Key Insights

The used construction equipment market, valued at approximately $131.38 billion in 2024, is projected to expand at a compound annual growth rate (CAGR) of 5.13% from 2024 to 2033. This growth is propelled by the increasing demand for cost-effective construction solutions, enhanced equipment reliability through advanced refurbishment, and a growing emphasis on sustainable building practices. Fluctuations in raw material costs for new equipment further bolster the demand for pre-owned machinery. Smaller construction firms and budget-conscious projects are key drivers for this trend.

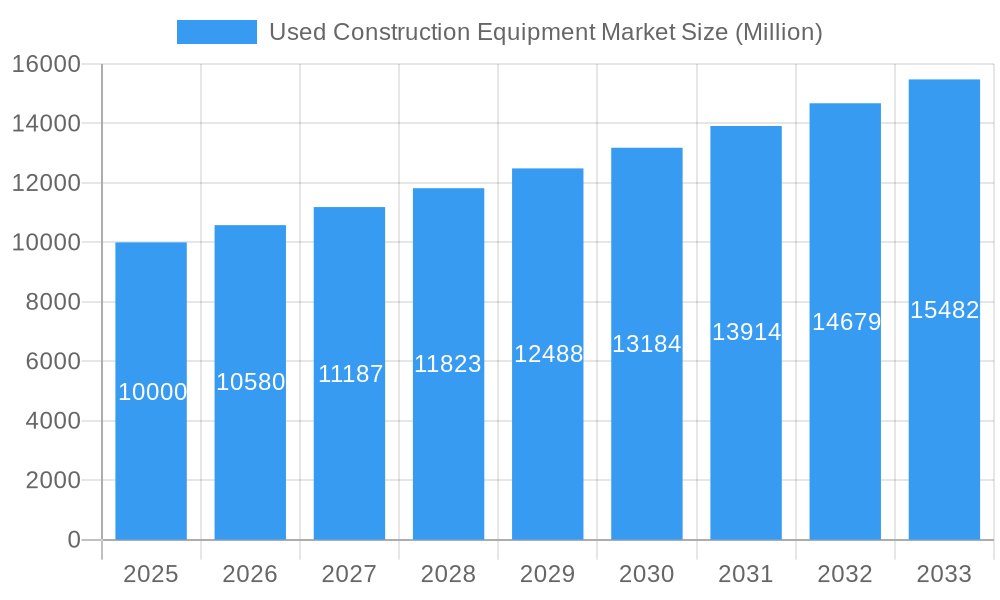

Used Construction Equipment Market Market Size (In Billion)

Market growth faces constraints including the inherent risks associated with purchasing used machinery, such as potential mechanical issues and shorter operational lifespans. Construction industry activity levels and the availability of certified, well-maintained used equipment also influence market dynamics. Despite these challenges, the used construction equipment market is experiencing increasing acceptance, particularly in developing economies with rapid infrastructure development. Key segments include cranes, excavators, and telescopic handlers, with internal combustion engine-powered machines currently leading. However, a gradual shift towards electric and hybrid drive types is anticipated due to rising sustainability concerns. Geographically, Asia-Pacific leads growth due to significant infrastructure projects, followed by North America and Europe.

Used Construction Equipment Market Company Market Share

This report delivers a comprehensive analysis of the Used Construction Equipment Market, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook from 2019-2033, with 2024 as the base and estimated year. The market is segmented by product type (Crane, Telescopic Handler, Excavator, Material Handling Equipment, Loader and Backhoe, Others) and drive type (Internal Combustion Engine, Electric, Hybrid), providing granular insights for strategic decision-making. The total market size in 2024 is estimated at 131.38 billion units.

Used Construction Equipment Market Dynamics & Structure

The used construction equipment market is characterized by a moderately concentrated landscape, with major players like Caterpillar Inc., Komatsu, and Volvo CE holding significant market share. However, the market also features a substantial number of smaller regional players and independent dealers. Technological innovation, particularly in areas like telematics and emission control, is a key driver, although high initial investment costs can act as a barrier for smaller companies. Stringent environmental regulations are shaping the market, favoring fuel-efficient and emission-reducing equipment. The rise of online marketplaces is disrupting traditional sales channels, creating new opportunities for both buyers and sellers. Mergers and acquisitions (M&A) activity is moderate, with larger companies consolidating their market position through acquisitions of smaller players. The market is also influenced by macroeconomic factors such as construction activity levels and economic growth. Substitution with new equipment is limited due to cost and efficiency considerations. The industry is experiencing a shift toward digitalization and data-driven decision-making.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Key drivers include telematics, emission control technologies, and automation.

- Regulatory Framework: Stringent environmental regulations impacting equipment choices and sales.

- Competitive Substitutes: Limited direct substitutes due to high costs of new equipment.

- End-User Demographics: Predominantly construction companies, rental firms, and individual contractors.

- M&A Trends: Moderate M&A activity, primarily driven by consolidation and expansion strategies. xx M&A deals recorded in the last 5 years.

Used Construction Equipment Market Growth Trends & Insights

The used construction equipment market has experienced steady growth over the historical period (2019-2024), driven by factors such as increasing infrastructure development, rising urbanization, and fluctuating new equipment prices. The market is expected to continue its growth trajectory throughout the forecast period (2025-2033), albeit at a potentially moderated pace due to global economic conditions. Adoption rates of used equipment vary across regions and equipment types. Technological disruptions, such as the introduction of electric and hybrid models, are gradually transforming the market. Consumer behavior is shifting towards online platforms for purchasing and rental, influencing market dynamics. The CAGR for the forecast period is estimated at xx%. Market penetration of used equipment is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Used Construction Equipment Market

North America and Europe currently dominate the used construction equipment market, driven by robust construction sectors and high equipment demand. However, rapidly developing economies in Asia-Pacific are emerging as significant growth markets. Within product types, excavators and loaders hold the largest market share, while within drive types, internal combustion engines still dominate, although electric and hybrid options are gaining traction.

- Leading Regions: North America and Europe.

- Key Growth Markets: Asia-Pacific (particularly China and India).

- Dominant Product Types: Excavators and Loaders (holding xx% and xx% of market share respectively in 2025).

- Dominant Drive Type: Internal Combustion Engine (holding xx% market share in 2025).

- Drivers: High infrastructure spending, urbanization, and rising construction activity.

Used Construction Equipment Market Product Landscape

The used construction equipment market offers a diverse range of products, including cranes, excavators, loaders, and material handling equipment. Recent innovations focus on improving fuel efficiency, enhancing safety features, and incorporating advanced technologies like telematics for remote monitoring and diagnostics. Unique selling propositions often center on cost savings compared to new equipment and the availability of a wide range of models and specifications. Technological advancements include the integration of GPS systems, improved hydraulics, and enhanced operator comfort features.

Key Drivers, Barriers & Challenges in Used Construction Equipment Market

Key Drivers:

- Rising infrastructure development globally.

- Increasing urbanization and construction activity.

- Cost-effectiveness of used equipment compared to new equipment.

- Growing demand from rental companies.

Key Challenges:

- Fluctuations in commodity prices impacting equipment costs.

- Stringent emission regulations and their impact on older equipment.

- Concerns regarding equipment reliability and maintenance. Maintenance costs represent approximately xx% of total ownership cost.

- Supply chain disruptions and logistical challenges affecting availability.

Emerging Opportunities in Used Construction Equipment Market

- Expansion into emerging markets with growing infrastructure needs.

- Development of specialized used equipment for niche applications.

- Growth of online marketplaces and digital sales channels.

- Adoption of data analytics and predictive maintenance technologies.

Growth Accelerators in the Used Construction Equipment Market Industry

Technological advancements, strategic partnerships, and market expansion into developing economies are key growth accelerators for the used construction equipment market. The development of innovative financing options and improved supply chain management are also crucial for stimulating market growth.

Key Players Shaping the Used Construction Equipment Market Market

Notable Milestones in Used Construction Equipment Market Sector

- January 2021: Launch of Kobelco Used Crane Finder service, expanding market access.

- November 2022: Maxim Crane Works launches Maxim MarketplaceTM, a significant advancement in online used equipment sales.

- December 2022: MyCrane expands to the US market, enhancing online crane rental and sales.

In-Depth Used Construction Equipment Market Market Outlook

The used construction equipment market is poised for continued growth, driven by sustained infrastructure development and the increasing adoption of digital technologies. Strategic partnerships, technological innovations, and expansion into new markets will further fuel this growth. The market is expected to witness significant consolidation, with larger players acquiring smaller companies to enhance their market share and expand their product portfolios. The focus will shift towards sustainable and technologically advanced equipment, leading to higher demand for fuel-efficient and emission-reducing models.

Used Construction Equipment Market Segmentation

-

1. Product Type

- 1.1. Crane

- 1.2. Telescopic Handler

- 1.3. Excavator

- 1.4. Material Handling Equipment

- 1.5. Loader and Backhoe

- 1.6. Others

-

2. Drive Type

- 2.1. Internal Combustion Engine

- 2.2. Electric

- 2.3. Hybrid

Used Construction Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Used Construction Equipment Market Regional Market Share

Geographic Coverage of Used Construction Equipment Market

Used Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Forklift; Others

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption; Others

- 3.4. Market Trends

- 3.4.1. High Cost of New Construction Equipment is driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handler

- 5.1.3. Excavator

- 5.1.4. Material Handling Equipment

- 5.1.5. Loader and Backhoe

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Crane

- 6.1.2. Telescopic Handler

- 6.1.3. Excavator

- 6.1.4. Material Handling Equipment

- 6.1.5. Loader and Backhoe

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Internal Combustion Engine

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Crane

- 7.1.2. Telescopic Handler

- 7.1.3. Excavator

- 7.1.4. Material Handling Equipment

- 7.1.5. Loader and Backhoe

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Internal Combustion Engine

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Crane

- 8.1.2. Telescopic Handler

- 8.1.3. Excavator

- 8.1.4. Material Handling Equipment

- 8.1.5. Loader and Backhoe

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Internal Combustion Engine

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of World Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Crane

- 9.1.2. Telescopic Handler

- 9.1.3. Excavator

- 9.1.4. Material Handling Equipment

- 9.1.5. Loader and Backhoe

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Internal Combustion Engine

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kobelco Construction Machinery

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Volvo CE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Manitou BF

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 John Deere & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Construction Machiner

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Komatsu

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Liebherr International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi heavy Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Terex Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Global Used Construction Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 5: North America Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 11: Europe Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: Europe Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 17: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Asia Pacific Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of World Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Rest of World Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of World Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 23: Rest of World Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Rest of World Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of World Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Global Used Construction Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 9: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 12: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 15: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Construction Equipment Market?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the Used Construction Equipment Market?

Key companies in the market include Kobelco Construction Machinery, Volvo CE, Manitou BF, John Deere & Co, Caterpillar Inc, Hitachi Construction Machiner, Komatsu, Liebherr International, Mitsubishi heavy Industries Ltd, Terex Corporation.

3. What are the main segments of the Used Construction Equipment Market?

The market segments include Product Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 131.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Forklift; Others.

6. What are the notable trends driving market growth?

High Cost of New Construction Equipment is driving the growth of the market.

7. Are there any restraints impacting market growth?

Supply Chain Disruption; Others.

8. Can you provide examples of recent developments in the market?

December 2022: MyCrane, a Dubai-based online crane rental service, has opened a branch in the United States. It is a new digital platform launched to disrupt and streamline the crane rental procurement process. It also provides the option to buy and sell cranes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Used Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence