Key Insights

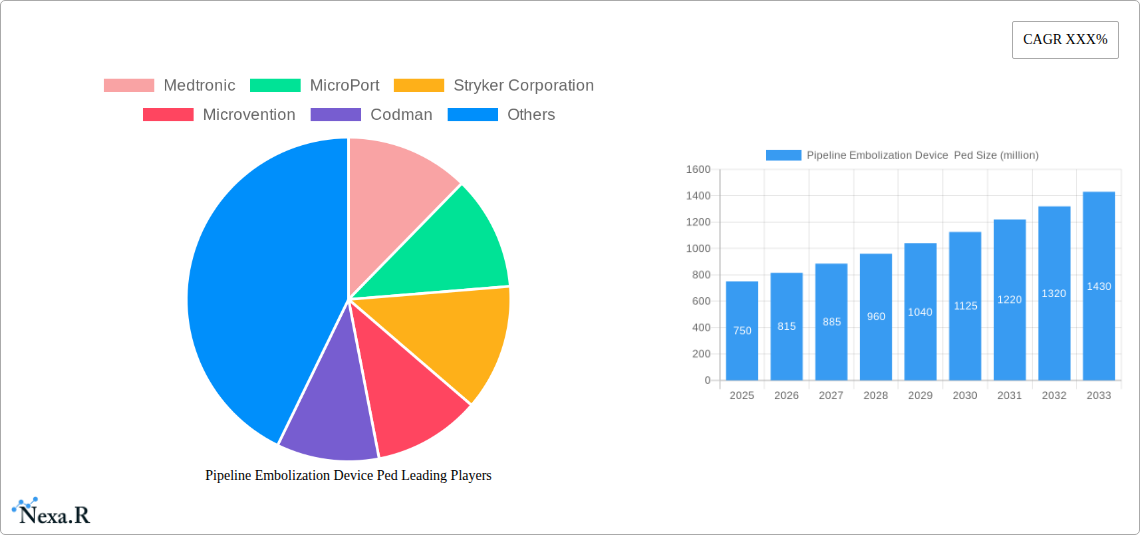

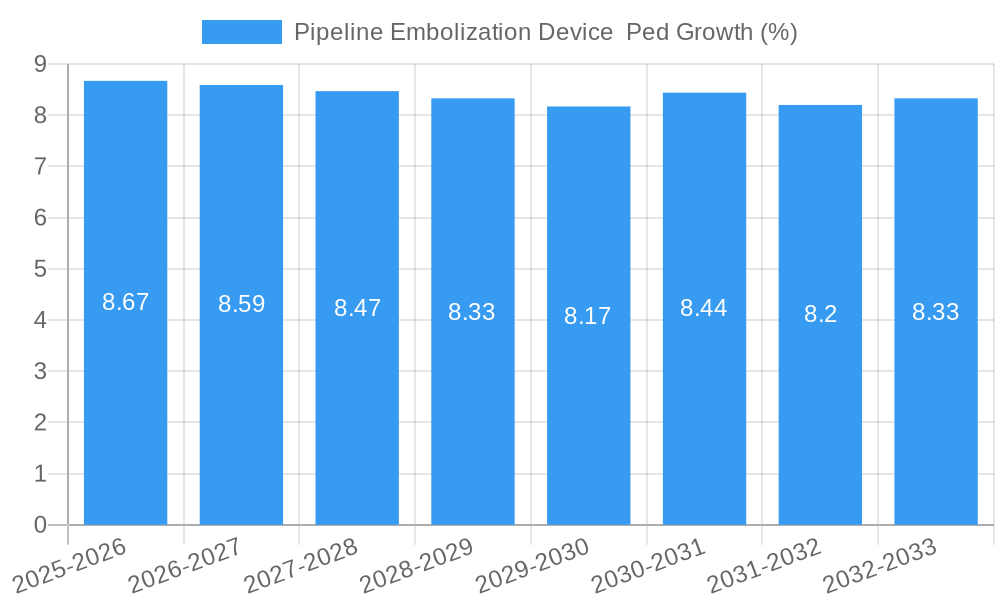

The global Pipeline Embolization Device (PED) market is poised for significant expansion, driven by the increasing prevalence of cerebrovascular diseases like intracranial aneurysms and arteriovenous malformations. With an estimated market size of USD 750 million in 2025, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% through 2033. This growth is fueled by advancements in minimally invasive neurovascular treatment technologies, a growing elderly population susceptible to such conditions, and increasing healthcare expenditure globally. The demand for PEDs is particularly strong in treating complex intracranial aneurysms that are difficult to manage with traditional coiling or surgical clipping. The rising adoption of endovascular procedures, owing to their reduced invasiveness and faster recovery times compared to open surgery, further propels market momentum. Technological innovations in device design, focusing on improved navigability, deliverability, and efficacy in occluding aneurysms, are also key contributors to this positive market trajectory.

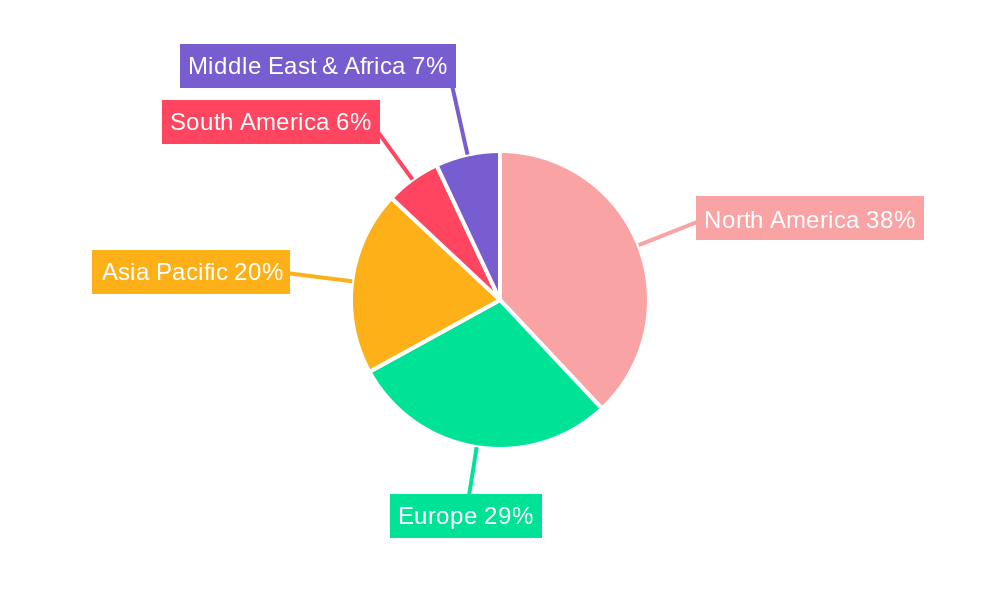

The market is segmented primarily by application and type. Intracranial Aneurysm Treatment and Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.) represent the dominant application segments. Within product types, 48 Alloy Wire Braided devices currently hold a significant market share, though 64 Alloy Wire Braided variants are gaining traction due to enhanced flexibility and deployment characteristics. Geographically, North America, led by the United States, is expected to maintain its leading position, owing to early adoption of advanced neurointerventional technologies and a high incidence of neurovascular disorders. Europe and the Asia Pacific region are also anticipated to exhibit substantial growth, driven by increasing healthcare infrastructure development, rising awareness of neurovascular disease treatment options, and a growing patient pool. Key players like Medtronic, MicroPort, Stryker Corporation, and Microvention are at the forefront, investing heavily in research and development to introduce next-generation PEDs and expand their market reach, indicating a competitive landscape focused on innovation and patient outcomes.

Pipeline Embolization Device Ped Market Dynamics & Structure

The Pipeline Embolization Device (PED) market is characterized by a moderately concentrated industry structure, with key players like Medtronic, MicroPort, Stryker Corporation, and MicroVention holding significant market shares. Technological innovation is a primary driver, fueled by the continuous demand for minimally invasive treatment options for complex cerebrovascular diseases. Advancements in stent design, material science (e.g., braided wire configurations), and imaging guidance are crucial for improving device efficacy and patient outcomes. Regulatory frameworks, particularly stringent FDA and EMA approvals, significantly influence market entry and product development timelines, acting as both a barrier and a quality assurance mechanism. Competitive product substitutes, though limited for PEDs specifically designed for aneurysm occlusion, include traditional coiling techniques and surgical clipping, each with their own risk profiles and indications. End-user demographics are shifting towards an aging global population, with a higher prevalence of intracranial aneurysms, thereby expanding the patient pool. Mergers and acquisitions (M&A) trends are observed as larger companies seek to consolidate their portfolios and expand their neurovascular offerings, exemplified by potential strategic alliances or acquisitions in the \$50-\$100 million range annually.

- Market Concentration: Moderate, with dominant players

- Technological Innovation: Crucial for efficacy and patient safety

- Regulatory Frameworks: Stringent, impacting market entry

- Competitive Landscape: Limited direct substitutes for PEDs, but traditional methods exist

- End-User Demographics: Growing due to aging population and increased aneurysm prevalence

- M&A Trends: Driven by portfolio consolidation and market expansion in the \$50-\$100 million range annually.

Pipeline Embolization Device Ped Growth Trends & Insights

The Pipeline Embolization Device (PED) market is poised for robust growth, projected to expand significantly from its current valuation. This expansion is underpinned by increasing adoption rates driven by growing awareness and acceptance of endovascular procedures among clinicians and patients. The estimated market size in 2025 is approximately \$850 million, with a projected Compound Annual Growth Rate (CAGR) of around 7-9% through 2033. This upward trajectory is fueled by a confluence of factors including the rising incidence of intracranial aneurysms, particularly in North America and Europe, which collectively represent over 60% of the global market. Technological disruptions are continuously enhancing the performance of PEDs, with innovations focusing on improved deliverability, enhanced thrombogenicity, and better integration with advanced imaging modalities for precise placement. Consumer behavior shifts are evident, with a growing preference for less invasive surgical interventions due to reduced recovery times and lower complication rates compared to open surgery. The market penetration of PEDs for specific indications like wide-necked and fusiform aneurysms is expected to increase as clinical evidence solidifies and reimbursement policies become more favorable. Market accessibility is also expanding into emerging economies, albeit at a slower pace, due to improving healthcare infrastructure and increasing investment in neurovascular care. The estimated market size for intracranial aneurysm treatment applications is expected to reach over \$1.2 billion by 2033.

Dominant Regions, Countries, or Segments in Pipeline Embolization Device Ped

The Application: Intracranial Aneurysm Treatment segment stands as the dominant force propelling the global Pipeline Embolization Device (PED) market. This segment, driven by the escalating prevalence of intracranial aneurysms, particularly among aging populations, accounts for an estimated 75-80% of the total market revenue in the forecast period. North America, led by the United States, currently holds the largest market share, estimated at around 40% of the global market, owing to its advanced healthcare infrastructure, high patient awareness, favorable reimbursement policies, and significant investment in neurovascular research and development.

Key Drivers of Dominance:

- High Incidence of Intracranial Aneurysms: The growing and aging population in developed nations directly correlates with a higher incidence of this life-threatening condition, creating a consistent demand for effective treatment solutions like PEDs.

- Technological Advancements in PEDs: Continuous innovation in device design, such as the development of highly flexible and precise braided wire structures, has made PEDs a preferred choice for treating complex aneurysms that were previously difficult to manage with conventional methods. The market for 64 Alloy Wire Braided devices is projected to see a CAGR of approximately 8%, surpassing the growth of other types.

- Minimally Invasive Treatment Preference: The strong clinical preference for endovascular procedures over open surgery due to reduced patient trauma, shorter hospital stays, and faster recovery times significantly bolsters the adoption of PEDs.

- Favorable Reimbursement Policies: Established and robust reimbursement structures in key markets like the U.S. and Western Europe facilitate broader access to PED treatments for a larger patient base.

- Established Neurovascular Centers of Excellence: The presence of specialized neurovascular centers equipped with advanced imaging and interventional technologies further concentrates the demand and application of PEDs in these regions.

While the Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.) segment is growing and contributes a significant portion, estimated at 15-20% of the market, and the "Other" applications are nascent, the sheer volume and unmet need in intracranial aneurysm treatment solidify its leading position. The market for PEDs specifically in the U.S. is estimated to be over \$350 million in 2025.

Pipeline Embolization Device Ped Product Landscape

The Pipeline Embolization Device (PED) product landscape is defined by continuous innovation in stent-graft technology, primarily focusing on enhancing flow diversion capabilities and device deliverability. Products like the Medtronic Pipeline Flex embolization device and MicroVention's Pipeline Vantage system exemplify advancements in braided wire mesh construction, offering improved flexibility and navigability through tortuous neurovasculature. These devices utilize advanced alloy compositions, such as 48 and 64 alloy wire braiding, to achieve optimal radial force and thrombogenicity, crucial for successful aneurysm occlusion. Unique selling propositions often revolve around their ability to treat a wide range of intracranial aneurysms, including wide-necked and complex fusiform types, with high success rates and minimal invasiveness. Technological advancements are also seen in improved imaging compatibility and deliverability systems, allowing for more precise deployment by neurointerventionalists.

Key Drivers, Barriers & Challenges in Pipeline Embolization Device Ped

Key Drivers:

The Pipeline Embolization Device (PED) market is propelled by several critical factors. The increasing global incidence of intracranial aneurysms, driven by an aging population and lifestyle factors, creates a substantial and growing patient pool requiring effective treatment. Furthermore, the technological advancements in PED design and material science, such as improved braided wire configurations and flow-diverting capabilities, enhance treatment efficacy and patient outcomes, leading to higher adoption rates. The strong clinician preference for minimally invasive endovascular procedures over traditional open surgery, due to reduced patient trauma and faster recovery, is a significant catalyst. Supportive reimbursement policies in developed nations further facilitate market access and growth.

Barriers & Challenges:

Despite the promising growth, the PED market faces notable challenges. High regulatory hurdles and lengthy approval processes by bodies like the FDA and EMA can significantly delay market entry for new devices and extensions, adding to development costs. The steep learning curve for neurointerventionalists in mastering the precise deployment techniques for PEDs necessitates extensive training and experience, which can be a barrier to widespread adoption, particularly in resource-limited settings. Potential for complications, although rare, such as thromboembolism or device migration, necessitates careful patient selection and post-procedural monitoring. The significant cost of PEDs compared to traditional treatments can also be a limiting factor, especially in healthcare systems with budget constraints. Furthermore, intense competition and the need for continuous innovation to maintain market leadership require substantial R&D investment.

Emerging Opportunities in Pipeline Embolization Device Ped

Emerging opportunities in the Pipeline Embolization Device (PED) market are diverse and promising. The expansion of PED applications beyond intracranial aneurysms, particularly into the treatment of complex arteriovenous malformations (AVMs) and other neurovascular abnormalities, presents a significant growth avenue. Untapped markets in developing economies in Asia-Pacific and Latin America, with improving healthcare infrastructure and increasing disposable incomes, offer substantial potential for market penetration. The development of next-generation PEDs with enhanced thrombogenicity, reduced material burden, and improved imaging characteristics for even greater precision during deployment represents a key technological opportunity. Furthermore, exploring novel indications for flow diversion, such as in the management of certain types of intracranial stenosis or dissection, could open up new market segments. Evolving consumer preferences for even less invasive and more predictable treatment outcomes will also drive demand for advanced PED designs.

Growth Accelerators in the Pipeline Embolization Device Ped Industry

Several key factors are accelerating growth within the Pipeline Embolization Device (PED) industry. Technological breakthroughs in braided wire technology, leading to more flexible, deliverable, and effective flow-diverting devices, are continuously improving treatment outcomes and expanding the range of treatable aneurysms. Strategic partnerships and collaborations between device manufacturers and research institutions are fostering innovation and accelerating the development of next-generation PEDs. Market expansion strategies, including increasing penetration in emerging economies and broadening the scope of indications, are crucial growth drivers. The increasing number of clinical studies demonstrating the long-term safety and efficacy of PEDs, along with growing physician confidence, also contributes significantly to market growth. Investments in robust clinical education and training programs for neurointerventionalists further support the adoption and optimal utilization of these advanced devices.

Key Players Shaping the Pipeline Embolization Device Ped Market

- Medtronic

- MicroPort

- Stryker Corporation

- Microvention

- Codman

- Boston Scientific

- Balt Extrusion

- Phenox GmbH

- Johnson & Johnson

- Ascendis Health

- ZYLOX-TONBRIDGE

- Accumedical

- Evasc

Notable Milestones in Pipeline Embolization Device Ped Sector

- 2019: Launch of next-generation Pipeline embolization devices with enhanced flexibility and deliverability by major manufacturers, improving treatment of complex aneurysms.

- 2020: Increased focus on long-term clinical data publication, reinforcing the safety and efficacy of Pipeline Embolization Devices (PEDs) for intracranial aneurysm treatment.

- 2021: Emergence of novel braided wire configurations and biomaterials for PEDs, aiming to optimize thrombogenicity and endothelialization.

- 2022: Significant M&A activity or strategic alliances in the neurovascular space, impacting the competitive landscape for PED manufacturers.

- 2023: Expansion of regulatory approvals for PEDs in new geographical markets, driven by growing demand for endovascular solutions.

- 2024: Continued advancements in imaging guidance and navigation technologies, enhancing the precision of PED deployment.

In-Depth Pipeline Embolization Device Ped Market Outlook

The Pipeline Embolization Device (PED) market is set for sustained and accelerated growth, driven by a combination of demographic shifts, technological prowess, and evolving clinical practices. The increasing global prevalence of cerebrovascular diseases, coupled with a growing preference for minimally invasive interventions, forms the bedrock of this expansion. Future growth will be significantly fueled by ongoing research and development, leading to the introduction of more sophisticated devices with improved efficacy and safety profiles, targeting even more complex vascular anatomies. Strategic market penetration into underserved regions, coupled with favorable reimbursement policies and robust clinical evidence, will further solidify its position. The industry is expected to witness continued innovation in material science and device engineering, potentially leading to novel applications beyond current indications. The overall outlook points to a dynamic and expanding market, presenting substantial opportunities for key players and advancements in patient care.

Pipeline Embolization Device Ped Segmentation

-

1. Application

- 1.1. Intracranial Aneurysm Treatment

- 1.2. Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.)

- 1.3. Other

-

2. Type

- 2.1. 48 Alloy Wire Braided

- 2.2. 64 Alloy Wire Braided

- 2.3. Other

Pipeline Embolization Device Ped Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pipeline Embolization Device Ped REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pipeline Embolization Device Ped Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Intracranial Aneurysm Treatment

- 5.1.2. Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.)

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 48 Alloy Wire Braided

- 5.2.2. 64 Alloy Wire Braided

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pipeline Embolization Device Ped Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Intracranial Aneurysm Treatment

- 6.1.2. Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.)

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 48 Alloy Wire Braided

- 6.2.2. 64 Alloy Wire Braided

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pipeline Embolization Device Ped Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Intracranial Aneurysm Treatment

- 7.1.2. Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.)

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 48 Alloy Wire Braided

- 7.2.2. 64 Alloy Wire Braided

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pipeline Embolization Device Ped Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Intracranial Aneurysm Treatment

- 8.1.2. Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.)

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 48 Alloy Wire Braided

- 8.2.2. 64 Alloy Wire Braided

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pipeline Embolization Device Ped Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Intracranial Aneurysm Treatment

- 9.1.2. Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.)

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 48 Alloy Wire Braided

- 9.2.2. 64 Alloy Wire Braided

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pipeline Embolization Device Ped Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Intracranial Aneurysm Treatment

- 10.1.2. Neurovascular Abnormal Embolization Treatment (Arteriovenous Malformation, etc.)

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 48 Alloy Wire Braided

- 10.2.2. 64 Alloy Wire Braided

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Medtronic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MicroPort

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stryker Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microvention

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Codman

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Boston Scientific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Balt Extrusion

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phenox GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ascendis Health

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZYLOX-TONBRIDGE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Accumedical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Evasc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Medtronic

List of Figures

- Figure 1: Global Pipeline Embolization Device Ped Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pipeline Embolization Device Ped Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pipeline Embolization Device Ped Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pipeline Embolization Device Ped Revenue (million), by Type 2024 & 2032

- Figure 5: North America Pipeline Embolization Device Ped Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Pipeline Embolization Device Ped Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pipeline Embolization Device Ped Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pipeline Embolization Device Ped Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pipeline Embolization Device Ped Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pipeline Embolization Device Ped Revenue (million), by Type 2024 & 2032

- Figure 11: South America Pipeline Embolization Device Ped Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Pipeline Embolization Device Ped Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pipeline Embolization Device Ped Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pipeline Embolization Device Ped Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pipeline Embolization Device Ped Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pipeline Embolization Device Ped Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Pipeline Embolization Device Ped Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Pipeline Embolization Device Ped Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pipeline Embolization Device Ped Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pipeline Embolization Device Ped Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pipeline Embolization Device Ped Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pipeline Embolization Device Ped Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Pipeline Embolization Device Ped Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Pipeline Embolization Device Ped Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pipeline Embolization Device Ped Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pipeline Embolization Device Ped Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pipeline Embolization Device Ped Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pipeline Embolization Device Ped Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Pipeline Embolization Device Ped Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Pipeline Embolization Device Ped Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pipeline Embolization Device Ped Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pipeline Embolization Device Ped Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pipeline Embolization Device Ped Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pipeline Embolization Device Ped Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Pipeline Embolization Device Ped Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pipeline Embolization Device Ped Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pipeline Embolization Device Ped Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Pipeline Embolization Device Ped Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pipeline Embolization Device Ped Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pipeline Embolization Device Ped Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Pipeline Embolization Device Ped Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pipeline Embolization Device Ped Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pipeline Embolization Device Ped Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Pipeline Embolization Device Ped Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pipeline Embolization Device Ped Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pipeline Embolization Device Ped Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Pipeline Embolization Device Ped Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pipeline Embolization Device Ped Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pipeline Embolization Device Ped Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Pipeline Embolization Device Ped Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pipeline Embolization Device Ped Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pipeline Embolization Device Ped?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Pipeline Embolization Device Ped?

Key companies in the market include Medtronic, MicroPort, Stryker Corporation, Microvention, Codman, Boston Scientific, Balt Extrusion, Phenox GmbH, Johnson & Johnson, Ascendis Health, ZYLOX-TONBRIDGE, Accumedical, Evasc.

3. What are the main segments of the Pipeline Embolization Device Ped?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pipeline Embolization Device Ped," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pipeline Embolization Device Ped report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pipeline Embolization Device Ped?

To stay informed about further developments, trends, and reports in the Pipeline Embolization Device Ped, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence