Key Insights

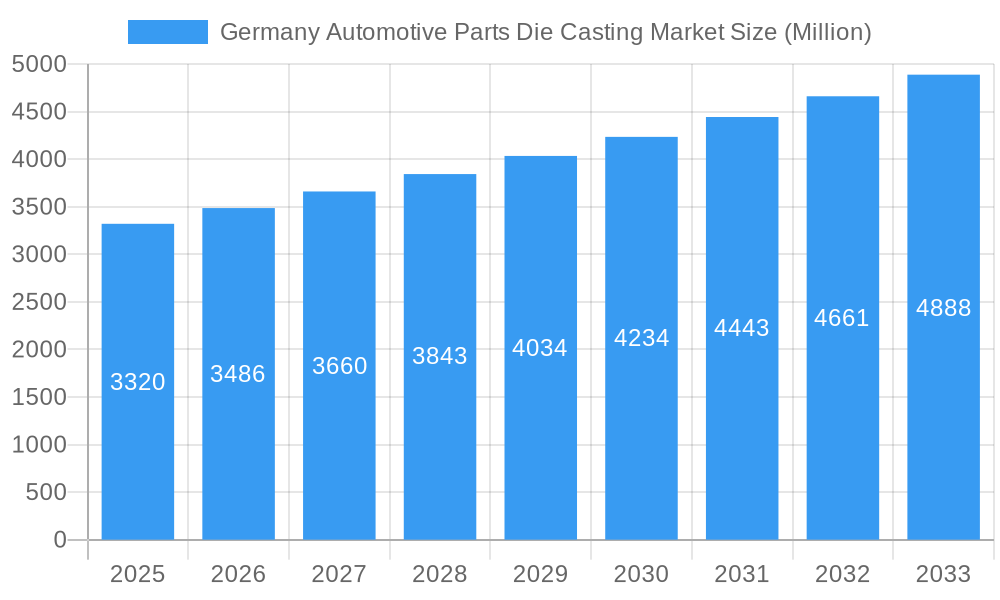

The Germany automotive parts die casting market, valued at €3.32 billion in 2025, is projected to experience robust growth, driven by the increasing demand for lightweight vehicles and the rising adoption of electric vehicles (EVs). The market's Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033 reflects a consistent expansion fueled by several key factors. The automotive industry's ongoing shift towards higher fuel efficiency and reduced emissions is a major driver, as die casting offers a cost-effective method for producing lightweight components made from aluminum, zinc, and magnesium alloys. Furthermore, advancements in die casting technologies, such as high-pressure die casting and semi-solid die casting, are enhancing component quality and production efficiency, further boosting market growth. The strong presence of established automotive manufacturers and a robust supplier ecosystem within Germany, particularly in regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, contribute significantly to the market's dynamism. While potential material cost fluctuations and supply chain disruptions could pose challenges, the overall outlook for the German automotive parts die casting market remains positive, driven by continuous technological innovations and the increasing demand for sophisticated automotive components.

Germany Automotive Parts Die Casting Market Market Size (In Billion)

The segmentation of the market reveals significant opportunities across various raw materials, application types, and production processes. Aluminum alloys dominate the raw material segment due to their lightweight yet strong properties, ideal for automotive applications. Engine parts, transmission components, and body parts are the major application areas, reflecting the widespread use of die casting in critical automotive systems. Pressure die casting remains the dominant production process due to its high productivity and cost-effectiveness, though vacuum and semi-solid die casting are gaining traction due to their superior surface finish and improved mechanical properties. Key players like Sandhar Technologies Ltd, Raltor Metal Technik India Pvt Ltd, and Endurance Group are well-positioned to capitalize on this growth, leveraging their expertise and established market presence. The continued expansion of the German automotive industry and the sustained focus on technological advancement will ensure the long-term success of the die casting market in the country.

Germany Automotive Parts Die Casting Market Company Market Share

This comprehensive report provides an in-depth analysis of the Germany automotive parts die casting market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report delves into the parent market (German automotive industry) and child markets (specific die casting applications within the automotive sector) to offer a granular understanding of this dynamic industry. The market size is presented in million units.

Germany Automotive Parts Die Casting Market Dynamics & Structure

The German automotive parts die casting market exhibits a moderately concentrated structure, with a few large players and numerous smaller specialized firms. Technological innovation, particularly in lightweight materials and high-precision casting techniques, is a key driver. Stringent environmental regulations and safety standards significantly influence market dynamics, compelling manufacturers to adopt sustainable practices and advanced quality control measures. The rise of electric vehicles (EVs) presents both challenges and opportunities, demanding lighter and more efficient components. Competitive pressure from alternative manufacturing processes (e.g., forging, machining) and the availability of imported parts are key factors. M&A activity remains moderate, with strategic acquisitions focused on enhancing technological capabilities and expanding market reach. The deal volume from 2019 to 2024 was estimated at xx deals, with an average deal size of xx million Euros.

- Market Concentration: Moderately Concentrated (HHI xx)

- Technological Innovation: Focus on lightweight materials (Aluminum, Magnesium alloys), automation, and precision casting.

- Regulatory Framework: Stringent emission standards and safety regulations drive adoption of advanced technologies.

- Competitive Substitutes: Forging, machining, injection molding.

- End-User Demographics: Primarily OEMs (Original Equipment Manufacturers) and Tier-1 automotive suppliers.

- M&A Trends: Strategic acquisitions focusing on technology and market expansion.

Germany Automotive Parts Die Casting Market Growth Trends & Insights

The German automotive parts die casting market witnessed substantial growth from 2019 to 2024, driven primarily by the increasing demand for lightweight vehicles and the rising adoption of advanced driver-assistance systems (ADAS). The market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. The forecast period (2025-2033) anticipates continued growth, fueled by the expanding EV market and the increasing complexity of automotive components. Technological advancements, such as the introduction of high-pressure die casting and semi-solid die casting, are further propelling market expansion. Consumer preferences towards fuel-efficient and environmentally friendly vehicles reinforce this trend. Market penetration of lightweight die-cast components is projected to reach xx% by 2033. However, economic fluctuations and supply chain disruptions pose potential challenges to sustained growth.

Dominant Regions, Countries, or Segments in Germany Automotive Parts Die Casting Market

Southern Germany, specifically Baden-Württemberg and Bavaria, are the epicenters of Germany's automotive parts die casting market, boasting a high concentration of automotive manufacturers and Tier-1 suppliers. Aluminum die castings command the largest market share, driven by their lightweight nature and cost-effectiveness. Zinc and magnesium castings also hold significant positions, contributing to the overall lightweighting trend in the automotive industry. Analyzing the application landscape, engine parts represent the most significant segment, followed by transmission components, body parts, and other applications. Pressure die casting remains the dominant production method, although the adoption of semi-solid die casting is steadily increasing due to its superior mechanical properties and potential for enhanced component performance.

- Key Regional Drivers (Southern Germany): High density of automotive manufacturing plants, a skilled and specialized workforce, and robust supporting infrastructure (including logistics and supply chains).

- Material Segment Analysis: Aluminum's dominance stems from its favorable strength-to-weight ratio, cost-effectiveness, and excellent castability. Zinc offers cost advantages for specific applications, while magnesium alloys are increasingly utilized for their exceptionally lightweight properties, particularly in electric vehicles.

- Leading Application Segment: The engine parts segment's leading position reflects the complexity of engine components and the demanding functional requirements they must meet. This necessitates advanced die casting technologies and high-precision manufacturing.

- Dominant Production Process: Pressure die casting's prevalence is attributed to its established technology base, high productivity rates, and established cost-effectiveness. However, semi-solid die casting is emerging as a strong contender due to its improved mechanical properties and potential to create more intricate and higher-performing parts.

Germany Automotive Parts Die Casting Market Product Landscape

The German automotive parts die casting market exhibits a diverse product landscape encompassing a wide array of components. From intricate engine blocks and transmission housings to complex body panels and smaller functional parts, die casting provides a versatile solution for diverse automotive needs. Ongoing innovations focus on enhancing the mechanical properties, surface quality, and dimensional accuracy of these components through advancements in alloy development, mold design, and casting processes. High-pressure die casting, in particular, is enabling the production of thinner-walled parts, leading to significant weight reduction and improved fuel efficiency. The competitive edge of many products lies in superior strength-to-weight ratios, optimized designs for enhanced performance, and cost-competitiveness against alternative manufacturing technologies.

Key Drivers, Barriers & Challenges in Germany Automotive Parts Die Casting Market

Key Drivers: The automotive industry's relentless pursuit of lightweight vehicles, coupled with increasingly stringent emission regulations and the explosive growth of the electric vehicle (EV) market, are potent drivers of growth. Technological advancements in die casting processes and material science are further fueling this expansion.

Challenges: The market faces significant hurdles including fluctuations in raw material prices (particularly aluminum and magnesium), potential supply chain disruptions, and intense competition from both domestic and international die casting manufacturers. Adherence to stringent environmental and safety regulations adds to the cost burden. Moreover, labor costs, a significant component of overall manufacturing expenses, require continuous optimization strategies.

Emerging Opportunities in Germany Automotive Parts Die Casting Market

Emerging opportunities lie in the growing demand for lightweight components in EVs, the adoption of advanced materials like magnesium alloys, and the development of innovative die casting technologies, such as 3D printing for tooling and near-net shape casting. Expansion into niche applications, such as battery casings and electric motor housings, presents further growth potential. Focus on customized solutions for specific OEM requirements and the exploration of sustainable manufacturing practices offer additional avenues for market expansion.

Growth Accelerators in the Germany Automotive Parts Die Casting Market Industry

Technological breakthroughs in die casting processes, materials science, and automation are crucial growth drivers. Strategic partnerships between die casters and automotive manufacturers facilitate the development of innovative components. Expansion into new markets and the diversification of product portfolios also contribute to long-term growth. Investment in R&D and the adoption of Industry 4.0 technologies are key factors in maintaining competitiveness.

Key Players Shaping the Germany Automotive Parts Die Casting Market Market

- Sandhar Technologies Ltd

- Raltor Metal Technik India Pvt Ltd

- Endurance Group

- Castwel Auto Parts Pvt Ltd

- Rockman Industries Ltd

- Mino Industry USA INC

- Gibbs Die Casting Group

- Dynacast

- Kinetic Die Casting Company

- Ningbo Parison Die Casting Co Ltd

Notable Milestones in Germany Automotive Parts Die Casting Market Sector

- 2021: A major player introduced a new high-pressure die casting facility, significantly increasing production capacity and technological capabilities.

- 2022: A leading automotive supplier invested heavily in R&D for lightweight magnesium alloys, showcasing a commitment to innovation and sustainability.

- 2023: A strategic partnership formed between a prominent die casting company and an automotive original equipment manufacturer (OEM) to jointly develop next-generation EV components, highlighting collaborative efforts within the industry.

- 2024: A larger multinational corporation acquired a smaller die casting firm, indicating industry consolidation and expansion of market share.

- [Add further milestones with specific data as it becomes available]

In-Depth Germany Automotive Parts Die Casting Market Market Outlook

The German automotive parts die casting market is poised for sustained growth over the forecast period (2025-2033), driven by technological advancements, increasing demand for lightweight vehicles, and the expanding EV sector. Strategic partnerships, investments in R&D, and the adoption of sustainable manufacturing practices will be key factors in realizing this growth potential. Companies that can adapt to evolving technological landscape and cater to the changing needs of the automotive industry will be best positioned to capture market share and achieve long-term success. The market is expected to reach xx million units by 2033.

Germany Automotive Parts Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

-

3. Application Type

- 3.1. Engine Parts

- 3.2. Transmission Components

- 3.3. Body Parts

- 3.4. Other Applications

Germany Automotive Parts Die Casting Market Segmentation By Geography

- 1. Germany

Germany Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of Germany Automotive Parts Die Casting Market

Germany Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market

- 3.3. Market Restrains

- 3.3.1. High Raw Material Prices May One of The Factors That Hindering Target Market Growth.

- 3.4. Market Trends

- 3.4.1. Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Engine Parts

- 5.3.2. Transmission Components

- 5.3.3. Body Parts

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar Technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Raltor Metal Technik India Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Endurance Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Castwel Auto Parts Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rockman Industries Ltd *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mino Industry USA INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gibbs Die Casting Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kinetic Die Casting Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ningbo Parison Die Casting Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sandhar Technologies Ltd

List of Figures

- Figure 1: Germany Automotive Parts Die Casting Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Automotive Parts Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 3: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 6: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 7: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 8: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive Parts Die Casting Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Germany Automotive Parts Die Casting Market?

Key companies in the market include Sandhar Technologies Ltd, Raltor Metal Technik India Pvt Ltd, Endurance Group, Castwel Auto Parts Pvt Ltd, Rockman Industries Ltd *List Not Exhaustive, Mino Industry USA INC, Gibbs Die Casting Group, Dynacast, Kinetic Die Casting Company, Ningbo Parison Die Casting Co Ltd.

3. What are the main segments of the Germany Automotive Parts Die Casting Market?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market.

6. What are the notable trends driving market growth?

Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market.

7. Are there any restraints impacting market growth?

High Raw Material Prices May One of The Factors That Hindering Target Market Growth..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the Germany Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence