Key Insights

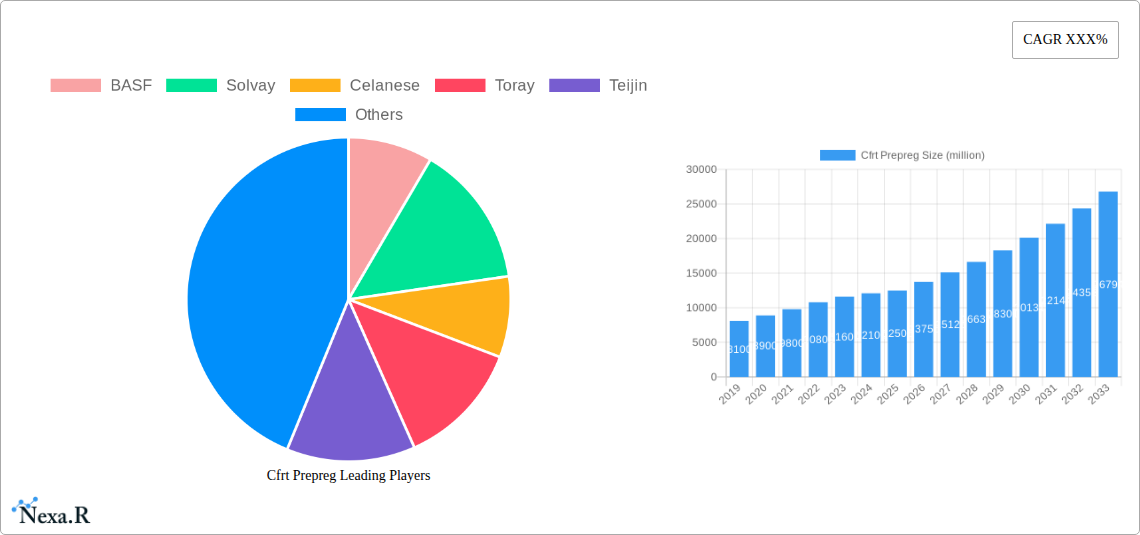

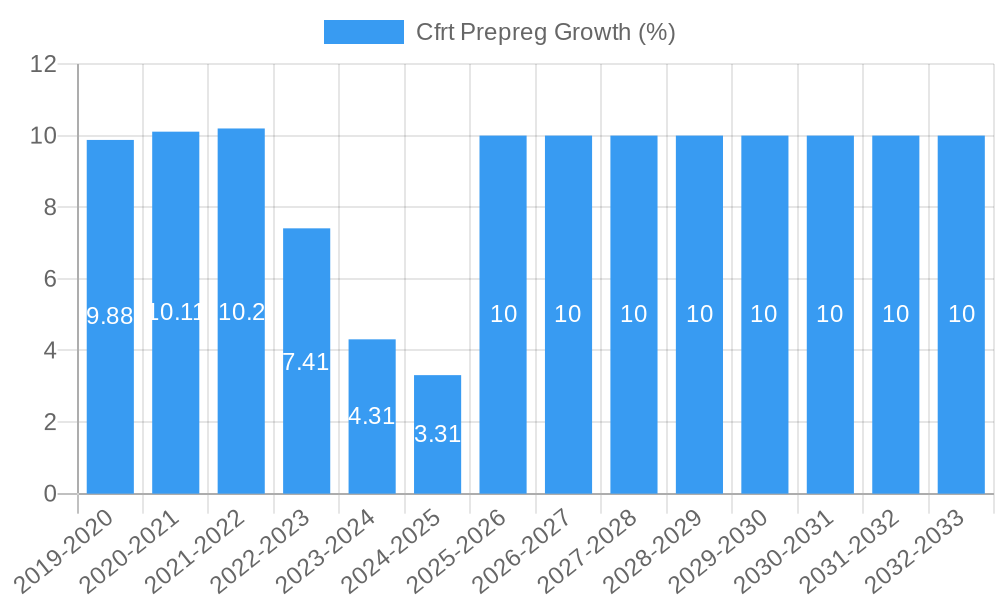

The global CFRT prepreg market is experiencing robust growth, projected to reach a significant market size of approximately $12,500 million by 2025, fueled by a compound annual growth rate (CAGR) of around 10.5% during the study period (2019-2033). This upward trajectory is primarily driven by the increasing demand for lightweight, high-strength materials across key industries. The automotive sector is a major contributor, driven by stringent fuel efficiency regulations and the growing adoption of electric vehicles (EVs) where weight reduction is paramount for enhanced range. Similarly, the aerospace industry's continuous pursuit of performance and fuel savings propels the demand for CFRT prepregs. Emerging applications in sporting goods, such as advanced bicycle frames and tennis rackets, also contribute to market expansion by offering superior performance characteristics.

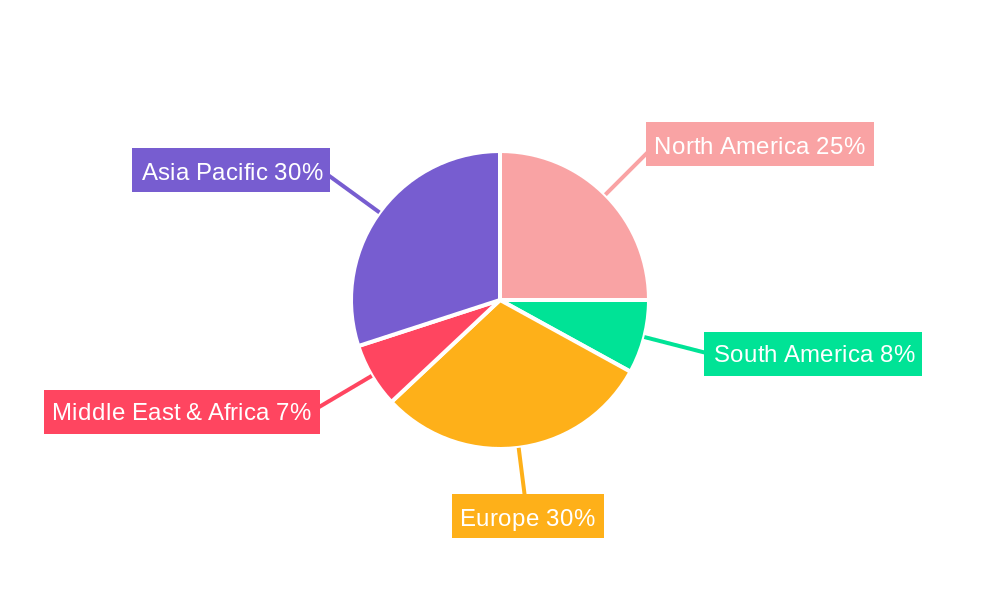

The market is segmented into key types, with Carbon Fiber prepregs holding a dominant share due to their exceptional strength-to-weight ratio and stiffness, making them ideal for high-performance applications. Fiberglass prepregs, while offering a more cost-effective solution, are also gaining traction in applications where extreme performance is not the sole requirement. Geographically, Asia Pacific, led by China, is emerging as the fastest-growing region, attributed to its expanding manufacturing base, increasing automotive production, and government initiatives supporting advanced materials. North America and Europe remain significant markets, driven by established aerospace and automotive industries, as well as a strong focus on sustainable and lightweight solutions. However, the market faces restraints such as the high cost of raw materials, particularly carbon fiber, and the complexity of manufacturing processes, which can hinder widespread adoption in cost-sensitive applications.

Unlocking the Future: Comprehensive Cfrt Prepreg Market Report (2019-2033)

This in-depth Cfrt Prepreg market report delivers a 360-degree view of the advanced composite materials sector, providing critical insights for stakeholders in the Automotive, Aerospace, Sporting Goods, and Other application segments, with a focus on Carbon Fiber and Fiberglass types. Spanning a comprehensive study period from 2019 to 2033, with 2025 as the base and estimated year, this analysis leverages predictive modeling for the forecast period (2025-2033) and historical data from 2019-2024. Discover market size evolution, technological disruptions, regional dominance, key player strategies, and emerging opportunities, all presented with actionable data and expert analysis.

Cfrt Prepreg Market Dynamics & Structure

The Cfrt Prepreg market exhibits a dynamic and evolving structure, characterized by a moderate to high level of market concentration driven by significant capital investment requirements for research, development, and manufacturing. Technological innovation is a primary driver, with continuous advancements in resin systems, fiber technologies, and manufacturing processes fueling demand for lighter, stronger, and more durable composite solutions. Regulatory frameworks, particularly in the aerospace and automotive industries, are increasingly stringent, mandating higher performance standards and sustainability metrics, which inadvertently favor advanced materials like Cfrt prepregs. Competitive product substitutes, such as traditional metals and other composite types, continue to pose a challenge, but the superior strength-to-weight ratio and design flexibility of Cfrt prepregs are solidifying their market position. End-user demographics are shifting towards sectors prioritizing lightweighting and performance enhancement, such as electric vehicles and advanced aerospace components. Mergers and acquisitions (M&A) activity, while present, is largely strategic, focused on consolidating capabilities, expanding geographical reach, or acquiring niche technological expertise.

- Market Concentration: Moderate to high, with key players investing heavily in R&D and production scale.

- Technological Innovation Drivers: Advancements in resin chemistry, improved fiber impregnation, and automation in manufacturing processes.

- Regulatory Frameworks: Stringent performance and sustainability mandates in aerospace and automotive are key enablers.

- Competitive Product Substitutes: Metals, advanced polymers, and other composite forms.

- End-User Demographics: Growing demand from lightweighting-focused industries like EVs and advanced aviation.

- M&A Trends: Strategic acquisitions for technology acquisition, market expansion, and vertical integration.

Cfrt Prepreg Growth Trends & Insights

The Cfrt Prepreg market is poised for substantial growth, driven by an insatiable demand for lightweight and high-performance materials across a spectrum of industries. Over the historical period (2019-2024), the market witnessed steady expansion, propelled by initial adoption in niche applications. The base year, 2025, marks a significant inflection point, with projected market size estimated at $15.5 billion. This growth trajectory is underpinned by escalating adoption rates, particularly within the automotive sector, where the drive for fuel efficiency and electric vehicle range extension necessitates significant weight reduction. Technological disruptions, such as the development of faster curing resin systems and enhanced automated fiber placement techniques, are further accelerating market penetration. Consumer behavior shifts, influenced by environmental consciousness and a preference for high-performance products in sporting goods, also contribute to the rising demand.

The forecast period (2025-2033) is expected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 8.7%, translating into a projected market size of $30.2 billion by 2033. This impressive expansion is fueled by several key factors. Firstly, the ongoing transition towards electric mobility is a primary catalyst, with Cfrt prepregs being integral to battery enclosures, chassis components, and body structures, contributing to increased range and safety. Secondly, the aerospace industry's continuous pursuit of fuel efficiency and payload capacity enhancement ensures sustained demand for high-strength, low-weight composite materials in aircraft structures and interiors. The sporting goods sector, ever on the forefront of material innovation, continues to leverage Cfrt prepregs for enhanced performance in equipment like bicycles, tennis rackets, and golf clubs. Furthermore, advancements in manufacturing technologies are making Cfrt prepregs more cost-competitive and accessible, broadening their application scope into new segments. The report will delve into granular market penetration figures for each application and type, alongside analyses of consumer purchasing drivers and the impact of sustainability initiatives on material selection.

Dominant Regions, Countries, or Segments in Cfrt Prepreg

The Automotive application segment, specifically driven by the burgeoning Carbon Fiber type, is emerging as the dominant force in the global Cfrt Prepreg market. This dominance is particularly pronounced in regions with strong automotive manufacturing bases and a progressive embrace of electric vehicle technology.

Key Drivers of Automotive Carbon Fiber Dominance:

- Electric Vehicle (EV) Revolution: The global push towards decarbonization and the rapid growth of the EV market are paramount. Automakers are heavily investing in lightweighting strategies to maximize battery range and improve overall vehicle efficiency. Cfrt prepregs, especially carbon fiber prepregs, offer an exceptional strength-to-weight ratio, making them ideal for critical components such as battery enclosures, chassis elements, body panels, and structural reinforcements. The estimated market share for automotive applications within the overall Cfrt prepreg market is projected to reach 45% by 2025, with carbon fiber prepregs accounting for a substantial portion of this.

- Fuel Efficiency Mandates: Increasingly stringent fuel economy regulations worldwide compel manufacturers to reduce vehicle weight. Cfrt prepregs provide a viable solution for achieving these targets without compromising structural integrity or safety.

- Performance Enhancement: Beyond fuel efficiency, Cfrt prepregs contribute to improved vehicle dynamics, handling, and overall performance, appealing to both mainstream consumers and performance-oriented segments.

- Technological Advancements in Manufacturing: Innovations in automated tape laying (ATL) and automated fiber placement (AFP) for automotive applications are reducing production costs and lead times, making carbon fiber prepregs more commercially viable for mass production.

- Economic Policies and Incentives: Government subsidies and tax incentives for EV adoption and the development of green automotive technologies are indirectly boosting the demand for lightweight materials like Cfrt prepregs.

Regional Dominance:

While a global market, North America and Europe are currently leading the charge in the adoption of Cfrt prepregs within the automotive sector. This is attributed to their mature automotive industries, strong presence of global OEMs, robust R&D ecosystems, and proactive governmental policies supporting sustainable mobility. Asia-Pacific, particularly China, is rapidly gaining traction due to its position as the largest automotive market and its aggressive expansion in EV manufacturing.

Growth Potential in Other Segments:

While automotive leads, the Aerospace sector remains a significant consumer, driven by its inherent demand for high-performance materials and long product lifecycles. Here, carbon fiber prepregs are indispensable for aircraft structures, wings, and fuselages, contributing to fuel savings and enhanced flight capabilities. The Sporting Goods segment, while smaller in volume, is a crucial innovator, with Cfrt prepregs enabling cutting-edge equipment design that translates to improved athletic performance. The "Other" segment, encompassing industrial applications, renewable energy (e.g., wind turbine blades), and infrastructure, presents substantial untapped growth potential as awareness and cost-effectiveness of Cfrt prepregs continue to rise.

Cfrt Prepreg Product Landscape

The Cfrt Prepreg product landscape is characterized by a relentless pursuit of enhanced performance and application-specific solutions. Innovations revolve around advanced resin chemistries, such as high-temperature epoxies and cyanate esters, offering superior thermal stability and chemical resistance. Developments in fiber technology, including multi-axial weaves and nano-engineered carbon fibers, further elevate the mechanical properties and enable tailored structural designs. Cfrt prepregs are increasingly being designed for specific curing cycles, allowing for faster production times and integration into more automated manufacturing processes. Their exceptional strength-to-weight ratio, fatigue resistance, and design flexibility remain core selling propositions, enabling engineers to create lighter, stronger, and more complex components for industries ranging from aerospace to high-performance automobiles and advanced sporting goods.

Key Drivers, Barriers & Challenges in Cfrt Prepreg

Key Drivers:

- Lightweighting Mandates: The imperative for reduced weight in transportation (automotive, aerospace) and performance enhancement in sporting goods is the primary growth engine.

- Technological Advancements: Ongoing innovation in resin systems, fiber technologies, and manufacturing processes are improving performance and reducing costs.

- Sustainability Initiatives: The drive for reduced energy consumption and lower emissions favors lightweight materials like Cfrt prepregs.

- Performance Demands: Superior strength-to-weight ratio, fatigue resistance, and design flexibility are critical for high-end applications.

Barriers & Challenges:

- High Material and Manufacturing Costs: The inherent cost of raw materials (carbon fiber, specialized resins) and complex manufacturing processes remains a significant barrier to widespread adoption, especially in cost-sensitive sectors.

- Recycling and End-of-Life Management: The development of effective and scalable recycling solutions for composite materials is still in its nascent stages, posing environmental challenges.

- Skilled Workforce Requirements: The specialized knowledge and training required for handling and processing Cfrt prepregs can be a constraint.

- Supply Chain Vulnerabilities: Reliance on a limited number of raw material suppliers and potential geopolitical disruptions can impact availability and pricing.

- Repair and Maintenance Complexity: Repairing damaged composite structures can be more complex and costly than repairing traditional metal components.

Emerging Opportunities in Cfrt Prepreg

The Cfrt Prepreg market is ripe with emerging opportunities, driven by technological innovation and evolving industry needs. The expansion of Cfrt prepregs into high-volume electric vehicle (EV) battery enclosures presents a substantial growth avenue, demanding lightweight, fire-resistant, and structurally robust solutions. Furthermore, the increasing focus on sustainable aviation is opening doors for Cfrt prepregs in interior components and smaller aircraft structures, where weight savings directly translate to reduced fuel consumption. The growing adoption of 3D printing and additive manufacturing for composite parts, utilizing specialized prepreg filaments or powders, offers new possibilities for complex geometries and rapid prototyping. Finally, the renewable energy sector, particularly in the development of larger and more efficient wind turbine blades, represents a significant untapped market for Cfrt prepregs' strength and durability.

Growth Accelerators in the Cfrt Prepreg Industry

Several catalysts are accelerating the growth of the Cfrt Prepreg industry. Technological breakthroughs in faster curing resin systems and automated manufacturing techniques are significantly improving production efficiency and reducing costs, making these materials more accessible. Strategic partnerships between raw material suppliers, prepreggers, and end-users are fostering collaborative innovation and accelerating product development cycles. Furthermore, the increasing geographical expansion of Cfrt prepreg manufacturers into emerging markets, coupled with significant investments in capacity expansion, is meeting the growing global demand. The development of hybrid composite structures that combine Cfrt prepregs with other materials to optimize cost and performance is also a key growth accelerator.

Key Players Shaping the Cfrt Prepreg Market

- BASF

- Solvay

- Celanese

- Toray

- Teijin

- Covestro

- Mitsui Chemicals

- DSM

- Evonik

Notable Milestones in Cfrt Prepreg Sector

- 2020: Launch of novel, high-temperature resistant epoxy resin systems by Evonik, enabling wider aerospace applications.

- 2021: Toray Industries announces significant expansion of its carbon fiber production capacity to meet growing automotive demand.

- 2022: Solvay introduces a new generation of lightweight thermoplastic prepregs for automotive structural components.

- 2023: Teijin develops an advanced prepreg technology for faster curing cycles in high-volume manufacturing.

- 2024: BASF invests in a new R&D center focused on sustainable composite solutions, including bio-based resins.

- 2025 (Estimated): Development of cost-effective automated prepreg layup systems for mass-market automotive production.

In-Depth Cfrt Prepreg Market Outlook

The Cfrt Prepreg market outlook is exceptionally strong, driven by an ongoing paradigm shift towards lightweight, high-performance materials across core industries. Growth accelerators, including continuous technological advancements in resin and fiber technology, coupled with the increasing adoption of automated manufacturing processes, are poised to further democratize access to these advanced composites. The automotive sector's transition to electric vehicles will remain a primary engine of demand, with significant growth anticipated in battery enclosures and structural components. Strategic collaborations and targeted investments in R&D by key players like BASF, Solvay, and Toray will continue to push the boundaries of material performance and cost-effectiveness. Emerging opportunities in renewable energy infrastructure and advanced sporting goods will contribute to a diversified and robust market expansion. Overall, the Cfrt Prepreg market is set for sustained, high-paced growth, offering substantial strategic opportunities for innovators and market participants.

Cfrt Prepreg Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Aerospace

- 1.3. Sporting Goods

- 1.4. Other

-

2. Type

- 2.1. Carbon Fiber

- 2.2. Fiberglass

Cfrt Prepreg Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cfrt Prepreg REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cfrt Prepreg Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Aerospace

- 5.1.3. Sporting Goods

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Carbon Fiber

- 5.2.2. Fiberglass

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cfrt Prepreg Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive

- 6.1.2. Aerospace

- 6.1.3. Sporting Goods

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Carbon Fiber

- 6.2.2. Fiberglass

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cfrt Prepreg Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive

- 7.1.2. Aerospace

- 7.1.3. Sporting Goods

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Carbon Fiber

- 7.2.2. Fiberglass

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cfrt Prepreg Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive

- 8.1.2. Aerospace

- 8.1.3. Sporting Goods

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Carbon Fiber

- 8.2.2. Fiberglass

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cfrt Prepreg Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive

- 9.1.2. Aerospace

- 9.1.3. Sporting Goods

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Carbon Fiber

- 9.2.2. Fiberglass

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cfrt Prepreg Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive

- 10.1.2. Aerospace

- 10.1.3. Sporting Goods

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Carbon Fiber

- 10.2.2. Fiberglass

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solvay

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Celanese

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toray

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teijin

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Covestro

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsui Chemicals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DSM

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evonik

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Cfrt Prepreg Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cfrt Prepreg Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cfrt Prepreg Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cfrt Prepreg Revenue (million), by Type 2024 & 2032

- Figure 5: North America Cfrt Prepreg Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Cfrt Prepreg Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cfrt Prepreg Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cfrt Prepreg Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cfrt Prepreg Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cfrt Prepreg Revenue (million), by Type 2024 & 2032

- Figure 11: South America Cfrt Prepreg Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Cfrt Prepreg Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cfrt Prepreg Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cfrt Prepreg Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cfrt Prepreg Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cfrt Prepreg Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Cfrt Prepreg Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Cfrt Prepreg Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cfrt Prepreg Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cfrt Prepreg Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cfrt Prepreg Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cfrt Prepreg Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Cfrt Prepreg Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Cfrt Prepreg Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cfrt Prepreg Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cfrt Prepreg Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cfrt Prepreg Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cfrt Prepreg Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Cfrt Prepreg Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Cfrt Prepreg Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cfrt Prepreg Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cfrt Prepreg Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cfrt Prepreg Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cfrt Prepreg Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Cfrt Prepreg Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cfrt Prepreg Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cfrt Prepreg Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Cfrt Prepreg Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cfrt Prepreg Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cfrt Prepreg Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Cfrt Prepreg Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cfrt Prepreg Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cfrt Prepreg Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Cfrt Prepreg Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cfrt Prepreg Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cfrt Prepreg Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Cfrt Prepreg Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cfrt Prepreg Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cfrt Prepreg Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Cfrt Prepreg Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cfrt Prepreg Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cfrt Prepreg?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Cfrt Prepreg?

Key companies in the market include BASF, Solvay, Celanese, Toray, Teijin, Covestro, Mitsui Chemicals, DSM, Evonik.

3. What are the main segments of the Cfrt Prepreg?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cfrt Prepreg," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cfrt Prepreg report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cfrt Prepreg?

To stay informed about further developments, trends, and reports in the Cfrt Prepreg, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence