Key Insights

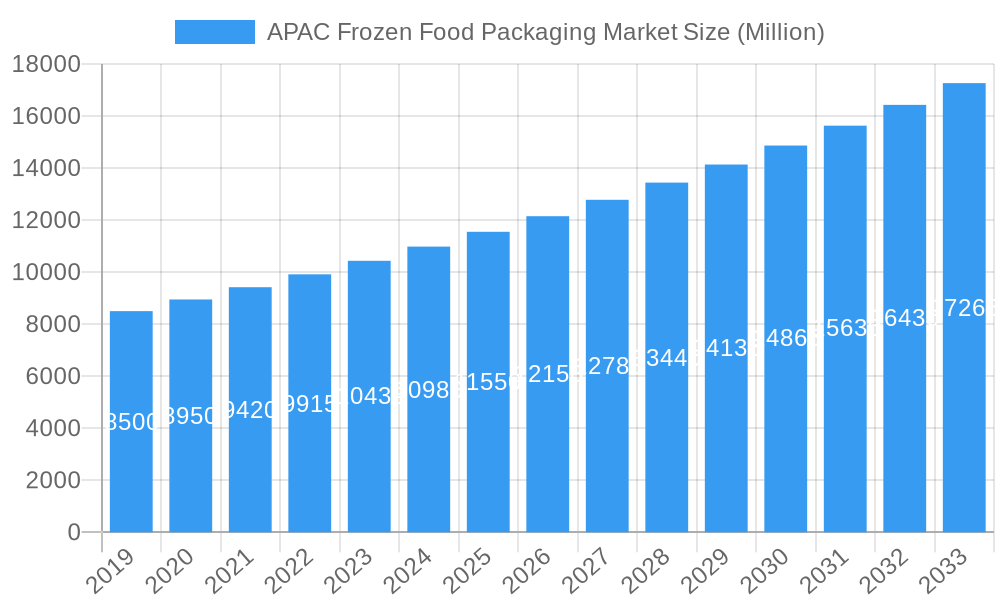

The APAC Frozen Food Packaging Market is poised for substantial growth, projected to reach an estimated market size of $XX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.34% anticipated through 2033. This expansion is primarily fueled by the increasing demand for convenience foods, evolving consumer lifestyles, and the burgeoning middle class across the Asia Pacific region. The rising adoption of modern retail formats, coupled with improved cold chain infrastructure, further supports this upward trajectory. Key drivers include the growing preference for ready-to-eat meals, a surge in the consumption of frozen fruits and vegetables, and the expanding market for frozen meat and seafood products. These factors are creating significant opportunities for innovative and sustainable packaging solutions.

APAC Frozen Food Packaging Market Market Size (In Billion)

The market's segmentation reveals a diverse landscape, with primary materials like plastic and paper leading the way due to their versatility and cost-effectiveness. In terms of packaging types, bags, boxes, and cartons are expected to dominate, offering optimal protection and shelf appeal for a wide array of frozen food items. Geographically, China, India, and Japan are identified as the leading markets, driven by their large populations and rapid economic development. However, emerging economies within the ASEAN region and Oceania also present considerable growth potential. While the market benefits from strong demand drivers, it faces certain restraints, including the increasing scrutiny on the environmental impact of packaging materials and the volatility in raw material prices. Nevertheless, technological advancements in packaging design, focusing on extended shelf life, enhanced food safety, and improved consumer experience, are expected to overcome these challenges and shape the future of the APAC frozen food packaging industry.

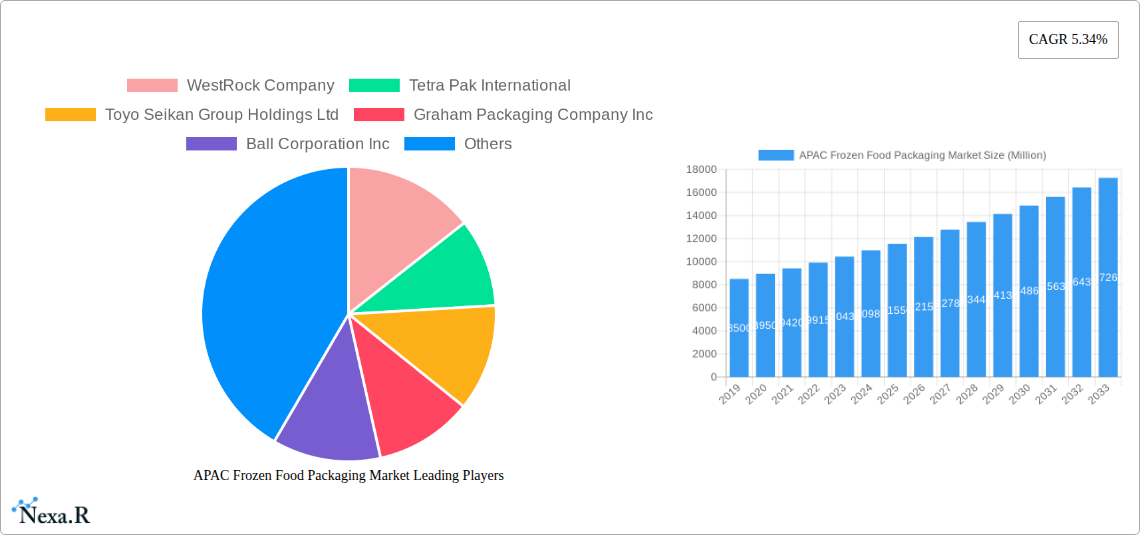

APAC Frozen Food Packaging Market Company Market Share

Here is a compelling, SEO-optimized report description for the APAC Frozen Food Packaging Market, designed for maximum visibility and industry engagement.

This in-depth report provides a definitive analysis of the APAC Frozen Food Packaging Market, exploring its dynamic structure, key growth trends, and future trajectory. Delve into critical factors shaping the market, from material innovations and packaging types to evolving consumer preferences and regional dominance. With comprehensive data spanning 2019–2033, including a Base Year of 2025 and a Forecast Period of 2025–2033, this report is an indispensable resource for stakeholders seeking to capitalize on the burgeoning opportunities within this rapidly expanding sector. Discover detailed insights into parent and child markets, key players, and influential industry developments.

APAC Frozen Food Packaging Market Market Dynamics & Structure

The APAC Frozen Food Packaging Market is characterized by a moderately concentrated landscape, with a blend of global giants and regional players driving innovation. Technological advancements in material science, particularly in sustainable and high-barrier plastics, are pivotal. Regulatory frameworks, increasingly focused on food safety and environmental impact, are also shaping packaging choices. Competitive product substitutes, ranging from reusable containers to compostable alternatives, present both challenges and opportunities. End-user demographics are shifting, with a growing middle class and increasing demand for convenience driving consumption of frozen ready-to-eat meals. Merger and acquisition (M&A) trends are evident as companies seek to expand their geographical reach and technological capabilities.

- Market Concentration: A moderate level of concentration, with leading players holding significant market share, but ample room for niche innovation.

- Technological Innovation Drivers: Development of advanced barrier materials, smart packaging solutions, and eco-friendly alternatives for enhanced shelf life and consumer appeal.

- Regulatory Frameworks: Growing emphasis on food safety compliance, recyclability mandates, and reduction of single-use plastics influencing material selection and design.

- Competitive Product Substitutes: Emergence of sustainable packaging solutions and the ongoing demand for cost-effective traditional options.

- End-User Demographics: Rising disposable incomes, urbanization, and a fast-paced lifestyle driving demand for convenient frozen food options.

- M&A Trends: Strategic acquisitions focused on expanding product portfolios, enhancing manufacturing capacities, and entering new geographical markets.

APAC Frozen Food Packaging Market Growth Trends & Insights

The APAC Frozen Food Packaging Market is poised for robust expansion, fueled by evolving consumer lifestyles and increased adoption of frozen food products across the region. The market size is projected to witness significant growth from xx Million units in 2019 to xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This growth is underpinned by an increasing demand for convenience, a wider variety of frozen food offerings, and enhanced cold chain logistics. Technological disruptions, such as the development of advanced barrier films and smart packaging, are enhancing product shelf-life and consumer engagement, thereby accelerating adoption rates. Consumer behavior shifts are notably contributing to market penetration, with a growing preference for value-added frozen meals, fresh-like frozen produce, and specialized frozen seafood. The rising penetration of e-commerce for grocery shopping further amplifies the demand for durable and protective frozen food packaging solutions that can withstand transit.

Dominant Regions, Countries, or Segments in APAC Frozen Food Packaging Market

Within the APAC Frozen Food Packaging Market, Plastic is the dominant primary material, accounting for an estimated xx% of the market share in 2025. This dominance is driven by its versatility, cost-effectiveness, and excellent barrier properties crucial for frozen food preservation. Among the packaging types, Trays and Bags are projected to lead, capturing a substantial portion of the market due to their suitability for a wide range of frozen food products like ready-to-eat meals and vegetables. China stands out as the leading geographical segment, driven by its massive population, rapidly growing middle class, and substantial food processing industry, contributing approximately xx% to the regional market value.

- Dominant Primary Material:

- Plastic: Leading due to its high performance, cost-effectiveness, and adaptability for various frozen food applications.

- Leading Packaging Types:

- Trays: Ideal for ready-to-eat meals, baked goods, and portioned products, offering convenience and portion control.

- Bags: Versatile for frozen fruits, vegetables, seafood, and meat products, providing efficient storage and handling.

- Leading Geographical Segment:

- China: Boasting the largest consumer base, significant advancements in cold chain infrastructure, and a rapidly expanding frozen food industry.

- India: Witnessing substantial growth due to increasing urbanization, evolving dietary habits, and a growing organized retail sector.

- South Korea: Characterized by a high demand for convenient and premium frozen food options, driving innovation in specialized packaging.

- Key Drivers of Dominance:

- Economic Policies: Government initiatives supporting food processing and retail sectors.

- Infrastructure Development: Expansion of cold chain logistics and warehousing facilities.

- Consumer Demand: Growing preference for convenience, variety, and quality in frozen food offerings.

- Technological Adoption: Increased use of advanced packaging technologies to enhance product appeal and shelf life.

APAC Frozen Food Packaging Market Product Landscape

The APAC Frozen Food Packaging Market product landscape is characterized by continuous innovation aimed at enhancing food preservation, consumer convenience, and sustainability. Key product developments include advanced multi-layer plastic films with superior oxygen and moisture barrier properties, recyclable paperboard cartons with specialized liners, and lightweight metal cans for a variety of frozen goods. Applications span from ready-to-eat meals and frozen fruits and vegetables to premium seafood and baked goods. Performance metrics focus on extended shelf-life, resistance to freezer burn, and excellent printability for attractive branding. Unique selling propositions often revolve around eco-friendly materials, improved seal integrity, and microwave-friendly designs, catering to evolving consumer demands.

Key Drivers, Barriers & Challenges in APAC Frozen Food Packaging Market

The APAC Frozen Food Packaging Market is propelled by several key drivers.

- Technological advancements in material science leading to more effective and sustainable packaging solutions.

- Rising disposable incomes and urbanization in developing economies are increasing demand for convenient frozen food options.

- Growth of the organized retail sector and e-commerce platforms are expanding the reach of frozen food products.

- Government initiatives promoting food security and cold chain infrastructure development.

However, the market faces significant challenges and barriers.

- Supply chain disruptions and volatile raw material prices can impact production costs and availability.

- Stringent regulatory frameworks regarding food contact materials and recyclability can necessitate costly redesigns.

- Consumer perception of frozen food quality and the increasing demand for fresh alternatives.

- Competition from lower-cost imported goods and established traditional packaging methods.

Emerging Opportunities in APAC Frozen Food Packaging Market

Emerging opportunities within the APAC Frozen Food Packaging Market are abundant. The growing demand for plant-based and alternative protein frozen meals presents a significant niche for specialized packaging. Untapped markets in Southeast Asia and emerging economies offer substantial growth potential as cold chain infrastructure improves. Innovative applications in personalized portion packaging for single-person households and the development of active and intelligent packaging that monitors food freshness are gaining traction. Evolving consumer preferences for sustainable and aesthetically pleasing packaging are driving demand for bio-based materials and minimalist designs, creating new avenues for innovation and market penetration.

Growth Accelerators in the APAC Frozen Food Packaging Market Industry

Several catalysts are accelerating the long-term growth of the APAC Frozen Food Packaging Market. Technological breakthroughs in biodegradable and compostable packaging materials are set to disrupt the market, aligning with global sustainability trends. Strategic partnerships between food manufacturers and packaging suppliers are fostering co-innovation, leading to tailored solutions that meet specific product needs. Market expansion strategies, particularly focusing on expanding into tier-2 and tier-3 cities with improving cold chain logistics, are unlocking new consumer bases. Furthermore, the increasing adoption of automation and advanced manufacturing processes within the packaging industry is improving efficiency and reducing production costs, further stimulating market growth.

Key Players Shaping the APAC Frozen Food Packaging Market Market

- WestRock Company

- Tetra Pak International

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company Inc

- Ball Corporation Inc

- Crown Holdings

- Rexam Company

- Placon Corporation

- Genpak LLC

- Amcor Ltd

Notable Milestones in APAC Frozen Food Packaging Market Sector

- March 2022: FOODEX JAPAN 2022, the 47th edition, showcased innovation in frozen foods and substitute foods, emphasizing SDGs and food-tech, driving advancements in packaging for these categories.

- June 2022: Walki launched a new range of recyclable frozen food packaging products, offering solutions recyclable with both paper and plastic, addressing the growing demand for sustainable packaging options.

In-Depth APAC Frozen Food Packaging Market Market Outlook

The APAC Frozen Food Packaging Market is set for sustained growth, driven by robust consumer demand for convenience and the increasing availability of diverse frozen food options. Key growth accelerators include the relentless pursuit of sustainable packaging solutions, such as recyclable and biodegradable materials, which are gaining significant traction among environmentally conscious consumers. Strategic alliances between packaging manufacturers and leading food producers will continue to foster product innovation, leading to the development of specialized packaging tailored to specific frozen food categories. The expansion of cold chain infrastructure in emerging Asian economies further unlocks new market potential, facilitating wider distribution of frozen goods and, consequently, their packaging. The industry is witnessing a significant uplift from technological advancements in barrier properties and convenience features, promising a dynamic and expanding market for years to come.

APAC Frozen Food Packaging Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Metal

- 1.4. Plastic

-

2. Type of Packaging

- 2.1. Bags

- 2.2. Boxes

- 2.3. Cans

- 2.4. Cartons

- 2.5. Trays

- 2.6. Wrappers

- 2.7. Other Packaging

-

3. Type of Food Product

- 3.1. Readymade Meals

- 3.2. Fruits and Vegetables

- 3.3. Meat

- 3.4. Sea Food

- 3.5. Baked Goods

- 3.6. Other Food Product

-

4. Geogrphy

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

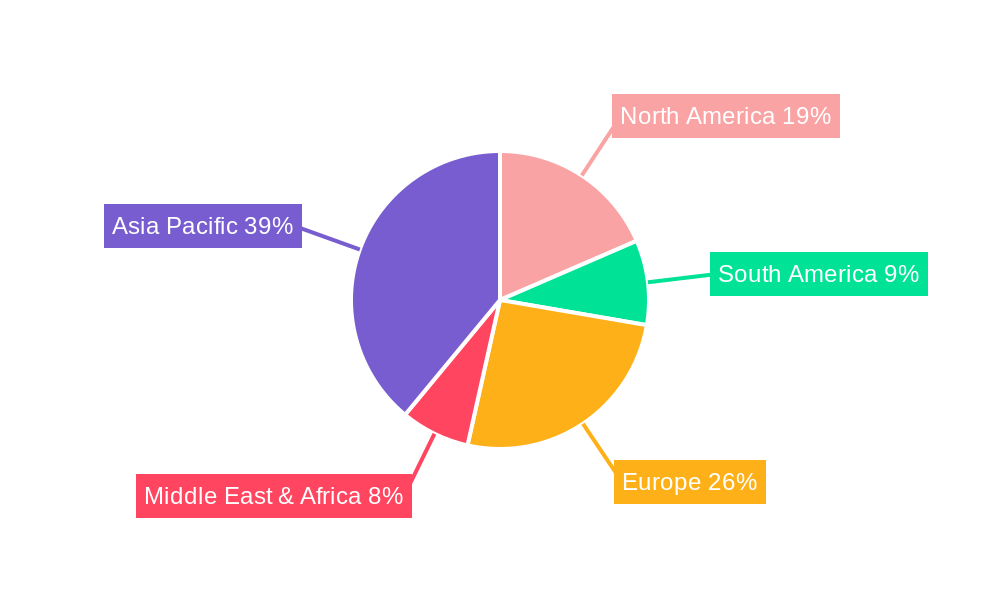

APAC Frozen Food Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Frozen Food Packaging Market Regional Market Share

Geographic Coverage of APAC Frozen Food Packaging Market

APAC Frozen Food Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience by Consumers; Increase in Disposable Income and Changing Consumer Behaviour

- 3.3. Market Restrains

- 3.3.1. Government Regulations and Interventions

- 3.4. Market Trends

- 3.4.1. Increase in Disposable Income and Changing Consumer Behaviour

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Frozen Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Type of Packaging

- 5.2.1. Bags

- 5.2.2. Boxes

- 5.2.3. Cans

- 5.2.4. Cartons

- 5.2.5. Trays

- 5.2.6. Wrappers

- 5.2.7. Other Packaging

- 5.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 5.3.1. Readymade Meals

- 5.3.2. Fruits and Vegetables

- 5.3.3. Meat

- 5.3.4. Sea Food

- 5.3.5. Baked Goods

- 5.3.6. Other Food Product

- 5.4. Market Analysis, Insights and Forecast - by Geogrphy

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. North America APAC Frozen Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 6.1.1. Glass

- 6.1.2. Paper

- 6.1.3. Metal

- 6.1.4. Plastic

- 6.2. Market Analysis, Insights and Forecast - by Type of Packaging

- 6.2.1. Bags

- 6.2.2. Boxes

- 6.2.3. Cans

- 6.2.4. Cartons

- 6.2.5. Trays

- 6.2.6. Wrappers

- 6.2.7. Other Packaging

- 6.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 6.3.1. Readymade Meals

- 6.3.2. Fruits and Vegetables

- 6.3.3. Meat

- 6.3.4. Sea Food

- 6.3.5. Baked Goods

- 6.3.6. Other Food Product

- 6.4. Market Analysis, Insights and Forecast - by Geogrphy

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 7. South America APAC Frozen Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 7.1.1. Glass

- 7.1.2. Paper

- 7.1.3. Metal

- 7.1.4. Plastic

- 7.2. Market Analysis, Insights and Forecast - by Type of Packaging

- 7.2.1. Bags

- 7.2.2. Boxes

- 7.2.3. Cans

- 7.2.4. Cartons

- 7.2.5. Trays

- 7.2.6. Wrappers

- 7.2.7. Other Packaging

- 7.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 7.3.1. Readymade Meals

- 7.3.2. Fruits and Vegetables

- 7.3.3. Meat

- 7.3.4. Sea Food

- 7.3.5. Baked Goods

- 7.3.6. Other Food Product

- 7.4. Market Analysis, Insights and Forecast - by Geogrphy

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 8. Europe APAC Frozen Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 8.1.1. Glass

- 8.1.2. Paper

- 8.1.3. Metal

- 8.1.4. Plastic

- 8.2. Market Analysis, Insights and Forecast - by Type of Packaging

- 8.2.1. Bags

- 8.2.2. Boxes

- 8.2.3. Cans

- 8.2.4. Cartons

- 8.2.5. Trays

- 8.2.6. Wrappers

- 8.2.7. Other Packaging

- 8.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 8.3.1. Readymade Meals

- 8.3.2. Fruits and Vegetables

- 8.3.3. Meat

- 8.3.4. Sea Food

- 8.3.5. Baked Goods

- 8.3.6. Other Food Product

- 8.4. Market Analysis, Insights and Forecast - by Geogrphy

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 9. Middle East & Africa APAC Frozen Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 9.1.1. Glass

- 9.1.2. Paper

- 9.1.3. Metal

- 9.1.4. Plastic

- 9.2. Market Analysis, Insights and Forecast - by Type of Packaging

- 9.2.1. Bags

- 9.2.2. Boxes

- 9.2.3. Cans

- 9.2.4. Cartons

- 9.2.5. Trays

- 9.2.6. Wrappers

- 9.2.7. Other Packaging

- 9.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 9.3.1. Readymade Meals

- 9.3.2. Fruits and Vegetables

- 9.3.3. Meat

- 9.3.4. Sea Food

- 9.3.5. Baked Goods

- 9.3.6. Other Food Product

- 9.4. Market Analysis, Insights and Forecast - by Geogrphy

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 10. Asia Pacific APAC Frozen Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Primary Material

- 10.1.1. Glass

- 10.1.2. Paper

- 10.1.3. Metal

- 10.1.4. Plastic

- 10.2. Market Analysis, Insights and Forecast - by Type of Packaging

- 10.2.1. Bags

- 10.2.2. Boxes

- 10.2.3. Cans

- 10.2.4. Cartons

- 10.2.5. Trays

- 10.2.6. Wrappers

- 10.2.7. Other Packaging

- 10.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 10.3.1. Readymade Meals

- 10.3.2. Fruits and Vegetables

- 10.3.3. Meat

- 10.3.4. Sea Food

- 10.3.5. Baked Goods

- 10.3.6. Other Food Product

- 10.4. Market Analysis, Insights and Forecast - by Geogrphy

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Primary Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tetra Pak International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toyo Seikan Group Holdings Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Graham Packaging Company Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ball Corporation Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Crown Holdings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rexam Company*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Placon Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Genpak LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amcor Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WestRock Company

List of Figures

- Figure 1: Global APAC Frozen Food Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Frozen Food Packaging Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 3: North America APAC Frozen Food Packaging Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 4: North America APAC Frozen Food Packaging Market Revenue (Million), by Type of Packaging 2025 & 2033

- Figure 5: North America APAC Frozen Food Packaging Market Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 6: North America APAC Frozen Food Packaging Market Revenue (Million), by Type of Food Product 2025 & 2033

- Figure 7: North America APAC Frozen Food Packaging Market Revenue Share (%), by Type of Food Product 2025 & 2033

- Figure 8: North America APAC Frozen Food Packaging Market Revenue (Million), by Geogrphy 2025 & 2033

- Figure 9: North America APAC Frozen Food Packaging Market Revenue Share (%), by Geogrphy 2025 & 2033

- Figure 10: North America APAC Frozen Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America APAC Frozen Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America APAC Frozen Food Packaging Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 13: South America APAC Frozen Food Packaging Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 14: South America APAC Frozen Food Packaging Market Revenue (Million), by Type of Packaging 2025 & 2033

- Figure 15: South America APAC Frozen Food Packaging Market Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 16: South America APAC Frozen Food Packaging Market Revenue (Million), by Type of Food Product 2025 & 2033

- Figure 17: South America APAC Frozen Food Packaging Market Revenue Share (%), by Type of Food Product 2025 & 2033

- Figure 18: South America APAC Frozen Food Packaging Market Revenue (Million), by Geogrphy 2025 & 2033

- Figure 19: South America APAC Frozen Food Packaging Market Revenue Share (%), by Geogrphy 2025 & 2033

- Figure 20: South America APAC Frozen Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America APAC Frozen Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe APAC Frozen Food Packaging Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 23: Europe APAC Frozen Food Packaging Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 24: Europe APAC Frozen Food Packaging Market Revenue (Million), by Type of Packaging 2025 & 2033

- Figure 25: Europe APAC Frozen Food Packaging Market Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 26: Europe APAC Frozen Food Packaging Market Revenue (Million), by Type of Food Product 2025 & 2033

- Figure 27: Europe APAC Frozen Food Packaging Market Revenue Share (%), by Type of Food Product 2025 & 2033

- Figure 28: Europe APAC Frozen Food Packaging Market Revenue (Million), by Geogrphy 2025 & 2033

- Figure 29: Europe APAC Frozen Food Packaging Market Revenue Share (%), by Geogrphy 2025 & 2033

- Figure 30: Europe APAC Frozen Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe APAC Frozen Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa APAC Frozen Food Packaging Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 33: Middle East & Africa APAC Frozen Food Packaging Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 34: Middle East & Africa APAC Frozen Food Packaging Market Revenue (Million), by Type of Packaging 2025 & 2033

- Figure 35: Middle East & Africa APAC Frozen Food Packaging Market Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 36: Middle East & Africa APAC Frozen Food Packaging Market Revenue (Million), by Type of Food Product 2025 & 2033

- Figure 37: Middle East & Africa APAC Frozen Food Packaging Market Revenue Share (%), by Type of Food Product 2025 & 2033

- Figure 38: Middle East & Africa APAC Frozen Food Packaging Market Revenue (Million), by Geogrphy 2025 & 2033

- Figure 39: Middle East & Africa APAC Frozen Food Packaging Market Revenue Share (%), by Geogrphy 2025 & 2033

- Figure 40: Middle East & Africa APAC Frozen Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa APAC Frozen Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific APAC Frozen Food Packaging Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 43: Asia Pacific APAC Frozen Food Packaging Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 44: Asia Pacific APAC Frozen Food Packaging Market Revenue (Million), by Type of Packaging 2025 & 2033

- Figure 45: Asia Pacific APAC Frozen Food Packaging Market Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 46: Asia Pacific APAC Frozen Food Packaging Market Revenue (Million), by Type of Food Product 2025 & 2033

- Figure 47: Asia Pacific APAC Frozen Food Packaging Market Revenue Share (%), by Type of Food Product 2025 & 2033

- Figure 48: Asia Pacific APAC Frozen Food Packaging Market Revenue (Million), by Geogrphy 2025 & 2033

- Figure 49: Asia Pacific APAC Frozen Food Packaging Market Revenue Share (%), by Geogrphy 2025 & 2033

- Figure 50: Asia Pacific APAC Frozen Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific APAC Frozen Food Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 2: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging 2020 & 2033

- Table 3: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2020 & 2033

- Table 4: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Geogrphy 2020 & 2033

- Table 5: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 7: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging 2020 & 2033

- Table 8: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2020 & 2033

- Table 9: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Geogrphy 2020 & 2033

- Table 10: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 15: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging 2020 & 2033

- Table 16: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2020 & 2033

- Table 17: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Geogrphy 2020 & 2033

- Table 18: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 23: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging 2020 & 2033

- Table 24: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2020 & 2033

- Table 25: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Geogrphy 2020 & 2033

- Table 26: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 37: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging 2020 & 2033

- Table 38: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2020 & 2033

- Table 39: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Geogrphy 2020 & 2033

- Table 40: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 48: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging 2020 & 2033

- Table 49: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2020 & 2033

- Table 50: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Geogrphy 2020 & 2033

- Table 51: Global APAC Frozen Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific APAC Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Frozen Food Packaging Market?

The projected CAGR is approximately 5.34%.

2. Which companies are prominent players in the APAC Frozen Food Packaging Market?

Key companies in the market include WestRock Company, Tetra Pak International, Toyo Seikan Group Holdings Ltd, Graham Packaging Company Inc, Ball Corporation Inc, Crown Holdings, Rexam Company*List Not Exhaustive, Placon Corporation, Genpak LLC, Amcor Ltd.

3. What are the main segments of the APAC Frozen Food Packaging Market?

The market segments include Primary Material, Type of Packaging, Type of Food Product, Geogrphy.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience by Consumers; Increase in Disposable Income and Changing Consumer Behaviour.

6. What are the notable trends driving market growth?

Increase in Disposable Income and Changing Consumer Behaviour.

7. Are there any restraints impacting market growth?

Government Regulations and Interventions.

8. Can you provide examples of recent developments in the market?

March 2022- "FOODEX JAPAN 2022," the 47th edition of Japan's primary food and beverage exhibition, brought together 1,461 enterprises from 41 countries and regions with 1,787 booths intending to present new ideas to the food industry, which has achieved fresh innovation in the face of the COVID-19 epidemic. The exhibition, which featured current food trends such as a wide variety of value-added "frozen foods" and "substitute foods" according to the Sustainable Development Goals (SDGs), as well as recently popular "food-tech," held at Makuhari Messe in Chiba Prefecture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Frozen Food Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Frozen Food Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Frozen Food Packaging Market?

To stay informed about further developments, trends, and reports in the APAC Frozen Food Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence