Key Insights

The Indonesian online ride-hailing market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.1%. The market size was valued at $163.55 billion in the base year 2025 and is expected to reach substantial figures by 2033. This expansion is propelled by a growing middle class seeking convenient and affordable mobility solutions, coupled with increasing smartphone penetration and robust internet infrastructure. Key market segments highlight a preference for two-wheelers, aligning with local traffic conditions and cost considerations. The dominance of online booking platforms underscores the market’s convenience-centric nature, with major players like Gojek and Grab driving adoption.

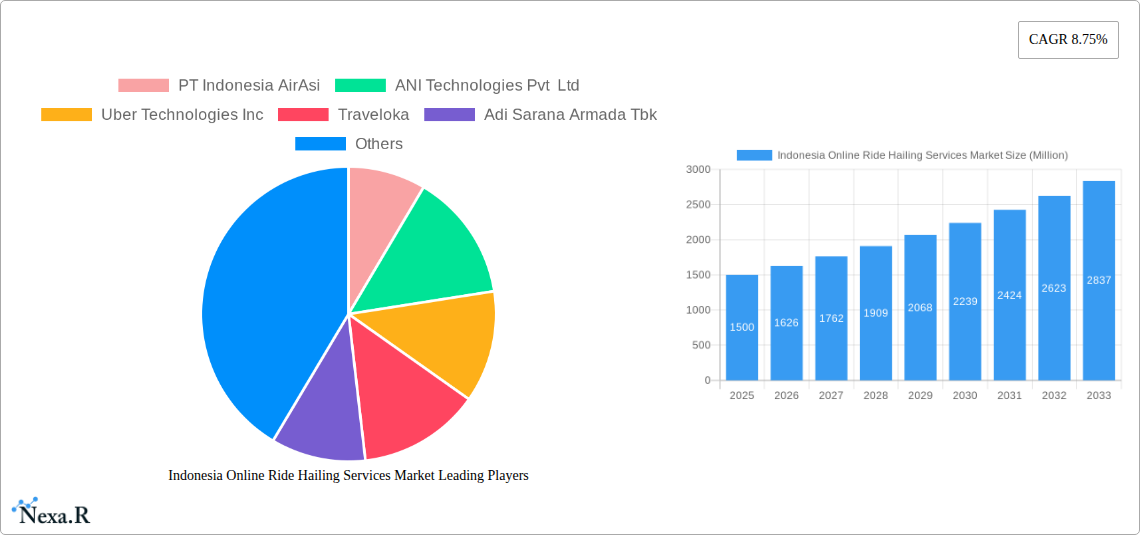

Indonesia Online Ride Hailing Services Market Market Size (In Billion)

Despite regulatory considerations and intense competition, the long-term outlook remains positive. Technological advancements, including autonomous vehicles and integrated logistics, alongside the expansion of services such as food delivery, present significant growth opportunities. Strategic partnerships and the integration of ride-hailing with public transportation are poised to enhance urban mobility and further fuel market expansion. The competitive environment, marked by innovation from leading platforms, ensures continued efficiency and development within the sector.

Indonesia Online Ride Hailing Services Market Company Market Share

Indonesia Online Ride Hailing Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Indonesia online ride-hailing services market, encompassing its dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines the parent market (Transportation Services) and child markets (Online Ride-Hailing Services) to provide a holistic understanding of this rapidly evolving sector. Market values are presented in million units.

Indonesia Online Ride Hailing Services Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Indonesian online ride-hailing sector. The report examines market concentration, highlighting the dominance of key players and assessing the potential for future consolidation. It also explores the influence of technological innovation, such as the integration of AI and GPS technology, on market growth and efficiency. Furthermore, the analysis incorporates the impact of government regulations on pricing, safety standards, and licensing, as well as the presence of competitive substitutes, such as traditional taxis and public transportation. Finally, the report reviews M&A activities, offering insights into their impact on market consolidation and future growth.

- Market Concentration: Gojek and Grab hold approximately xx% of the market share, indicating a highly concentrated market. Other players like Traveloka and AirAsia's recent entry are challenging this dominance.

- Technological Innovation: Adoption of AI-powered route optimization, dynamic pricing algorithms, and integrated payment systems drive efficiency and customer satisfaction.

- Regulatory Framework: Government regulations regarding licensing, safety standards, and pricing strategies significantly influence market operations. Recent regulatory changes have impacted pricing models and operating permits.

- Competitive Substitutes: Traditional taxis and public transportation remain significant substitutes, especially in areas with limited online ride-hailing penetration.

- End-User Demographics: The market caters to a diverse population, with significant growth fueled by rising middle-class disposable incomes and increased smartphone penetration. Personal use accounts for approximately xx% of the market, while commercial use constitutes xx%.

- M&A Trends: The market has witnessed xx M&A deals in the past five years, primarily driven by strategies to expand market share and enhance service offerings.

Indonesia Online Ride Hailing Services Market Growth Trends & Insights

This section delves into the historical and projected growth of the Indonesian online ride-hailing market. Using proprietary data analysis (XXX), the report charts the evolution of market size, adoption rates, and technological disruptions. It identifies key factors contributing to market expansion, including increasing smartphone penetration, rising urbanization, and the growing preference for convenient and affordable transportation. The analysis also explores shifting consumer behavior, highlighting trends in ride-sharing preferences, payment methods, and service expectations.

The market experienced a CAGR of xx% during the historical period (2019-2024). The market penetration rate is currently estimated at xx%, with projections for significant growth during the forecast period (2025-2033), driven by factors such as increased smartphone usage, evolving consumer preferences, and further investments in infrastructure. Technological disruptions, such as the introduction of electric vehicles and autonomous driving technologies, are expected to further shape market dynamics in the coming years.

Dominant Regions, Countries, or Segments in Indonesia Online Ride Hailing Services Market

This section identifies the leading regions, countries, or segments within the Indonesian online ride-hailing market. The analysis focuses on key growth drivers for each segment (Personal, Commercial; Two Wheeler, Passenger Car; Online, Offline) and evaluates market share and future growth potential. The report details the factors contributing to the dominance of specific regions, considering economic factors, infrastructure development, and population density.

- End-Use: The Personal segment currently dominates, accounting for xx% of the market, fueled by increasing individual mobility needs. The Commercial segment is expected to see strong growth driven by businesses integrating ride-hailing into logistics and employee transportation.

- Vehicle Type: Two-wheelers represent a larger market share (xx%) due to affordability and maneuverability in congested urban areas. Passenger cars are also experiencing robust growth, driven by increased demand for comfort and larger group transportation.

- Booking Type: Online bookings clearly dominate (xx%) due to convenience and technological advancements. Offline bookings retain a niche presence, primarily in less tech-savvy areas.

- Regional Dominance: Jakarta and other major urban centers exhibit the highest market penetration and growth rates, driven by high population density, better infrastructure, and increased smartphone adoption.

Indonesia Online Ride Hailing Services Market Product Landscape

The Indonesian online ride-hailing market offers diverse services, ranging from basic point-to-point transportation to specialized options like bike taxis, carpooling, and premium rides. Continuous product innovation focuses on enhancing user experience, including features like in-app navigation, real-time tracking, cashless payments, and integrated ride-sharing options. Technological advancements, such as AI-powered route optimization and dynamic pricing algorithms, contribute to improved efficiency and customer satisfaction. Unique selling propositions often revolve around pricing strategies, loyalty programs, and additional features like insurance and customer support.

Key Drivers, Barriers & Challenges in Indonesia Online Ride Hailing Services Market

Key Drivers: The market is driven by increasing smartphone penetration, rising urbanization, growing disposable incomes, and government initiatives promoting digitalization. The convenience and affordability offered by online ride-hailing services are major catalysts.

Key Barriers & Challenges: Regulatory hurdles concerning licensing and pricing, intense competition among established players, and potential supply chain disruptions related to fuel costs and vehicle availability pose significant challenges. Addressing safety concerns and ensuring driver welfare are also crucial for sustainable growth. The impact of these challenges can be measured by a reduced market growth rate by approximately xx% in some instances.

Emerging Opportunities in Indonesia Online Ride Hailing Services Market

Untapped potential exists in expanding services to smaller cities and rural areas, integrating ride-hailing with other transportation modes (e.g., public transit), and developing specialized services catering to specific needs (e.g., medical transport, deliveries). The emergence of electric vehicles and autonomous driving technologies presents further opportunities for innovation and sustainable growth. Furthermore, expanding partnerships with businesses can unlock new revenue streams.

Growth Accelerators in the Indonesia Online Ride Hailing Services Market Industry

Long-term growth will be fueled by continued technological innovation, strategic partnerships (such as the ComfortDelGro collaboration), and expansion into underserved markets. Government initiatives promoting digital infrastructure and sustainable transportation will further accelerate market growth. Investment in driver training and safety measures, enhancing rider experience, and broadening service options will also contribute to expansion.

Key Players Shaping the Indonesia Online Ride Hailing Services Market Market

- PT Indonesia AirAsia

- ANI Technologies Pvt Ltd

- Uber Technologies Inc

- Traveloka

- Adi Sarana Armada Tbk

- PT Gojek

- Grab Holdings Inc

Notable Milestones in Indonesia Online Ride Hailing Services Market Sector

- September 2022: AirAsia launched its ride-hailing service in Indonesia, focusing on four-wheeled transportation. This entry significantly intensified competition.

- November 2022: Indonesian ride-hailing services partnered with ComfortDelGro, a Singaporean taxi provider, to explore market expansion opportunities. This partnership signaled a move towards international collaboration and potential for enhanced service offerings.

In-Depth Indonesia Online Ride Hailing Services Market Market Outlook

The Indonesian online ride-hailing market presents significant long-term growth potential, driven by strong underlying factors such as rising urbanization, increasing smartphone penetration, and government support for digitalization. Strategic investments in technology, expansion into new markets, and diversification of service offerings will be crucial for companies to capitalize on this potential. The market is poised for continued consolidation, with opportunities for both established players and new entrants to gain market share through innovation and strategic partnerships.

Indonesia Online Ride Hailing Services Market Segmentation

-

1. Vehicle Type

- 1.1. Two-wheelers

- 1.2. Passenger Cars

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. End Use

- 3.1. Personal

- 3.2. Commercial

Indonesia Online Ride Hailing Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Online Ride Hailing Services Market Regional Market Share

Geographic Coverage of Indonesia Online Ride Hailing Services Market

Indonesia Online Ride Hailing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Fast Food is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increase in the Online Food Deliveries May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Activities to Positively Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Online Ride Hailing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-wheelers

- 5.1.2. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by End Use

- 5.3.1. Personal

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Indonesia AirAsi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ANI Technologies Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uber Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Traveloka

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Adi Sarana Armada Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Gojek

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grab Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 PT Indonesia AirAsi

List of Figures

- Figure 1: Indonesia Online Ride Hailing Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Online Ride Hailing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 4: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 8: Indonesia Online Ride Hailing Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Online Ride Hailing Services Market?

The projected CAGR is approximately 9.1%.

2. Which companies are prominent players in the Indonesia Online Ride Hailing Services Market?

Key companies in the market include PT Indonesia AirAsi, ANI Technologies Pvt Ltd, Uber Technologies Inc, Traveloka, Adi Sarana Armada Tbk, PT Gojek, Grab Holdings Inc.

3. What are the main segments of the Indonesia Online Ride Hailing Services Market?

The market segments include Vehicle Type, Booking Type, End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.55 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Fast Food is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Rise in Tourism Activities to Positively Drive the Market.

7. Are there any restraints impacting market growth?

Increase in the Online Food Deliveries May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2022: Indonesia ride-hailing services announced the partnership with the Singapore taxi provider ComfortDelGro in order to explore the ride-hailing market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Online Ride Hailing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Online Ride Hailing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Online Ride Hailing Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Online Ride Hailing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence