Key Insights

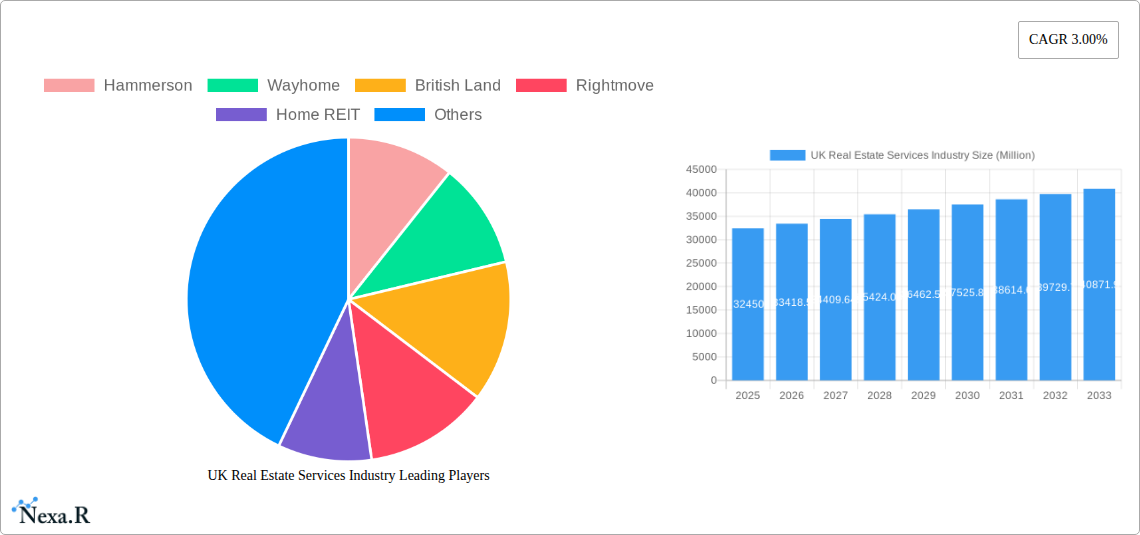

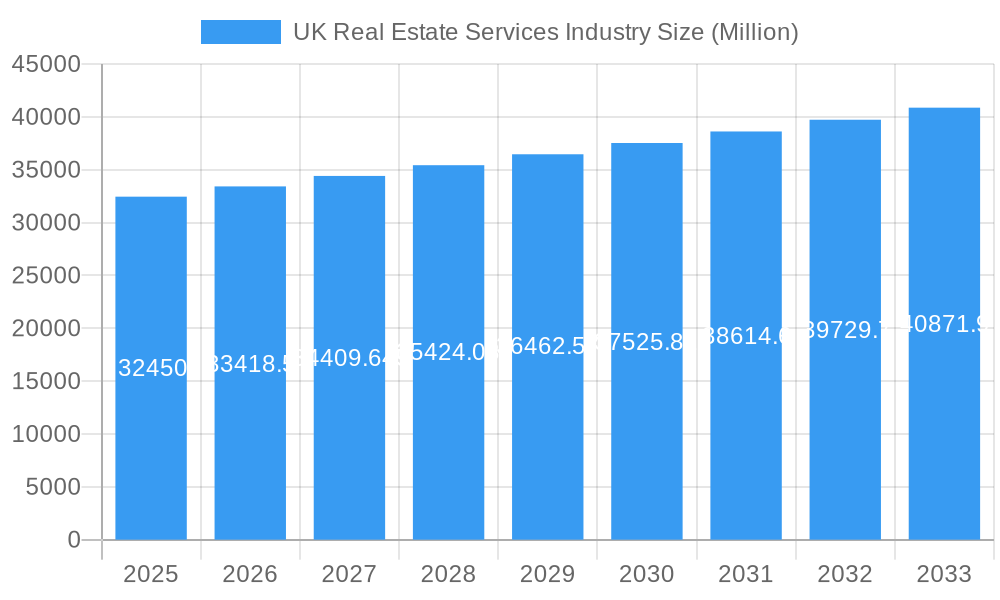

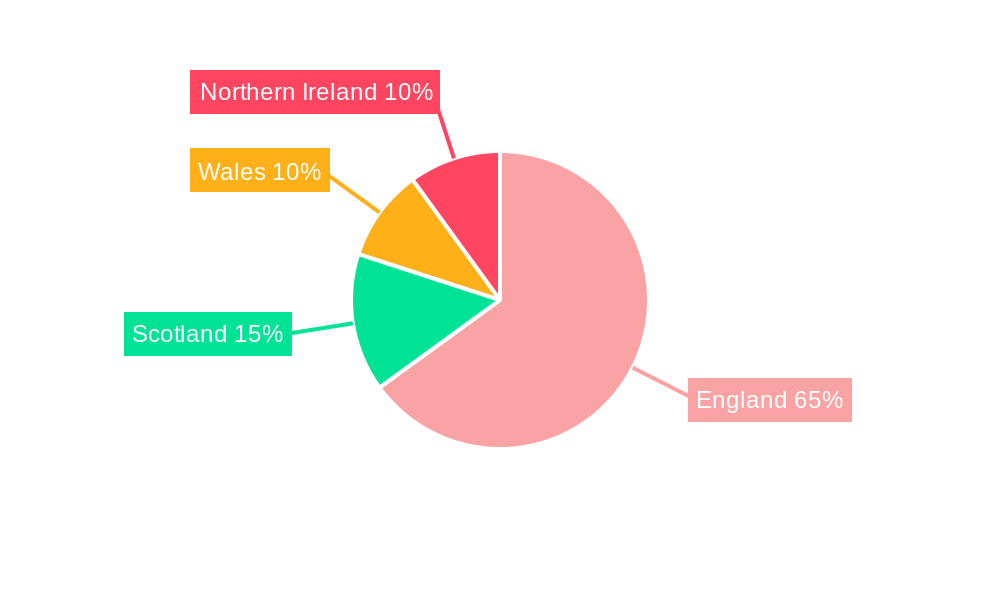

The UK real estate services industry, valued at £32.45 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 3.00% from 2025 to 2033. This growth is driven by several factors. Increased urbanization and population growth in key regions like London and other major cities fuel demand for residential properties, bolstering property management and valuation services. The burgeoning commercial sector, fueled by technological advancements and a growing economy, further enhances market expansion. Government initiatives supporting infrastructure development and affordable housing also contribute positively. However, economic uncertainty, fluctuating interest rates, and potential regulatory changes pose challenges to sustained market growth. Market segmentation reveals a strong emphasis on residential property services, but significant potential exists within commercial and other property types, presenting opportunities for diversification and expansion for industry players. Competition among established players like Hammerson, Rightmove, and Berkeley Group, as well as smaller, specialized firms, is intense, requiring companies to continuously innovate and offer specialized services to maintain market share. The regional breakdown shows strong performance across England, Scotland, and Wales, with Northern Ireland exhibiting moderate growth potential reflecting its unique market characteristics.

UK Real Estate Services Industry Market Size (In Billion)

The forecast period (2025-2033) suggests a continued, albeit gradual, expansion of the market. The industry's performance will be closely linked to broader economic trends, including inflation, employment rates, and government policies. The dominance of residential properties within the market signifies a focus on individual needs, while the commercial sector offers opportunities for large-scale projects and investment. Further analysis of specific service segments, such as property management and valuation, will reveal more granular insights into the market’s dynamics and opportunities for targeted investments. The significant number of companies operating in this market indicates a mature and competitive environment, with established players and emerging firms constantly vying for market share. Therefore, strategic planning and adaptability are crucial for success in this dynamic landscape.

UK Real Estate Services Industry Company Market Share

UK Real Estate Services Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK real estate services market, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand the market dynamics, growth trends, and future opportunities within the UK's dynamic real estate sector. The report delves into key segments – residential, commercial, and other property types – and services including property management, valuation, and other related services. With a focus on parent markets (Real Estate) and child markets (specific property types and services), this report delivers actionable intelligence for strategic decision-making.

Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025-2033 | Historical Period: 2019-2024

UK Real Estate Services Industry Market Dynamics & Structure

This section analyzes the UK real estate services market's structure, encompassing market concentration, technological innovation, regulatory landscapes, competitive dynamics, and M&A activity. The market is characterized by a mix of large multinational corporations and smaller, specialized firms.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players in specific segments (e.g., Rightmove in online property portals). However, significant competition exists across various service offerings. xx% of the market is controlled by the top 5 players.

- Technological Innovation: Proptech advancements are reshaping the industry, with increasing adoption of online platforms, data analytics, and AI-powered tools. However, the pace of adoption varies across different segments, with some facing higher barriers to innovation due to legacy systems and regulatory complexities.

- Regulatory Framework: Stringent regulations related to property transactions, environmental standards, and data protection significantly influence market operations. Changes in these regulations can directly impact market growth and investment strategies.

- Competitive Product Substitutes: The emergence of alternative investment options and evolving consumer preferences present potential competitive pressures. The rise of co-living spaces and shared ownership models represents a notable shift in the residential sector.

- End-User Demographics: The changing demographics of the UK population, including aging populations and shifts in household structures, significantly impact demand for different property types and services. The increasing demand for rental properties is a key observation.

- M&A Trends: The sector witnesses significant M&A activity, driven by consolidation and expansion strategies. The number of deals completed between 2019 and 2024 totaled approximately xx deals, with a total value of £xx million. The acquisition of UK Sotheby's International Realty is a recent example of this trend.

UK Real Estate Services Industry Growth Trends & Insights

This section provides a detailed analysis of the UK real estate services market’s growth trajectory, using robust data and qualitative insights. The market has shown consistent growth over the historical period (2019-2024), with a CAGR of xx%. Several factors are driving this growth, including increasing urbanization, robust economic activity, and government initiatives promoting housing development. However, challenges such as Brexit and the impact of the global financial market have had a varied impact on different segments of the market. The forecast period (2025-2033) is expected to witness continued expansion, driven by [Insert specific drivers and expected CAGR]. The market is anticipated to reach a value of £xx million by 2033. Technological advancements such as blockchain for secure transactions and the use of AI for property valuations are accelerating growth and changing consumer behavior, leading to increased transparency and efficiency. This analysis further considers market penetration across various segments and regions.

Dominant Regions, Countries, or Segments in UK Real Estate Services Industry

The UK real estate services market exhibits regional variations in growth. London and the South East remain dominant due to higher property values, strong economic activity, and a large concentration of commercial real estate. However, other regions are witnessing increased activity, particularly in major cities like Manchester and Birmingham, driven by regeneration projects and population growth.

- Dominant Segment: Residential: The residential segment is the largest, driven by population growth, urbanization, and government initiatives aimed at increasing homeownership.

- Dominant Service: Property Management holds a significant market share due to the increasing demand for professional property management services, especially in the rental sector.

- Key Drivers: Strong economic growth, population increase in key regions, and government policies supporting housing development are key drivers of growth in the residential segment. Infrastructure projects and urban regeneration initiatives further boost growth in both residential and commercial sectors.

UK Real Estate Services Industry Product Landscape

The UK real estate services industry offers a wide range of products and services, spanning traditional brokerage and property management to innovative proptech solutions. These services are constantly evolving with the integration of technologies such as virtual reality for property viewings and AI-powered valuation tools. Innovative business models, such as build-to-rent schemes and co-living spaces, are creating new product offerings catering to the changing needs of UK consumers and investors. These products often boast unique selling propositions such as enhanced transparency, streamlined processes, and improved customer experience.

Key Drivers, Barriers & Challenges in UK Real Estate Services Industry

Key Drivers:

- Growing population and urbanization in major cities fuel demand for both residential and commercial properties.

- Government initiatives promoting housing development and infrastructure projects stimulate market activity.

- Technological advancements improve efficiency and create new market opportunities.

Key Challenges:

- Regulatory hurdles, including planning permissions and environmental regulations, hinder development projects and increase costs. The impact is estimated to be a xx% reduction in development capacity.

- Supply chain issues, particularly material shortages and rising construction costs, affect development timelines and profitability. This causes an average delay of xx months in construction projects.

- Intense competition among established players and emerging proptech companies creates pressure on margins and necessitates continuous innovation. This competition has resulted in a reduction in average profit margin by xx% over the past 5 years.

Emerging Opportunities in UK Real Estate Services Industry

The UK real estate services market presents several exciting opportunities for growth and innovation. These include:

- The increasing adoption of sustainable building practices and green technologies offers substantial opportunities for companies offering related services.

- The growing demand for flexible workspaces and co-working environments creates opportunities in commercial real estate.

- The rise of Build-to-Rent (BTR) offers opportunities for investment and management in purpose-built rental accommodations.

Growth Accelerators in the UK Real Estate Services Industry

Long-term growth in the UK real estate services industry will be accelerated by several factors, including further adoption of PropTech, strategic partnerships between traditional real estate firms and tech companies, and expansion into underserved markets. Government initiatives focused on infrastructure development and affordable housing will also contribute significantly to overall market growth.

Key Players Shaping the UK Real Estate Services Industry Market

- Hammerson

- Wayhome

- British Land

- Rightmove

- Home REIT

- Bridgewater Housing Association Ltd

- Shaftesbury PLC

- Berkeley Group Holdings PLC

- Derwent London

- Tritax Big Box Reit PLC

- Capital & Counties Properties PLC

- Sanctuary Housing Association

- Unite Group PLC

Notable Milestones in UK Real Estate Services Industry Sector

- November 2022: JLL reports £10bn (USD 12.73bn) annual investment in UK living real estate in Q3 2022, highlighting the significant investor interest in the sector.

- January 2023: Acquisition of UK Sotheby's International Realty by Sotheby's Dubai, signifying international investment and consolidation within the market.

In-Depth UK Real Estate Services Industry Market Outlook

The UK real estate services market is poised for continued growth driven by robust economic fundamentals, technological advancements, and government support. Strategic partnerships and innovations in PropTech are expected to further drive efficiency and create new market opportunities. The market's long-term potential is significant, offering substantial returns for investors and ample opportunities for established and emerging players. The focus on sustainable development and affordable housing will shape future market dynamics.

UK Real Estate Services Industry Segmentation

-

1. Property type

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Property Types

-

2. Service

- 2.1. Property Management

- 2.2. Valuation

- 2.3. Other Services

UK Real Estate Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Real Estate Services Industry Regional Market Share

Geographic Coverage of UK Real Estate Services Industry

UK Real Estate Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements in Infrastructure and New Development; Population Growth and Demographic Changes

- 3.3. Market Restrains

- 3.3.1. Housing Shortages; Increasing Awareness towards Environmental Issues

- 3.4. Market Trends

- 3.4.1. Increasing in the United Kingdom House Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Property Management

- 5.2.2. Valuation

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property type

- 6. North America UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Property type

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Property Types

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Property Management

- 6.2.2. Valuation

- 6.2.3. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Property type

- 7. South America UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Property type

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Property Types

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Property Management

- 7.2.2. Valuation

- 7.2.3. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Property type

- 8. Europe UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Property type

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Property Types

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Property Management

- 8.2.2. Valuation

- 8.2.3. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Property type

- 9. Middle East & Africa UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Property type

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Property Types

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Property Management

- 9.2.2. Valuation

- 9.2.3. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Property type

- 10. Asia Pacific UK Real Estate Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Property type

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Property Types

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Property Management

- 10.2.2. Valuation

- 10.2.3. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Property type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hammerson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wayhome

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 British Land

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rightmove

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Home REIT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bridgewater Housing Association Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shaftesbury PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berkeley Group Holdings PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Derwent London

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tritax Big Box Reit PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Capital & Counties Properties PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sanctuary Housing Association

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Unite Group PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Hammerson

List of Figures

- Figure 1: Global UK Real Estate Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 3: North America UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 4: North America UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 5: North America UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 9: South America UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 10: South America UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 11: South America UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: South America UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 15: Europe UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 16: Europe UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 17: Europe UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 21: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 22: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 23: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 24: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Property type 2025 & 2033

- Figure 27: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Property type 2025 & 2033

- Figure 28: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Service 2025 & 2033

- Figure 29: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 2: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Global UK Real Estate Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 5: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 11: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 17: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 29: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 30: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2020 & 2033

- Table 38: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 39: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Real Estate Services Industry?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the UK Real Estate Services Industry?

Key companies in the market include Hammerson, Wayhome, British Land, Rightmove, Home REIT, Bridgewater Housing Association Ltd, Shaftesbury PLC, Berkeley Group Holdings PLC, Derwent London, Tritax Big Box Reit PLC, Capital & Counties Properties PLC, Sanctuary Housing Association, Unite Group PLC.

3. What are the main segments of the UK Real Estate Services Industry?

The market segments include Property type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Improvements in Infrastructure and New Development; Population Growth and Demographic Changes.

6. What are the notable trends driving market growth?

Increasing in the United Kingdom House Prices.

7. Are there any restraints impacting market growth?

Housing Shortages; Increasing Awareness towards Environmental Issues.

8. Can you provide examples of recent developments in the market?

January 2023: United Kingdom Sotheby's Property Business Acquired by the Dubai Branch of Sotheby's. UK Sotheby International Realty was previously owned by Robin Paterson, who sold the business to his business partner and affiliate, George Azar. George Azar currently holds and operates Sotheby's Dubai and the MENA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Real Estate Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Real Estate Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Real Estate Services Industry?

To stay informed about further developments, trends, and reports in the UK Real Estate Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence