Key Insights

The global children's cough medicine market is experiencing robust growth, projected to reach a significant valuation by the end of the forecast period. Driven by increasing instances of respiratory ailments among children, coupled with a growing awareness among parents regarding effective treatment options, the market demonstrates a strong upward trajectory. Key drivers include a rising pediatric population, advancements in pharmaceutical formulations offering improved efficacy and safety profiles, and the expanding accessibility of both over-the-counter (OTC) and prescription medications. The trend towards natural and homeopathic remedies is also shaping consumer preferences, pushing manufacturers to innovate and diversify their product portfolios. Furthermore, the influence of digital health platforms and telemedicine is indirectly contributing by enhancing diagnosis and treatment accessibility, thereby boosting market demand.

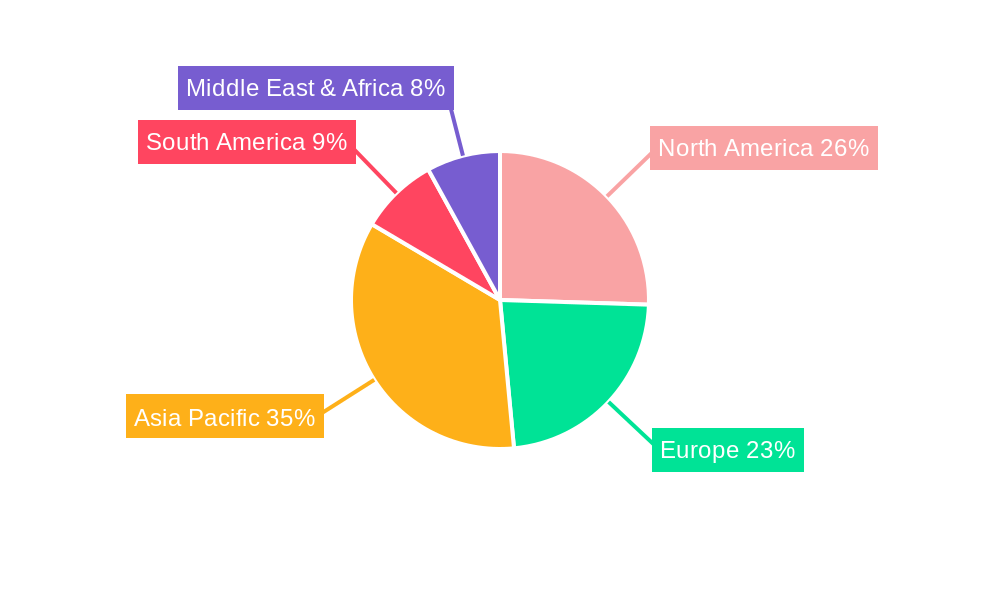

The market is segmented into various applications, with hospitals and drug stores representing the primary distribution channels. Within these channels, both OTC and prescription medicines play crucial roles. The forecast period is expected to witness sustained growth across these segments, albeit with potential shifts in dominance influenced by regulatory changes and evolving treatment guidelines. Geographically, the Asia Pacific region, particularly China and India, is anticipated to emerge as a significant growth engine due to its large pediatric population, rising disposable incomes, and improving healthcare infrastructure. North America and Europe are mature markets expected to maintain steady growth, driven by innovation and product line expansions from established players. Key players in this competitive landscape are continuously investing in research and development to introduce new products and expand their market reach.

Children Cough Medicine Market Dynamics & Structure

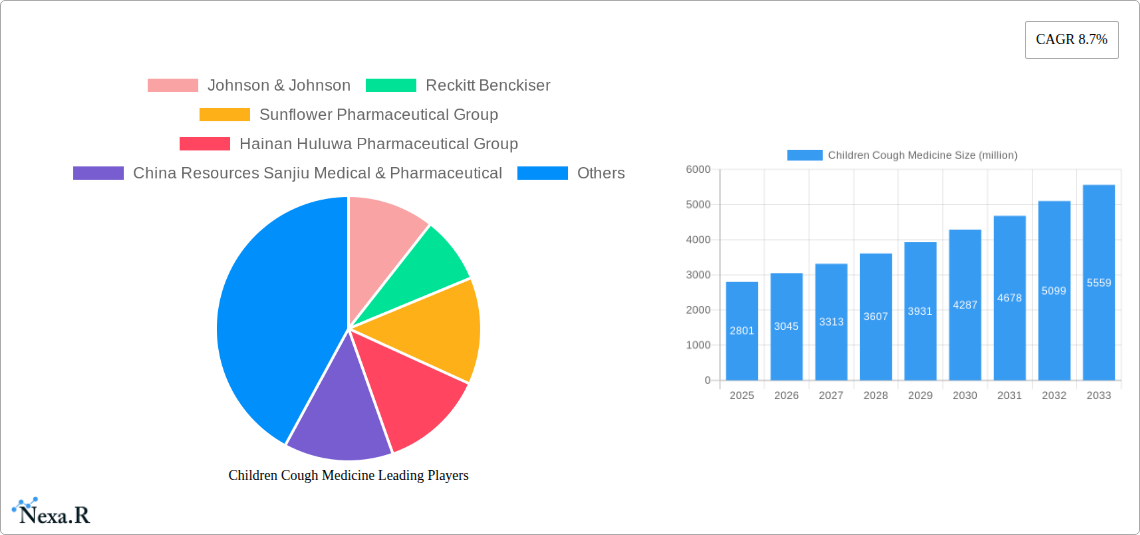

The global children cough medicine market exhibits a moderately consolidated structure, with key players like Johnson & Johnson, Reckitt Benckiser, and China Resources Sanjiu Medical & Pharmaceutical holding significant market shares. Technological innovation is primarily driven by the development of safer, more effective formulations with reduced side effects, and the increasing adoption of natural or herbal-based remedies appealing to health-conscious parents. Regulatory frameworks, such as stringent approval processes for pediatric medications and evolving guidelines on antibiotic use, profoundly influence market entry and product development. Competitive product substitutes include home remedies, alternative therapies, and the broader over-the-counter (OTC) and prescription medicine segments. End-user demographics reveal a growing preference for child-friendly dosage forms and appealing flavors, alongside a rising parental awareness regarding appropriate medication for different cough types. Mergers & Acquisitions (M&A) trends indicate strategic consolidations aimed at expanding product portfolios, gaining market access, and leveraging R&D capabilities. For instance, the acquisition of Hyland's by Foundation Consumer Healthcare (Dimetapp) in 2022 for an undisclosed sum aimed to strengthen its position in the natural remedies segment. The market concentration ratio is estimated at 65%, with the top 5 players accounting for this share. M&A deal volumes have averaged 3 deals per year over the historical period of 2019-2024. Innovation barriers include the high cost of clinical trials for pediatric populations and the challenge of developing palatable yet effective formulations.

- Market Concentration: Moderately consolidated, driven by established pharmaceutical giants.

- Technological Innovation: Focus on safety, efficacy, natural ingredients, and child-friendly formulations.

- Regulatory Frameworks: Strict approval processes, evolving guidelines on pediatric medication.

- Competitive Substitutes: Home remedies, alternative therapies, broader OTC/prescription segments.

- End-User Demographics: Parental preference for safety, efficacy, taste, and natural options.

- M&A Trends: Strategic consolidation for portfolio expansion and market access.

Children Cough Medicine Growth Trends & Insights

The children cough medicine market has witnessed robust growth over the historical period, projected to continue its upward trajectory. The market size, valued at approximately 8,500 million units in 2019, is anticipated to reach an estimated 11,200 million units by the base year of 2025, demonstrating a Compound Annual Growth Rate (CAGR) of around 4.8% during the historical period. This growth is underpinned by increasing incidences of respiratory ailments in children, driven by factors such as air pollution, climate change, and the spread of viral infections. Adoption rates for specialized pediatric cough formulations are steadily rising as parents become more discerning about the appropriate and safe treatment options for their children. Technological disruptions are playing a significant role, with advancements in drug delivery systems enhancing efficacy and patient compliance. The development of novel active pharmaceutical ingredients (APIs) with improved safety profiles and targeted action against specific cough types is also a key trend. Consumer behavior shifts are marked by a growing demand for natural and organic ingredients, a heightened concern for the potential side effects of synthetic medications, and an increased reliance on online health platforms for product information and purchasing. The market penetration for specialized children cough medicines is estimated at 70% in developed economies and is rapidly growing in emerging markets. The shift towards evidence-based natural remedies is a notable behavioral change. For instance, the rise of studies supporting the efficacy of honey for cough relief in children has led to increased consumer interest and product development in this area. The market size for children cough medicine is projected to grow from an estimated 11,200 million units in 2025 to 15,800 million units by 2033, exhibiting a healthy CAGR of approximately 4.5% during the forecast period of 2025–2033. This sustained growth is fueled by an expanding pediatric population, escalating healthcare expenditure, and continuous product innovation.

Dominant Regions, Countries, or Segments in Children Cough Medicine

The Drug Stores segment, encompassing pharmacies and retail outlets, is the dominant application driving growth in the children cough medicine market. This dominance is attributed to its accessibility and convenience for parents seeking immediate relief for their children's cough symptoms. Drug stores offer a wide array of over-the-counter (OTC) options, catering to the most common pediatric cough conditions. The market share of the Drug Stores segment is estimated at 60% of the total application market. Key drivers for this segment's leadership include:

- High Consumer Traffic: Drug stores are frequently visited by consumers for various health and wellness needs, making them a prime point of purchase for children's cough medicines.

- Wide Product Availability: Pharmacies stock a comprehensive range of brands and formulations, allowing parents to choose based on specific symptoms, ingredients, and price points.

- Expert Advice: Pharmacists often provide guidance on medication selection and dosage, building consumer confidence.

- Convenience: The immediate availability of products without the need for a prescription (for OTC medicines) is a significant advantage.

Geographically, North America currently holds a dominant position in the children cough medicine market, driven by a combination of high disposable incomes, advanced healthcare infrastructure, and a strong emphasis on pediatric health and safety. The market share of North America is estimated at 35%. Key drivers for its dominance include:

- High Healthcare Expenditure: Significant spending on healthcare, including over-the-counter and prescription medications for children.

- Strict Regulatory Standards: A well-established regulatory environment that ensures the safety and efficacy of pediatric medicines, fostering consumer trust.

- Awareness and Education: High levels of parental awareness regarding respiratory health and the appropriate use of cough medicines.

- Technological Adoption: Early adoption of new product formulations and delivery systems.

- Strong Presence of Key Players: The presence of major global pharmaceutical companies with dedicated pediatric divisions.

The OTC Medicines segment, representing a substantial portion of the children cough medicine market, plays a pivotal role in its overall growth. This segment's dominance is driven by its accessibility, affordability, and widespread availability for common cough and cold symptoms. The market share of OTC Medicines is estimated at 75% of the total type market. Key factors contributing to its prominence include:

- Self-Medication Trend: Parents often opt for OTC medicines for mild to moderate cough symptoms, seeking quick and accessible treatment solutions.

- Affordability: OTC medications are generally more affordable than prescription drugs, making them a preferred choice for many households.

- Broad Product Range: The availability of diverse formulations, including syrups, lozenges, and dissolvable tablets, caters to varied preferences and age groups.

- Over-the-Counter Access: These medicines can be purchased without a prescription, facilitating immediate access and convenience for parents.

Children Cough Medicine Product Landscape

The children cough medicine product landscape is characterized by continuous innovation focused on enhancing efficacy and palatability. Leading products feature unique selling propositions such as sugar-free formulations, natural ingredient bases like honey and herbal extracts, and allergen-free compositions. Technological advancements are evident in the development of multi-symptom relief formulations addressing cough, congestion, and sore throat simultaneously. Performance metrics consistently highlight improved cough suppression, reduced mucus viscosity, and faster symptom alleviation, with adherence to strict pediatric safety guidelines remaining paramount.

Key Drivers, Barriers & Challenges in Children Cough Medicine

Key Drivers:

- Rising Incidence of Pediatric Respiratory Illnesses: Growing rates of cough and cold, exacerbated by environmental factors and viral outbreaks, propel demand.

- Parental Health Consciousness: Increased parental awareness regarding the importance of appropriate and safe cough management for children.

- Product Innovation: Development of novel formulations, natural ingredients, and child-friendly delivery systems.

- Growing Healthcare Expenditure: Increased spending on pediatric healthcare, including over-the-counter and prescription medications.

- Expanding Pediatric Population: A consistently growing global child population directly contributes to market expansion.

Barriers & Challenges:

- Stringent Regulatory Scrutiny: Rigorous approval processes for pediatric medications can lead to lengthy development times and high costs.

- Safety Concerns & Side Effects: The inherent concern among parents regarding potential side effects of medications in children limits market adoption for certain products.

- Counterfeit Products: The prevalence of counterfeit medicines in some regions poses a threat to consumer safety and brand reputation.

- Competition from Home Remedies: Traditional home remedies and alternative treatments continue to be popular alternatives for mild coughs.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of raw materials and finished products, estimated to have caused a 5% increase in production costs during the historical period.

Emerging Opportunities in Children Cough Medicine

Emerging opportunities lie in the development of precision medicine approaches tailored to specific genetic predispositions or cough triggers in children. The growing demand for natural and organic cough remedies presents a significant avenue, with substantial growth potential in plant-based formulations and homeopathic solutions that align with evolving consumer preferences. Furthermore, untapped markets in developing economies, coupled with increasing access to healthcare and rising disposable incomes, offer substantial growth prospects. The integration of smart packaging solutions for dosage tracking and adherence monitoring also represents an innovative area for future development.

Growth Accelerators in the Children Cough Medicine Industry

Long-term growth in the children cough medicine industry will be significantly accelerated by continuous technological breakthroughs in drug discovery and delivery systems, leading to more targeted and effective treatments with minimal side effects. Strategic partnerships between pharmaceutical companies and research institutions will foster innovation and expedite the development of novel APIs. Market expansion strategies focusing on emerging economies, where the pediatric population is substantial and healthcare infrastructure is developing, will also be crucial growth accelerators. The increasing emphasis on evidence-based efficacy and transparency in product labeling will further build consumer trust and drive market penetration.

Key Players Shaping the Children Cough Medicine Market

- Johnson & Johnson

- Reckitt Benckiser

- Sunflower Pharmaceutical Group

- Hainan Huluwa Pharmaceutical Group

- China Resources Sanjiu Medical & Pharmaceutical

- STADA

- Sanofi

- Jumpcan Pharmaceutical

- Hyland's

- Foundation Consumer Healthcare (Dimetapp)

Notable Milestones in Children Cough Medicine Sector

- 2020: Launch of a new sugar-free, natural honey-based cough syrup for toddlers by Reckitt Benckiser, responding to parental demand for healthier options.

- 2021: STADA expands its pediatric portfolio with the acquisition of a regional cough medicine brand, enhancing its market presence in Eastern Europe.

- 2022: Johnson & Johnson introduces an improved formulation with a faster-acting mechanism for daytime cough relief in children.

- 2023: Hainan Huluwa Pharmaceutical Group invests in advanced manufacturing facilities to increase production capacity for its popular children's cough medicine line.

- 2024 (estimated): China Resources Sanjiu Medical & Pharmaceutical announces plans for clinical trials of a novel herbal compound for severe pediatric cough conditions.

In-Depth Children Cough Medicine Market Outlook

The future outlook for the children cough medicine market is exceptionally promising, driven by a confluence of sustained demand, ongoing innovation, and expanding market reach. Growth accelerators such as the development of microbiome-friendly cough treatments and personalized medication approaches will redefine therapeutic efficacy and safety. Strategic alliances and collaborations will continue to be instrumental in unlocking new markets and product pipelines. The increasing global focus on preventative healthcare and the demand for natural, safe, and effective solutions position the children cough medicine sector for significant and sustained expansion over the forecast period.

Children Cough Medicine Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Drug Stores

-

2. Type

- 2.1. OTC Medicines

- 2.2. Prescription Medicines

Children Cough Medicine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Children Cough Medicine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

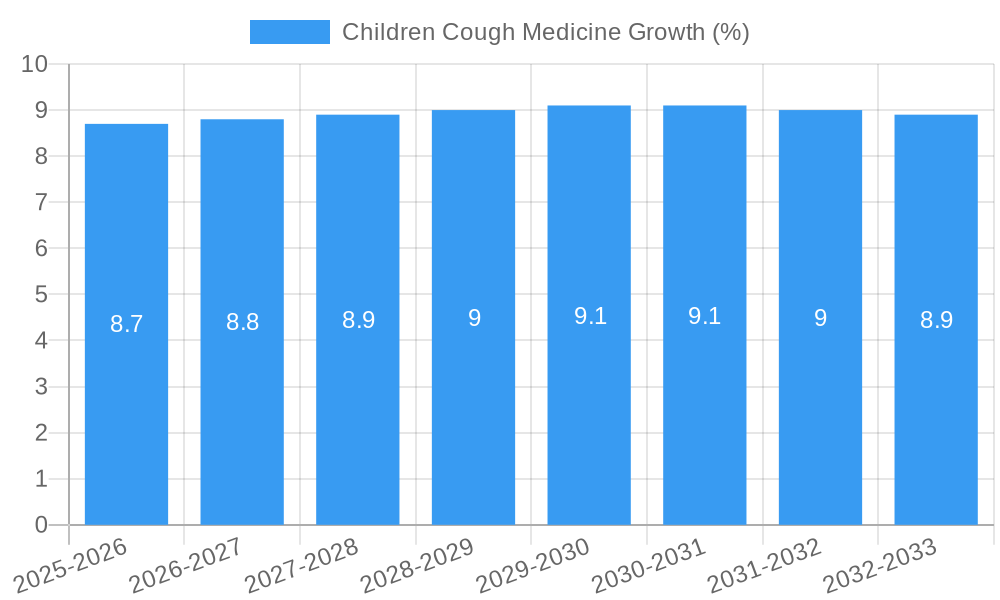

| Growth Rate | CAGR of 8.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Children Cough Medicine Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Drug Stores

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. OTC Medicines

- 5.2.2. Prescription Medicines

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Children Cough Medicine Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Drug Stores

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. OTC Medicines

- 6.2.2. Prescription Medicines

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Children Cough Medicine Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Drug Stores

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. OTC Medicines

- 7.2.2. Prescription Medicines

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Children Cough Medicine Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Drug Stores

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. OTC Medicines

- 8.2.2. Prescription Medicines

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Children Cough Medicine Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Drug Stores

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. OTC Medicines

- 9.2.2. Prescription Medicines

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Children Cough Medicine Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Drug Stores

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. OTC Medicines

- 10.2.2. Prescription Medicines

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Johnson & Johnson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Reckitt Benckiser

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sunflower Pharmaceutical Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hainan Huluwa Pharmaceutical Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Resources Sanjiu Medical & Pharmaceutical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STADA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sanofi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jumpcan Pharmaceutical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hyland's

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Foundation Consumer Healthcare (Dimetapp)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Johnson & Johnson

List of Figures

- Figure 1: Global Children Cough Medicine Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Children Cough Medicine Revenue (million), by Application 2024 & 2032

- Figure 3: North America Children Cough Medicine Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Children Cough Medicine Revenue (million), by Type 2024 & 2032

- Figure 5: North America Children Cough Medicine Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Children Cough Medicine Revenue (million), by Country 2024 & 2032

- Figure 7: North America Children Cough Medicine Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Children Cough Medicine Revenue (million), by Application 2024 & 2032

- Figure 9: South America Children Cough Medicine Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Children Cough Medicine Revenue (million), by Type 2024 & 2032

- Figure 11: South America Children Cough Medicine Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Children Cough Medicine Revenue (million), by Country 2024 & 2032

- Figure 13: South America Children Cough Medicine Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Children Cough Medicine Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Children Cough Medicine Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Children Cough Medicine Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Children Cough Medicine Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Children Cough Medicine Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Children Cough Medicine Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Children Cough Medicine Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Children Cough Medicine Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Children Cough Medicine Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Children Cough Medicine Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Children Cough Medicine Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Children Cough Medicine Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Children Cough Medicine Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Children Cough Medicine Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Children Cough Medicine Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Children Cough Medicine Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Children Cough Medicine Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Children Cough Medicine Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Children Cough Medicine Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Children Cough Medicine Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Children Cough Medicine Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Children Cough Medicine Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Children Cough Medicine Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Children Cough Medicine Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Children Cough Medicine Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Children Cough Medicine Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Children Cough Medicine Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Children Cough Medicine Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Children Cough Medicine Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Children Cough Medicine Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Children Cough Medicine Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Children Cough Medicine Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Children Cough Medicine Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Children Cough Medicine Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Children Cough Medicine Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Children Cough Medicine Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Children Cough Medicine Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Children Cough Medicine Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Children Cough Medicine?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Children Cough Medicine?

Key companies in the market include Johnson & Johnson, Reckitt Benckiser, Sunflower Pharmaceutical Group, Hainan Huluwa Pharmaceutical Group, China Resources Sanjiu Medical & Pharmaceutical, STADA, Sanofi, Jumpcan Pharmaceutical, Hyland's, Foundation Consumer Healthcare (Dimetapp).

3. What are the main segments of the Children Cough Medicine?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2801 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Children Cough Medicine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Children Cough Medicine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Children Cough Medicine?

To stay informed about further developments, trends, and reports in the Children Cough Medicine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence