Key Insights

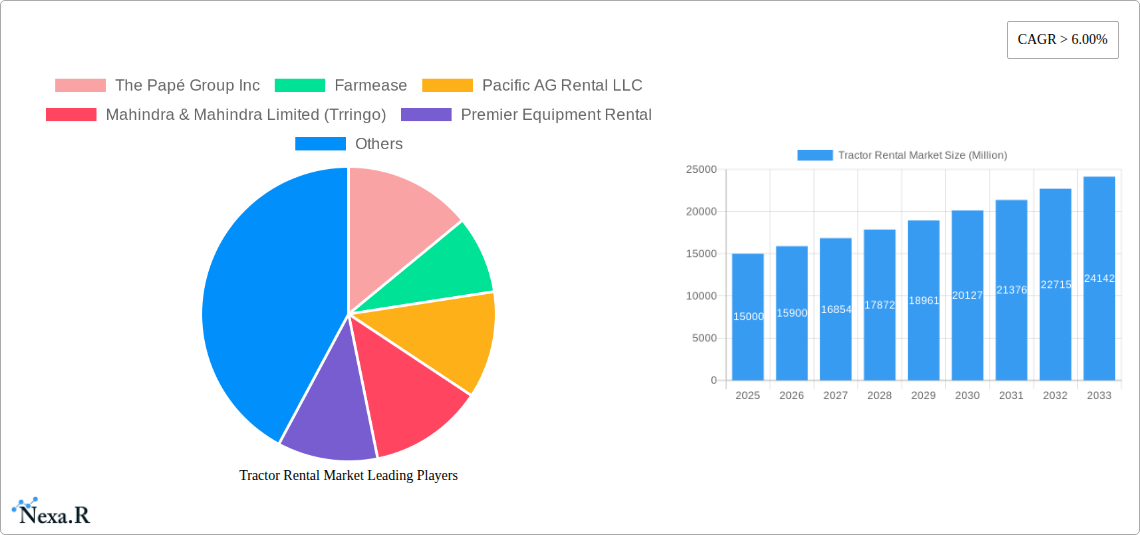

The global Tractor Rental Market is poised for significant expansion, projected to reach a substantial market size of approximately $7,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 6.00% throughout the study period (2025-2033). This upward trajectory is primarily fueled by a confluence of compelling drivers, including the increasing adoption of modern farming practices, a growing demand for advanced agricultural machinery, and the prevailing trend of farmers opting for rental solutions over outright ownership to manage capital expenditure and ensure access to the latest technology. The market is witnessing a pronounced shift towards utility and row crop tractors, catering to the diverse needs of both smallholdings and large-scale agricultural operations. Furthermore, the increasing electrification of machinery, though nascent, represents a significant future growth avenue, aligning with global sustainability initiatives and reducing operational costs for end-users.

Tractor Rental Market Market Size (In Billion)

The market's growth is further propelled by emerging trends such as the rise of smart farming technologies integrated into rental fleets and the expansion of rental services into developing economies seeking to mechanize their agricultural sectors. However, the market is not without its restraints. Factors such as the high initial cost of advanced tractor models, the potential for damage or misuse of rented equipment, and the availability of used tractor markets can temper the growth rate. Nevertheless, the sheer volume of agricultural land requiring cultivation and the ongoing need for efficient and cost-effective farming solutions underscore the strong market potential. Key regions like Asia Pacific, particularly India and China, are expected to be major growth engines due to their vast agricultural bases and increasing mechanization efforts, while North America and Europe will continue to be significant markets driven by technological adoption and specialized farming needs. Leading companies are actively expanding their rental portfolios and service networks to capture this burgeoning market.

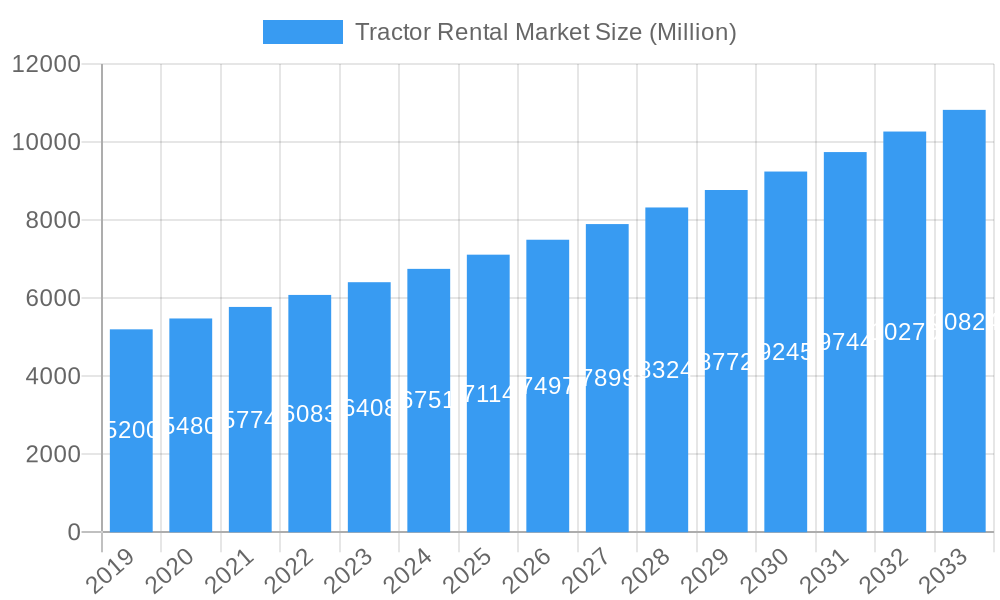

Tractor Rental Market Company Market Share

Tractor Rental Market: Comprehensive Industry Report & Forecast (2019-2033)

This in-depth report provides a detailed analysis of the global tractor rental market, encompassing utility tractors, row crop tractors, industrial tractors, and earth moving tractors. The study covers a comprehensive study period from 2019 to 2033, with a base year of 2025, an estimated year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019-2024. We explore the evolving landscape driven by IC Engine and emerging Electric power sources, segmenting by power type including less than 100 hp, 100-200 hp, and more than 200 hp. This report is an essential resource for industry professionals, investors, and stakeholders seeking to understand market dynamics, growth drivers, competitive strategies, and future opportunities within the farm equipment rental and construction equipment rental sectors.

Tractor Rental Market Market Dynamics & Structure

The tractor rental market is characterized by a moderately fragmented structure, with a mix of large, established players and numerous regional and local operators. Technological innovation, particularly in telematics, GPS tracking, and the development of more fuel-efficient and versatile tractor models, acts as a significant driver of market growth. Regulatory frameworks, including emissions standards and equipment safety mandates, influence manufacturing and operational costs. Competitive substitutes include outright purchase of tractors, alternative agricultural machinery, and manual labor, though the cost-effectiveness and flexibility of rental solutions are increasingly recognized.

- Market Concentration: While key global manufacturers and rental providers hold substantial market share, the presence of smaller, localized businesses contributes to a competitive and diverse market landscape.

- Technological Innovation: Advancements in precision farming technology, automation, and the development of electric-powered tractors are creating new rental opportunities and improving operational efficiency.

- Regulatory Frameworks: Stringent safety and emissions regulations necessitate continuous investment in compliant machinery, impacting rental fleet modernization.

- Competitive Product Substitutes: While ownership offers long-term benefits, the upfront cost and maintenance associated with purchasing tractors are significant deterrents for many users, driving rental demand.

- End-User Demographics: The market serves a diverse range of end-users, from smallholder farmers to large agricultural corporations and construction companies, each with distinct equipment needs and rental preferences.

- M&A Trends: Mergers and acquisitions are observed as companies seek to expand their geographical reach, enhance their fleet capabilities, and gain a competitive edge. For instance, strategic acquisitions by larger rental companies aim to consolidate market presence and offer comprehensive service packages.

Tractor Rental Market Growth Trends & Insights

The global tractor rental market is experiencing robust growth, driven by the increasing need for flexible and cost-effective machinery solutions across agriculture and construction. The market size is projected to expand significantly, with adoption rates for rental services steadily increasing as more users recognize the benefits of avoiding high capital expenditure and maintenance costs associated with tractor ownership. Technological disruptions are playing a pivotal role, with the integration of IoT sensors for predictive maintenance, GPS for efficient fleet management, and the advent of more powerful and specialized rental tractors enhancing operational capabilities.

Consumer behavior shifts are also evident, with a growing preference for on-demand rental services that offer access to the latest equipment without the burden of depreciation and obsolescence. This trend is particularly pronounced in emerging economies where access to capital for machinery purchase can be limited. The increasing mechanization in agriculture, coupled with infrastructure development projects globally, are creating sustained demand for a wide array of tractor types. The rising popularity of utility tractors for diverse farming tasks and industrial tractors for construction and land management further fuels market expansion. The transition towards more sustainable practices is also subtly influencing the market, with early adoption of electric-powered tractors in niche applications hinting at future trends.

The farm equipment rental market segment, in particular, is benefiting from government initiatives aimed at boosting agricultural productivity and supporting small and marginal farmers. These initiatives often involve promoting equipment sharing and rental platforms to ensure access to essential machinery. Similarly, the construction equipment rental market is witnessing increased demand due to ongoing urbanization and infrastructure projects worldwide. The hourly rental model, as exemplified by the app-based system launched in Bihar, is gaining traction for its convenience and cost-efficiency for short-term needs. The CAGR for the tractor rental market is projected to be in the range of 5-7% over the forecast period, indicating a healthy and sustained growth trajectory. Market penetration is expected to rise as awareness and accessibility of rental services improve across different regions. The increasing average rental duration for specific project types, coupled with higher rental rates for specialized equipment, are also contributing to the market's overall value growth.

Dominant Regions, Countries, or Segments in Tractor Rental Market

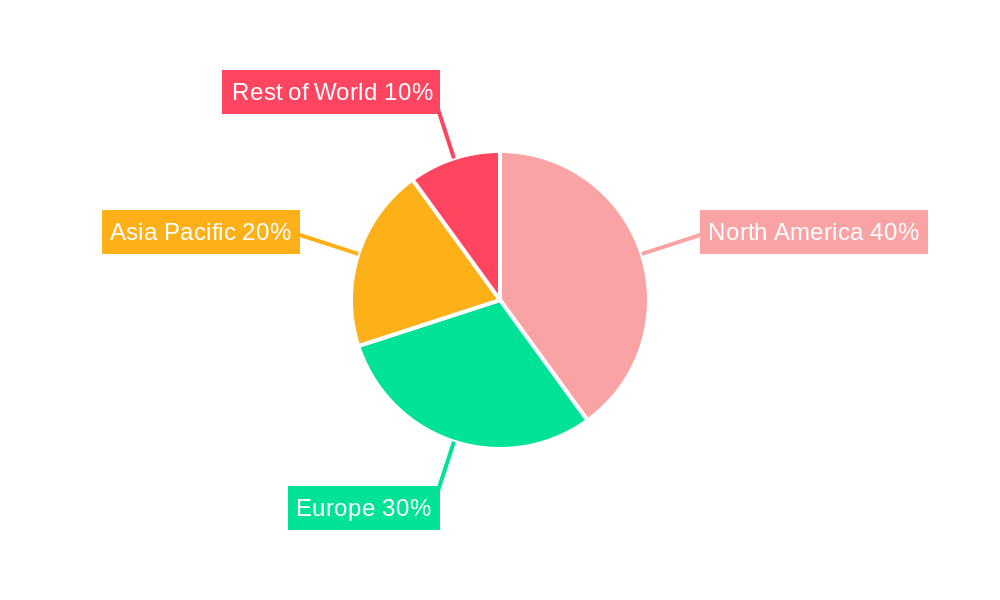

The tractor rental market is experiencing dynamic growth across various regions and segments, with North America and Europe currently holding significant market share due to established agricultural and construction sectors. However, the Asia Pacific region is emerging as a dominant growth driver, fueled by rapid industrialization, increasing agricultural mechanization, and a burgeoning construction industry. This region's dominance is further amplified by a large population of small and marginal farmers who are increasingly adopting rental solutions for their cultivation needs.

Within the Tractor Type segment, Utility Tractors are consistently the most dominant, accounting for over 40% of the rental market. Their versatility in performing a wide range of agricultural and light construction tasks makes them a go-to choice for many rental customers. Row Crop Tractors also hold a substantial share, particularly in regions with intensive row cropping farming practices. The Industrial Tractors segment is experiencing rapid growth, driven by infrastructure development and land management projects. Earth Moving Tractors are crucial for large-scale construction and mining operations, contributing significantly to the overall market value in specific regions.

Regarding Power Source, the IC Engine remains the dominant power source, representing over 90% of the current market. However, the Electric power source is witnessing a nascent but promising growth, particularly for smaller utility tractors and specialized industrial applications where emission regulations are stringent or for operational cost savings in the long run. The Power Type segmentation reveals that Less than 100 hp tractors constitute the largest share of rentals due to their affordability, ease of operation, and suitability for a wide array of common tasks. The 100-200 hp segment is experiencing steady growth, catering to more demanding agricultural and construction needs. The More than 200 hp segment, while smaller in volume, represents significant value due to the high cost of these powerful machines and their application in heavy-duty operations.

Key drivers for regional dominance include supportive government policies promoting mechanization and infrastructure development, favorable economic conditions enabling capital investment in rental fleets, and a strong existing user base for tractors. For instance, countries like India and China in the Asia Pacific are witnessing massive growth in their construction sectors, creating a substantial demand for industrial and earth-moving tractor rentals. Furthermore, initiatives like the Bihar cooperative department's app-based rental system are crucial for increasing market penetration among smaller farmers, who form a significant portion of the agricultural workforce. The availability of a vast and growing rental fleet, coupled with competitive pricing strategies, further solidifies the dominance of certain regions and segments. The market share for Utility Tractors in rentals is estimated at 42 million units, Row Crop Tractors at 25 million units, Industrial Tractors at 18 million units, and Earth Moving Tractors at 12 million units for the base year 2025.

Tractor Rental Market Product Landscape

The tractor rental market product landscape is characterized by a continuous evolution driven by technological advancements and the demand for versatile, efficient, and sustainable machinery. Rental fleets increasingly feature tractors equipped with advanced GPS navigation systems for precision farming, telematics for real-time performance monitoring and maintenance, and improved fuel efficiency technologies. Innovations in utility tractors include enhanced hydraulic systems for greater attachment versatility and more comfortable operator cabins for extended use.

The emergence of electric tractors, though still in its nascent stages, represents a significant product innovation, offering zero emissions and reduced operating costs, particularly for smaller horsepower categories. Performance metrics such as fuel consumption, power output, and maneuverability are critical factors influencing rental choices, with operators seeking equipment that optimizes task completion and minimizes downtime. Unique selling propositions for rental providers include the availability of specialized attachments, flexible rental duration options (hourly, daily, weekly, monthly), and comprehensive maintenance services included in the rental agreement. The focus is on delivering reliable and performance-driven machinery to meet the diverse needs of agricultural and construction clients.

Key Drivers, Barriers & Challenges in Tractor Rental Market

The tractor rental market is propelled by several key drivers that are shaping its growth trajectory. The increasing cost of tractor ownership, coupled with the need for flexible access to modern machinery, stands as a primary economic driver. Government initiatives promoting agricultural mechanization and infrastructure development projects globally also significantly boost demand. Technological advancements in tractor design, leading to greater efficiency and specialized capabilities, encourage users to rent rather than purchase. The growing emphasis on precision agriculture and sustainable farming practices further fuels the need for advanced and adaptable equipment.

- Key Drivers:

- High upfront cost of tractor ownership

- Need for flexible and on-demand machinery access

- Government support for mechanization and infrastructure

- Technological advancements and specialized equipment

- Rise of precision agriculture and sustainable farming

However, the market also faces significant barriers and challenges. Supply chain disruptions, particularly in the manufacturing and delivery of new tractors and parts, can impact the availability and maintenance of rental fleets. Stringent and evolving regulatory frameworks related to emissions and safety can increase operational costs and necessitate fleet upgrades. Intense competition from both organized rental companies and informal operators can lead to price wars and pressure on profit margins. Furthermore, the seasonal nature of agricultural demand can lead to underutilization of equipment during off-peak periods, impacting revenue streams.

- Key Barriers & Challenges:

- Supply chain volatility and parts availability

- Complex and evolving regulatory landscape

- Intense competition and pricing pressures

- Seasonal demand fluctuations leading to underutilization

- Need for substantial capital investment in modern fleets

Emerging Opportunities in Tractor Rental Market

Emerging opportunities in the tractor rental market are centered around technological integration and catering to underserved segments. The development of user-friendly mobile applications for seamless booking, tracking, and payment of tractor rentals is a significant opportunity, exemplified by initiatives like the Bihar cooperative department's app. Expansion into emerging economies with a large base of smallholder farmers represents a vast untapped market. Furthermore, the growing demand for specialized tractors in niche sectors like landscaping, forestry, and renewable energy installations presents lucrative rental avenues.

- Untapped Markets: Focus on rural and remote areas with limited access to ownership options.

- Innovative Applications: Rental solutions for specialized tasks such as vineyard management, precision planting, and environmental remediation.

- Evolving Consumer Preferences: Offering a range of fuel-efficient and electric tractor options to meet sustainability demands.

Growth Accelerators in the Tractor Rental Market Industry

Several catalysts are driving long-term growth within the tractor rental market industry. Continued technological breakthroughs in automation, artificial intelligence, and IoT integration are enabling smarter, more efficient, and predictive rental services. Strategic partnerships between equipment manufacturers, rental companies, and technology providers are crucial for developing innovative rental solutions and expanding market reach. Market expansion strategies, including geographical diversification into developing regions and penetration into new industrial sectors, will further accelerate growth. The increasing adoption of subscription-based rental models and comprehensive maintenance packages will also enhance customer loyalty and revenue stability.

Key Players Shaping the Tractor Rental Market Market

- Farmease

- EM3 Agri Services

- Premier Equipment Rental

- The Pape Group Inc

- Trringo

- Kwipped Inc

- Flaman Group of Companies

- Titan Machinery

- Pacific Tractor & Implement

- John Deere

- JFarm Services

Notable Milestones in Tractor Rental Market Sector

- June 2022: The Bihar cooperative department launched an app-based system for renting farm equipment, including tractors, to small and marginal farmers across approximately 3,000 primary agricultural credit societies. This initiative allows farmers to book machinery for tilling and other cultivation needs through the app, with delivery based on availability on an hourly rental basis.

In-Depth Tractor Rental Market Market Outlook

The tractor rental market is poised for sustained and significant growth, driven by a confluence of factors. The ongoing push for agricultural mechanization, especially in developing economies, combined with the continuous demand from infrastructure and construction projects, forms a robust foundation for rental services. Technological advancements, such as the integration of AI and IoT for enhanced fleet management and predictive maintenance, will streamline operations and improve customer experience. The increasing environmental consciousness will also likely drive the adoption of electric and hybrid tractor rentals in the long term, creating new market segments. Strategic collaborations between rental providers, manufacturers, and technology firms will be crucial in developing innovative, user-centric rental solutions and expanding into new geographical territories. The market's future success hinges on its ability to adapt to evolving customer needs, embrace technological innovation, and navigate the dynamic regulatory landscape.

Tractor Rental Market Segmentation

-

1. Tractor Type

- 1.1. Utility Tractors

- 1.2. Row Crop Tractors

- 1.3. Industrial Tractors

- 1.4. Earth Moving Tractors

-

2. Power Source

- 2.1. IC Engine

- 2.2. Electric

-

3. Power Type

- 3.1. Less than 100 hp

- 3.2. 100-200 hp

- 3.3. More than 200 hp

Tractor Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Tractor Rental Market Regional Market Share

Geographic Coverage of Tractor Rental Market

Tractor Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Increase in Online Rental Services is driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tractor Type

- 5.1.1. Utility Tractors

- 5.1.2. Row Crop Tractors

- 5.1.3. Industrial Tractors

- 5.1.4. Earth Moving Tractors

- 5.2. Market Analysis, Insights and Forecast - by Power Source

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Power Type

- 5.3.1. Less than 100 hp

- 5.3.2. 100-200 hp

- 5.3.3. More than 200 hp

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tractor Type

- 6. North America Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tractor Type

- 6.1.1. Utility Tractors

- 6.1.2. Row Crop Tractors

- 6.1.3. Industrial Tractors

- 6.1.4. Earth Moving Tractors

- 6.2. Market Analysis, Insights and Forecast - by Power Source

- 6.2.1. IC Engine

- 6.2.2. Electric

- 6.3. Market Analysis, Insights and Forecast - by Power Type

- 6.3.1. Less than 100 hp

- 6.3.2. 100-200 hp

- 6.3.3. More than 200 hp

- 6.1. Market Analysis, Insights and Forecast - by Tractor Type

- 7. Europe Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tractor Type

- 7.1.1. Utility Tractors

- 7.1.2. Row Crop Tractors

- 7.1.3. Industrial Tractors

- 7.1.4. Earth Moving Tractors

- 7.2. Market Analysis, Insights and Forecast - by Power Source

- 7.2.1. IC Engine

- 7.2.2. Electric

- 7.3. Market Analysis, Insights and Forecast - by Power Type

- 7.3.1. Less than 100 hp

- 7.3.2. 100-200 hp

- 7.3.3. More than 200 hp

- 7.1. Market Analysis, Insights and Forecast - by Tractor Type

- 8. Asia Pacific Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tractor Type

- 8.1.1. Utility Tractors

- 8.1.2. Row Crop Tractors

- 8.1.3. Industrial Tractors

- 8.1.4. Earth Moving Tractors

- 8.2. Market Analysis, Insights and Forecast - by Power Source

- 8.2.1. IC Engine

- 8.2.2. Electric

- 8.3. Market Analysis, Insights and Forecast - by Power Type

- 8.3.1. Less than 100 hp

- 8.3.2. 100-200 hp

- 8.3.3. More than 200 hp

- 8.1. Market Analysis, Insights and Forecast - by Tractor Type

- 9. Rest of the World Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tractor Type

- 9.1.1. Utility Tractors

- 9.1.2. Row Crop Tractors

- 9.1.3. Industrial Tractors

- 9.1.4. Earth Moving Tractors

- 9.2. Market Analysis, Insights and Forecast - by Power Source

- 9.2.1. IC Engine

- 9.2.2. Electric

- 9.3. Market Analysis, Insights and Forecast - by Power Type

- 9.3.1. Less than 100 hp

- 9.3.2. 100-200 hp

- 9.3.3. More than 200 hp

- 9.1. Market Analysis, Insights and Forecast - by Tractor Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Farmease

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EM3 Agri Services

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Premier Equipment Rental

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Pape Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Trringo*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kwipped Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Flaman Group of Companies

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Titan Machinery

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Pacific Tractor & Implement

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 John Deere

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 JFarm Services

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Farmease

List of Figures

- Figure 1: Global Tractor Rental Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Tractor Rental Market Revenue (Million), by Tractor Type 2025 & 2033

- Figure 3: North America Tractor Rental Market Revenue Share (%), by Tractor Type 2025 & 2033

- Figure 4: North America Tractor Rental Market Revenue (Million), by Power Source 2025 & 2033

- Figure 5: North America Tractor Rental Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 6: North America Tractor Rental Market Revenue (Million), by Power Type 2025 & 2033

- Figure 7: North America Tractor Rental Market Revenue Share (%), by Power Type 2025 & 2033

- Figure 8: North America Tractor Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Tractor Rental Market Revenue (Million), by Tractor Type 2025 & 2033

- Figure 11: Europe Tractor Rental Market Revenue Share (%), by Tractor Type 2025 & 2033

- Figure 12: Europe Tractor Rental Market Revenue (Million), by Power Source 2025 & 2033

- Figure 13: Europe Tractor Rental Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 14: Europe Tractor Rental Market Revenue (Million), by Power Type 2025 & 2033

- Figure 15: Europe Tractor Rental Market Revenue Share (%), by Power Type 2025 & 2033

- Figure 16: Europe Tractor Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Tractor Rental Market Revenue (Million), by Tractor Type 2025 & 2033

- Figure 19: Asia Pacific Tractor Rental Market Revenue Share (%), by Tractor Type 2025 & 2033

- Figure 20: Asia Pacific Tractor Rental Market Revenue (Million), by Power Source 2025 & 2033

- Figure 21: Asia Pacific Tractor Rental Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 22: Asia Pacific Tractor Rental Market Revenue (Million), by Power Type 2025 & 2033

- Figure 23: Asia Pacific Tractor Rental Market Revenue Share (%), by Power Type 2025 & 2033

- Figure 24: Asia Pacific Tractor Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Tractor Rental Market Revenue (Million), by Tractor Type 2025 & 2033

- Figure 27: Rest of the World Tractor Rental Market Revenue Share (%), by Tractor Type 2025 & 2033

- Figure 28: Rest of the World Tractor Rental Market Revenue (Million), by Power Source 2025 & 2033

- Figure 29: Rest of the World Tractor Rental Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 30: Rest of the World Tractor Rental Market Revenue (Million), by Power Type 2025 & 2033

- Figure 31: Rest of the World Tractor Rental Market Revenue Share (%), by Power Type 2025 & 2033

- Figure 32: Rest of the World Tractor Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2020 & 2033

- Table 2: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 3: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2020 & 2033

- Table 4: Global Tractor Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2020 & 2033

- Table 6: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 7: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2020 & 2033

- Table 8: Global Tractor Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2020 & 2033

- Table 13: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 14: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2020 & 2033

- Table 15: Global Tractor Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2020 & 2033

- Table 21: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 22: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2020 & 2033

- Table 23: Global Tractor Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2020 & 2033

- Table 30: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 31: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2020 & 2033

- Table 32: Global Tractor Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: South America Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Middle East and Africa Tractor Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tractor Rental Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Tractor Rental Market?

Key companies in the market include Farmease, EM3 Agri Services, Premier Equipment Rental, The Pape Group Inc, Trringo*List Not Exhaustive, Kwipped Inc, Flaman Group of Companies, Titan Machinery, Pacific Tractor & Implement, John Deere, JFarm Services.

3. What are the main segments of the Tractor Rental Market?

The market segments include Tractor Type, Power Source, Power Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Increase in Online Rental Services is driving the Market.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

In June 2022, The Bihar cooperative department will launch an app-based system for renting farm equipment such as harvesters and tractors to small and marginal farmers in approximately 3,000 primary agricultural credit societies. Farmers who do not have farm equipment for tilling the land or other cultivation needs would be able to book it through the app, and the machines would be delivered to their door based on availability. According to sources, the rental would be on an hourly basis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tractor Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tractor Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tractor Rental Market?

To stay informed about further developments, trends, and reports in the Tractor Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence