Key Insights

The Italian dental chair market is forecast to experience robust growth, reaching a market size of 2.1 billion by 2033. This is driven by a projected Compound Annual Growth Rate (CAGR) of 6.9% from the base year of 2025. Key growth drivers include rising demand for advanced dental treatments, increased focus on preventive oral care, and technological advancements in diagnostic equipment, digital imaging, and laser dentistry. An aging population and growing awareness of oral health's impact on overall well-being are also contributing to increased patient volumes.

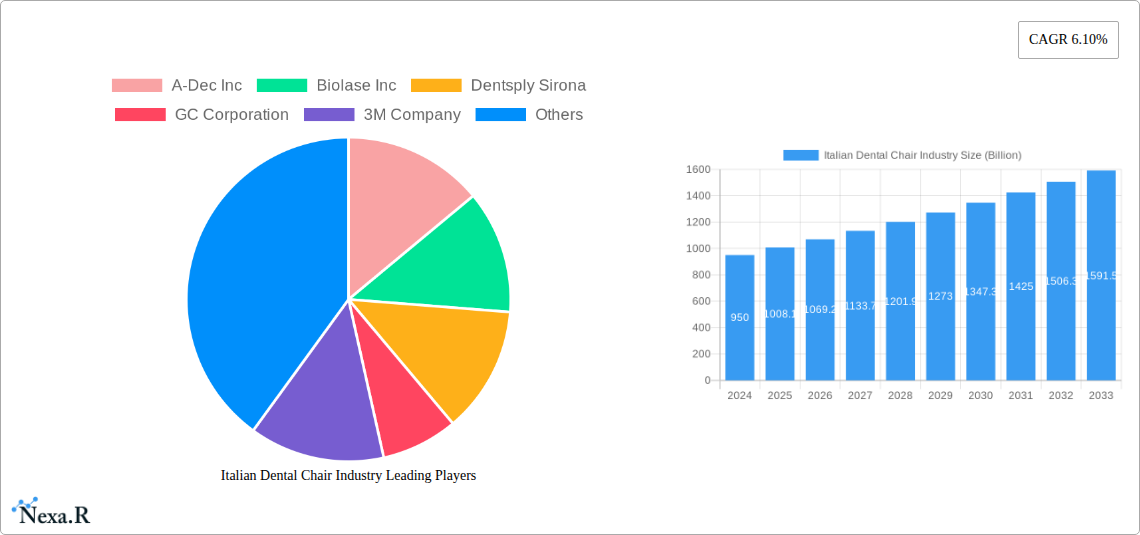

Italian Dental Chair Industry Market Size (In Billion)

Significant trends shaping the Italian dental chair market include the widespread adoption of digital dentistry solutions such as CAD/CAM, 3D printing, and intraoral scanners, which enhance treatment precision and patient experience. There is also a growing demand for specialized equipment for orthodontics and endodontics. While market expansion is propelled by innovation and healthcare spending, high initial investment costs for advanced equipment and evolving regulations present potential challenges. Strategic collaborations and product innovation are expected to facilitate market growth.

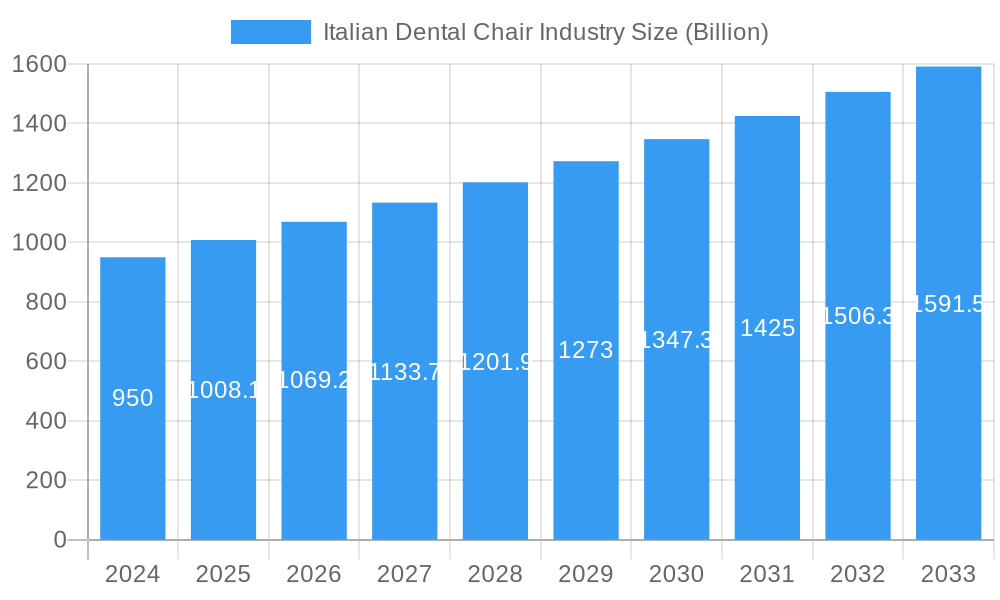

Italian Dental Chair Industry Company Market Share

This report provides an in-depth analysis of the Italian Dental Chair Industry, examining market dynamics, growth trends, regional insights, product segmentation, and key players. Covering the period from 2019 to 2033, with a base year of 2025, it offers a comprehensive outlook on the industry's evolution and future potential. Monetary values are presented in billion units. This study is vital for stakeholders aiming to understand the Italian dental sector, identify opportunities, and navigate the competitive landscape.

Italian Dental Chair Industry Market Dynamics & Structure

The Italian Dental Chair Industry exhibits a moderately concentrated market structure, characterized by the presence of both established global players and specialized local manufacturers. Technological innovation remains a significant driver, with advancements in ergonomic design, integrated digital imaging, and patient comfort systems continuously shaping product offerings. The regulatory framework, aligned with European Union standards, emphasizes safety, efficacy, and data privacy, influencing product development and market entry strategies. Competitive product substitutes, such as advancements in dental imaging and diagnostic tools that reduce the reliance on traditional chair-mounted equipment, pose a dynamic challenge. End-user demographics are shifting, with an increasing demand for advanced treatment solutions and a growing preference for aesthetic dentistry influencing purchasing decisions. Mergers and acquisitions (M&A) are anticipated to play a role in market consolidation, with larger entities seeking to expand their portfolios and market reach.

- Market Concentration: Dominated by a blend of multinational corporations and niche Italian manufacturers.

- Technological Innovation: Driven by R&D in AI-powered diagnostics, laser dentistry, and advanced patient experience features.

- Regulatory Landscape: Stringent EU regulations ensure high standards for safety and efficacy.

- Competitive Substitutes: Innovations in standalone diagnostic equipment and cloud-based treatment planning software.

- End-User Demographics: Increasing demand from private clinics and specialized dental practices.

- M&A Trends: Potential for consolidation as larger players acquire smaller innovators.

Italian Dental Chair Industry Growth Trends & Insights

The Italian Dental Chair Industry is projected to experience robust growth driven by escalating healthcare expenditure, an aging population, and a rising awareness of oral hygiene and aesthetic dental treatments. The market size is expected to witness a significant expansion, fueled by the adoption of technologically advanced dental chairs and integrated diagnostic equipment. The increasing penetration of digital dentistry, including intraoral scanners and CAD/CAM systems, directly influences the demand for dental chairs equipped with compatible interfaces and functionalities. Consumer behavior is evolving, with patients actively seeking personalized treatment plans and minimally invasive procedures, thereby pushing dentists to invest in state-of-the-art equipment. The CAGR is predicted to be a healthy xx% during the forecast period, reflecting sustained market expansion. Adoption rates of advanced dental chairs are on an upward trajectory, particularly within urban centers and established dental practices. Technological disruptions, such as the integration of AI for diagnostics and robotic assistance, are beginning to shape the future of dental chair design and functionality. The market penetration of sophisticated dental chairs is anticipated to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Italian Dental Chair Industry

Within the Italian Dental Chair Industry, the Product: General and Diagnostics Equipment, specifically Dental Chair and Equipment, emerges as the dominant segment driving market growth. This dominance is underpinned by the foundational role of dental chairs in virtually all dental procedures, from routine check-ups to complex restorative work. The continuous need for upgrades and replacements, coupled with the integration of new technologies, ensures sustained demand. Within this segment, Radiology Equipment also holds significant sway due to the increasing reliance on advanced imaging for accurate diagnosis and treatment planning. The Treatment: Prosthodontics segment is another key contributor, as the demand for crowns, bridges, and implants, which are often fabricated using chair-side technologies, directly influences the types of dental chairs and associated equipment required.

- Dominant Segment: Dental Chair and Equipment, a cornerstone of dental practice.

- Key Product Drivers:

- Dental Chair and Equipment: Essential for all dental procedures, driving consistent demand.

- Radiology Equipment: Crucial for diagnosis and treatment planning, with ongoing technological advancements.

- Dental Lasers: Growing adoption for minimally invasive treatments, particularly Soft Tissue Lasers.

- Dominant Treatment:

- Prosthodontics: High demand for restorative treatments necessitates advanced chair functionalities and integrated equipment.

- Orthodontics: Growing awareness and demand for aesthetic alignment.

- Dominant End User:

- Clinics: The primary consumers, particularly private dental practices and specialized clinics, seeking efficiency and patient satisfaction.

- Market Share & Growth Potential: The Dental Chair and Equipment segment is expected to capture xx% of the market share in 2025, with a projected growth rate of xx% over the forecast period. The increasing investment in clinic infrastructure and the demand for modern patient amenities further bolster its dominance. The integration of digital workflows and AI-powered diagnostic aids within dental chairs is a significant growth catalyst.

Italian Dental Chair Industry Product Landscape

The Italian Dental Chair Industry product landscape is characterized by a relentless pursuit of innovation, focusing on enhanced ergonomics, integrated digital capabilities, and improved patient comfort. Leading companies are introducing dental chairs with advanced articulation, adjustable height and backrest positions, and built-in multimedia systems to create a more relaxing patient experience. The integration of diagnostic tools directly into the dental chair unit, such as intraoral cameras and digital radiography sensors, streamlines workflows and improves diagnostic accuracy. The performance metrics are increasingly being evaluated based on their contribution to treatment efficiency, operator comfort, and patient outcomes. Unique selling propositions often revolve around advanced AI-driven diagnostic assistance, customizable treatment modules, and superior materials for durability and hygiene. Technological advancements are enabling a more integrated and intuitive dental treatment environment.

Key Drivers, Barriers & Challenges in Italian Dental Chair Industry

Key Drivers: The Italian Dental Chair Industry is propelled by several key drivers. Technological advancements in digital dentistry, including AI-powered diagnostics and integrated imaging systems, are significantly enhancing treatment precision and efficiency. Growing awareness among the populace regarding oral health and aesthetic dentistry fuels demand for advanced dental care, necessitating modern equipment. Government initiatives and healthcare reforms that support the modernization of dental facilities also act as a significant catalyst. The increasing number of dental professionals investing in private practices further contributes to the demand for high-quality dental chairs.

Barriers & Challenges: Despite positive growth prospects, the industry faces several barriers and challenges. High initial investment costs for advanced dental chairs and integrated technologies can be a deterrent for smaller practices or those in less affluent regions. Stringent regulatory compliance and the need for ongoing product certifications add to development costs and time. Intense competition from both global and domestic manufacturers can lead to price pressures. Furthermore, the slow adoption rate of new technologies in some segments of the dental community, coupled with challenges in supply chain logistics for specialized components, can hinder market expansion. Economic downturns and unpredictable healthcare funding can also pose significant restraints.

Emerging Opportunities in Italian Dental Chair Industry

Emerging opportunities in the Italian Dental Chair Industry lie in the increasing demand for minimally invasive treatment solutions, which drives the integration of laser technology and advanced irrigation systems within dental chairs. The growing focus on teledentistry presents an opportunity for developing chairs with enhanced connectivity and remote diagnostic capabilities. Furthermore, the untapped potential in rural areas and for specialized dental treatments, such as pediatric dentistry and orthodontics, offers avenues for targeted product development. The trend towards sustainable and eco-friendly dental practices also presents an opportunity for manufacturers to develop energy-efficient and ergonomically designed chairs with reduced environmental impact.

Growth Accelerators in the Italian Dental Chair Industry Industry

Several catalysts are accelerating the long-term growth of the Italian Dental Chair Industry. The ongoing digital transformation in dentistry, with the widespread adoption of AI, IoT, and cloud-based solutions, is a major growth accelerator. Strategic partnerships between dental chair manufacturers and technology providers are fostering innovation and enabling the development of integrated solutions. Market expansion strategies targeting emerging demographics and underserved regions, coupled with a focus on user-friendly interfaces and customizable configurations, are also driving growth. The increasing emphasis on preventative and cosmetic dentistry, supported by advanced chair technologies, is creating new revenue streams and pushing the boundaries of what is possible in dental care.

Key Players Shaping the Italian Dental Chair Industry Market

- A-Dec Inc

- Biolase Inc

- Dentsply Sirona

- GC Corporation

- 3M Company

- Envista Holdings Corporation

- Planmeca

- Carestream Health Inc

Notable Milestones in Italian Dental Chair Industry Sector

- May 2021: Pearl announced that it had received CE certification for its Second Opinion AI solution, a product designed to assist dentists in the radiological detection of dental pathologies.

- April 2021: BIOLASE, Inc., in collaboration with EdgeEndo, announced plans to develop the new EdgePRO laser-assisted microfluidic irrigation device for endodontists.

In-Depth Italian Dental Chair Industry Market Outlook

The Italian Dental Chair Industry is poised for sustained growth, driven by a confluence of technological advancements, evolving patient demands, and a supportive healthcare ecosystem. The outlook is characterized by an increasing integration of artificial intelligence, robotics, and advanced digital imaging systems, transforming dental chairs from passive equipment into sophisticated treatment hubs. Emerging opportunities in personalized dentistry, teledentistry, and sustainable practices will further shape the market. Strategic partnerships and a focus on delivering enhanced patient experience and operational efficiency will be crucial for market players to capitalize on the projected expansion and solidify their positions in this dynamic and evolving sector.

Italian Dental Chair Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

-

1.1.1. Dental Lasers

- 1.1.1.1. Soft Tissue Lasers

- 1.1.1.2. Hard Tissue Lasers

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic Equipment

-

1.1.1. Dental Lasers

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontics

- 2.2. Endodontics

- 2.3. Periodontics

- 2.4. Prosthodontics

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

Italian Dental Chair Industry Segmentation By Geography

- 1. Italia

Italian Dental Chair Industry Regional Market Share

Geographic Coverage of Italian Dental Chair Industry

Italian Dental Chair Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 As the demand for advanced dental care and cosmetic dentistry continues to rise

- 3.2.2 so does the need for high-quality equipment. Italian dental chairs are highly sought after due to their reputation for blending functionality

- 3.2.3 durability

- 3.2.4 and design.

- 3.3. Market Restrains

- 3.3.1 Italian dental chairs are often positioned in the premium segment of the market due to their high-quality materials

- 3.3.2 advanced technology

- 3.3.3 and design. This can limit their adoption in lower-income markets or smaller clinics with tight budget

- 3.4. Market Trends

- 3.4.1 The future of the Italian dental chair industry is likely to involve further integration with digital dentistry. Smart chairs that can monitor patient vitals

- 3.4.2 communicate with other dental equipment

- 3.4.3 and adjust settings automatically based on patient data are expected to become more common

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Dental Chair Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Lasers

- 5.1.1.1.1. Soft Tissue Lasers

- 5.1.1.1.2. Hard Tissue Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic Equipment

- 5.1.1.1. Dental Lasers

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontics

- 5.2.2. Endodontics

- 5.2.3. Periodontics

- 5.2.4. Prosthodontics

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A-Dec Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Biolase Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dentsply Sirona

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GC Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3M Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Envista Holdings Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Planmeca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carestream Health Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 A-Dec Inc

List of Figures

- Figure 1: Italian Dental Chair Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italian Dental Chair Industry Share (%) by Company 2025

List of Tables

- Table 1: Italian Dental Chair Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Italian Dental Chair Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 3: Italian Dental Chair Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 4: Italian Dental Chair Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 5: Italian Dental Chair Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Italian Dental Chair Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 7: Italian Dental Chair Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Italian Dental Chair Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Italian Dental Chair Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Italian Dental Chair Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 11: Italian Dental Chair Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 12: Italian Dental Chair Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 13: Italian Dental Chair Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Italian Dental Chair Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Italian Dental Chair Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Italian Dental Chair Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Dental Chair Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Italian Dental Chair Industry?

Key companies in the market include A-Dec Inc, Biolase Inc, Dentsply Sirona, GC Corporation, 3M Company, Envista Holdings Corporation, Planmeca, Carestream Health Inc.

3. What are the main segments of the Italian Dental Chair Industry?

The market segments include Product, Treatment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

As the demand for advanced dental care and cosmetic dentistry continues to rise. so does the need for high-quality equipment. Italian dental chairs are highly sought after due to their reputation for blending functionality. durability. and design..

6. What are the notable trends driving market growth?

The future of the Italian dental chair industry is likely to involve further integration with digital dentistry. Smart chairs that can monitor patient vitals. communicate with other dental equipment. and adjust settings automatically based on patient data are expected to become more common.

7. Are there any restraints impacting market growth?

Italian dental chairs are often positioned in the premium segment of the market due to their high-quality materials. advanced technology. and design. This can limit their adoption in lower-income markets or smaller clinics with tight budget.

8. Can you provide examples of recent developments in the market?

In May 2021, Pearl announced that it had received CE certification for its Second Opinion AI solution. The product will help dentists in the radiological detection of dental pathologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Dental Chair Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Dental Chair Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Dental Chair Industry?

To stay informed about further developments, trends, and reports in the Italian Dental Chair Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence