Key Insights

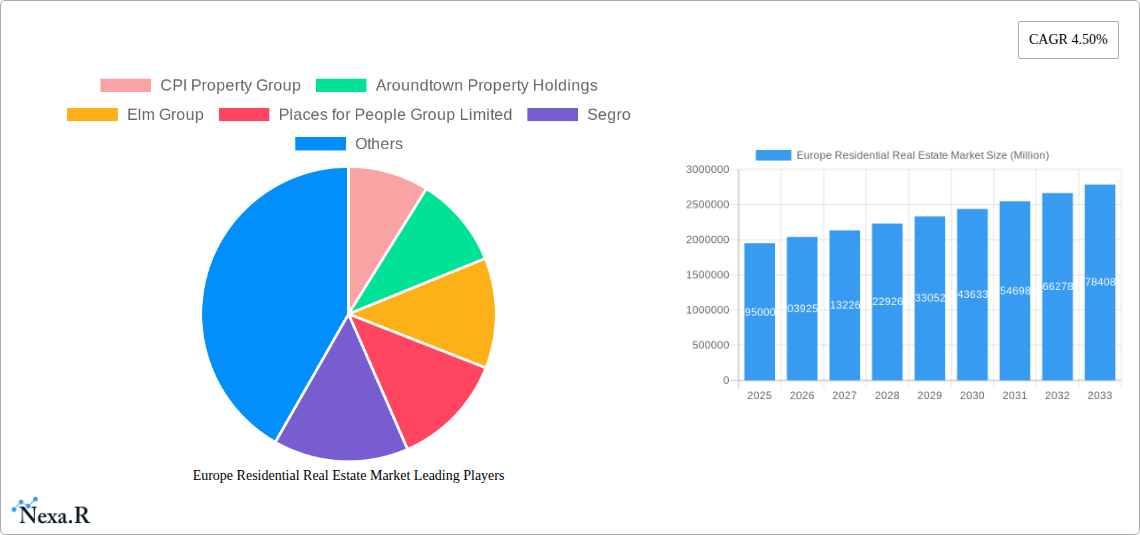

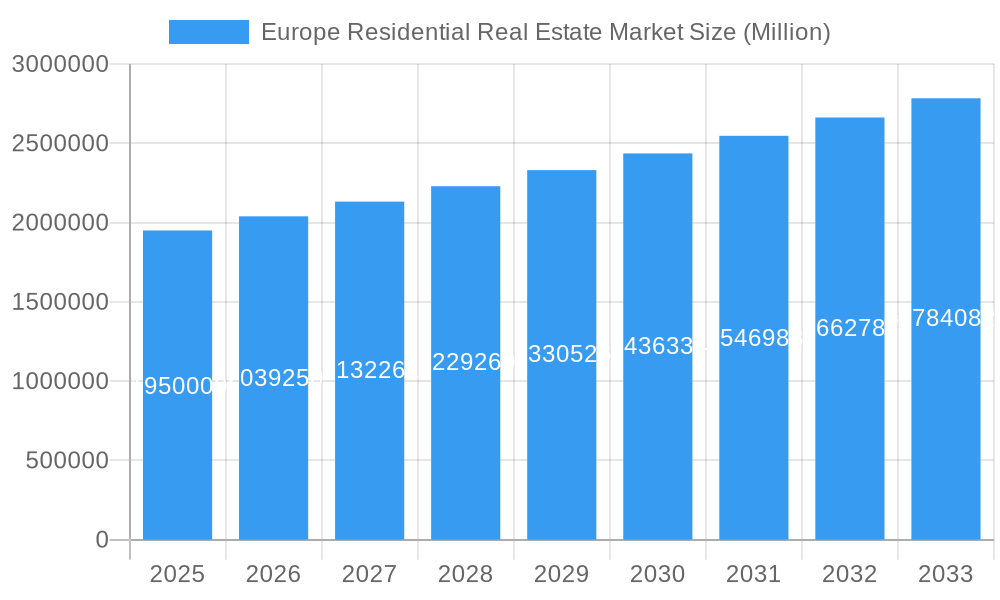

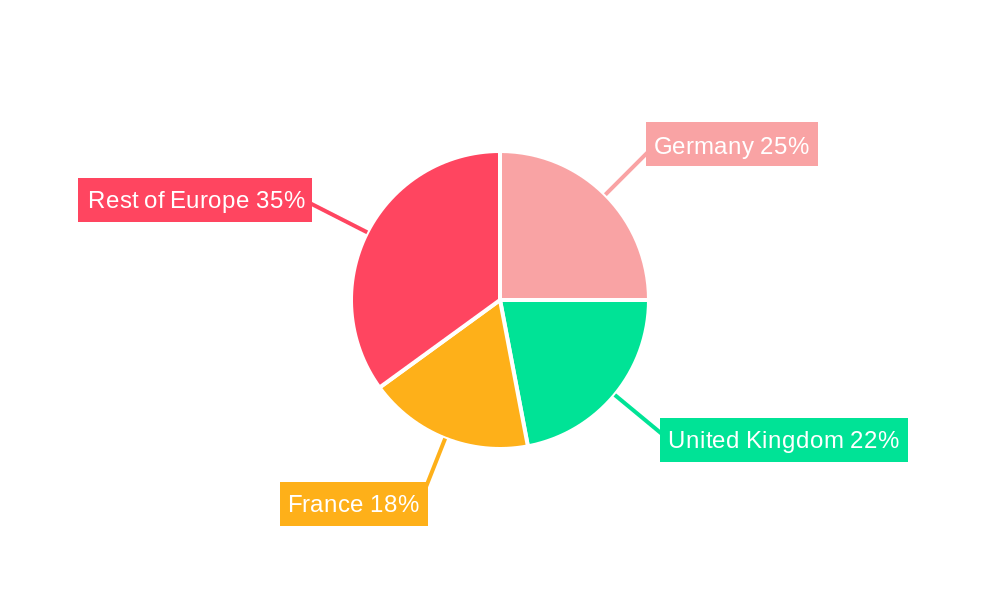

The European residential real estate market, valued at €1.95 trillion in 2025, is projected to experience steady growth, driven by several key factors. A robust CAGR of 4.5% from 2025 to 2033 indicates a significant expansion. This growth is fueled by increasing urbanization, particularly in major cities like London, Paris, and Berlin, leading to higher demand for housing. Furthermore, favorable government policies aimed at stimulating homeownership, coupled with a rising middle class with increased disposable income, contribute significantly to market expansion. The market is segmented by property type (condominiums/apartments, villas/landed houses) and geography (Germany, UK, France, and the rest of Europe), reflecting diverse housing preferences and regional economic variations. While Germany and the UK are expected to dominate the market due to their size and economic strength, France and other European nations also present substantial growth opportunities. However, challenges such as fluctuating interest rates, potential economic downturns, and regulatory hurdles regarding construction and development could impact the market’s trajectory. Competition among major players like CPI Property Group, Aroundtown Property Holdings, and others will remain fierce, pushing innovation in design, sustainability, and property management strategies.

Europe Residential Real Estate Market Market Size (In Million)

The projected market size for 2033 can be estimated by applying the CAGR to the 2025 figure. Given a 4.5% CAGR over 8 years (2025-2033), the market is expected to grow significantly. While precise forecasting requires more detailed data, this growth indicates substantial investment opportunities across various segments. The demand for sustainable and energy-efficient housing is increasing, creating a niche market for developers focused on eco-friendly building practices. Furthermore, the rise of remote work has altered housing preferences, influencing demand for suburban properties and creating opportunities in previously less-developed regions. This dynamic interplay of factors underscores the complexities and opportunities present within the European residential real estate market.

Europe Residential Real Estate Market Company Market Share

This comprehensive report provides an in-depth analysis of the European residential real estate market, encompassing historical data (2019-2024), current market dynamics (2025), and future projections (2025-2033). The report segments the market by type (Condominiums and Apartments, Villas and Landed Houses) and country (Germany, United Kingdom, France, Rest of Europe), offering granular insights for investors, developers, and industry professionals. The study period covers 2019-2033, with 2025 as the base and estimated year. Key players such as CPI Property Group, Aroundtown Property Holdings, Elm Group, Places for People Group Limited, Segro, LEG Immobilien AG, Unibail-Rodamco, Covivio, Gecina, and Consus Real Estate AG are analyzed, alongside an additional 73 other companies.

Europe Residential Real Estate Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and key market trends. The European residential real estate market is characterized by a moderately concentrated structure, with a few major players holding significant market share, estimated at xx% collectively in 2025. However, a large number of smaller firms contribute to overall market activity.

- Market Concentration: The top 10 players account for an estimated xx% of the total market value (2025). This concentration is influenced by significant M&A activity, with an estimated xx Million units of transactions completed between 2019 and 2024.

- Technological Innovation: Proptech solutions are driving efficiency and transforming the market. Key innovations include online property portals, virtual tours, and automated valuation models. Barriers to innovation include legacy systems and data privacy concerns.

- Regulatory Frameworks: Varying regulations across European countries significantly impact development costs and timelines. Harmonization efforts are underway but face challenges due to differing national priorities.

- Competitive Product Substitutes: The primary substitute is the rental market, competing for end-user demand. This competition influences pricing dynamics and occupancy rates.

- End-User Demographics: Changing demographics, such as aging populations and urbanization trends, impact demand for different property types and locations. The millennial and Gen Z cohorts are driving demand for sustainable and tech-enabled homes.

- M&A Trends: The sector has witnessed significant M&A activity in recent years, driven by consolidation and expansion strategies. The average deal value in 2024 was approximately xx Million units.

Europe Residential Real Estate Market Growth Trends & Insights

The European residential real estate market is projected to experience robust growth throughout the forecast period (2025-2033). The market size, currently estimated at xx Million units in 2025, is expected to reach xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by various factors including: rising urbanization, increasing disposable incomes, supportive government policies in certain regions, and ongoing investment in infrastructure. However, economic downturns, particularly in specific markets, can impact growth negatively.

Technological disruption, including the rise of Proptech solutions, is also accelerating market efficiency and influencing consumer behavior. Consumers are increasingly using online platforms to search for properties, leading to a shift in traditional brokerage models. Market penetration of Proptech solutions is estimated at xx% in 2025, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Europe Residential Real Estate Market

Germany, the United Kingdom, and France represent the largest national markets, collectively accounting for approximately xx% of the total market value in 2025. However, growth rates vary significantly across these markets.

- Germany: Strong economic performance and government initiatives promoting housing development contribute to Germany's market dominance. The focus on sustainable building practices further shapes market trends.

- United Kingdom: The UK market is characterized by fluctuating economic conditions, influencing the demand for both residential and commercial real estate. Brexit impacts have caused some uncertainty but the market remains robust.

- France: France's market shows steady growth, driven by robust infrastructure investment and government policies that encourage homeownership. Paris, in particular, remains a key driver for the French market.

- Rest of Europe: This segment exhibits diverse growth patterns, depending on economic conditions and specific national policies. Emerging markets in Central and Eastern Europe offer high growth potential, albeit with potential risks.

By property type, Condominiums and Apartments represent the larger segment in most European countries, driven by urbanization and preference for low-maintenance living. Villas and Landed Houses maintain a strong presence, particularly in regions with more extensive land availability and high demand from upper-income households.

Europe Residential Real Estate Market Product Landscape

The residential real estate market offers a diverse product landscape, encompassing various property types, sizes, and amenities. Technological advancements have led to the development of smart homes and sustainable building practices. Unique selling propositions include energy efficiency, location, and access to amenities, which influence consumer choices. Competition is fierce and market leaders focus on differentiation strategies.

Key Drivers, Barriers & Challenges in Europe Residential Real Estate Market

Key Drivers:

- Strong underlying demand driven by population growth and urbanization.

- Increasing disposable incomes in several European countries.

- Government incentives and subsidies promoting homeownership.

- Technological advancements enhancing efficiency and transparency.

Key Challenges and Restraints:

- High construction costs and material shortages, leading to reduced supply. (Impact: xx% increase in construction costs in 2024 compared to 2019.)

- Stringent building regulations and bureaucratic processes.

- Economic uncertainty and potential downturns impacting affordability.

- Competition from the rental market and limited availability of affordable housing.

Emerging Opportunities in Europe Residential Real Estate Market

- Growing demand for sustainable and energy-efficient housing.

- Expansion into previously untapped markets in Eastern Europe.

- Development of co-living and co-working spaces.

- Leveraging Proptech solutions to improve efficiency and consumer experience.

Growth Accelerators in the Europe Residential Real Estate Market Industry

Several factors are poised to fuel long-term market expansion. These include ongoing technological innovation, strategic partnerships between developers and technology firms, and government policies promoting sustainable housing developments. Expanding into secondary markets and leveraging new financing models are also crucial growth strategies.

Key Players Shaping the Europe Residential Real Estate Market Market

- CPI Property Group

- Aroundtown Property Holdings

- Elm Group

- Places for People Group Limited

- Segro

- LEG Immobilien AG

- Unibail-Rodamco

- Covivio

- Gecina

- Consus Real Estate AG

- 73 Other Companies

Notable Milestones in Europe Residential Real Estate Market Sector

- November 2023: DoorFeed, a Proptech company, secured EUR 12 million (USD 13.24 million) in seed funding, signaling growing investor interest in the sector's technological advancements. This signifies a shift toward technology-driven investment strategies within the residential real estate space.

- October 2023: H.I.G.'s investment in The Grounds Real Estate Development AG highlights the increasing capital inflow directed towards German residential development. This demonstrates the continued investor confidence in the German residential market.

In-Depth Europe Residential Real Estate Market Market Outlook

The European residential real estate market is projected to experience continued growth in the coming years, driven by sustained demand, technological innovations, and strategic investments. Opportunities exist in sustainable developments, smart home technologies, and expansion into underserved markets. Strategic partnerships, technological integration, and adaptation to evolving consumer preferences will be crucial for long-term success in this dynamic market.

Europe Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Countries

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

Europe Residential Real Estate Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Residential Real Estate Market Regional Market Share

Geographic Coverage of Europe Residential Real Estate Market

Europe Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Developments in the Residential Segment; Investments in the Senior Living Units

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Land Hindering the Market

- 3.4. Market Trends

- 3.4.1. Student Housing to Gain Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Countries

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Rest of Europe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CPI Property Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aroundtown Property Holdings

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elm Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Places for People Group Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Segro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LEG Immobilien AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unibail-Rodamco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Covivio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gecina**List Not Exhaustive 7 3 Other Companie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Consus Real Estate AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CPI Property Group

List of Figures

- Figure 1: Europe Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Residential Real Estate Market Revenue Million Forecast, by Countries 2020 & 2033

- Table 3: Europe Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Residential Real Estate Market Revenue Million Forecast, by Countries 2020 & 2033

- Table 6: Europe Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Residential Real Estate Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Europe Residential Real Estate Market?

Key companies in the market include CPI Property Group, Aroundtown Property Holdings, Elm Group, Places for People Group Limited, Segro, LEG Immobilien AG, Unibail-Rodamco, Covivio, Gecina**List Not Exhaustive 7 3 Other Companie, Consus Real Estate AG.

3. What are the main segments of the Europe Residential Real Estate Market?

The market segments include Type, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Developments in the Residential Segment; Investments in the Senior Living Units.

6. What are the notable trends driving market growth?

Student Housing to Gain Traction.

7. Are there any restraints impacting market growth?

Limited Availability of Land Hindering the Market.

8. Can you provide examples of recent developments in the market?

November 2023: DoorFeed, a Proptech company, raised EUR 12 million (USD 13.24 million) in seed funding, led by Motive Ventures and Stride and supported by renowned investors, including Seedcamp. Founded by veteran proptech entrepreneur and ex-Uber employee James Kirimi, DoorFeed aims to be the first choice for institutional investors seeking to invest in residential real estate. The company is looking to expand its footprint across Europe, with a focus on Spain, Germany, and the United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Europe Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence