Key Insights

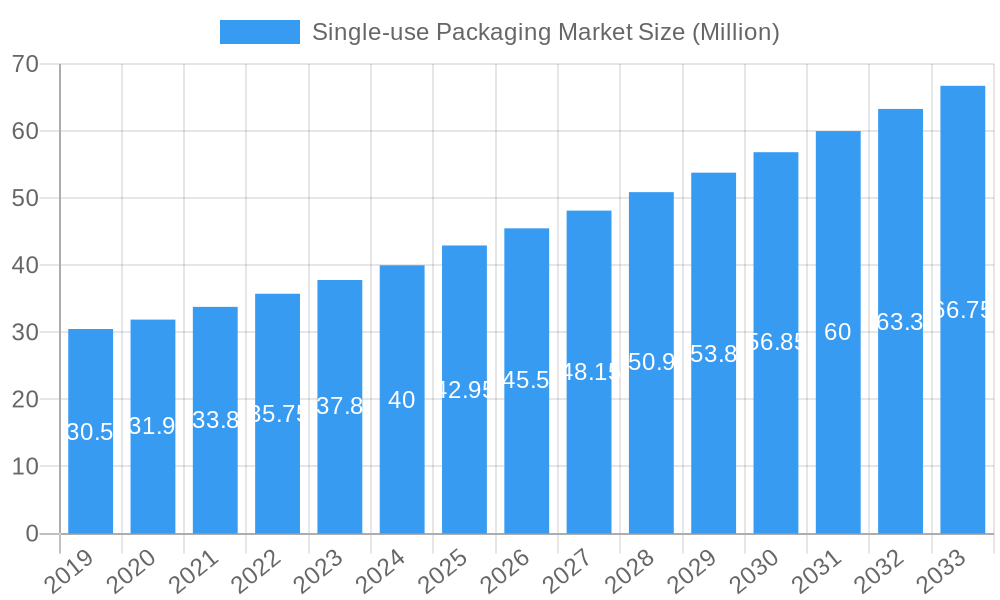

The global single-use packaging market is poised for substantial growth, projected to reach an estimated $42.95 million in 2025. This expansion is driven by a confluence of factors, including the ever-increasing demand for convenience across various consumer sectors and the sustained need for hygienic and protective packaging solutions, particularly in the food, beverage, and pharmaceutical industries. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 5.93% from 2025 to 2033, underscoring its robust trajectory. Key material types dominating the market include paper and paperboard, plastics, and glass, each catering to specific product requirements and regulatory landscapes. Innovations in sustainable materials and eco-friendly packaging alternatives are also emerging as significant trends, aiming to mitigate environmental concerns associated with single-use items. The market's dynamism is further fueled by evolving consumer preferences for on-the-go consumption and the stringent safety standards prevalent in sectors like pharmaceuticals and healthcare.

Single-use Packaging Market Market Size (In Million)

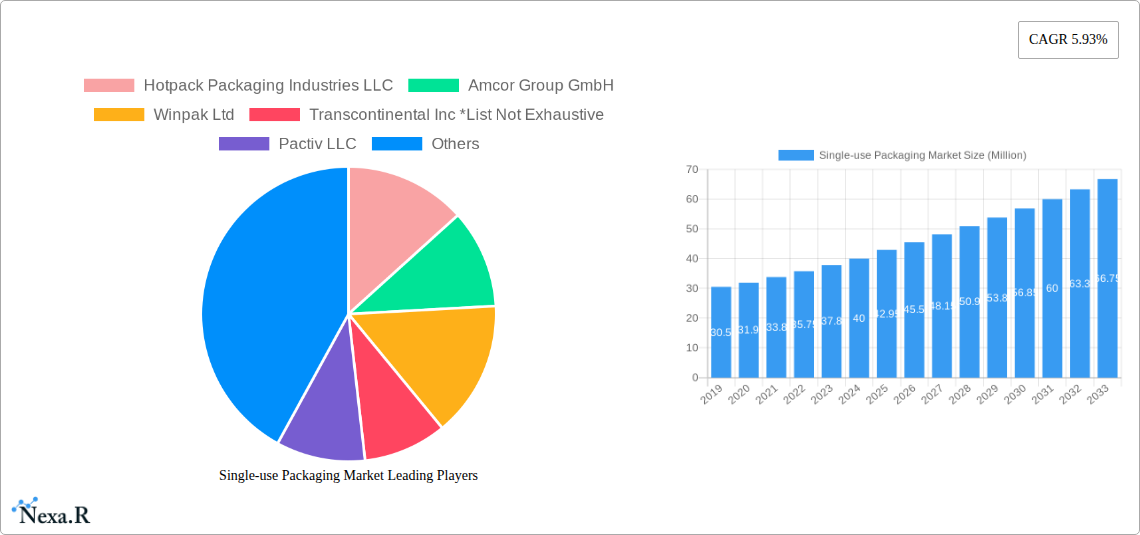

Despite the strong growth outlook, the single-use packaging market faces certain restraints. The increasing global focus on environmental sustainability and the subsequent rise in regulations aimed at reducing plastic waste and promoting reusable alternatives present a significant challenge. Growing consumer awareness and corporate social responsibility initiatives are also pushing for a shift towards more sustainable packaging models. However, the inherent advantages of single-use packaging in terms of hygiene, cost-effectiveness, and protection, especially for perishable goods and sensitive products, are expected to maintain its relevance. Key players in the market, such as Hotpack Packaging Industries LLC, Amcor Group GmbH, and Winpak Ltd, are actively investing in research and development to offer a wider range of compliant and increasingly sustainable single-use packaging solutions, thereby navigating these challenges and capitalizing on market opportunities across diverse end-user industries. The Asia Pacific region, with its large population and rapidly expanding consumer base, is anticipated to be a significant growth engine.

Single-use Packaging Market Company Market Share

Single-use Packaging Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the single-use packaging market, a vital sector driven by convenience, hygiene, and evolving consumer demands across numerous industries. With a study period spanning 2019-2033, including a base and estimated year of 2025, and a forecast period of 2025-2033, this report offers critical insights into market dynamics, growth trends, and the competitive landscape. We delve into parent and child market segments, exploring the intricate relationships between material types, end-user industries, and the overarching market trajectory, presenting all values in Million units.

Single-use Packaging Market Market Dynamics & Structure

The single-use packaging market is characterized by a moderate to high degree of market concentration, with key players investing heavily in technological innovation to meet evolving sustainability demands and regulatory pressures. Drivers of innovation include the development of bio-based and compostable materials, enhanced barrier properties for product preservation, and lightweighting for reduced transportation costs. Regulatory frameworks, particularly concerning plastic waste reduction and the promotion of recyclable and reusable alternatives, are significantly shaping market strategies. Competitive product substitutes, such as reusable packaging systems and alternative materials like bamboo and bagasse, are gaining traction, compelling manufacturers to innovate and offer sustainable options. End-user demographics, with a growing preference for convenient, on-the-go consumption, continue to fuel demand. Mergers and acquisitions (M&A) are prevalent as companies seek to expand their product portfolios, gain market share, and acquire advanced manufacturing capabilities. For instance, the paper and paperboard segment, valued at $150,000 million units in 2025, sees significant consolidation. The plastic segment, projected to reach $200,000 million units by 2025, is a hub for M&A activities aimed at developing advanced recycling technologies.

Single-use Packaging Market Growth Trends & Insights

The single-use packaging market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2033, reaching an estimated market size of $450,000 million units by 2033. This expansion is underpinned by increasing demand from the food and beverage sector, which accounted for 65% of the market in 2025, driven by urbanization, a growing middle class, and the rise of e-commerce food delivery services. Technological disruptions, such as advancements in material science leading to the development of high-performance, sustainable single-use packaging solutions, are significantly influencing adoption rates. For example, the integration of smart packaging features for enhanced traceability and shelf-life monitoring is a growing trend. Consumer behavior shifts, including a heightened awareness of hygiene and convenience, especially post-pandemic, continue to propel the demand for single-use options in sectors like personal care and pharmaceuticals. Market penetration is highest in developed economies, but emerging markets in Asia-Pacific and Latin America are expected to be key growth engines due to their burgeoning populations and increasing disposable incomes. The report analyzes the adoption rates of novel biodegradable and compostable packaging, which are expected to grow at a CAGR of 8.5% during the forecast period.

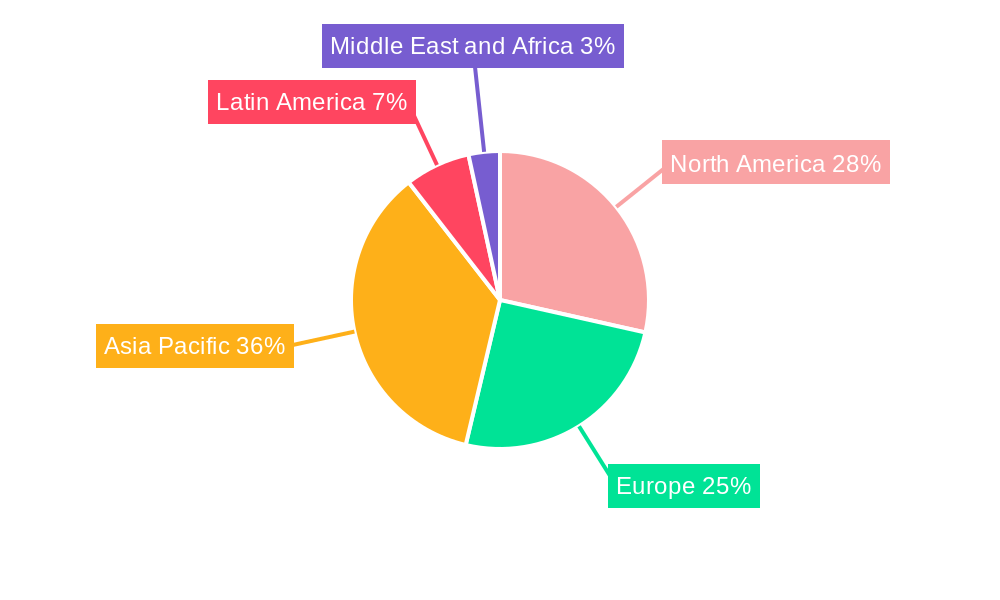

Dominant Regions, Countries, or Segments in Single-use Packaging Market

The single-use packaging market is witnessing significant dominance from the plastic segment within the Asia-Pacific region. In 2025, the plastic segment is projected to hold a market share of 45%, driven by its versatility, cost-effectiveness, and widespread application across various end-user industries. The Asia-Pacific region, expected to account for 38% of the global market in 2025, is a powerhouse due to its massive population, rapid industrialization, and burgeoning consumer base, particularly in countries like China and India. The food and beverage end-user industry, also a dominant segment, represents 40% of the global market share in 2025, heavily reliant on plastic packaging for its convenience and protective properties.

- Dominant Segment (Material Type): Plastic

- Estimated Market Share in 2025: 45% (representing $202,500 million units)

- Key Drivers: Cost-effectiveness, durability, excellent barrier properties, versatility for diverse applications.

- Growth Potential: Driven by continuous innovation in recyclable and biodegradable plastics, and demand from emerging economies.

- Dominant End-user Industry: Food & Beverage

- Estimated Market Share in 2025: 40% (representing $180,000 million units)

- Key Drivers: Growing demand for convenience foods, ready-to-eat meals, and expanding food delivery services.

- Growth Potential: Fueled by evolving consumer lifestyles and the need for safe, hygienic, and long-lasting food packaging.

- Dominant Region: Asia-Pacific

- Estimated Market Share in 2025: 38% (representing $171,000 million units)

- Key Drivers: Large and growing population, rapid economic development, increasing disposable incomes, and expanding manufacturing base.

- Growth Potential: Significant untapped markets and increasing adoption of modern packaging solutions across various sectors.

The dominance of plastic in Asia-Pacific is further bolstered by economic policies promoting manufacturing and consumption, alongside infrastructural development facilitating efficient supply chains. While environmental concerns are leading to the exploration of alternatives, the sheer volume of demand and the cost-effectiveness of plastic continue to solidify its leading position. The paper and paperboard segment, valued at $150,000 million units in 2025, is experiencing growth due to increasing consumer preference for sustainable options, particularly in developed markets, and is expected to capture a significant share.

Single-use Packaging Market Product Landscape

The single-use packaging market product landscape is characterized by continuous innovation aimed at enhancing functionality, sustainability, and consumer appeal. Key developments include advanced multi-layer plastic films offering superior barrier properties to extend shelf life for food and pharmaceutical products, and the increasing adoption of molded pulp and paperboard for a wide array of food service applications. Innovations in coatings and barrier technologies are enabling the use of more sustainable materials, such as recyclable paperboard, in traditionally plastic-dominated areas. Performance metrics like puncture resistance, thermal insulation, and seal integrity are critical selling points. Unique selling propositions include lightweight designs for reduced shipping costs, extended product freshness, and improved recyclability. Technological advancements are also focused on creating compostable and biodegradable alternatives that can degrade safely without leaving harmful residues.

Key Drivers, Barriers & Challenges in Single-use Packaging Market

Key Drivers:

- Convenience and Hygiene: The inherent convenience and germ-blocking properties of single-use packaging remain a primary driver, especially in food service, personal care, and healthcare.

- E-commerce Growth: The surge in online shopping, particularly for groceries and ready-to-eat meals, directly fuels the demand for robust and protective single-use packaging.

- Cost-Effectiveness: For many applications, single-use packaging offers a more economical solution compared to reusable alternatives, particularly in terms of initial investment and cleaning/maintenance costs.

- Technological Advancements: Innovations in material science are leading to the development of more sustainable, lightweight, and high-performance single-use packaging options.

Barriers & Challenges:

- Environmental Concerns and Regulations: Growing global awareness of plastic pollution and stricter government regulations (e.g., bans on single-use plastics, extended producer responsibility schemes) pose significant challenges.

- Supply Chain Volatility: Fluctuations in the prices of raw materials (e.g., crude oil for plastics, pulp for paper) and global supply chain disruptions can impact production costs and availability.

- Competition from Reusable Alternatives: The increasing adoption and consumer acceptance of reusable packaging systems present a direct competitive threat.

- Consumer Perception and Behavior Change: Shifting consumer preferences towards sustainability can create pressure on brands to move away from single-use solutions, despite convenience benefits.

Emerging Opportunities in Single-use Packaging Market

Emerging opportunities in the single-use packaging market lie in the development and widespread adoption of truly circular economy solutions. This includes advancements in chemical recycling technologies that can transform mixed plastic waste back into virgin-quality polymers, thus closing the loop for plastic packaging. The demand for bio-based and compostable packaging made from renewable resources like corn starch, sugarcane, and algae presents a significant growth area, particularly for food service and e-commerce applications. Furthermore, innovative designs for lightweight, high-performance packaging that minimize material usage while maintaining product integrity are gaining traction. Untapped markets in developing regions, where the demand for convenient and hygienic packaging is rapidly increasing alongside economic growth, also represent substantial opportunities.

Growth Accelerators in the Single-use Packaging Market Industry

Several growth accelerators are propelling the single-use packaging market forward. Technological breakthroughs in material science, such as the development of biodegradable polymers with enhanced barrier properties and compostable materials that meet rigorous certification standards, are key catalysts. Strategic partnerships between packaging manufacturers, material suppliers, and end-user brands are crucial for co-developing and scaling innovative sustainable packaging solutions. Market expansion strategies, including the penetration of emerging economies with growing middle classes and increasing demand for convenience, further fuel growth. The ongoing investment in advanced recycling infrastructure and technologies is also a critical accelerator, enabling a more sustainable future for single-use packaging by facilitating a closed-loop system and reducing reliance on virgin resources.

Key Players Shaping the Single-use Packaging Market Market

- Hotpack Packaging Industries LLC

- Amcor Group GmbH

- Winpak Ltd

- Transcontinental Inc

- Pactiv LLC

- Graphic Packaging International LLC

- Novolex

- Berry Global Inc

- Huhtamaki Oyj

- Dart Container Corporation

Notable Milestones in Single-use Packaging Market Sector

- April 2023: Seal Package announced the launch of Infinity Top Seal, a one-piece, recyclable packaging solution for food service and deliveries. Infinity Top Seal is made from Klöckner Pentaplast's monolithic, heat-sealed packaging solution from a heat-resistant polypropylene expandable lid with a sealable film, enhancing convenience and sustainability.

- March 2023: Burger King's German restaurants introduced single-use polypropylene cups, which are both recyclable and reusable, to conserve packaging resources and reduce waste generated by single-use cups. The cups are intended for use with the establishment's beverages, milkshakes, and ice cream, with the RECUP deposit system facilitating their implementation.

In-Depth Single-use Packaging Market Market Outlook

The future outlook for the single-use packaging market is characterized by a dynamic interplay between convenience-driven demand and the imperative for sustainability. Growth accelerators, including ongoing innovations in bio-based and recyclable materials, coupled with robust investments in advanced recycling infrastructure, will shape the market's trajectory. Strategic partnerships and market expansion into developing economies with burgeoning consumer bases will unlock significant potential. The market is poised to witness a gradual shift towards more circular models, where design for recyclability and the development of high-quality recycled content become paramount. Companies that can effectively balance cost-effectiveness with environmental responsibility will be best positioned for success. The integration of smart technologies for enhanced traceability and waste management will also be a key differentiator, paving the way for a more efficient and sustainable single-use packaging ecosystem.

Single-use Packaging Market Segmentation

-

1. Material Type

- 1.1. Paper and Paperboard

- 1.2. Plastic

- 1.3. Glass

- 1.4. Other Material Types (Metals and Wood)

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal Care

- 2.4. Pharmaceutical

- 2.5. Other End-user Industries

Single-use Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Single-use Packaging Market Regional Market Share

Geographic Coverage of Single-use Packaging Market

Single-use Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-commerce in Developing Nations; Growing Demand for Online Food Delivery Services

- 3.3. Market Restrains

- 3.3.1. Ban on Single use Plastic Products by European Union

- 3.4. Market Trends

- 3.4.1. Growing Demand for Food and beverage segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Single-use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper and Paperboard

- 5.1.2. Plastic

- 5.1.3. Glass

- 5.1.4. Other Material Types (Metals and Wood)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal Care

- 5.2.4. Pharmaceutical

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Single-use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Paper and Paperboard

- 6.1.2. Plastic

- 6.1.3. Glass

- 6.1.4. Other Material Types (Metals and Wood)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Personal Care

- 6.2.4. Pharmaceutical

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Single-use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Paper and Paperboard

- 7.1.2. Plastic

- 7.1.3. Glass

- 7.1.4. Other Material Types (Metals and Wood)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Personal Care

- 7.2.4. Pharmaceutical

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Single-use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Paper and Paperboard

- 8.1.2. Plastic

- 8.1.3. Glass

- 8.1.4. Other Material Types (Metals and Wood)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Personal Care

- 8.2.4. Pharmaceutical

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Single-use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Paper and Paperboard

- 9.1.2. Plastic

- 9.1.3. Glass

- 9.1.4. Other Material Types (Metals and Wood)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Personal Care

- 9.2.4. Pharmaceutical

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Single-use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Paper and Paperboard

- 10.1.2. Plastic

- 10.1.3. Glass

- 10.1.4. Other Material Types (Metals and Wood)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Personal Care

- 10.2.4. Pharmaceutical

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hotpack Packaging Industries LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amcor Group GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Winpak Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Transcontinental Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pactiv LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Graphic Packaging International LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Novolex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berry Global Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huhtamaki Oyj

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dart Container Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hotpack Packaging Industries LLC

List of Figures

- Figure 1: Global Single-use Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Single-use Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Single-use Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Single-use Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Single-use Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Single-use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Single-use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Single-use Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 9: Europe Single-use Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: Europe Single-use Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Single-use Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Single-use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Single-use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Single-use Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 15: Asia Pacific Single-use Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Asia Pacific Single-use Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Single-use Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Single-use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Single-use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Single-use Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Latin America Single-use Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Latin America Single-use Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Single-use Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Single-use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Single-use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Single-use Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Middle East and Africa Single-use Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East and Africa Single-use Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Single-use Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Single-use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Single-use Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Single-use Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Single-use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 10: Global Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Single-use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Single-use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 25: Global Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Single-use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Mexico Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 31: Global Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Single-use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single-use Packaging Market?

The projected CAGR is approximately 5.93%.

2. Which companies are prominent players in the Single-use Packaging Market?

Key companies in the market include Hotpack Packaging Industries LLC, Amcor Group GmbH, Winpak Ltd, Transcontinental Inc *List Not Exhaustive, Pactiv LLC, Graphic Packaging International LLC, Novolex, Berry Global Inc, Huhtamaki Oyj, Dart Container Corporation.

3. What are the main segments of the Single-use Packaging Market?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-commerce in Developing Nations; Growing Demand for Online Food Delivery Services.

6. What are the notable trends driving market growth?

Growing Demand for Food and beverage segment.

7. Are there any restraints impacting market growth?

Ban on Single use Plastic Products by European Union.

8. Can you provide examples of recent developments in the market?

April 2023: Seal Package has announced the launch of Infinity Top Seal - a one-piece, recyclable packaging solution for food service and deliveries. Infinity Top Seal is made from Klöckner Pentaplast's monolithic, heat-sealed packaging solution from a heat-resistant polypropylene expandable lid with a sealable film.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Single-use Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Single-use Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Single-use Packaging Market?

To stay informed about further developments, trends, and reports in the Single-use Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence