Key Insights

The global Metal Precision Turned Product Manufacturing market is experiencing robust growth, projected to reach a value of $96.06 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.26% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for precision components across diverse industries, including automotive, electronics, and healthcare, is a primary driver. Advancements in CNC machining technology are enhancing efficiency and precision, leading to higher production volumes and improved product quality. Furthermore, the rising adoption of automation in manufacturing processes contributes to cost reduction and improved productivity, further bolstering market growth. However, challenges remain, such as fluctuating raw material prices and intense competition among manufacturers. The market is segmented by operation type (manual and CNC), machine type (automatic screw machines, rotary transfer machines, CNC lathes, etc.), and end-user industry. The CNC operation segment is expected to dominate due to its superior precision and efficiency compared to manual operations. Similarly, the automotive sector is anticipated to maintain its position as a significant end-user due to the high demand for precision parts in vehicle manufacturing.

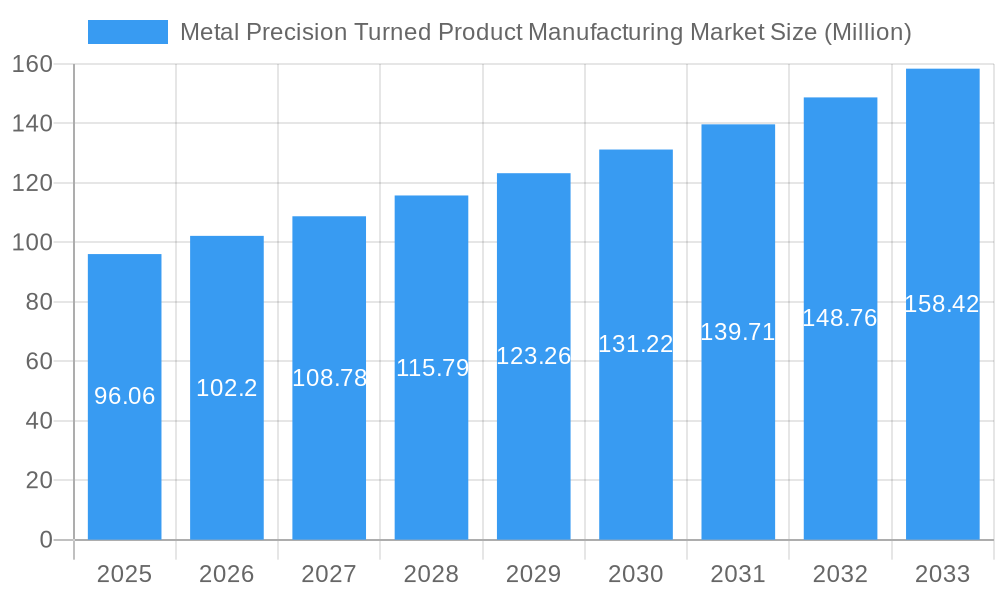

Metal Precision Turned Product Manufacturing Market Market Size (In Million)

The Asia-Pacific region is likely to represent a major share of the global market, driven by rapid industrialization and a growing manufacturing base in countries like China and India. North America and Europe also contribute significantly, albeit at a comparatively slower growth rate due to market maturity. The competitive landscape is fragmented, with several key players vying for market share. While specific company market share data is unavailable, the presence of numerous companies suggests a competitive yet dynamic environment. Future growth will depend on the continuous improvement of manufacturing technologies, the exploration of new materials, and the ability of manufacturers to adapt to evolving industry standards and customer demands for higher precision and customized solutions. Successfully navigating these factors will be crucial for sustained growth in this competitive market.

Metal Precision Turned Product Manufacturing Market Company Market Share

Metal Precision Turned Product Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Metal Precision Turned Product Manufacturing Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market. The parent market is the broader precision engineering market, while the child market focuses specifically on metal precision turned products.

Value estimations are presented in million units.

Metal Precision Turned Product Manufacturing Market Market Dynamics & Structure

The metal precision turned product manufacturing market exhibits a moderately concentrated structure, with a few dominant players alongside a multitude of smaller, specialized manufacturers. This dynamic landscape is significantly shaped by several key factors. Technological innovation, particularly in CNC machining and advanced automation technologies like robotics and AI-powered systems, serves as a primary growth driver, enhancing efficiency and precision. Simultaneously, stringent regulatory frameworks related to safety, environmental sustainability (including waste reduction and emissions control), and worker safety directly impact operational costs and necessitate innovative, compliant product designs. The market faces increasing competitive pressure from alternative materials (e.g., plastics, advanced composites, ceramics) and manufacturing processes (e.g., 3D printing, additive manufacturing, injection molding). This competitive landscape necessitates continuous innovation and adaptation. Key end-user demographics reveal strong demand from the automotive, electronics, medical device, aerospace, and renewable energy sectors, with each industry demanding specific material properties and precision levels. The market has witnessed a moderate yet consistent level of mergers and acquisitions (M&A) activity in recent years, primarily driven by strategies focused on consolidation, market expansion, and the acquisition of specialized technologies.

- Market Concentration (2024): xx% held by top 5 players. Further analysis should delineate market share distribution among leading players and assess the competitive intensity.

- Technological Innovation: Continuous advancements in CNC technology, automation (including robotic systems and automated guided vehicles), and sophisticated quality control systems are driving improvements in efficiency, precision, and overall product quality.

- Regulatory Framework: Stringent environmental regulations (e.g., regarding waste disposal, emissions, and resource consumption), safety standards (e.g., OSHA compliance), and material traceability regulations impact manufacturing processes, material selection, and overall operational costs. Compliance necessitates investment in advanced technologies and processes.

- Competitive Substitutes: The increasing sophistication and capabilities of additive manufacturing (3D printing) and the growing availability of alternative, high-performance materials present a substantial competitive challenge, forcing manufacturers to differentiate through superior precision, customization capabilities, or cost-effectiveness.

- End-User Demographics: Automotive, electronics, medical devices, aerospace, and renewable energy sectors are key drivers, each presenting unique demands regarding material specifications, tolerances, and surface finishes.

- M&A Activity (2019-2024): xx M&A deals recorded, with an average deal value of xx million units. Analysis of the types of deals (e.g., horizontal vs. vertical integration) would provide further insight into market consolidation trends.

Metal Precision Turned Product Manufacturing Market Growth Trends & Insights

The metal precision turned product manufacturing market demonstrated a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). This robust growth trajectory is projected to continue at a CAGR of xx% during the forecast period (2025-2033), culminating in a market size of xx million units by 2033. Current market penetration stands at xx%, indicating significant untapped potential for expansion, particularly within emerging economies characterized by rapid industrialization and infrastructure development. Technological disruptions, notably the widespread adoption of Industry 4.0 technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and advanced data analytics, are driving substantial efficiency gains, enhanced product quality, and improved supply chain management. Furthermore, evolving consumer preferences, favoring higher-quality, customized products and components with enhanced durability and performance characteristics, are contributing to the market's expansion. The increasing demand for lightweight, high-strength, and precision-engineered components within the automotive, aerospace, and renewable energy sectors serves as a major growth catalyst.

Dominant Regions, Countries, or Segments in Metal Precision Turned Product Manufacturing Market

The Asia-Pacific region, particularly China, dominates the metal precision turned product manufacturing market, driven by a large manufacturing base, robust industrial growth, and supportive government policies. Within the segments, CNC operation holds the largest market share, reflecting the increasing adoption of advanced manufacturing technologies. The automotive sector constitutes the largest end-user segment, followed by electronics and healthcare.

- Leading Region: Asia-Pacific (xx% market share in 2024).

- Key Country: China (xx% of the regional market).

- Dominant Segment (Operation): CNC Operation (xx% market share in 2024).

- Dominant Segment (Machine Type): CNC Lathes/Turning Centers (xx% market share in 2024).

- Dominant Segment (End-User): Automotive Industry (xx% market share in 2024).

Metal Precision Turned Product Manufacturing Market Product Landscape

The market offers a diverse range of precision turned metal products, encompassing various materials (e.g., stainless steel, aluminum, brass), sizes, and finishes. Recent product innovations focus on improving dimensional accuracy, surface finish, and material strength. Advanced manufacturing techniques like micro-machining and multi-axis machining enable the production of highly complex components. Key selling propositions emphasize precision, quality, cost-effectiveness, and customization capabilities.

Key Drivers, Barriers & Challenges in Metal Precision Turned Product Manufacturing Market

Key Drivers:

- Increasing demand from key end-user industries (automotive, electronics, healthcare).

- Technological advancements in CNC machining and automation.

- Government initiatives promoting industrial automation and technological upgrades.

Key Challenges:

- Fluctuations in raw material prices (e.g., steel, aluminum).

- Intense competition from low-cost manufacturers.

- Skilled labor shortages in certain regions.

- Supply chain disruptions due to geopolitical factors.

Emerging Opportunities in Metal Precision Turned Product Manufacturing Market

- The burgeoning aerospace industry, driven by both commercial and defense applications, presents significant opportunities for manufacturers specializing in high-precision, lightweight components capable of withstanding extreme conditions.

- The rapidly expanding renewable energy sector (e.g., wind turbines, solar energy infrastructure) requires specialized components with high durability and precision, creating substantial demand for metal precision turned products.

- Increasing demand for customized and high-precision components, driven by the need for tailored solutions in diverse industries, fuels innovation and creates niche market opportunities for manufacturers offering specialized capabilities and design services.

- Expansion into new and emerging markets, especially in regions with rapid industrialization and infrastructure development, offers substantial untapped potential for growth and market share expansion.

- Development of sustainable and environmentally friendly manufacturing practices, such as the use of recycled materials and optimized energy consumption, aligns with growing sustainability concerns and presents a competitive advantage.

Growth Accelerators in the Metal Precision Turned Product Manufacturing Market Industry

Strategic partnerships and collaborations between manufacturers, technology providers (e.g., software companies developing advanced CAM software, automation equipment suppliers), and materials suppliers are driving innovation and accelerating market growth by fostering the development of advanced technologies and integrated solutions. Significant investments in advanced manufacturing technologies (e.g., multi-axis CNC machining centers, advanced robotics, automated quality control systems), coupled with strategic expansion into new geographical markets, are key growth catalysts. The adoption of Industry 4.0 principles, including data analytics for predictive maintenance and process optimization, digitalization of manufacturing processes, and advanced supply chain management, is optimizing efficiency, enhancing product quality, and improving overall responsiveness to market demands. A commitment to continuous improvement, process optimization, and skilled workforce development is also crucial for long-term success.

Key Players Shaping the Metal Precision Turned Product Manufacturing Market Market

- Zhejiang Rongyi Precision Machinery Co Ltd

- Kunshan Kesen Technology Co Ltd

- Suzhou Ruima Precision Industry Co Ltd

- Jiangsu Mimo Metal Co Ltd

- PMP Inc

- Precision Metal Products Company

- Jiangsu Jingyan Technology Co Ltd

- APCS

- 6 Other Companies

- 3 Other Companies

Notable Milestones in Metal Precision Turned Product Manufacturing Market Sector

- November 2023: Catamaran's planned investment in precision manufacturing startups signals growing interest in the sector.

- February 2023: Andra Tech Group's acquisition of DKH demonstrates consolidation trends within the market.

In-Depth Metal Precision Turned Product Manufacturing Market Market Outlook

The long-term outlook for the metal precision turned product manufacturing market remains positive, fueled by continuous technological advancements, increasing demand from key industries (particularly automotive, aerospace, and medical devices), and expansion into new and developing markets. Strategic investments in automation, digitalization (including data analytics and AI), sustainable manufacturing practices, and skilled workforce development are crucial for long-term competitiveness and success. This market presents considerable opportunities for both established players, leveraging their expertise and scale, and new entrants offering innovative solutions and specialized capabilities to capitalize on the growing demand for high-precision, customized, and sustainable components.

Metal Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled(CNC)

- 2.4. Lathes or Turning Center

- 2.5. Other Machine Types

-

3. End User

- 3.1. Industries

- 3.2. Automobile

- 3.3. Electronics

- 3.4. Defense and Healthcare

- 3.5. Other End Users

Metal Precision Turned Product Manufacturing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Rest of the World

Metal Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of Metal Precision Turned Product Manufacturing Market

Metal Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Booming Automotive sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled(CNC)

- 5.2.4. Lathes or Turning Center

- 5.2.5. Other Machine Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Industries

- 5.3.2. Automobile

- 5.3.3. Electronics

- 5.3.4. Defense and Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. North America Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operation

- 6.1.1. Manual Operation

- 6.1.2. CNC Operation

- 6.2. Market Analysis, Insights and Forecast - by Machine Types

- 6.2.1. Automatic Screw Machines

- 6.2.2. Rotary Transfer Machines

- 6.2.3. Computer Numerically Controlled(CNC)

- 6.2.4. Lathes or Turning Center

- 6.2.5. Other Machine Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Industries

- 6.3.2. Automobile

- 6.3.3. Electronics

- 6.3.4. Defense and Healthcare

- 6.3.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Operation

- 7. Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operation

- 7.1.1. Manual Operation

- 7.1.2. CNC Operation

- 7.2. Market Analysis, Insights and Forecast - by Machine Types

- 7.2.1. Automatic Screw Machines

- 7.2.2. Rotary Transfer Machines

- 7.2.3. Computer Numerically Controlled(CNC)

- 7.2.4. Lathes or Turning Center

- 7.2.5. Other Machine Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Industries

- 7.3.2. Automobile

- 7.3.3. Electronics

- 7.3.4. Defense and Healthcare

- 7.3.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Operation

- 8. Asia Pacific Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operation

- 8.1.1. Manual Operation

- 8.1.2. CNC Operation

- 8.2. Market Analysis, Insights and Forecast - by Machine Types

- 8.2.1. Automatic Screw Machines

- 8.2.2. Rotary Transfer Machines

- 8.2.3. Computer Numerically Controlled(CNC)

- 8.2.4. Lathes or Turning Center

- 8.2.5. Other Machine Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Industries

- 8.3.2. Automobile

- 8.3.3. Electronics

- 8.3.4. Defense and Healthcare

- 8.3.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Operation

- 9. Middle East and Africa Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operation

- 9.1.1. Manual Operation

- 9.1.2. CNC Operation

- 9.2. Market Analysis, Insights and Forecast - by Machine Types

- 9.2.1. Automatic Screw Machines

- 9.2.2. Rotary Transfer Machines

- 9.2.3. Computer Numerically Controlled(CNC)

- 9.2.4. Lathes or Turning Center

- 9.2.5. Other Machine Types

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Industries

- 9.3.2. Automobile

- 9.3.3. Electronics

- 9.3.4. Defense and Healthcare

- 9.3.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Operation

- 10. Rest of the World Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operation

- 10.1.1. Manual Operation

- 10.1.2. CNC Operation

- 10.2. Market Analysis, Insights and Forecast - by Machine Types

- 10.2.1. Automatic Screw Machines

- 10.2.2. Rotary Transfer Machines

- 10.2.3. Computer Numerically Controlled(CNC)

- 10.2.4. Lathes or Turning Center

- 10.2.5. Other Machine Types

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Industries

- 10.3.2. Automobile

- 10.3.3. Electronics

- 10.3.4. Defense and Healthcare

- 10.3.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Operation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zhejiang Rongyi Precision Machinery Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kunshan Kesen Technology Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Suzhou Ruima Precision Industry Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jiangsu Mimo Metal Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pmpinc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Precision Metal Products Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jiangsu Jingyan Technology Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 APCS*List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Zhejiang Rongyi Precision Machinery Co Ltd

List of Figures

- Figure 1: Global Metal Precision Turned Product Manufacturing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Metal Precision Turned Product Manufacturing Market Revenue (Million), by Operation 2025 & 2033

- Figure 3: North America Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Operation 2025 & 2033

- Figure 4: North America Metal Precision Turned Product Manufacturing Market Revenue (Million), by Machine Types 2025 & 2033

- Figure 5: North America Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Machine Types 2025 & 2033

- Figure 6: North America Metal Precision Turned Product Manufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Metal Precision Turned Product Manufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Metal Precision Turned Product Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Metal Precision Turned Product Manufacturing Market Revenue (Million), by Operation 2025 & 2033

- Figure 11: Europe Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Operation 2025 & 2033

- Figure 12: Europe Metal Precision Turned Product Manufacturing Market Revenue (Million), by Machine Types 2025 & 2033

- Figure 13: Europe Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Machine Types 2025 & 2033

- Figure 14: Europe Metal Precision Turned Product Manufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Metal Precision Turned Product Manufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Metal Precision Turned Product Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue (Million), by Operation 2025 & 2033

- Figure 19: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Operation 2025 & 2033

- Figure 20: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue (Million), by Machine Types 2025 & 2033

- Figure 21: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Machine Types 2025 & 2033

- Figure 22: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue (Million), by Operation 2025 & 2033

- Figure 27: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Operation 2025 & 2033

- Figure 28: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue (Million), by Machine Types 2025 & 2033

- Figure 29: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Machine Types 2025 & 2033

- Figure 30: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue (Million), by Operation 2025 & 2033

- Figure 35: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Operation 2025 & 2033

- Figure 36: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue (Million), by Machine Types 2025 & 2033

- Figure 37: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Machine Types 2025 & 2033

- Figure 38: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Metal Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 2: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 3: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 6: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 7: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 10: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 11: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 14: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 15: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 18: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 19: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 22: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 23: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Metal Precision Turned Product Manufacturing Market?

Key companies in the market include Zhejiang Rongyi Precision Machinery Co Ltd, Kunshan Kesen Technology Co Ltd, Suzhou Ruima Precision Industry Co Ltd, Jiangsu Mimo Metal Co Ltd, Pmpinc, Precision Metal Products Company, Jiangsu Jingyan Technology Co Ltd, APCS*List Not Exhaustive 6 3 Other Companies (Key Information/Overview.

3. What are the main segments of the Metal Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.06 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Booming Automotive sector.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

November 2023: Catamaran, a venture capital firm co-founded by Infosys co-founder N. Srinivasan, planned to diversify its portfolio with investments in precision manufacturing startups that can export and manufacture deep tech and automotive components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the Metal Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence