Key Insights

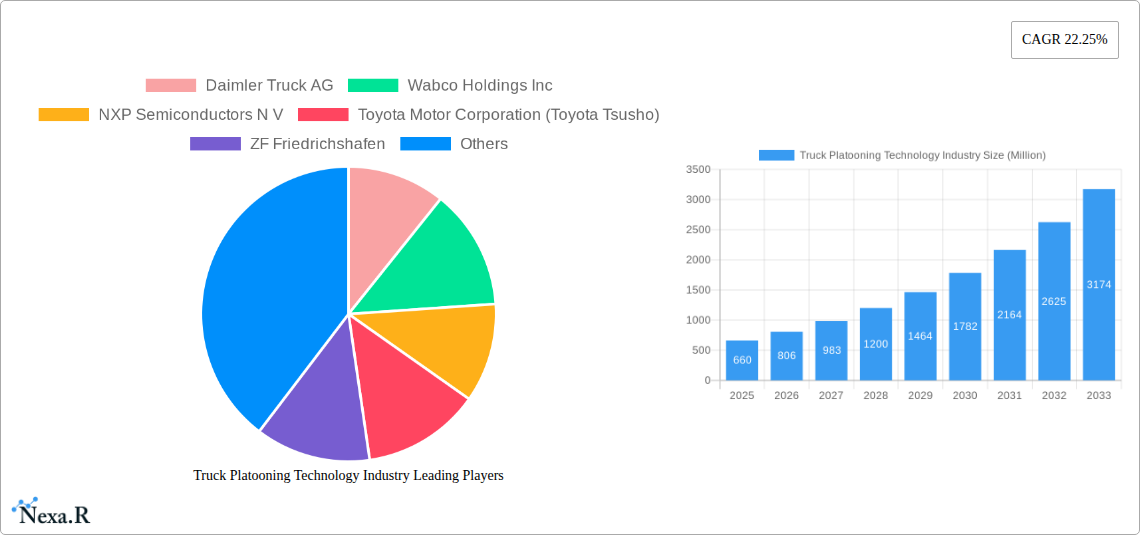

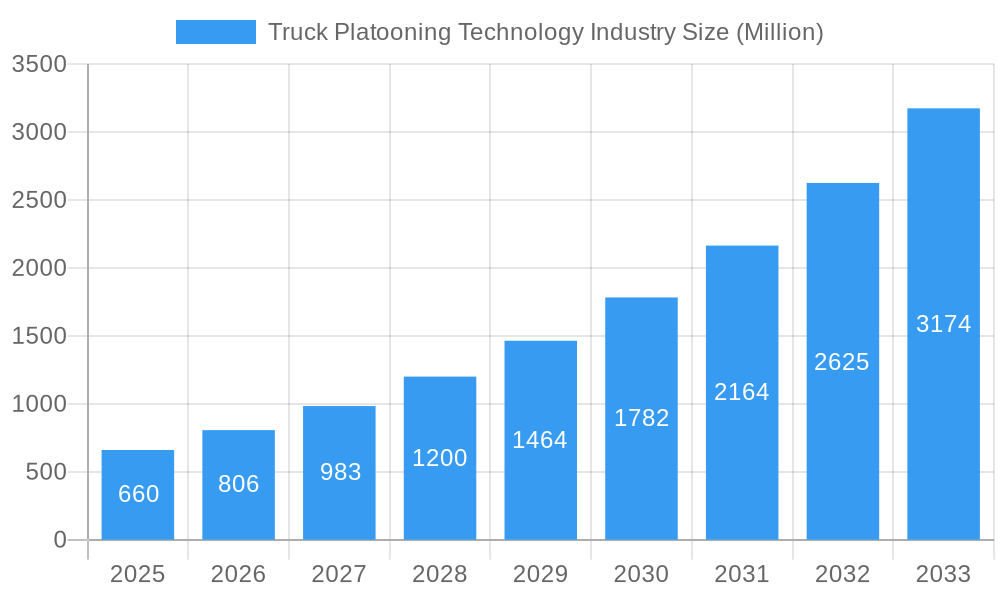

The global truck platooning technology market is experiencing robust growth, projected to reach a significant size driven by the increasing demand for fuel efficiency, enhanced safety, and reduced transportation costs. The market's Compound Annual Growth Rate (CAGR) of 22.25% from 2019 to 2024 indicates a strong upward trajectory, suggesting continued momentum through 2033. Key drivers include stringent emission regulations pushing for fuel-efficient solutions, escalating fuel prices, and a growing focus on improving road safety. Technological advancements in areas like adaptive cruise control, automated emergency braking, and vehicle-to-vehicle (V2V) communication are further accelerating market expansion. The market is segmented by platooning type (driver-assistive and autonomous), technology type (various advanced driver-assistance systems (ADAS)), and infrastructure type (V2V, V2I, GPS). While initial infrastructure investment presents a challenge, the long-term benefits of reduced operational costs and improved logistics efficiency are strong incentives for adoption. The competitive landscape comprises major automotive manufacturers, technology providers, and Tier-1 suppliers, each contributing to innovation and market penetration. North America and Europe currently hold significant market share, but the Asia-Pacific region is projected to witness substantial growth due to increasing freight volumes and government initiatives.

Truck Platooning Technology Industry Market Size (In Million)

The evolution of truck platooning technology is expected to see a shift towards greater automation. While driver-assistive platooning is currently prevalent, the long-term focus is on the development and deployment of fully autonomous systems. This transition will require substantial advancements in sensor technology, artificial intelligence, and robust communication networks. Furthermore, the integration of truck platooning with broader smart transportation systems is crucial for optimizing traffic flow and maximizing efficiency. Regulatory frameworks will play a significant role in shaping the market's future, as standardized safety and communication protocols will be essential for widespread adoption. Ongoing research and development efforts focused on addressing challenges like cybersecurity, reliability, and scalability will be critical in determining the market's long-term success and overall impact on the logistics industry. The market's future hinges on successfully navigating these technological, regulatory, and infrastructural hurdles.

Truck Platooning Technology Industry Company Market Share

Truck Platooning Technology Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Truck Platooning Technology industry, encompassing market dynamics, growth trends, regional landscapes, product innovations, key players, and future outlook. The report covers the parent market of Commercial Vehicle Technology and the child market of Autonomous Driving Systems, offering invaluable insights for industry professionals, investors, and strategists. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report projects a market size of xx Million units by 2033.

Truck Platooning Technology Industry Market Dynamics & Structure

The Truck Platooning Technology market is characterized by a moderately concentrated landscape, with key players like Daimler Truck AG, Wabco Holdings Inc, and Continental AG holding significant market share. Technological innovation, driven by advancements in autonomous driving, V2V/V2I communication, and sensor technologies, is a major growth catalyst. Stringent regulatory frameworks concerning safety and data privacy, however, present significant hurdles. The emergence of driver-assistance systems is creating a competitive landscape for both fully autonomous and partially autonomous solutions. End-user demographics are shifting towards larger logistics companies and fleet operators seeking efficiency improvements and cost reductions. M&A activity is expected to remain moderate (xx deals per year) focusing on strengthening technological capabilities and expanding geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Rapid advancements in AI, sensor technology, and communication protocols are driving innovation.

- Regulatory Frameworks: Stringent safety regulations and data privacy concerns are creating challenges for market entry.

- Competitive Substitutes: Traditional trucking solutions present a significant competitive threat.

- End-User Demographics: Primarily large logistics companies and fleet operators.

- M&A Trends: Consolidation through acquisitions to strengthen technology and expand market presence.

Truck Platooning Technology Industry Growth Trends & Insights

The Truck Platooning Technology market has experienced substantial expansion and is set for continued robust growth. Driven by persistent factors such as escalating fuel costs, the escalating demand for highly efficient logistics operations, and the critical need to mitigate ongoing truck driver shortages, the market has demonstrated remarkable resilience. During the historical period (2019-2024), the market size achieved a Compound Annual Growth Rate (CAGR) of **[Insert Historical CAGR Here]%**. Looking ahead, the market is projected to maintain a strong CAGR of **[Insert Projected CAGR Here]%** between 2025 and 2033, with an anticipated market size reaching **[Insert Projected Market Size Here] million units** by 2033. Adoption rates are on a consistent upward trajectory, especially in regions with advanced infrastructure and a proactive approach to technological integration. Emerging technological disruptions, including the pervasive adoption of 5G connectivity for enhanced communication and sophisticated sensor fusion techniques for superior environmental perception, are significantly accelerating market growth. Concurrently, evolving consumer behavior, characterized by a growing acceptance of advanced driver-assistance systems (ADAS), is laying a crucial groundwork for the wider acceptance and eventual mainstream adoption of fully autonomous platooning solutions.

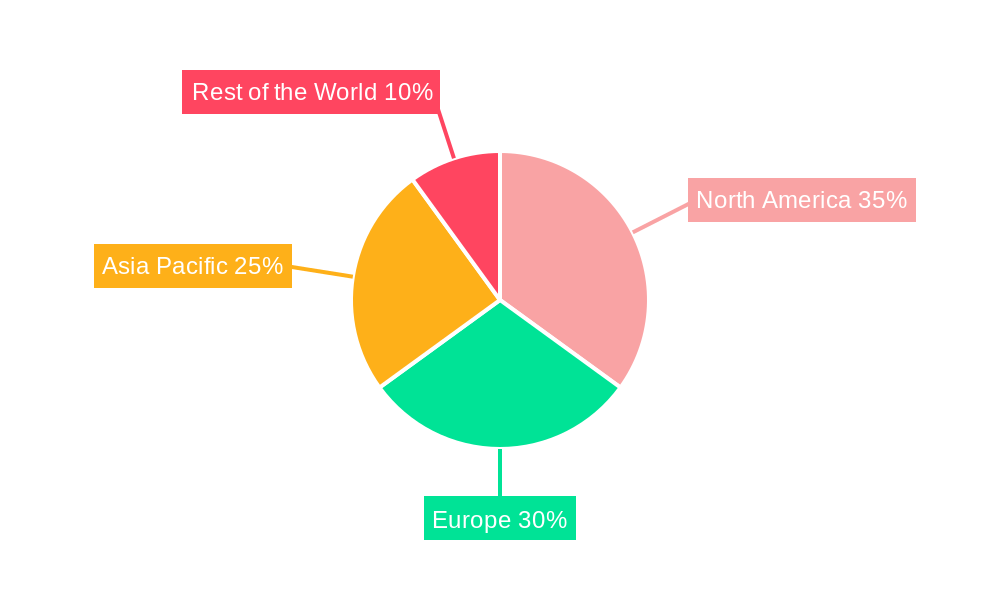

Dominant Regions, Countries, or Segments in Truck Platooning Technology Industry

North America currently dominates the Truck Platooning Technology market, followed by Europe and Asia Pacific. This dominance stems from robust infrastructure development, supportive government policies, and a high concentration of key players in these regions. Within the segment breakdown:

- By Platooning Type: Driver-Assistive Truck Platooning (DATP) currently holds a larger market share due to its lower cost of implementation and faster adoption. However, Autonomous Truck Platooning is projected to witness higher growth rates in the forecast period.

- By Technology Type: Adaptive Cruise Control and Forward Collision Warning systems are widely adopted, while Automated Emergency Braking and Active Brake Assist are gaining traction. The "Others" category, including Blind Spot Warning, is also experiencing significant growth.

- By Infrastructure Type: V2V communication technology is currently dominant, followed by GPS. V2I infrastructure is still under development but is anticipated to show significant growth in the coming years.

Key Drivers:

- North America: Strong government support, advanced infrastructure, and early adoption of autonomous technologies.

- Europe: Focus on fuel efficiency and environmental regulations.

- Asia Pacific: Growing logistics sector and increasing demand for efficient transportation solutions.

Truck Platooning Technology Industry Product Landscape

The truck platooning technology ecosystem comprises a sophisticated array of interconnected products and systems designed to enable safe and efficient automated convoy operations. This includes cutting-edge Advanced Driver-Assistance Systems (ADAS) that augment driver capabilities, fully autonomous driving systems that aim to remove the human element from driving, and robust communication modules facilitating Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) interactions. Complementing these are advanced fleet management software solutions that orchestrate and monitor platooning operations. The defining characteristics of these products revolve around their profound impact on enhancing road safety, optimizing fuel efficiency through reduced aerodynamic drag, and ultimately decreasing overall transportation costs. Key differentiators and unique selling propositions are found in advanced features such as automated lane keeping, sophisticated collision avoidance systems, and intelligent algorithms that precisely manage fuel consumption. The landscape is continuously evolving due to relentless technological advancements in sensor technologies, enabling more accurate environmental sensing, and the integration of artificial intelligence, which drives significant improvements in the accuracy, reliability, and overall performance of platooning systems.

Key Drivers, Barriers & Challenges in Truck Platooning Technology Industry

Key Drivers:

- Economic Imperatives: Continuously rising fuel prices and the overarching need for more cost-effective and efficient transportation solutions are primary catalysts.

- Safety Enhancements: The growing demand for improved road safety, a significant reduction in accidents, and the protection of life and cargo are powerful motivators for platooning adoption.

- Addressing Labor Gaps: Persistent shortages of qualified and experienced truck drivers in numerous global regions create a compelling case for platooning as a viable solution to maintain logistics flow.

- Regulatory Support & Sustainability Goals: Proactive government initiatives promoting the adoption of automation, coupled with increasing pressure for sustainable and environmentally friendly transportation methods, are fostering a supportive environment.

Key Challenges:

- Capital Investment: The substantial initial investment required for acquiring and implementing platooning technology presents a significant barrier for many fleet operators.

- Regulatory Landscape: The absence of clear, standardized, and universally adopted regulations and protocols across different jurisdictions creates uncertainty and hinders widespread deployment.

- Cybersecurity Risks: The interconnected nature of platooning systems raises significant concerns regarding cybersecurity, including potential data breaches, system vulnerabilities, and malicious interference.

- Socio-Economic Impact: Potential concerns surrounding job displacement for truck drivers and the broader socio-economic implications of widespread automation require careful consideration and proactive management.

Emerging Opportunities in Truck Platooning Technology Industry

Emerging opportunities include expansion into untapped markets (e.g., developing countries), development of niche applications (e.g., off-highway platooning), and increasing integration of platooning technology with other transportation modes (e.g., rail, maritime). Evolving consumer preferences towards safer and more sustainable transportation solutions are creating new growth avenues.

Growth Accelerators in the Truck Platooning Technology Industry Industry

Technological advancements, strategic partnerships between technology providers and fleet operators, and government policies promoting automation and infrastructure development are driving long-term growth. The increasing availability of high-bandwidth 5G networks and the development of sophisticated AI algorithms are further accelerating the pace of innovation.

Key Players Shaping the Truck Platooning Technology Market

- Daimler Truck AG

- Wabco Holdings Inc

- NXP Semiconductors N V

- Toyota Motor Corporation (Toyota Tsusho)

- ZF Friedrichshafen

- Continental AG

- Peloton Technology

- Hyundai Motor Company

- Paccar Inc (DAF Trucks)

- Robert Bosch GmbH

- Iveco S p A

- Volkswagen Group (MAN Scania)

- Knorr-Bremse AG

- AB Volvo

Notable Milestones in Truck Platooning Technology Industry Sector

- December 2023: Softbank and West Japan Railway Company partner to research 5G-enabled V2V technology for BRT and truck platooning.

- July 2023: FPInnovations collaborates with RRAI to adapt self-driving technology to off-highway forestry, completing initial tests for truck platooning.

- March 2023: Ohmio conducts a three-vehicle platooning demonstration at JFK International Airport.

In-Depth Truck Platooning Technology Industry Market Outlook

The Truck Platooning Technology market is strategically positioned for an era of significant and transformative growth. This optimistic outlook is fueled by a powerful convergence of factors: rapid advancements in enabling technologies, the development of more supportive and adaptable regulatory frameworks, and the ever-increasing global imperative for more efficient, sustainable, and safe transportation solutions across diverse industrial sectors. The competitive landscape is expected to continue its dynamic evolution, marked by an increasing number of strategic partnerships, crucial mergers, and targeted acquisitions. These activities will likely lead to the emergence of larger, more integrated, and technologically advanced industry players. Ultimately, the successful realization of platooning's full potential will hinge on a relentless focus on ensuring paramount safety standards, robust cybersecurity measures, and seamless integration with existing transportation infrastructure and logistical networks. Addressing these critical aspects will be pivotal in unlocking the groundbreaking benefits of this transformative technology.

Truck Platooning Technology Industry Segmentation

-

1. Platooning Type

- 1.1. Driver-Assistive Truck Platooning (DATP)

- 1.2. Autonomous Truck Platooning

-

2. Technology Type

- 2.1. Adaptive Cruise Control

- 2.2. Forward Collision Warning

- 2.3. Automated Emergency Braking

- 2.4. Active Brake Assist

- 2.5. Lane Keep Assist

- 2.6. Others (Blind Spot Warning, etc.)

-

3. Infrastructure Type

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Global Positioning System (GPS)

Truck Platooning Technology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Truck Platooning Technology Industry Regional Market Share

Geographic Coverage of Truck Platooning Technology Industry

Truck Platooning Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Platooning Technology Deters Market Growth

- 3.4. Market Trends

- 3.4.1. Adaptive Cruise Control Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 5.1.1. Driver-Assistive Truck Platooning (DATP)

- 5.1.2. Autonomous Truck Platooning

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Adaptive Cruise Control

- 5.2.2. Forward Collision Warning

- 5.2.3. Automated Emergency Braking

- 5.2.4. Active Brake Assist

- 5.2.5. Lane Keep Assist

- 5.2.6. Others (Blind Spot Warning, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Global Positioning System (GPS)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6. North America Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6.1.1. Driver-Assistive Truck Platooning (DATP)

- 6.1.2. Autonomous Truck Platooning

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Adaptive Cruise Control

- 6.2.2. Forward Collision Warning

- 6.2.3. Automated Emergency Braking

- 6.2.4. Active Brake Assist

- 6.2.5. Lane Keep Assist

- 6.2.6. Others (Blind Spot Warning, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.3.1. Vehicle-to-Vehicle (V2V)

- 6.3.2. Vehicle-to-Infrastructure (V2I)

- 6.3.3. Global Positioning System (GPS)

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7. Europe Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7.1.1. Driver-Assistive Truck Platooning (DATP)

- 7.1.2. Autonomous Truck Platooning

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Adaptive Cruise Control

- 7.2.2. Forward Collision Warning

- 7.2.3. Automated Emergency Braking

- 7.2.4. Active Brake Assist

- 7.2.5. Lane Keep Assist

- 7.2.6. Others (Blind Spot Warning, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.3.1. Vehicle-to-Vehicle (V2V)

- 7.3.2. Vehicle-to-Infrastructure (V2I)

- 7.3.3. Global Positioning System (GPS)

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8. Asia Pacific Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8.1.1. Driver-Assistive Truck Platooning (DATP)

- 8.1.2. Autonomous Truck Platooning

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Adaptive Cruise Control

- 8.2.2. Forward Collision Warning

- 8.2.3. Automated Emergency Braking

- 8.2.4. Active Brake Assist

- 8.2.5. Lane Keep Assist

- 8.2.6. Others (Blind Spot Warning, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.3.1. Vehicle-to-Vehicle (V2V)

- 8.3.2. Vehicle-to-Infrastructure (V2I)

- 8.3.3. Global Positioning System (GPS)

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9. Rest of the World Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9.1.1. Driver-Assistive Truck Platooning (DATP)

- 9.1.2. Autonomous Truck Platooning

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Adaptive Cruise Control

- 9.2.2. Forward Collision Warning

- 9.2.3. Automated Emergency Braking

- 9.2.4. Active Brake Assist

- 9.2.5. Lane Keep Assist

- 9.2.6. Others (Blind Spot Warning, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.3.1. Vehicle-to-Vehicle (V2V)

- 9.3.2. Vehicle-to-Infrastructure (V2I)

- 9.3.3. Global Positioning System (GPS)

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Daimler Truck AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wabco Holdings Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toyota Motor Corporation (Toyota Tsusho)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZF Friedrichshafen

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Peloton Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Paccar Inc (DAF Trucks)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Iveco S p A

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Volkswagen Group (MAN Scania)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Knorr-Bremse AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 AB Volvo

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Daimler Truck AG

List of Figures

- Figure 1: Global Truck Platooning Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 3: North America Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 4: North America Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 5: North America Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 7: North America Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 8: North America Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 11: Europe Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 12: Europe Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 13: Europe Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 15: Europe Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 16: Europe Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 19: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 20: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 27: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 28: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 29: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 31: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 32: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 2: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 4: Global Truck Platooning Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 6: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 8: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 13: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 15: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 22: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 23: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 24: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 31: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 32: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 33: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Truck Platooning Technology Industry?

The projected CAGR is approximately 22.25%.

2. Which companies are prominent players in the Truck Platooning Technology Industry?

Key companies in the market include Daimler Truck AG, Wabco Holdings Inc, NXP Semiconductors N V, Toyota Motor Corporation (Toyota Tsusho), ZF Friedrichshafen, Continental AG, Peloton Technology, Hyundai Motor Company, Paccar Inc (DAF Trucks), Robert Bosch GmbH, Iveco S p A, Volkswagen Group (MAN Scania), Knorr-Bremse AG, AB Volvo.

3. What are the main segments of the Truck Platooning Technology Industry?

The market segments include Platooning Type, Technology Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Adaptive Cruise Control Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Platooning Technology Deters Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2023, Softbank announced its partnership with West Japan Railway Company to research 5G-enabled Vehicle-to-Vehicle (V2V) technology for a Bus Rapid Transit (BRT) system and truck platooning on Japanese highways. The research aims to enhance the country's logistics sector by facilitating advanced communication technology while assisting in addressing the issue of driver shortages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Truck Platooning Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Truck Platooning Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Truck Platooning Technology Industry?

To stay informed about further developments, trends, and reports in the Truck Platooning Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence