Key Insights

The global vehicle security market is projected for significant expansion, driven by rising vehicle theft rates, heightened consumer demand for advanced security solutions, and stringent regulatory mandates for enhanced vehicle safety. Anticipated to grow at a compound annual growth rate (CAGR) of 11%, the market is expected to reach a size of $3.37 billion by 2025. Key growth catalysts include the integration of smart technologies like smartphone connectivity and remote access, alongside the increasing adoption of advanced driver-assistance systems (ADAS) that incorporate security functionalities. The escalating sophistication of theft methods further fuels the demand for continuous innovation in vehicle security technologies. Growth is expected across various segments, including alarm systems, keyless entry, immobilizers, and central locking systems, with a notable emphasis on biometric authentication and GPS tracking.

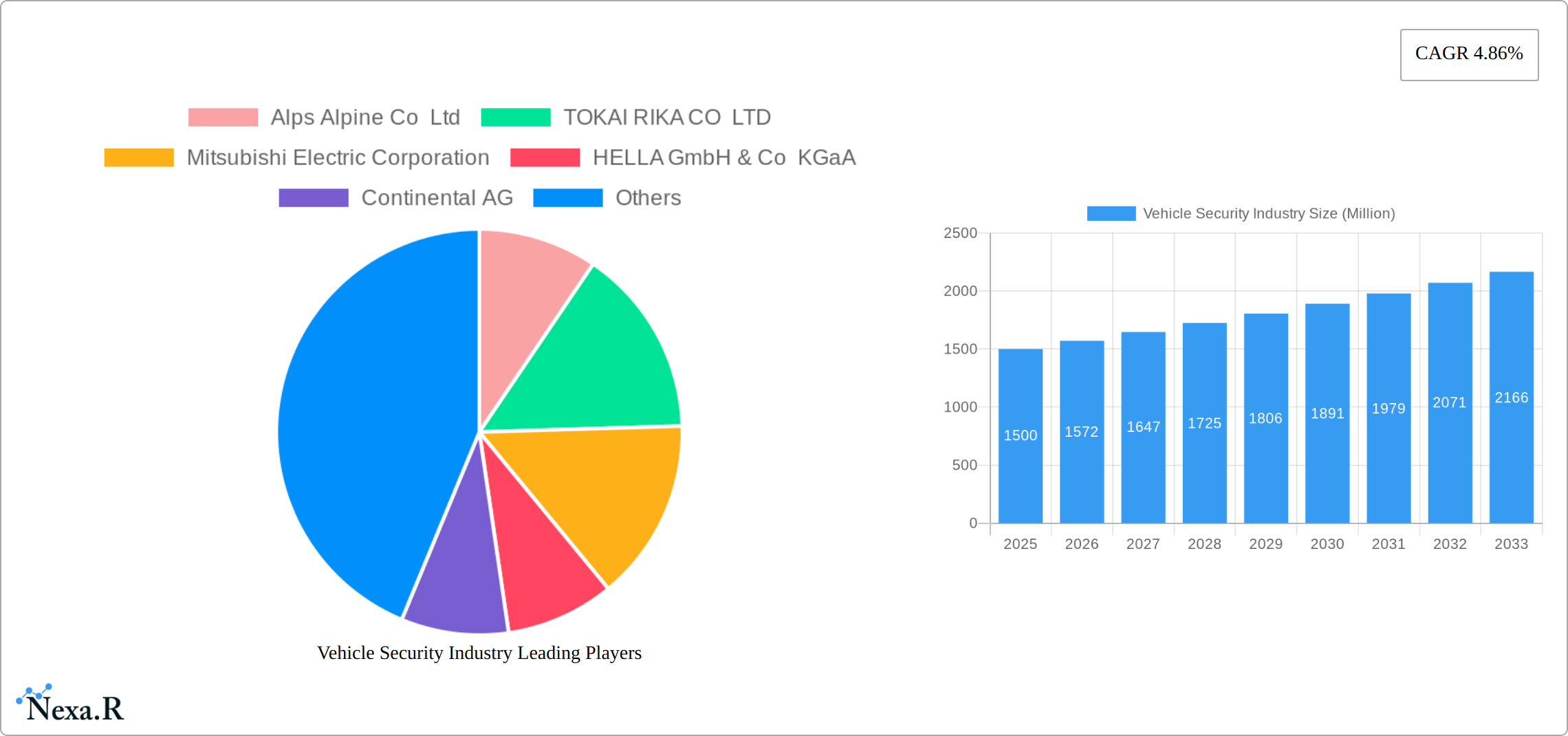

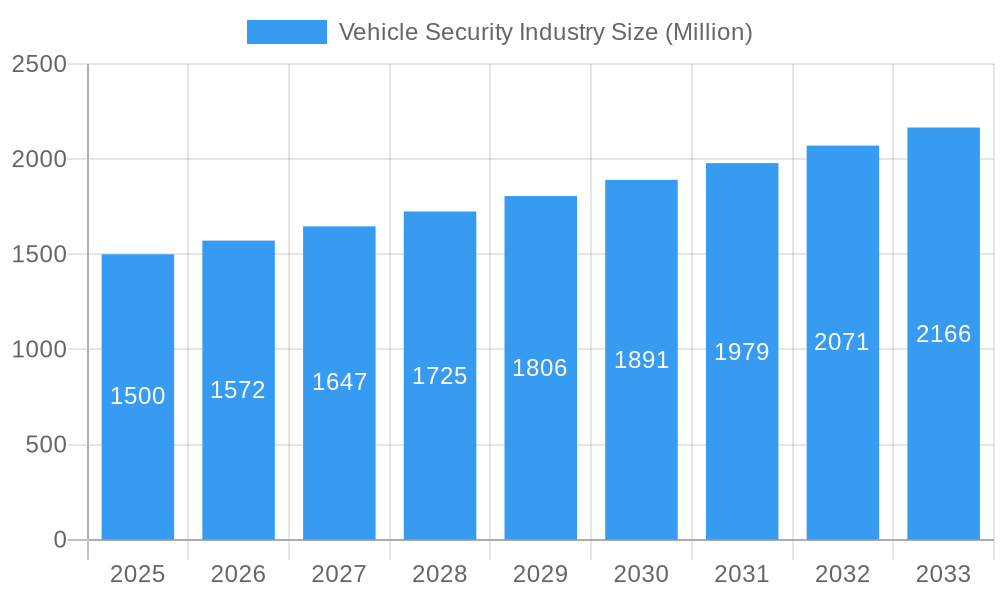

Vehicle Security Industry Market Size (In Billion)

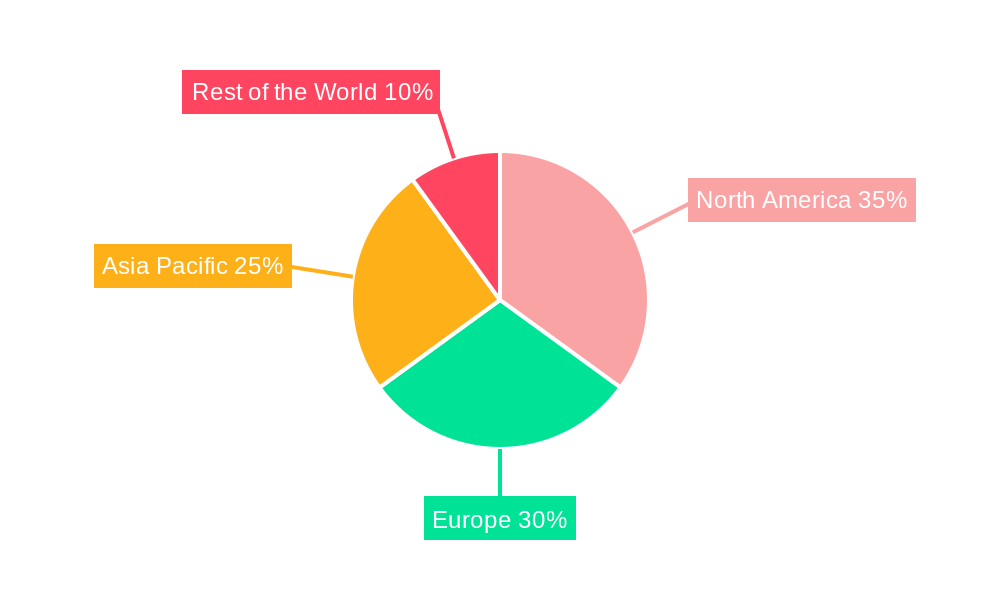

Regionally, North America and Europe currently dominate market share, while the Asia-Pacific region is poised for substantial growth, fueled by rising vehicle ownership and infrastructure development. Despite a positive outlook, market expansion may be tempered by high initial investment costs for sophisticated security systems, particularly in emerging economies. Concerns surrounding cybersecurity vulnerabilities and data privacy within connected vehicle ecosystems also present potential challenges. However, the ongoing development of cost-effective solutions and robust cybersecurity frameworks is expected to address these impediments. The competitive environment is characterized by a mix of established automotive suppliers and specialized security providers, fostering innovation and competitive pricing.

Vehicle Security Industry Company Market Share

Vehicle Security Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Vehicle Security Industry, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report focuses on key segments within the industry, including Alarm, Keyless Entry, Immobilizer, Central Locking, and Other Types, providing granular insights into market size (in Million units) and future projections. The parent market is the automotive industry, and the child market is vehicle safety and security systems.

Vehicle Security Industry Market Dynamics & Structure

The Vehicle Security Industry is a dynamic and evolving sector characterized by a moderately concentrated market structure. A few leading companies command a significant portion of the market share, driving innovation and setting industry standards. The relentless pace of technological advancement is a primary engine of growth, particularly with breakthroughs in areas such as digital key technology, advanced driver-assistance systems (ADAS), and integrated biometric authentication. These innovations not only enhance vehicle safety but also offer consumers greater convenience and control. Furthermore, a robust and evolving regulatory landscape, with governments worldwide imposing increasingly stringent mandates on vehicle safety and cybersecurity, is actively shaping market dynamics and compelling manufacturers to adopt cutting-edge security solutions. Intense competitive pressures are evident, as companies continuously strive to develop and integrate novel, differentiating features to capture consumer attention and secure market leadership. The industry also experiences a consistent and strategic flow of mergers and acquisitions (M&A), enabling larger entities to broaden their product portfolios, acquire specialized technological expertise, and expand their geographical reach. The widespread adoption of connected car technologies, coupled with growing global concerns about vehicle theft and unauthorized access, are powerful catalysts propelling sustained market expansion and demand for sophisticated security measures.

- Market Concentration: Moderately concentrated, with the top 5 players estimated to hold approximately 60-70% of the global market share in 2024.

- Technological Innovation: Rapid advancements are being observed in the development and integration of digital keys (including smartphone-based access), advanced biometrics (fingerprint, facial recognition), robust cybersecurity solutions for connected vehicles, and sophisticated anti-theft systems.

- Regulatory Framework: Stringent government regulations concerning automotive safety, data privacy, and cybersecurity are significantly driving the adoption of advanced security technologies and solutions across the industry.

- Competitive Substitutes: While direct substitutes for integrated vehicle security systems are limited, alternative and supplementary security measures such as aftermarket alarms, tracking devices, and robust physical deterrents do exist, though they often lack the seamless integration and advanced functionality of OEM solutions.

- End-User Demographics: Market growth is substantially driven by increasing global vehicle ownership, particularly the rapid expansion of the automotive sector and rising disposable incomes in emerging markets, leading to a larger consumer base for security features.

- M&A Trends: A steady and strategic increase in M&A activity is evident, with a strong focus on acquiring innovative technologies, expanding product portfolios, and consolidating market presence; an estimated 40-50 significant deals were recorded between 2019-2024.

Vehicle Security Industry Growth Trends & Insights

The global Vehicle Security Industry witnessed robust growth during the historical period (2019-2024), expanding at a CAGR of xx%. This growth is attributed to the increasing adoption of advanced security features in both passenger and commercial vehicles. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of digital keys and smartphone connectivity, are significantly influencing consumer behavior, driving demand for more sophisticated security systems. Market penetration of advanced features varies across regions, with developed markets showing higher adoption rates compared to emerging economies. However, the latter is projected to show accelerated growth in the coming years.

Dominant Regions, Countries, or Segments in Vehicle Security Industry

North America currently holds the largest market share in the Vehicle Security Industry, driven by high vehicle ownership rates and strong consumer demand for advanced security features. Within the product segments, Keyless Entry systems currently dominate, followed closely by Alarm systems. However, the Immobilizer segment is anticipated to witness significant growth due to increasing vehicle theft incidents.

Key Drivers in North America: Strong consumer preference for advanced features, high vehicle sales, and supportive government regulations.

Key Drivers in Europe: Stricter vehicle safety standards, increasing demand for connected car technologies, and a substantial automotive manufacturing base.

Key Drivers in Asia-Pacific: Rapid urbanization, rising disposable incomes, increasing vehicle ownership, and the emergence of smart cities.

Segment Dominance: Keyless Entry systems hold the largest market share (xx million units in 2024), followed by Alarm systems (xx million units).

Vehicle Security Industry Product Landscape

The Vehicle Security Industry offers a diverse range of products, from basic alarm systems to sophisticated integrated security solutions incorporating digital keys, biometric authentication, and remote vehicle monitoring capabilities. Continuous innovation is focused on enhancing security, improving user experience, and integrating with connected car ecosystems. Unique selling propositions (USPs) often center around advanced encryption techniques, ease of use, and seamless integration with other vehicle systems.

Key Drivers, Barriers & Challenges in Vehicle Security Industry

Key Drivers: The escalating adoption of sophisticated connected car technologies, a persistent and growing concern over vehicle theft and tampering incidents, and the enforcement of increasingly stringent government regulations aimed at enhancing vehicle security and data protection are the primary growth drivers. Furthermore, the escalating demand for advanced driver-assistance systems (ADAS) that often incorporate security-related functionalities, and a heightened consumer awareness of the importance of protecting their vehicles and personal data, are also significant contributors to market expansion.

Key Challenges: The industry faces considerable challenges, including persistent supply chain disruptions that can impact the availability of critical components, fluctuating global raw material prices that affect manufacturing costs, the continuous need to meet and exceed stringent evolving cybersecurity standards, and intense competition from both well-established industry giants and agile emerging players. Navigating complex and varied regulatory hurdles across different geographical regions also presents significant obstacles to widespread adoption and implementation of standardized solutions.

Emerging Opportunities in Vehicle Security Industry

Emerging opportunities lie in the expansion of digital key technologies, the integration of advanced cybersecurity solutions, and the growth of the aftermarket segment for security upgrades. The increasing adoption of autonomous vehicles presents new opportunities for developing specialized security solutions to protect against cyberattacks and unauthorized access.

Growth Accelerators in the Vehicle Security Industry

Several factors are poised to significantly accelerate the growth trajectory of the Vehicle Security Industry. Continued technological advancements, particularly in the realm of AI and machine learning for predictive threat detection and advanced anomaly identification, will play a crucial role. Strategic partnerships between automakers, technology providers, and cybersecurity firms will foster innovation and streamline the integration of cutting-edge security solutions. Furthermore, proactive market expansion into rapidly growing emerging economies, where vehicle ownership is on the rise and security needs are becoming more pronounced, will unlock substantial growth opportunities. The ongoing development and integration of advanced security features powered by artificial intelligence (AI) and machine learning (ML) algorithms are expected to be key differentiators and major catalysts for market expansion.

Key Players Shaping the Vehicle Security Industry Market

- Alps Alpine Co Ltd

- TOKAI RIKA CO LTD

- Mitsubishi Electric Corporation

- HELLA GmbH & Co KGaA

- Continental AG

- Viper Security Systems (Directed Electronics)

- Robert Bosch GmbH

- Valeo SA

- Clifford (Directed Inc)

- Brogwarner Inc

- ZF Friedrichshafen AG

Notable Milestones in Vehicle Security Industry Sector

- June 2022: STMicroelectronics launched a new generation of secure system-on-chip (SoC) solutions specifically designed for secure car access, achieving full compliance with the latest CCC Digital Key release 3.0 standards, enhancing interoperability and security.

- May 2022: Alps Alpine Co., Ltd. and Giesecke+Devrient GmbH announced a significant joint development of a CCC-compliant wireless digital key system, offering a secure and convenient alternative to traditional physical keys for vehicle access.

- July 2021: ZF unveiled its advanced ZF ProAI supercomputer, featuring significantly enhanced security mechanisms and robust protection for software-defined vehicles, anticipating the evolving needs of autonomous and connected mobility.

- March 2021: Hella GmbH & Co. KGaA strategically expanded its capabilities by opening a new development center in Craiova, Romania, with a specific focus on bolstering its expertise in software development and electronics for advanced automotive applications, including security systems.

In-Depth Vehicle Security Industry Market Outlook

The Vehicle Security Industry is on a trajectory for substantial and sustained growth in the foreseeable future. This expansion will be primarily fueled by the continuous wave of technological innovation, the pervasive increase in vehicle connectivity, and a growing consumer awareness regarding the imperative need for robust vehicle security. To effectively capitalize on emerging opportunities and maintain a decisive competitive edge within this rapidly evolving market, companies will need to prioritize strategic partnerships, make significant investments in research and development (R&D), and aggressively pursue expansion into new and burgeoning markets. The accelerating adoption of electric vehicles (EVs) and the imminent widespread deployment of autonomous vehicles (AVs) will undoubtedly create a heightened demand for highly sophisticated and integrated security solutions, further propelling market growth and innovation.

Vehicle Security Industry Segmentation

-

1. Type

- 1.1. Alarm

- 1.2. Keyless Entry

- 1.3. Immobilizer

- 1.4. Central Locking

- 1.5. Other Types

Vehicle Security Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Vehicle Security Industry Regional Market Share

Geographic Coverage of Vehicle Security Industry

Vehicle Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Sports Bike to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Premium Helmets Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Number of Advanced Technologies to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Alarm

- 5.1.2. Keyless Entry

- 5.1.3. Immobilizer

- 5.1.4. Central Locking

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Alarm

- 6.1.2. Keyless Entry

- 6.1.3. Immobilizer

- 6.1.4. Central Locking

- 6.1.5. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Alarm

- 7.1.2. Keyless Entry

- 7.1.3. Immobilizer

- 7.1.4. Central Locking

- 7.1.5. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Alarm

- 8.1.2. Keyless Entry

- 8.1.3. Immobilizer

- 8.1.4. Central Locking

- 8.1.5. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Alarm

- 9.1.2. Keyless Entry

- 9.1.3. Immobilizer

- 9.1.4. Central Locking

- 9.1.5. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Alps Alpine Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TOKAI RIKA CO LTD

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Electric Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 HELLA GmbH & Co KGaA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Viper Security Systems (Directed Electronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Valeo SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Clifford (Directed Inc )

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Brogwarner Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ZF Friedrichshafen AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Alps Alpine Co Ltd

List of Figures

- Figure 1: Global Vehicle Security Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 7: Europe Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Asia Pacific Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Rest of the World Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Vehicle Security Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: China Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: South America Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Security Industry?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Vehicle Security Industry?

Key companies in the market include Alps Alpine Co Ltd, TOKAI RIKA CO LTD, Mitsubishi Electric Corporation, HELLA GmbH & Co KGaA, Continental AG, Viper Security Systems (Directed Electronics, Robert Bosch GmbH, Valeo SA, Clifford (Directed Inc ), Brogwarner Inc, ZF Friedrichshafen AG.

3. What are the main segments of the Vehicle Security Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Sports Bike to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Increasing Number of Advanced Technologies to Boost the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Premium Helmets Deter Market Growth.

8. Can you provide examples of recent developments in the market?

June 2022: STMicroelectronics introduced a new system-on-chip solution for secure car access that is Car Connectivity Consortium (CCC) Digital Key release 3.0 compliant to accelerate the introduction of digital car keys, giving users keyless access to vehicles via their mobile devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Security Industry?

To stay informed about further developments, trends, and reports in the Vehicle Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence