Key Insights

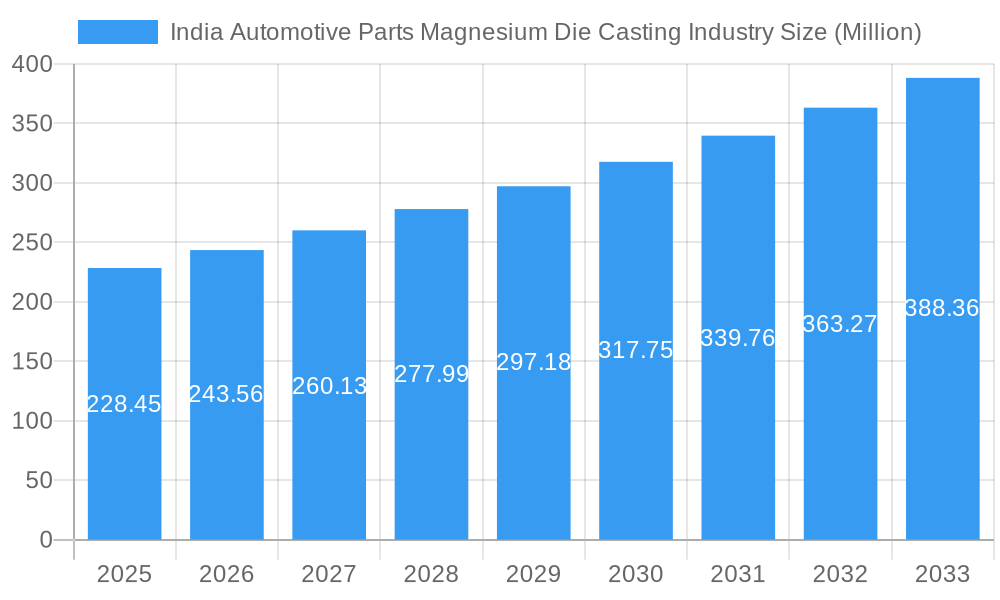

The India automotive parts magnesium die casting market exhibits robust growth potential, projected to reach $228.45 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.60% from 2025 to 2033. This expansion is fueled by the burgeoning Indian automotive industry, increasing demand for lightweight vehicles to improve fuel efficiency, and the inherent advantages of magnesium die casting—namely its lightweight nature, high strength-to-weight ratio, and excellent castability. Key application segments driving growth include body assemblies and engine parts, reflecting the industry's shift toward more efficient and environmentally friendly vehicles. The adoption of advanced production processes like pressure die casting and vacuum die casting further contributes to market expansion. However, challenges such as the relatively high cost of magnesium compared to aluminum and potential supply chain complexities could act as restraints. Leading players like Ryobi Die Casting, Pace Industries, and Sundaram Clayton Ltd are leveraging technological advancements and strategic partnerships to gain a competitive edge. Regional variations exist, with growth likely concentrated in regions with robust automotive manufacturing hubs such as North and South India.

India Automotive Parts Magnesium Die Casting Industry Market Size (In Million)

The forecast period (2025-2033) anticipates sustained market expansion driven by government initiatives promoting electric vehicle adoption and stringent emission norms, further strengthening the demand for lightweight materials. The market segmentation reveals a significant share held by pressure die casting, indicating a preference for established and cost-effective techniques. Future growth will be influenced by technological advancements in die casting processes, an increase in investments in research and development aimed at improving magnesium alloys, and collaborations between automotive manufacturers and die casting companies to optimize designs and reduce costs. Despite potential challenges, the overall outlook for the India automotive parts magnesium die casting market remains positive, with significant opportunities for growth and innovation over the forecast period.

India Automotive Parts Magnesium Die Casting Industry Company Market Share

India Automotive Parts Magnesium Die Casting Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India automotive parts magnesium die casting industry, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. Market values are presented in million units. This analysis is crucial for industry professionals, investors, and strategic decision-makers seeking a nuanced understanding of this rapidly evolving sector.

India Automotive Parts Magnesium Die Casting Industry Market Dynamics & Structure

The Indian automotive parts magnesium die casting market is characterized by a moderately concentrated landscape, with a few major players and several smaller regional entities vying for market share. The market size in 2025 is estimated at XX million units. Technological innovation, particularly in areas like semi-solid die casting and vacuum die casting, is a key driver. Stringent emission norms and a growing focus on lightweight vehicles are further fueling demand. However, high initial investment costs and the complexity of the process present significant barriers to entry. The regulatory framework, while evolving, presents both opportunities and challenges, especially regarding environmental regulations. The competitive landscape includes both domestic and international players, with a notable increase in M&A activity in recent years, with approximately xx deals recorded between 2019 and 2024, leading to a market concentration of xx%. The increasing adoption of electric vehicles is expected to significantly influence the market dynamics over the coming years.

- Market Concentration: Moderately concentrated, with xx% market share held by the top 5 players in 2025.

- Technological Innovation: Focus on semi-solid and vacuum die casting techniques.

- Regulatory Framework: Stringent emission norms and evolving environmental regulations.

- Competitive Landscape: Mix of domestic and international players, with growing M&A activity.

- End-User Demographics: Primarily automotive OEMs and Tier-1 suppliers.

- Substitute Products: Aluminum and other lightweight materials.

India Automotive Parts Magnesium Die Casting Industry Growth Trends & Insights

The Indian automotive parts magnesium die casting market experienced significant growth during the historical period (2019-2024), driven by the increasing demand for lightweight vehicles and stringent fuel efficiency standards. The market size expanded at a CAGR of xx% during this period, reaching xx million units in 2024. The forecast period (2025-2033) projects continued growth, fueled by rising disposable incomes, expanding automotive production, and technological advancements in die-casting processes. This growth will be further bolstered by the increasing adoption of electric and hybrid vehicles, which require lightweight components to optimize battery range and performance. Market penetration within the automotive sector is also poised for significant expansion, with a predicted CAGR of xx% over the forecast period, reaching an estimated xx million units by 2033. Technological disruptions, particularly in automation and process optimization, will also contribute significantly to industry expansion. Changing consumer preferences towards more fuel-efficient and feature-rich vehicles will continue to drive market growth.

Dominant Regions, Countries, or Segments in India Automotive Parts Magnesium Die Casting Industry

While the entire nation shows growth, certain regions and segments within the Indian automotive parts magnesium die casting industry are leading the expansion. The southern states, particularly Tamil Nadu, are currently dominating the market due to a strong presence of automotive manufacturers and supporting infrastructure. Within production process types, Pressure Die Casting holds the largest market share (xx%), owing to its cost-effectiveness and suitability for high-volume production. The Application Type segment showing the most growth is Body Assemblies (xx%), driven by increasing demand for lightweight body structures in passenger vehicles. Key growth drivers include favorable government policies promoting automotive manufacturing, rising investments in infrastructure, and the presence of a skilled workforce. This will contribute to xx% and xx% growth for pressure die casting and body assemblies, respectively, during the forecast period.

- Leading Region: Southern States (Tamil Nadu leading).

- Dominant Production Process: Pressure Die Casting.

- Fastest-Growing Application: Body Assemblies.

- Key Drivers: Favorable government policies, infrastructure development, skilled workforce.

India Automotive Parts Magnesium Die Casting Industry Product Landscape

The product landscape is characterized by a range of magnesium die-cast components tailored to various automotive applications. Innovations focus on improving component strength, reducing weight, and enhancing surface finish. Pressure die casting remains the dominant production method, with advancements in automation and process optimization leading to improved productivity and quality. Vacuum die casting is gaining traction for its ability to produce complex shapes with superior surface quality, while semi-solid die casting offers a route to enhanced mechanical properties. Unique selling propositions revolve around improved lightweighting, superior dimensional accuracy, and cost-effective production. Technological advancements are centered on process optimization, material innovation, and the integration of automation technologies.

Key Drivers, Barriers & Challenges in India Automotive Parts Magnesium Die Casting Industry

Key Drivers: The increasing adoption of lightweighting strategies in the automotive sector is a primary driver, driven by government regulations emphasizing fuel efficiency and reduced emissions. Moreover, the growing demand for passenger vehicles, coupled with increasing disposable incomes, stimulates market expansion. Technological advancements in die-casting techniques further enhance efficiency and product quality.

Key Barriers & Challenges: High initial investment costs associated with setting up advanced die-casting facilities are a major barrier. The availability of skilled labor and the complexity of the manufacturing process also present challenges. Supply chain disruptions, exacerbated by global events, impact production and pricing. Regulatory compliance, including environmental regulations, can add to operational costs. The industry faces intense competition, both domestically and internationally, which necessitates continuous innovation and cost optimization.

Emerging Opportunities in India Automotive Parts Magnesium Die Casting Industry

Emerging opportunities lie in the growing adoption of electric vehicles (EVs) and the increasing demand for lightweight components in these vehicles. Expanding into niche applications, such as structural components for commercial vehicles, also presents significant potential. Further opportunities arise from collaborations and partnerships with automotive OEMs to develop customized solutions. The development of sustainable and recyclable magnesium alloys will also attract increased investment.

Growth Accelerators in the India Automotive Parts Magnesium Die Casting Industry

Technological breakthroughs in automation and process optimization are key growth accelerators, improving efficiency and reducing production costs. Strategic partnerships between die casters and automotive OEMs foster innovation and enhance product development. Government initiatives promoting sustainable manufacturing and investments in infrastructure are expected to drive growth further. Market expansion into new segments, such as commercial vehicles and electric vehicles, provides substantial opportunities for long-term growth.

Key Players Shaping the India Automotive Parts Magnesium Die Casting Industry Market

- Ryobi Die Casting

- Pace Industries

- Sundaram Clayton Ltd

- Magic Precision

- Dynacast International

- Shiloh Industries Inc

- George Fischer Ltd

- JPM Group

- Meridian Lightweight Technologies Inc

- Sandhar Group

Notable Milestones in India Automotive Parts Magnesium Die Casting Industry Sector

- May 2022: GF Casting Solutions announced turnkey solutions for automotive challenges, highlighting its electric drive and lightweight structural part capabilities.

- January 2022: Bühler Group launched the "Carat 560 SM" magnesium die-casting machine for high-volume production of lightweight automotive parts.

In-Depth India Automotive Parts Magnesium Die Casting Industry Market Outlook

The Indian automotive parts magnesium die casting industry is poised for robust growth over the forecast period. Continued technological advancements, strategic partnerships, and increasing demand from the automotive sector will drive expansion. The focus on lightweighting and the emergence of electric vehicles present significant opportunities for growth. The market is expected to witness increased consolidation, with larger players potentially acquiring smaller companies. Strategic investments in automation and sustainable practices will be key to long-term success in this dynamic market.

India Automotive Parts Magnesium Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Cating

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Applications

India Automotive Parts Magnesium Die Casting Industry Segmentation By Geography

- 1. India

India Automotive Parts Magnesium Die Casting Industry Regional Market Share

Geographic Coverage of India Automotive Parts Magnesium Die Casting Industry

India Automotive Parts Magnesium Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Properties of Magnesium Led to Increased Adoption in Automobile Sector; Others

- 3.3. Market Restrains

- 3.3.1. Cost and Innovation in Alternate Production Processes; Others

- 3.4. Market Trends

- 3.4.1. Increasing automobile sales will help the market grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Parts Magnesium Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Cating

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ryobi Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pace Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sundaram Clayton Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Magic Precision

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dynacast Internationa;

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shiloh Industries Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 George Fischer Ltd *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JPM Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meridian Lightweight Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sandhar Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ryobi Die Casting

List of Figures

- Figure 1: India Automotive Parts Magnesium Die Casting Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Automotive Parts Magnesium Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: India Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: India Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: India Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 5: India Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: India Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Parts Magnesium Die Casting Industry?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the India Automotive Parts Magnesium Die Casting Industry?

Key companies in the market include Ryobi Die Casting, Pace Industries, Sundaram Clayton Ltd, Magic Precision, Dynacast Internationa;, Shiloh Industries Inc, George Fischer Ltd *List Not Exhaustive, JPM Group, Meridian Lightweight Technologies Inc, Sandhar Group.

3. What are the main segments of the India Automotive Parts Magnesium Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 228.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Properties of Magnesium Led to Increased Adoption in Automobile Sector; Others.

6. What are the notable trends driving market growth?

Increasing automobile sales will help the market grow.

7. Are there any restraints impacting market growth?

Cost and Innovation in Alternate Production Processes; Others.

8. Can you provide examples of recent developments in the market?

May 2022: GF Casting Solutions announced turnkey solutions to the many complex issues faced by automotive, showcasing its agility with its pioneering approach to developing electric drive components as well as lightweight structural parts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Parts Magnesium Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Parts Magnesium Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Parts Magnesium Die Casting Industry?

To stay informed about further developments, trends, and reports in the India Automotive Parts Magnesium Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence