Key Insights

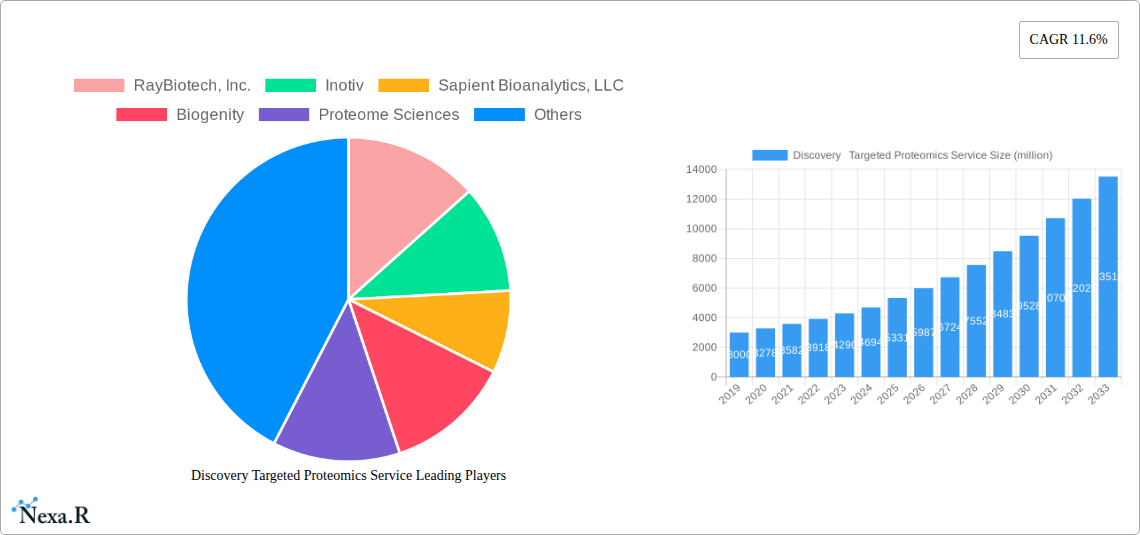

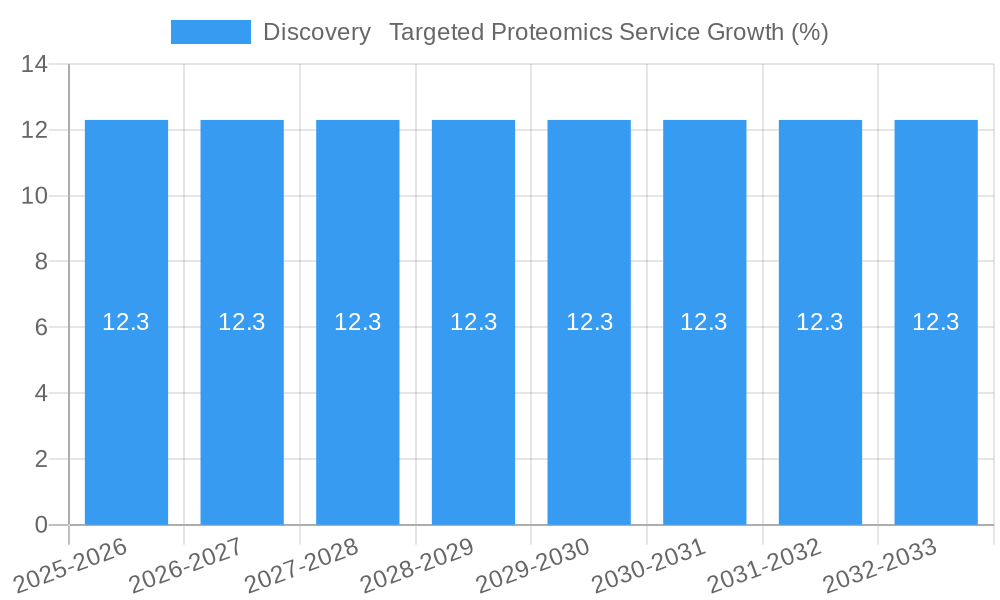

The global Discovery and Targeted Proteomics Services market is poised for substantial growth, projected to reach approximately $5331 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.6% during the forecast period of 2025-2033. This robust expansion is primarily driven by the escalating demand for advanced diagnostic tools, the burgeoning field of personalized medicine, and the critical role of proteomics in understanding disease mechanisms and developing novel therapeutics. The segment of Discovery Proteomics is expected to witness significant adoption as researchers delve deeper into comprehensive protein profiling to identify potential biomarkers and therapeutic targets. Simultaneously, Targeted Proteomics is gaining traction for its precision in quantifying specific proteins, crucial for validating findings from discovery studies and advancing drug development pipelines.

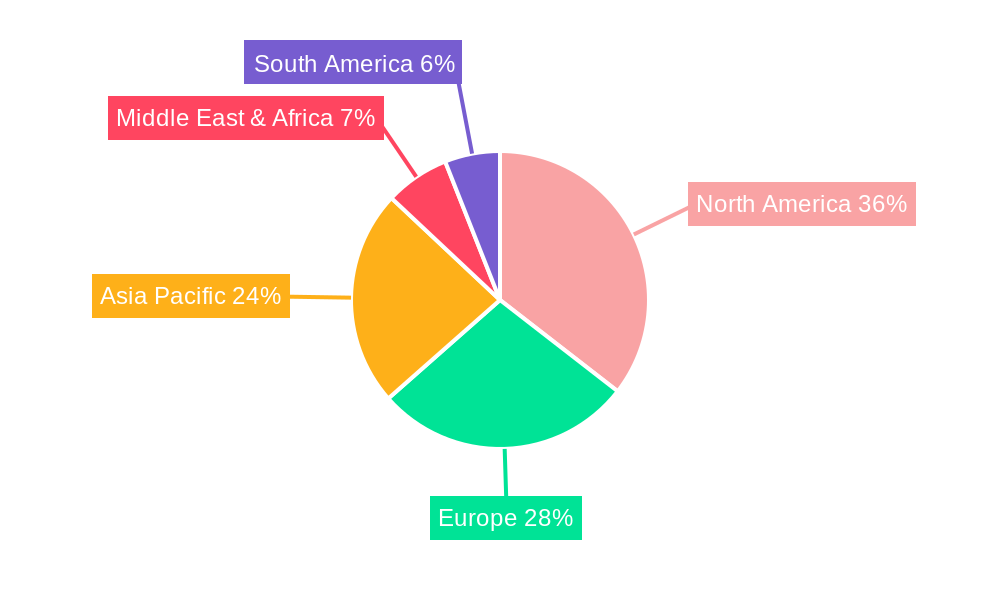

The market's dynamism is further fueled by continuous technological advancements in mass spectrometry and bioinformatics, enhancing the sensitivity, accuracy, and throughput of proteomic analyses. Key applications span across the validation of disease biomarkers, the intricate processes of drug development and precision medicine, and in-depth studies of protein function and interactions. North America is anticipated to lead the market, driven by strong research infrastructure, significant investments in biotechnology, and a high prevalence of chronic diseases. Europe and Asia Pacific are also expected to exhibit strong growth, propelled by increasing R&D activities and a growing focus on personalized healthcare solutions. While the market enjoys strong growth drivers, potential restraints such as high operational costs and the need for specialized expertise could influence the pace of adoption in certain regions or segments.

This comprehensive report provides an in-depth analysis of the global Discovery Targeted Proteomics Service market, a critical component for advancements in biomarker discovery, drug development, and precision medicine. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, and emerging opportunities. We explore the intricate structure of this vital market, identifying key players and notable milestones that are shaping its future trajectory. This report is essential for industry professionals, researchers, investors, and stakeholders seeking to understand the current state and future potential of the discovery targeted proteomics service sector.

Discovery Targeted Proteomics Service Market Dynamics & Structure

The Discovery Targeted Proteomics Service market exhibits a dynamic and evolving structure, characterized by a growing concentration of expertise and innovation, particularly within the drug development and precision medicine segment. Technological advancements in mass spectrometry and bioinformatics are primary innovation drivers, enabling higher sensitivity and specificity in protein quantification. Regulatory frameworks, especially those governing drug approval and diagnostic development, indirectly influence market adoption and service offerings. Competitive product substitutes, while present in broader omics services, are less direct within highly specialized targeted proteomics. End-user demographics are shifting towards academic research institutions and biopharmaceutical companies, with an increasing demand from contract research organizations (CROs). Merger and acquisition (M&A) activity is moderate, often driven by companies seeking to expand their service portfolios or gain access to specialized technologies.

- Market Concentration: The market features a blend of large, established players and specialized niche providers, with a trend towards consolidation in key application areas.

- Technological Innovation: High-resolution mass spectrometry, advanced sample preparation techniques, and sophisticated data analysis algorithms are continuously enhancing capabilities.

- Regulatory Influence: Compliance with GLP/GMP standards for clinical applications and data integrity are critical considerations for service providers.

- End-User Segments: Growing demand from pharmaceutical R&D, diagnostics development, and academic research institutions fuels market expansion.

- M&A Trends: Strategic acquisitions are focused on integrating complementary technologies and expanding geographical reach.

Discovery Targeted Proteomics Service Growth Trends & Insights

The Discovery Targeted Proteomics Service market is projected to witness robust growth, driven by an escalating need for precise molecular insights in healthcare. The market size is expected to expand significantly, fueled by increasing adoption rates in early-stage drug discovery and the burgeoning field of personalized medicine. Technological disruptions, such as the integration of artificial intelligence (AI) in data analysis and the development of novel assay platforms, are transforming how proteomics data is generated and interpreted. Consumer behavior shifts are evident in the growing preference for outsourcing complex proteomic analyses to specialized service providers, allowing researchers to focus on core scientific objectives. The estimated market size for discovery targeted proteomics services is projected to reach approximately $2,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025–2033). This growth is underpinned by a significant increase in the volume of clinical trials utilizing proteomic biomarkers and a rising investment in precision oncology. The market penetration of targeted proteomics in therapeutic areas like autoimmune diseases and neurodegenerative disorders is steadily increasing, reflecting its growing importance. Historical data from 2019–2024 indicates a steady upward trend, with market expansion driven by increased research funding and a deeper understanding of disease pathophysiology at the molecular level. The increasing complexity of biological systems being studied necessitates highly specific and sensitive analytical techniques, positioning targeted proteomics as an indispensable tool. Furthermore, the demand for robust validation of potential drug targets and biomarkers before expensive clinical development is a key market driver, contributing to the sustained growth of this sector. The evolving landscape of biotherapeutics, including antibody-drug conjugates and gene therapies, also necessitates detailed protein-level analysis, further bolstering demand for targeted proteomics services.

Dominant Regions, Countries, or Segments in Discovery Targeted Proteomics Service

The Drug Development and Precision Medicine segment stands as the dominant force driving growth within the Discovery Targeted Proteomics Service market. This segment's ascendancy is directly linked to the global pharmaceutical industry's relentless pursuit of novel therapeutics and personalized treatment strategies. North America, particularly the United States, consistently leads in market share due to its extensive biopharmaceutical R&D infrastructure, substantial government funding for research, and a high prevalence of chronic diseases necessitating advanced diagnostic and therapeutic solutions. The Screening and Validation of Disease Biomarkers application is intricately intertwined with drug development, serving as a foundational element for identifying targets and assessing treatment efficacy.

- Dominant Segment (Application): Drug Development and Precision Medicine, accounting for an estimated 65% of the market revenue in 2025.

- Key Drivers: Increasing investment in R&D for novel drug discovery, demand for personalized therapies, and the growing recognition of proteomic biomarkers in clinical decision-making.

- Growth Potential: High, driven by the expanding pipeline of biopharmaceuticals and the need for robust biomarker strategies.

- Dominant Segment (Type): Targeted Proteomics, valued at approximately $1,800 million in 2025.

- Key Drivers: Superior sensitivity and specificity for quantifying low-abundance proteins, suitability for validation studies, and its role in confirming findings from discovery-stage research.

- Growth Potential: Substantial, as it serves as the essential validation arm for discovery proteomics and other omics approaches.

- Leading Region: North America, with an estimated market share of 40% in 2025.

- Key Drivers: Presence of major pharmaceutical and biotechnology hubs, robust venture capital funding for life sciences, and a proactive regulatory environment for novel therapies.

- Economic Policies: Favorable R&D tax credits and government initiatives supporting biomedical innovation.

- Infrastructure: Advanced research institutions, cutting-edge analytical facilities, and a skilled workforce.

Europe follows closely, driven by strong academic research institutions and a growing biotech sector. Asia-Pacific is emerging as a significant growth region, propelled by increasing government investments in healthcare and life sciences, a burgeoning pharmaceutical industry, and cost-effective service delivery.

Discovery Targeted Proteomics Service Product Landscape

The product landscape for discovery targeted proteomics services is characterized by highly sophisticated and integrated solutions. Service providers offer a spectrum of methodologies, including Selected Reaction Monitoring (SRM), Parallel Reaction Monitoring (PRM), and Data-Independent Acquisition (DIA), all leveraging state-of-the-art mass spectrometry platforms. These services are critical for precise protein quantification, enabling the identification and validation of disease biomarkers, the assessment of drug efficacy and toxicity, and the elucidation of complex protein-protein interactions. Unique selling propositions often lie in the depth of expertise in assay development, customized peptide synthesis, and advanced bioinformatics analysis, ensuring high-quality, reproducible data for demanding research applications. Technological advancements are continuously enhancing throughput, sensitivity, and the ability to analyze challenging sample matrices.

Key Drivers, Barriers & Challenges in Discovery Targeted Proteomics Service

The Discovery Targeted Proteomics Service market is propelled by several key drivers. The increasing complexity of biological research, demanding deeper molecular understanding, fuels the need for precise protein analysis. Advancements in mass spectrometry technology, offering higher sensitivity and throughput, are critical enablers. The burgeoning fields of precision medicine and personalized therapeutics necessitate reliable biomarker identification and validation, a core strength of targeted proteomics. Furthermore, growing investment in R&D by pharmaceutical and biotechnology companies directly translates to increased demand for specialized proteomic services.

Challenges and Restraints include the high cost of advanced instrumentation and consumables, which can translate to significant service fees. The specialized expertise required for experimental design, data acquisition, and interpretation represents a barrier to entry and a challenge in talent acquisition. Ensuring data reproducibility and standardization across different labs and platforms remains an ongoing concern, impacting the comparability of results. The lengthy timelines associated with drug development can also influence the demand cycle for these services. Supply chain issues for specialized reagents and consumables, while currently manageable, could pose a future challenge. The regulatory landscape for diagnostic applications, while evolving, can be complex and time-consuming to navigate.

Emerging Opportunities in Discovery Targeted Proteomics Service

Emerging opportunities in the Discovery Targeted Proteomics Service market are significant and diverse. The expanding application of targeted proteomics in infectious disease research, particularly in understanding pathogen-host interactions and developing novel diagnostics and therapeutics, presents a major growth avenue. The increasing focus on proteogenomics, integrating proteomic data with genomic and transcriptomic information, offers a more comprehensive understanding of cellular processes and disease mechanisms, creating new service demands. The development of highly multiplexed targeted assays capable of quantifying hundreds or thousands of proteins simultaneously will further enhance efficiency and broaden applications. Untapped markets in specific therapeutic areas, such as rare diseases and neurodegenerative disorders, where deep molecular insights are critically needed, represent substantial growth potential. Evolving consumer preferences are leaning towards data-driven healthcare, increasing the demand for robust proteomic profiling as a component of proactive health management and early disease detection.

Growth Accelerators in the Discovery Targeted Proteomics Service Industry

The Discovery Targeted Proteomics Service industry is experiencing significant growth acceleration driven by several critical factors. Technological breakthroughs in mass spectrometry, including ion mobility and advanced detector technologies, are continuously pushing the boundaries of sensitivity, specificity, and speed. Strategic partnerships between CROs and pharmaceutical companies are becoming more prevalent, fostering collaborative research and accelerating the translation of proteomic findings into clinical applications. The increasing adoption of targeted proteomics for the validation of biomarkers identified through high-throughput discovery platforms is a major growth catalyst, ensuring the reliability of downstream research and development. Furthermore, market expansion strategies by service providers into emerging geographical regions with growing biopharmaceutical ecosystems are contributing to sustained growth.

Key Players Shaping the Discovery Targeted Proteomics Service Market

- RayBiotech, Inc.

- Inotiv

- Sapient Bioanalytics, LLC

- Biogenity

- Proteome Sciences

- VProteomics

- Creative Proteomics

- Charles River Laboratories

- MtoZ Biolabs

- Panome Bio

- PolyQuant GmbH

- MS Bioworks

- LABTOO

- BGI Genomics

- Biotech Pack

- APPLIED PROTEIN TECHNOLOGY

- OBiO Technology (Shanghai) Corp.,Ltd.

- Suzhou PANOMIX Biomedical Tech Co.,Ltd

- Novogene

- OeBiotech

- ChomiX Biotech Co., Ltd

Notable Milestones in Discovery Targeted Proteomics Service Sector

- 2019: Increased adoption of data-independent acquisition (DIA) techniques for more comprehensive targeted proteomic profiling.

- 2020: Significant rise in demand for proteomics services to support COVID-19 research, including biomarker discovery and understanding viral-host interactions.

- 2021: Advancements in AI-driven bioinformatics tools for faster and more accurate analysis of complex proteomic datasets.

- 2022: Growth in partnerships between CROs and academic institutions to accelerate the discovery and validation of proteomic biomarkers for rare diseases.

- 2023: Enhanced integration of targeted proteomics with other omics technologies, leading to more holistic biological insights.

- 2024: Increased investment in automation for sample preparation and assay development, improving throughput and reproducibility.

In-Depth Discovery Targeted Proteomics Service Market Outlook

The future outlook for the Discovery Targeted Proteomics Service market is exceptionally promising, characterized by sustained high growth and expanding applications. Growth accelerators, including ongoing technological innovations in mass spectrometry, AI-driven data analysis, and the strategic expansion of service portfolios by key players, will continue to fuel market expansion. The increasing demand for precise biomarker validation in drug development and the burgeoning field of precision medicine will remain primary drivers. Opportunities in emerging markets and novel applications, such as infectious disease research and the detailed analysis of biologics, offer significant untapped potential. Strategic partnerships and collaborations will be crucial for navigating the complex research landscape and accelerating the translation of scientific discoveries into tangible healthcare solutions, ensuring the continued upward trajectory of this vital sector.

Discovery Targeted Proteomics Service Segmentation

-

1. Application

- 1.1. Screening and Validation of Disease Biomarkers

- 1.2. Drug Development and Precision Medicine

- 1.3. Protein Function and Interaction Studies

- 1.4. Other

-

2. Type

- 2.1. Discovery Proteomics

- 2.2. Targeted Poteomics

Discovery Targeted Proteomics Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Discovery Targeted Proteomics Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Discovery Targeted Proteomics Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Screening and Validation of Disease Biomarkers

- 5.1.2. Drug Development and Precision Medicine

- 5.1.3. Protein Function and Interaction Studies

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Discovery Proteomics

- 5.2.2. Targeted Poteomics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Discovery Targeted Proteomics Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Screening and Validation of Disease Biomarkers

- 6.1.2. Drug Development and Precision Medicine

- 6.1.3. Protein Function and Interaction Studies

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Discovery Proteomics

- 6.2.2. Targeted Poteomics

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Discovery Targeted Proteomics Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Screening and Validation of Disease Biomarkers

- 7.1.2. Drug Development and Precision Medicine

- 7.1.3. Protein Function and Interaction Studies

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Discovery Proteomics

- 7.2.2. Targeted Poteomics

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Discovery Targeted Proteomics Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Screening and Validation of Disease Biomarkers

- 8.1.2. Drug Development and Precision Medicine

- 8.1.3. Protein Function and Interaction Studies

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Discovery Proteomics

- 8.2.2. Targeted Poteomics

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Discovery Targeted Proteomics Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Screening and Validation of Disease Biomarkers

- 9.1.2. Drug Development and Precision Medicine

- 9.1.3. Protein Function and Interaction Studies

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Discovery Proteomics

- 9.2.2. Targeted Poteomics

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Discovery Targeted Proteomics Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Screening and Validation of Disease Biomarkers

- 10.1.2. Drug Development and Precision Medicine

- 10.1.3. Protein Function and Interaction Studies

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Discovery Proteomics

- 10.2.2. Targeted Poteomics

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 RayBiotech Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inotiv

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sapient Bioanalytics LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Biogenity

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Proteome Sciences

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VProteomics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Creative Proteomics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Charles River Laboratories

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MtoZ Biolabs

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panome Bio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PolyQuant GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MS Bioworks

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LABTOO

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BGI Genomics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Biotech Pack

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 APPLIED PROTEIN TECHNOLOGY

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 OBiO Technology ( Shanghai ) Corp.Ltd.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Suzhou PANOMIX Biomedical Tech Co.Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Novogene

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 OeBiotech

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 ChomiX Biotech Co. Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 RayBiotech Inc.

List of Figures

- Figure 1: Global Discovery Targeted Proteomics Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Discovery Targeted Proteomics Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Discovery Targeted Proteomics Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Discovery Targeted Proteomics Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Discovery Targeted Proteomics Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Discovery Targeted Proteomics Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Discovery Targeted Proteomics Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Discovery Targeted Proteomics Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Discovery Targeted Proteomics Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Discovery Targeted Proteomics Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Discovery Targeted Proteomics Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Discovery Targeted Proteomics Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Discovery Targeted Proteomics Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Discovery Targeted Proteomics Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Discovery Targeted Proteomics Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Discovery Targeted Proteomics Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Discovery Targeted Proteomics Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Discovery Targeted Proteomics Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Discovery Targeted Proteomics Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Discovery Targeted Proteomics Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Discovery Targeted Proteomics Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Discovery Targeted Proteomics Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Discovery Targeted Proteomics Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Discovery Targeted Proteomics Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Discovery Targeted Proteomics Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Discovery Targeted Proteomics Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Discovery Targeted Proteomics Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Discovery Targeted Proteomics Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Discovery Targeted Proteomics Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Discovery Targeted Proteomics Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Discovery Targeted Proteomics Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Discovery Targeted Proteomics Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Discovery Targeted Proteomics Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Discovery Targeted Proteomics Service?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the Discovery Targeted Proteomics Service?

Key companies in the market include RayBiotech, Inc., Inotiv, Sapient Bioanalytics, LLC, Biogenity, Proteome Sciences, VProteomics, Creative Proteomics, Charles River Laboratories, MtoZ Biolabs, Panome Bio, PolyQuant GmbH, MS Bioworks, LABTOO, BGI Genomics, Biotech Pack, APPLIED PROTEIN TECHNOLOGY, OBiO Technology ( Shanghai ) Corp.,Ltd., Suzhou PANOMIX Biomedical Tech Co.,Ltd, Novogene, OeBiotech, ChomiX Biotech Co., Ltd.

3. What are the main segments of the Discovery Targeted Proteomics Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5331 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Discovery Targeted Proteomics Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Discovery Targeted Proteomics Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Discovery Targeted Proteomics Service?

To stay informed about further developments, trends, and reports in the Discovery Targeted Proteomics Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence