Key Insights

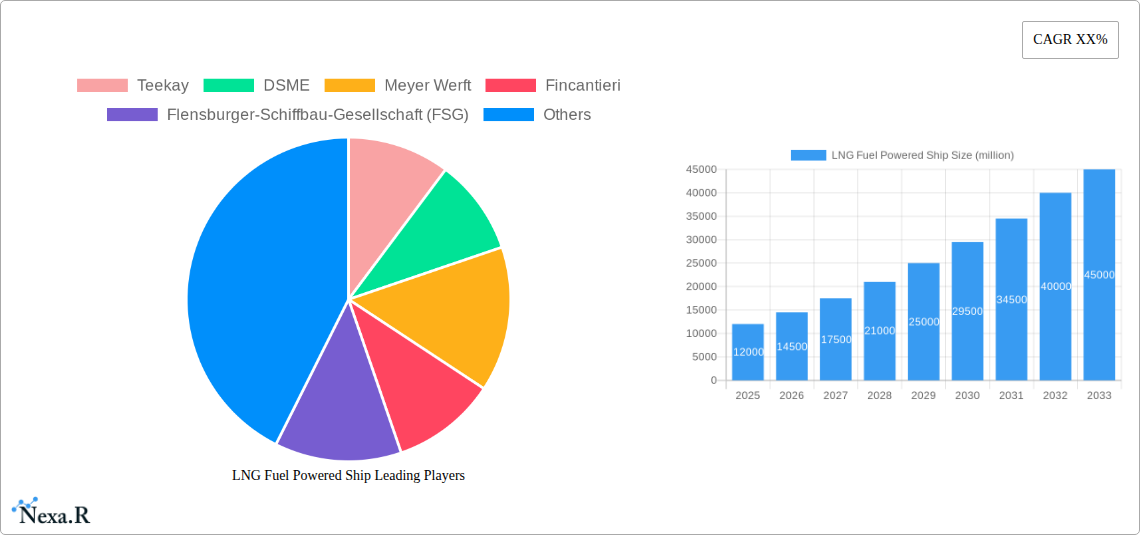

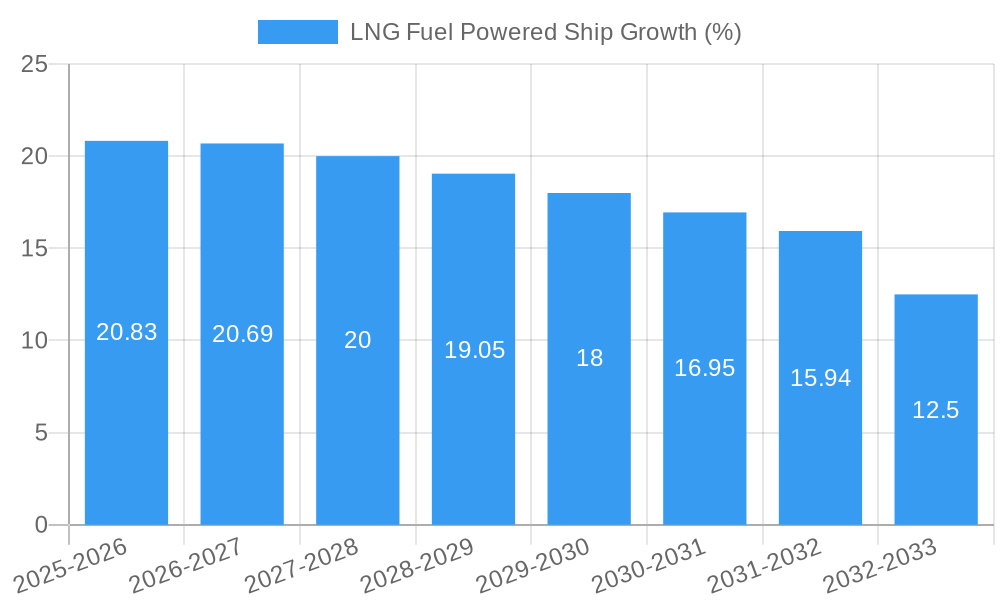

The global LNG Fuel Powered Ship market is poised for substantial growth, projected to reach approximately USD 45,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 18% during the forecast period. This expansion is fundamentally driven by increasing environmental regulations aimed at curbing greenhouse gas emissions from the maritime sector, alongside the growing adoption of Liquefied Natural Gas (LNG) as a cleaner and more cost-effective alternative to traditional heavy fuel oil. The inherent advantages of LNG, including its lower sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions, make it an attractive fuel for shipowners striving to comply with stringent international maritime conventions. The market is further bolstered by governmental incentives and the development of robust LNG bunkering infrastructure across key shipping lanes, facilitating the transition towards greener maritime operations.

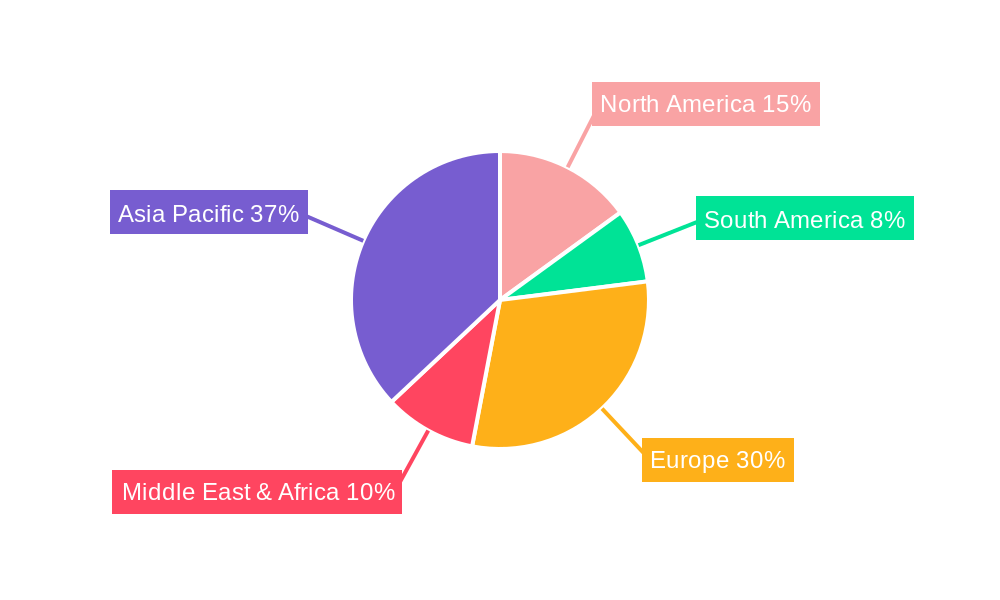

The market's segmentation reveals a dynamic landscape with both Commercial and Civil applications contributing to overall demand. Within the types of vessels, Riverboats and Sea Boats are both experiencing uptake, though larger sea-going vessels, particularly those in the cargo and passenger segments, are likely to represent a significant portion of LNG adoption due to their higher fuel consumption and longer operational lifespans. Leading shipbuilding companies such as Teekay, DSME, Meyer Werft, and Fincantieri are at the forefront, investing in the development and construction of LNG-powered vessels. Geographically, Asia Pacific, driven by China and South Korea's advanced shipbuilding capabilities and significant maritime trade, is anticipated to lead the market. Europe also holds a strong position due to strict environmental policies and a developed LNG supply network.

This comprehensive report offers an in-depth analysis of the global LNG fuel-powered ship market, a rapidly expanding sector driven by stringent environmental regulations and the pursuit of sustainable maritime operations. Spanning a study period from 2019 to 2033, with a base year of 2025, this research provides critical insights into market dynamics, growth trends, regional dominance, and the competitive landscape for industry professionals. We leverage sophisticated market sizing and forecasting techniques to deliver actionable intelligence, including a detailed CAGR of xx% for the forecast period.

This report will equip stakeholders with a clear understanding of the parent market (global maritime industry) and the child market (LNG fuel-powered ships), enabling strategic decision-making and identifying lucrative investment opportunities. With a focus on high-traffic keywords such as "LNG powered ships," "liquefied natural gas marine fuel," "sustainable shipping," "dual-fuel vessels," and "maritime emissions reduction," this report is optimized for maximum search engine visibility.

LNG Fuel Powered Ship Market Dynamics & Structure

The global LNG fuel-powered ship market exhibits a moderately concentrated structure, with key shipbuilding giants and specialized engine manufacturers vying for market share. Technological innovation is primarily driven by the imperative to meet evolving emissions standards (e.g., IMO 2020, EEDI) and improve fuel efficiency. Major drivers include advancements in LNG storage and handling systems, dual-fuel engine technology, and the development of robust bunkering infrastructure. Regulatory frameworks, such as International Maritime Organization (IMO) mandates and regional Emission Control Areas (ECAs), act as significant accelerators. Competitive product substitutes are limited, with methanol and ammonia-powered vessels emerging as long-term alternatives, but LNG currently holds a dominant position due to its established infrastructure and relative maturity. End-user demographics are shifting towards major shipping lines, cargo operators, and ferry services seeking to reduce their environmental footprint and operational costs. Merger and acquisition (M&A) trends are observed, with larger shipyards acquiring specialized LNG technology providers or consolidating to gain economies of scale.

- Market Concentration: Dominated by a handful of major shipbuilders and technology providers.

- Technological Innovation Drivers: Emissions regulations, fuel efficiency, LNG infrastructure development.

- Regulatory Frameworks: IMO mandates, ECAs, regional environmental policies.

- Competitive Product Substitutes: Methanol, ammonia (long-term); low-sulfur fuels (short-term).

- End-User Demographics: Global shipping lines, cargo operators, ferry services, offshore support vessels.

- M&A Trends: Consolidation for scale, acquisition of specialized LNG technology expertise.

LNG Fuel Powered Ship Growth Trends & Insights

The global LNG fuel-powered ship market is on an upward trajectory, projected to grow from an estimated xx million units in 2025 to xx million units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%. This expansion is fueled by a confluence of factors, including increasingly stringent global environmental regulations, a growing awareness of the environmental impact of traditional marine fuels, and the economic advantages offered by LNG in terms of fuel cost volatility and reduced sulfur oxide (SOx) and nitrogen oxide (NOx) emissions. The base year of 2025 sees a significant uptick in newbuilding orders for LNG-powered vessels, indicating a strong commitment from shipowners to adopt this cleaner fuel alternative.

Technological disruptions are playing a pivotal role in this growth. Advancements in cryogenic fuel containment systems, highly efficient dual-fuel engines capable of operating on both LNG and conventional fuels, and the development of more compact and integrated LNG fuel gas supply systems are making LNG a more practical and attractive option for a wider range of vessel types and sizes. Furthermore, the operational performance metrics of LNG-powered ships, such as extended range capabilities and reduced maintenance needs in some components, are contributing to their appeal.

Consumer behavior within the maritime industry is also undergoing a palpable shift. Shippers are increasingly demanding greener logistics solutions, and charterers are factoring environmental compliance into their vessel selection criteria. This growing demand for sustainable shipping practices directly translates into a higher adoption rate for LNG-powered vessels. The market penetration of LNG as a marine fuel is expected to accelerate significantly, moving beyond early adopters to become a mainstream choice for new constructions across various maritime segments. The forecast period (2025-2033) is anticipated to witness a substantial increase in the global fleet of LNG-powered ships, driven by both new builds and retrofitting initiatives, as the industry collectively strives to decarbonize its operations and meet long-term sustainability goals. The study period (2019-2033) highlights the foundational growth phase and the subsequent acceleration into mainstream adoption.

Dominant Regions, Countries, or Segments in LNG Fuel Powered Ship

The Commercial application segment, particularly for Sea Boat types, is currently the dominant force driving growth in the global LNG fuel-powered ship market. This dominance stems from several key factors, including the sheer volume of global trade reliant on large commercial vessels like container ships, LNG carriers, tankers, and bulk carriers. These vessels operate on long-haul routes where the economic benefits of LNG – such as reduced fuel costs and compliance with stricter emission regulations in major shipping lanes – are most pronounced. The market share within this segment is substantial, with new orders for LNG-powered container ships and LNG carriers consistently outnumbering other vessel types.

Key drivers fueling this dominance include economic policies that incentivize the adoption of cleaner fuels, such as tax breaks and subsidies for vessels meeting specific emissions standards. Furthermore, the development of robust bunkering infrastructure in major global ports is crucial. Regions with significant port activity and established LNG supply chains, like Northern Europe (e.g., Rotterdam, Antwerp), East Asia (e.g., Singapore, China, South Korea), and the Gulf Coast of North America, are at the forefront of LNG adoption for commercial vessels. Countries like China, South Korea, and Japan, with their strong shipbuilding capacities and proactive government support for green maritime technologies, are leading in the construction of these vessels.

The growth potential for commercial sea boats powered by LNG remains immense. As global trade continues to expand and environmental pressures intensify, the demand for cleaner and more efficient shipping solutions will only increase. While Civil applications and Riverboat types are also experiencing growth, their market share and immediate impact on overall market expansion are comparatively smaller. Riverboats, for instance, are often subject to different regulatory environments and infrastructure limitations. However, the increasing focus on inland waterway transport as a sustainable alternative to road and rail could see a rise in demand for LNG-powered riverboats in the future. The current market leadership of commercial sea boats, however, is firmly established due to their operational scale, economic drivers, and the availability of supporting infrastructure.

- Dominant Application: Commercial Shipping

- Dominant Vessel Type: Sea Boat (Container Ships, LNG Carriers, Tankers, Bulk Carriers)

- Key Drivers:

- Economic incentives and subsidies.

- Expansion of global trade and shipping routes.

- Stringent emissions regulations for international waters.

- Availability of LNG bunkering infrastructure in major ports.

- Cost-effectiveness of LNG fuel over traditional heavy fuel oil.

- Leading Regions: Northern Europe, East Asia, North America (Gulf Coast).

- Leading Countries: China, South Korea, Japan, Norway.

- Market Share & Growth Potential: High market share and significant ongoing growth potential driven by fleet renewals and newbuilding orders.

LNG Fuel Powered Ship Product Landscape

The LNG fuel-powered ship product landscape is characterized by continuous innovation in propulsion systems and fuel containment. Leading shipbuilders like Hyundai Heavy Industries (HHI), Samsung Heavy Industries, and Daewoo are at the forefront of developing advanced dual-fuel engines and integrated LNG fuel gas supply systems. Ship types range from massive container vessels and LNG carriers to passenger ferries and offshore support vessels. Unique selling propositions include significant reductions in SOx, NOx, and particulate matter emissions, contributing to a cleaner maritime environment. Technological advancements focus on improving the efficiency and safety of cryogenic fuel storage, such as membrane-type tanks and advanced insulation techniques. Performance metrics highlight extended operational ranges and reduced fuel consumption compared to conventional fuels.

Key Drivers, Barriers & Challenges in LNG Fuel Powered Ship

Key Drivers: The primary forces propelling the LNG fuel-powered ship market include increasingly stringent global environmental regulations mandating lower emissions (e.g., IMO 2020 and future targets), the inherent cost advantage of LNG over traditional marine fuels, and the growing corporate sustainability commitments of shipping companies. Technological advancements in engine design and fuel handling systems have made LNG a more viable and efficient option.

- Regulatory Push: IMO's decarbonization agenda.

- Economic Incentives: Lower and more stable fuel prices.

- Environmental Imperative: Reducing GHG and air pollutants.

- Technological Maturity: Reliable dual-fuel engines and bunkering solutions.

Barriers & Challenges: Significant challenges include the initial high capital investment for new builds and retrofits, the limited global availability and inconsistency of LNG bunkering infrastructure, and the safety concerns associated with handling liquefied natural gas. Supply chain complexities for LNG fuel, fluctuating LNG prices, and the need for specialized crew training also pose hurdles.

- Infrastructure Gaps: Uneven global bunkering network.

- Capital Expenditure: High upfront costs for vessels and infrastructure.

- Safety & Handling: Specialized procedures for cryogenic fuel.

- Supply Chain Volatility: Ensuring consistent and reliable fuel supply.

- Regulatory Ambiguity: Evolving international and regional rules.

Emerging Opportunities in LNG Fuel Powered Ship

Emerging opportunities in the LNG fuel-powered ship sector lie in the development of smaller-scale LNG bunkering solutions for regional trades and inland waterways. The increasing demand for green shipping certifications by cargo owners presents a significant market for LNG-powered vessels. Furthermore, advancements in liquefaction technologies for onboard fuel processing and the exploration of hybrid propulsion systems integrating LNG with renewable energy sources offer substantial untapped potential. The growing focus on energy efficiency and emission reduction in the offshore sector also presents a burgeoning market for LNG-powered support vessels.

Growth Accelerators in the LNG Fuel Powered Ship Industry

Growth accelerators in the LNG fuel-powered ship industry include strategic partnerships between shipyards, engine manufacturers, and LNG suppliers to overcome infrastructure challenges. The continued development of innovative dual-fuel engine technologies that offer higher efficiency and lower emissions will further boost adoption. Moreover, supportive government policies, such as tax incentives and grants for adopting cleaner fuels, coupled with the increasing awareness and demand for sustainable maritime solutions from end-users, are significant growth catalysts. Expansion into new geographical markets with emerging LNG supply chains will also play a crucial role.

Key Players Shaping the LNG Fuel Powered Ship Market

- Teekay

- DSME

- Meyer Werft

- Fincantieri

- Flensburger-Schiffbau-Gesellschaft (FSG)

- Hyundai Heavy Industries (HHI)

- Samsung Heavy Industries

- Hudong-Zhonghua Shipbuilding

- Kawasaki

- Japan Marine United

- IMABARI SHIPBUILDING

- Kleven Vreft

- Ferus Smit

- Daewoo

- Mitsubishi Heavy Industries

Notable Milestones in LNG Fuel Powered Ship Sector

- 2019: Increased regulatory pressure from IMO on sulfur emissions leading to a surge in interest for alternative fuels.

- 2020: Launch of several new dual-fuel engine models optimized for LNG by major manufacturers.

- 2021: Significant increase in newbuilding orders for LNG-powered container ships and LNG carriers.

- 2022: Expansion of LNG bunkering facilities in key European and Asian ports.

- 2023: Introduction of the first LNG-powered cruise ships, signaling market diversification.

- 2024: Growing trend of retrofitting existing vessels with LNG fuel systems to meet upcoming regulations.

In-Depth LNG Fuel Powered Ship Market Outlook

- 2019: Increased regulatory pressure from IMO on sulfur emissions leading to a surge in interest for alternative fuels.

- 2020: Launch of several new dual-fuel engine models optimized for LNG by major manufacturers.

- 2021: Significant increase in newbuilding orders for LNG-powered container ships and LNG carriers.

- 2022: Expansion of LNG bunkering facilities in key European and Asian ports.

- 2023: Introduction of the first LNG-powered cruise ships, signaling market diversification.

- 2024: Growing trend of retrofitting existing vessels with LNG fuel systems to meet upcoming regulations.

In-Depth LNG Fuel Powered Ship Market Outlook

The future outlook for the LNG fuel-powered ship market is exceptionally robust, driven by a clear global mandate for decarbonization and the established economic and environmental benefits of LNG. Growth accelerators such as advancements in onboard liquefaction technologies, expansion of bunkering infrastructure in emerging markets, and strong government support will continue to fuel adoption. Strategic partnerships and collaborations will be pivotal in addressing infrastructure challenges and ensuring a seamless supply chain. The market is poised for sustained expansion, with LNG expected to remain a dominant transitional fuel in the maritime sector for the foreseeable future, offering significant opportunities for innovation and investment in sustainable shipping solutions.

LNG Fuel Powered Ship Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Civil

-

2. Types

- 2.1. Riverboat

- 2.2. Sea Boat

LNG Fuel Powered Ship Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LNG Fuel Powered Ship REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LNG Fuel Powered Ship Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Civil

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Riverboat

- 5.2.2. Sea Boat

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LNG Fuel Powered Ship Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Civil

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Riverboat

- 6.2.2. Sea Boat

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America LNG Fuel Powered Ship Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Civil

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Riverboat

- 7.2.2. Sea Boat

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe LNG Fuel Powered Ship Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Civil

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Riverboat

- 8.2.2. Sea Boat

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa LNG Fuel Powered Ship Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Civil

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Riverboat

- 9.2.2. Sea Boat

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific LNG Fuel Powered Ship Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Civil

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Riverboat

- 10.2.2. Sea Boat

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Teekay

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DSME

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meyer Werft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fincantieri

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Flensburger-Schiffbau-Gesellschaft (FSG)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hyundai Heavy Industries(HHI)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung Heavy Industries

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hudong-Zhonghua Shipbuilding

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kawasaki

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Japan Marine United

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IMABARI SHIPBUILDING

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kleven Vreft

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ferus Smit

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Daewoo

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mitsubishi Heavy Industries

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Teekay

List of Figures

- Figure 1: Global LNG Fuel Powered Ship Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America LNG Fuel Powered Ship Revenue (million), by Application 2024 & 2032

- Figure 3: North America LNG Fuel Powered Ship Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America LNG Fuel Powered Ship Revenue (million), by Types 2024 & 2032

- Figure 5: North America LNG Fuel Powered Ship Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America LNG Fuel Powered Ship Revenue (million), by Country 2024 & 2032

- Figure 7: North America LNG Fuel Powered Ship Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America LNG Fuel Powered Ship Revenue (million), by Application 2024 & 2032

- Figure 9: South America LNG Fuel Powered Ship Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America LNG Fuel Powered Ship Revenue (million), by Types 2024 & 2032

- Figure 11: South America LNG Fuel Powered Ship Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America LNG Fuel Powered Ship Revenue (million), by Country 2024 & 2032

- Figure 13: South America LNG Fuel Powered Ship Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe LNG Fuel Powered Ship Revenue (million), by Application 2024 & 2032

- Figure 15: Europe LNG Fuel Powered Ship Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe LNG Fuel Powered Ship Revenue (million), by Types 2024 & 2032

- Figure 17: Europe LNG Fuel Powered Ship Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe LNG Fuel Powered Ship Revenue (million), by Country 2024 & 2032

- Figure 19: Europe LNG Fuel Powered Ship Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa LNG Fuel Powered Ship Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa LNG Fuel Powered Ship Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa LNG Fuel Powered Ship Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa LNG Fuel Powered Ship Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa LNG Fuel Powered Ship Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa LNG Fuel Powered Ship Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific LNG Fuel Powered Ship Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific LNG Fuel Powered Ship Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific LNG Fuel Powered Ship Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific LNG Fuel Powered Ship Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific LNG Fuel Powered Ship Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific LNG Fuel Powered Ship Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LNG Fuel Powered Ship Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global LNG Fuel Powered Ship Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global LNG Fuel Powered Ship Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global LNG Fuel Powered Ship Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global LNG Fuel Powered Ship Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global LNG Fuel Powered Ship Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global LNG Fuel Powered Ship Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global LNG Fuel Powered Ship Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global LNG Fuel Powered Ship Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global LNG Fuel Powered Ship Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global LNG Fuel Powered Ship Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global LNG Fuel Powered Ship Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global LNG Fuel Powered Ship Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global LNG Fuel Powered Ship Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global LNG Fuel Powered Ship Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global LNG Fuel Powered Ship Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global LNG Fuel Powered Ship Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global LNG Fuel Powered Ship Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global LNG Fuel Powered Ship Revenue million Forecast, by Country 2019 & 2032

- Table 41: China LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific LNG Fuel Powered Ship Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LNG Fuel Powered Ship?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the LNG Fuel Powered Ship?

Key companies in the market include Teekay, DSME, Meyer Werft, Fincantieri, Flensburger-Schiffbau-Gesellschaft (FSG), Hyundai Heavy Industries(HHI), Samsung Heavy Industries, Hudong-Zhonghua Shipbuilding, Kawasaki, Japan Marine United, IMABARI SHIPBUILDING, Kleven Vreft, Ferus Smit, Daewoo, Mitsubishi Heavy Industries.

3. What are the main segments of the LNG Fuel Powered Ship?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LNG Fuel Powered Ship," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LNG Fuel Powered Ship report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LNG Fuel Powered Ship?

To stay informed about further developments, trends, and reports in the LNG Fuel Powered Ship, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence