Key Insights

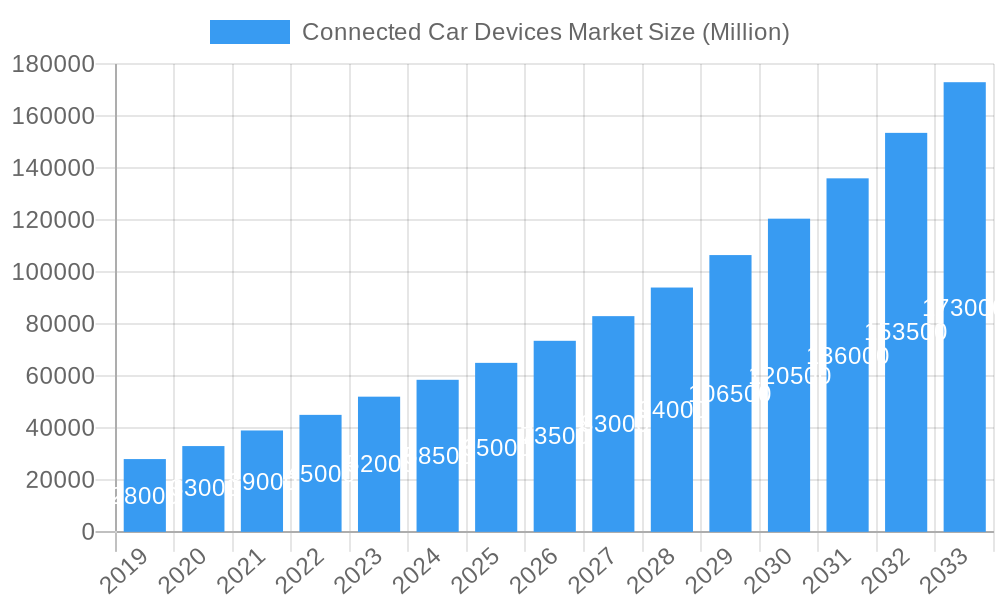

The Connected Car Devices Market is set for significant expansion, projected to reach USD 63.27 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 14.83%. This growth is fueled by advancements in vehicle safety, infotainment, and efficiency technologies. Key drivers include rising consumer demand for seamless connectivity and advanced driver-assistance systems (ADAS), alongside regulatory mandates for enhanced vehicle safety features. The integration of telematics and the expansion of V2X (Vehicle-to-Everything) communication, including V2V, V2I, and V2P, are pivotal to this market's evolution. The increasing adoption of electric vehicles (EVs) such as Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Vehicles (FCVs) also acts as a catalyst, as these advanced powertrains typically incorporate integrated connectivity solutions.

Connected Car Devices Market Market Size (In Billion)

Market dynamics are further influenced by trends like 5G network deployment, enhancing data transmission speeds for connected car applications, and a growing emphasis on cybersecurity to safeguard vehicle systems and user data. Potential growth restraints include the high implementation costs of advanced connected car technologies, consumer concerns over data privacy and security, and the challenge of establishing standardized communication protocols across the automotive industry. The market is segmented by end-user, communication type, product type, and vehicle type, reflecting diverse applications and innovations. Key industry players such as Robert Bosch GmbH, Continental AG, and Infineon Technologies AG are investing heavily in research and development to secure a substantial market share.

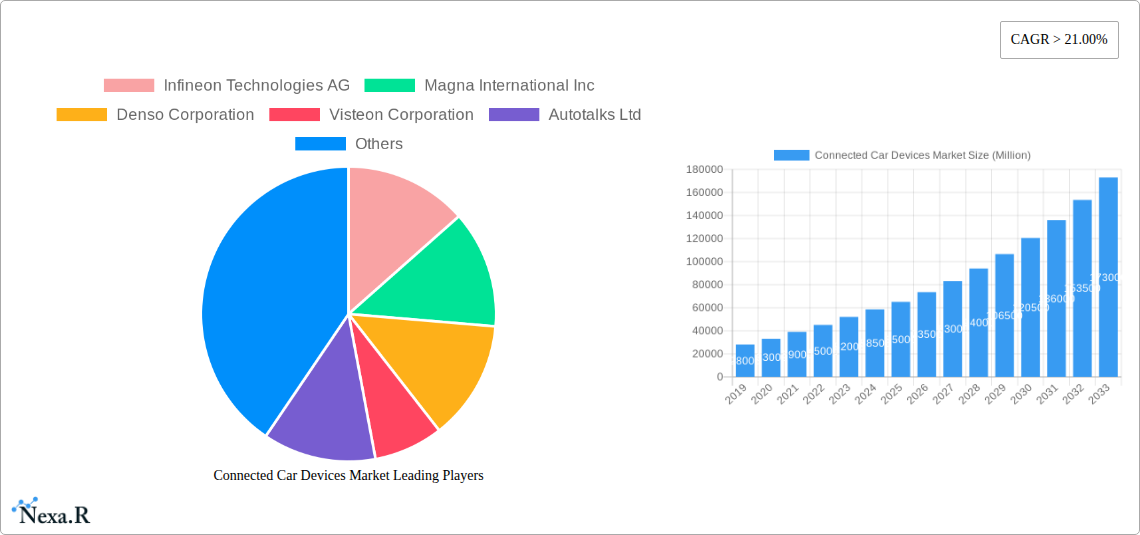

Connected Car Devices Market Company Market Share

Connected Car Devices Market Report Description

Report Title: Connected Car Devices Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast (2019–2033)

Report Overview:

This comprehensive report provides an in-depth analysis of the global Connected Car Devices Market, offering detailed insights into its dynamics, growth trajectories, and future outlook. Spanning the historical period of 2019–2024, with a base year of 2025 and a forecast period extending to 2033, this study is essential for stakeholders seeking to understand the evolution and potential of this rapidly expanding sector. The report meticulously examines market segmentation across End-user Type (OEM, Aftermarket), Communication Type (V2V, V2I, V2P), Product Type (Driver Assistance System (DAS), Telematics), and Vehicle Type (IC Engine, Electric – Battery Electric Vehicle, Hybrid Electric Vehicle, Fuel Cell Vehicle). With a focus on quantitative data presented in Million units, the report equips industry professionals with actionable intelligence to navigate this dynamic market.

Connected Car Devices Market Market Dynamics & Structure

The Connected Car Devices Market is characterized by a moderately consolidated structure, driven by intense technological innovation and evolving regulatory landscapes. Key players like Robert Bosch GmbH, Continental AG, and Panasonic Corp are at the forefront of developing advanced connectivity solutions, influencing market concentration through strategic investments and product development. The primary drivers of technological innovation include the escalating demand for enhanced safety features, infotainment services, and autonomous driving capabilities. Regulatory frameworks, such as those mandating eCall systems and promoting cybersecurity standards, are significantly shaping product development and adoption rates. Competitive product substitutes, though emerging, are largely focused on specific niche applications rather than broad market disruption. End-user demographics reveal a growing preference among tech-savvy consumers for integrated vehicle experiences, propelling aftermarket adoption. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their portfolios and gain a competitive edge. For instance, numerous smaller technology firms specializing in AI, IoT, and cybersecurity have been acquired by larger automotive suppliers and OEMs, underscoring the strategic importance of these capabilities. Innovation barriers, such as the high cost of R&D and the complex integration process, are being addressed through collaborative efforts and platform standardization. The market witnessed an estimated XX M&A deals in the historical period.

- Market Concentration: Moderately consolidated with strong presence of Tier-1 automotive suppliers and OEMs.

- Technological Innovation Drivers: Autonomous driving, advanced driver-assistance systems (ADAS), infotainment, over-the-air (OTA) updates, cybersecurity, and V2X communication.

- Regulatory Frameworks: Government mandates for safety features (e.g., eCall), data privacy regulations, and cybersecurity standards.

- Competitive Product Substitutes: Emerging specialized solutions for specific connectivity needs, but limited broad market replacement.

- End-User Demographics: Increasing demand from tech-savvy consumers, fleet operators, and ride-sharing services.

- M&A Trends: Active acquisition of startups and technology providers to enhance capabilities in AI, V2X, and cybersecurity.

Connected Car Devices Market Growth Trends & Insights

The Connected Car Devices Market is poised for robust growth, driven by the escalating integration of digital technologies into vehicles. The market size is projected to expand significantly from its base year value of approximately $XX,XXX million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx.x% during the forecast period of 2025–2033. This expansion is fueled by several key trends. Firstly, the increasing adoption of advanced driver-assistance systems (ADAS) and the burgeoning development of autonomous driving technologies are creating a substantial demand for sophisticated connected car hardware and software. These systems rely heavily on real-time data exchange and processing, making connectivity a fundamental requirement. Secondly, consumer expectations are rapidly evolving; drivers now anticipate seamless integration of their digital lives with their vehicles, demanding advanced infotainment, personalized services, and remote vehicle management capabilities. This shift in consumer behavior is a major catalyst for aftermarket solutions and OEM-integrated systems.

Technological disruptions are playing a pivotal role in accelerating market penetration. The proliferation of 5G networks is enabling faster and more reliable data transmission, unlocking new possibilities for V2X (Vehicle-to-Everything) communication, real-time traffic management, and enhanced in-car experiences. The development of AI and machine learning algorithms further empowers connected car devices to offer predictive maintenance, personalized driving assistance, and more intuitive user interfaces. Furthermore, the growing awareness and implementation of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication protocols are not only enhancing safety by enabling collision avoidance and optimized traffic flow but are also creating new revenue streams through data monetization and smart city integration. The electrification of the automotive industry, with the surge in Battery Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs), is also a significant growth driver, as these vehicles often come equipped with more advanced digital features and require sophisticated connectivity for battery management, charging optimization, and remote diagnostics. Market penetration is expected to reach xx% by 2033, indicating a widespread embrace of connected car technologies across diverse vehicle segments. The historical period (2019–2024) has laid a strong foundation, with steady adoption rates and foundational technology development paving the way for this accelerated future growth.

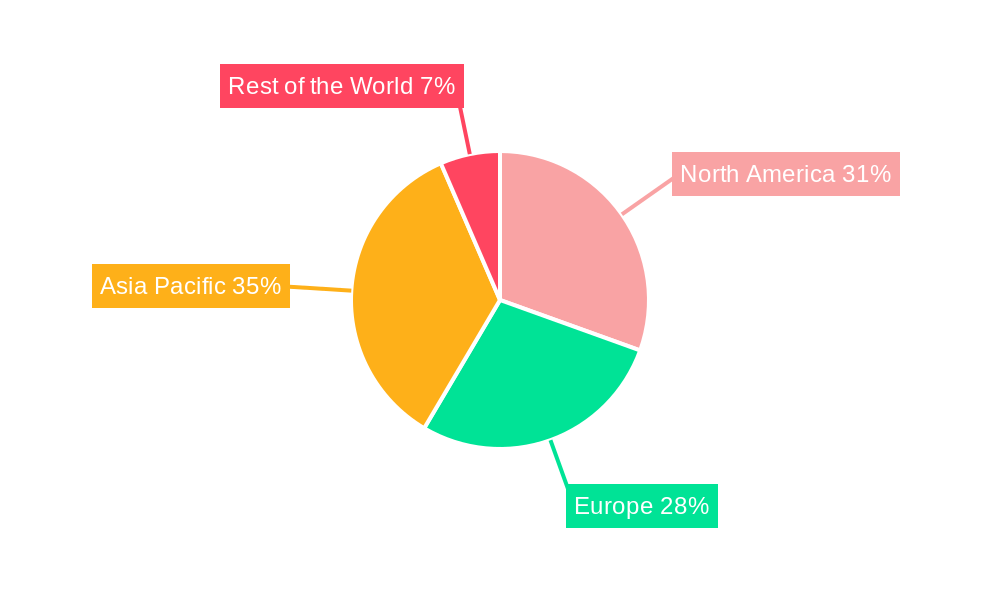

Dominant Regions, Countries, or Segments in Connected Car Devices Market

North America and Europe currently stand as the dominant regions in the Connected Car Devices Market, driven by a confluence of factors including high disposable incomes, advanced technological infrastructure, and stringent safety regulations. The OEM segment within the End-user Type is commanding the largest market share, accounting for approximately xx% of the total market in 2025. This dominance is attributed to automakers integrating connected car technologies as standard features in new vehicle models to enhance their competitive edge and meet consumer demand for advanced functionalities. Countries like the United States, Germany, and China are spearheading this growth, fueled by substantial investments in automotive R&D and the rapid adoption of electric and autonomous vehicle technologies.

Within the Communication Type segment, V2I (Vehicle-to-Infrastructure) communication is emerging as a significant growth driver, projected to capture xx% of the market by 2033. This is propelled by smart city initiatives and the development of intelligent transportation systems aimed at optimizing traffic flow, reducing congestion, and enhancing road safety through communication with traffic signals, roadside units, and other infrastructure elements. Driver Assistance Systems (DAS) from the Product Type segment are currently the largest revenue generator, holding an estimated xx% market share in 2025. The increasing focus on vehicle safety and the growing prevalence of semi-autonomous driving features are fueling this demand. However, Telematics, encompassing fleet management, remote diagnostics, and infotainment services, is witnessing a rapid expansion, driven by the commercial sector and the increasing demand for efficient operational management and enhanced user experiences.

The Vehicle Type segment is experiencing a transformative shift, with Electric Vehicles (EVs) – including Battery Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs) – showing the highest growth potential. While IC Engine vehicles still represent a significant portion, the market share of connected technologies within EVs is projected to surge from xx% in 2025 to xx% by 2033. This is due to the inherent technological sophistication of EVs, often necessitating advanced connectivity for battery management, charging infrastructure integration, and software updates. Factors contributing to the dominance in these segments include supportive government policies, substantial venture capital funding for automotive tech startups, and a strong consumer appetite for innovative and connected mobility solutions. For example, the US government's investment in smart city infrastructure and the EU's regulatory push for enhanced vehicle safety are significant economic policies driving adoption.

Connected Car Devices Market Product Landscape

The Connected Car Devices Market product landscape is characterized by a rapid evolution of intelligent and integrated solutions. Key innovations include the widespread adoption of sophisticated Driver Assistance Systems (DAS) leveraging AI for real-time hazard detection and predictive warnings, and advanced Telematics units enabling seamless infotainment, over-the-air (OTA) updates, and remote diagnostics. The increasing deployment of V2X (Vehicle-to-Everything) communication modules, supporting V2V, V2I, and V2P (Vehicle-to-Pedestrian) interactions, is enhancing safety and traffic efficiency. Performance metrics are seeing continuous improvement with faster processing speeds, lower latency, and enhanced data security protocols. Unique selling propositions often lie in the integration of multiple functionalities into single, compact units, offering OEMs and the aftermarket a cost-effective and space-efficient solution. Technological advancements are also focused on miniaturization, improved power efficiency, and robust connectivity through 5G and beyond.

Key Drivers, Barriers & Challenges in Connected Car Devices Market

Key Drivers:

- Technological Advancements: The relentless pace of innovation in AI, IoT, 5G, and sensor technology is a primary growth accelerator.

- Demand for Safety and Convenience: Escalating consumer demand for advanced safety features like ADAS and enhanced in-car infotainment and connectivity services.

- Regulatory Mandates: Government regulations pushing for enhanced vehicle safety (e.g., eCall) and promoting connected vehicle technologies.

- Growth of Electric Vehicles (EVs): EVs are inherently equipped with more digital capabilities and connectivity, driving the adoption of related devices.

- Data Monetization Opportunities: The vast amount of data generated by connected cars presents new revenue streams for service providers and automakers.

Barriers & Challenges:

- Cybersecurity Threats: The increasing interconnectedness of vehicles makes them vulnerable to cyberattacks, posing significant security risks.

- High Development and Integration Costs: The complex nature of connected car technology leads to substantial R&D and integration expenses for automakers.

- Regulatory Hurdles and Standardization: Inconsistent global regulations and the lack of universal standards for V2X communication can impede widespread adoption.

- Data Privacy Concerns: Growing consumer apprehension regarding the collection and usage of personal vehicle data.

- Supply Chain Disruptions: The reliance on specialized semiconductor components and the susceptibility to global supply chain issues can impact production and availability. The semiconductor shortage, for instance, significantly impacted the automotive industry's ability to produce connected car components in the historical period.

Emerging Opportunities in Connected Car Devices Market

Emerging opportunities in the Connected Car Devices Market lie in the expansion of AI-powered predictive maintenance, offering proactive issue detection and reduced downtime. The development of sophisticated in-car personalized services, ranging from customized infotainment to integrated health and wellness features, presents a significant growth avenue. Furthermore, the increasing integration of connected cars with smart city ecosystems, enabling seamless interaction with urban infrastructure and public services, holds immense potential. The growth of shared mobility services and the demand for advanced fleet management solutions are also creating untapped markets for specialized connected car devices. The potential for over-the-air (OTA) software updates to enable new functionalities and revenue streams post-purchase is another area of burgeoning opportunity.

Growth Accelerators in the Connected Car Devices Market Industry

Several catalysts are accelerating the long-term growth of the Connected Car Devices Market. The ongoing advancements in telecommunications, particularly the widespread rollout of 5G networks, are crucial for enabling high-bandwidth, low-latency applications like real-time V2X communication and advanced autonomous driving features. Strategic partnerships between traditional automotive manufacturers, technology giants, and semiconductor suppliers are fostering innovation and accelerating the development and deployment of new connected car technologies. Market expansion strategies, including the penetration into emerging economies with growing automotive sales and increasing consumer demand for digital features, are also significant growth accelerators. The development of robust cybersecurity frameworks and the establishment of clear data governance policies will further build consumer trust and facilitate broader adoption.

Key Players Shaping the Connected Car Devices Market Market

- Infineon Technologies AG

- Magna International Inc

- Denso Corporation

- Visteon Corporation

- Autotalks Ltd

- Panasonic Corp

- Continental AG

- Autoliv Inc

- Harman International Industries Incorporated

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Notable Milestones in Connected Car Devices Market Sector

- 2019: Widespread adoption of 5G trials for automotive applications, demonstrating potential for enhanced V2X capabilities.

- 2020: Increased focus on cybersecurity in connected vehicles due to rising threat landscape.

- 2021: Significant advancements in AI algorithms for driver assistance systems (DAS) leading to improved safety features.

- 2022: Growing emphasis on over-the-air (OTA) updates for software deployment and vehicle feature enhancements.

- 2023: Rise in partnerships between automotive OEMs and tech companies to develop integrated connected car ecosystems.

- 2024: Introduction of enhanced Telematics solutions for advanced fleet management and predictive maintenance.

In-Depth Connected Car Devices Market Market Outlook

The Connected Car Devices Market is on an upward trajectory, with significant growth accelerators shaping its future. The continued evolution of 5G technology will unlock unprecedented capabilities in vehicle connectivity, enabling more sophisticated V2X applications and paving the way for truly autonomous driving. Strategic collaborations between industry leaders and innovative startups will foster a dynamic ecosystem of cutting-edge solutions. The increasing electrification of vehicles further propels the demand for advanced connectivity. Emerging economies present substantial untapped markets with a growing appetite for advanced automotive features. The focus on user experience, safety, and data-driven services will remain paramount, ensuring sustained demand for connected car devices. The market outlook is exceptionally positive, driven by innovation, consumer demand, and supportive industry developments, promising a future of highly intelligent and integrated vehicles.

Connected Car Devices Market Segmentation

-

1. End-user Type

- 1.1. OEM

- 1.2. Aftermarket

-

2. Communication Type

- 2.1. V2V

- 2.2. V2I

- 2.3. V2P

-

3. Product Type

- 3.1. Driver Assistance System (DAS)

- 3.2. Telematics

-

4. Vehicle Type

- 4.1. IC Engine

-

4.2. Electric

- 4.2.1. Battery Electric Vehicle

- 4.2.2. Hybrid Electric Vehicle

- 4.2.3. Fuel Cell Vehicle

Connected Car Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Connected Car Devices Market Regional Market Share

Geographic Coverage of Connected Car Devices Market

Connected Car Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Safety Awareness is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Concerns is Anticipated to Restrain the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Electrification and Automation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 5.1.1. OEM

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Communication Type

- 5.2.1. V2V

- 5.2.2. V2I

- 5.2.3. V2P

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Driver Assistance System (DAS)

- 5.3.2. Telematics

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. IC Engine

- 5.4.2. Electric

- 5.4.2.1. Battery Electric Vehicle

- 5.4.2.2. Hybrid Electric Vehicle

- 5.4.2.3. Fuel Cell Vehicle

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 6. North America Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 6.1.1. OEM

- 6.1.2. Aftermarket

- 6.2. Market Analysis, Insights and Forecast - by Communication Type

- 6.2.1. V2V

- 6.2.2. V2I

- 6.2.3. V2P

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Driver Assistance System (DAS)

- 6.3.2. Telematics

- 6.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.4.1. IC Engine

- 6.4.2. Electric

- 6.4.2.1. Battery Electric Vehicle

- 6.4.2.2. Hybrid Electric Vehicle

- 6.4.2.3. Fuel Cell Vehicle

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 7. Europe Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 7.1.1. OEM

- 7.1.2. Aftermarket

- 7.2. Market Analysis, Insights and Forecast - by Communication Type

- 7.2.1. V2V

- 7.2.2. V2I

- 7.2.3. V2P

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Driver Assistance System (DAS)

- 7.3.2. Telematics

- 7.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.4.1. IC Engine

- 7.4.2. Electric

- 7.4.2.1. Battery Electric Vehicle

- 7.4.2.2. Hybrid Electric Vehicle

- 7.4.2.3. Fuel Cell Vehicle

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 8. Asia Pacific Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 8.1.1. OEM

- 8.1.2. Aftermarket

- 8.2. Market Analysis, Insights and Forecast - by Communication Type

- 8.2.1. V2V

- 8.2.2. V2I

- 8.2.3. V2P

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Driver Assistance System (DAS)

- 8.3.2. Telematics

- 8.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.4.1. IC Engine

- 8.4.2. Electric

- 8.4.2.1. Battery Electric Vehicle

- 8.4.2.2. Hybrid Electric Vehicle

- 8.4.2.3. Fuel Cell Vehicle

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 9. Rest of the World Connected Car Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 9.1.1. OEM

- 9.1.2. Aftermarket

- 9.2. Market Analysis, Insights and Forecast - by Communication Type

- 9.2.1. V2V

- 9.2.2. V2I

- 9.2.3. V2P

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Driver Assistance System (DAS)

- 9.3.2. Telematics

- 9.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.4.1. IC Engine

- 9.4.2. Electric

- 9.4.2.1. Battery Electric Vehicle

- 9.4.2.2. Hybrid Electric Vehicle

- 9.4.2.3. Fuel Cell Vehicle

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Magna International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Denso Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Visteon Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Autotalks Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Panasonic Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Continental AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Autoliv Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Harman International Industries Incorporated

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Valeo SA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 ZF Friedrichshafen AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Connected Car Devices Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 3: North America Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 4: North America Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 5: North America Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 6: North America Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 7: North America Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 9: North America Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: North America Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 13: Europe Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 14: Europe Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 15: Europe Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 16: Europe Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Europe Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 19: Europe Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 23: Asia Pacific Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Asia Pacific Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 25: Asia Pacific Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 26: Asia Pacific Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 29: Asia Pacific Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Asia Pacific Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Connected Car Devices Market Revenue (billion), by End-user Type 2025 & 2033

- Figure 33: Rest of the World Connected Car Devices Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 34: Rest of the World Connected Car Devices Market Revenue (billion), by Communication Type 2025 & 2033

- Figure 35: Rest of the World Connected Car Devices Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 36: Rest of the World Connected Car Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Rest of the World Connected Car Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Rest of the World Connected Car Devices Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 39: Rest of the World Connected Car Devices Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Rest of the World Connected Car Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World Connected Car Devices Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 2: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 3: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Connected Car Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 7: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 8: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 9: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 15: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 16: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Germany Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 25: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 26: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: China Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Japan Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: India Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Connected Car Devices Market Revenue billion Forecast, by End-user Type 2020 & 2033

- Table 34: Global Connected Car Devices Market Revenue billion Forecast, by Communication Type 2020 & 2033

- Table 35: Global Connected Car Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Connected Car Devices Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Connected Car Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South America Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Middle East Connected Car Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected Car Devices Market?

The projected CAGR is approximately 14.83%.

2. Which companies are prominent players in the Connected Car Devices Market?

Key companies in the market include Infineon Technologies AG, Magna International Inc, Denso Corporation, Visteon Corporation, Autotalks Ltd, Panasonic Corp, Continental AG, Autoliv Inc, Harman International Industries Incorporated, Robert Bosch GmbH, Valeo SA, ZF Friedrichshafen AG.

3. What are the main segments of the Connected Car Devices Market?

The market segments include End-user Type, Communication Type, Product Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Safety Awareness is Driving the Market Growth.

6. What are the notable trends driving market growth?

Increasing Electrification and Automation.

7. Are there any restraints impacting market growth?

Cybersecurity Concerns is Anticipated to Restrain the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Connected Car Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Connected Car Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Connected Car Devices Market?

To stay informed about further developments, trends, and reports in the Connected Car Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence