Key Insights

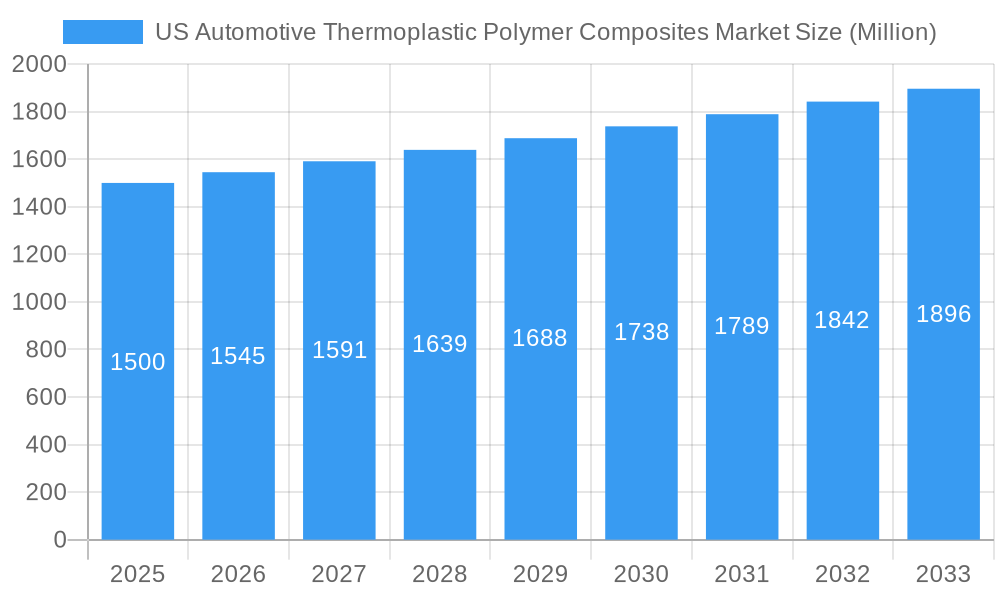

The US automotive thermoplastic polymer composites market is experiencing steady growth, driven by increasing demand for lightweight yet high-strength materials in vehicle manufacturing. A CAGR of 3.00% from 2019 to 2024 suggests a robust market, projected to continue its expansion through 2033. This growth is fueled by several key factors. Firstly, the automotive industry's ongoing push for fuel efficiency and reduced emissions necessitates the adoption of lighter materials, making thermoplastic composites a compelling alternative to traditional metals. Secondly, advancements in manufacturing technologies, particularly in injection molding and compression molding, are enhancing the cost-effectiveness and scalability of thermoplastic composite production, making them increasingly attractive to automakers. The growing popularity of electric vehicles (EVs) also contributes significantly to market expansion, as these vehicles often require more structural reinforcement due to the weight of batteries, furthering the demand for high-performance composites. Finally, the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies necessitates more complex and lightweight components, creating new opportunities for thermoplastic composites in various applications, including structural assemblies, powertrain components, and interior/exterior parts.

US Automotive Thermoplastic Polymer Composites Market Market Size (In Billion)

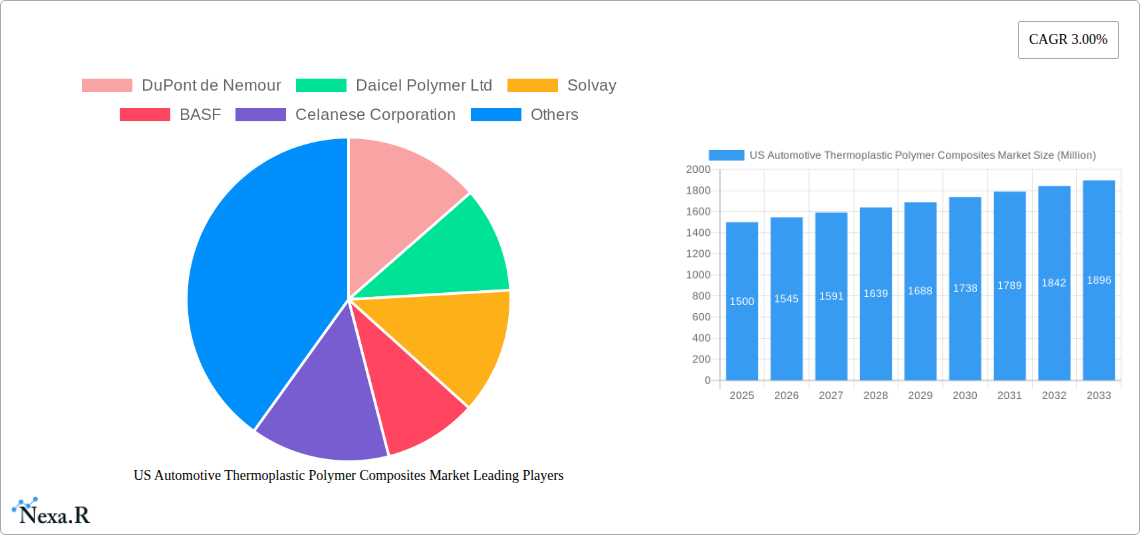

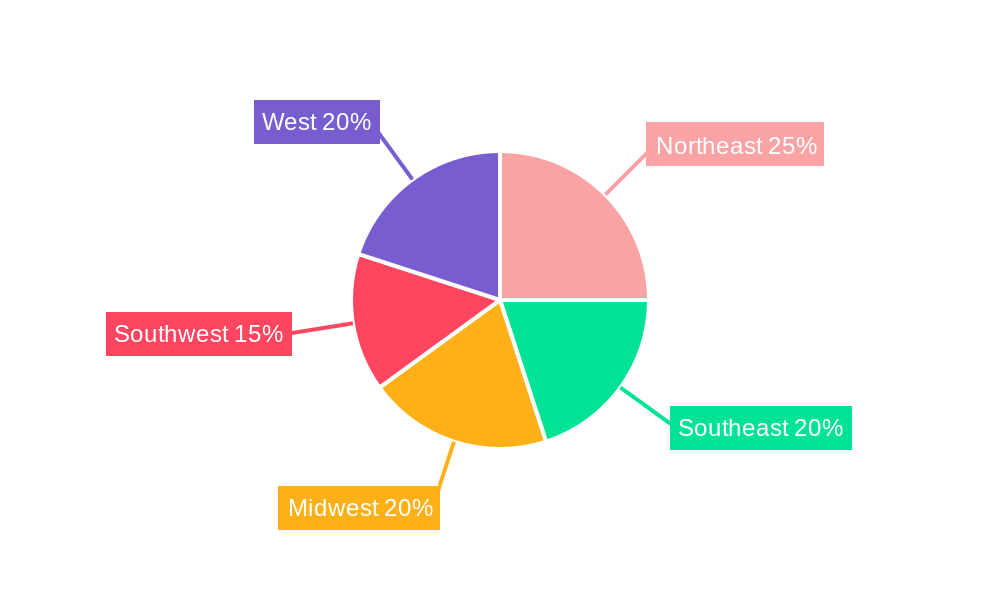

Segmentation within the US market reveals a dynamic landscape. While hand layup and resin transfer molding remain established production methods, injection molding and compression molding are gaining traction due to their automation potential and higher production volumes. Applications span across critical vehicle areas: structural assemblies (e.g., body panels, bumpers), powertrain components (e.g., engine covers, transmission casings), and interior/exterior elements (e.g., dashboards, door panels). Key players like DuPont, Daicel, Solvay, BASF, and Celanese are actively involved in research and development, fostering innovation and driving market growth through improved material properties and manufacturing processes. Regional variations in growth are expected, with regions like the Northeast and West potentially witnessing higher adoption rates due to the concentration of automotive manufacturing hubs and early adoption of advanced technologies. The forecast period (2025-2033) promises further growth as the market consolidates and new applications emerge, driven by continuous innovation in both material science and manufacturing techniques.

US Automotive Thermoplastic Polymer Composites Market Company Market Share

US Automotive Thermoplastic Polymer Composites Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the US Automotive Thermoplastic Polymer Composites Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, and key players. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. This detailed analysis will equip industry professionals, investors, and stakeholders with the knowledge necessary to navigate this dynamic market. The parent market is the broader US automotive market, and the child market is thermoplastic polymer composites specifically for automotive applications.

US Automotive Thermoplastic Polymer Composites Market Market Dynamics & Structure

The US automotive thermoplastic polymer composites market is characterized by moderate concentration, with key players such as DuPont de Nemour, Daicel Polymer Ltd, Solvay, BASF, and Celanese Corporation holding significant market share. The market is driven by technological innovations focusing on lightweighting, improved fuel efficiency, and enhanced design flexibility. Stringent government regulations regarding emissions and fuel economy further propel market growth. Competitive pressures arise from the availability of alternative materials like metals and thermoset composites. End-user demographics heavily influence demand, with trends towards SUVs and electric vehicles impacting material selection. The market has witnessed a moderate level of M&A activity in recent years, with xx deals recorded between 2019 and 2024, resulting in a xx% market share shift among leading players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on lightweighting, improved strength-to-weight ratio, and enhanced recyclability.

- Regulatory Framework: Stringent fuel efficiency and emission standards drive demand for lightweight materials.

- Competitive Substitutes: Metals, thermoset composites, and other advanced materials pose competitive challenges.

- End-User Demographics: Growing demand for SUVs and electric vehicles fuels market growth.

- M&A Trends: xx M&A deals between 2019-2024, resulting in xx% market share shift. Innovation barriers include high R&D costs and complex manufacturing processes.

US Automotive Thermoplastic Polymer Composites Market Growth Trends & Insights

The US automotive thermoplastic polymer composites market experienced robust growth between 2019 and 2024, with a CAGR of xx%. This growth is attributed to several factors, including increasing demand for lightweight vehicles, advancements in polymer composite technology, and favorable government regulations. Market penetration is expected to increase steadily in the forecast period (2025-2033), driven by the rising adoption of thermoplastic composites in various automotive applications. Technological disruptions, such as the development of high-performance thermoplastic composites with enhanced properties, are further propelling market growth. Consumer preferences are shifting towards fuel-efficient and environmentally friendly vehicles, creating a positive outlook for the market. The market size is projected to reach xx million units by 2033, with a CAGR of xx% during the forecast period. This growth will be primarily driven by the increasing adoption of thermoplastic composites in structural components and interior applications due to their enhanced performance and recyclability.

Dominant Regions, Countries, or Segments in US Automotive Thermoplastic Polymer Composites Market

The Midwest and Southern regions of the US continue to be at the forefront of automotive thermoplastic polymer composite adoption. This leadership is directly linked to the significant presence of major automotive manufacturing hubs and a favorable regulatory environment that actively encourages the integration of advanced, lightweight materials. Examining production techniques, Injection Molding and Resin Transfer Molding (RTM) stand out as the dominant processes, collectively accounting for a substantial portion of the market share. These methods are favored for their efficiency and scalability in producing complex automotive components. In terms of application, Structural Assembly commands the largest market share, a direct consequence of the relentless pursuit of lighter yet exceptionally strong components essential for enhancing vehicle performance and fuel economy. Looking ahead, the future growth trajectory is strongly influenced by the expanding application of these composites in powertrain components, a trend amplified by the accelerating transition towards electric vehicles (EVs), which demand innovative thermal management and structural solutions.

- Key Regional Drivers: Robust concentration of automotive manufacturing facilities, particularly in the Midwest and Southern states, fostering localized demand and innovation.

- Production Type Drivers: Injection Molding and Resin Transfer Molding are favored for their cost-effectiveness, high production volumes, and ability to create intricate part designs.

- Application Type Drivers: Structural assemblies, including chassis components and body panels, lead due to their critical role in weight reduction. Interior applications also represent a significant and growing segment.

- Emerging Growth Potential: Powertrain components, especially for EVs (e.g., battery enclosures, thermal management systems), and advanced exterior applications offer substantial opportunities for innovation and market penetration.

US Automotive Thermoplastic Polymer Composites Market Product Landscape

The US automotive thermoplastic polymer composites market is characterized by a rich and diverse product portfolio, meticulously engineered to meet the evolving demands of various automotive applications. These advanced materials are distinguished by their exceptional strength-to-weight ratios, offering a compelling alternative to traditional metals. Furthermore, they provide unparalleled design flexibility, enabling the creation of more integrated and aesthetically pleasing components. A key advantage is their inherent recyclability, aligning with the industry's increasing focus on sustainability. Recent breakthroughs in material science have led to the development of high-performance composites boasting enhanced thermal and chemical resistance, opening doors for their utilization in highly demanding environments such as under-the-hood applications and engine components. The unique selling propositions of these composites are multifaceted, encompassing significant lightweighting capabilities that directly translate to improved vehicle fuel efficiency, and a competitive cost-effectiveness when compared to other high-performance advanced materials, making them an increasingly attractive choice for automotive manufacturers.

Key Drivers, Barriers & Challenges in US Automotive Thermoplastic Polymer Composites Market

Key Drivers:

- Increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions.

- Advancements in material science leading to improved performance characteristics of thermoplastic composites.

- Favorable government regulations promoting the adoption of sustainable and lightweight materials.

Key Challenges:

- High initial investment costs associated with the manufacturing and processing of thermoplastic composites.

- Supply chain complexities and dependence on raw material availability impacting production capacity.

- Competitive pressures from existing materials and the emergence of alternative technologies.

Emerging Opportunities in US Automotive Thermoplastic Polymer Composites Market

Emerging opportunities include expanding into untapped markets like electric vehicle components, developing innovative applications utilizing recycled materials, and meeting the increasing demand for customized composite solutions. Consumer preferences for sustainable and environmentally friendly vehicles will drive demand for recyclable and bio-based thermoplastic composites. The market presents potential for partnerships with automotive OEMs and material suppliers to develop innovative solutions for future vehicle designs.

Growth Accelerators in the US Automotive Thermoplastic Polymer Composites Market Industry

The long-term growth trajectory of the US automotive thermoplastic polymer composites market is set to be profoundly influenced by several converging factors. Technological advancements in material science are paramount, promising the development of composites with even more superior properties and functionalities. Strategic partnerships and collaborations between leading automotive manufacturers and specialized material suppliers will be crucial for co-developing tailored solutions and accelerating market penetration. Furthermore, supportive government initiatives and regulatory frameworks that promote the development and adoption of sustainable automotive materials are expected to provide a significant boost. The continuous innovation in cost-effective manufacturing processes, coupled with the establishment of robust recycling infrastructure for these composite materials, will further accelerate their widespread adoption and market growth.

Key Players Shaping the US Automotive Thermoplastic Polymer Composites Market Market

- DuPont de Nemours, Inc.

- Daicel Corporation (Including its polymer divisions)

- Solvay

- BASF SE

- Celanese Corporation

- Arkema Group

- Gurit

- 3B-Fiberglass

- Cytec Industries Inc. (An integral part of Solvay)

Notable Milestones in US Automotive Thermoplastic Polymer Composites Market Sector

- 2021: DuPont launches a new line of high-performance thermoplastic composites for electric vehicle applications.

- 2022: BASF and Ford Motor Company announce a strategic partnership to develop sustainable automotive materials.

- 2023: Solvay invests in a new manufacturing facility for thermoplastic composites in the US Midwest.

In-Depth US Automotive Thermoplastic Polymer Composites Market Market Outlook

The outlook for the US automotive thermoplastic polymer composites market remains exceptionally strong, underpinned by a confluence of driving forces. Continued technological innovation in material science is a key enabler, leading to the creation of composites with enhanced performance characteristics. The persistent and increasing demand for lightweight vehicles, driven by regulatory mandates for improved fuel efficiency and reduced emissions, directly fuels the adoption of these materials. Additionally, proactive government policies aimed at promoting advanced manufacturing and sustainable transportation solutions are creating a fertile ground for market expansion. Crucially, the forging of robust strategic partnerships between innovative material suppliers and original equipment manufacturers (OEMs) will be instrumental in shaping the market's future landscape. Significant opportunities are emerging for companies that can deliver cost-effective and environmentally sustainable solutions, capitalizing on the escalating consumer and regulatory preference for greener vehicles. The future potential of this market is vast, promising substantial avenues for groundbreaking innovation and strategic growth.

US Automotive Thermoplastic Polymer Composites Market Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Compression Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Power Train Components

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

US Automotive Thermoplastic Polymer Composites Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Automotive Thermoplastic Polymer Composites Market Regional Market Share

Geographic Coverage of US Automotive Thermoplastic Polymer Composites Market

US Automotive Thermoplastic Polymer Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Compression Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Power Train Components

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. North America US Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 6.1.1. Hand Layup

- 6.1.2. Resin Transfer Molding

- 6.1.3. Vacuum Infusion Processing

- 6.1.4. Injection Molding

- 6.1.5. Compression Molding

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Structural Assembly

- 6.2.2. Power Train Components

- 6.2.3. Interior

- 6.2.4. Exterior

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 7. South America US Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 7.1.1. Hand Layup

- 7.1.2. Resin Transfer Molding

- 7.1.3. Vacuum Infusion Processing

- 7.1.4. Injection Molding

- 7.1.5. Compression Molding

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Structural Assembly

- 7.2.2. Power Train Components

- 7.2.3. Interior

- 7.2.4. Exterior

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 8. Europe US Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 8.1.1. Hand Layup

- 8.1.2. Resin Transfer Molding

- 8.1.3. Vacuum Infusion Processing

- 8.1.4. Injection Molding

- 8.1.5. Compression Molding

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Structural Assembly

- 8.2.2. Power Train Components

- 8.2.3. Interior

- 8.2.4. Exterior

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 9. Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 9.1.1. Hand Layup

- 9.1.2. Resin Transfer Molding

- 9.1.3. Vacuum Infusion Processing

- 9.1.4. Injection Molding

- 9.1.5. Compression Molding

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Structural Assembly

- 9.2.2. Power Train Components

- 9.2.3. Interior

- 9.2.4. Exterior

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 10. Asia Pacific US Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 10.1.1. Hand Layup

- 10.1.2. Resin Transfer Molding

- 10.1.3. Vacuum Infusion Processing

- 10.1.4. Injection Molding

- 10.1.5. Compression Molding

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Structural Assembly

- 10.2.2. Power Train Components

- 10.2.3. Interior

- 10.2.4. Exterior

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DuPont de Nemour

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daicel Polymer Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Celanese Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gurit

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3B-Fiberglass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cytec Industries Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 DuPont de Nemour

List of Figures

- Figure 1: Global US Automotive Thermoplastic Polymer Composites Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Production Type 2025 & 2033

- Figure 3: North America US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Production Type 2025 & 2033

- Figure 4: North America US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Production Type 2025 & 2033

- Figure 9: South America US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Production Type 2025 & 2033

- Figure 10: South America US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Application Type 2025 & 2033

- Figure 11: South America US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Production Type 2025 & 2033

- Figure 15: Europe US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Production Type 2025 & 2033

- Figure 16: Europe US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Europe US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Production Type 2025 & 2033

- Figure 21: Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Production Type 2025 & 2033

- Figure 22: Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Production Type 2025 & 2033

- Figure 27: Asia Pacific US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Production Type 2025 & 2033

- Figure 28: Asia Pacific US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Asia Pacific US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific US Automotive Thermoplastic Polymer Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Automotive Thermoplastic Polymer Composites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Production Type 2020 & 2033

- Table 2: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Production Type 2020 & 2033

- Table 5: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Production Type 2020 & 2033

- Table 11: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Production Type 2020 & 2033

- Table 17: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Production Type 2020 & 2033

- Table 29: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 30: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Production Type 2020 & 2033

- Table 38: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 39: Global US Automotive Thermoplastic Polymer Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Automotive Thermoplastic Polymer Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Automotive Thermoplastic Polymer Composites Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the US Automotive Thermoplastic Polymer Composites Market?

Key companies in the market include DuPont de Nemour, Daicel Polymer Ltd, Solvay, BASF, Celanese Corporation, Arkema Group, Gurit, 3B-Fiberglass, Cytec Industries Inc.

3. What are the main segments of the US Automotive Thermoplastic Polymer Composites Market?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Automotive Thermoplastic Polymer Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Automotive Thermoplastic Polymer Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Automotive Thermoplastic Polymer Composites Market?

To stay informed about further developments, trends, and reports in the US Automotive Thermoplastic Polymer Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence