Key Insights

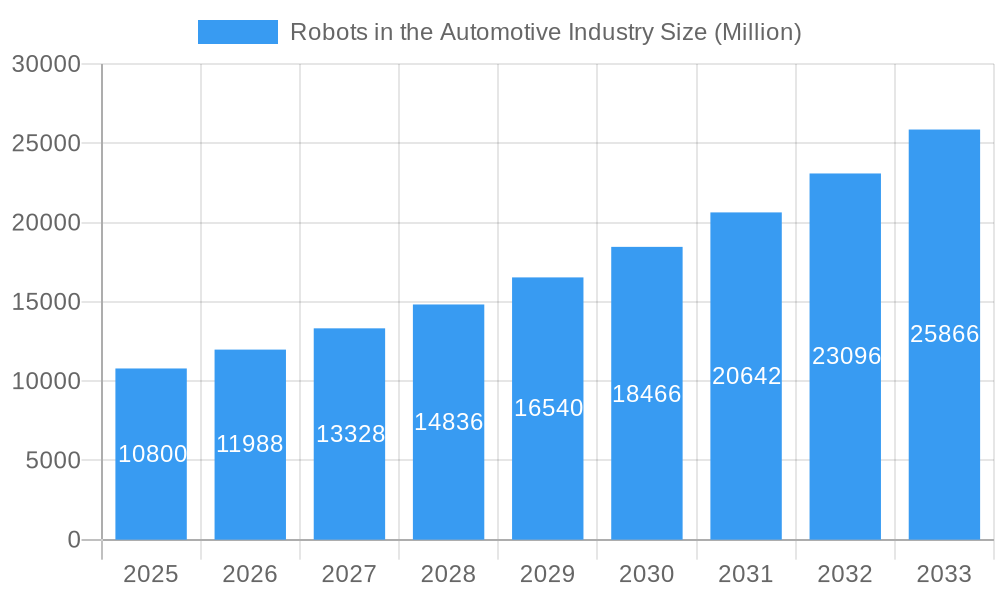

The global automotive robotics market, valued at $10.80 billion in 2025, is projected to experience robust growth, driven by increasing automation in vehicle manufacturing and the rising demand for enhanced production efficiency. The market's Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033 signifies significant expansion opportunities. Key drivers include the rising adoption of advanced technologies like AI and machine learning in robotics, leading to improved precision, speed, and flexibility in automotive assembly lines. Furthermore, the automotive industry's ongoing shift towards electric vehicles (EVs) and the consequent need for specialized robotic systems for battery production and assembly contribute to market expansion. The increasing complexity of modern vehicles, coupled with the need for higher production volumes, necessitates the use of sophisticated robotic systems capable of handling intricate tasks. Growth is further fueled by government initiatives promoting industrial automation and technological advancements aimed at improving robot safety and human-robot collaboration. While initial investment costs remain a restraint, the long-term return on investment (ROI) associated with increased productivity and reduced labor costs is compelling manufacturers to adopt automation solutions.

Robots in the Automotive Industry Market Size (In Billion)

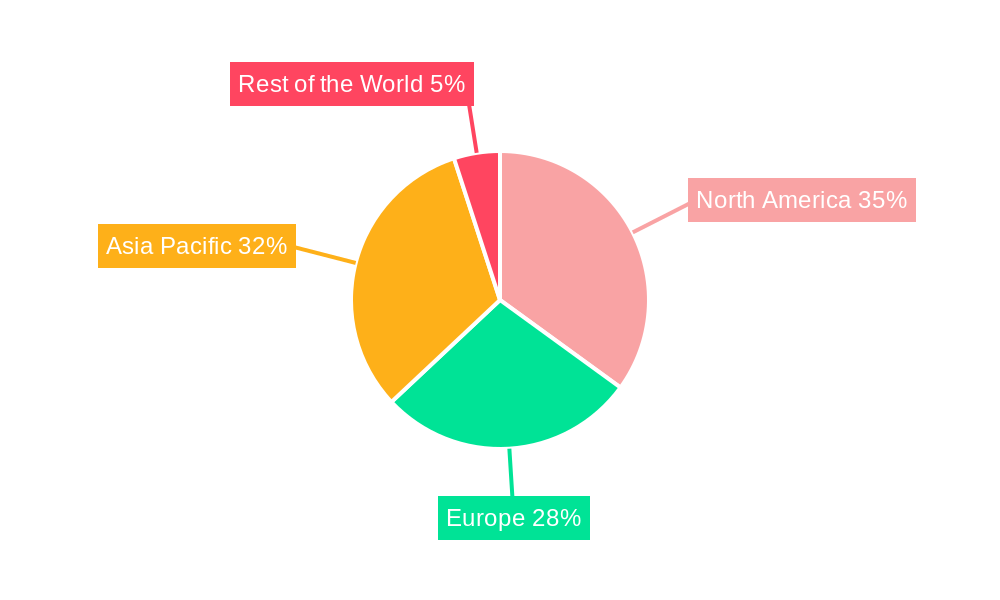

Segment-wise analysis reveals strong growth across various robotic types, with articulated robots leading due to their versatility in handling complex assembly tasks. Similarly, the demand for welding and painting robots remains high due to their efficiency in automating these critical processes. Geographically, North America and Asia Pacific are expected to dominate the market, driven by strong automotive manufacturing hubs in these regions. The increasing focus on sustainability and reduced environmental impact further drives the adoption of energy-efficient robotic systems, creating new growth avenues for manufacturers. Competition within the market is intense, with major players such as ABB, FANUC, KUKA, and Yaskawa continuously innovating to stay ahead of the curve. This competitive landscape ensures a continuous push towards technological advancements and the development of more advanced and cost-effective robotic solutions. The continued rise of Industry 4.0 and smart factories will only accelerate the market's growth in the coming years.

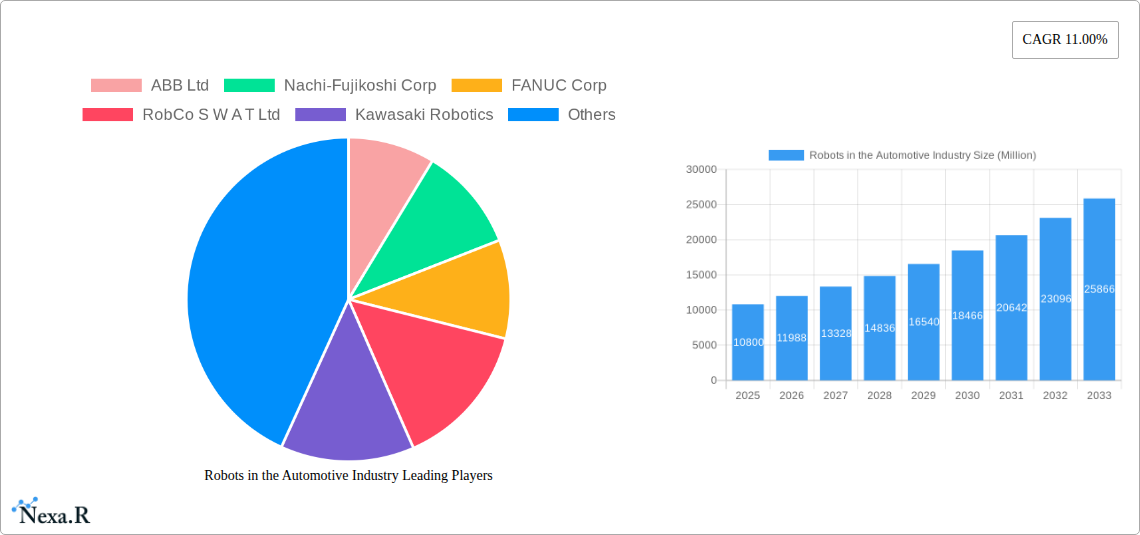

Robots in the Automotive Industry Company Market Share

Robots in the Automotive Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Robots in the Automotive Industry market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. With a focus on both parent (Industrial Robotics) and child (Automotive Robotics) markets, this report is essential for industry professionals seeking to understand and capitalize on the transformative potential of robotics in automotive manufacturing. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Market values are expressed in million units.

Robots in the Automotive Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends within the automotive robotics sector. The global automotive robotics market is experiencing significant growth, driven by the increasing demand for automation in vehicle manufacturing and component production.

- Market Concentration: The market is moderately concentrated, with key players like ABB Ltd, FANUC Corp, and KUKA Robotics holding substantial market share (estimated at xx% combined in 2025). However, the presence of numerous smaller, specialized players indicates a dynamic competitive landscape.

- Technological Innovation: Advancements in artificial intelligence (AI), machine learning (ML), and sensor technologies are driving the adoption of more sophisticated and efficient robots. This includes collaborative robots (cobots) and autonomous mobile robots (AMRs) which are transforming manufacturing processes.

- Regulatory Frameworks: Government regulations regarding workplace safety and environmental impact are influencing the design and deployment of robots. Compliance standards and safety certifications are crucial aspects for manufacturers.

- Competitive Product Substitutes: While robotic systems offer superior speed and precision, alternative automation methods, such as advanced CNC machining, pose some competitive pressure.

- End-User Demographics: The primary end-users are vehicle manufacturers (OEMs) and automotive component manufacturers (Tier 1 & Tier 2 suppliers), with OEMs accounting for a larger share of the market (estimated at xx% in 2025).

- M&A Trends: The automotive robotics industry has witnessed a moderate number of mergers and acquisitions (M&A) in recent years (xx deals in 2019-2024), primarily driven by companies seeking to expand their product portfolio and market reach.

Robots in the Automotive Industry Growth Trends & Insights

The automotive robotics market is exhibiting robust growth, driven by the increasing adoption of automation across the automotive value chain. The market size is projected to reach xx million units by 2033, demonstrating a CAGR of xx% during the forecast period. This growth is attributed to factors such as increased productivity, improved product quality, and reduced labor costs. Technological advancements like the integration of AI and the rise of AMRs are further accelerating market adoption. Market penetration among automotive manufacturers is also increasing significantly, with xx% of manufacturing processes expected to be automated by 2033.

Dominant Regions, Countries, or Segments in Robots in the Automotive Industry

The automotive robotics market is geographically diverse, with significant contributions from North America, Europe, and Asia. However, Asia, particularly China and Japan, currently holds a dominant position (estimated at xx% of the global market share in 2025) due to the high concentration of automotive manufacturing and a robust electronics manufacturing sector supporting robot development.

- By Component Type: Robotic arms constitute the largest segment (xx million units in 2025) driven by their versatility in various manufacturing processes. Controllers and sensors are also experiencing significant growth.

- By Product Type: Articulated robots dominate due to their dexterity and adaptability (xx million units in 2025), followed by SCARA robots for specific applications.

- By Function Type: Welding robots maintain a significant share (xx million units in 2025), crucial for vehicle body assembly. Painting and assembly/disassembly robots also hold considerable market share.

- By End-user Type: Vehicle manufacturers represent the largest end-user segment (xx million units in 2025), followed by automotive component manufacturers.

Key growth drivers for the dominant regions include government support for automation, investments in advanced manufacturing infrastructure, and a highly developed automotive supply chain. Growth potential remains high in developing economies as well due to increasing automotive production and the need for enhanced manufacturing efficiency.

Robots in the Automotive Industry Product Landscape

The automotive robotics market is characterized by a wide array of products, ranging from traditional industrial robots to advanced collaborative robots and autonomous mobile robots. Key innovations include improved precision, enhanced safety features, increased payload capacities, and better integration with existing manufacturing systems. Many robots now feature advanced sensors and AI capabilities, enabling greater flexibility and adaptability to various manufacturing tasks. The development of robots tailored to specific automotive processes, such as highly precise welding and intricate assembly tasks, is a key trend.

Key Drivers, Barriers & Challenges in Robots in the Automotive Industry

Key Drivers: The primary drivers are the need for increased efficiency and productivity in automotive manufacturing, the rising cost of labor, and government initiatives promoting automation. Technological advancements and improvements in robot design are further fueling market expansion.

Challenges: High initial investment costs, the need for skilled labor for integration and maintenance, and concerns about job displacement are significant challenges. Supply chain disruptions and geopolitical uncertainties can also impact market growth. The increasing complexity of robots and their integration into production lines requires significant expertise and technical know-how, resulting in a potential shortage of skilled workforce. Estimated implementation cost may act as a barrier to some smaller manufacturers.

Emerging Opportunities in Robots in the Automotive Industry

Emerging opportunities exist in the development and adoption of collaborative robots (cobots) for safer and more efficient human-robot interaction in manufacturing environments. The rise of autonomous mobile robots (AMRs) for material handling and logistics within factories promises significant improvements in efficiency. The demand for customized solutions and specialized robots tailored to specific automotive processes, including lightweight robots for advanced materials like carbon fiber, also presents a considerable growth opportunity.

Growth Accelerators in the Robots in the Automotive Industry Industry

Several factors will accelerate the growth of the automotive robotics market in the coming years. These include continuous technological advancements, leading to more efficient, versatile, and safer robots. Strategic partnerships between robotics companies and automotive manufacturers to develop customized solutions will also play a crucial role. Finally, expanding the adoption of robotics into the broader automotive supply chain, including smaller component manufacturers, will drive substantial growth.

Key Players Shaping the Robots in the Automotive Industry Market

- ABB Ltd

- Nachi-Fujikoshi Corp

- FANUC Corp

- RobCo S W A T Ltd

- Kawasaki Robotics

- Omron Adept Robotics

- KUKA Robotics

- Honda Motor Co Ltd

- Harmonic Drive System

- Yaskawa Electric Corporation

Notable Milestones in Robots in the Automotive Industry Sector

- November 2023: ABB Robotics expands its industrial SCARA robot portfolio with the IRB 930, enhancing its market position.

- August 2023: Kia announces plans to launch a new automotive robot in 2024, in collaboration with Boston Dynamics, signaling increased interest in collaborative robotics.

- September 2023: OTTO Motors unveils the OTTO 1200 AMR, showcasing advancements in heavy-duty mobile robotics for compact environments.

In-Depth Robots in the Automotive Industry Market Outlook

The future of the automotive robotics market is exceptionally promising. Continuous technological advancements, particularly in AI and machine learning, will drive the development of increasingly sophisticated and adaptable robots. Strategic collaborations between robotics companies and automotive OEMs will lead to innovative solutions tailored to specific manufacturing needs, further boosting market growth. Expanding automation beyond major manufacturers to encompass the wider automotive supply chain will unlock new growth opportunities. The integration of robots into smart factories and the adoption of Industry 4.0 principles will create a significant demand for advanced robotics solutions.

Robots in the Automotive Industry Segmentation

-

1. End-user Type

- 1.1. Vehicle Manufacturers

- 1.2. Automotive Component Manufacturers

-

2. Component Type

- 2.1. Controllers

- 2.2. Robotic Arms

- 2.3. End Effectors

- 2.4. Drive and Sensors

-

3. Product Type

- 3.1. Cartesian Robots

- 3.2. SCARA Robots

- 3.3. Articulated Robots

- 3.4. Other Product Types

-

4. Function Type

- 4.1. Welding Robots

- 4.2. Painting Robots

- 4.3. Assembling and Disassembling Robots

- 4.4. Cutting and Milling Robots

Robots in the Automotive Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Robots in the Automotive Industry Regional Market Share

Geographic Coverage of Robots in the Automotive Industry

Robots in the Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. Welding Robots Hold the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 5.1.1. Vehicle Manufacturers

- 5.1.2. Automotive Component Manufacturers

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Controllers

- 5.2.2. Robotic Arms

- 5.2.3. End Effectors

- 5.2.4. Drive and Sensors

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Cartesian Robots

- 5.3.2. SCARA Robots

- 5.3.3. Articulated Robots

- 5.3.4. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Function Type

- 5.4.1. Welding Robots

- 5.4.2. Painting Robots

- 5.4.3. Assembling and Disassembling Robots

- 5.4.4. Cutting and Milling Robots

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 6. North America Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 6.1.1. Vehicle Manufacturers

- 6.1.2. Automotive Component Manufacturers

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Controllers

- 6.2.2. Robotic Arms

- 6.2.3. End Effectors

- 6.2.4. Drive and Sensors

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Cartesian Robots

- 6.3.2. SCARA Robots

- 6.3.3. Articulated Robots

- 6.3.4. Other Product Types

- 6.4. Market Analysis, Insights and Forecast - by Function Type

- 6.4.1. Welding Robots

- 6.4.2. Painting Robots

- 6.4.3. Assembling and Disassembling Robots

- 6.4.4. Cutting and Milling Robots

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 7. Europe Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 7.1.1. Vehicle Manufacturers

- 7.1.2. Automotive Component Manufacturers

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Controllers

- 7.2.2. Robotic Arms

- 7.2.3. End Effectors

- 7.2.4. Drive and Sensors

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Cartesian Robots

- 7.3.2. SCARA Robots

- 7.3.3. Articulated Robots

- 7.3.4. Other Product Types

- 7.4. Market Analysis, Insights and Forecast - by Function Type

- 7.4.1. Welding Robots

- 7.4.2. Painting Robots

- 7.4.3. Assembling and Disassembling Robots

- 7.4.4. Cutting and Milling Robots

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 8. Asia Pacific Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 8.1.1. Vehicle Manufacturers

- 8.1.2. Automotive Component Manufacturers

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Controllers

- 8.2.2. Robotic Arms

- 8.2.3. End Effectors

- 8.2.4. Drive and Sensors

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Cartesian Robots

- 8.3.2. SCARA Robots

- 8.3.3. Articulated Robots

- 8.3.4. Other Product Types

- 8.4. Market Analysis, Insights and Forecast - by Function Type

- 8.4.1. Welding Robots

- 8.4.2. Painting Robots

- 8.4.3. Assembling and Disassembling Robots

- 8.4.4. Cutting and Milling Robots

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 9. Rest of the World Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 9.1.1. Vehicle Manufacturers

- 9.1.2. Automotive Component Manufacturers

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Controllers

- 9.2.2. Robotic Arms

- 9.2.3. End Effectors

- 9.2.4. Drive and Sensors

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Cartesian Robots

- 9.3.2. SCARA Robots

- 9.3.3. Articulated Robots

- 9.3.4. Other Product Types

- 9.4. Market Analysis, Insights and Forecast - by Function Type

- 9.4.1. Welding Robots

- 9.4.2. Painting Robots

- 9.4.3. Assembling and Disassembling Robots

- 9.4.4. Cutting and Milling Robots

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nachi-Fujikoshi Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FANUC Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 RobCo S W A T Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kawasaki Robotics

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Omron Adept Robotics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KUKA Robotics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Honda Motor Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Harmonic Drive System

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yaskawa Electric Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Global Robots in the Automotive Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 3: North America Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 4: North America Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 5: North America Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 6: North America Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 7: North America Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 9: North America Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: North America Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 13: Europe Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 14: Europe Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 15: Europe Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Europe Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Europe Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 19: Europe Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 20: Europe Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 25: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 26: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 29: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 30: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 33: Rest of the World Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 34: Rest of the World Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 35: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 36: Rest of the World Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Rest of the World Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 39: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 40: Rest of the World Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 2: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 3: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 5: Global Robots in the Automotive Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 7: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 8: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 10: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 15: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 16: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 18: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 24: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 25: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 27: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Korea Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 34: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 35: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 37: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South America Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Middle East and Africa Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robots in the Automotive Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Robots in the Automotive Industry?

Key companies in the market include ABB Ltd, Nachi-Fujikoshi Corp, FANUC Corp, RobCo S W A T Ltd, Kawasaki Robotics, Omron Adept Robotics, KUKA Robotics, Honda Motor Co Ltd, Harmonic Drive System, Yaskawa Electric Corporation.

3. What are the main segments of the Robots in the Automotive Industry?

The market segments include End-user Type, Component Type, Product Type, Function Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Welding Robots Hold the Highest Share.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

September 2023: OTTO Motors announced the OTTO 1200, which it claimed is the highest-performing, heavy-duty mobile robot for compact environments. It can safely move payloads of up to 1,200 kg (2,650 lb). The autonomous mobile robot (AMR) is equipped with patented adaptive fieldset technology to quickly and safely maneuver around people in narrow spaces, as claimed by OTTO Motors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robots in the Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robots in the Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robots in the Automotive Industry?

To stay informed about further developments, trends, and reports in the Robots in the Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence