Key Insights

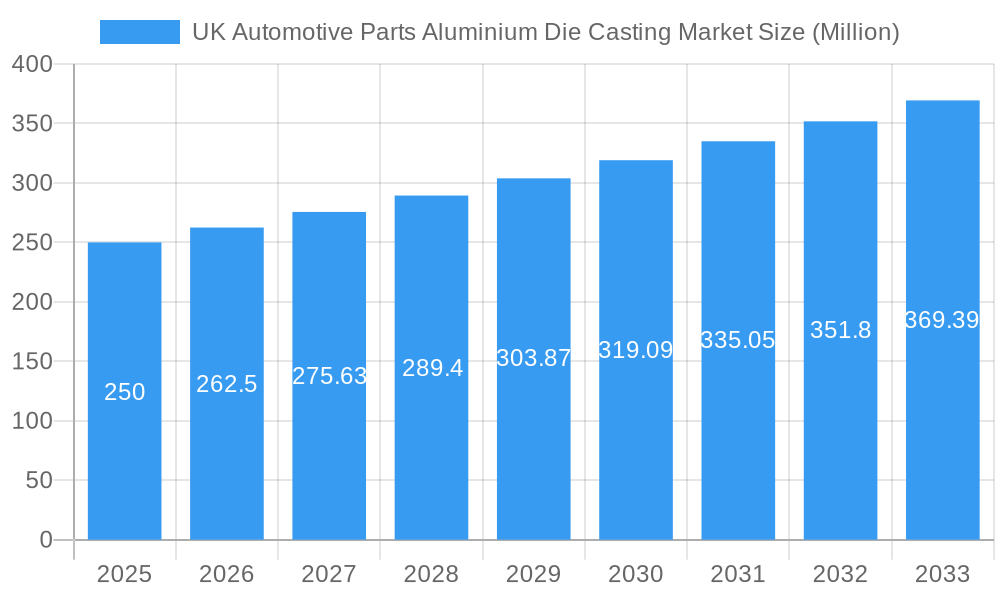

The UK automotive parts aluminum die casting market is projected for significant expansion, driven by the escalating demand for lightweight vehicle components and the rapid adoption of electric vehicles (EVs). The market, valued at £82.6 billion in the base year of 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2025 and 2033. Key growth drivers include the automotive sector's focus on enhanced fuel efficiency and reduced emissions, necessitating increased use of lightweight aluminum parts. Technological advancements in die casting, such as high-pressure and semi-solid die casting, facilitate the production of intricate, high-precision components. Furthermore, a notable trend involves the outsourcing of manufacturing to specialized die casting firms. Major application segments encompass body assemblies, engine parts, and transmission components. Despite challenges like raw material price volatility and stringent environmental regulations, the market outlook remains favorable, bolstered by government initiatives promoting EV adoption and domestic manufacturing.

UK Automotive Parts Aluminium Die Casting Market Market Size (In Billion)

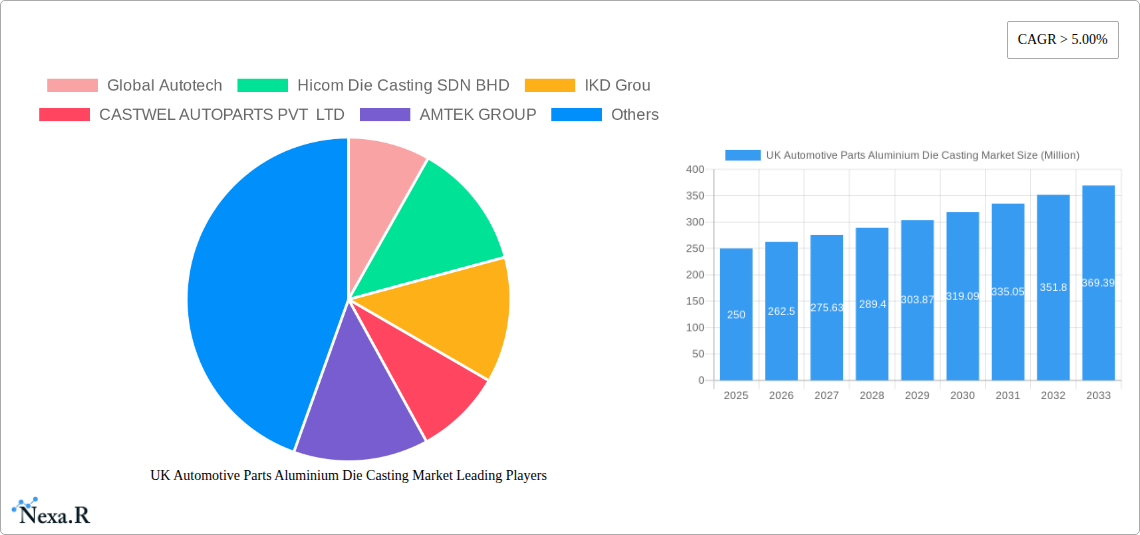

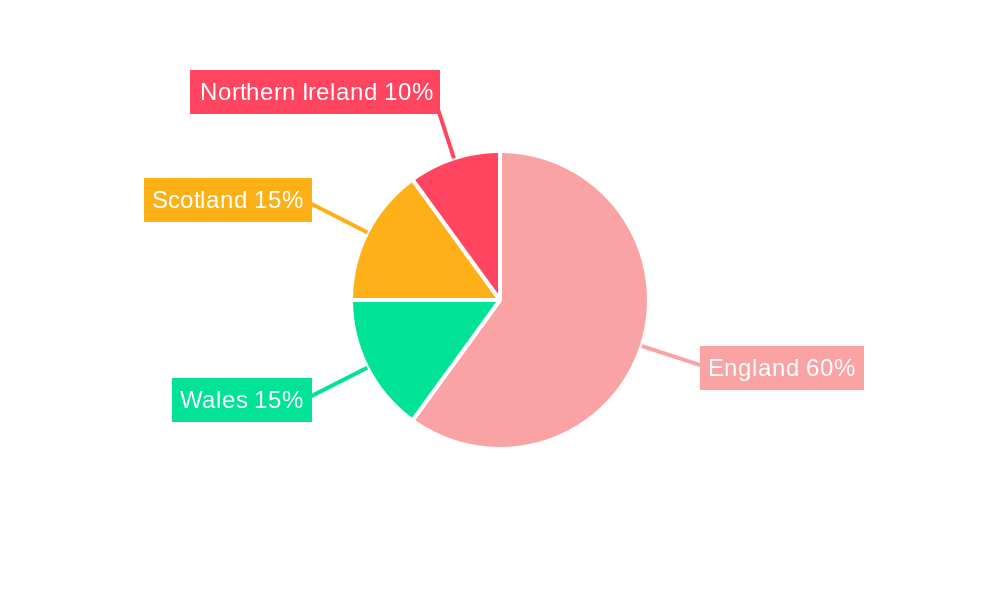

The competitive landscape features a blend of global and domestic manufacturers focused on innovation, strategic alliances, and operational efficiency. Regional market dynamics within the UK are concentrated in established automotive manufacturing centers in England, Wales, and Scotland. Forecasts indicate sustained market growth across these regions, supported by ongoing investments in automotive manufacturing infrastructure and favorable government policies. Detailed segment analysis confirms pressure die casting as the predominant manufacturing process, with increasing adoption of advanced techniques like vacuum and semi-solid die casting expected to improve part quality and minimize material waste. This trend, combined with robust demand for lightweight components in the burgeoning EV sector, positions the UK automotive parts aluminum die casting market for sustained and substantial growth. Market consolidation is likely as major players seek to enhance competitive advantage and operational scale.

UK Automotive Parts Aluminium Die Casting Market Company Market Share

UK Automotive Parts Aluminium Die Casting Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK automotive parts aluminium die casting market, offering invaluable insights for industry professionals, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 (base year 2025, estimated year 2025). It meticulously examines market dynamics, growth trends, key players, and future opportunities within the parent market (UK Automotive Parts Market) and the child market (UK Aluminium Die Casting Market). Expect detailed analysis across key segments: Production Process (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-solid Die Casting) and Application Type (Body Assemblies, Engine Parts, Transmission Parts, Others). Market values are presented in Million units.

UK Automotive Parts Aluminium Die Casting Market Market Dynamics & Structure

This section analyzes the UK automotive parts aluminium die casting market's competitive landscape, technological advancements, regulatory influences, and market trends. The market is characterized by a moderate level of concentration, with key players holding significant market share. Technological innovation, particularly in die casting processes and material science, is a key driver. Stringent environmental regulations regarding emissions and material usage influence manufacturing practices. The market also faces competition from alternative materials like plastics and steel. The automotive industry's cyclical nature and fluctuating demand for vehicles impact the market's growth. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on lightweighting, high-pressure die casting, and automation driving improvements in efficiency and product quality.

- Regulatory Framework: Stringent environmental regulations impacting material selection and manufacturing processes.

- Competitive Substitutes: Plastics and steel present competitive challenges, particularly in cost-sensitive applications.

- End-User Demographics: Primarily driven by OEMs and Tier-1 automotive suppliers.

- M&A Trends: Moderate M&A activity, with xx deals recorded between 2019 and 2024, primarily focused on consolidation and expansion.

UK Automotive Parts Aluminium Die Casting Market Growth Trends & Insights

The UK automotive parts aluminium die casting market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth was primarily driven by increasing demand for lightweight vehicles, stringent fuel efficiency standards, and advancements in die casting technologies. Market penetration of aluminium die casting in automotive applications is expected to increase further, driven by the rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which require lightweight components for improved battery range and performance. Technological disruptions, such as additive manufacturing and the use of advanced alloys, are also influencing market growth. Consumer preferences towards fuel-efficient and environmentally friendly vehicles further bolster market expansion. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033.

Dominant Regions, Countries, or Segments in UK Automotive Parts Aluminium Die Casting Market

The Midlands region of the UK stands as the undisputed heartland for automotive parts production, and consequently, aluminium die casting. This regional supremacy is deeply rooted in the unparalleled concentration of major automotive manufacturing plants and a robust, well-established supplier ecosystem within its confines. This synergy fosters innovation and efficient supply chains, cementing the Midlands' leading position.

Within the production process segments, High-Pressure Die Casting (HPDC) commands the largest market share. This dominance is attributable to its inherent advantages of cost-effectiveness, high production volumes, exceptional accuracy, and the ability to produce intricate designs with thin walls. These characteristics are precisely what the modern automotive industry demands.

Examining application types, Engine Parts and Body Assemblies represent the most significant segments. Aluminium die castings are crucial in these areas for their ability to contribute to vehicle lightweighting, which directly translates to improved fuel efficiency and enhanced performance. The demand for more sophisticated and lighter engine components, alongside the growing need for aerodynamic and lightweight body structures, continues to fuel the growth of these segments.

- Key Drivers: The potent combination of a formidable automotive manufacturing base in the Midlands, supportive government incentives aimed at promoting lightweight vehicle production, and continuous technological advancements in pressure die casting processes are the primary growth engines.

- Dominance Factors: The dense cluster of established automotive manufacturers and their Tier 1 and Tier 2 suppliers, coupled with world-class infrastructure and a highly skilled workforce specializing in precision manufacturing, are pivotal to the region's dominance.

- Growth Potential: The market is set for continued expansion, propelled by the unwavering global demand for lighter and more fuel-efficient vehicles, the rapidly evolving electric vehicle (EV) sector which heavily relies on lightweight materials, and ongoing breakthroughs in die casting technology that enable greater complexity and material efficiency.

UK Automotive Parts Aluminium Die Casting Market Product Landscape

The UK automotive parts aluminium die casting market is characterized by a diverse and sophisticated array of products, meticulously engineered to meet the stringent demands of modern vehicle applications. These castings are renowned for their exceptional high precision, intricate geometric capabilities, and superior surface finishes, often reducing the need for secondary machining operations. Product innovation is a relentless pursuit, with a sharp focus on achieving significant lightweighting benefits, maximizing strength-to-weight ratios, and ensuring superior corrosion resistance. These advancements are achieved through the development of advanced aluminium alloys and cutting-edge surface treatment technologies.

The unique selling propositions (USPs) in this market revolve around optimized designs tailored for specific performance requirements, enabling automotive manufacturers to achieve their targets for efficiency and dynamics. Furthermore, the emphasis on efficient and cost-effective production processes is paramount, ensuring competitive pricing without compromising on quality. Technological leaps in die casting, including advancements in high-pressure die casting, vacuum die casting, and multi-slide die casting, are not only driving product improvements but also enabling the creation of previously unachievable part complexities and functionalities.

Key Drivers, Barriers & Challenges in UK Automotive Parts Aluminium Die Casting Market

Key Drivers:

- Increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions.

- Growing adoption of electric vehicles requiring lightweight components.

- Advancements in die casting technologies leading to improved quality and efficiency.

Challenges & Restraints:

- Fluctuations in raw material prices (aluminium) impacting production costs.

- Competition from alternative materials such as plastics and steel.

- Stringent environmental regulations requiring sustainable manufacturing practices.

- Potential supply chain disruptions impacting timely delivery of castings.

Emerging Opportunities in UK Automotive Parts Aluminium Die Casting Market

- Growing demand for customized and specialized aluminium die castings for niche automotive applications.

- Expansion into the electric vehicle and hybrid electric vehicle markets.

- Development of innovative alloys with improved properties (strength, lightweight, corrosion resistance).

- Adoption of Industry 4.0 technologies (automation, data analytics) to enhance efficiency and productivity.

Growth Accelerators in the UK Automotive Parts Aluminium Die Casting Market Industry

The trajectory of the UK automotive parts aluminium die casting market is significantly influenced by a confluence of powerful growth accelerators. Chief among these are the continuous technological advancements in die casting processes, which are enabling manufacturers to produce lighter, stronger, and more complex components with greater efficiency. This is intrinsically linked to the escalating global demand for lightweight and fuel-efficient vehicles, a trend further amplified by stringent environmental regulations. The burgeoning electric vehicle (EV) market presents a particularly fertile ground for growth, as EVs necessitate extensive use of lightweight materials to maximize battery range and performance.

Furthermore, the cultivation of strategic partnerships and collaborative efforts between die casters and leading automotive manufacturers is a critical factor. These alliances foster innovation, ensure alignment with industry needs, and facilitate the rapid integration of new technologies. Substantial investments in research and development (R&D), aimed at enhancing material properties, optimizing manufacturing processes, and reducing production costs, are also vital. Lastly, the strategic expansion into new, emerging markets and niche application segments, including specialized components for high-performance vehicles or new mobility solutions, will contribute to the sustained long-term growth and diversification of the industry.

Key Players Shaping the UK Automotive Parts Aluminium Die Casting Market Market

- Global Autotech

- Hicom Die Casting SDN BHD

- IKD Group

- CASTWEL AUTOPARTS PVT LTD

- AMTEK GROUP

- Gibbs Die Casting Group

- George Fisher Ltd

- BUVO Castings (EU)

- Aluminum Die Casting (China) Ltd

- ENDURANCE GROUP

- London Die Casting

- Metflam S.p.A.

- Cambridge Consultants (for advanced design and simulation)

- William Cook Castings

Notable Milestones in UK Automotive Parts Aluminium Die Casting Market Sector

- 2021: Introduction of a new high-pressure die casting machine by a major player, increasing production capacity.

- 2022: Partnership between a leading die caster and an automotive OEM to develop lightweight components for EVs.

- 2023: Launch of a new aluminium alloy with improved strength and corrosion resistance.

In-Depth UK Automotive Parts Aluminium Die Casting Market Market Outlook

The outlook for the UK automotive parts aluminium die casting market is exceptionally robust, characterized by a trajectory of sustained and significant growth. This positive forecast is primarily underpinned by the persistent and intensifying global trend towards vehicle lightweighting, a crucial strategy for enhancing fuel efficiency and reducing emissions. The rapid expansion and maturation of the electric vehicle (EV) market represent another powerful catalyst, as EVs rely heavily on lightweight aluminium components to optimize battery performance and driving range. Furthermore, ongoing continuous improvements and innovations in die casting technologies, including the adoption of advanced automation, digitalization, and more efficient tooling, are continuously enhancing production capabilities and product quality.

The future landscape of this market will be profoundly shaped by the strategic forging of collaborative partnerships and joint ventures between die casting specialists and automotive OEMs. Significant investments in R&D, focusing on novel alloy development and sustainable manufacturing practices, will be pivotal. The widespread adoption of Industry 4.0 principles, such as the integration of smart manufacturing technologies, data analytics, and artificial intelligence, will drive operational efficiencies and foster greater agility. The market presents substantial and multifaceted opportunities for companies that demonstrate a commitment to innovation, possess the adaptability to respond to evolving consumer preferences and regulatory demands, and are adept at building resilient and responsive supply chains. The projected forecast period, spanning 2025 to 2033, is anticipated to witness substantial market expansion, driven by the synergistic effect of these powerful market forces.

UK Automotive Parts Aluminium Die Casting Market Segmentation

-

1. Production Process

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-solid Die Casting

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Others

UK Automotive Parts Aluminium Die Casting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Automotive Parts Aluminium Die Casting Market Regional Market Share

Geographic Coverage of UK Automotive Parts Aluminium Die Casting Market

UK Automotive Parts Aluminium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Electrification

- 3.3. Market Restrains

- 3.3.1. The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 3.4. Market Trends

- 3.4.1. Passenger Vehicle Sales Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 6. North America UK Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Process

- 6.1.1. Pressure Die Casting

- 6.1.2. Vacuum Die Casting

- 6.1.3. Squeeze Die Casting

- 6.1.4. Semi-solid Die Casting

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Body Assemblies

- 6.2.2. Engine Parts

- 6.2.3. Transmission Parts

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Process

- 7. South America UK Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Process

- 7.1.1. Pressure Die Casting

- 7.1.2. Vacuum Die Casting

- 7.1.3. Squeeze Die Casting

- 7.1.4. Semi-solid Die Casting

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Body Assemblies

- 7.2.2. Engine Parts

- 7.2.3. Transmission Parts

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Process

- 8. Europe UK Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Process

- 8.1.1. Pressure Die Casting

- 8.1.2. Vacuum Die Casting

- 8.1.3. Squeeze Die Casting

- 8.1.4. Semi-solid Die Casting

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Body Assemblies

- 8.2.2. Engine Parts

- 8.2.3. Transmission Parts

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Process

- 9. Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Process

- 9.1.1. Pressure Die Casting

- 9.1.2. Vacuum Die Casting

- 9.1.3. Squeeze Die Casting

- 9.1.4. Semi-solid Die Casting

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Body Assemblies

- 9.2.2. Engine Parts

- 9.2.3. Transmission Parts

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Process

- 10. Asia Pacific UK Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Process

- 10.1.1. Pressure Die Casting

- 10.1.2. Vacuum Die Casting

- 10.1.3. Squeeze Die Casting

- 10.1.4. Semi-solid Die Casting

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Body Assemblies

- 10.2.2. Engine Parts

- 10.2.3. Transmission Parts

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Global Autotech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hicom Die Casting SDN BHD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IKD Grou

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CASTWEL AUTOPARTS PVT LTD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AMTEK GROUP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gibbs Die Casting Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 George Fisher Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BUVO Castings (EU)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aluminum Die Casting (China) Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ENDURANCE GROUP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Global Autotech

List of Figures

- Figure 1: Global UK Automotive Parts Aluminium Die Casting Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Production Process 2025 & 2033

- Figure 3: North America UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Production Process 2025 & 2033

- Figure 4: North America UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Application Type 2025 & 2033

- Figure 5: North America UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Production Process 2025 & 2033

- Figure 9: South America UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Production Process 2025 & 2033

- Figure 10: South America UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Application Type 2025 & 2033

- Figure 11: South America UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Production Process 2025 & 2033

- Figure 15: Europe UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Production Process 2025 & 2033

- Figure 16: Europe UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Application Type 2025 & 2033

- Figure 17: Europe UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Production Process 2025 & 2033

- Figure 21: Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Production Process 2025 & 2033

- Figure 22: Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Production Process 2025 & 2033

- Figure 27: Asia Pacific UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Production Process 2025 & 2033

- Figure 28: Asia Pacific UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Asia Pacific UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific UK Automotive Parts Aluminium Die Casting Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Automotive Parts Aluminium Die Casting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process 2020 & 2033

- Table 2: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process 2020 & 2033

- Table 5: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process 2020 & 2033

- Table 11: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process 2020 & 2033

- Table 17: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process 2020 & 2033

- Table 29: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 30: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process 2020 & 2033

- Table 38: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 39: Global UK Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Automotive Parts Aluminium Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Automotive Parts Aluminium Die Casting Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the UK Automotive Parts Aluminium Die Casting Market?

Key companies in the market include Global Autotech, Hicom Die Casting SDN BHD, IKD Grou, CASTWEL AUTOPARTS PVT LTD, AMTEK GROUP, Gibbs Die Casting Group, George Fisher Ltd, BUVO Castings (EU), Aluminum Die Casting (China) Ltd, ENDURANCE GROUP.

3. What are the main segments of the UK Automotive Parts Aluminium Die Casting Market?

The market segments include Production Process, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Electrification.

6. What are the notable trends driving market growth?

Passenger Vehicle Sales Driving Growth.

7. Are there any restraints impacting market growth?

The Cost of Raw Materials Used in the Manufacturing of Switches is High.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Automotive Parts Aluminium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Automotive Parts Aluminium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Automotive Parts Aluminium Die Casting Market?

To stay informed about further developments, trends, and reports in the UK Automotive Parts Aluminium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence