Key Insights

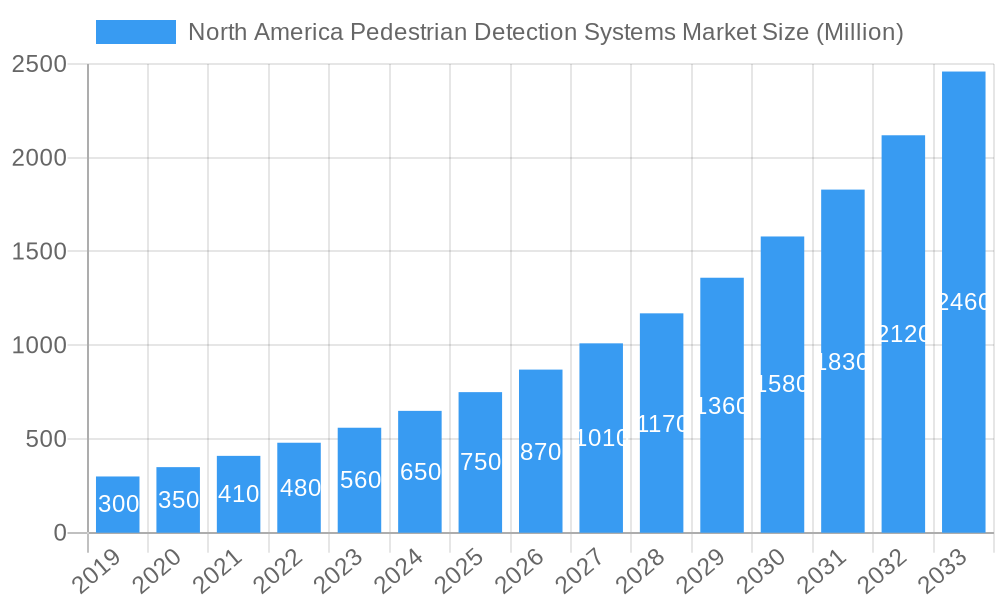

The North America Pedestrian Detection Systems Market is poised for explosive growth, projected to surpass a market size of approximately $750 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 15.00% through 2033. This robust expansion is primarily fueled by the escalating demand for advanced driver-assistance systems (ADAS) across the United States, Canada, and Mexico. The increasing adoption of intelligent automotive technologies, driven by a heightened focus on road safety and a desire to reduce pedestrian-related accidents, serves as a significant catalyst. Furthermore, stringent government regulations and evolving consumer expectations for safer vehicles are compelling automakers and suppliers to integrate sophisticated pedestrian detection solutions as standard or optional features in a wider range of vehicle models. The market is witnessing a significant push towards more accurate and reliable systems capable of identifying pedestrians in various lighting and weather conditions, further propelling innovation and market penetration.

North America Pedestrian Detection Systems Market Market Size (In Million)

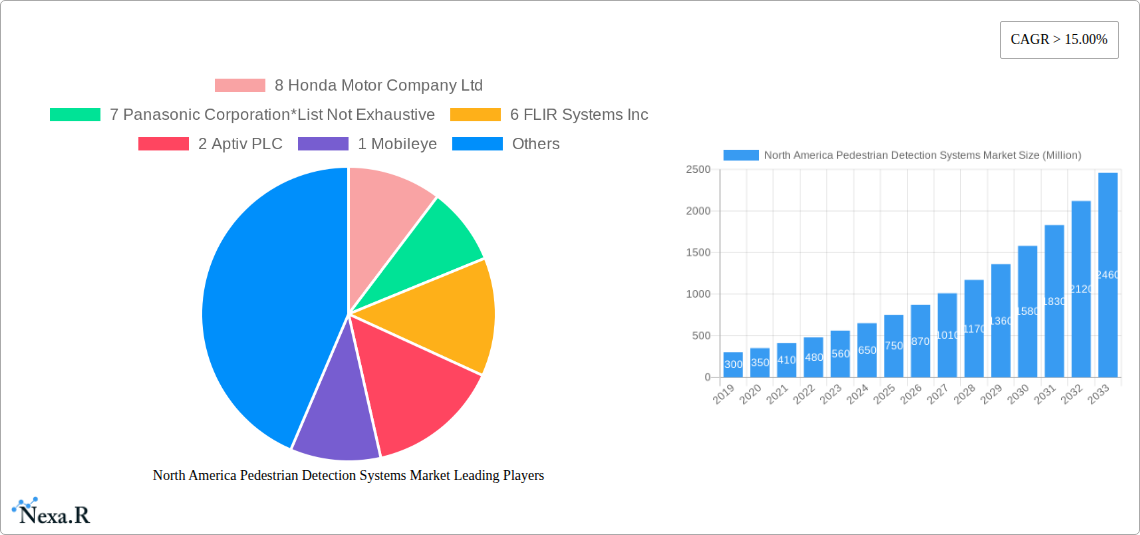

The competitive landscape is characterized by the active participation of both established automotive manufacturers like General Motors, BMW Group, Toyota, and Nissan, alongside prominent Tier-1 suppliers such as Continental AG, Robert Bosch GmbH, and DENSO Corporation, alongside specialized ADAS technology providers like Mobileye and FLIR Systems Inc. The market segments are broadly categorized by technology type, with Video-based systems currently holding a dominant share due to their cost-effectiveness and versatility. However, Infrared and Hybrid systems are gaining traction for their enhanced performance in challenging environmental conditions. The ongoing advancements in sensor fusion, artificial intelligence, and machine learning are critical trends shaping the future of this market, enabling more precise object recognition and predictive capabilities. While the market is experiencing rapid growth, potential restraints could include the high cost of integration for certain advanced technologies and the need for widespread infrastructure support to complement vehicle-based systems, though these are anticipated to be overcome by technological advancements and economies of scale.

North America Pedestrian Detection Systems Market Company Market Share

North America Pedestrian Detection Systems Market Report: Unveiling Growth, Innovation, and Future Trends (2019-2033)

This comprehensive report offers an in-depth analysis of the North America Pedestrian Detection Systems Market, meticulously tracking its trajectory from 2019-2033. With a base year of 2025 and a forecast period from 2025–2033, this study delves into the critical factors driving the adoption of advanced driver-assistance systems (ADAS) and their integral components. We provide detailed insights into market size evolution, technological advancements, regional dominance, competitive landscapes, and emerging opportunities, all essential for automotive manufacturers, component suppliers, technology providers, and industry stakeholders seeking to navigate this dynamic sector. The report quantifies market values in Million units to offer clear financial perspectives.

North America Pedestrian Detection Systems Market Market Dynamics & Structure

The North America Pedestrian Detection Systems Market is characterized by a moderately concentrated structure, with key players continuously investing in research and development to enhance system accuracy and reliability. Technological innovation is a primary driver, fueled by increasing consumer demand for safer vehicles and stringent regulatory frameworks mandating ADAS features. Regulatory bodies like NHTSA play a crucial role in setting safety standards, pushing manufacturers to integrate sophisticated pedestrian detection capabilities. Competitive product substitutes, primarily advancements in existing sensor technologies and algorithmic improvements, are constantly evolving, necessitating continuous innovation. End-user demographics show a growing preference for vehicles equipped with advanced safety features, particularly among younger, tech-savvy demographics and families. Mergers and acquisitions (M&A) activity is notable, as larger automotive players and technology firms seek to acquire innovative startups and bolster their ADAS portfolios. For instance, the acquisition of specialized AI perception companies by major automotive suppliers has been a recurring theme, demonstrating a strategic focus on integrating cutting-edge software and hardware. Innovation barriers include the high cost of advanced sensor development and the complex integration challenges within vehicle architectures.

- Market Concentration: Moderately concentrated, with a few leading automotive manufacturers and Tier-1 suppliers dominating the landscape.

- Technological Innovation Drivers: Enhanced AI algorithms, advanced sensor fusion, miniaturization of components, and the drive towards autonomous driving capabilities.

- Regulatory Frameworks: Mandates and incentives from governmental bodies promoting ADAS deployment, particularly concerning pedestrian safety.

- Competitive Product Substitutes: Improvements in camera resolution, LiDAR and radar technology advancements, and sophisticated sensor fusion algorithms.

- End-User Demographics: Growing demand from safety-conscious consumers, urban dwellers, and early adopters of advanced vehicle technology.

- M&A Trends: Strategic acquisitions of AI and sensor technology companies by established automotive players and suppliers to enhance in-house capabilities.

North America Pedestrian Detection Systems Market Growth Trends & Insights

The North America Pedestrian Detection Systems Market has experienced robust growth, driven by an escalating awareness of road safety and a proactive approach from automotive manufacturers to integrate advanced driver-assistance systems (ADAS). The market size has seen a significant evolution, moving from niche integration to a standard offering in many new vehicle models. Adoption rates for pedestrian detection systems, a crucial component of ADAS, are projected to continue their upward trajectory, with penetration expected to reach substantial levels by 2025 and beyond. Technological disruptions, such as the advent of AI-powered machine learning for enhanced object recognition and predictive analysis, are fundamentally reshaping the capabilities of these systems. Consumer behavior is also shifting, with pedestrian detection and automatic emergency braking (AEB) with pedestrian detection becoming key purchase decision factors for a growing segment of car buyers. The continuous improvement in sensor fusion, combining data from cameras, radar, and LiDAR, has led to more reliable and accurate detection across diverse environmental conditions, including low light and adverse weather. This has spurred demand for hybrid detection systems, offering a synergistic approach to safety.

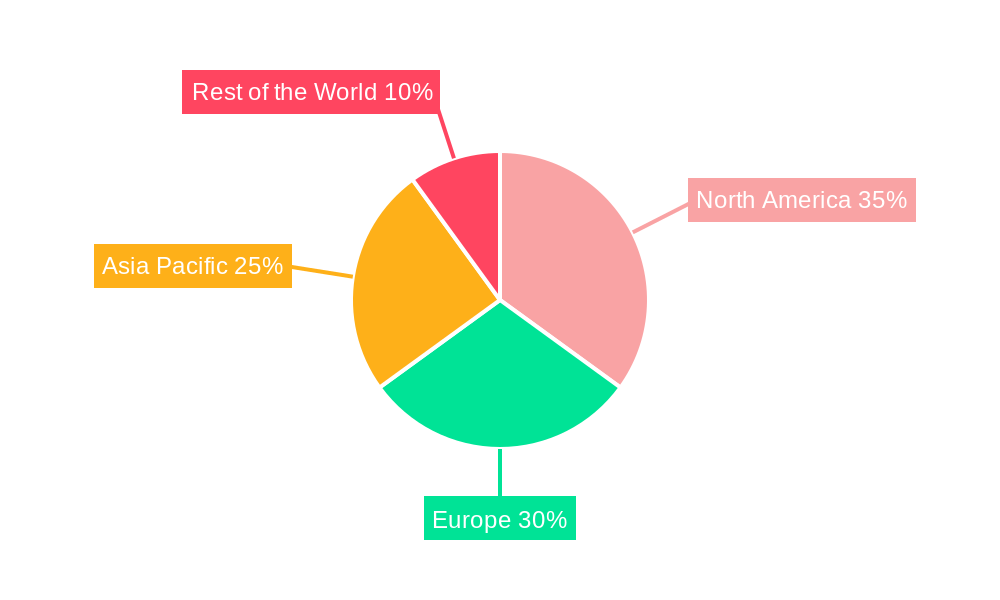

Dominant Regions, Countries, or Segments in North America Pedestrian Detection Systems Market

Within the North America Pedestrian Detection Systems Market, the Video-based pedestrian detection system segment is currently the dominant force, driven by its cost-effectiveness, scalability, and rapid technological advancements in image processing and AI. The United States stands out as the leading country, owing to its large automotive market, strong consumer demand for advanced safety features, and proactive regulatory environment. Several key drivers contribute to this dominance. The economic policies in the U.S. have consistently supported automotive innovation and safety enhancements, fostering an environment ripe for ADAS adoption. Significant investments in automotive R&D by both domestic and international manufacturers operating in North America further fuel the demand for sophisticated pedestrian detection technologies. Infrastructure development, particularly in smart city initiatives and pedestrian safety campaigns, also indirectly boosts the perceived value and necessity of these systems.

- Dominant Segment: Video-based pedestrian detection systems, leveraging high-resolution cameras and advanced AI algorithms for object recognition.

- Key Drivers: Cost-effectiveness, continuous improvements in image processing, and widespread integration across various vehicle platforms.

- Market Share: Holding a significant majority of the overall pedestrian detection systems market due to its versatility.

- Leading Country: United States.

- Dominance Factors: Largest automotive market in North America, high consumer disposable income, strong emphasis on vehicle safety, and a proactive regulatory landscape.

- Growth Potential: Continues to be a primary market for new vehicle sales and ADAS penetration.

- Economic Policies: Government incentives for ADAS development and deployment, coupled with consumer demand for advanced safety.

- Infrastructure: Investments in intelligent transportation systems and urban safety initiatives, increasing the relevance of pedestrian detection.

- Technological Advancements: The rapid evolution of AI and machine learning algorithms is particularly enhancing the performance of video-based systems, making them more adept at recognizing pedestrians in complex scenarios.

North America Pedestrian Detection Systems Market Product Landscape

The product landscape of the North America Pedestrian Detection Systems Market is characterized by a rapid evolution of intelligent sensors and sophisticated software algorithms. Innovations focus on enhancing detection accuracy, expanding the operational range, and improving performance in challenging environmental conditions such as low light and adverse weather. Key applications include automatic emergency braking (AEB) systems with pedestrian detection, cross-traffic alerts, and night vision enhancements. Performance metrics are constantly being refined, with systems now capable of differentiating between pedestrians, cyclists, and static objects with high precision. Unique selling propositions include real-time threat assessment, predictive braking, and seamless integration with other ADAS functionalities like adaptive cruise control. Technological advancements are pushing towards more robust and cost-effective solutions, making advanced pedestrian safety features accessible across a wider spectrum of vehicle segments.

Key Drivers, Barriers & Challenges in North America Pedestrian Detection Systems Market

Key Drivers:

The North America Pedestrian Detection Systems Market is propelled by a confluence of critical factors. Foremost among these is the escalating global emphasis on road safety, driven by increasing pedestrian fatalities and injuries. Regulatory mandates from bodies like NHTSA, which increasingly require advanced safety features, are a significant catalyst. Technological advancements in AI, machine learning, and sensor fusion enable more accurate and reliable pedestrian detection, thereby driving adoption. Furthermore, growing consumer awareness and demand for vehicles equipped with comprehensive ADAS packages, including pedestrian detection and AEB, directly fuels market growth.

Barriers & Challenges:

Despite the robust growth, the market faces several hurdles. High development and integration costs for advanced pedestrian detection systems can be a barrier, particularly for mass-market vehicles. The complexity of sensor fusion and the need for extensive validation and testing to ensure accuracy across diverse environmental conditions pose significant technical challenges. Cybersecurity concerns related to connected vehicle systems also require careful consideration. Supply chain disruptions for critical electronic components, exacerbated by global events, can impact production volumes and timelines. Competitive pressures from numerous established and emerging players necessitate continuous innovation and cost optimization.

Emerging Opportunities in North America Pedestrian Detection Systems Market

Emerging opportunities within the North America Pedestrian Detection Systems Market are manifold, driven by the relentless pursuit of enhanced vehicle safety and the advancement of autonomous driving technologies. The increasing adoption of electric vehicles (EVs), which often come equipped with advanced electronic architectures, presents a fertile ground for integrating sophisticated ADAS, including pedestrian detection. The development of "smart city" initiatives and connected infrastructure provides a synergy for vehicle-to-infrastructure (V2I) communication, enabling vehicles to receive real-time information about pedestrian presence, further enhancing detection capabilities. There is also a growing opportunity in the aftermarket segment, with retrofitting solutions for older vehicles becoming a niche but expanding market. Evolving consumer preferences for advanced safety features, even in entry-level segments, are opening up new avenues for market penetration.

Growth Accelerators in the North America Pedestrian Detection Systems Market Industry

Several growth accelerators are shaping the long-term trajectory of the North America Pedestrian Detection Systems Market. Continuous technological breakthroughs in artificial intelligence, particularly deep learning algorithms for object recognition and scene understanding, are significantly enhancing the performance and reliability of pedestrian detection systems. Strategic partnerships between automotive OEMs, Tier-1 suppliers, and technology companies are crucial, fostering collaboration and accelerating the development and deployment of next-generation ADAS. Market expansion strategies, including the increasing standardization of pedestrian detection as a core safety feature across all vehicle models and segments, are also significant growth drivers. The ongoing push towards higher levels of vehicle autonomy further necessitates and drives the advancement and widespread adoption of robust pedestrian detection capabilities.

Key Players Shaping the North America Pedestrian Detection Systems Market Market

- Honda Motor Company Ltd

- Panasonic Corporation

- FLIR Systems Inc

- Aptiv PLC

- Mobileye

- General Motors Company

- BMW Group

- Automobile Manufacturers

- Peugeot

- Continental AG

- Suppliers of Pedestrian Detection Systems and Components

- Volvo Cars

- DENSO CORPORATION

- Robert Bosch GmbH

- Nissan Motor Co Ltd

- Toyota Motor Corporation

- Audi AG

- Mercedes-Benz

Notable Milestones in North America Pedestrian Detection Systems Market Sector

- September 2022: GMC revealed the all-new 2024 Acadia premium mid-size SUV, featuring ADAS technology, including a Front and Rear pedestrian system.

- December 2022: Toyota Motor Co. introduced the 2023 Toyota Prius in North American markets, standard with Toyota Safety Sense 3.0, including a Pre-Collision System with Pedestrian Detection.

- January 2023: Valeo Group debuted Smart Pole at CES 2023, a sensor and technology bundle offering safe pedestrian crossing in metropolitan environments.

- February 2023: The 2024 Toyota Grand Highlander made its global debut, featuring Toyota Safety Sense 3.0 with an enhanced Pre-Collision System with Pedestrian Detection.

- May 2023: Toyota announced the 2024 Grand Highlander's arrival at U.S. dealerships, standard with TSS 3.0, including an enhanced Pre-Collision System with Pedestrian Detection.

In-Depth North America Pedestrian Detection Systems Market Market Outlook

The future outlook for the North America Pedestrian Detection Systems Market is exceptionally promising, characterized by continuous innovation and expanding applications. Growth accelerators such as the relentless pursuit of Level 3 and higher autonomous driving capabilities will mandate even more sophisticated pedestrian detection technologies. Strategic partnerships between AI developers and automotive giants will continue to drive the integration of advanced perception systems. The market expansion into emerging segments and the increasing demand for safety-conscious features in commercial vehicle fleets represent significant untapped potential. The synergy between vehicle-to-everything (V2X) communication and advanced sensor systems is poised to create a more interconnected and safer transportation ecosystem, further solidifying the critical role of pedestrian detection systems in the automotive industry.

North America Pedestrian Detection Systems Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Infrared

- 1.3. Hybrid

- 1.4. Other Types

North America Pedestrian Detection Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Pedestrian Detection Systems Market Regional Market Share

Geographic Coverage of North America Pedestrian Detection Systems Market

North America Pedestrian Detection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Road Fatalities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Infrared

- 5.1.3. Hybrid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 8 Honda Motor Company Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 7 Panasonic Corporation*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 6 FLIR Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 1 Mobileye

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 9 General Motors Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3 BMW Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Automobile Manufacturers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 7 Peugeot

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 4 Continental AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Suppliers of Pedestrian Detection Systems and Components*

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 2 Volvo Cars

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 5 DENSO Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 3 Robert Bosch GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 6 Nissan Motor Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 1 Toyota Motor Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 5 Audi AG

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 4 Mercedes-Benz

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 8 Honda Motor Company Ltd

List of Figures

- Figure 1: North America Pedestrian Detection Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Pedestrian Detection Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Pedestrian Detection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Pedestrian Detection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Pedestrian Detection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pedestrian Detection Systems Market?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the North America Pedestrian Detection Systems Market?

Key companies in the market include 8 Honda Motor Company Ltd, 7 Panasonic Corporation*List Not Exhaustive, 6 FLIR Systems Inc, 2 Aptiv PLC, 1 Mobileye, 9 General Motors Company, 3 BMW Group, Automobile Manufacturers, 7 Peugeot, 4 Continental AG, Suppliers of Pedestrian Detection Systems and Components*, 2 Volvo Cars, 5 DENSO Corporation, 3 Robert Bosch GmbH, 6 Nissan Motor Co Ltd, 1 Toyota Motor Corporation, 5 Audi AG, 4 Mercedes-Benz.

3. What are the main segments of the North America Pedestrian Detection Systems Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Increase in the Number of Road Fatalities.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

September 2022: GMC revealed the all-new 2024 Acadia premium mid-size SUV, which will be produced at GM's Lansing Delta Township Assembly and is expected to be available in early 2024. The SUV has ADAS technology, which includes a Front and Rear pedestrian system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pedestrian Detection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pedestrian Detection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pedestrian Detection Systems Market?

To stay informed about further developments, trends, and reports in the North America Pedestrian Detection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence