Key Insights

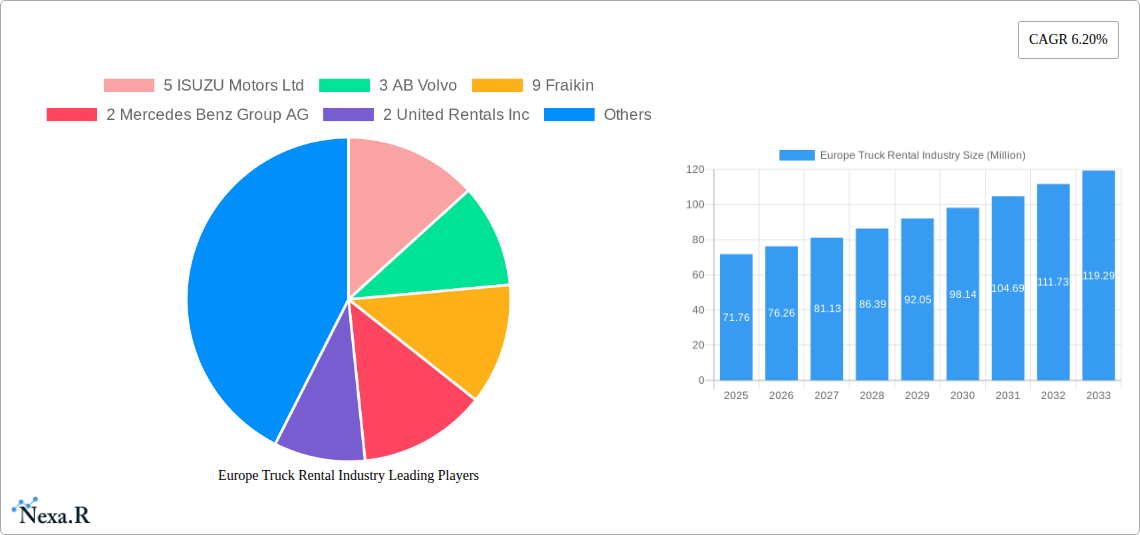

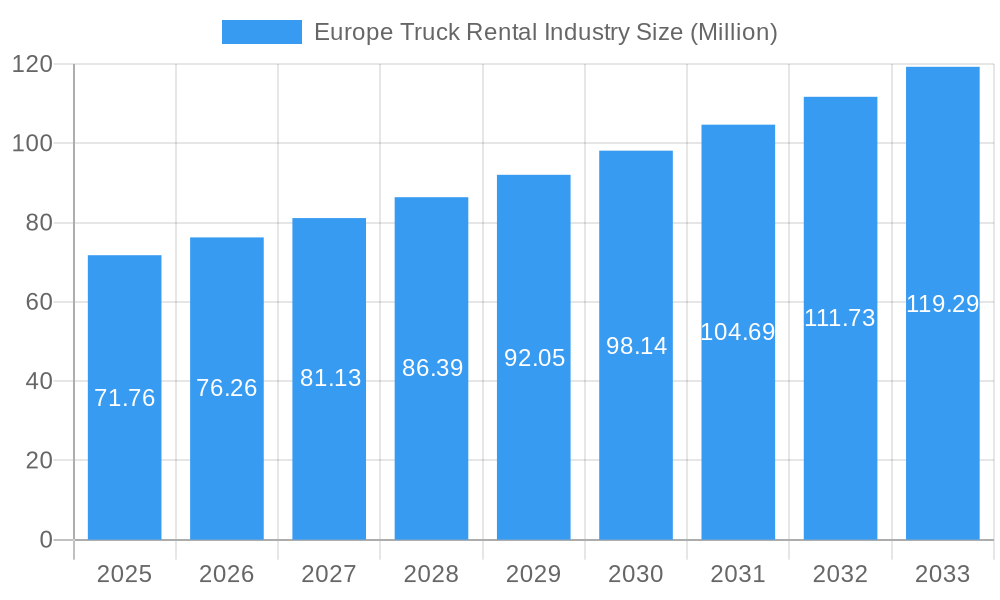

The European truck rental market, valued at €71.76 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector necessitates efficient and flexible logistics solutions, increasing demand for short-term truck rentals. Simultaneously, the construction and manufacturing industries, experiencing periods of growth and fluctuation, rely on rental fleets to manage their transportation needs effectively, avoiding the large capital expenditure of vehicle ownership. Furthermore, stringent emission regulations are encouraging fleet operators to transition to newer, more environmentally friendly trucks, stimulating rental activity as a cost-effective alternative to purchasing new vehicles. The rise of digital platforms and online booking systems is also streamlining the rental process, attracting a wider range of customers and driving market growth. Germany, the UK, France, and Spain are the major contributors to the market’s size, reflecting their robust economies and extensive transportation networks. However, potential restraints include economic downturns, fluctuating fuel prices, and competition from established players like Isuzu, Volvo, and Mercedes-Benz. The market is segmented by booking type (online and offline), rental type (short-term and long-term), and geographically across major European countries.

Europe Truck Rental Industry Market Size (In Million)

The competitive landscape includes both truck manufacturers offering leasing services and dedicated truck rental firms. Major players such as Ryder, Penske, and Fraikin are leveraging their extensive networks and technological advancements to gain market share. However, the market also features several smaller, regional operators catering to niche needs. The long-term outlook remains positive, given the continuous growth in e-commerce, industrial activity, and the evolving preferences for flexible transportation solutions. The market's ongoing digital transformation and the adoption of innovative rental models, such as subscription services, will further shape the future of the European truck rental market. Strategic partnerships and mergers & acquisitions are expected to play a significant role in consolidating the market and driving innovation.

Europe Truck Rental Industry Company Market Share

Europe Truck Rental Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European truck rental industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector.

Keywords: Europe Truck Rental, Truck Leasing, Short-Term Leasing, Long-Term Leasing, Truck Rental Market, Commercial Vehicle Rental, Truck Rental Companies, Online Truck Rental, Offline Truck Rental, Germany Truck Rental, UK Truck Rental, France Truck Rental, Spain Truck Rental, Italy Truck Rental, Electric Truck Rental, Hydrogen Truck Rental, Truck Rental Industry Analysis, Market Size, Market Share, CAGR, Market Forecast, Competitive Analysis, Industry Trends

Europe Truck Rental Industry Market Dynamics & Structure

The European truck rental market is characterized by a moderately concentrated structure, with a mix of large multinational players and smaller regional operators. Market concentration is influenced by the presence of major truck manufacturers also involved in leasing, like AB Volvo and Mercedes-Benz Group AG. The industry experiences continuous technological innovation, driven by the adoption of electric and hydrogen-powered trucks, telematics, and digitalization of rental processes. Stringent emission regulations and sustainability initiatives are reshaping the competitive landscape, favoring companies offering eco-friendly solutions. The market also faces competitive pressure from alternative transportation methods, including rail and shipping. The industry's M&A activity has seen xx deals in the past 5 years, primarily focused on consolidation and expansion into new markets.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Technological Innovation: Electric and hydrogen trucks, telematics, online booking platforms.

- Regulatory Framework: Stringent emission norms driving adoption of cleaner vehicles.

- Competitive Substitutes: Rail freight, shipping.

- End-User Demographics: Primarily logistics companies, construction firms, and transportation businesses.

- M&A Trends: xx deals in the past 5 years, focusing on consolidation and expansion.

Europe Truck Rental Industry Growth Trends & Insights

The European truck rental market has experienced significant growth between 2019 and 2024, driven by factors including the rise of e-commerce, increasing cross-border trade, and infrastructure development. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx%. The adoption of online booking platforms is accelerating, with an estimated xx% of bookings now done online. Technological disruptions, such as the introduction of autonomous vehicles and digital fleet management systems, are further transforming the industry. Consumer behavior is shifting toward greater demand for flexible rental options, with short-term leasing gaining traction.

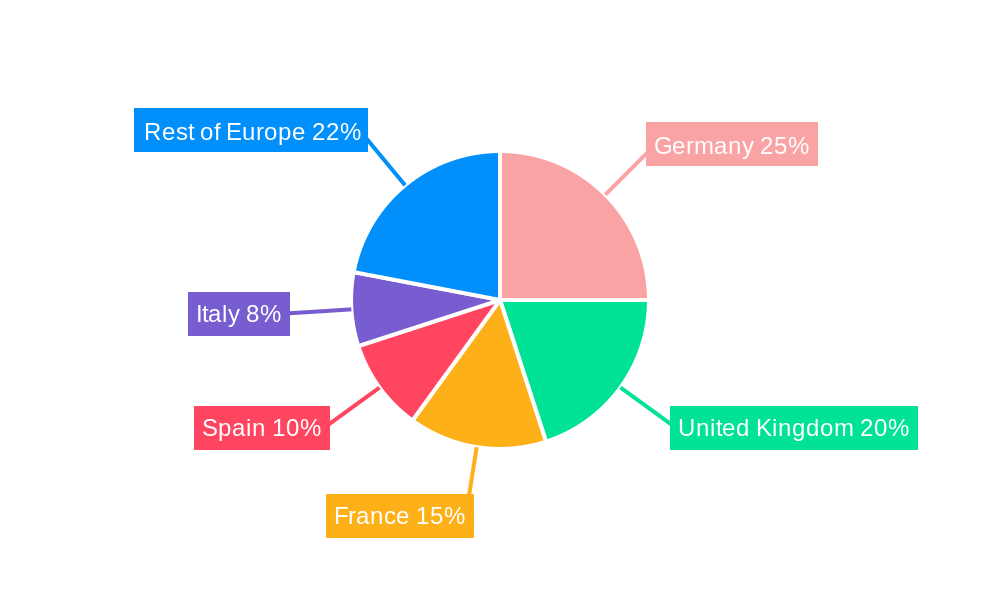

Dominant Regions, Countries, or Segments in Europe Truck Rental Industry

Germany, the United Kingdom, and France are the dominant markets in Europe, accounting for xx% of the total market share in 2024. Growth is driven by strong logistics sectors, robust infrastructure, and favorable economic conditions. The long-term leasing segment holds a significant market share, reflecting the preference for stable, predictable rental costs among large fleet operators. Online bookings are growing rapidly, particularly among smaller businesses and individual users.

- Germany: Strong logistics sector, robust infrastructure, high demand for long-term leasing.

- United Kingdom: Significant e-commerce activity driving demand for short-term rentals.

- France: Growing adoption of online booking platforms, expanding logistics networks.

- Long-Term Leasing: Preference for cost predictability among large fleet operators.

- Online Booking: Rapid growth, particularly among smaller businesses and individuals.

Europe Truck Rental Industry Product Landscape

The truck rental industry offers a range of vehicles, from small vans to heavy-duty trucks, catering to diverse customer needs. Recent innovations include the introduction of electric and hydrogen-powered trucks, aimed at reducing environmental impact. Telematics systems offer real-time vehicle tracking, improved fleet management, and enhanced security. Rental companies are increasingly adopting subscription models and pay-per-use options to provide greater flexibility and cost control. Unique selling propositions include guaranteed uptime, maintenance packages, and comprehensive insurance coverage.

Key Drivers, Barriers & Challenges in Europe Truck Rental Industry

Key Drivers:

- Growing e-commerce and cross-border trade increasing demand for logistics and transportation.

- Investments in infrastructure development enhancing road networks and logistics efficiency.

- Stringent emission regulations promoting adoption of electric and alternative fuel vehicles.

Key Challenges:

- Supply chain disruptions impacting vehicle availability and rental costs.

- High upfront investment costs for electric and hydrogen trucks hindering widespread adoption.

- Intense competition among rental providers leading to pricing pressure.

Emerging Opportunities in Europe Truck Rental Industry

The expanding market for electric and hydrogen trucks presents significant growth potential. The integration of autonomous driving technology within rental fleets will create new business models. Rental companies can leverage data analytics and AI to optimize pricing strategies and improve customer service. Untapped markets in Eastern European countries represent another major opportunity.

Growth Accelerators in the Europe Truck Rental Industry Industry

Technological advancements, particularly in electric vehicle technology and autonomous driving, will be crucial growth drivers. Strategic partnerships between truck manufacturers, rental companies, and technology providers will streamline operations and improve customer experiences. Expanding into underserved markets and offering customized rental solutions can further drive growth.

Key Players Shaping the Europe Truck Rental Industry Market

- ISUZU Motors Ltd

- AB Volvo

- Fraikin

- Mercedes-Benz Group AG

- United Rentals Inc

- Traton SE

- Tip Trailer Services Germany GmbH

- Heisterkamp Truck Rental

- PACCAR Inc

- Easy Rent Truck and Trailer GmbH

- Paccar Leasing Gmbh (paccar Inc )

- Ryder Group

- Man Financial Services/Euro-leasing

- Penske Truck Leasing

- IVECO SpA

Notable Milestones in Europe Truck Rental Industry Sector

- Sept 2022: Iveco Group announces GATE Green and Advanced Transport Ecosystem, a pay-per-use model for electric trucks and vans.

- Apr 2022: Hylane GmbH launches, offering rental of fuel-cell electric trucks from Hyzon Motors, including maintenance and downtime coverage.

- Apr 2022: Hylane GmbH, a subsidiary of DEVK Versicherung, officially begins offering hydrogen truck rentals.

In-Depth Europe Truck Rental Industry Market Outlook

The European truck rental market is poised for continued growth, fueled by technological innovation, evolving consumer preferences, and sustainable transportation initiatives. The shift toward electric and alternative fuel vehicles will create new opportunities, while strategic partnerships and market expansion will further shape the industry landscape. Companies that can adapt to changing regulations and customer demands while investing in innovative technologies will be best positioned to thrive in this dynamic market.

Europe Truck Rental Industry Segmentation

-

1. Booking Type

- 1.1. Offline Booking

- 1.2. Online Booking

-

2. Rental Type

- 2.1. Short-term Leasing

- 2.2. Long-term Leasing

Europe Truck Rental Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Truck Rental Industry Regional Market Share

Geographic Coverage of Europe Truck Rental Industry

Europe Truck Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shifting Consumer Preference toward Eco-friendly Medium of Transportation

- 3.3. Market Restrains

- 3.3.1. Growing Incidents of Bike Damage and Theft

- 3.4. Market Trends

- 3.4.1. Rising Emission Standards in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Truck Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline Booking

- 5.1.2. Online Booking

- 5.2. Market Analysis, Insights and Forecast - by Rental Type

- 5.2.1. Short-term Leasing

- 5.2.2. Long-term Leasing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 5 ISUZU Motors Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 AB Volvo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 9 Fraikin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Mercedes Benz Group AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 2 United Rentals Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4 Traton SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 1 Tip Trailer Services Germany GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Truck Manufacturers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 5 Heisterkamp Truck Rental

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 PACCAR Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Truck Rental Firms

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 6 Easy Rent Truck and Trailer GmbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 4 Paccar Leasing Gmbh (paccar Inc )

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 8 Ryder Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 7 Man Financial Services/Euro-leasing

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 3 Penske Truck Leasing

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 6 IVECO SpA*List Not Exhaustive

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 5 ISUZU Motors Ltd

List of Figures

- Figure 1: Europe Truck Rental Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Truck Rental Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Truck Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Europe Truck Rental Industry Revenue Million Forecast, by Rental Type 2020 & 2033

- Table 3: Europe Truck Rental Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Truck Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 5: Europe Truck Rental Industry Revenue Million Forecast, by Rental Type 2020 & 2033

- Table 6: Europe Truck Rental Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Truck Rental Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Truck Rental Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Europe Truck Rental Industry?

Key companies in the market include 5 ISUZU Motors Ltd, 3 AB Volvo, 9 Fraikin, 2 Mercedes Benz Group AG, 2 United Rentals Inc, 4 Traton SE, 1 Tip Trailer Services Germany GmbH, Truck Manufacturers, 5 Heisterkamp Truck Rental, 1 PACCAR Inc, Truck Rental Firms, 6 Easy Rent Truck and Trailer GmbH, 4 Paccar Leasing Gmbh (paccar Inc ), 8 Ryder Group, 7 Man Financial Services/Euro-leasing, 3 Penske Truck Leasing, 6 IVECO SpA*List Not Exhaustive.

3. What are the main segments of the Europe Truck Rental Industry?

The market segments include Booking Type, Rental Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Shifting Consumer Preference toward Eco-friendly Medium of Transportation.

6. What are the notable trends driving market growth?

Rising Emission Standards in Europe.

7. Are there any restraints impacting market growth?

Growing Incidents of Bike Damage and Theft.

8. Can you provide examples of recent developments in the market?

Sept 2022: GATE Green and Advanced Transport Ecosystem, a long-term, an all-inclusive rental model for electric trucks and vans, was announced by Iveco Group. The new entity will provide a comprehensive service based on a pay-per-use model, giving customers access to tomorrow's propulsion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Truck Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Truck Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Truck Rental Industry?

To stay informed about further developments, trends, and reports in the Europe Truck Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence