Key Insights

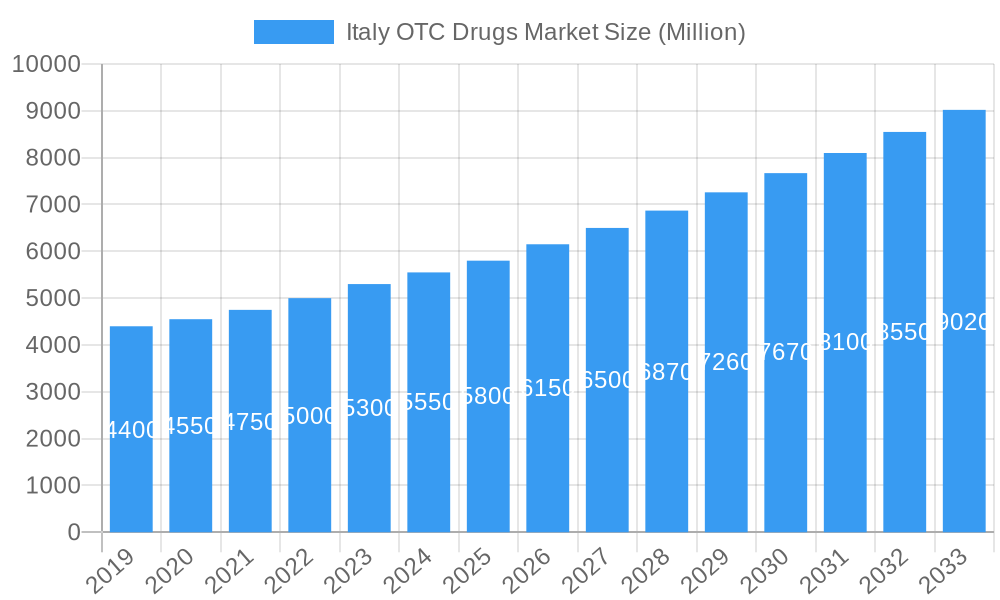

The Italian Over-the-Counter (OTC) Drugs Market is poised for substantial growth, with an estimated market size of 55.5 billion by 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.4% through 2033. This expansion is driven by rising consumer self-care awareness, an increasing elderly population, and broader accessibility of OTC medications via retail and online platforms. The demand for natural and herbal OTC products is also a significant growth driver, aligning with global wellness trends. Key segments such as Cough, Cold, and Flu Products and Analgesics are expected to lead, with Dermatology Products showing strong potential due to rising skin condition prevalence. The growing adoption of e-pharmacies is reshaping distribution strategies and enhancing market reach.

Italy OTC Drugs Market Market Size (In Billion)

Challenges for the Italian OTC Drugs Market include consumer price sensitivity, competition from private label brands, and evolving regulatory frameworks. However, product innovation in formulations and targeted therapies, coupled with strategic marketing by leading companies, is expected to counter these restraints. While traditional distribution channels like retail and hospital pharmacies remain crucial, adaptation to the e-commerce sector is vital for sustained competitive advantage and broader consumer engagement.

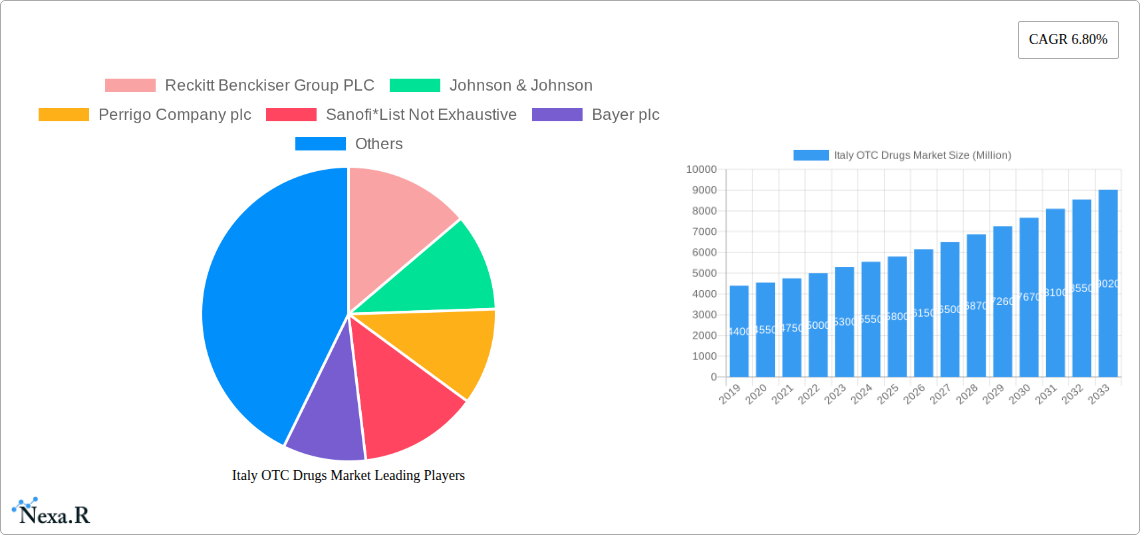

Italy OTC Drugs Market Company Market Share

This comprehensive report offers strategic insights into the Italy OTC drugs market, analyzing market dynamics, growth drivers, key players, and future opportunities. It covers the historical period (2019-2024), a base year of 2025, and a forecast period extending to 2033, serving as an essential resource for stakeholders in the Italian pharmaceutical market, over-the-counter medications, and self-medication trends.

Key Market Segments:

Key Companies: Reckitt Benckiser Group PLC, Johnson & Johnson, Perrigo Company plc, Sanofi, Bayer plc, GlaxoSmithKline PLC, Pfizer Inc.

- Product Types: Cough, Cold, and Flu Products, Analgesics, Dermatology Products, Gastrointestinal Products, Other Product Types

- Routes of Administration: Oral, Topical, Parenteral

- Distribution Channels: Retail Pharmacy, Hospital Pharmacy, E-Pharmacy

Italy OTC Drugs Market Market Dynamics & Structure

The Italy OTC drugs market is characterized by a moderately concentrated structure, with leading pharmaceutical giants and agile specialty players vying for market share. Technological innovation serves as a significant driver, pushing advancements in drug delivery systems and formulation technologies to enhance efficacy and patient compliance. The regulatory framework, governed by the Italian Medicines Agency (AIFA) and European Union directives, influences product approvals, labeling, and marketing practices for non-prescription medicines. The competitive landscape is shaped by established brands, the threat of over-the-counter drug substitutes across various therapeutic areas, and evolving consumer healthcare preferences. End-user demographics, including an aging population and a growing focus on preventative health, are molding demand patterns for self-care products. Mergers and acquisitions (M&A) are prevalent, with companies like Adare Pharma Solutions strategically acquiring capabilities to strengthen their position in the pharmaceutical contract manufacturing sector and enhance their drug formulation expertise.

- Market Concentration: Dominated by multinational corporations, with a growing presence of local manufacturers and CDMOs.

- Technological Innovation: Focus on improved bioavailability, patient-friendly dosage forms, and digital health integration.

- Regulatory Landscape: Stringent but supportive of accessible healthcare solutions.

- Competitive Substitutes: High availability of branded and generic OTC products.

- End-User Demographics: Aging population and increased health consciousness drive demand for specific therapeutic categories.

- M&A Trends: Strategic acquisitions to enhance R&D, manufacturing, and distribution capabilities.

Italy OTC Drugs Market Growth Trends & Insights

The Italy OTC drugs market is projected for robust growth, fueled by increasing consumer demand for accessible and affordable healthcare solutions, a growing emphasis on self-medication for minor ailments, and the continuous introduction of innovative pharmaceutical products. The market size is expected to evolve significantly, driven by rising healthcare expenditure and a greater awareness of preventive healthcare. Adoption rates of new OTC formulations, particularly those offering enhanced convenience or efficacy, are anticipated to rise. Technological disruptions, such as advancements in drug delivery technologies and the growing influence of e-commerce pharmacies, are reshaping how consumers access and utilize over-the-counter medications. Consumer behavior shifts, including a preference for evidence-based self-treatment and a willingness to invest in health and wellness, will further accelerate market expansion. The CAGR for the forecast period is estimated to be xx%, indicating a healthy growth trajectory. Market penetration for specific OTC therapeutic segments, such as pain relief medications and digestive health products, is already high and expected to see incremental gains. The digitalization of healthcare and the increasing reliance on online platforms for health information and product purchases are key factors contributing to the market's dynamic evolution.

Dominant Regions, Countries, or Segments in Italy OTC Drugs Market

The Italy OTC drugs market is primarily driven by the Analgesics segment, which consistently demonstrates high demand due to the prevalence of chronic pain conditions and everyday discomforts. Within Italy, the Retail Pharmacy distribution channel holds the dominant position, accounting for a substantial market share of xx%, owing to its extensive network and established trust among consumers for obtaining prescription-free medicines. The Oral route of administration remains the most popular choice for OTC drugs due to its convenience and ease of use, contributing significantly to the overall market volume of xx million units.

Dominant Product Type: Analgesics:

- High prevalence of pain conditions, from headaches to musculoskeletal pain.

- Strong brand loyalty and a wide array of formulations (tablets, capsules, topical creams).

- Increasing demand for targeted pain relief solutions.

Dominant Distribution Channel: Retail Pharmacy:

- Extensive network of pharmacies across urban and rural areas.

- Trusted source of advice and product recommendations from pharmacists.

- Convenient access for immediate purchase of OTC medications.

- Growing integration of digital services within retail pharmacies.

Dominant Route of Administration: Oral:

- High consumer preference for ingestible forms due to familiarity and ease of use.

- Wide availability of tablets, capsules, and oral solutions for various conditions.

- Advancements in oral drug delivery continue to enhance efficacy and patient compliance.

Economic Policies: Government initiatives promoting self-care and affordable healthcare access indirectly benefit the OTC pharmaceutical sector.

Infrastructure: Well-established pharmaceutical supply chain and distribution networks ensure product availability.

Growth Potential: Continued innovation in analgesic formulations and targeted pain management solutions will further solidify its dominance.

Italy OTC Drugs Market Product Landscape

The product landscape of the Italy OTC drugs market is characterized by a continuous stream of innovations aimed at improving efficacy, convenience, and patient experience. Key developments include advanced topical formulations for dermatology and pain management, such as Futura Medical's MED3000 topical gel for erectile dysfunction, which has gained certification as a Class IIb medical device. Furthermore, companies are focusing on developing novel drug delivery systems for oral administration that offer faster absorption and sustained release. The market also sees a growing emphasis on natural and herbal OTC products, catering to consumer demand for gentler alternatives. The unique selling propositions often lie in the combination of active ingredients, improved taste profiles, and eco-friendly packaging, driving consumer preference.

Key Drivers, Barriers & Challenges in Italy OTC Drugs Market

Key Drivers:

- Increasing self-medication trends: Consumers are increasingly empowered to manage minor health issues independently.

- Aging population: A larger elderly demographic drives demand for chronic condition management OTC drugs.

- Growing health consciousness: Consumers are more proactive in managing their well-being and seeking preventive solutions.

- Technological advancements: Innovations in drug formulation and delivery systems enhance product appeal and effectiveness.

- E-pharmacy growth: Increased accessibility and convenience of purchasing OTC medications online.

Barriers & Challenges:

- Regulatory hurdles: Stringent approval processes for new OTC products can delay market entry.

- Price sensitivity: Consumers often seek cost-effective over-the-counter solutions, leading to intense price competition.

- Brand loyalty: Established brands can create barriers for new entrants.

- Supply chain disruptions: Global events can impact the availability and cost of raw materials, affecting production of pharmaceutical ingredients.

- Competition from prescription drugs: For certain conditions, consumers may opt for physician-prescribed treatments.

Emerging Opportunities in Italy OTC Drugs Market

Emerging opportunities within the Italy OTC drugs market lie in the development of specialized self-care solutions for niche therapeutic areas, such as women's health and mental well-being. The increasing consumer interest in personalized medicine opens avenues for tailored OTC formulations that cater to specific genetic or lifestyle needs. Furthermore, the integration of digital health tools and telehealth services presents a significant opportunity to enhance patient engagement and product accessibility, particularly for chronic condition management. The growing demand for sustainable and eco-friendly packaging for OTC products also represents an untapped market potential, aligning with evolving consumer values. The expansion of e-commerce pharmacies and direct-to-consumer models offers a platform to reach a wider audience and offer more personalized shopping experiences for non-prescription drugs.

Growth Accelerators in the Italy OTC Drugs Market Industry

Growth accelerators in the Italy OTC drugs market are primarily driven by ongoing technological breakthroughs in pharmaceutical research and development, leading to the introduction of more effective and convenient OTC medications. Strategic partnerships between pharmaceutical manufacturers and digital health companies are fostering innovative approaches to patient education and adherence programs. Market expansion strategies, including the penetration of OTC products into emerging channels like specialized online health retailers and direct-to-consumer platforms, are further boosting growth. The continuous development of over-the-counter alternatives for previously prescription-only medications also presents a significant growth catalyst, expanding the self-treatable condition landscape.

Key Players Shaping the Italy OTC Drugs Market Market

- Reckitt Benckiser Group PLC

- Johnson & Johnson

- Perrigo Company plc

- Sanofi

- Bayer plc

- GlaxoSmithKline PLC

- Pfizer Inc

Notable Milestones in Italy OTC Drugs Market Sector

- December 2021: Adare Pharma Solutions acquired Frontida BioPharm, reinforcing its capabilities in oral formulation development and manufacturing.

- May 2021: Futura Medical's MED3000 topical gel for erectile dysfunction achieved Class IIb medical device certification in the EU, marking a significant advancement in topical OTC treatments.

In-Depth Italy OTC Drugs Market Market Outlook

The outlook for the Italy OTC drugs market remains exceptionally positive, driven by persistent consumer demand for accessible healthcare and continuous innovation. Growth accelerators, including advancements in drug delivery technologies and strategic collaborations, will further unlock market potential. The increasing integration of digital platforms and a growing focus on personalized self-care solutions are poised to redefine consumer engagement and product accessibility. The market is expected to witness sustained expansion, with opportunities for companies to leverage emerging trends and cater to evolving consumer health needs.

Italy OTC Drugs Market Segmentation

-

1. Product Type

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Other Product Types

-

2. Route of Administration

- 2.1. Oral

- 2.2. Topical

- 2.3. Parenteral

-

3. Distribution Channel

- 3.1. Retail Pharmacy

- 3.2. Hospital Pharmacy

- 3.3. E-Pharmacy

Italy OTC Drugs Market Segmentation By Geography

- 1. Italy

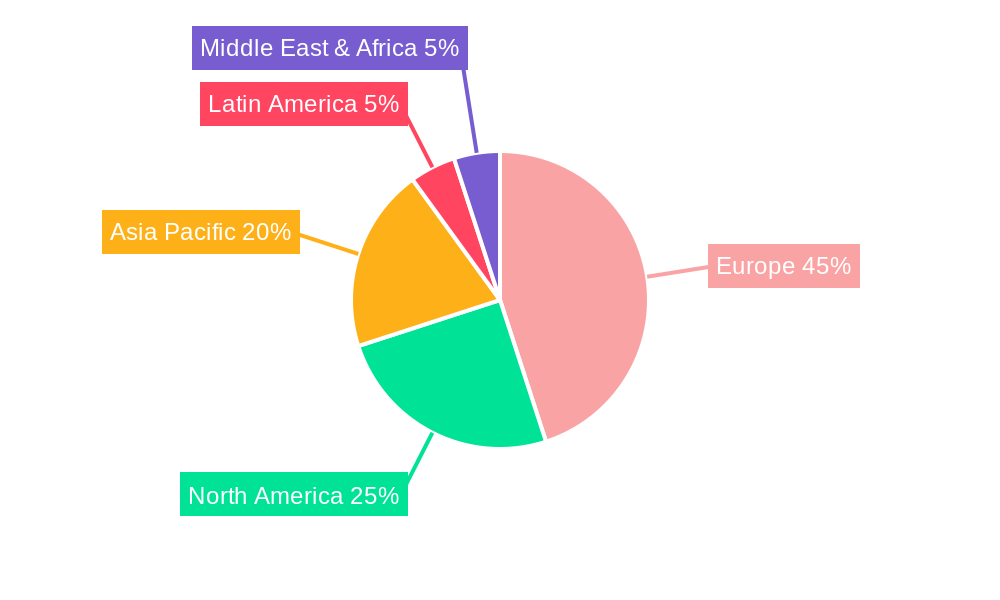

Italy OTC Drugs Market Regional Market Share

Geographic Coverage of Italy OTC Drugs Market

Italy OTC Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Self-medication; Increasing Number of Product Launches

- 3.3. Market Restrains

- 3.3.1. High Probability of OTC Drug Abuse and Lack of Awareness

- 3.4. Market Trends

- 3.4.1 Cough

- 3.4.2 Cold

- 3.4.3 and Flu Products are Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy OTC Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Topical

- 5.2.3. Parenteral

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Retail Pharmacy

- 5.3.2. Hospital Pharmacy

- 5.3.3. E-Pharmacy

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reckitt Benckiser Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson & Johnson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Perrigo Company plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sanofi*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bayer plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GlaxoSmithKline PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pfizer Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: Italy OTC Drugs Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy OTC Drugs Market Share (%) by Company 2025

List of Tables

- Table 1: Italy OTC Drugs Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Italy OTC Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 3: Italy OTC Drugs Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Italy OTC Drugs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy OTC Drugs Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Italy OTC Drugs Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 7: Italy OTC Drugs Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Italy OTC Drugs Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy OTC Drugs Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Italy OTC Drugs Market?

Key companies in the market include Reckitt Benckiser Group PLC, Johnson & Johnson, Perrigo Company plc, Sanofi*List Not Exhaustive, Bayer plc, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Italy OTC Drugs Market?

The market segments include Product Type, Route of Administration, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Self-medication; Increasing Number of Product Launches.

6. What are the notable trends driving market growth?

Cough. Cold. and Flu Products are Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Probability of OTC Drug Abuse and Lack of Awareness.

8. Can you provide examples of recent developments in the market?

In December 2021, Adare Pharma Solutions, a technology-driven contract development and manufacturing organization (CDMO), acquired Frontida BioPharm, a vertically integrated CDMO focused on oral formulations. The acquisition reinforces Adare's commitment to transforming drug delivery by providing world-class solutions from product development through commercial-scale manufacturing and packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy OTC Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy OTC Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy OTC Drugs Market?

To stay informed about further developments, trends, and reports in the Italy OTC Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence