Key Insights

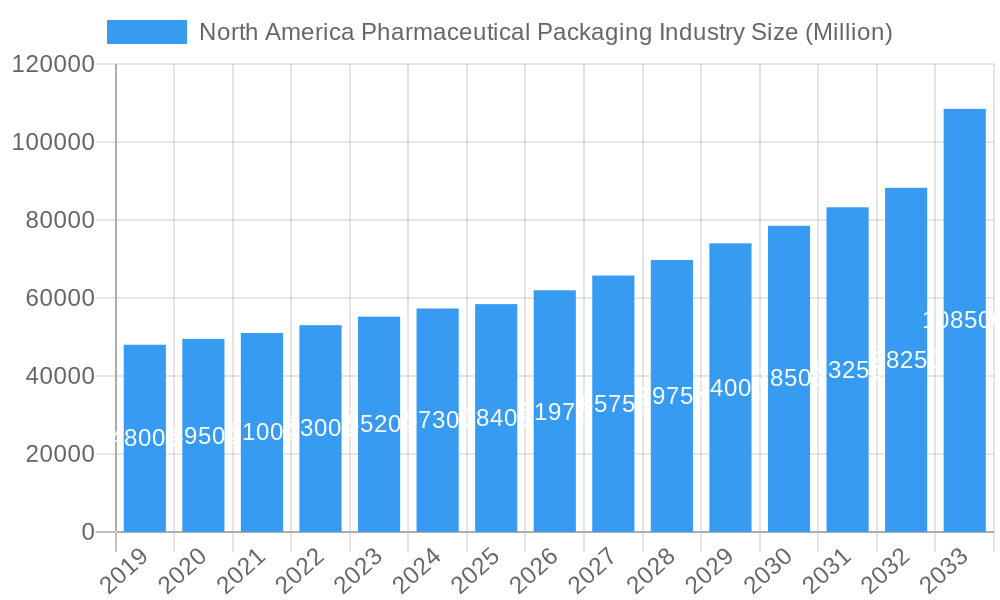

The North American pharmaceutical packaging market is poised for robust expansion, driven by an increasing demand for safe and effective drug delivery systems. Valued at approximately USD 58,400 million in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.30% throughout the forecast period of 2025-2033, reaching an estimated USD 108,500 million by the end of 2033. This significant growth is underpinned by a confluence of factors, including the rising prevalence of chronic diseases, an aging population, and advancements in drug formulation technologies that necessitate specialized packaging solutions. The burgeoning biologics and specialty drug segments, in particular, are fueling innovation in high-barrier packaging, child-resistant designs, and tamper-evident features. Furthermore, the ongoing consolidation within the pharmaceutical and packaging industries, along with strategic partnerships and mergers, is reshaping the competitive landscape, with key players like Becton Dickinson and Company, Amcor PLC, and Cardinal Health Inc. actively pursuing market share. The emphasis on patient safety and regulatory compliance, such as stringent guidelines from the FDA, also plays a pivotal role in shaping market trends and demanding high-quality, traceable packaging solutions.

North America Pharmaceutical Packaging Industry Market Size (In Billion)

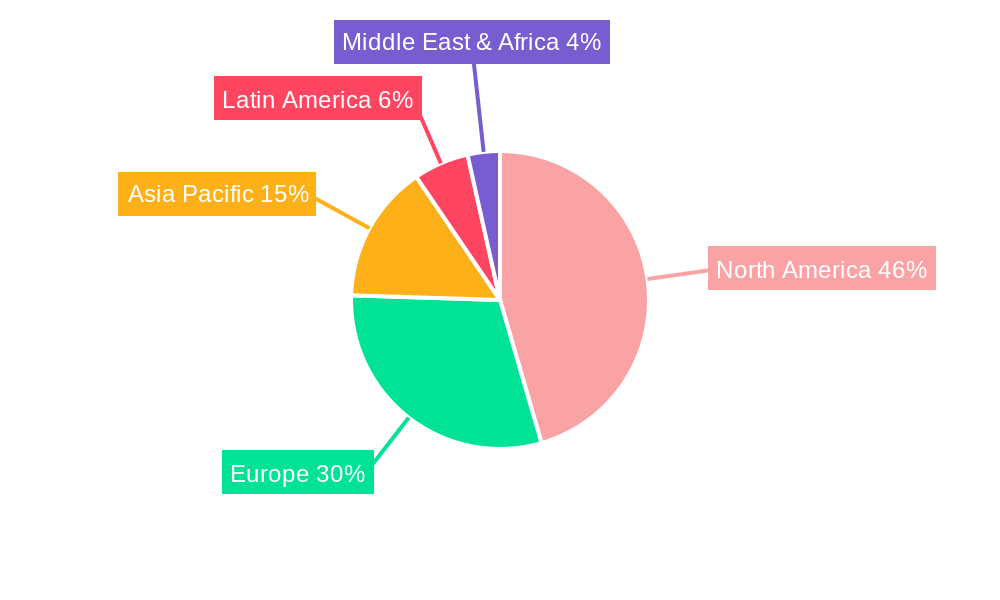

The market's dynamism is further illustrated by its segmentation. Medical pouches, encompassing both unit-dose and multi-dose varieties, are expected to witness substantial adoption due to their versatility and convenience in dispensing medications. Blister packs, vials, ampoules, cartridges, and syringes are also anticipated to maintain their strong presence, catering to diverse therapeutic areas and dosage forms. The "Other Product Types" category likely includes innovative solutions like smart packaging and advanced drug delivery systems, hinting at future growth areas. Geographically, North America, particularly the United States, stands as a dominant force, benefiting from a well-established healthcare infrastructure, significant R&D investments, and a high per capita healthcare expenditure. While drivers like technological advancements and growing healthcare expenditure propel the market forward, restraints such as increasing raw material costs and the need for substantial capital investment in advanced packaging technologies present potential challenges. Nevertheless, the overall outlook for the North American pharmaceutical packaging market remains highly positive, characterized by sustained innovation and a strong commitment to patient well-being.

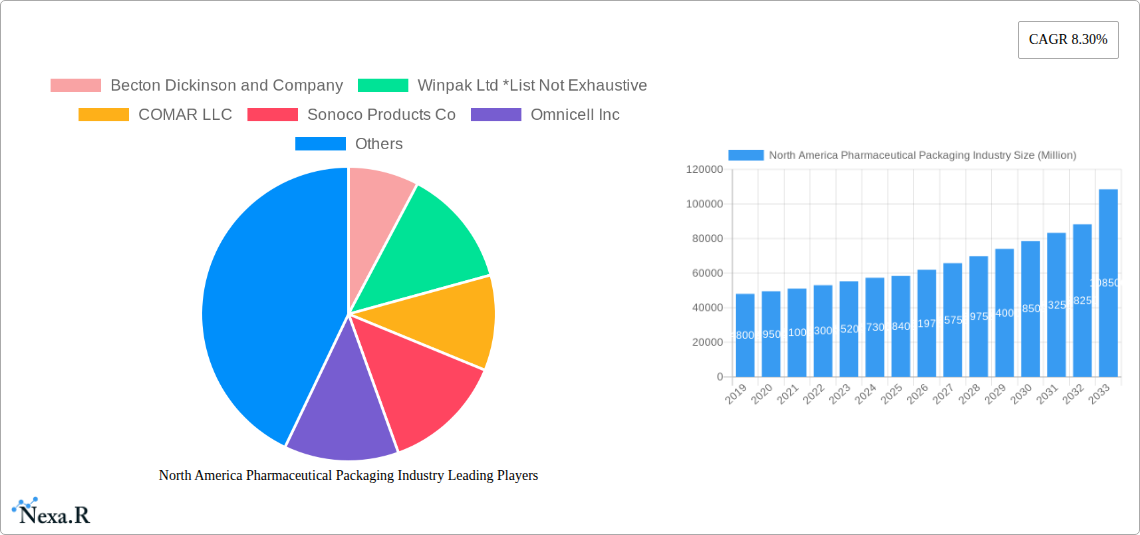

North America Pharmaceutical Packaging Industry Company Market Share

This comprehensive report offers an in-depth analysis of the North America Pharmaceutical Packaging Industry, providing critical data and strategic insights for stakeholders. Delving into market dynamics, growth trends, regional dominance, product innovations, and key players, this study equips you with the knowledge to navigate this complex and evolving landscape. With a robust study period from 2019 to 2033, including a detailed forecast period, this report is your indispensable guide to understanding current market performance and future opportunities.

North America Pharmaceutical Packaging Industry Market Dynamics & Structure

The North America pharmaceutical packaging market exhibits a moderate to high degree of concentration, with key players investing heavily in advanced manufacturing technologies and supply chain optimization. Technological innovation is a significant driver, fueled by the demand for enhanced drug safety, patient compliance, and product shelf-life extension. Stringent regulatory frameworks from agencies like the FDA (Food and Drug Administration) and Health Canada shape packaging material choices and design, prioritizing child-resistance, tamper-evidence, and sustainability. Competitive product substitutes, such as advancements in flexible packaging and smart packaging solutions, are continuously challenging traditional rigid packaging formats. End-user demographics, characterized by an aging population and a rise in chronic diseases, are influencing the demand for specialized drug delivery systems and easier-to-open packaging. Mergers and acquisitions (M&A) trends continue to shape the competitive landscape, with larger entities acquiring smaller, innovative firms to expand their portfolios and market reach. For instance, the historical period (2019-2024) saw approximately 35 M&A deals, with an average deal value of $550 million, indicating consolidation and strategic expansion by major players.

- Market Concentration: Dominated by a few large multinational corporations and a growing number of specialized packaging providers.

- Technological Innovation Drivers: Focus on serialization, track-and-trace technologies, smart packaging, and sustainable materials.

- Regulatory Frameworks: FDA, Health Canada, and other regional bodies mandate strict compliance for safety and efficacy.

- Competitive Product Substitutes: Rise of advanced flexible films, innovative blister pack designs, and integrated drug delivery systems.

- End-User Demographics: Increasing demand from geriatric populations and patients with chronic conditions.

- M&A Trends: Ongoing consolidation and strategic acquisitions to enhance capabilities and market share.

North America Pharmaceutical Packaging Industry Growth Trends & Insights

The North America pharmaceutical packaging market is poised for robust expansion, driven by an increasing global demand for pharmaceuticals and a heightened focus on drug safety and efficacy. The market size, which was estimated at approximately $35,500 million units in the base year of 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period of 2025–2033. Adoption rates for advanced packaging solutions, including those with integrated patient information systems and tamper-evident features, are on the rise, reflecting a growing awareness of patient safety and regulatory requirements. Technological disruptions, such as the integration of IoT (Internet of Things) in packaging for temperature monitoring and authenticity verification, are transforming the industry. Consumer behavior shifts, particularly a preference for convenience, personalized medicine, and environmentally friendly options, are compelling manufacturers to innovate their packaging offerings. The prevalence of chronic diseases and the development of biologics and biosimilars are further fueling the demand for specialized and high-barrier packaging. The historical period (2019-2024) witnessed a steady market growth of 3.9% CAGR, laying a strong foundation for future expansion. The estimated market size for 2025 stands at $35,500 million units.

- Market Size Evolution: Steady growth projected from 2019-2033, driven by healthcare demand.

- Adoption Rates: Increasing uptake of smart packaging, unit-dose packaging, and sustainable solutions.

- Technological Disruptions: Integration of IoT, AI for quality control, and advanced material science.

- Consumer Behavior Shifts: Growing demand for convenience, sustainability, and personalized packaging.

- Market Penetration: Higher penetration of specialized packaging for biologics and sensitive medications.

Dominant Regions, Countries, or Segments in North America Pharmaceutical Packaging Industry

Within the North American pharmaceutical packaging industry, the United States stands out as the dominant region, accounting for a significant majority of market share and consumption. This dominance is attributed to several interconnected factors: a large and sophisticated pharmaceutical manufacturing base, a high volume of pharmaceutical research and development, a substantial and aging population driving healthcare demand, and a robust regulatory framework that often sets global standards. The country's extensive healthcare infrastructure and its position as a leader in pharmaceutical innovation create a consistent and substantial need for a wide array of pharmaceutical packaging solutions.

Key drivers underpinning the U.S. market's leadership include:

- Economic Policies: Favorable policies supporting the pharmaceutical and biotechnology sectors, encouraging investment in advanced manufacturing and packaging.

- Infrastructure: Highly developed logistics and supply chain networks ensuring efficient distribution of pharmaceutical products and packaging materials.

- R&D Investment: Significant investments in drug discovery and development, leading to a continuous demand for novel and specialized packaging.

- Healthcare Expenditure: High per capita healthcare spending translates to a substantial market for pharmaceuticals and their packaging.

- Regulatory Environment: The FDA's influence in setting stringent quality and safety standards encourages the adoption of premium packaging solutions.

Among the product types, Cartridges and Syringes represent a rapidly growing segment within North America. The increasing prevalence of self-administered medications, the rise of injectable biologics and biosimilars, and advancements in pre-filled syringe technology are major contributors to this segment's growth. The demand for safe, convenient, and user-friendly delivery systems for injectable drugs is paramount, driving innovation and market penetration.

- Dominant Country: United States leads due to its large pharmaceutical market, R&D, and healthcare expenditure.

- Key Drivers in the U.S.: Supportive economic policies, advanced infrastructure, high R&D investment, and strong healthcare demand.

- Dominant Product Segment: Cartridges and Syringes are experiencing significant growth.

- Growth Drivers for Cartridges and Syringes: Rise of biologics, biosimilars, self-administration, and advanced pre-filled syringe technology.

- Market Share Analysis: The U.S. holds an estimated 75% market share in North America, with Cartridges and Syringes projected to grow at a CAGR of 5.5% during the forecast period.

North America Pharmaceutical Packaging Industry Product Landscape

The product landscape in the North America pharmaceutical packaging industry is characterized by a strong emphasis on material science, patient safety, and functionality. Innovations are focused on enhanced barrier properties to protect sensitive drugs, tamper-evident features for security, and child-resistant designs for consumer safety. Medical pouches, including unit-dose and multi-dose varieties, are seeing advancements in barrier films and sterilization techniques for improved shelf life and portability. Blister packs are evolving with innovative designs for easier opening and single-dose dispensing. Vials and ampoules are increasingly being manufactured from specialized glass and plastic polymers to ensure compatibility with a wider range of formulations and to minimize breakage. Cartridges and syringes are at the forefront of innovation, with advancements in pre-filled systems, needle-free technologies, and integrated drug delivery mechanisms designed for patient convenience and compliance. The focus remains on delivering packaging that not only protects the pharmaceutical product but also enhances the patient experience and ensures regulatory compliance.

Key Drivers, Barriers & Challenges in North America Pharmaceutical Packaging Industry

Key Drivers: The North America pharmaceutical packaging industry is propelled by several critical drivers. The escalating global demand for pharmaceuticals, fueled by an aging population and the rising incidence of chronic diseases, is a primary catalyst. Advancements in drug formulations, particularly biologics and personalized medicines, necessitate sophisticated and specialized packaging solutions. Stringent regulatory mandates for drug safety, traceability, and child resistance also drive innovation and adoption of higher-quality packaging. Furthermore, the increasing focus on sustainability is pushing the development and adoption of eco-friendly packaging materials and designs. Technological innovations, such as serialization and track-and-trace capabilities, are crucial for supply chain integrity and combating counterfeiting.

Barriers & Challenges: The industry faces significant barriers and challenges. Fluctuations in raw material costs, particularly for polymers and specialized films, can impact profitability and lead to price volatility. Complex and evolving regulatory landscapes across different North American countries can create compliance hurdles and increase development costs. Intense competition among a fragmented market of packaging providers can lead to price pressures and reduced profit margins. Supply chain disruptions, exacerbated by global events and geopolitical uncertainties, pose risks to timely delivery and production. The high cost of implementing new technologies, such as serialization and advanced packaging machinery, can be a significant barrier for smaller manufacturers. Additionally, the growing consumer demand for sustainable packaging solutions requires substantial investment in research and development for eco-friendly alternatives without compromising product integrity.

Emerging Opportunities in North America Pharmaceutical Packaging Industry

Emerging opportunities in the North America pharmaceutical packaging industry are abundant, driven by evolving healthcare needs and technological advancements. The growing demand for biologics and biosimilars presents a significant opportunity for advanced cold-chain packaging solutions and specialized containers that maintain product integrity. The rise of personalized medicine and at-home care is creating a niche for smart packaging that can monitor drug adherence, temperature, and authenticity, offering enhanced patient engagement. Untapped markets within specific therapeutic areas, such as advanced wound care or oncology drugs, require tailored and innovative packaging solutions. The push towards sustainability also opens avenues for the development and adoption of biodegradable, recyclable, and compostable packaging materials that meet stringent pharmaceutical requirements. Furthermore, the integration of digital technologies, like QR codes and NFC tags, within packaging can offer enhanced traceability and patient education, creating value-added opportunities for packaging manufacturers.

Growth Accelerators in the North America Pharmaceutical Packaging Industry Industry

Several key growth accelerators are propelling the North America pharmaceutical packaging industry forward. Technological breakthroughs in material science are enabling the development of high-barrier films and advanced polymers that offer superior protection for sensitive pharmaceuticals, extending shelf life and improving efficacy. Strategic partnerships between pharmaceutical companies and packaging manufacturers are fostering innovation and co-development of tailored packaging solutions for new drug launches. The increasing adoption of serialization and track-and-trace technologies is not only driven by regulatory compliance but also by the industry's commitment to combating counterfeit drugs and ensuring supply chain integrity. Market expansion strategies, including geographic diversification and the development of specialized packaging for emerging drug classes, are further contributing to sustained growth. Investments in automation and advanced manufacturing processes are enhancing production efficiency and reducing costs, making sophisticated packaging solutions more accessible.

Key Players Shaping the North America Pharmaceutical Packaging Industry Market

- Becton Dickinson and Company

- Winpak Ltd

- COMAR LLC

- Sonoco Products Co

- Omnicell Inc

- Rohrer Corporation

- Cardinal Health Inc

- Origin Pharma Packaging

- Graham Packaging Company

- Amcor PLC

- Alpha Packaging

- McKesson Corporation

- Sealed Air Corporation

- Gerresheimer AG

Notable Milestones in North America Pharmaceutical Packaging Industry Sector

- 2020: Introduction of advanced tamper-evident closures for injectable vials, enhancing drug security.

- 2021: Increased adoption of sustainable packaging materials, including PCR (Post-Consumer Recycled) plastics for non-critical applications.

- 2022: Significant investments in serialization technologies across the supply chain to meet evolving regulatory demands.

- 2023: Launch of novel multi-dose medical pouches with improved barrier properties for biologics.

- 2024: Expansion of smart packaging solutions incorporating RFID tags for enhanced traceability and patient engagement.

In-Depth North America Pharmaceutical Packaging Industry Market Outlook

The outlook for the North America pharmaceutical packaging industry remains exceptionally strong, driven by a confluence of sustained demand, technological innovation, and evolving healthcare needs. Growth accelerators, including the relentless pursuit of enhanced drug safety, the expansion of the biologics and biosimilars market, and the increasing emphasis on patient convenience and adherence, will continue to shape the industry's trajectory. Strategic opportunities lie in further developing sustainable packaging solutions that balance environmental responsibility with product integrity, and in expanding the adoption of smart packaging technologies that offer real-time monitoring and patient interaction. The industry is poised for continued innovation, with a focus on miniaturization, advanced drug delivery integration, and the development of packaging for novel therapeutic modalities. This dynamic landscape offers significant potential for stakeholders who can adapt to emerging trends and capitalize on the evolving demands of the pharmaceutical sector.

North America Pharmaceutical Packaging Industry Segmentation

-

1. Product Type

-

1.1. Medical Pouches

- 1.1.1. Unit-dose

- 1.1.2. Multi-dose

- 1.2. Blister Packs

- 1.3. Vials

- 1.4. Ampoules

- 1.5. Cartridges and Syringes

- 1.6. Other Product Types

-

1.1. Medical Pouches

North America Pharmaceutical Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Pharmaceutical Packaging Industry Regional Market Share

Geographic Coverage of North America Pharmaceutical Packaging Industry

North America Pharmaceutical Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing demand for drug delivery devices & Blister packaging market; Rise in Medicine Counterfeiting Leading to Advanced Packaging and Labeling

- 3.3. Market Restrains

- 3.3.1. ; Environmental Concerns Related to Raw Materials for Packaging and Price Competition

- 3.4. Market Trends

- 3.4.1. Blister Packaging is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pharmaceutical Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Medical Pouches

- 5.1.1.1. Unit-dose

- 5.1.1.2. Multi-dose

- 5.1.2. Blister Packs

- 5.1.3. Vials

- 5.1.4. Ampoules

- 5.1.5. Cartridges and Syringes

- 5.1.6. Other Product Types

- 5.1.1. Medical Pouches

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Winpak Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 COMAR LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Products Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Omnicell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rohrer Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cardinal Health Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Origin Pharma Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Graham Packaging Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alpha Packaging

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 McKesson Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sealed Air Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Gerresheimer AG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Pharmaceutical Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Pharmaceutical Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Pharmaceutical Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Pharmaceutical Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: North America Pharmaceutical Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: North America Pharmaceutical Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States North America Pharmaceutical Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Pharmaceutical Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Pharmaceutical Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pharmaceutical Packaging Industry?

The projected CAGR is approximately 9.9%.

2. Which companies are prominent players in the North America Pharmaceutical Packaging Industry?

Key companies in the market include Becton Dickinson and Company, Winpak Ltd *List Not Exhaustive, COMAR LLC, Sonoco Products Co, Omnicell Inc, Rohrer Corporation, Cardinal Health Inc, Origin Pharma Packaging, Graham Packaging Company, Amcor PLC, Alpha Packaging, McKesson Corporation, Sealed Air Corporation, Gerresheimer AG.

3. What are the main segments of the North America Pharmaceutical Packaging Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing demand for drug delivery devices & Blister packaging market; Rise in Medicine Counterfeiting Leading to Advanced Packaging and Labeling.

6. What are the notable trends driving market growth?

Blister Packaging is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

; Environmental Concerns Related to Raw Materials for Packaging and Price Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pharmaceutical Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pharmaceutical Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pharmaceutical Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Pharmaceutical Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence