Key Insights

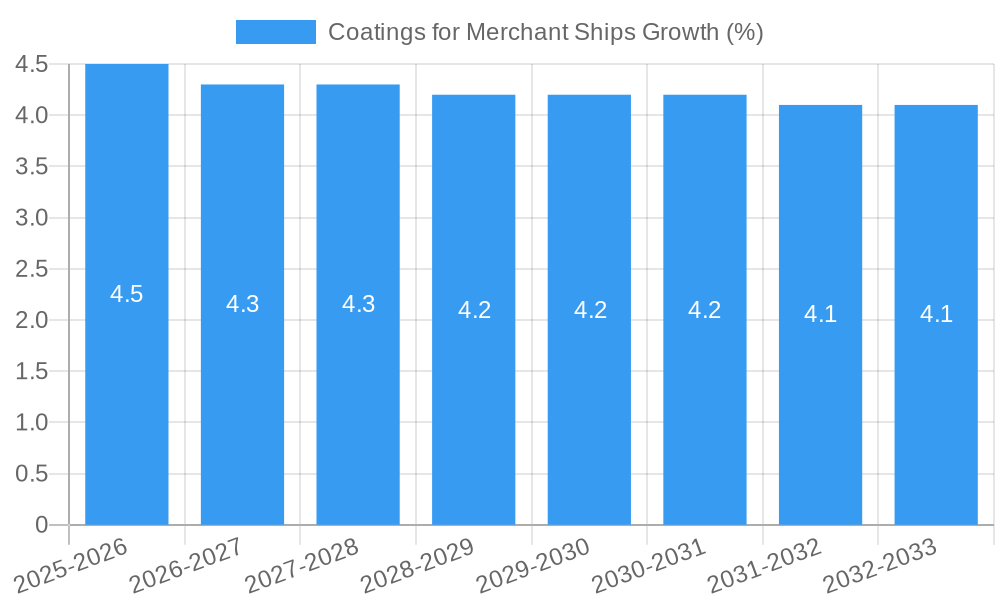

The global market for coatings for merchant ships is poised for significant expansion, projected to reach a valuation of approximately $6,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 4.5% anticipated over the forecast period of 2025-2033. This growth is primarily propelled by the increasing global trade volumes and the subsequent demand for efficient and expanded shipping fleets. The necessity for advanced coatings that enhance fuel efficiency, prolong vessel lifespan, and reduce operational costs are key drivers. Anti-corrosion coatings are critical in protecting vessels from the harsh marine environment, while antifouling coatings are essential for preventing the accumulation of marine organisms, thereby minimizing drag and improving speed. The continuous innovation in coating technologies, focusing on eco-friendly formulations and superior performance, is further stimulating market growth. The demand is particularly strong from the cargo ship segment, which constitutes the largest share of the market due to the sheer volume of global maritime trade carried by these vessels.

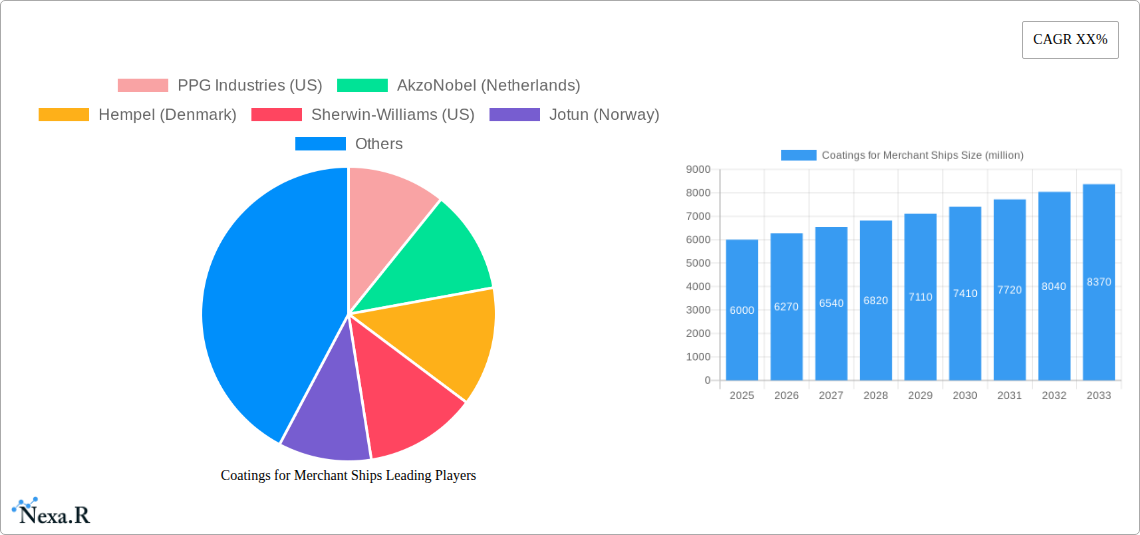

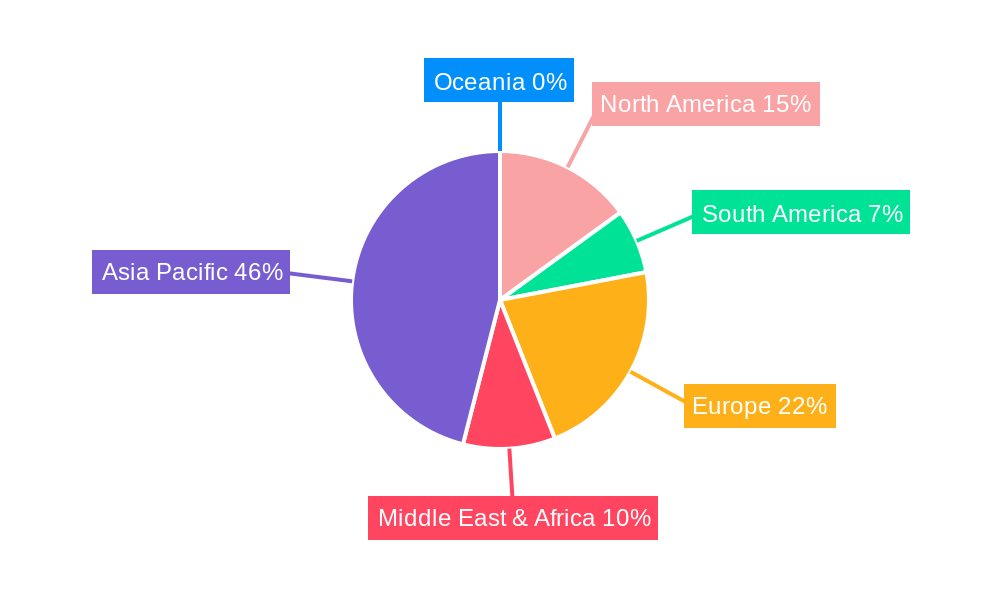

Despite the positive outlook, the market faces certain restraints. Stringent environmental regulations concerning volatile organic compounds (VOCs) and the disposal of spent coatings necessitate significant investment in research and development for sustainable alternatives. Fluctuations in raw material prices, particularly for resins and pigments, can also impact profit margins for manufacturers. Geographically, the Asia Pacific region, led by China and India, is expected to dominate the market due to its extensive shipbuilding activities and the rapid expansion of its maritime trade routes. North America and Europe, while mature markets, are witnessing growth driven by retrofitting initiatives and the adoption of high-performance coatings for existing fleets. Emerging economies in South America and the Middle East & Africa also present substantial growth opportunities as their maritime infrastructure develops. Key players like PPG Industries, AkzoNobel, and Hempel are actively engaged in strategic collaborations and product development to capture market share and address the evolving needs of the shipping industry.

Coatings for Merchant Ships Market Report: Navigating Growth and Innovation

This comprehensive report, "Coatings for Merchant Ships," offers an in-depth analysis of the global market for protective and functional coatings applied to cargo ships, passenger vessels, and boats. The study spans the historical period from 2019 to 2024, with a base year of 2025 and an extensive forecast period from 2025 to 2033. We dissect the parent market of marine coatings and its child markets, providing granular insights into segmentation by application and type, with a specific focus on anti-corrosion and antifouling coatings. This report is an essential resource for manufacturers, suppliers, shipbuilders, and industry stakeholders seeking to understand market dynamics, growth trends, and strategic opportunities within this critical sector.

Coatings for Merchant Ships Market Dynamics & Structure

The global coatings for merchant ships market is characterized by a moderate to high concentration, with leading players like PPG Industries, AkzoNobel, Hempel, Sherwin-Williams, and Jotun holding significant market shares. Technological innovation is a primary driver, propelled by the constant demand for enhanced performance, reduced environmental impact, and longer vessel lifecycles. Stringent regulatory frameworks, particularly concerning volatile organic compounds (VOCs) and the control of invasive species via antifouling technologies, are shaping product development and market access. Competitive product substitutes, while present in niche applications, are largely outpaced by advancements in high-performance coatings. End-user demographics are shifting towards larger and more specialized vessels, demanding tailored coating solutions. Mergers and acquisitions (M&A) remain a key strategy for market expansion and consolidation, with several significant deal volumes observed in recent years as companies seek to broaden their product portfolios and geographic reach.

- Market Concentration: Moderate to High, with key players dominating.

- Technological Innovation Drivers: Increased vessel efficiency, extended lifespan, environmental compliance.

- Regulatory Frameworks: IMO regulations (e.g., Ballast Water Management Convention), regional VOC limits.

- Competitive Product Substitutes: Limited impact on core applications due to specialized performance requirements.

- End-User Demographics: Growing demand for coatings for large cargo vessels and cruise ships.

- M&A Trends: Strategic acquisitions to gain market share, technology, and expanded product lines. For instance, recent M&A activity indicates an aggregate deal volume of approximately $1,200 million over the historical period.

Coatings for Merchant Ships Growth Trends & Insights

The global coatings for merchant ships market is poised for substantial growth, driven by an increasing global trade volume necessitating a larger and more active merchant fleet. The market size is projected to expand from an estimated $12,500 million in 2025 to $17,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5%. This growth is fueled by an increasing adoption rate of advanced, eco-friendly coating technologies that offer superior performance, such as self-polishing antifouling and advanced anticorrosion systems. Technological disruptions, including the development of nanotechnology-based coatings for enhanced durability and self-healing properties, are significantly impacting the market. Consumer behavior is shifting towards prioritizing lifecycle cost savings, operational efficiency, and environmental sustainability when selecting coating solutions. Furthermore, the growing emphasis on fleet modernization and maintenance to meet stricter environmental regulations is acting as a significant growth accelerator. The penetration of specialized coatings for new builds and the increasing demand for maintenance and repair coatings for existing fleets are also contributing to the market's upward trajectory.

- Market Size Evolution: Projected to grow from $12,500 million in 2025 to $17,800 million by 2033.

- CAGR: Approximately 4.5% during the forecast period.

- Adoption Rates: Rising for eco-friendly and high-performance coating solutions.

- Technological Disruptions: Nanotechnology, bio-fouling resistant materials, and smart coatings.

- Consumer Behavior Shifts: Focus on lifecycle cost, operational efficiency, and environmental compliance.

- Market Penetration: Increasing for specialized coatings in both new build and retrofitting segments.

Dominant Regions, Countries, or Segments in Coatings for Merchant Ships

The Cargo Ship segment, particularly within the Anti-Corrosion Coating type, is the dominant force driving growth in the global coatings for merchant ships market. Asia-Pacific, led by China, South Korea, and Japan, emerges as the leading region due to its vast shipbuilding capacity and extensive maritime trade. The sheer volume of cargo vessels, from bulk carriers to container ships, necessitates a continuous demand for robust anti-corrosion solutions to protect against harsh marine environments and maintain structural integrity. The economic policies favoring trade and infrastructure development in these Asian nations further bolster the shipbuilding and shipping industries, consequently amplifying the need for high-performance coatings. Market share within this segment is substantial, estimated at over 45% of the total market value in 2025. The growth potential remains exceptionally high, driven by ongoing fleet expansion and the increasing complexity of cargo handling operations, which demand advanced protective measures.

- Dominant Application Segment: Cargo Ship.

- Dominant Coating Type: Anti-Corrosion Coating.

- Leading Region: Asia-Pacific (China, South Korea, Japan).

- Key Drivers for Dominance:

- Economic Policies: Pro-trade policies and government support for shipbuilding.

- Infrastructure Development: Expansion of ports and global trade routes.

- Fleet Size and Activity: Largest global fleet segment, requiring extensive coating application.

- Environmental Regulations: Increasing stringency for vessel maintenance and lifespan extension.

- Market Share (Cargo Ship, Anti-Corrosion): Estimated at over 45% of the total market in 2025.

- Growth Potential: Significant, fueled by new builds and retrofitting.

Coatings for Merchant Ships Product Landscape

The product landscape for coatings for merchant ships is increasingly sophisticated, focusing on advanced formulations that deliver superior protection and operational efficiencies. Innovations in anti-corrosion coatings include high-solid content epoxy and advanced polyurethanes offering extended dry-docking intervals and enhanced resistance to corrosion. Antifouling coatings are seeing advancements in biocide-free technologies and silicone-based foul-release systems that minimize drag, improve fuel efficiency, and reduce environmental impact. Product applications range from the initial protection of new builds to the comprehensive maintenance and repair of existing fleets, with specialized coatings designed for ballast tanks, cargo holds, and underwater hulls. Unique selling propositions often revolve around extended service life, ease of application, and compliance with evolving environmental standards. Technological advancements are enabling coatings with self-healing capabilities and improved adhesion, contributing to longer-lasting protection and reduced maintenance costs.

Key Drivers, Barriers & Challenges in Coatings for Merchant Ships

Key Drivers:

- Growing Global Trade: Increased demand for shipping services fuels the need for more vessels and thus coatings.

- Stringent Environmental Regulations: IMO regulations (e.g., IMO 2020, Ballast Water Management Convention) necessitate advanced, eco-friendly coatings.

- Technological Advancements: Development of high-performance, low-VOC, and sustainable coating solutions.

- Lifecycle Cost Optimization: Focus on coatings that reduce maintenance, improve fuel efficiency, and extend vessel lifespan.

- Fleet Expansion and Modernization: Ongoing construction of new vessels and upgrades of existing fleets.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in raw material prices and availability, impacting production costs. The estimated impact on cost can be up to 15% variability.

- Regulatory Hurdles: Complex and evolving international and regional regulations requiring continuous adaptation.

- High Initial Investment: Advanced coating systems can have higher upfront costs, posing a challenge for some operators.

- Skilled Labor Shortage: Availability of trained applicators for specialized coating systems.

- Economic Downturns: Global economic slowdowns can impact shipping demand and new vessel orders, affecting coating sales.

Emerging Opportunities in Coatings for Merchant Ships

Emerging opportunities in the coatings for merchant ships market lie in the development and adoption of smart coatings with integrated sensors for real-time monitoring of hull condition and performance. The growing demand for sustainable solutions is also opening avenues for bio-based and recycled material coatings. Furthermore, the increasing focus on digitalization and data analytics in the maritime sector presents an opportunity for coatings that integrate with fleet management systems, offering predictive maintenance insights. Untapped markets in regions with developing maritime infrastructure also offer significant potential for growth. The trend towards specialized coatings for vessels operating in specific environmental conditions, such as ice-breaking or extreme temperature regions, is another area of burgeoning opportunity.

Growth Accelerators in the Coatings for Merchant Ships Industry

Long-term growth in the coatings for merchant ships industry is being significantly accelerated by a confluence of factors. Technological breakthroughs in material science are yielding coatings with unprecedented durability, self-cleaning properties, and fuel-saving capabilities, directly impacting operational economics. Strategic partnerships between coating manufacturers, shipyards, and ship owners are fostering collaborative innovation and faster market adoption of new technologies. Furthermore, a proactive approach to environmental compliance, driven by industry-wide sustainability initiatives and stricter regulations, is pushing the development and adoption of eco-friendly coating solutions. The growing trend of retrofitting older vessels with advanced coatings to enhance their efficiency and extend their service life also acts as a powerful growth accelerator, ensuring continued demand even during periods of reduced new build orders.

Key Players Shaping the Coatings for Merchant Ships Market

- PPG Industries

- AkzoNobel

- Hempel

- Sherwin-Williams

- Jotun

- Chugoku Marine Paints

- Nippon Paint

- Kansai Paint

- Axalta

- BASF Coatings

Notable Milestones in Coatings for Merchant Ships Sector

- 2019: Introduction of new low-VOC compliant coating systems by major manufacturers.

- 2020: Increased focus on biocide-free antifouling technologies due to environmental concerns.

- 2021: Significant investment in R&D for self-healing and nanotechnology-enhanced coatings.

- 2022: Several strategic M&A activities aimed at consolidating market share and expanding product portfolios.

- 2023: Launch of advanced foul-release coating systems offering enhanced fuel savings.

- Q1 2024: Growing demand for sustainable and bio-based coating alternatives.

In-Depth Coatings for Merchant Ships Market Outlook

The outlook for the coatings for merchant ships market remains exceptionally robust, driven by an ongoing commitment to operational efficiency, environmental stewardship, and fleet longevity. Growth accelerators such as advanced material science, strategic collaborations, and proactive regulatory compliance are setting a strong trajectory for future expansion. The continuous evolution of shipbuilding and maritime trade ensures a perpetual demand for protective and performance-enhancing coatings. Strategic opportunities lie in capitalizing on the burgeoning demand for eco-friendly solutions, the digital integration of coating performance data, and the expansion into emerging maritime markets. The industry is well-positioned to navigate future challenges, with innovation and sustainability at the forefront of its development.

Coatings for Merchant Ships Segmentation

-

1. Application

- 1.1. Cargo Ship

- 1.2. Passenger Ship

- 1.3. Boat

-

2. Types

- 2.1. Anti-Corrosion Coating

- 2.2. Antifouling Coating

Coatings for Merchant Ships Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Coatings for Merchant Ships REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coatings for Merchant Ships Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cargo Ship

- 5.1.2. Passenger Ship

- 5.1.3. Boat

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Anti-Corrosion Coating

- 5.2.2. Antifouling Coating

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Coatings for Merchant Ships Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cargo Ship

- 6.1.2. Passenger Ship

- 6.1.3. Boat

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Anti-Corrosion Coating

- 6.2.2. Antifouling Coating

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Coatings for Merchant Ships Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cargo Ship

- 7.1.2. Passenger Ship

- 7.1.3. Boat

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Anti-Corrosion Coating

- 7.2.2. Antifouling Coating

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Coatings for Merchant Ships Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cargo Ship

- 8.1.2. Passenger Ship

- 8.1.3. Boat

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Anti-Corrosion Coating

- 8.2.2. Antifouling Coating

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Coatings for Merchant Ships Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cargo Ship

- 9.1.2. Passenger Ship

- 9.1.3. Boat

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Anti-Corrosion Coating

- 9.2.2. Antifouling Coating

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Coatings for Merchant Ships Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cargo Ship

- 10.1.2. Passenger Ship

- 10.1.3. Boat

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Anti-Corrosion Coating

- 10.2.2. Antifouling Coating

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PPG Industries (US)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AkzoNobel (Netherlands)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hempel (Denmark)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sherwin-Williams (US)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jotun (Norway)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chugoku Marine Paints (Japan)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nippon Paint (Japan)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kansai Paint (Japan)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Axalta (US)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF Coatings (Germany)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PPG Industries (US)

List of Figures

- Figure 1: Global Coatings for Merchant Ships Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Coatings for Merchant Ships Revenue (million), by Application 2024 & 2032

- Figure 3: North America Coatings for Merchant Ships Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Coatings for Merchant Ships Revenue (million), by Types 2024 & 2032

- Figure 5: North America Coatings for Merchant Ships Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Coatings for Merchant Ships Revenue (million), by Country 2024 & 2032

- Figure 7: North America Coatings for Merchant Ships Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Coatings for Merchant Ships Revenue (million), by Application 2024 & 2032

- Figure 9: South America Coatings for Merchant Ships Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Coatings for Merchant Ships Revenue (million), by Types 2024 & 2032

- Figure 11: South America Coatings for Merchant Ships Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Coatings for Merchant Ships Revenue (million), by Country 2024 & 2032

- Figure 13: South America Coatings for Merchant Ships Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Coatings for Merchant Ships Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Coatings for Merchant Ships Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Coatings for Merchant Ships Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Coatings for Merchant Ships Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Coatings for Merchant Ships Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Coatings for Merchant Ships Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Coatings for Merchant Ships Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Coatings for Merchant Ships Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Coatings for Merchant Ships Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Coatings for Merchant Ships Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Coatings for Merchant Ships Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Coatings for Merchant Ships Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Coatings for Merchant Ships Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Coatings for Merchant Ships Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Coatings for Merchant Ships Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Coatings for Merchant Ships Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Coatings for Merchant Ships Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Coatings for Merchant Ships Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Coatings for Merchant Ships Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Coatings for Merchant Ships Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Coatings for Merchant Ships Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Coatings for Merchant Ships Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Coatings for Merchant Ships Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Coatings for Merchant Ships Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Coatings for Merchant Ships Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Coatings for Merchant Ships Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Coatings for Merchant Ships Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Coatings for Merchant Ships Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Coatings for Merchant Ships Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Coatings for Merchant Ships Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Coatings for Merchant Ships Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Coatings for Merchant Ships Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Coatings for Merchant Ships Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Coatings for Merchant Ships Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Coatings for Merchant Ships Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Coatings for Merchant Ships Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Coatings for Merchant Ships Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Coatings for Merchant Ships Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coatings for Merchant Ships?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Coatings for Merchant Ships?

Key companies in the market include PPG Industries (US), AkzoNobel (Netherlands), Hempel (Denmark), Sherwin-Williams (US), Jotun (Norway), Chugoku Marine Paints (Japan), Nippon Paint (Japan), Kansai Paint (Japan), Axalta (US), BASF Coatings (Germany).

3. What are the main segments of the Coatings for Merchant Ships?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coatings for Merchant Ships," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coatings for Merchant Ships report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coatings for Merchant Ships?

To stay informed about further developments, trends, and reports in the Coatings for Merchant Ships, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence