Key Insights

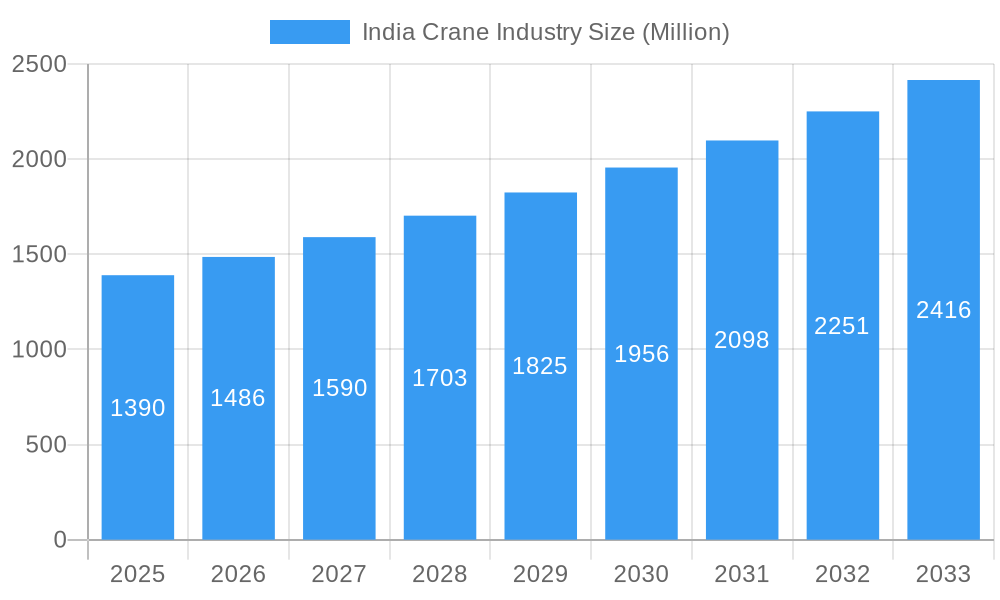

The India crane industry, valued at $1.39 billion in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.79% from 2025 to 2033. This expansion is driven by several key factors. Firstly, significant investments in infrastructure development across India, particularly in construction and transportation, fuel demand for diverse crane types. The ongoing urbanization and industrialization initiatives across the country significantly contribute to this heightened demand. Secondly, the increasing adoption of technologically advanced cranes, including those incorporating automation and remote control features, enhances efficiency and safety on construction sites and industrial projects, further boosting market growth. Government initiatives promoting infrastructure development and ease of doing business also play a significant role. The market is segmented by machine type (mobile, fixed, marine and port) and application (construction, mining, marine & offshore, industrial, and others), with the construction sector acting as a major driver. Leading players like Kobelco, Konecranes, Liebherr, and SANY are competing intensely, offering a variety of cranes to cater to specific project needs. Regional variations exist, with growth likely to be strong across all regions – North, South, East, and West India – reflecting the widespread infrastructure development across the country.

India Crane Industry Market Size (In Billion)

Despite positive growth projections, the industry faces challenges. The high initial investment cost of cranes can be a barrier to entry for smaller companies, creating a more concentrated market. Furthermore, fluctuations in raw material prices and the availability of skilled labor can impact operational costs and profitability. Stringent safety regulations and environmental concerns also present opportunities for innovation but require significant investment in compliance. However, the long-term outlook remains positive, driven by sustained government investments and the nation's ongoing economic growth, making the India crane industry an attractive investment opportunity.

India Crane Industry Company Market Share

India Crane Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India crane industry, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. Market values are presented in million units.

India Crane Industry Market Dynamics & Structure

The Indian crane market is characterized by a moderately concentrated landscape, with both multinational giants and domestic players vying for market share. Technological innovation, driven by the need for enhanced efficiency and safety, is a key growth driver. Stringent regulatory frameworks, particularly concerning safety and emission standards, shape market dynamics. Competitive pressures from substitute products, such as specialized lifting equipment, are also present. The end-user demographics are diverse, encompassing construction, mining, ports, and industrial sectors. M&A activity remains relatively moderate, with xx deals recorded in the last 5 years, primarily focused on expanding market reach and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on automation, remote operation, and electric/hybrid powertrains.

- Regulatory Framework: Emphasis on safety standards, emission norms, and operational licensing.

- Competitive Substitutes: Specialized lifting equipment, including hoists and jacks.

- End-User Demographics: Construction (xx%), Mining & Excavation (xx%), Marine & Offshore (xx%), Industrial (xx%), Others (xx%).

- M&A Trends: xx deals over the past 5 years, primarily driven by expansion and technological acquisition. Significant barriers to entry include high capital investment and complex regulatory compliance.

India Crane Industry Growth Trends & Insights

The Indian crane market exhibited strong growth during the historical period (2019-2024), driven by robust infrastructure development and industrial expansion. The market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. This growth is expected to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033), reaching xx million units by 2033. Technological disruptions, particularly the adoption of advanced control systems and electric cranes, are accelerating market transformation. Consumer behavior is shifting towards preference for higher efficiency, safety, and environmentally friendly solutions. Increased adoption of rental services is also influencing market dynamics. Market penetration in underserved regions presents significant future growth opportunities.

Dominant Regions, Countries, or Segments in India Crane Industry

The construction sector, particularly in rapidly developing urban centers like Mumbai, Delhi, Bengaluru, and Chennai, dominates the Indian crane market, accounting for approximately xx% of total demand. Within machine types, mobile cranes hold the largest market share (xx%), followed by fixed cranes (xx%) and marine and port cranes (xx%). This dominance is driven by the ongoing expansion of infrastructure projects, including highways, railways, and real estate developments.

- Key Drivers: Government infrastructure spending, urbanization, industrial growth, and rising demand for high-rise buildings.

- Dominance Factors: High construction activity, strong economic growth, and supportive government policies.

- Growth Potential: Significant growth potential in emerging markets and through the adoption of advanced crane technologies. The mining and excavation segments are also experiencing considerable growth due to increased mining activities and infrastructure development.

India Crane Industry Product Landscape

The Indian crane market offers a diverse range of products, including mobile, fixed, and specialized cranes catering to different applications. Recent innovations focus on enhanced safety features, improved load capacity, and environmentally friendly powertrains. Manufacturers are increasingly emphasizing remote operation and digital monitoring systems. Unique selling propositions (USPs) include advanced control systems, customized solutions, and after-sales service packages.

Key Drivers, Barriers & Challenges in India Crane Industry

Key Drivers:

- Robust infrastructure development initiatives by the Indian government.

- Growing industrialization and manufacturing sector.

- Increasing urbanization and construction activities in metro cities.

Challenges & Restraints:

- High initial investment costs and operational expenses.

- Stringent safety regulations and compliance requirements.

- Dependence on imported components and technology.

- Intense competition from both domestic and international players. This leads to price wars and reduced profit margins. Supply chain disruptions, particularly in the procurement of specialized components, can impact market growth.

Emerging Opportunities in India Crane Industry

- Expansion into rural and semi-urban markets.

- Growing demand for specialized cranes in renewable energy projects.

- Increasing adoption of crane rental services.

- Opportunities in specialized applications like wind energy and nuclear power plants.

Growth Accelerators in the India Crane Industry

Technological advancements in crane design and control systems, coupled with strategic partnerships to expand market reach and distribution networks, will be key catalysts for long-term growth in the Indian crane industry. Government initiatives promoting infrastructure development and industrialization will also play a crucial role in driving industry expansion.

Key Players Shaping the India Crane Industry Market

- Kobelco Construction Equipment India

- Konecranes

- Santek

- Action Construction Equipment Limited

- Anupam Industries Limited

- Liebherr Group

- Palfinger AG

- Meltech Cranes Pvt Ltd

- TIL Ltd

- SANY Group

- Escorts Ltd

- Tata Hitachi Construction Machinery

Notable Milestones in India Crane Industry Sector

- December 2023: Manitowoc Company unveils Potain MCH 175 luffing cranes at CII Excon.

- September 2023: MyCrane launches fully owned operations in India.

- February 2023: Action Construction Equipment (ACE) introduces India's first fully electric mobile crane and self-propelled aerial work platforms at Bauma Conexpo 2023.

In-Depth India Crane Industry Market Outlook

The Indian crane industry is poised for sustained growth over the next decade, fueled by ongoing infrastructure development, industrial expansion, and technological advancements. Strategic partnerships, investment in R&D, and the adoption of innovative business models, such as crane rental services, will play a crucial role in shaping the future landscape of the market. Companies focused on providing sustainable and technologically advanced solutions will be well-positioned to capitalize on the significant growth opportunities ahead.

India Crane Industry Segmentation

-

1. Machine Type

- 1.1. Mobile Cranes

- 1.2. Fixed Cranes

- 1.3. Marine and Port Cranes

-

2. Application

- 2.1. Contruction

- 2.2. Mining and Excavation

- 2.3. Marine and Offshore

- 2.4. Industrial

- 2.5. Other Applications

India Crane Industry Segmentation By Geography

- 1. India

India Crane Industry Regional Market Share

Geographic Coverage of India Crane Industry

India Crane Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment in Smart Cities and Housing Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Operators Is Anticipate To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Mobile Cranes to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Crane Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Mobile Cranes

- 5.1.2. Fixed Cranes

- 5.1.3. Marine and Port Cranes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Contruction

- 5.2.2. Mining and Excavation

- 5.2.3. Marine and Offshore

- 5.2.4. Industrial

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Euipment India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Konecranes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Santek

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Action Construction Euipment Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anupam Industries Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Liebherr Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Palfinger A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meltech Cranes Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TIL Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SANY Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Escorts Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tata Hitachi Construciton Machinery

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Euipment India

List of Figures

- Figure 1: India Crane Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Crane Industry Share (%) by Company 2025

List of Tables

- Table 1: India Crane Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: India Crane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: India Crane Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Crane Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 5: India Crane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: India Crane Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Crane Industry?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the India Crane Industry?

Key companies in the market include Kobelco Construction Euipment India, Konecranes, Santek, Action Construction Euipment Limited, Anupam Industries Limited, Liebherr Group, Palfinger A, Meltech Cranes Pvt Ltd, TIL Ltd, SANY Group, Escorts Ltd, Tata Hitachi Construciton Machinery.

3. What are the main segments of the India Crane Industry?

The market segments include Machine Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Investment in Smart Cities and Housing Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Mobile Cranes to Boost the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Operators Is Anticipate To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2023 Manitowoc Company unveiled its latest Potain MCH 175 luffing cranes at the CII Excon Event one of the leading construction equipment exhibition in South Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Crane Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Crane Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Crane Industry?

To stay informed about further developments, trends, and reports in the India Crane Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence