Key Insights

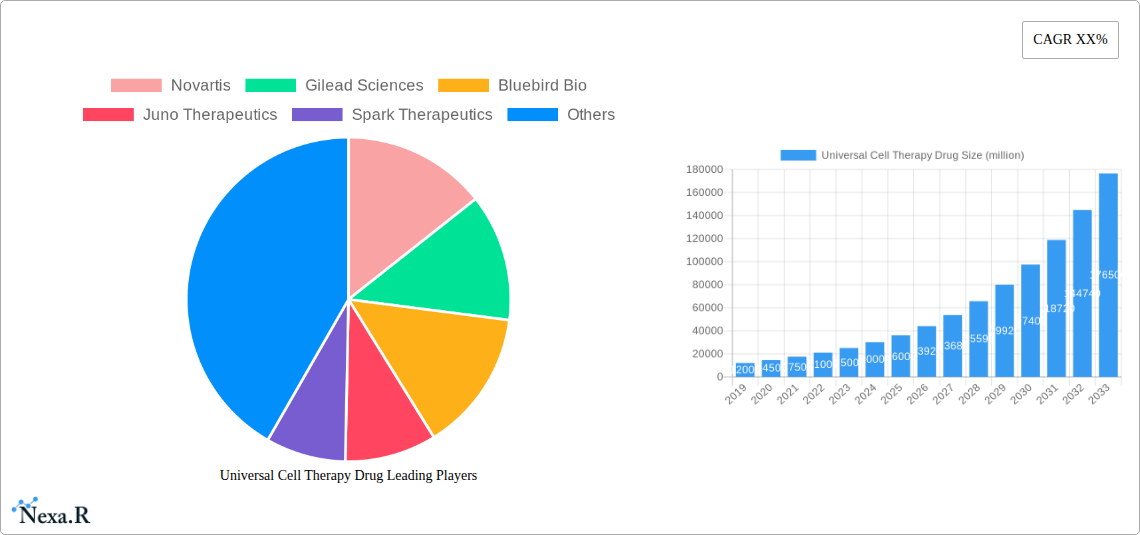

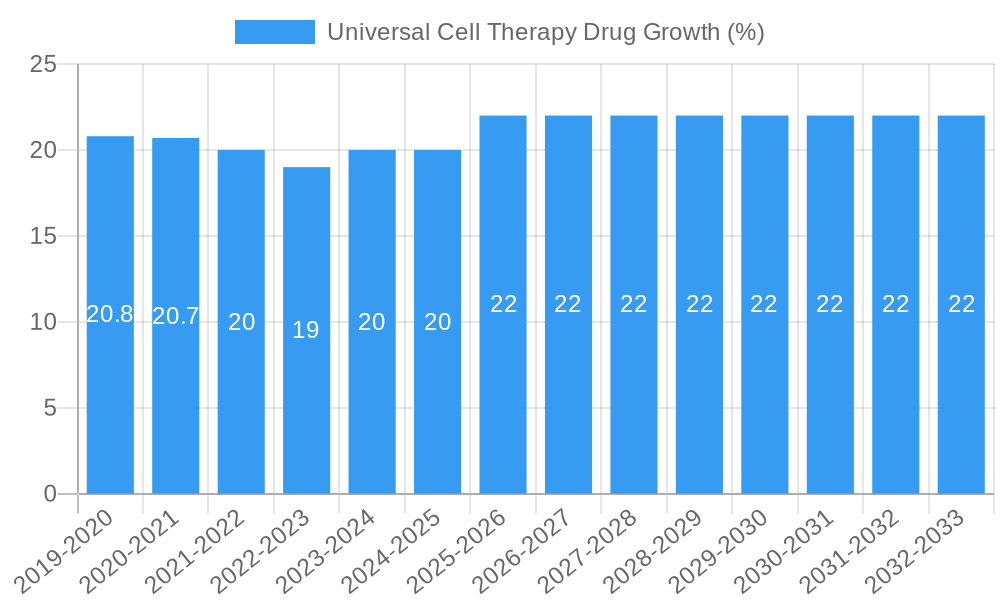

The Universal Cell Therapy Drug market is poised for remarkable expansion, projected to reach a substantial market size of approximately $45,000 million by 2025, growing at a robust Compound Annual Growth Rate (CAGR) of 22% through 2033. This dynamic growth is propelled by significant advancements in cellular and gene engineering, increasing investment in biotechnology research and development, and a growing recognition of cell therapy's potential to address a wide range of unmet medical needs, particularly in oncology and rare genetic disorders. Key drivers include the rising incidence of chronic and complex diseases, a greater understanding of disease pathology at the cellular level, and the development of more sophisticated and targeted therapeutic approaches. The market is segmented into distinct application areas, with Hospitals currently leading in adoption due to their infrastructure to administer complex treatments, and Research Centers playing a crucial role in pipeline development and preclinical validation.

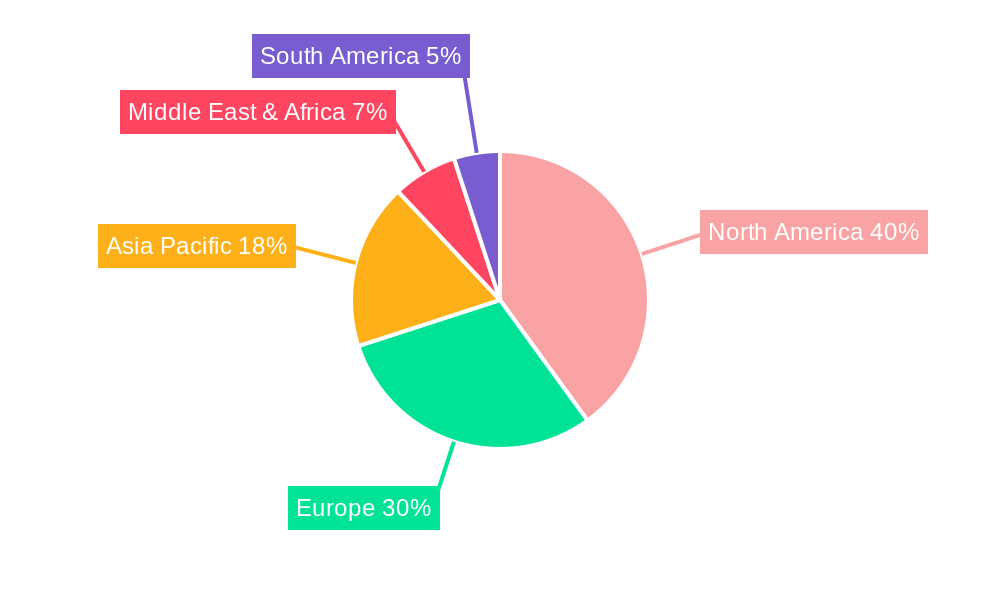

The market's trajectory is further shaped by innovative therapeutic types such as Cell Therapy, Gene Therapy, and Stem Cell Therapy, each offering unique mechanisms for disease correction and regeneration. While the potential of these therapies is vast, certain restraints, such as the high cost of treatment, complex manufacturing processes, and stringent regulatory hurdles, are being actively addressed through technological innovation and evolving healthcare policies. Emerging trends point towards personalized medicine, the development of off-the-shelf cell therapies to improve accessibility, and the integration of artificial intelligence in drug discovery and patient selection. Companies like Novartis, Gilead Sciences, and Bluebird Bio are at the forefront of this innovation, investing heavily in R&D and strategic collaborations to expand their portfolios and market reach. Geographically, North America, particularly the United States, is expected to maintain its leadership position, driven by strong R&D infrastructure and a favorable regulatory environment, closely followed by Europe and the rapidly growing Asia Pacific region.

Universal Cell Therapy Drug Market Dynamics & Structure

The universal cell therapy drug market is characterized by high technological sophistication and a rapidly evolving competitive landscape. Market concentration is moderate, with a few dominant players like Novartis, Gilead Sciences, and Kite Pharma (a subsidiary of Gilead) holding significant shares due to their early-mover advantages and substantial R&D investments. However, emerging companies such as Bluebird Bio, Juno Therapeutics (acquired by Celgene, then Bristol Myers Squibb), Spark Therapeutics (acquired by Roche), Adaptimmune, and CRISPR Therapeutics are actively challenging the status quo through novel approaches and platform technologies. Technological innovation is the primary driver, with continuous advancements in gene editing, CAR-T cell engineering, and induced pluripotent stem cell (iPSC) technologies pushing the boundaries of therapeutic efficacy and patient accessibility. Regulatory frameworks, while becoming more streamlined for advanced therapies, still present a significant barrier due to the complexity of clinical trials and manufacturing standards. Competitive product substitutes are limited for highly specialized indications, but the development of next-generation cell therapies and combination approaches represents a growing area of indirect competition. End-user demographics are primarily focused on patients with severe, life-threatening diseases like certain cancers and rare genetic disorders, with an increasing emphasis on pediatric applications. Merger and acquisition (M&A) trends are robust, driven by the need for companies to acquire promising technologies, expand their pipelines, and achieve economies of scale. Over the historical period (2019-2024), there were approximately 15 major M&A deals, with an estimated total value exceeding $50,000 million units, indicating strong industry consolidation and investment. Barriers to innovation include the high cost of R&D, the long duration of clinical development, and the manufacturing complexities associated with personalized therapies.

Universal Cell Therapy Drug Growth Trends & Insights

The universal cell therapy drug market is poised for exponential growth, driven by a confluence of groundbreaking scientific discoveries, increasing therapeutic applications, and supportive regulatory initiatives. The market size evolution for universal cell therapy drugs is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 25% from the base year of 2025 to 2033. In 2025, the global market is estimated to be valued at $15,000 million units, with projections reaching over $70,000 million units by 2033. This substantial expansion is underpinned by rising adoption rates in oncology, where cell therapies have demonstrated remarkable success in treating hematological malignancies, and a growing pipeline for solid tumors. Technological disruptions, such as the development of allogeneic ("off-the-shelf") cell therapies, are set to revolutionize the market by addressing the manufacturing and scalability challenges of autologous therapies, thereby improving patient access and reducing treatment costs. Furthermore, advancements in gene editing technologies like CRISPR-Cas9 are enabling more precise and efficient genetic modifications, leading to enhanced therapeutic efficacy and reduced off-target effects.

Consumer behavior shifts are also playing a crucial role. Patients and healthcare providers are increasingly seeking advanced treatment options for diseases that were previously considered untreatable or had limited therapeutic choices. The perceived efficacy and potential for long-term remission offered by cell therapies are driving demand. Market penetration is expected to accelerate as these therapies gain approval for broader indications and become more accessible through established healthcare systems. The transition from niche treatments for rare diseases to mainstream applications in more common conditions will significantly amplify market reach. The increasing emphasis on personalized medicine and the development of therapies tailored to individual patient profiles further contribute to this growth trajectory. The market is also benefiting from a growing understanding of the underlying biological mechanisms of various diseases, paving the way for novel cell therapy targets and applications. The economic impact of these therapies, while initially high, is being offset by their potential to reduce long-term healthcare costs associated with chronic disease management and hospitalizations. The development of innovative delivery mechanisms and improved patient monitoring tools will also contribute to the seamless integration of these therapies into standard clinical practice. The continuous influx of venture capital and strategic investments into the sector further validates the optimistic growth outlook.

Dominant Regions, Countries, or Segments in Universal Cell Therapy Drug

The universal cell therapy drug market's dominance is currently and will continue to be significantly influenced by a few key regions and specific market segments. North America, particularly the United States, has emerged as the leading region driving market growth, projected to hold a substantial market share exceeding 45% throughout the forecast period (2025-2033). This leadership is attributed to a robust research and development infrastructure, a strong presence of leading pharmaceutical and biotechnology companies (including Novartis, Gilead Sciences, and the historical influence of Kite Pharma), a favorable regulatory environment that supports the approval of innovative therapies, and high healthcare expenditure. The presence of major research centers and academic institutions fosters continuous innovation and the early adoption of cutting-edge technologies.

Within the Types segment, Cell Therapy as a broad category, encompassing both autologous and allogeneic approaches, is the dominant force. However, Gene Therapy, which often overlaps and is a crucial component of advanced cell therapies, is exhibiting the fastest growth. The ability to directly correct genetic defects or introduce therapeutic genes into cells makes it a critical enabler for a wide range of diseases. Stem Cell Therapy also plays a pivotal role, especially in regenerative medicine and in the development of more robust and functional cell therapies. Its foundational role in generating diverse cell types for therapeutic purposes ensures its continued relevance and growth.

In terms of Application, the Hospital segment is the primary driver of market demand. This is where complex cell therapies are administered, requiring specialized infrastructure, trained medical personnel, and sophisticated patient monitoring capabilities. The inpatient and outpatient settings within hospitals are the primary channels for treatment delivery. The Research Center segment, while smaller in terms of direct revenue generation, is indispensable for driving future growth through preclinical and clinical research, discovery of new targets, and validation of novel therapeutic strategies.

Key drivers for North America's dominance include significant government funding for biomedical research, substantial private sector investment, and a large patient pool with access to advanced healthcare. Favorable reimbursement policies for groundbreaking treatments, though evolving, have also contributed to market expansion. The concentration of leading companies with established pipelines and manufacturing capabilities further solidifies its leading position. While Europe also presents a significant market with strong players and research institutions, and Asia-Pacific shows rapid growth potential due to expanding healthcare infrastructure and increasing investment, North America's established ecosystem and early adoption trends currently position it as the undisputed leader in the universal cell therapy drug market.

Universal Cell Therapy Drug Product Landscape

The universal cell therapy drug product landscape is characterized by groundbreaking innovations and a relentless pursuit of enhanced efficacy and patient safety. Key product advancements focus on improving T-cell receptor (TCR) engineering for better tumor recognition and persistence, developing CAR-NK and CAR-Treg cell therapies for broader applicability and reduced toxicity, and advancing gene-edited stem cells for in vivo editing and long-term engraftment. Products are increasingly designed for allogeneic use, aiming to overcome the manufacturing bottlenecks and higher costs associated with autologous therapies. Unique selling propositions lie in the specificity of targeting, the potential for durable responses, and the expansion into previously untreatable or difficult-to-treat conditions, particularly in hematological malignancies and solid tumors. Technological advancements include the integration of multiple targeting domains, the use of suicide genes for safety, and the development of "off-the-shelf" platforms that can be rapidly manufactured and deployed.

Key Drivers, Barriers & Challenges in Universal Cell Therapy Drug

Key Drivers:

- Unmet Medical Needs: The persistent demand for effective treatments for life-threatening diseases like advanced cancers and rare genetic disorders is the primary engine of market growth.

- Technological Advancements: Breakthroughs in genetic engineering, immunology, and stem cell biology are continuously expanding the therapeutic potential of cell therapies.

- Regulatory Support: Evolving regulatory pathways and designations (e.g., RMAT) by agencies like the FDA are accelerating the development and approval of innovative cell therapies.

- Increasing R&D Investment: Significant capital inflow from venture capital firms and established pharmaceutical companies is fueling pipeline development and research.

Key Barriers & Challenges:

- High Manufacturing Costs & Complexity: The intricate process of producing personalized cell therapies remains a significant hurdle, impacting affordability and scalability.

- Regulatory Hurdles & Long Clinical Trials: Navigating complex regulatory requirements and conducting lengthy, expensive clinical trials pose considerable challenges.

- Limited Approved Indications: The current approved indications for cell therapies are relatively narrow, restricting their widespread adoption.

- Supply Chain Management: Ensuring the integrity and timely delivery of complex biological products across a global supply chain is a significant operational challenge.

- Competitive Pressures: While direct competition for specific indications is limited, the development of alternative therapies and the evolving landscape of cell therapy platforms create competitive pressures.

Emerging Opportunities in Universal Cell Therapy Drug

Emerging opportunities in the universal cell therapy drug sector are vast and transformative. The expansion of cell therapies beyond hematological malignancies into solid tumors represents a significant untapped market, requiring novel approaches to overcome the tumor microenvironment and enhance CAR T-cell infiltration. The development of allogeneic cell therapies, leveraging universal donor cells, promises to democratize access and reduce manufacturing complexities, opening doors for broader patient populations. Furthermore, exploring cell therapies for autoimmune diseases, neurodegenerative disorders, and infectious diseases presents exciting new frontiers. The integration of advanced delivery systems, such as in vivo gene editing using viral or non-viral vectors, offers the potential for more targeted and less invasive therapeutic interventions. Innovations in combination therapies, pairing cell therapies with small molecules, biologics, or immunomodulatory agents, also hold immense promise for synergistic efficacy.

Growth Accelerators in the Universal Cell Therapy Drug Industry

Several catalysts are accelerating the long-term growth of the universal cell therapy drug industry. Foremost among these are continuous technological breakthroughs in areas like CRISPR-based gene editing, advanced immunotherapy platforms, and stem cell differentiation. These advancements are not only enhancing the efficacy and safety profiles of existing therapies but are also paving the way for entirely new therapeutic modalities. Strategic partnerships between large pharmaceutical companies and innovative biotechnology firms are crucial, enabling the pooling of resources, expertise, and R&D pipelines, thus accelerating drug development and commercialization. Market expansion strategies, including the pursuit of approvals in new geographic regions and for a broader range of indications, are vital for driving sustained growth. Furthermore, the increasing focus on developing robust manufacturing processes and supply chain solutions will be critical in addressing scalability and cost challenges, ultimately leading to wider patient access and market penetration.

Key Players Shaping the Universal Cell Therapy Drug Market

Novartis Gilead Sciences Bluebird Bio Juno Therapeutics Spark Therapeutics Kite Pharma Celgene Regeneron Pharmaceuticals Adaptimmune CRISPR Therapeutics

Notable Milestones in Universal Cell Therapy Drug Sector

- 2017: FDA approval of Kymriah (Novartis) and Yescarta (Kite Pharma), marking the first CAR-T cell therapies for certain blood cancers.

- 2018: FDA approval of Luxturna (Spark Therapeutics), the first in vivo gene therapy for a rare inherited retinal disease.

- 2019: Celgene acquires Juno Therapeutics for $8.7 billion, consolidating significant CAR-T cell therapy capabilities.

- 2020: Gilead Sciences acquires Kite Pharma, strengthening its position in cell therapy.

- 2021: Advancements in allogeneic cell therapy research and early-stage clinical trials by various companies, signaling a shift towards "off-the-shelf" solutions.

- 2022: Increased focus on developing cell therapies for solid tumors, with several promising clinical trial results reported.

- 2023: Growing interest in gene-edited stem cell therapies for a wider range of genetic disorders.

In-Depth Universal Cell Therapy Drug Market Outlook

The future outlook for the universal cell therapy drug market is exceptionally promising, driven by sustained innovation and expanding therapeutic applications. Growth accelerators, including advancements in gene editing and the development of allogeneic platforms, are poised to significantly broaden patient access and reduce treatment complexities. Strategic partnerships between industry leaders and emerging biotech firms will continue to streamline the R&D process and accelerate the translation of novel discoveries into approved therapies. The increasing focus on addressing unmet needs in solid tumors, autoimmune diseases, and neurodegenerative disorders represents a substantial untapped market potential. As regulatory pathways mature and manufacturing processes become more efficient, the market is expected to experience robust growth, offering transformative treatment options for a wider array of debilitating diseases.

Universal Cell Therapy Drug Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Research Center

-

2. Types

- 2.1. Cell Therapy

- 2.2. Gene Therapy

- 2.3. Stem Cell Therapy

Universal Cell Therapy Drug Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Universal Cell Therapy Drug REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Universal Cell Therapy Drug Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Research Center

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cell Therapy

- 5.2.2. Gene Therapy

- 5.2.3. Stem Cell Therapy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Universal Cell Therapy Drug Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Research Center

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cell Therapy

- 6.2.2. Gene Therapy

- 6.2.3. Stem Cell Therapy

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Universal Cell Therapy Drug Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Research Center

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cell Therapy

- 7.2.2. Gene Therapy

- 7.2.3. Stem Cell Therapy

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Universal Cell Therapy Drug Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Research Center

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cell Therapy

- 8.2.2. Gene Therapy

- 8.2.3. Stem Cell Therapy

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Universal Cell Therapy Drug Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Research Center

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cell Therapy

- 9.2.2. Gene Therapy

- 9.2.3. Stem Cell Therapy

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Universal Cell Therapy Drug Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Research Center

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cell Therapy

- 10.2.2. Gene Therapy

- 10.2.3. Stem Cell Therapy

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Novartis

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gilead Sciences

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bluebird Bio

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Juno Therapeutics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Spark Therapeutics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kite Pharma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Celgene

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Regeneron Pharmaceuticals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adaptimmune

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CRISPR Therapeutics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Novartis

List of Figures

- Figure 1: Global Universal Cell Therapy Drug Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Universal Cell Therapy Drug Revenue (million), by Application 2024 & 2032

- Figure 3: North America Universal Cell Therapy Drug Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Universal Cell Therapy Drug Revenue (million), by Types 2024 & 2032

- Figure 5: North America Universal Cell Therapy Drug Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Universal Cell Therapy Drug Revenue (million), by Country 2024 & 2032

- Figure 7: North America Universal Cell Therapy Drug Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Universal Cell Therapy Drug Revenue (million), by Application 2024 & 2032

- Figure 9: South America Universal Cell Therapy Drug Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Universal Cell Therapy Drug Revenue (million), by Types 2024 & 2032

- Figure 11: South America Universal Cell Therapy Drug Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Universal Cell Therapy Drug Revenue (million), by Country 2024 & 2032

- Figure 13: South America Universal Cell Therapy Drug Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Universal Cell Therapy Drug Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Universal Cell Therapy Drug Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Universal Cell Therapy Drug Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Universal Cell Therapy Drug Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Universal Cell Therapy Drug Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Universal Cell Therapy Drug Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Universal Cell Therapy Drug Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Universal Cell Therapy Drug Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Universal Cell Therapy Drug Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Universal Cell Therapy Drug Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Universal Cell Therapy Drug Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Universal Cell Therapy Drug Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Universal Cell Therapy Drug Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Universal Cell Therapy Drug Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Universal Cell Therapy Drug Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Universal Cell Therapy Drug Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Universal Cell Therapy Drug Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Universal Cell Therapy Drug Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Universal Cell Therapy Drug Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Universal Cell Therapy Drug Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Universal Cell Therapy Drug Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Universal Cell Therapy Drug Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Universal Cell Therapy Drug Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Universal Cell Therapy Drug Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Universal Cell Therapy Drug Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Universal Cell Therapy Drug Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Universal Cell Therapy Drug Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Universal Cell Therapy Drug Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Universal Cell Therapy Drug Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Universal Cell Therapy Drug Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Universal Cell Therapy Drug Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Universal Cell Therapy Drug Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Universal Cell Therapy Drug Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Universal Cell Therapy Drug Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Universal Cell Therapy Drug Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Universal Cell Therapy Drug Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Universal Cell Therapy Drug Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Universal Cell Therapy Drug Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Universal Cell Therapy Drug?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Universal Cell Therapy Drug?

Key companies in the market include Novartis, Gilead Sciences, Bluebird Bio, Juno Therapeutics, Spark Therapeutics, Kite Pharma, Celgene, Regeneron Pharmaceuticals, Adaptimmune, CRISPR Therapeutics.

3. What are the main segments of the Universal Cell Therapy Drug?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Universal Cell Therapy Drug," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Universal Cell Therapy Drug report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Universal Cell Therapy Drug?

To stay informed about further developments, trends, and reports in the Universal Cell Therapy Drug, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence