industry

The European commercial vehicle ADAS market is ripe with emerging opportunities poised to shape its future trajectory. A significant area of growth lies in the integration of ADAS with telematics and comprehensive fleet management systems. This synergy allows for real-time data analysis, predictive maintenance, driver behavior monitoring, and optimized route planning, creating a holistic operational intelligence platform. The ongoing development of advanced features such as fully functional automated emergency braking (AEB) and sophisticated adaptive cruise control (ACC) systems tailored for the unique demands of commercial vehicles, with a strong focus on paving the way for autonomous driving capabilities, holds immense long-term potential. This includes features like platooning and automated docking. Furthermore, the historically underserved untapped markets in Eastern Europe represent substantial growth prospects, as these regions increasingly adopt stricter safety standards and recognize the economic benefits of advanced vehicle technologies. The development of specialized ADAS solutions for specific commercial vehicle segments, such as long-haul trucking or urban delivery vans, also presents niche but lucrative opportunities.

Growth Accelerators in the Europe Commercial Vehicle ADAS Industry Industry

Technological advancements, particularly in AI and machine learning, are enabling more sophisticated and effective ADAS features. Strategic partnerships and collaborations among automotive manufacturers, technology providers, and map data companies are accelerating product development and market penetration. Government initiatives promoting the adoption of ADAS technologies through subsidies and incentives further propel market growth.

Key Players Shaping the Europe Commercial Vehicle ADAS Industry Market

- Robert Bosch GmbH: A leading global supplier of technology and services, renowned for its comprehensive range of ADAS components and integrated solutions.

- Autoliv AB: A major player in automotive safety, focusing on passive and active safety systems, including many ADAS-related technologies.

- Harman International (A Samsung Company): Offers a wide array of connected car technologies, including ADAS features and integrated software solutions.

- Delphi Technologies (now part of BorgWarner): Known for its advanced electronics and powertrain technologies, contributing significantly to ADAS development.

- Continental AG: A major automotive supplier providing a broad spectrum of ADAS sensors, ECUs, and software for commercial vehicles.

- Hyundai Mobis: A significant global automotive parts supplier with a growing portfolio in ADAS and autonomous driving technologies.

- Hella KGaA Hueck & Co (now part of Faurecia SE): A specialist in lighting technology and electronics, contributing innovative sensor and perception systems to ADAS.

- Panasonic Corporation: Develops advanced sensor technologies, cameras, and integrated electronic systems vital for ADAS implementation.

- ZF Friedrichshafen AG: Another prominent global technology company providing systems for mobility, including advanced ADAS solutions and electrification technologies.

- Denso Corporation: A leading automotive components manufacturer with a strong focus on safety systems and electronic control units for ADAS.

Notable Milestones in Europe Commercial Vehicle ADAS Industry Sector

- April 2023: Continental, HERE Technologies, and IVECO partnered to integrate intelligent speed assistance (ISA) and fuel-saving functions into IVECO's commercial vehicles for the EU market.

- January 2022: Bosch and Cariad (Volkswagen subsidiary) partnered to develop technology for automated vehicles and advanced driver-assistance systems.

In-Depth Europe Commercial Vehicle ADAS Industry Market Outlook

The outlook for the European commercial vehicle ADAS market is exceptionally robust and poised for sustained, significant growth. This optimistic projection is underpinned by a powerful interplay of continuous technological advancements, such as the increasing sophistication of AI-driven perception systems and the miniaturization of sensor technology, coupled with stricter regulatory frameworks being progressively introduced across EU member states to enhance road safety. The burgeoning demand for safer, more efficient, and sustainable transportation solutions by logistics companies and governments alike further solidifies this positive trajectory. In this dynamic environment, strategic partnerships between technology providers, vehicle manufacturers, and fleet operators will be paramount for co-developing and deploying innovative, integrated ADAS solutions that address specific industry needs and gain crucial market share. The market is not merely poised for growth; it is undergoing a transformative evolution. Substantial opportunities exist for forward-thinking and innovative players to not only capitalize on emerging technologies like advanced sensor fusion and predictive safety algorithms but also to explore and penetrate underserved market segments, including specialized vehicle applications and emerging economies within Eastern Europe, thereby securing a leading position in this critical sector of the automotive industry.

Europe Commercial Vehicle ADAS Industry Segmentation

-

1. Type

- 1.1. Parking Assist System

- 1.2. Adaptive Front-lighting

- 1.3. Night Vision System

- 1.4. Blind Spot Detection

- 1.5. Lane Departure Warning

- 1.6. Other Types

-

2. Technology

- 2.1. Radar

- 2.2. Li-Dar

- 2.3. Camera

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicle

Europe Commercial Vehicle ADAS Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Rest of Europe

Europe Commercial Vehicle ADAS Industry Regional Market Share

Geographic Coverage of Europe Commercial Vehicle ADAS Industry

Europe Commercial Vehicle ADAS Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For ADAS features in Vehicles

- 3.3. Market Restrains

- 3.3.1. High Up-Front Cost And Maintenance Cost

- 3.4. Market Trends

- 3.4.1. Growing Demand For ADAS Features in Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Parking Assist System

- 5.1.2. Adaptive Front-lighting

- 5.1.3. Night Vision System

- 5.1.4. Blind Spot Detection

- 5.1.5. Lane Departure Warning

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Radar

- 5.2.2. Li-Dar

- 5.2.3. Camera

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. France

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Parking Assist System

- 6.1.2. Adaptive Front-lighting

- 6.1.3. Night Vision System

- 6.1.4. Blind Spot Detection

- 6.1.5. Lane Departure Warning

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Radar

- 6.2.2. Li-Dar

- 6.2.3. Camera

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Parking Assist System

- 7.1.2. Adaptive Front-lighting

- 7.1.3. Night Vision System

- 7.1.4. Blind Spot Detection

- 7.1.5. Lane Departure Warning

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Radar

- 7.2.2. Li-Dar

- 7.2.3. Camera

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Italy Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Parking Assist System

- 8.1.2. Adaptive Front-lighting

- 8.1.3. Night Vision System

- 8.1.4. Blind Spot Detection

- 8.1.5. Lane Departure Warning

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Radar

- 8.2.2. Li-Dar

- 8.2.3. Camera

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Parking Assist System

- 9.1.2. Adaptive Front-lighting

- 9.1.3. Night Vision System

- 9.1.4. Blind Spot Detection

- 9.1.5. Lane Departure Warning

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Radar

- 9.2.2. Li-Dar

- 9.2.3. Camera

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Parking Assist System

- 10.1.2. Adaptive Front-lighting

- 10.1.3. Night Vision System

- 10.1.4. Blind Spot Detection

- 10.1.5. Lane Departure Warning

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Radar

- 10.2.2. Li-Dar

- 10.2.3. Camera

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bosch Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Autoliv AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Harman International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Delphi Automotive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Continental AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hyundai Mobi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hella KGaA Hueck & Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Panasonic Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Bosch Group

List of Figures

- Figure 1: Europe Commercial Vehicle ADAS Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Commercial Vehicle ADAS Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 15: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 16: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 20: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 23: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Commercial Vehicle ADAS Industry?

The projected CAGR is approximately 18%.

2. Which companies are prominent players in the Europe Commercial Vehicle ADAS Industry?

Key companies in the market include Bosch Group, Autoliv AB, Harman International, Delphi Automotive, Continental AG, Hyundai Mobi, Hella KGaA Hueck & Co, Panasonic Corporatio.

3. What are the main segments of the Europe Commercial Vehicle ADAS Industry?

The market segments include Type, Technology, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For ADAS features in Vehicles.

6. What are the notable trends driving market growth?

Growing Demand For ADAS Features in Vehicles.

7. Are there any restraints impacting market growth?

High Up-Front Cost And Maintenance Cost.

8. Can you provide examples of recent developments in the market?

April 2023: Continental and HERE Technologies announced a partnership with IVECO to offer intelligent speed assistance (ISA) and fuel-saving functions for its commercial vehicles segment across Europe. Through this collaboration, starting in 2023, IVECO's heavy-duty, medium-duty, buses, and light-duty vehicles intended for the European Union (EU) market will integrate HERE maps specifically tailored for advanced driver assistance systems (ADAS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Commercial Vehicle ADAS Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Commercial Vehicle ADAS Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Commercial Vehicle ADAS Industry?

To stay informed about further developments, trends, and reports in the Europe Commercial Vehicle ADAS Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence