Key Insights

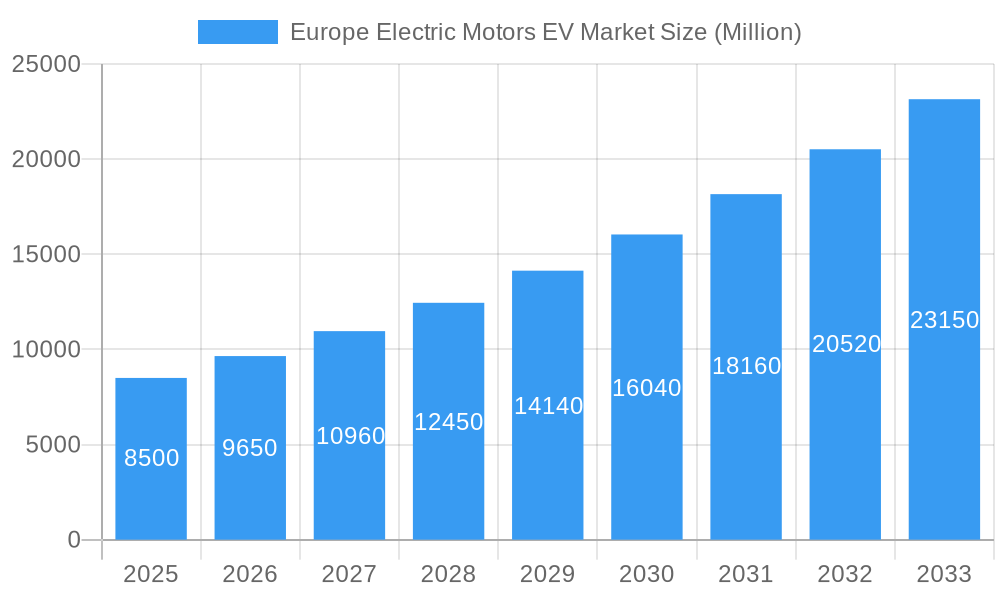

The European Electric Motors for Electric Vehicles (EV) market is poised for substantial growth, driven by escalating environmental regulations, government incentives for EV adoption, and increasing consumer awareness regarding the benefits of electric mobility. With an impressive Compound Annual Growth Rate (CAGR) of 13.87%, the market is projected to expand significantly from its current estimated size, reaching a valuation of billions by 2033. This robust expansion is fueled by the dual forces of technological advancements in motor efficiency and battery technology, making EVs a more attractive and viable option for both passenger cars and commercial vehicles. The increasing demand for higher performance, longer range, and faster charging capabilities further propels innovation in electric motor design, including advancements in AC and DC motor technologies. The market's trajectory suggests a strong shift towards Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), solidifying their position as the dominant vehicle types in the coming years.

Europe Electric Motors EV Market Market Size (In Billion)

The European region, a frontrunner in EV adoption, is expected to be a major contributor to this market's expansion. Key countries like Germany, France, and the United Kingdom are leading the charge with supportive policies and a burgeoning EV infrastructure. While the market benefits from strong demand, certain restraints, such as the upfront cost of EVs and the availability of charging infrastructure in some areas, may temper the growth rate in specific sub-segments or timelines. However, the overarching trends towards sustainability and electrification are undeniable. Key industry players, including Bosch, DENSO, and Siemens AG, are investing heavily in research and development to optimize motor performance, reduce costs, and enhance the overall EV ownership experience. This competitive landscape fosters continuous innovation, ensuring the European EV motor market remains dynamic and responsive to evolving consumer and regulatory demands.

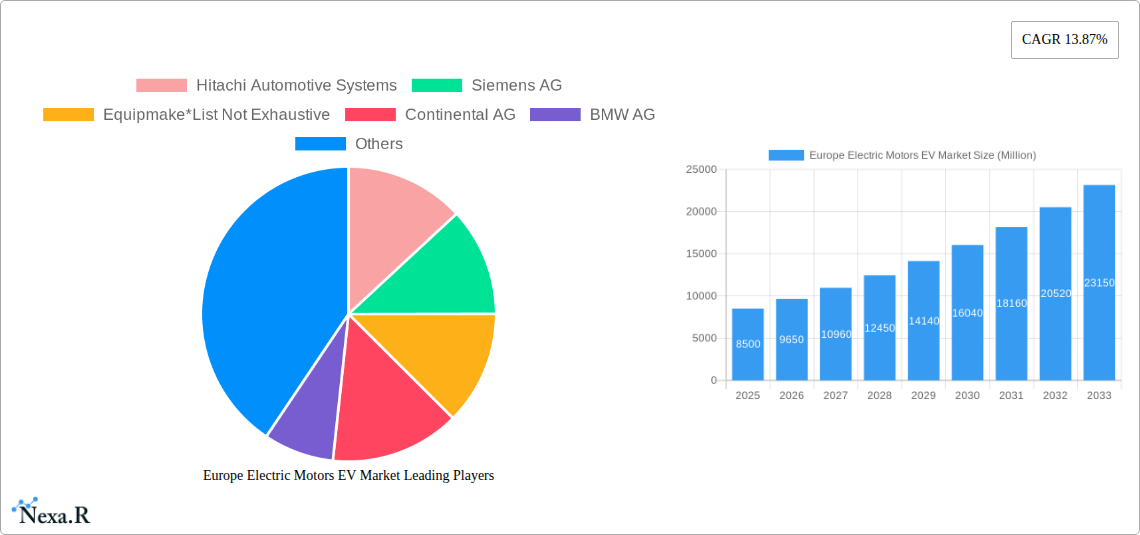

Europe Electric Motors EV Market Company Market Share

This comprehensive report provides an in-depth analysis of the Europe Electric Motors EV Market, a critical component of the burgeoning electric vehicle (EV) ecosystem. Covering the study period from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, growth accelerators, and key players. Our analysis leverages extensive data to offer actionable insights for stakeholders aiming to capitalize on this rapidly evolving market.

Europe Electric Motors EV Market Market Dynamics & Structure

The Europe Electric Motors EV Market is characterized by dynamic competition and rapid technological advancement. Market concentration is evolving as major automotive suppliers and dedicated EV component manufacturers vie for dominance. Key innovation drivers include the relentless pursuit of higher power density, improved efficiency, and reduced manufacturing costs, directly fueled by stringent EU emissions regulations and escalating consumer demand for sustainable transportation. Regulatory frameworks, such as CO2 emission standards and incentives for EV adoption, play a pivotal role in shaping market direction. Competitive product substitutes are primarily traditional internal combustion engine (ICE) vehicles, but the growing performance and cost-competitiveness of EVs are rapidly eroding ICE market share. End-user demographics are shifting towards a more environmentally conscious and tech-savvy consumer base, with a strong preference for longer range, faster charging, and integrated smart features. Mergers and acquisitions (M&A) are becoming increasingly common as companies seek to secure critical technologies, expand their production capacity, and gain a competitive edge. For instance, several strategic alliances have been formed to accelerate the development of next-generation electric powertrains. Innovation barriers include the high capital investment required for R&D and manufacturing, the complexity of supply chains for specialized components, and the need for skilled labor in advanced manufacturing processes.

Europe Electric Motors EV Market Growth Trends & Insights

The Europe Electric Motors EV Market is poised for exceptional growth, driven by a confluence of factors that are fundamentally reshaping the automotive industry. The market size is projected to witness a substantial expansion, transitioning from historical figures in the range of xx million units in 2024 to an estimated xx million units in 2025, and is anticipated to surge to xx million units by 2033. This exponential growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Adoption rates for electric vehicles are accelerating across the continent, propelled by government incentives, falling battery costs, and increasing model availability across all vehicle segments. Technological disruptions, such as advancements in motor efficiency, power electronics, and integrated thermal management systems, are enhancing EV performance and appeal. Consumer behavior is undergoing a significant shift, with a growing preference for the quiet operation, lower running costs, and environmental benefits of EVs. Market penetration is steadily increasing, with projections indicating that EVs will constitute a significant portion of new vehicle sales in key European nations by the end of the forecast period. The integration of advanced materials and sophisticated control algorithms is further optimizing electric motor performance, contributing to longer driving ranges and improved acceleration. The demand for electric motors is directly correlated with the increasing production volumes of hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery/pure electric vehicles (BEVs). The evolving landscape of charging infrastructure and the increasing awareness of the total cost of ownership are further reinforcing the adoption trends. The market is also witnessing the introduction of novel motor architectures designed for specific applications, such as in-wheel motors for enhanced maneuverability and distributed drive systems for improved scalability.

Dominant Regions, Countries, or Segments in Europe Electric Motors EV Market

The Battery/Pure Electric Vehicle segment is the dominant force driving growth in the Europe Electric Motors EV Market. This segment is experiencing unparalleled expansion due to strong consumer preference for zero-emission mobility and supportive government policies. Within this segment, Passenger Cars represent the largest application type, accounting for a significant share of electric motor demand. The AC Motor type is the prevailing technology in this segment, favored for its efficiency, durability, and performance characteristics in high-speed applications. Countries like Germany, Norway, the UK, and France are leading the charge, driven by ambitious EV adoption targets, robust charging infrastructure development, and substantial government subsidies. For example, Norway has consistently achieved the highest EV market share globally, setting a benchmark for other nations. Germany, as the largest automotive market in Europe, plays a pivotal role in shaping the overall demand for electric motors, with its established automotive manufacturers heavily investing in EV production. The economic policies in these leading countries, including tax incentives, purchase grants, and stringent CO2 emission regulations for manufacturers, are crucial in stimulating demand for electric vehicles and, consequently, electric motors. The expanding charging infrastructure, coupled with the increasing availability of diverse BEV models, further reinforces the dominance of this segment. Market share for BEVs in new car registrations has seen a dramatic surge, indicating a fundamental shift in consumer choices. The growth potential of the Battery/Pure Electric Vehicle segment is immense, fueled by ongoing technological advancements in battery energy density and charging speeds, which address key consumer concerns regarding range anxiety and charging times. The increasing focus on sustainable manufacturing practices within the automotive sector also favors the adoption of electric powertrains.

Europe Electric Motors EV Market Product Landscape

The Europe Electric Motors EV Market is characterized by continuous innovation in product development, focusing on enhanced performance, efficiency, and integration. Manufacturers are developing advanced motor designs, including axial flux motors and switched reluctance motors, which offer higher power density and improved torque characteristics. These innovations are crucial for meeting the evolving demands of passenger cars, commercial vehicles, and specialized applications within the hybrid electric vehicle, plug-in hybrid electric vehicle, and battery/pure electric vehicle segments. Key product advancements include the integration of power electronics and thermal management systems directly into the motor housing, leading to more compact and efficient powertrains. The focus on lightweight materials and advanced cooling techniques contributes to improved energy efficiency and extended motor lifespan, offering unique selling propositions.

Key Drivers, Barriers & Challenges in Europe Electric Motors EV Market

Key Drivers: The Europe Electric Motors EV Market is propelled by a trifecta of technological innovation, supportive government policies, and increasing consumer demand for sustainable transportation. Technological advancements in battery technology, motor efficiency, and power electronics are making EVs more viable and appealing. Stringent EU emission regulations and government incentives for EV adoption, such as subsidies and tax breaks, are significant demand boosters. Growing environmental awareness and the desire for lower running costs are driving consumer preference towards electric vehicles.

Barriers & Challenges: Significant challenges persist, including the high initial cost of EVs compared to traditional vehicles, which can deter price-sensitive consumers. The availability and density of charging infrastructure remain a concern in certain regions, contributing to range anxiety. Supply chain complexities for critical raw materials, such as lithium and cobalt, and the reliance on a limited number of suppliers can lead to price volatility and production bottlenecks. Furthermore, the need for specialized workforce training in EV manufacturing and maintenance poses an ongoing challenge.

Emerging Opportunities in Europe Electric Motors EV Market

Emerging opportunities in the Europe Electric Motors EV Market lie in the expansion of electric motors for commercial vehicles, including delivery vans and trucks, as businesses increasingly seek to decarbonize their fleets and reduce operating costs. The development of more compact and powerful electric motors for performance-oriented EVs and the integration of smart motor technologies for enhanced vehicle autonomy and connectivity present lucrative avenues. Furthermore, the growing demand for retrofitting existing ICE vehicles with electric powertrains represents an untapped market. The circular economy approach, focusing on the remanufacturing and recycling of electric motors, also offers significant sustainability and economic benefits.

Growth Accelerators in the Europe Electric Motors EV Market Industry

Several catalysts are accelerating the long-term growth of the Europe Electric Motors EV Market. Breakthroughs in solid-state battery technology promise to significantly enhance energy density and reduce charging times, directly boosting EV adoption. Strategic partnerships between automotive manufacturers and electric motor suppliers are crucial for scaling up production and driving down costs. Furthermore, the expansion of charging infrastructure networks across Europe, supported by public and private investment, is a critical enabler of mass EV adoption. The increasing integration of electric motors into various mobility solutions, beyond passenger cars, such as e-scooters and electric buses, further diversifies and expands the market.

Key Players Shaping the Europe Electric Motors EV Market Market

- Hitachi Automotive Systems

- Siemens AG

- Equipmake

- Continental AG

- BMW AG

- BorgWarner Inc

- Robert Bosch GmbH

- Delphi Technologies

- DENSO Corporation

- LG Electronics

Notable Milestones in Europe Electric Motors EV Market Sector

- 2023: Launch of new high-efficiency permanent magnet synchronous motors by Continental AG, enhancing EV range and performance.

- 2023: Siemens AG announces significant investment in expanding its e-mobility component manufacturing facilities in Germany to meet growing demand.

- 2024: Equipmake unveils its advanced electric drive unit (EDU) technology, offering exceptional power-to-weight ratios for electric vehicles.

- 2024: Robert Bosch GmbH introduces a new generation of integrated drive units, combining motor, power electronics, and transmission for greater efficiency.

- 2024: LG Electronics expands its EV component portfolio, including advanced electric motors, to cater to increasing OEM demand.

In-Depth Europe Electric Motors EV Market Market Outlook

The Europe Electric Motors EV Market is characterized by sustained growth, driven by ongoing technological advancements and strong policy support. Future market potential lies in the continued innovation of higher-performance, more cost-effective, and sustainably manufactured electric motors. Strategic opportunities include capitalizing on the expanding commercial vehicle electrification trend, developing specialized motor solutions for niche applications, and embracing the principles of the circular economy in production and end-of-life management. The convergence of electric mobility with autonomous driving and smart connectivity will further unlock new avenues for electric motor integration and demand.

Europe Electric Motors EV Market Segmentation

-

1. Application Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Motor Type

- 2.1. AC Motor

- 2.2. DC Motor

-

3. Vehicle Type

- 3.1. Hybrid Electric Vehicle

- 3.2. Plug-in Hybrid Electric Vehicle

- 3.3. Battery/Pure Electric Vehicle

Europe Electric Motors EV Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

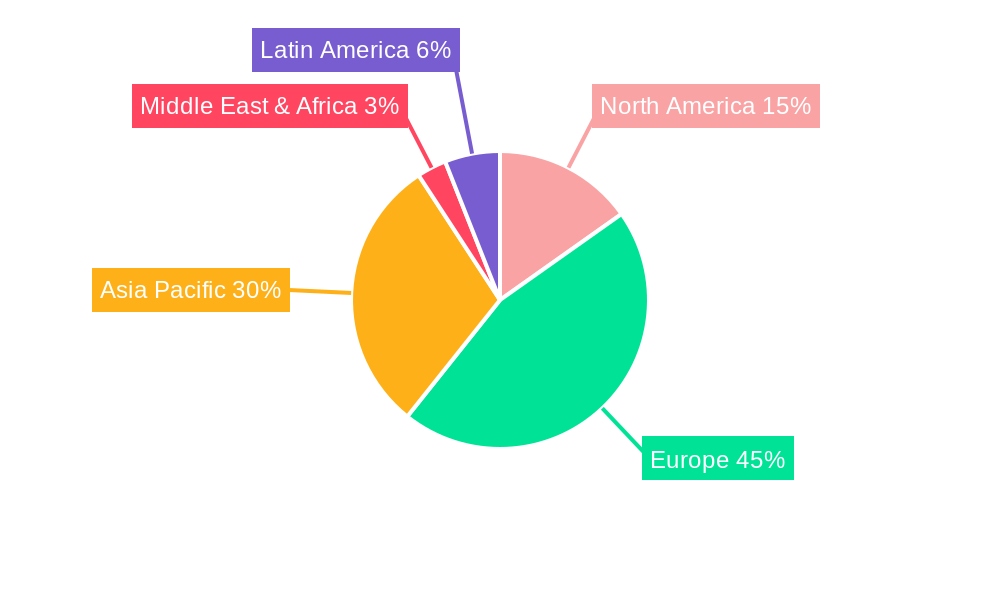

Europe Electric Motors EV Market Regional Market Share

Geographic Coverage of Europe Electric Motors EV Market

Europe Electric Motors EV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passenger cars Captures Major Share in Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Motors EV Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Motor Type

- 5.2.1. AC Motor

- 5.2.2. DC Motor

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Hybrid Electric Vehicle

- 5.3.2. Plug-in Hybrid Electric Vehicle

- 5.3.3. Battery/Pure Electric Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Automotive Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Equipmake*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Continental AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BMW AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Delphi Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DENSO Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hitachi Automotive Systems

List of Figures

- Figure 1: Europe Electric Motors EV Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Electric Motors EV Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Electric Motors EV Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Europe Electric Motors EV Market Revenue Million Forecast, by Motor Type 2020 & 2033

- Table 3: Europe Electric Motors EV Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Electric Motors EV Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Electric Motors EV Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Europe Electric Motors EV Market Revenue Million Forecast, by Motor Type 2020 & 2033

- Table 7: Europe Electric Motors EV Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Europe Electric Motors EV Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Motors EV Market?

The projected CAGR is approximately 13.87%.

2. Which companies are prominent players in the Europe Electric Motors EV Market?

Key companies in the market include Hitachi Automotive Systems, Siemens AG, Equipmake*List Not Exhaustive, Continental AG, BMW AG, BorgWarner Inc, Robert Bosch GmbH, Delphi Technologies, DENSO Corporation, LG Electronics.

3. What are the main segments of the Europe Electric Motors EV Market?

The market segments include Application Type, Motor Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Passenger cars Captures Major Share in Market.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Motors EV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Motors EV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Motors EV Market?

To stay informed about further developments, trends, and reports in the Europe Electric Motors EV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence