Key Insights

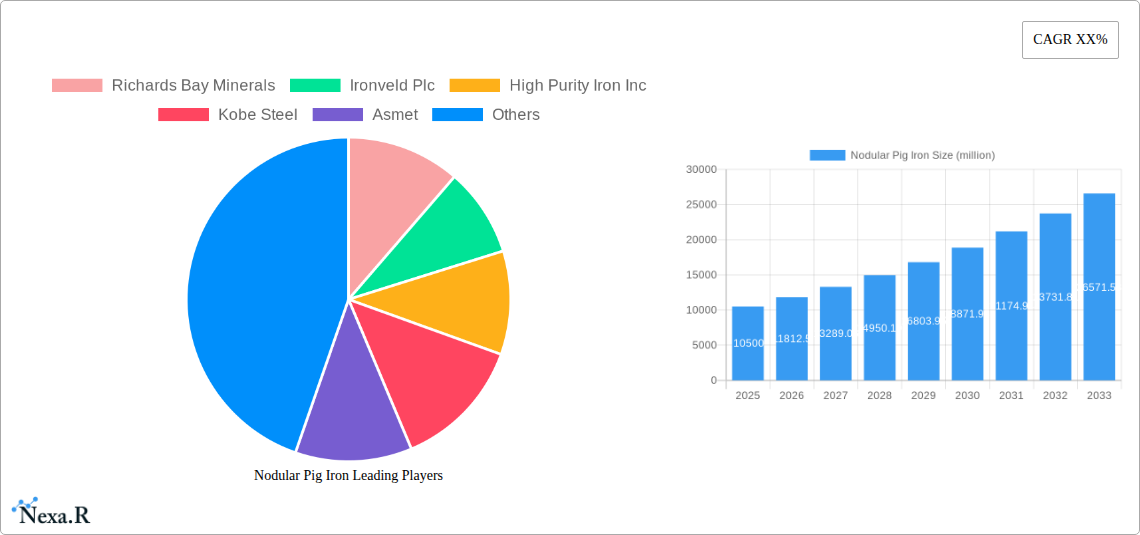

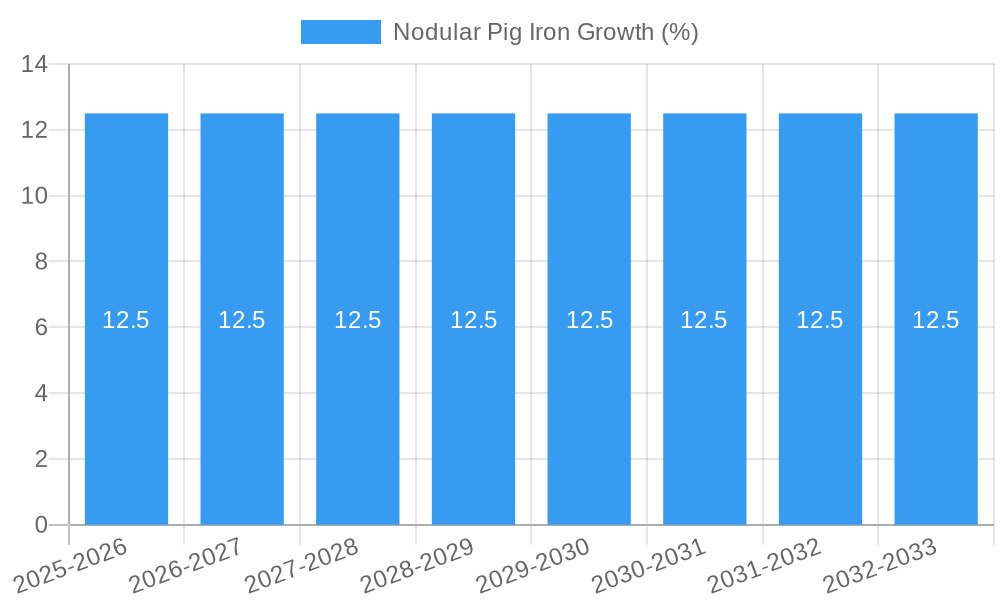

The global market for Nodular Pig Iron is poised for substantial growth, projected to reach an estimated $10,500 million by the end of 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% anticipated through 2033. This expansion is primarily fueled by the burgeoning demand from the foundry sector, a critical component in the production of automotive parts, heavy machinery, and construction materials. The increasing adoption of advanced manufacturing techniques and the continuous development of specialized alloys are further propelling the market forward. While Ordinary Type nodular pig iron holds a significant share, the Special Type segment is exhibiting remarkable growth, driven by applications requiring enhanced strength, durability, and specific metallurgical properties. This signifies a shift towards higher-value, performance-driven solutions within the industry.

Several key drivers underpin this optimistic market outlook. The escalating global automotive production, coupled with the increasing complexity and demand for lightweight, high-performance components, directly translates to a greater need for nodular pig iron. Similarly, the infrastructure development boom across emerging economies, particularly in Asia Pacific, is a significant catalyst. The "Other" application segment, encompassing diverse industrial uses beyond traditional foundries, is also demonstrating consistent expansion. However, the market faces certain restraints, including the volatility of raw material prices, particularly iron ore and alloying elements, which can impact production costs and profitability. Stringent environmental regulations related to iron and steel production also present challenges, necessitating investments in cleaner technologies and sustainable practices. Despite these hurdles, the inherent advantages of nodular pig iron in terms of its superior mechanical properties ensure its continued relevance and growth trajectory.

Nodular Pig Iron Market Analysis: Dynamics, Growth, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Nodular Pig Iron market, encompassing its intricate dynamics, historical trends, current growth trajectories, and future potential. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report offers unparalleled insights for industry stakeholders, investors, and decision-makers. The analysis includes a detailed examination of parent and child markets, key players, product innovations, regional dominance, and emerging opportunities, all presented with a focus on search engine optimization and user engagement.

Nodular Pig Iron Market Dynamics & Structure

The global Nodular Pig Iron market is characterized by a moderate to high concentration, with a few key players dominating production and supply. Technological innovation serves as a significant driver, particularly in enhancing the properties of nodular pig iron for specialized applications, leading to the development of new grades with superior strength and ductility. Regulatory frameworks, while evolving, primarily focus on environmental compliance and product quality standards, influencing production processes and raw material sourcing. Competitive product substitutes include various grades of cast iron and steel, whose availability and pricing can impact nodular pig iron demand. End-user demographics are predominantly industrial, with the automotive and heavy machinery sectors being major consumers. Mergers and acquisitions (M&A) trends indicate a strategic consolidation within the industry, aimed at expanding market reach, securing raw material supplies, and acquiring technological expertise. For instance, M&A deal volumes in the last three years are estimated at xx million units. Innovation barriers, such as high capital investment for advanced processing technologies and stringent quality control requirements, are also notable.

- Market Concentration: Moderately High, with key players holding significant market share (estimated at xx% by leading players).

- Technological Innovation Drivers: Development of higher-strength and more ductile grades, improved casting processes, and cost-efficiency enhancements.

- Regulatory Frameworks: Environmental standards (e.g., emissions control), product quality certifications, and international trade policies.

- Competitive Product Substitutes: Ductile iron, gray cast iron, malleable iron, and various steel alloys.

- End-User Demographics: Primarily industrial; automotive manufacturers, heavy equipment producers, agricultural machinery makers, and infrastructure developers.

- M&A Trends: Strategic acquisitions to gain market share, technological capabilities, and raw material access. Estimated M&A deal volumes: xx million units.

- Innovation Barriers: High upfront capital expenditure for advanced manufacturing, stringent quality assurance, and long product development cycles.

Nodular Pig Iron Growth Trends & Insights

The global Nodular Pig Iron market is projected for robust growth, driven by increasing demand from key end-use industries and a continuous push for material performance enhancements. The market size evolution is expected to witness a steady upward trajectory, fueled by the rising adoption rates of nodular pig iron in applications demanding higher mechanical properties, such as automotive components (e.g., engine blocks, crankshafts) and critical industrial machinery parts. Technological disruptions are playing a pivotal role, with advancements in smelting technologies and alloying techniques leading to the production of specialized nodular pig iron grades that offer superior wear resistance, fatigue strength, and thermal stability. Consumer behavior shifts are evident, with manufacturers increasingly prioritizing materials that enhance product durability, reduce weight, and improve fuel efficiency, directly benefiting nodular pig iron. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at xx% (based on the analysis leveraging market research data and predictive analytics), indicating a healthy expansion. Market penetration in emerging economies is also expected to rise as industrialization accelerates.

- Market Size Evolution: Steady growth anticipated, driven by expanding industrial applications and global economic development. Estimated market size in 2025: $xx billion, projected to reach $xx billion by 2033.

- Adoption Rates: Increasing adoption in high-performance automotive parts, heavy machinery, and infrastructure projects.

- Technological Disruptions: Innovations in ferroalloy production, advanced smelting techniques, and computational material science enabling tailored nodular pig iron properties.

- Consumer Behavior Shifts: Growing demand for materials offering enhanced durability, weight reduction, and improved lifecycle performance.

- CAGR: Estimated at xx% for the forecast period (2025-2033).

- Market Penetration: Increasing penetration in developing regions due to industrial growth and infrastructure development.

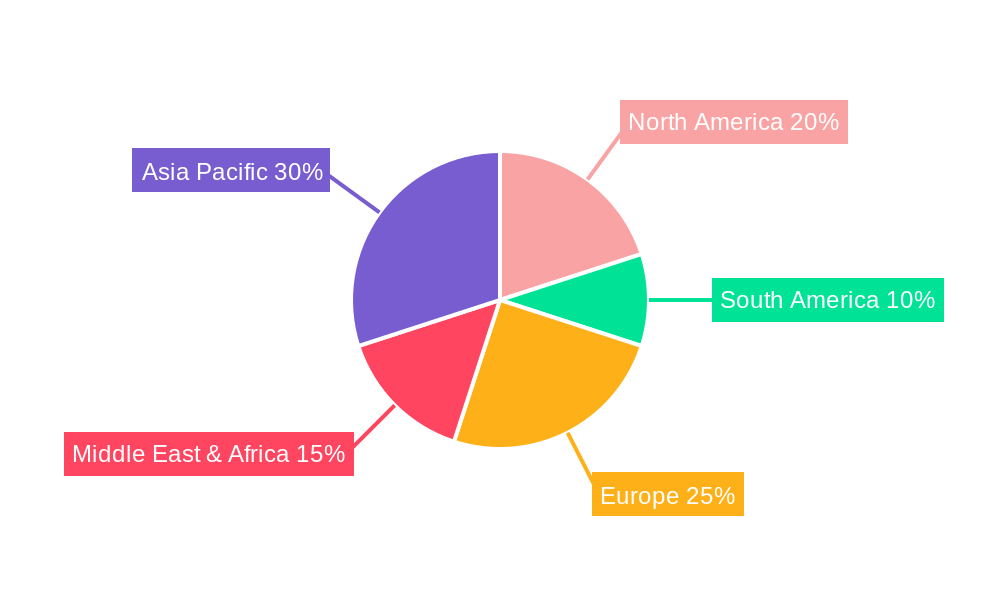

Dominant Regions, Countries, or Segments in Nodular Pig Iron

The Foundry application segment is currently the dominant force driving growth in the global Nodular Pig Iron market. This dominance is attributed to the inherent properties of nodular pig iron, such as its excellent castability, high tensile strength, and ductility, which make it an ideal material for a vast array of casting applications. Key drivers for this segment's leadership include the robust automotive industry, which relies heavily on nodular pig iron for critical engine components, and the burgeoning infrastructure sector, demanding durable and high-performance castings for bridges, pipelines, and machinery.

Economically, regions with a strong manufacturing base and significant automotive production are leading the charge. Asia-Pacific, particularly China, stands out as a dominant country due to its massive industrial output and extensive foundry network. Government initiatives supporting manufacturing and infrastructure development in countries like China and India further bolster demand.

Within the Types classification, the Ordinary Type of nodular pig iron holds a substantial market share, catering to a wide range of standard casting needs across various industries. However, the Special Type segment is experiencing rapid growth, driven by the increasing demand for customized solutions with enhanced properties for niche applications, such as high-temperature environments or corrosive conditions. This growth in special types reflects the industry's move towards higher-value products and sophisticated material science.

- Dominant Application Segment: Foundry (estimated market share: xx%)

- Key Drivers: High demand from automotive manufacturing for engine blocks, crankshafts, and exhaust manifolds; growth in heavy machinery and construction equipment; increasing use in agricultural implements.

- Market Share Analysis: Foundry segment accounts for the largest portion of nodular pig iron consumption.

- Growth Potential: Continued strong growth due to ongoing industrialization and demand for durable components.

- Dominant Region: Asia-Pacific (estimated market share: xx%)

- Key Drivers: China's massive manufacturing sector, significant automotive production, and government investment in infrastructure. India's growing industrial base.

- Economic Policies: Favorable industrial policies and manufacturing incentives in key Asia-Pacific countries.

- Infrastructure Development: Extensive investment in infrastructure projects driving demand for castings.

- Dominant Country: China (estimated market share: xx%)

- Market Share: Holds the largest share of global nodular pig iron production and consumption.

- Growth Potential: Continued expansion driven by domestic demand and export opportunities.

- Dominant Type Segment: Ordinary Type (estimated market share: xx%)

- Key Drivers: Wide applicability in standard industrial castings.

- Growth Potential: Stable demand, with growth tied to overall industrial output.

- Emerging Type Segment: Special Type

- Key Drivers: Demand for enhanced properties (e.g., high temperature resistance, corrosion resistance, increased strength) in specialized applications.

- Growth Potential: High growth potential driven by technological advancements and niche market demands.

Nodular Pig Iron Product Landscape

The nodular pig iron product landscape is characterized by continuous innovation focused on enhancing material performance and expanding application versatility. Advanced manufacturing processes are enabling the production of highly engineered grades with tailored microstructures, leading to superior mechanical properties such as increased tensile strength, improved ductility, and enhanced fatigue resistance. These innovations are crucial for applications in demanding sectors like automotive, aerospace, and heavy machinery, where component reliability and longevity are paramount. Unique selling propositions often lie in the ability to offer customized compositions for specific end-use requirements, alongside stringent quality control measures ensuring consistent performance and adherence to international standards. Technological advancements are also addressing sustainability concerns, with efforts to optimize production efficiency and reduce the environmental footprint of nodular pig iron manufacturing.

Key Drivers, Barriers & Challenges in Nodular Pig Iron

Key Drivers:

- Automotive Industry Growth: Increasing demand for lightweight, high-strength components for fuel efficiency and performance.

- Infrastructure Development: Global investment in infrastructure projects necessitates durable and reliable castings.

- Technological Advancements: Development of specialized grades with superior mechanical properties.

- Industrialization in Emerging Economies: Growing manufacturing sectors in developing countries drive demand.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in iron ore and other raw material costs impact production economics.

- Environmental Regulations: Stricter environmental compliance requirements add to production costs.

- Competition from Substitutes: Availability of alternative materials like steel and other cast iron grades.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the availability and cost of materials.

- Energy Costs: High energy consumption in smelting processes makes it susceptible to energy price fluctuations.

Emerging Opportunities in Nodular Pig Iron

Emerging opportunities in the Nodular Pig Iron industry are centered on the development of advanced, high-performance grades for critical applications and the expansion into new geographical markets. There's a growing demand for nodular pig iron with enhanced wear resistance and corrosion properties for use in renewable energy infrastructure, such as wind turbine components and solar panel mounting systems. Furthermore, the push for lightweighting in the transportation sector extends beyond automotive to include rail and marine applications, presenting new avenues for specialized nodular pig iron alloys. Untapped markets in developing regions with rapidly expanding industrial bases offer significant growth potential. Evolving consumer preferences towards sustainable and longer-lasting products also favor materials like nodular pig iron that contribute to product durability and reduced replacement frequency.

Growth Accelerators in the Nodular Pig Iron Industry

The long-term growth of the Nodular Pig Iron industry is significantly propelled by ongoing technological breakthroughs in metallurgical science and advanced manufacturing techniques. The development of novel alloying elements and sophisticated heat treatment processes continues to unlock new levels of performance for nodular pig iron, making it suitable for even more demanding engineering applications. Strategic partnerships between raw material suppliers, pig iron producers, and end-users are becoming increasingly crucial for co-developing tailored solutions and ensuring a stable supply chain. Market expansion strategies, including targeting emerging economies and penetrating new application sectors, are also vital catalysts for sustained growth. Investment in research and development to create more environmentally friendly production methods will further enhance its market appeal.

Key Players Shaping the Nodular Pig Iron Market

- Richards Bay Minerals

- Ironveld Plc

- High Purity Iron Inc

- Kobe Steel

- Asmet

- Hebei Longfengshan

Notable Milestones in Nodular Pig Iron Sector

- 2019: Significant advancements in high-temperature nodular pig iron alloys reported, expanding its use in critical industrial furnaces.

- 2020: Increased M&A activity focused on securing raw material sources and expanding production capacity, with several key deals valued in the xx million unit range.

- 2021: Introduction of new environmental standards in major producing regions, leading to investments in cleaner production technologies.

- 2022: Breakthroughs in computational material design enabling faster development of customized nodular pig iron grades.

- 2023: Growing adoption of nodular pig iron in renewable energy infrastructure components, such as specialized castings for wind turbines.

- 2024: Enhanced focus on supply chain resilience and diversification in response to global logistical challenges.

In-Depth Nodular Pig Iron Market Outlook

The outlook for the Nodular Pig Iron market is exceptionally positive, driven by sustained demand from its core applications and the emergence of new growth frontiers. The increasing imperative for high-performance materials in automotive, infrastructure, and energy sectors will continue to fuel the adoption of advanced nodular pig iron grades. Strategic investments in R&D to enhance material properties and production efficiency, coupled with a focus on sustainable manufacturing practices, will further solidify its market position. Expansion into rapidly industrializing regions and the development of innovative applications, particularly in areas like advanced manufacturing and specialized machinery, represent significant opportunities for future market growth. The industry is well-positioned to capitalize on global trends emphasizing durability, reliability, and resource efficiency.

Nodular Pig Iron Segmentation

-

1. Application

- 1.1. Foundry

- 1.2. Other

-

2. Types

- 2.1. Ordinary Type

- 2.2. Special Type

Nodular Pig Iron Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nodular Pig Iron REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nodular Pig Iron Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Foundry

- 5.1.2. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Ordinary Type

- 5.2.2. Special Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nodular Pig Iron Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Foundry

- 6.1.2. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Ordinary Type

- 6.2.2. Special Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Nodular Pig Iron Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Foundry

- 7.1.2. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Ordinary Type

- 7.2.2. Special Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nodular Pig Iron Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Foundry

- 8.1.2. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Ordinary Type

- 8.2.2. Special Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Nodular Pig Iron Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Foundry

- 9.1.2. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Ordinary Type

- 9.2.2. Special Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Nodular Pig Iron Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Foundry

- 10.1.2. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Ordinary Type

- 10.2.2. Special Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Richards Bay Minerals

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ironveld Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 High Purity Iron Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kobe Steel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Asmet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hebei Longfengshan

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Richards Bay Minerals

List of Figures

- Figure 1: Global Nodular Pig Iron Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Nodular Pig Iron Revenue (million), by Application 2024 & 2032

- Figure 3: North America Nodular Pig Iron Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Nodular Pig Iron Revenue (million), by Types 2024 & 2032

- Figure 5: North America Nodular Pig Iron Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Nodular Pig Iron Revenue (million), by Country 2024 & 2032

- Figure 7: North America Nodular Pig Iron Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Nodular Pig Iron Revenue (million), by Application 2024 & 2032

- Figure 9: South America Nodular Pig Iron Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Nodular Pig Iron Revenue (million), by Types 2024 & 2032

- Figure 11: South America Nodular Pig Iron Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Nodular Pig Iron Revenue (million), by Country 2024 & 2032

- Figure 13: South America Nodular Pig Iron Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Nodular Pig Iron Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Nodular Pig Iron Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Nodular Pig Iron Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Nodular Pig Iron Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Nodular Pig Iron Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Nodular Pig Iron Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Nodular Pig Iron Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Nodular Pig Iron Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Nodular Pig Iron Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Nodular Pig Iron Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Nodular Pig Iron Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Nodular Pig Iron Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Nodular Pig Iron Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Nodular Pig Iron Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Nodular Pig Iron Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Nodular Pig Iron Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Nodular Pig Iron Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Nodular Pig Iron Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nodular Pig Iron Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Nodular Pig Iron Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Nodular Pig Iron Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Nodular Pig Iron Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Nodular Pig Iron Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Nodular Pig Iron Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Nodular Pig Iron Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Nodular Pig Iron Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Nodular Pig Iron Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Nodular Pig Iron Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Nodular Pig Iron Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Nodular Pig Iron Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Nodular Pig Iron Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Nodular Pig Iron Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Nodular Pig Iron Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Nodular Pig Iron Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Nodular Pig Iron Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Nodular Pig Iron Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Nodular Pig Iron Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Nodular Pig Iron Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nodular Pig Iron?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Nodular Pig Iron?

Key companies in the market include Richards Bay Minerals, Ironveld Plc, High Purity Iron Inc, Kobe Steel, Asmet, Hebei Longfengshan.

3. What are the main segments of the Nodular Pig Iron?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nodular Pig Iron," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nodular Pig Iron report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nodular Pig Iron?

To stay informed about further developments, trends, and reports in the Nodular Pig Iron, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence