Key Insights

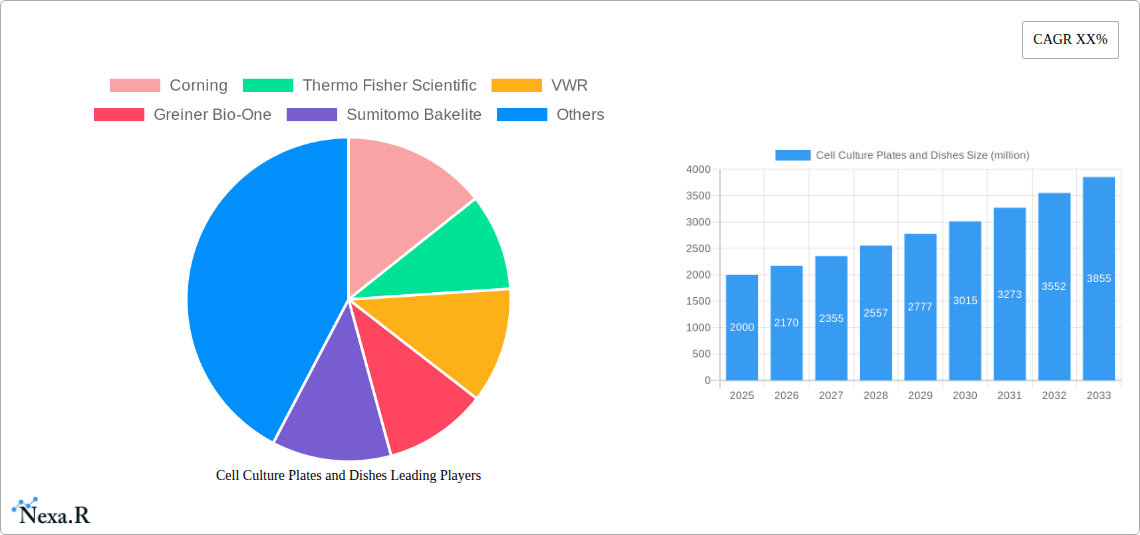

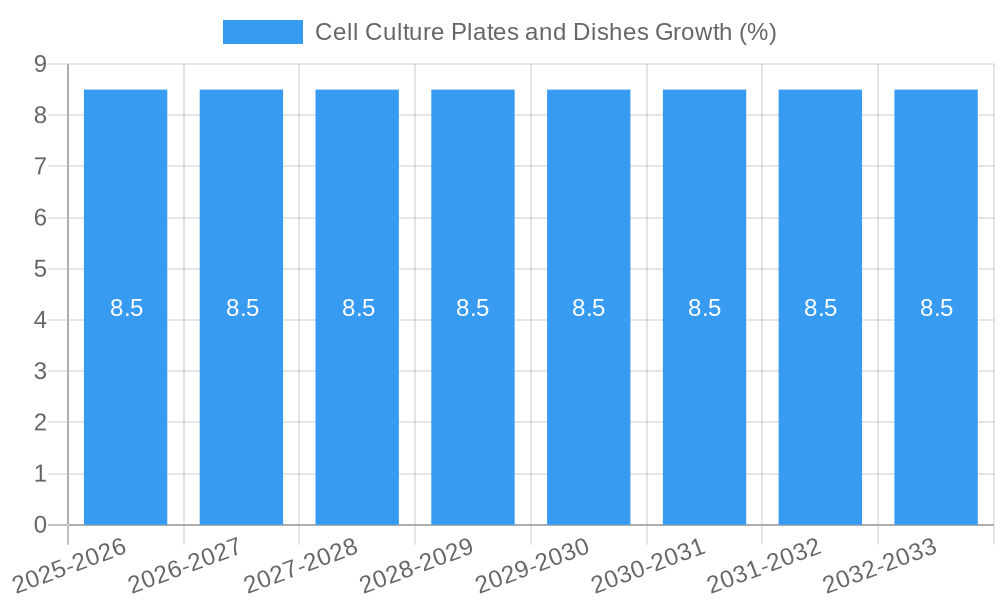

The global cell culture plates and dishes market is poised for significant expansion, projected to reach an estimated market size of approximately \$2,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 8.5% expected throughout the forecast period. This growth is primarily fueled by the escalating demand from the pharmaceutical and biotechnology sectors, driven by an intensified focus on drug discovery, development, and the production of biologics. Academic institutes also contribute substantially as key end-users, leveraging these essential labware for cutting-edge research in life sciences, disease modeling, and regenerative medicine. The burgeoning field of cell-based therapies, personalized medicine, and the increasing prevalence of chronic diseases necessitating advanced research further propel the market forward. Technological advancements, such as the development of specialized surface treatments for enhanced cell adhesion and growth, and the increasing adoption of automation in cell culture workflows, are also key drivers.

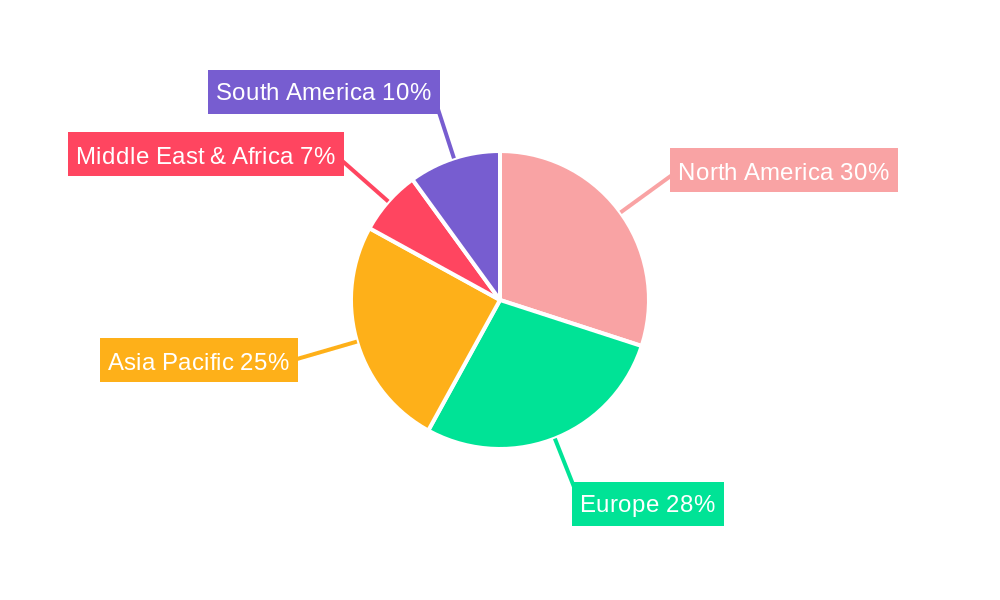

Despite the promising outlook, the market faces certain restraints, including the high cost associated with advanced cell culture consumables and the stringent regulatory requirements for products used in clinical applications. However, these challenges are being mitigated by the continuous innovation in materials science and manufacturing processes, leading to more cost-effective and compliant solutions. The market is segmented by application into Pharmaceutical and Biotechnology, Academic Institutes, and Others, with the former two holding the dominant share. By type, Culture Dishes and Culture Plates represent the primary product categories. Geographically, the Asia Pacific region, particularly China and India, is emerging as a rapidly growing market due to increasing healthcare investments and a burgeoning biopharmaceutical industry. North America and Europe continue to be mature yet significant markets, driven by established research infrastructure and a high concentration of leading biopharmaceutical companies. The competitive landscape is characterized by the presence of several global players, including Corning, Thermo Fisher Scientific, and VWR, who are actively engaged in product innovation, strategic collaborations, and market expansion initiatives to capture market share.

This comprehensive report delves into the dynamic cell culture plates and dishes market, a critical component of life sciences research and biopharmaceutical development. Spanning from 2019 to 2033, with a base and estimated year of 2025, this analysis provides in-depth insights into market evolution, growth drivers, regional dominance, product landscape, and key player strategies. Our expert analysis leverages extensive data to offer actionable intelligence for stakeholders across the pharmaceutical and biotechnology, academic institutes, and other sectors.

Cell Culture Plates and Dishes Market Dynamics & Structure

The global cell culture plates and dishes market exhibits a moderately concentrated structure, with key players like Corning, Thermo Fisher Scientific, and VWR holding significant market share. Technological innovation remains a primary driver, fueled by advancements in surface treatments for enhanced cell adhesion, biocompatible materials, and specialized formats for high-throughput screening and single-cell analysis. Regulatory frameworks, particularly those governing biopharmaceutical manufacturing and research, influence product design and quality standards. Competitive product substitutes include 3D cell culture scaffolds and organ-on-a-chip technologies, posing a gradual challenge to traditional 2D culture formats. End-user demographics are shifting towards a greater emphasis on personalized medicine, regenerative therapies, and drug discovery, demanding more sophisticated and versatile cell culture solutions. Mergers and acquisitions (M&A) are infrequent but strategic, aimed at consolidating market presence, acquiring innovative technologies, or expanding product portfolios. For instance, there were approximately 5 significant M&A deals in the parent market between 2021-2023, impacting specific niches within the cell culture consumables sector. Barriers to innovation include the high cost of R&D, stringent validation processes for new materials, and the need for extensive clinical validation for advanced cell culture applications.

- Market Concentration: Moderately concentrated with leading players holding substantial market influence.

- Technological Innovation: Driven by enhanced cell adhesion surfaces, advanced materials, and specialized formats.

- Regulatory Frameworks: Influencing product design and quality for biopharmaceutical and research applications.

- Competitive Substitutes: 3D cell culture scaffolds and organ-on-a-chip technologies are emerging alternatives.

- End-User Demographics: Shifting towards personalized medicine, regenerative therapies, and drug discovery.

- M&A Trends: Strategic and infrequent, focusing on technology acquisition and portfolio expansion.

- Innovation Barriers: High R&D costs, stringent validation processes, and extensive clinical validation requirements.

Cell Culture Plates and Dishes Growth Trends & Insights

The cell culture plates and dishes market is projected to experience robust growth from 2019 to 2033, driven by the accelerating pace of biopharmaceutical research and development, the burgeoning demand for biologics and personalized medicines, and the expansion of academic research initiatives worldwide. The parent market size, encompassing all cell culture consumables, was valued at approximately $10.5 billion in 2024 and is forecast to reach $18.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period. Within this, the specific market for cell culture plates and dishes is estimated to grow from $4.2 billion in 2024 to $7.1 billion by 2033, with a CAGR of 5.8%. Adoption rates for advanced cell culture technologies, such as multi-well plates with specialized coatings and sterile-packaged dishes for sensitive cell lines, are steadily increasing. Technological disruptions, including the integration of AI and automation in cell culture workflows and the development of novel biomaterials, are poised to further reshape market dynamics. Consumer behavior is shifting towards a preference for high-quality, reliable, and cost-effective consumables that minimize experimental variability and maximize reproducibility. This is evident in the increasing demand for products that offer improved cell viability, enhanced growth characteristics, and reduced contamination risks. The sub-market for cell culture plates is anticipated to witness a CAGR of 6.0%, outpacing the culture dish segment's projected 5.5% CAGR, due to the escalating needs of high-throughput screening and drug discovery applications. The overall market penetration of advanced cell culture consumables is expected to rise from 35% in 2024 to 45% by 2033.

Dominant Regions, Countries, or Segments in Cell Culture Plates and Dishes

The pharmaceutical and biotechnology application segment is the undisputed leader in the global cell culture plates and dishes market, driven by extensive R&D investments in drug discovery, vaccine development, and the production of biotherapeutics. In 2025, this segment is estimated to account for approximately 58% of the global market value, contributing an estimated $2.4 billion to the overall cell culture plates and dishes market size of $4.2 billion. North America, particularly the United States, stands out as the dominant region, holding an estimated 35% market share in 2025, due to its robust biopharmaceutical industry, extensive academic research infrastructure, and significant government funding for life sciences.

Dominant Application Segment: Pharmaceutical and Biotechnology

- Market Share (2025): ~58% of global cell culture plates and dishes market.

- Key Drivers:

- Escalating R&D expenditure in drug discovery and biologics development.

- Growth in personalized medicine and regenerative therapies.

- Increasing demand for monoclonal antibodies and vaccines.

- Expansion of contract research organizations (CROs) and contract manufacturing organizations (CMOs).

- Growth Potential: Sustained high growth due to continuous innovation in therapeutic modalities and precision medicine.

Dominant Region: North America

- Market Share (2025): ~35% of global cell culture plates and dishes market.

- Key Drivers:

- Presence of leading pharmaceutical and biotechnology companies.

- Strong academic research institutions and government funding.

- Favorable regulatory environment for life sciences innovation.

- High adoption rates of advanced cell culture technologies.

- Growth Potential: Steady growth supported by ongoing research breakthroughs and expanding biomanufacturing capabilities.

Dominant Product Type: Culture Plate

- Market Share (2025): ~62% of global cell culture plates and dishes market.

- Key Drivers:

- Essential for high-throughput screening (HTS) and drug discovery.

- Wide variety of formats (e.g., 6-well, 12-well, 24-well, 96-well, 384-well) catering to diverse experimental needs.

- Increasing use in genomics, proteomics, and cell-based assays.

- Growth Potential: Driven by the growing complexity of biological research and the need for parallel experimentation.

The culture plate segment is anticipated to exhibit a CAGR of 6.0% during the forecast period, driven by the increasing adoption of automated liquid handling systems and the demand for miniaturized assays in drug discovery.

Cell Culture Plates and Dishes Product Landscape

The product landscape of cell culture plates and dishes is characterized by continuous innovation aimed at enhancing cell growth, viability, and experimental reproducibility. Leading manufacturers are developing advanced surface treatments, such as tissue-culture treated, low-adhesion, and specialized polymer coatings, to mimic physiological conditions and support diverse cell types. Products now feature improved lid designs for reduced evaporation and contamination, precise well geometry for uniform cell distribution, and sterile packaging for enhanced aseptic handling. Performance metrics focus on maximizing cell attachment, proliferation rates, and maintaining cellular morphology. Unique selling propositions include proprietary surface technologies that promote specific cell behaviors, such as differentiation or spheroid formation, and integrated features for easier media exchange or imaging. Technological advancements are also seen in the development of low-binding plates for sensitive biomolecules and optically clear bottom plates for advanced microscopy.

Key Drivers, Barriers & Challenges in Cell Culture Plates and Dishes

Key Drivers:

- Growing Biopharmaceutical Industry: The expanding pipeline of biologics, vaccines, and gene therapies fuels demand for high-quality cell culture consumables.

- Advancements in Research Technologies: Innovations in drug discovery, regenerative medicine, and personalized medicine necessitate sophisticated cell culture solutions.

- Increasing Investment in Life Sciences: Government initiatives and private funding are boosting research activities globally.

- Technological Sophistication: Development of specialized plates and dishes with enhanced cell adhesion and growth properties.

Barriers & Challenges:

- High Cost of R&D and Manufacturing: Developing novel materials and advanced features can be expensive, impacting product pricing.

- Stringent Regulatory Compliance: Meeting quality standards for cell culture products, especially for therapeutic applications, is a significant hurdle.

- Competition from Emerging Technologies: 3D cell culture and organ-on-a-chip systems offer alternative research platforms.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and finished goods, with an estimated impact of 3-5% on production timelines for critical raw materials in the past.

Emerging Opportunities in Cell Culture Plates and Dishes

Emerging opportunities in the cell culture plates and dishes market lie in the growing demand for specialized cell culture formats for organoid development, spheroid cultures, and single-cell analysis. The rise of cell and gene therapies presents a significant opportunity for specialized cell culture vessels designed for stem cell expansion and precise cell manipulation. Untapped markets include developing economies with expanding research infrastructure and a growing focus on biopharmaceutical manufacturing. Furthermore, the integration of smart technologies, such as embedded sensors for real-time monitoring of cell culture conditions, represents a futuristic avenue for innovation.

Growth Accelerators in the Cell Culture Plates and Dishes Industry

Long-term growth in the cell culture plates and dishes industry will be significantly accelerated by breakthroughs in biomaterial science, leading to the development of more biocompatible and functional surfaces that better mimic in vivo environments. Strategic partnerships between consumable manufacturers and biotechnology companies developing novel cell-based therapies will drive the co-development of specialized culture solutions. Market expansion strategies, particularly in emerging economies with burgeoning life science sectors, will further fuel growth. The increasing adoption of automation and robotics in cell culture workflows will also necessitate the development of compatible and standardized cell culture consumables.

Key Players Shaping the Cell Culture Plates and Dishes Market

- Corning

- Thermo Fisher Scientific

- VWR

- Greiner Bio-One

- Sumitomo Bakelite

- Sarstedt

- TPP Techno Plastic Products

- Jet Bio-Filtration

- sorfa Life Science

- Wuxi NEST Biotechnology

- Crystalgen

- Merck

- CELLTREAT Scientific

- Himedia Laboratories

- Membrane Solution

- ExCell Bio

- Beaver Biomedical Engineering

- Suzhou ConRem Biomedical Technology

- Guangzhou Jet Bio-Filtration

- Cellverse Bioscience Technology

- Citotest Labware Manufacturing

- Xiamen Bioendo Technology

- Hong Kong aibisheng biological technology group

Notable Milestones in Cell Culture Plates and Dishes Sector

- 2020: Launch of advanced sterile-packaged cell culture plates with enhanced optical clarity for high-resolution microscopy.

- 2021: Introduction of novel low-adhesion surface-treated culture dishes designed for efficient spheroid formation.

- 2022: Significant expansion of manufacturing capacity for multi-well plates by a leading player to meet surging demand from the biopharmaceutical sector.

- 2023: Acquisition of a niche cell culture consumables manufacturer by a major industry player to broaden its product portfolio in specialized cell culture.

- 2024 (Estimated): Expected introduction of biodegradable cell culture plates utilizing novel sustainable materials.

In-Depth Cell Culture Plates and Dishes Market Outlook

- 2020: Launch of advanced sterile-packaged cell culture plates with enhanced optical clarity for high-resolution microscopy.

- 2021: Introduction of novel low-adhesion surface-treated culture dishes designed for efficient spheroid formation.

- 2022: Significant expansion of manufacturing capacity for multi-well plates by a leading player to meet surging demand from the biopharmaceutical sector.

- 2023: Acquisition of a niche cell culture consumables manufacturer by a major industry player to broaden its product portfolio in specialized cell culture.

- 2024 (Estimated): Expected introduction of biodegradable cell culture plates utilizing novel sustainable materials.

In-Depth Cell Culture Plates and Dishes Market Outlook

The future outlook for the cell culture plates and dishes market is exceptionally positive, driven by sustained innovation and expanding applications in life sciences. Growth accelerators such as advancements in biomaterials, the burgeoning cell and gene therapy market, and increasing adoption of automation will continue to propel market expansion. Strategic partnerships and expansion into emerging geographical markets present significant opportunities for market players to solidify their positions. The continuous demand for reliable and high-performance cell culture consumables for research, diagnostics, and biopharmaceutical production ensures a robust growth trajectory for this essential market segment over the next decade.

Cell Culture Plates and Dishes Segmentation

-

1. Application

- 1.1. Pharmaceutical and Biotechnology

- 1.2. Academic Institutes

- 1.3. Others

-

2. Types

- 2.1. Culture Dish

- 2.2. Culture Plate

Cell Culture Plates and Dishes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cell Culture Plates and Dishes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell Culture Plates and Dishes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical and Biotechnology

- 5.1.2. Academic Institutes

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Culture Dish

- 5.2.2. Culture Plate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cell Culture Plates and Dishes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical and Biotechnology

- 6.1.2. Academic Institutes

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Culture Dish

- 6.2.2. Culture Plate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cell Culture Plates and Dishes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical and Biotechnology

- 7.1.2. Academic Institutes

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Culture Dish

- 7.2.2. Culture Plate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cell Culture Plates and Dishes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical and Biotechnology

- 8.1.2. Academic Institutes

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Culture Dish

- 8.2.2. Culture Plate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cell Culture Plates and Dishes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical and Biotechnology

- 9.1.2. Academic Institutes

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Culture Dish

- 9.2.2. Culture Plate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cell Culture Plates and Dishes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical and Biotechnology

- 10.1.2. Academic Institutes

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Culture Dish

- 10.2.2. Culture Plate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Corning

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 VWR

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Greiner Bio-One

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sumitomo Bakelite

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sarstedt

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TPP Techno Plastic Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jet Bio-Filtration

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 sorfa Life Science

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wuxi NEST Biotechnology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Crystalgen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Merck

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CELLTREAT Scientific

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Himedia Laboratories

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Membrane Solution

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ExCell Bio

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Beaver Biomedical Engineerin

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Suzhou ConRem Biomedical Technology

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Guangzhou Jet Bio-Filtration

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Cellverse Bioscience Technology

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Citotest Labware Manufacturing

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Xiamen Bioendo Technology

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Hong Kong aibisheng biological technology group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Corning

List of Figures

- Figure 1: Global Cell Culture Plates and Dishes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Cell Culture Plates and Dishes Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Cell Culture Plates and Dishes Revenue (million), by Application 2024 & 2032

- Figure 4: North America Cell Culture Plates and Dishes Volume (K), by Application 2024 & 2032

- Figure 5: North America Cell Culture Plates and Dishes Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Cell Culture Plates and Dishes Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Cell Culture Plates and Dishes Revenue (million), by Types 2024 & 2032

- Figure 8: North America Cell Culture Plates and Dishes Volume (K), by Types 2024 & 2032

- Figure 9: North America Cell Culture Plates and Dishes Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Cell Culture Plates and Dishes Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Cell Culture Plates and Dishes Revenue (million), by Country 2024 & 2032

- Figure 12: North America Cell Culture Plates and Dishes Volume (K), by Country 2024 & 2032

- Figure 13: North America Cell Culture Plates and Dishes Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cell Culture Plates and Dishes Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Cell Culture Plates and Dishes Revenue (million), by Application 2024 & 2032

- Figure 16: South America Cell Culture Plates and Dishes Volume (K), by Application 2024 & 2032

- Figure 17: South America Cell Culture Plates and Dishes Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Cell Culture Plates and Dishes Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Cell Culture Plates and Dishes Revenue (million), by Types 2024 & 2032

- Figure 20: South America Cell Culture Plates and Dishes Volume (K), by Types 2024 & 2032

- Figure 21: South America Cell Culture Plates and Dishes Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Cell Culture Plates and Dishes Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Cell Culture Plates and Dishes Revenue (million), by Country 2024 & 2032

- Figure 24: South America Cell Culture Plates and Dishes Volume (K), by Country 2024 & 2032

- Figure 25: South America Cell Culture Plates and Dishes Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Cell Culture Plates and Dishes Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Cell Culture Plates and Dishes Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Cell Culture Plates and Dishes Volume (K), by Application 2024 & 2032

- Figure 29: Europe Cell Culture Plates and Dishes Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Cell Culture Plates and Dishes Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Cell Culture Plates and Dishes Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Cell Culture Plates and Dishes Volume (K), by Types 2024 & 2032

- Figure 33: Europe Cell Culture Plates and Dishes Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Cell Culture Plates and Dishes Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Cell Culture Plates and Dishes Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Cell Culture Plates and Dishes Volume (K), by Country 2024 & 2032

- Figure 37: Europe Cell Culture Plates and Dishes Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Cell Culture Plates and Dishes Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Cell Culture Plates and Dishes Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Cell Culture Plates and Dishes Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Cell Culture Plates and Dishes Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Cell Culture Plates and Dishes Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Cell Culture Plates and Dishes Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Cell Culture Plates and Dishes Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Cell Culture Plates and Dishes Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Cell Culture Plates and Dishes Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Cell Culture Plates and Dishes Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Cell Culture Plates and Dishes Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Cell Culture Plates and Dishes Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Cell Culture Plates and Dishes Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Cell Culture Plates and Dishes Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Cell Culture Plates and Dishes Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Cell Culture Plates and Dishes Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Cell Culture Plates and Dishes Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Cell Culture Plates and Dishes Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Cell Culture Plates and Dishes Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Cell Culture Plates and Dishes Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Cell Culture Plates and Dishes Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Cell Culture Plates and Dishes Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Cell Culture Plates and Dishes Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Cell Culture Plates and Dishes Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Cell Culture Plates and Dishes Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cell Culture Plates and Dishes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cell Culture Plates and Dishes Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Cell Culture Plates and Dishes Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Cell Culture Plates and Dishes Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Cell Culture Plates and Dishes Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Cell Culture Plates and Dishes Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Cell Culture Plates and Dishes Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Cell Culture Plates and Dishes Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Cell Culture Plates and Dishes Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Cell Culture Plates and Dishes Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Cell Culture Plates and Dishes Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Cell Culture Plates and Dishes Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Cell Culture Plates and Dishes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Cell Culture Plates and Dishes Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Cell Culture Plates and Dishes Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Cell Culture Plates and Dishes Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Cell Culture Plates and Dishes Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Cell Culture Plates and Dishes Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Cell Culture Plates and Dishes Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Cell Culture Plates and Dishes Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Cell Culture Plates and Dishes Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Cell Culture Plates and Dishes Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Cell Culture Plates and Dishes Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Cell Culture Plates and Dishes Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Cell Culture Plates and Dishes Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Cell Culture Plates and Dishes Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Cell Culture Plates and Dishes Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Cell Culture Plates and Dishes Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Cell Culture Plates and Dishes Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Cell Culture Plates and Dishes Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Cell Culture Plates and Dishes Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Cell Culture Plates and Dishes Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Cell Culture Plates and Dishes Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Cell Culture Plates and Dishes Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Cell Culture Plates and Dishes Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Cell Culture Plates and Dishes Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Cell Culture Plates and Dishes Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Cell Culture Plates and Dishes Volume K Forecast, by Country 2019 & 2032

- Table 81: China Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Cell Culture Plates and Dishes Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Cell Culture Plates and Dishes Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell Culture Plates and Dishes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Cell Culture Plates and Dishes?

Key companies in the market include Corning, Thermo Fisher Scientific, VWR, Greiner Bio-One, Sumitomo Bakelite, Sarstedt, TPP Techno Plastic Products, Jet Bio-Filtration, sorfa Life Science, Wuxi NEST Biotechnology, Crystalgen, Merck, CELLTREAT Scientific, Himedia Laboratories, Membrane Solution, ExCell Bio, Beaver Biomedical Engineerin, Suzhou ConRem Biomedical Technology, Guangzhou Jet Bio-Filtration, Cellverse Bioscience Technology, Citotest Labware Manufacturing, Xiamen Bioendo Technology, Hong Kong aibisheng biological technology group.

3. What are the main segments of the Cell Culture Plates and Dishes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell Culture Plates and Dishes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell Culture Plates and Dishes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell Culture Plates and Dishes?

To stay informed about further developments, trends, and reports in the Cell Culture Plates and Dishes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence