Key Insights

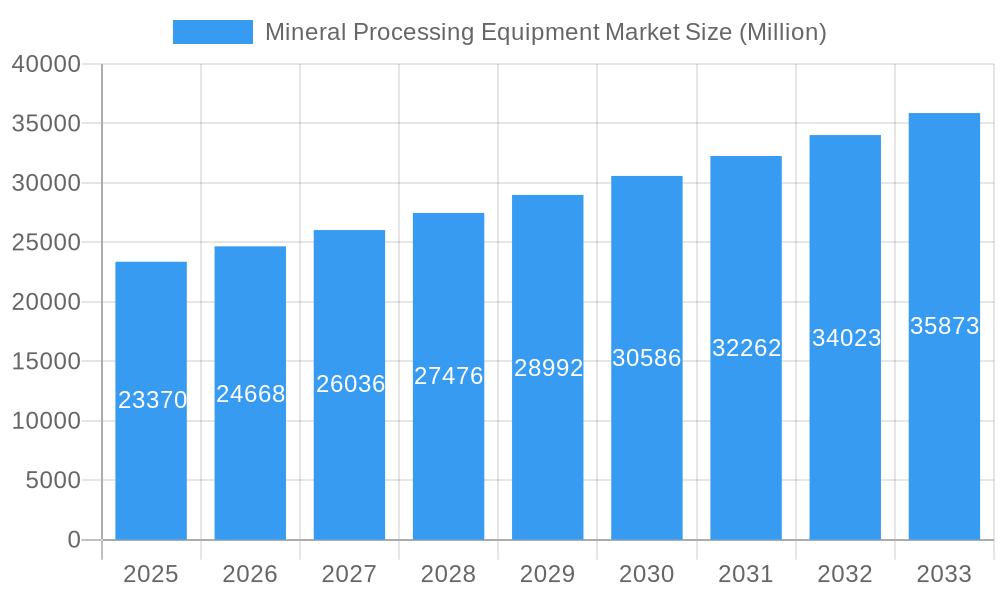

The global mineral processing equipment market, valued at $23.37 billion in 2025, is projected to experience robust growth, driven by increasing demand for minerals across various industries, particularly construction, automotive, and electronics. The market's Compound Annual Growth Rate (CAGR) of 5.35% from 2025 to 2033 indicates a significant expansion over the forecast period. Key growth drivers include the rising global infrastructure development, the increasing adoption of advanced mining technologies (like automation and data analytics) to improve efficiency and productivity, and the growing focus on sustainable mining practices to reduce environmental impact. The market is segmented by equipment type (crushers, feeders, conveyors, drills and breakers, others) and mineral mining sector (bauxite, iron, lithium, others), reflecting diverse applications and specialized equipment needs. While the market faces restraints such as fluctuating mineral prices and stringent environmental regulations, the long-term outlook remains positive, fueled by consistent demand for minerals and technological advancements. The Asia-Pacific region, particularly China and India, is expected to contribute substantially to market growth, driven by rapid industrialization and infrastructure development in these regions. Major players like Metso Outotec, Sandvik AB, and FLSmidth A/S are actively shaping market dynamics through strategic investments in R&D, mergers and acquisitions, and the introduction of innovative equipment.

Mineral Processing Equipment Market Market Size (In Billion)

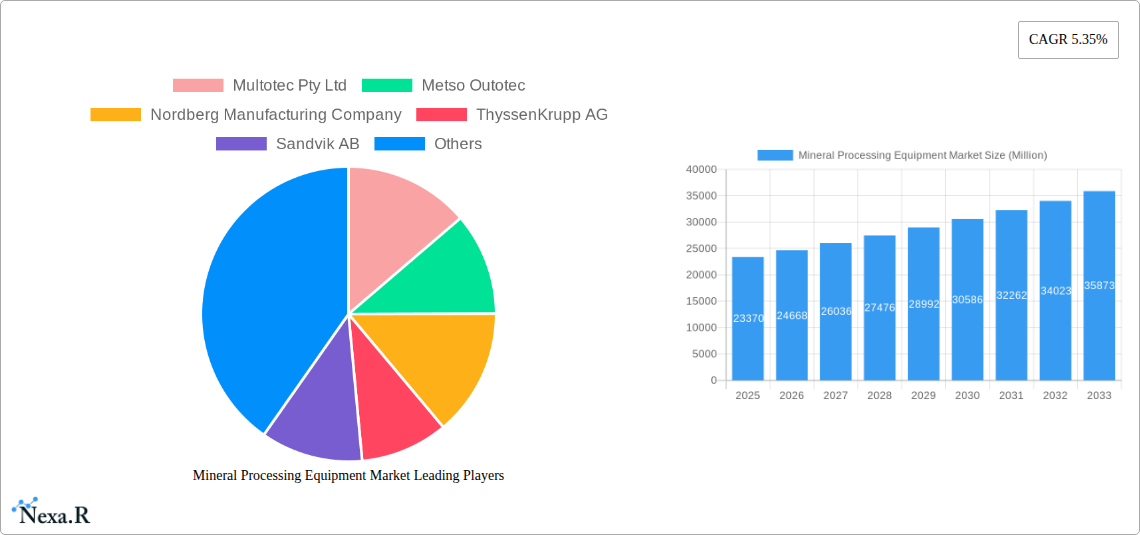

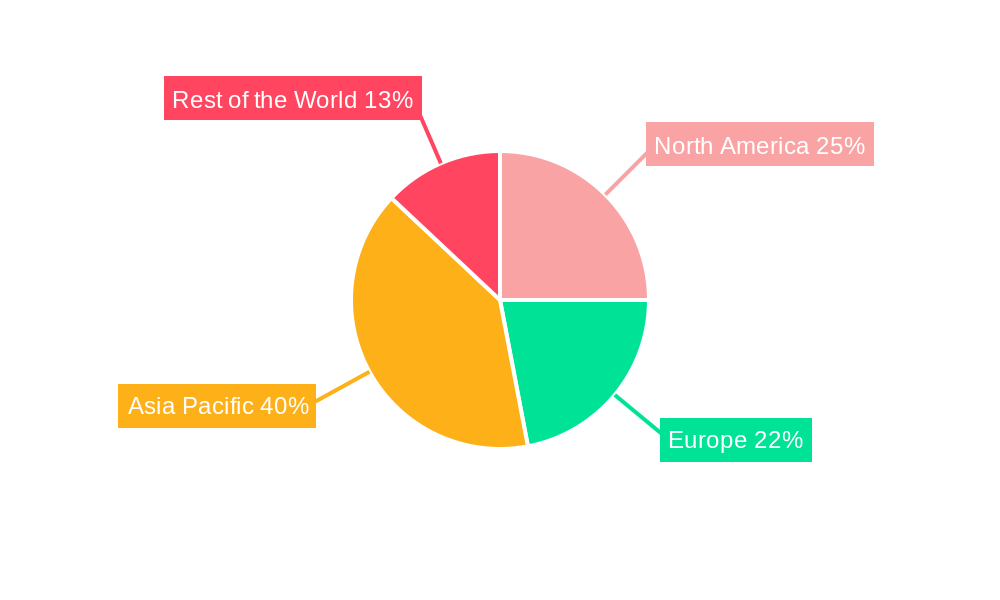

The competitive landscape is characterized by both established multinational corporations and specialized regional players. The market is witnessing a trend towards the adoption of sophisticated equipment offering higher efficiency, safety, and automation. This trend is further reinforced by a growing emphasis on energy efficiency and reduced operational costs. The continued exploration and exploitation of new mineral deposits, especially those rich in lithium and other critical minerals required for electric vehicle batteries and renewable energy technologies, is anticipated to significantly impact the growth trajectory of the market. While North America and Europe maintain significant market shares, the rapidly developing economies of the Asia-Pacific region are poised to become increasingly prominent market participants in the coming years. The market will likely witness further consolidation and strategic alliances between companies in the pursuit of enhanced market position and technology advancement.

Mineral Processing Equipment Market Company Market Share

Mineral Processing Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Mineral Processing Equipment market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). The report segments the market by equipment type (Crushers, Feeders, Conveyors, Drills & Breakers, Others) and mineral mining sector (Bauxite, Iron, Lithium, Others), offering granular insights into market dynamics, growth trends, and key players. With a focus on high-growth segments like Lithium processing and advancements in automation, this report is essential for industry professionals, investors, and strategic decision-makers. The market size is projected to reach xx Million units by 2033.

Mineral Processing Equipment Market Dynamics & Structure

The mineral processing equipment market is characterized by a moderately concentrated landscape with several multinational corporations holding significant market share. Metso Outotec, FLSmidth A/S, and Sandvik AB are among the leading players, accounting for approximately xx% of the global market in 2024. However, the market also features numerous regional and specialized players, fostering competition and innovation.

Technological innovation is a key driver, with advancements in automation, digitalization, and sustainable technologies shaping industry trends. Stringent environmental regulations and the increasing demand for efficient and eco-friendly mineral extraction methods are also significant drivers. The market faces challenges from substitute materials and alternative processing techniques.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2024.

- Technological Innovation: Automation, digitalization, and sustainable technologies are key drivers.

- Regulatory Framework: Stringent environmental regulations impact equipment design and adoption.

- Competitive Substitutes: Alternative processing techniques and substitute materials pose challenges.

- M&A Activity: Moderate M&A activity observed in the historical period (2019-2024), with approximately xx deals recorded. Deals primarily focused on expanding product portfolios and geographic reach.

- End-User Demographics: Primarily large-scale mining operations, with a growing segment of smaller, independent miners.

Mineral Processing Equipment Market Growth Trends & Insights

The global mineral processing equipment market experienced steady growth during the historical period (2019-2024), driven by increased mining activities and infrastructure development across emerging economies. The market is expected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the rising demand for minerals driven by global industrialization and technological advancements across various sectors. Significant technological disruptions, such as the increasing adoption of automation and AI-powered solutions in mineral processing, are accelerating market expansion and improving efficiency. Consumer behavior shifts, such as the emphasis on sustainable mining practices, are also influencing market dynamics. The market penetration rate for advanced technologies like gearless conveyor drives is increasing, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Mineral Processing Equipment Market

The Asia-Pacific region is the dominant market, driven by robust mining activities and infrastructure development in countries like China, Australia, and India. North America and Europe also hold substantial market shares, but their growth rates are comparatively slower. Within the equipment segments, crushers and conveyors account for the largest market share, reflecting their essential role in mineral processing operations. The lithium mining sector is experiencing significant growth, driven by the increasing demand for electric vehicle batteries.

- Key Drivers (Asia-Pacific):

- Robust mining activities

- Extensive infrastructure development

- Government support for mining and related industries

- Dominant Segments:

- Crushers (xx% market share in 2024)

- Conveyors (xx% market share in 2024)

- Lithium Mining Sector (projected xx% CAGR 2025-2033)

Mineral Processing Equipment Market Product Landscape

The mineral processing equipment market is characterized by a comprehensive and evolving product landscape, encompassing everything from foundational machinery like crushers, screens, and feeders to highly sophisticated, integrated automated systems. Recent advancements are prominently focused on enhancing operational efficiency through improved throughput and reduced energy consumption. Safety remains a paramount concern, with innovations incorporating advanced protective features and ergonomic designs. The pervasive integration of digital technologies is a significant trend, enabling real-time monitoring, data analytics, and advanced process optimization. This digital transformation is further amplified by the burgeoning influence of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are instrumental in developing predictive maintenance systems, which drastically minimize unplanned downtime and optimize overall operational efficiency and asset lifespan. Furthermore, there's a growing emphasis on developing equipment with a minimized environmental footprint, addressing concerns around dust suppression, water conservation, and waste reduction.

Key Drivers, Barriers & Challenges in Mineral Processing Equipment Market

Key Drivers:

- Rising demand for minerals due to industrialization and technological advancements.

- Increasing adoption of automation and digital technologies in mining operations.

- Growing focus on sustainable and environmentally friendly mining practices.

Key Challenges:

- Fluctuations in commodity prices impacting investment decisions.

- Stringent environmental regulations and compliance costs.

- Supply chain disruptions and material shortages. The impact of these shortages was estimated at a xx% reduction in production during Q3 2024.

- Intense competition from established and emerging players.

Emerging Opportunities in Mineral Processing Equipment Market

- The escalating global demand for critical minerals such as lithium, cobalt, nickel, and rare earth elements, driven by the rapid expansion of the electric vehicle (EV) and renewable energy sectors, presents a substantial opportunity.

- The exploration and development of mining activities in previously untapped geographical regions and emerging markets are creating new frontiers for equipment manufacturers.

- The continuous development and adoption of cutting-edge technologies, including AI-powered process optimization, autonomous operations, advanced sensor technologies, and sophisticated predictive maintenance solutions, are opening up new avenues for innovation and market penetration.

- A growing focus on circular economy principles and the reprocessing of mine tailings and waste rock for valuable mineral recovery is creating demand for specialized equipment and processing solutions.

Growth Accelerators in the Mineral Processing Equipment Market Industry

Technological advancements, strategic partnerships, and market expansion into emerging economies are key growth accelerators. The development of more sustainable and resource-efficient equipment is a significant driver. Strategic alliances between equipment manufacturers and mining companies are fostering innovation and driving the adoption of advanced technologies.

Key Players Shaping the Mineral Processing Equipment Market Market

- Multotec Pty Ltd

- Metso Outotec

- Terex Corporation

- FEECO International Inc

- FLSmidth A/S

- Komatsu Ltd

- Nordberg Manufacturing Company

- ThyssenKrupp AG

- Sandvik AB

- Sotecma

- McCloskey International

- Wirtgen Group

- McLanahan Corporation

- TAKRAF GmbH

Notable Milestones in Mineral Processing Equipment Market Sector

- March 2024: TAKRAF and ABB solidified their strategic partnership, with a particular emphasis on advancing gearless conveyor drive technology to enhance sustainability and operational efficiency in mining operations.

- July 2023: Metso secured a significant EUR 20 million (USD 22.35 million) order from First Quantum Minerals to supply critical equipment for the expansion of the Kansanshi copper mine, highlighting continued investment in large-scale mining projects.

- January 2024: FLSmidth announced the acquisition of Valmet's automation business, further strengthening its digital offerings and integrated solutions for the minerals processing industry.

- November 2023: Sandvik launched its new range of autonomous drilling rigs, showcasing advancements in automation and remote operation capabilities to improve safety and productivity.

In-Depth Mineral Processing Equipment Market Market Outlook

The mineral processing equipment market is projected to experience robust and sustained growth, propelled by the evergreen, long-term demand for essential minerals across various industries and the accelerating adoption of advanced, digital-centric technologies. Strategic collaborations, groundbreaking technological innovations, and strategic expansion into burgeoning global markets are anticipated to significantly amplify the market's potential. A critical driver for future growth will be the increasing imperative for sustainable mining practices. This will undoubtedly fuel a strong demand for eco-friendly, energy-efficient, and environmentally responsible equipment, presenting substantial and lucrative opportunities for pioneering companies that can deliver innovative solutions aligned with these critical sustainability goals.

Mineral Processing Equipment Market Segmentation

-

1. Mineral Mining Sector

- 1.1. Bauxite

- 1.2. Iron

- 1.3. Lithium

- 1.4. Others

-

2. Equipment

- 2.1. Crushers

- 2.2. Feeders

- 2.3. Conveyors

- 2.4. Drills and Breakers

- 2.5. Others

Mineral Processing Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Mineral Processing Equipment Market Regional Market Share

Geographic Coverage of Mineral Processing Equipment Market

Mineral Processing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Metals and Minerals to Fuel the Market

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations and Community Concerns may Hinder the Market

- 3.4. Market Trends

- 3.4.1. Iron is Poised to be the Fastest-growing Segment Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mineral Processing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 5.1.1. Bauxite

- 5.1.2. Iron

- 5.1.3. Lithium

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Equipment

- 5.2.1. Crushers

- 5.2.2. Feeders

- 5.2.3. Conveyors

- 5.2.4. Drills and Breakers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 6. North America Mineral Processing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 6.1.1. Bauxite

- 6.1.2. Iron

- 6.1.3. Lithium

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Equipment

- 6.2.1. Crushers

- 6.2.2. Feeders

- 6.2.3. Conveyors

- 6.2.4. Drills and Breakers

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 7. Europe Mineral Processing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 7.1.1. Bauxite

- 7.1.2. Iron

- 7.1.3. Lithium

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Equipment

- 7.2.1. Crushers

- 7.2.2. Feeders

- 7.2.3. Conveyors

- 7.2.4. Drills and Breakers

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 8. Asia Pacific Mineral Processing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 8.1.1. Bauxite

- 8.1.2. Iron

- 8.1.3. Lithium

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Equipment

- 8.2.1. Crushers

- 8.2.2. Feeders

- 8.2.3. Conveyors

- 8.2.4. Drills and Breakers

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 9. Rest of the World Mineral Processing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 9.1.1. Bauxite

- 9.1.2. Iron

- 9.1.3. Lithium

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Equipment

- 9.2.1. Crushers

- 9.2.2. Feeders

- 9.2.3. Conveyors

- 9.2.4. Drills and Breakers

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Mineral Mining Sector

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Multotec Pty Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Metso Outotec

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nordberg Manufacturing Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ThyssenKrupp AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sandvik AB

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Terex Corporatio

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 FEECO International Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 FLSmidth A/S

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Komatsu Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sotecma

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 McCloskey International

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Wirtgen Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 McLanahan Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 TAKRAF GmbH

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Multotec Pty Ltd

List of Figures

- Figure 1: Global Mineral Processing Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mineral Processing Equipment Market Revenue (Million), by Mineral Mining Sector 2025 & 2033

- Figure 3: North America Mineral Processing Equipment Market Revenue Share (%), by Mineral Mining Sector 2025 & 2033

- Figure 4: North America Mineral Processing Equipment Market Revenue (Million), by Equipment 2025 & 2033

- Figure 5: North America Mineral Processing Equipment Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 6: North America Mineral Processing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Mineral Processing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Mineral Processing Equipment Market Revenue (Million), by Mineral Mining Sector 2025 & 2033

- Figure 9: Europe Mineral Processing Equipment Market Revenue Share (%), by Mineral Mining Sector 2025 & 2033

- Figure 10: Europe Mineral Processing Equipment Market Revenue (Million), by Equipment 2025 & 2033

- Figure 11: Europe Mineral Processing Equipment Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 12: Europe Mineral Processing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Mineral Processing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Mineral Processing Equipment Market Revenue (Million), by Mineral Mining Sector 2025 & 2033

- Figure 15: Asia Pacific Mineral Processing Equipment Market Revenue Share (%), by Mineral Mining Sector 2025 & 2033

- Figure 16: Asia Pacific Mineral Processing Equipment Market Revenue (Million), by Equipment 2025 & 2033

- Figure 17: Asia Pacific Mineral Processing Equipment Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 18: Asia Pacific Mineral Processing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Mineral Processing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Mineral Processing Equipment Market Revenue (Million), by Mineral Mining Sector 2025 & 2033

- Figure 21: Rest of the World Mineral Processing Equipment Market Revenue Share (%), by Mineral Mining Sector 2025 & 2033

- Figure 22: Rest of the World Mineral Processing Equipment Market Revenue (Million), by Equipment 2025 & 2033

- Figure 23: Rest of the World Mineral Processing Equipment Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 24: Rest of the World Mineral Processing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Mineral Processing Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mineral Processing Equipment Market Revenue Million Forecast, by Mineral Mining Sector 2020 & 2033

- Table 2: Global Mineral Processing Equipment Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 3: Global Mineral Processing Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Mineral Processing Equipment Market Revenue Million Forecast, by Mineral Mining Sector 2020 & 2033

- Table 5: Global Mineral Processing Equipment Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 6: Global Mineral Processing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Mineral Processing Equipment Market Revenue Million Forecast, by Mineral Mining Sector 2020 & 2033

- Table 11: Global Mineral Processing Equipment Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 12: Global Mineral Processing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Mineral Processing Equipment Market Revenue Million Forecast, by Mineral Mining Sector 2020 & 2033

- Table 19: Global Mineral Processing Equipment Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 20: Global Mineral Processing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: India Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Mineral Processing Equipment Market Revenue Million Forecast, by Mineral Mining Sector 2020 & 2033

- Table 27: Global Mineral Processing Equipment Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 28: Global Mineral Processing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Mineral Processing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mineral Processing Equipment Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the Mineral Processing Equipment Market?

Key companies in the market include Multotec Pty Ltd, Metso Outotec, Nordberg Manufacturing Company, ThyssenKrupp AG, Sandvik AB, Terex Corporatio, FEECO International Inc, FLSmidth A/S, Komatsu Ltd, Sotecma, McCloskey International, Wirtgen Group, McLanahan Corporation, TAKRAF GmbH.

3. What are the main segments of the Mineral Processing Equipment Market?

The market segments include Mineral Mining Sector, Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Metals and Minerals to Fuel the Market.

6. What are the notable trends driving market growth?

Iron is Poised to be the Fastest-growing Segment Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations and Community Concerns may Hinder the Market.

8. Can you provide examples of recent developments in the market?

March 2024: TAKRAF, a prominent player in bulk material handling solutions, reaffirmed its strategic partnership with ABB, a global leader in electrification and automation technology. This renewal focuses on the continued deployment of the gearless conveyor drive (GCD) technology, which is aimed at fostering a more sustainable and resource-efficient future. This initiative underscores the commitment of both entities to advancing sustainability in the mineral processing equipment market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mineral Processing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mineral Processing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mineral Processing Equipment Market?

To stay informed about further developments, trends, and reports in the Mineral Processing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence